444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam seed industry market represents a dynamic and rapidly evolving agricultural sector that serves as the foundation for the country’s food security and agricultural modernization efforts. Vietnam’s agricultural landscape has undergone significant transformation over the past decade, with the seed industry playing a pivotal role in enhancing crop productivity and supporting the nation’s growing population of over 97 million people.

Agricultural innovation has become increasingly important as Vietnam transitions from traditional farming methods to more sophisticated agricultural practices. The country’s tropical climate and diverse geographical regions create favorable conditions for cultivating various crops, including rice, corn, vegetables, and fruits. Seed quality improvements have contributed to yield increases of approximately 15-20% across major crop categories, demonstrating the sector’s significant impact on agricultural productivity.

Government initiatives have substantially supported the development of the seed industry through policy reforms, research investments, and international collaboration programs. The Vietnamese government’s commitment to agricultural modernization has created an enabling environment for both domestic and international seed companies to establish operations and contribute to the sector’s growth. Technology adoption rates in seed development have increased by approximately 25% over the past five years, reflecting the industry’s progressive approach to innovation.

Market dynamics indicate strong potential for continued expansion, driven by increasing demand for high-quality seeds, growing awareness of sustainable farming practices, and rising agricultural exports. The integration of biotechnology and advanced breeding techniques has positioned Vietnam as an emerging hub for seed production and distribution in the Southeast Asian region.

The Vietnam seed industry market refers to the comprehensive ecosystem encompassing the research, development, production, distribution, and commercialization of agricultural seeds within Vietnam’s borders. This market includes various seed categories such as field crops, vegetables, fruits, and specialty crops, along with the supporting infrastructure, regulatory framework, and technological innovations that facilitate seed industry operations.

Seed industry participants include government research institutions, private breeding companies, multinational corporations, local distributors, and agricultural cooperatives that collectively contribute to the development and supply of improved seed varieties. The market encompasses both traditional open-pollinated varieties and modern hybrid seeds, catering to diverse farmer preferences and agricultural requirements across different regions of Vietnam.

Quality standards and certification processes form integral components of the market definition, ensuring that seeds meet specific genetic purity, germination rates, and disease resistance criteria. The industry operates within a regulatory framework established by the Ministry of Agriculture and Rural Development, which oversees seed registration, quality control, and market access requirements for both domestic and imported seed varieties.

Value chain integration extends from basic research and variety development through commercial production, processing, packaging, and distribution to end-users, including smallholder farmers, commercial agricultural enterprises, and export-oriented production systems.

Vietnam’s seed industry has emerged as a critical component of the country’s agricultural transformation strategy, demonstrating remarkable growth potential and increasing sophistication in recent years. The market benefits from favorable climatic conditions, government support, and growing demand for improved crop varieties that enhance productivity and sustainability.

Key market characteristics include a diverse crop portfolio dominated by rice, corn, and vegetable seeds, with increasing emphasis on hybrid varieties and biotechnology applications. The industry has experienced significant modernization, with hybrid seed adoption rates reaching approximately 60% in major crop categories, reflecting farmers’ growing recognition of the benefits associated with improved seed technologies.

Competitive landscape features a mix of international seed companies, domestic enterprises, and government research institutions, creating a dynamic environment for innovation and market development. Foreign investment has increased substantially, bringing advanced technologies and global best practices to the Vietnamese market while fostering knowledge transfer and capacity building initiatives.

Market growth drivers include population growth, urbanization, changing dietary preferences, export market opportunities, and government policies promoting agricultural modernization. The sector faces challenges related to intellectual property protection, regulatory harmonization, and the need for continued investment in research and development infrastructure.

Future prospects remain highly positive, with anticipated expansion in biotechnology applications, precision agriculture integration, and sustainable farming practices. The industry is positioned to play an increasingly important role in Vietnam’s economic development and food security objectives.

Strategic market insights reveal several critical trends and developments shaping the Vietnam seed industry landscape:

Market penetration strategies increasingly focus on building strong relationships with local distributors, agricultural cooperatives, and extension services to ensure effective reach to smallholder farmers who represent the majority of Vietnam’s agricultural producers.

Population growth serves as a fundamental driver for the Vietnam seed industry, with the country’s expanding population creating sustained demand for increased agricultural productivity. The need to feed a growing population while maintaining food security has intensified focus on high-yielding seed varieties and improved agricultural technologies.

Government policy support represents another crucial driver, with Vietnamese authorities implementing comprehensive agricultural modernization programs that prioritize seed industry development. Policy initiatives include research funding, tax incentives for seed companies, and infrastructure development programs that facilitate market access and distribution efficiency.

Economic development and rising income levels have contributed to changing dietary preferences and increased demand for diverse, high-quality agricultural products. This trend drives demand for specialized seed varieties that can produce premium crops for both domestic consumption and export markets.

Climate change adaptation requirements are driving innovation in seed development, with increasing focus on varieties that can withstand extreme weather conditions, drought stress, and changing precipitation patterns. Farmers are increasingly seeking resilient seed varieties that can maintain productivity under challenging environmental conditions.

Export market opportunities continue to expand as Vietnam strengthens its position in global agricultural trade. The development of export-oriented seed varieties and production systems creates additional demand for high-quality seeds that meet international standards and market requirements.

Technology advancement in breeding techniques, biotechnology applications, and precision agriculture tools is creating opportunities for more efficient and effective seed development processes, driving industry growth and innovation.

Regulatory complexity poses significant challenges for the Vietnam seed industry, particularly regarding the approval and registration processes for new seed varieties. Lengthy approval timelines and complex documentation requirements can delay market introduction of innovative products and increase development costs for seed companies.

Intellectual property protection concerns continue to affect industry development, with inadequate enforcement mechanisms potentially discouraging investment in research and development activities. Weak intellectual property frameworks can undermine innovation incentives and limit technology transfer opportunities.

Limited research infrastructure in certain regions restricts the development of locally adapted seed varieties and slows the pace of innovation. Insufficient investment in research facilities, equipment, and human resources can constrain the industry’s ability to develop competitive products.

Farmer education gaps represent ongoing challenges, as many smallholder farmers lack awareness of improved seed technologies and their potential benefits. Limited extension services and training programs can slow adoption rates and reduce market penetration for advanced seed varieties.

Financial constraints among smallholder farmers can limit their ability to purchase higher-priced improved seeds, despite their superior performance characteristics. Limited access to agricultural credit and insurance products can further constrain demand for premium seed varieties.

Infrastructure limitations in rural areas, including inadequate storage facilities, transportation networks, and distribution systems, can affect seed quality and availability, particularly in remote agricultural regions.

Biotechnology advancement presents substantial opportunities for the Vietnam seed industry, with potential applications in developing drought-resistant, disease-tolerant, and nutritionally enhanced crop varieties. The integration of modern biotechnology tools can accelerate breeding programs and create competitive advantages in both domestic and export markets.

Regional market expansion offers significant growth potential, as Vietnam’s strategic location and competitive production costs create opportunities for seed exports to neighboring Southeast Asian countries. Developing regional distribution networks and partnerships can unlock substantial market opportunities.

Precision agriculture integration creates opportunities for seed companies to develop comprehensive solutions that combine improved seed varieties with digital farming technologies, data analytics, and precision application systems. This integrated approach can enhance farmer productivity and create additional revenue streams.

Sustainable agriculture trends are driving demand for environmentally friendly seed varieties that reduce chemical inputs, improve soil health, and enhance resource efficiency. Companies that develop sustainable seed solutions can capture growing market segments focused on environmental stewardship.

Public-private partnerships offer opportunities for collaboration between government research institutions and private companies, leveraging complementary strengths and resources to accelerate innovation and market development. Such partnerships can facilitate technology transfer and capacity building initiatives.

Value-added services including farmer training, technical support, and crop management consulting represent opportunities for seed companies to differentiate their offerings and build stronger customer relationships while generating additional revenue streams.

Supply chain evolution continues to reshape the Vietnam seed industry, with increasing emphasis on efficiency, quality control, and traceability throughout the value chain. Modern supply chain management practices are improving seed availability, reducing costs, and enhancing customer satisfaction levels across different market segments.

Competitive intensity has increased significantly as both domestic and international companies expand their presence in the Vietnamese market. This competition is driving innovation, improving product quality, and creating more choices for farmers while potentially pressuring profit margins for industry participants.

Technology adoption patterns vary considerably across different regions and farm sizes, with larger commercial operations typically adopting new technologies more rapidly than smallholder farmers. Understanding these adoption patterns is crucial for developing effective market strategies and distribution approaches.

Seasonal demand fluctuations create challenges and opportunities for seed companies, requiring sophisticated inventory management, production planning, and distribution strategies to meet peak demand periods while maintaining cost efficiency during slower periods.

Price sensitivity among farmers influences purchasing decisions and market dynamics, with cost-benefit analysis playing a crucial role in seed variety selection. Companies must balance innovation investments with price competitiveness to maintain market share and profitability.

Regulatory changes continue to impact market dynamics, with evolving policies affecting product approval processes, quality standards, and market access requirements. Industry participants must maintain flexibility and adaptability to navigate changing regulatory environments effectively.

Comprehensive market analysis for the Vietnam seed industry employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines primary data collection, secondary source analysis, and expert consultation to develop a complete understanding of market dynamics and trends.

Primary research activities include structured interviews with industry executives, government officials, agricultural researchers, distributors, and farmers across different regions of Vietnam. These interviews provide firsthand insights into market conditions, challenges, opportunities, and future prospects from various stakeholder perspectives.

Secondary research encompasses analysis of government publications, industry reports, academic studies, trade association data, and company financial statements to gather quantitative and qualitative information about market size, growth trends, competitive landscape, and regulatory environment.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and employing statistical analysis techniques to ensure data accuracy and reliability. This rigorous validation approach enhances the credibility and usefulness of research findings.

Market modeling techniques utilize historical data, trend analysis, and forecasting methodologies to project future market developments and identify emerging opportunities. These models incorporate various economic, demographic, and technological factors that influence market growth and evolution.

Expert consultation with agricultural specialists, industry analysts, and academic researchers provides additional validation and insights that enhance the overall quality and depth of the market analysis.

Northern Vietnam represents a significant portion of the country’s seed market, with the Red River Delta region serving as a major agricultural hub. This area accounts for approximately 35% of total seed consumption, driven by intensive rice cultivation and diversified cropping systems. The region benefits from established research institutions, government support, and proximity to major distribution centers.

Central Vietnam contributes approximately 25% of market demand, characterized by diverse agricultural systems ranging from coastal aquaculture to highland crop production. The region’s varied topography and climate conditions create demand for specialized seed varieties adapted to specific environmental conditions and farming systems.

Southern Vietnam dominates the market with approximately 40% of total seed consumption, led by the Mekong Delta region’s extensive agricultural production. This area serves as Vietnam’s primary rice-producing region and supports significant vegetable and fruit production, creating substantial demand for diverse seed varieties.

Regional distribution networks vary in sophistication and efficiency, with more developed infrastructure in major agricultural areas and ongoing improvements in remote regions. Companies are investing in regional distribution capabilities to improve market penetration and customer service levels.

Climate variations across regions influence seed variety preferences and agricultural practices, requiring companies to develop region-specific product portfolios and marketing strategies. Understanding regional differences is crucial for successful market penetration and customer satisfaction.

Government support programs often target specific regions based on agricultural priorities and development objectives, creating opportunities for seed companies to participate in public-private partnerships and development initiatives.

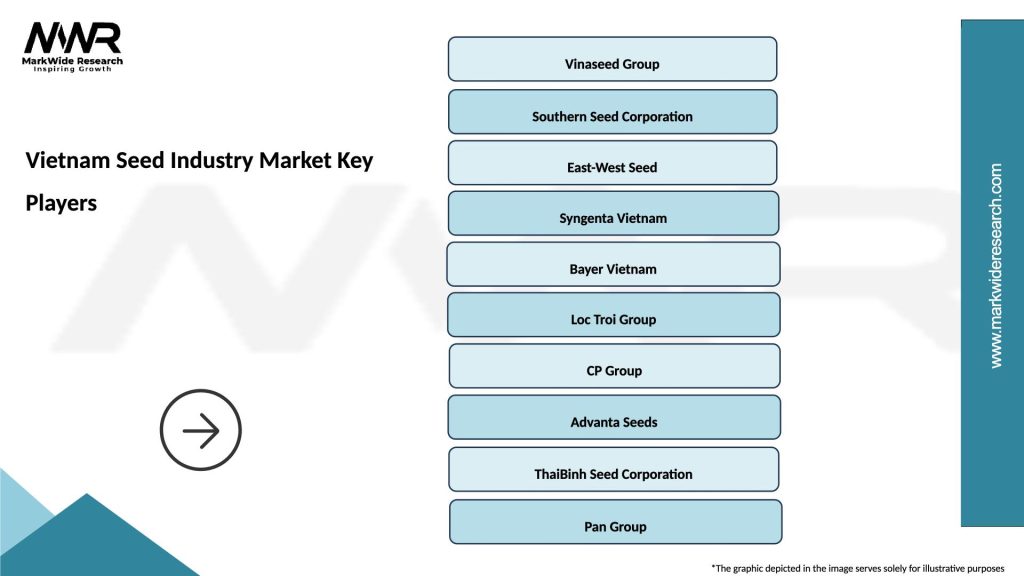

Market leadership in Vietnam’s seed industry is shared among several key players, each bringing unique strengths and capabilities to the market:

Competitive strategies vary among market participants, with some companies focusing on premium technology products while others emphasize cost-effective solutions for price-sensitive market segments. Innovation capabilities, distribution networks, and customer relationships serve as key competitive differentiators.

Market consolidation trends are creating opportunities for strategic partnerships, acquisitions, and joint ventures as companies seek to strengthen their market positions and expand their capabilities. These activities are reshaping the competitive landscape and creating new market dynamics.

Local partnerships play crucial roles in market success, with international companies typically establishing relationships with domestic distributors, research institutions, and agricultural organizations to enhance their market penetration and customer relationships.

By Crop Type: The Vietnam seed industry serves diverse agricultural segments with varying characteristics and requirements:

By Technology: Market segmentation based on breeding and production technologies:

By Distribution Channel: Various pathways for reaching end-users:

Rice seed category maintains its position as the cornerstone of Vietnam’s seed industry, driven by the crop’s cultural significance and economic importance. Hybrid rice adoption has reached approximately 45% of total rice area, with farmers increasingly recognizing the yield advantages and quality improvements offered by modern varieties. Premium rice varieties for export markets are creating additional growth opportunities within this segment.

Vegetable seed segment demonstrates the highest growth potential, fueled by urbanization, dietary diversification, and export market development. Greenhouse cultivation and protected agriculture systems are driving demand for specialized vegetable varieties with enhanced disease resistance and shelf life characteristics. This segment benefits from higher profit margins and shorter production cycles compared to field crops.

Corn seed category is experiencing rapid expansion due to growing livestock industry demand and industrial applications. Hybrid corn varieties now account for approximately 70% of planted area, reflecting farmers’ strong preference for improved productivity and uniformity. Feed quality requirements and processing industry standards are driving demand for specific corn types and characteristics.

Specialty crop seeds including fruits, flowers, and niche vegetables represent emerging opportunities with high value potential. These categories often require specialized knowledge, distribution channels, and customer support services, creating barriers to entry but also opportunities for differentiation and premium pricing.

Organic seed segment is gaining traction as consumer awareness of organic products increases and export markets demand certified organic produce. This niche category requires specialized production methods and certification processes but offers premium pricing opportunities.

Seed companies benefit from Vietnam’s large agricultural market, favorable growing conditions, and supportive government policies that create opportunities for business expansion and profitability. The market offers potential for both volume sales and premium product positioning, depending on company strategies and capabilities.

Farmers gain access to improved seed varieties that enhance productivity, reduce production risks, and improve crop quality. Modern seed technologies can increase yields by 20-40% compared to traditional varieties while reducing input costs and labor requirements. Enhanced disease resistance and stress tolerance provide additional benefits in challenging growing conditions.

Government stakeholders achieve agricultural development objectives through increased food security, rural income generation, and export revenue enhancement. The seed industry contributes to technology transfer, capacity building, and agricultural modernization goals that support broader economic development strategies.

Research institutions benefit from collaboration opportunities with private companies, access to advanced technologies, and funding for research programs. These partnerships accelerate innovation and facilitate the development of locally adapted varieties that address specific agricultural challenges.

Distributors and retailers participate in a growing market with opportunities for business expansion and service diversification. The seed industry provides stable demand for agricultural input distribution services while creating opportunities for value-added services such as technical support and farmer training.

Consumers ultimately benefit from improved food quality, enhanced nutrition, and more stable food supplies resulting from advanced seed technologies and increased agricultural productivity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing the Vietnam seed industry through the integration of precision agriculture technologies, data analytics, and mobile applications that enhance farmer decision-making and crop management practices. Digital adoption rates among progressive farmers have increased by approximately 35% over the past three years, indicating strong momentum for technology-enabled agriculture.

Sustainability focus continues to gain prominence as environmental concerns and regulatory requirements drive demand for seeds that reduce chemical inputs, improve resource efficiency, and enhance soil health. Companies are investing heavily in developing varieties that support sustainable farming practices while maintaining productivity and profitability.

Climate resilience has become a critical priority, with increasing emphasis on developing seed varieties that can withstand drought, flooding, extreme temperatures, and other climate-related stresses. MarkWide Research analysis indicates that climate-adapted varieties are experiencing adoption rates of approximately 25% annually among farmers in vulnerable regions.

Value chain integration is creating opportunities for seed companies to expand their offerings beyond traditional products to include comprehensive agricultural solutions, technical services, and digital platforms that support farmers throughout the production cycle.

Premium market development reflects growing consumer demand for high-quality, specialty, and organic agricultural products that require specific seed varieties and production practices. This trend is creating opportunities for differentiated products and premium pricing strategies.

Regional collaboration is increasing as companies seek to leverage Vietnam’s strategic position to serve broader Southeast Asian markets through regional production, distribution, and research partnerships.

Research infrastructure expansion has accelerated significantly, with both government and private sector investments in modern breeding facilities, biotechnology laboratories, and field testing stations. These developments are enhancing Vietnam’s capacity for indigenous seed development and reducing dependence on imported varieties.

Regulatory modernization efforts are streamlining seed registration processes, harmonizing quality standards with international practices, and creating more predictable regulatory environments for industry participants. Recent policy changes have reduced approval timelines by approximately 20% for certain seed categories.

International partnerships continue to expand, with global seed companies establishing local operations, research collaborations, and technology transfer agreements that bring advanced capabilities to the Vietnamese market while supporting local capacity building initiatives.

Distribution network modernization is improving seed availability and quality through investments in cold storage facilities, transportation systems, and retail network development. These improvements are particularly important for maintaining seed viability in Vietnam’s tropical climate conditions.

Farmer education programs have intensified through public-private partnerships that provide training, demonstration plots, and technical support services to improve adoption rates of improved seed varieties and associated agricultural practices.

Technology commercialization activities are accelerating the transfer of research innovations from laboratories to commercial applications, with several promising varieties moving through the development pipeline toward market introduction.

Investment prioritization should focus on developing climate-resilient varieties that can address Vietnam’s increasing vulnerability to extreme weather events and changing precipitation patterns. MWR recommends that companies allocate significant resources to breeding programs that emphasize drought tolerance, flood resistance, and heat stress adaptation.

Market penetration strategies should emphasize building strong relationships with local distributors, agricultural cooperatives, and extension services to effectively reach smallholder farmers who represent the majority of Vietnam’s agricultural producers. Successful companies will invest in comprehensive farmer education and support programs.

Technology integration opportunities should be pursued through partnerships with digital agriculture companies, precision farming service providers, and agricultural technology startups that can enhance the value proposition of improved seed varieties through integrated solutions.

Regulatory engagement is crucial for companies operating in Vietnam’s evolving policy environment. Active participation in industry associations, government consultations, and policy development processes can help shape favorable regulatory conditions and ensure compliance with changing requirements.

Sustainability positioning will become increasingly important as environmental regulations tighten and consumer preferences shift toward sustainable agricultural products. Companies should develop comprehensive sustainability strategies that encompass product development, production practices, and supply chain management.

Regional expansion strategies should leverage Vietnam’s strategic location and competitive advantages to serve broader Southeast Asian markets through regional production, distribution, and research networks that create economies of scale and market diversification benefits.

Long-term growth prospects for Vietnam’s seed industry remain highly positive, driven by continued population growth, economic development, and agricultural modernization initiatives. The industry is expected to experience sustained expansion over the next decade, with compound annual growth rates projected at approximately 8-12% across major seed categories.

Technology advancement will continue to reshape the industry landscape, with biotechnology applications, precision agriculture integration, and digital farming solutions becoming increasingly important competitive factors. Companies that successfully integrate these technologies will gain significant market advantages and growth opportunities.

Market consolidation trends are likely to continue as companies seek to achieve economies of scale, enhance research capabilities, and expand market reach through strategic partnerships, acquisitions, and joint ventures. This consolidation will create both challenges and opportunities for industry participants.

Export market development presents substantial growth potential as Vietnam strengthens its position in global agricultural trade and regional food systems. The development of export-oriented seed varieties and production systems will create additional revenue streams and market diversification opportunities.

Sustainability requirements will become increasingly stringent, driving innovation in environmentally friendly seed varieties and production practices. Companies that proactively address sustainability challenges will be better positioned for long-term success in evolving market conditions.

Government support is expected to continue through policy initiatives, research funding, and infrastructure development programs that create favorable conditions for industry growth and innovation. Public-private partnerships will play increasingly important roles in achieving agricultural development objectives.

The Vietnam seed industry market represents a dynamic and rapidly evolving sector with substantial growth potential and strategic importance for the country’s agricultural development and food security objectives. Market fundamentals remain strong, supported by favorable climatic conditions, government policy support, growing population, and increasing demand for agricultural productivity improvements.

Industry transformation is being driven by technological advancement, sustainability requirements, climate change adaptation needs, and evolving consumer preferences that create both challenges and opportunities for market participants. Companies that successfully navigate these trends while building strong local partnerships and capabilities will be well-positioned for long-term success.

Competitive dynamics continue to evolve as both domestic and international companies expand their presence and capabilities in the Vietnamese market. Success factors include innovation capacity, distribution network strength, regulatory compliance, and ability to serve diverse farmer segments with appropriate products and services.

Future growth will be supported by continued economic development, agricultural modernization, export market opportunities, and technology integration that enhance the value proposition of improved seed varieties. The industry’s contribution to Vietnam’s agricultural transformation and economic development will continue to expand, creating value for all stakeholders throughout the agricultural value chain.

What is Vietnam Seed Industry?

The Vietnam Seed Industry encompasses the production, distribution, and sale of seeds for various agricultural crops, including rice, vegetables, and fruits. It plays a crucial role in enhancing agricultural productivity and ensuring food security in the region.

What are the key players in the Vietnam Seed Industry Market?

Key players in the Vietnam Seed Industry Market include companies like Syngenta, Bayer Crop Science, and Vietnam National Seed Group. These companies are involved in developing and supplying high-quality seeds to farmers, among others.

What are the growth factors driving the Vietnam Seed Industry Market?

The growth of the Vietnam Seed Industry Market is driven by increasing agricultural productivity demands, advancements in seed technology, and a growing focus on sustainable farming practices. Additionally, government support for agricultural innovation contributes to market expansion.

What challenges does the Vietnam Seed Industry Market face?

The Vietnam Seed Industry Market faces challenges such as regulatory hurdles, the prevalence of counterfeit seeds, and climate change impacts on crop yields. These factors can hinder the growth and stability of the industry.

What opportunities exist in the Vietnam Seed Industry Market?

Opportunities in the Vietnam Seed Industry Market include the development of genetically modified seeds, increasing investment in agricultural research, and expanding export markets for high-quality seeds. These factors can enhance competitiveness and innovation.

What trends are shaping the Vietnam Seed Industry Market?

Trends shaping the Vietnam Seed Industry Market include the rise of precision agriculture, the adoption of digital farming technologies, and a growing emphasis on organic seed production. These trends are transforming how seeds are developed and utilized in agriculture.

Vietnam Seed Industry Market

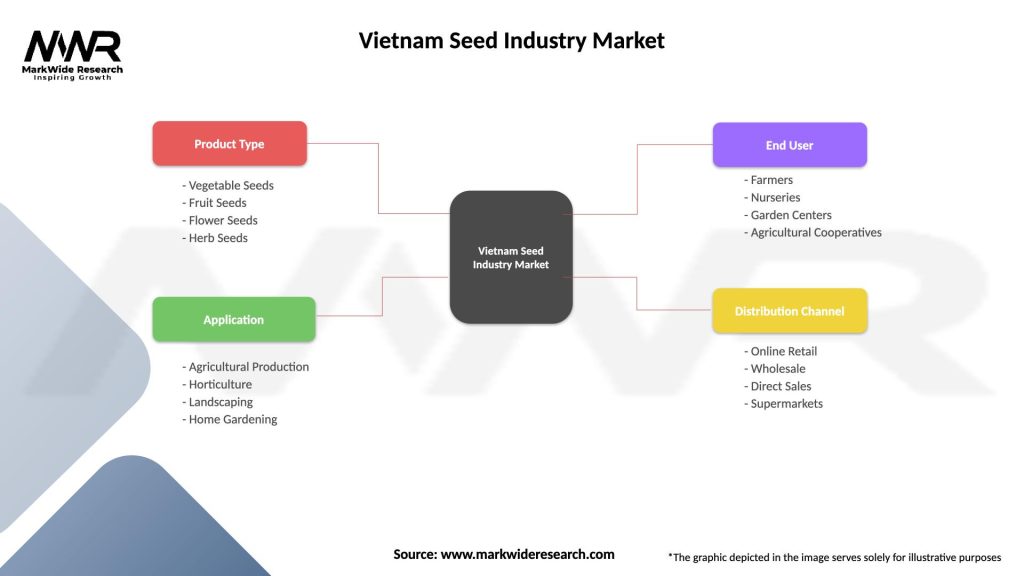

| Segmentation Details | Description |

|---|---|

| Product Type | Vegetable Seeds, Fruit Seeds, Flower Seeds, Herb Seeds |

| Application | Agricultural Production, Horticulture, Landscaping, Home Gardening |

| End User | Farmers, Nurseries, Garden Centers, Agricultural Cooperatives |

| Distribution Channel | Online Retail, Wholesale, Direct Sales, Supermarkets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Seed Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at