444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The viral vector purification market has witnessed significant growth in recent years due to the increasing demand for gene and cell therapies. Viral vectors play a crucial role in delivering therapeutic genes to target cells, making them a valuable tool in the field of modern medicine. This comprehensive analysis delves into the various aspects of the viral vector purification market, including its meaning, key market insights, market dynamics, regional analysis, competitive landscape, segmentation, and future outlook.

Meaning:

Viral vector purification refers to the process of isolating, purifying, and concentrating viral vectors used in gene therapy and vaccine production. This purification process ensures the removal of impurities, such as host cell proteins, nucleic acids, and process-related impurities, while retaining the integrity and efficacy of the viral vectors. Effective purification techniques are crucial to ensure the safety and potency of viral vectors for successful gene and cell therapies.

Executive Summary:

The viral vector purification market is experiencing robust growth, driven by the increasing prevalence of genetic disorders, advancements in biotechnology, and the rising adoption of gene and cell therapies. This executive summary provides a concise overview of the market’s key findings, including market drivers, restraints, opportunities, and the competitive landscape. It serves as a quick reference guide for industry participants and stakeholders looking to understand the current market scenario.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Dominance of Chromatography: Ion exchange and affinity chromatography account for over 60% of purification protocols due to their high selectivity.

Emerging Single-Use Technologies: Single-use tangential flow filtration (TFF) systems reduce cross-contamination risk and cleaning validation burden.

Need for High-Capacity Media: As clinical doses scale from 10¹² to 10¹⁵ viral genomes, high dynamic binding capacity resins become critical.

Adoption of Continuous Processing: Perfusion-based upstream production coupled with continuous downstream capture can double productivity.

Regulatory Emphasis on Empty Capsid Removal: New guidelines recommend minimizing non‑functional capsids to reduce immunogenic load.

Market Drivers

Clinical Pipeline Growth: Over 300 cell and gene therapies in late-stage trials drive demand for large‑scale purification.

Vaccine Development: Use of viral vectors for next-generation vaccines beyond COVID‑19 (e.g., HIV, CMV) requires robust purification platforms.

Bioprocess Intensification: Industry trend toward higher titers (10¹⁴–10¹⁵ vg/L) necessitates purification solutions with increased capacity.

Regulatory Pressure: Stricter impurity limits and quality-by-design (QbD) frameworks push manufacturers to refine downstream processes.

Outsourcing Trends: Rising reliance on CDMOs and contract manufacturing organizations for complete end-to-end vector production—from cell bank to fill-finish.

Market Restraints

High Cost of Goods: Purification steps can represent 50–70% of overall manufacturing costs for viral vectors.

Process Complexity: Multi‑step protocols (clarification → capture → intermediate → polishing) require specialized expertise.

Scale-Up Challenges: Technologies that work at 100 L may underperform at 1,000 L or higher volumes without process re‑optimization.

Ligand Development: Designing affinity ligands that bind specific serotypes (e.g., AAV1 vs. AAV8) is time-consuming and costly.

Market Opportunities

Continuous Downstream Processing: Adoption of continuous capture and polishing can reduce footprint and operational costs while increasing productivity.

Advanced Affinity Ligands: Next‑generation ligands with higher specificity and binding capacity for different viral vector families.

Integration of In-line Analytics: Real-time monitoring (e.g., multi-angle light scattering, fluorescence) for PAT (Process Analytical Technology).

Modular, Single-Use Platforms: Plug‑and‑play purification trains reduce cleaning validation and facility downtime.

Market Dynamics

Supply-Side: Suppliers are investing in resin R&D, single-use TFF modules, and integrated perfusion‑to‑purification systems.

Demand-Side: Biotech firms seek turnkey CDMO partnerships to accelerate vector supply for clinical trials.

Economic & Policy: Governments are offering grants for advanced therapy manufacturing innovation; however, pricing pressure persists as payers demand lower COGs.

Regional Analysis

North America (40%+ share): Home to leading biotech hubs—Boston, San Francisco—and major CDMOs.

Europe (30%): Strong gene therapy ecosystem (UK, Germany, France) and favorable EMA guidelines.

Asia‑Pacific (20%): Rising biopharma investment in China, Japan, and India; building local capacity for viral vector manufacturing.

Rest of World: Emerging interest in Latin America and Middle East for vaccine production drives initial capacity building.

Competitive Landscape

Leading companies in the Viral Vector Purification Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

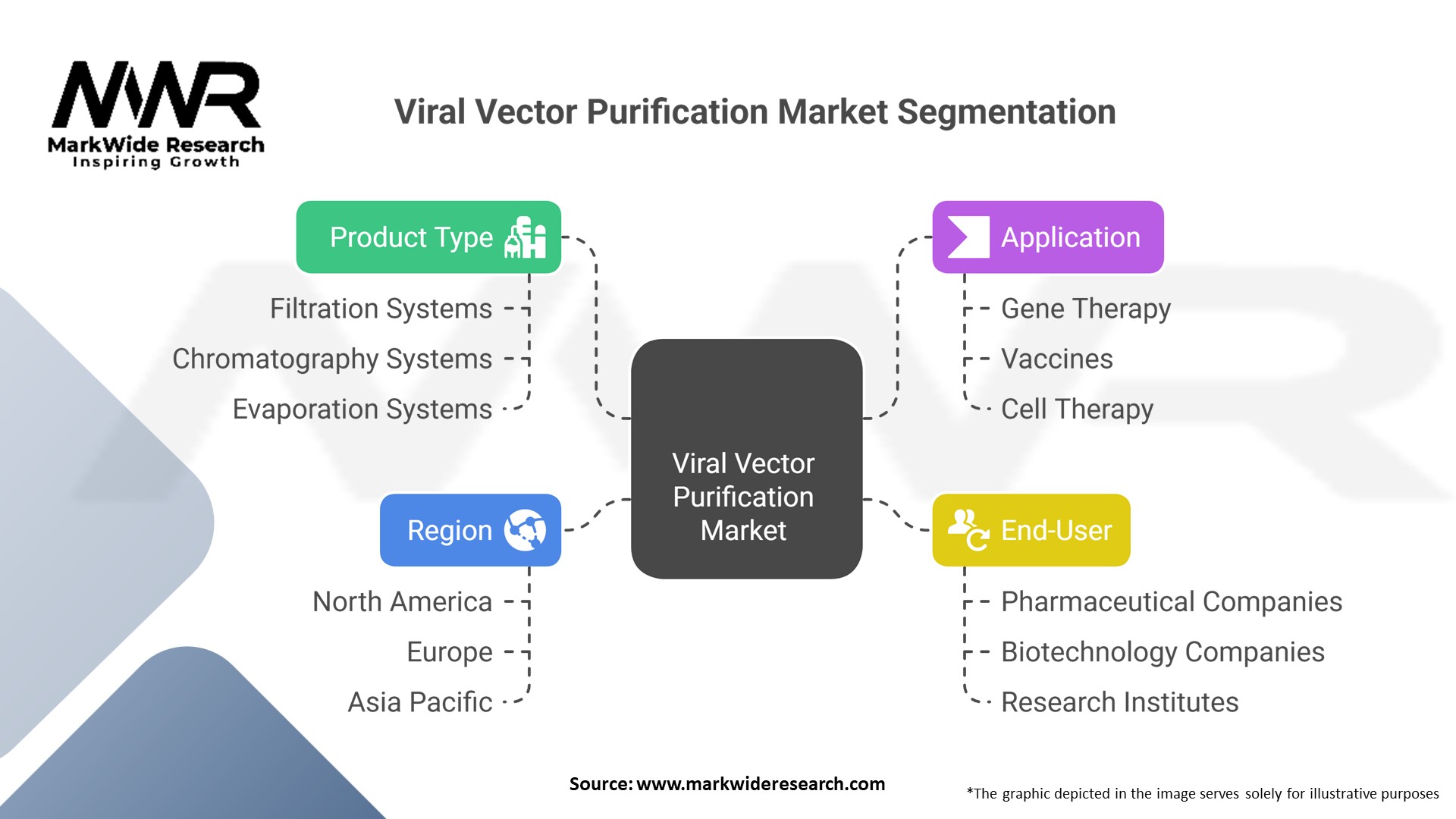

Segmentation

By Viral Vector Type:

Adeno-Associated Virus (AAV)

Lentivirus

Adenovirus

Others (e.g., retrovirus, poxvirus)

By Purification Technology:

Chromatography (Affinity, Ion Exchange, Size Exclusion)

Filtration (TFF/Ultrafiltration)

Precipitation

By End-User:

Pharmaceutical & Biotechnology Companies

Contract Development & Manufacturing Organizations (CDMOs)

Research Institutes & Academic Centers

By Region: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa

Category-wise Insights

AAV Purification: Affinity chromatography dominates due to high selectivity—resins like POROS™ CaptureSelect™ AAVX provide up to 99% impurity removal.

Lentivirus Purification: Ion exchange and membrane-based TFF are preferred for speed and virus integrity.

Adenovirus Purification: A combination of anion exchange chromatography and TFF achieves high yield and purity for vaccine platforms.

Key Benefits for Industry Participants and Stakeholders

Enhanced Safety & Efficacy: High‑purity vectors reduce immunogenic risk and improve patient outcomes.

Regulatory Compliance: Streamlined processes aligned with ICH Q8–Q11 guidelines and FDA/EMA expectations.

Reduced Time-to-Market: Integrated service offerings and single‑use platforms accelerate clinical supply timelines.

Cost Optimization: Continuous and high‑capacity purification reduces COGs per dose as vector demand scales.

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has had a significant impact on the healthcare industry, including the viral vector purification market. The analysis explores the implications of the pandemic on the market, such as disruptions in supply chains, delays in clinical trials, and accelerated research efforts in viral vector-based vaccine development.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The viral vector purification market is poised for significant growth in the coming years. Advancements in purification techniques, increasing adoption of gene and cell therapies, and expanding applications of viral vectors are expected to drive market expansion. However, challenges such as high costs and regulatory complexities need to be addressed to unlock the market’s full potential.

Conclusion:

The viral vector purification market presents lucrative opportunities for industry participants and stakeholders in the field of gene and cell therapies. With increasing investments, technological advancements, and growing demand for personalized medicine, the market is expected to witness substantial growth. By understanding the market dynamics, embracing innovation, and navigating regulatory challenges, companies can position themselves for success in this evolving landscape.

What is Viral Vector Purification?

Viral Vector Purification refers to the processes used to isolate and purify viral vectors, which are tools commonly used in gene therapy and vaccine development. These processes ensure that the vectors are free from contaminants and are suitable for therapeutic applications.

What are the key companies in the Viral Vector Purification Market?

Key companies in the Viral Vector Purification Market include Lonza, Sartorius, and Thermo Fisher Scientific, which provide various technologies and services for the purification of viral vectors. These companies are known for their innovative solutions and extensive experience in bioprocessing, among others.

What are the growth factors driving the Viral Vector Purification Market?

The growth of the Viral Vector Purification Market is driven by the increasing demand for gene therapies and vaccines, advancements in purification technologies, and the rising prevalence of genetic disorders. Additionally, the expansion of research activities in biotechnology and pharmaceuticals contributes to market growth.

What challenges does the Viral Vector Purification Market face?

The Viral Vector Purification Market faces challenges such as the complexity of purification processes, high costs associated with advanced technologies, and regulatory hurdles. These factors can hinder the efficiency and scalability of viral vector production.

What opportunities exist in the Viral Vector Purification Market?

Opportunities in the Viral Vector Purification Market include the development of novel purification methods, increasing collaborations between academic institutions and industry players, and the growing focus on personalized medicine. These trends are expected to enhance the efficiency and effectiveness of viral vector applications.

What trends are shaping the Viral Vector Purification Market?

Trends shaping the Viral Vector Purification Market include the integration of automation and artificial intelligence in purification processes, the rise of continuous manufacturing techniques, and the increasing emphasis on quality by design (QbD) approaches. These innovations aim to improve the overall efficiency and reliability of viral vector production.

Viral Vector Purification Market

| Segmentation | Details |

|---|---|

| Product Type | Filtration Systems, Chromatography Systems, Evaporation Systems, Others |

| Application | Gene Therapy, Vaccines, Cell Therapy, Others |

| End-User | Pharmaceutical and Biotechnology Companies, Contract Manufacturing Organizations, Research Institutes, Others |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Viral Vector Purification Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at