444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam prefabricated buildings market represents a transformative sector within the country’s rapidly evolving construction industry. Prefabricated construction has emerged as a cornerstone of Vietnam’s infrastructure development strategy, driven by urbanization demands and the need for efficient building solutions. The market encompasses various construction methodologies including modular buildings, pre-engineered structures, and factory-manufactured components that are assembled on-site.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects Vietnam’s commitment to modernizing its construction practices while addressing the growing demand for residential, commercial, and industrial facilities. The adoption of prefabricated building technologies has accelerated significantly, particularly in urban centers like Ho Chi Minh City and Hanoi, where rapid development requires efficient construction solutions.

Government initiatives supporting sustainable construction practices have further propelled market growth. Vietnam’s construction sector has embraced prefabrication as a means to reduce construction timelines, minimize waste, and improve overall building quality. The market serves diverse applications including affordable housing projects, commercial complexes, educational facilities, and industrial warehouses, each contributing to the sector’s comprehensive growth trajectory.

The Vietnam prefabricated buildings market refers to the comprehensive ecosystem of companies, technologies, and services involved in the design, manufacture, and assembly of building components that are produced in controlled factory environments before being transported and assembled at construction sites. This market encompasses various prefabrication methodologies including modular construction, pre-engineered buildings, and panelized systems that collectively transform traditional construction approaches.

Prefabricated construction in Vietnam involves the systematic production of building elements such as walls, floors, roofs, and entire room modules in specialized manufacturing facilities. These components are then transported to construction sites where they are assembled using standardized connection systems and construction techniques. The approach significantly reduces on-site construction time while maintaining high quality standards through controlled manufacturing processes.

Market participants include manufacturers of prefabricated components, specialized construction companies, technology providers, and service organizations that support the entire prefabrication value chain. The sector serves multiple end-user segments including residential developers, commercial property owners, industrial facility operators, and government agencies implementing large-scale infrastructure projects throughout Vietnam.

Vietnam’s prefabricated buildings market has established itself as a critical component of the country’s construction industry transformation. The sector demonstrates strong momentum driven by urbanization pressures, government policy support, and increasing recognition of prefabrication benefits among developers and contractors. Market penetration has reached approximately 15% of total construction activity, indicating substantial room for continued expansion.

Key market drivers include Vietnam’s rapid economic growth, increasing foreign investment in manufacturing and logistics facilities, and growing demand for affordable housing solutions. The market benefits from favorable government policies promoting sustainable construction practices and the adoption of modern building technologies. Industrial applications currently represent the largest market segment, accounting for approximately 40% of prefabricated building demand.

Technological advancement continues to shape market evolution, with increasing adoption of Building Information Modeling (BIM), automated manufacturing processes, and advanced materials. The sector faces challenges related to initial investment requirements and the need for skilled workforce development, but these are being addressed through industry collaboration and government support programs.

Future prospects remain highly positive, with market expansion expected to accelerate as Vietnam continues its infrastructure development initiatives and more stakeholders recognize the efficiency and quality benefits of prefabricated construction solutions.

Strategic market insights reveal several critical factors driving the Vietnam prefabricated buildings market’s development and future trajectory:

Primary market drivers propelling the Vietnam prefabricated buildings market include a combination of economic, social, and technological factors that create favorable conditions for sector growth.

Economic development serves as the fundamental driver, with Vietnam’s sustained GDP growth creating demand for new construction across all sectors. The country’s emergence as a manufacturing hub attracts foreign investment requiring rapid facility development, where prefabricated buildings offer optimal solutions for quick deployment. Government infrastructure spending on transportation, education, and healthcare facilities further stimulates market demand.

Urbanization pressures create urgent needs for housing and commercial facilities in major cities. Traditional construction methods cannot keep pace with demand, making prefabricated construction an essential solution for addressing housing shortages and supporting urban development initiatives. The need for affordable housing particularly drives adoption of modular and panelized building systems.

Labor market dynamics increasingly favor prefabrication, as skilled construction workers become scarce and expensive. Factory-based manufacturing requires fewer on-site workers while maintaining higher productivity levels. Quality consistency demands from international investors and modern Vietnamese consumers also drive adoption of prefabricated building solutions that deliver superior and predictable results.

Environmental consciousness and sustainability requirements encourage prefabrication adoption due to reduced material waste, energy efficiency, and lower environmental impact compared to traditional construction methods.

Market restraints present challenges that may limit the full potential of Vietnam’s prefabricated buildings market, requiring strategic attention from industry participants and policymakers.

Initial capital requirements represent a significant barrier, as prefabricated building manufacturing requires substantial upfront investment in specialized equipment, facilities, and technology systems. Many local construction companies lack the financial resources to transition from traditional methods to prefabricated construction approaches, limiting market participation and competition.

Technical expertise limitations constrain market growth, as prefabrication requires specialized knowledge in design, manufacturing, and assembly processes. Vietnam’s construction workforce needs extensive training and skill development to effectively implement prefabricated building projects. The shortage of experienced engineers and technicians familiar with prefabrication technologies creates bottlenecks in project execution.

Regulatory challenges emerge from building codes and approval processes that were designed for traditional construction methods. Adapting regulations to accommodate innovative prefabrication approaches requires time and coordination among various government agencies. Standardization issues also complicate market development, as lack of unified standards for prefabricated components creates compatibility and quality assurance challenges.

Cultural resistance to new construction methods among some developers and end-users creates market adoption barriers. Traditional preferences for conventional construction approaches require education and demonstration of prefabricated building benefits to overcome resistance and build market acceptance.

Significant market opportunities exist within Vietnam’s prefabricated buildings sector, driven by evolving market conditions and emerging applications that promise substantial growth potential.

Government housing initiatives present major opportunities, as Vietnam implements large-scale affordable housing programs requiring rapid deployment of cost-effective building solutions. Prefabricated buildings align perfectly with government objectives for efficient, quality housing delivery. Social housing projects across major cities offer substantial market potential for modular and panelized building systems.

Industrial expansion creates opportunities as Vietnam continues attracting foreign manufacturing investment. International companies require modern, quickly deployable facilities that meet global standards, making prefabricated industrial buildings highly attractive. The growth of logistics and e-commerce sectors also drives demand for specialized warehouse and distribution facilities.

Technology advancement opportunities include integration of smart building systems, sustainable materials, and advanced manufacturing processes. Digital construction technologies like BIM and automated manufacturing create competitive advantages for early adopters. The development of Vietnam-specific prefabrication solutions tailored to local climate and cultural requirements represents significant market potential.

Regional expansion opportunities emerge as Vietnam-based prefabrication companies can serve neighboring Southeast Asian markets, leveraging cost advantages and growing expertise to capture regional market share in the broader ASEAN construction sector.

Market dynamics within Vietnam’s prefabricated buildings sector reflect complex interactions between supply-side capabilities, demand-side requirements, and external environmental factors that shape industry evolution.

Supply chain evolution demonstrates increasing sophistication as local manufacturers develop capabilities to produce high-quality prefabricated components. The establishment of specialized manufacturing facilities and the adoption of advanced production technologies enhance supply reliability and quality consistency. International partnerships between Vietnamese companies and global prefabrication leaders facilitate technology transfer and capability development.

Demand patterns show increasing sophistication among Vietnamese customers who now prioritize quality, speed, and sustainability alongside cost considerations. End-user preferences are shifting toward customizable solutions that combine prefabrication efficiency with design flexibility. The market demonstrates growing acceptance of prefabricated buildings across all major sectors, from residential to industrial applications.

Competitive dynamics intensify as more players enter the market, driving innovation and service improvement. Local companies compete with international entrants, creating a dynamic environment that benefits customers through improved offerings and competitive pricing. Collaboration trends emerge between traditional construction companies and prefabrication specialists, combining expertise to deliver comprehensive solutions.

Regulatory evolution supports market development as government agencies adapt policies and standards to accommodate prefabrication technologies, creating a more favorable operating environment for industry participants.

Comprehensive research methodology employed in analyzing Vietnam’s prefabricated buildings market incorporates multiple data sources and analytical approaches to ensure accurate and reliable market insights.

Primary research involves extensive interviews with key industry stakeholders including prefabricated building manufacturers, construction companies, developers, government officials, and end-users across Vietnam’s major economic centers. These interviews provide firsthand insights into market trends, challenges, and opportunities while validating secondary research findings through direct industry feedback.

Secondary research encompasses analysis of government statistics, industry reports, company financial statements, and construction industry publications to establish market baselines and identify trends. Data triangulation methods ensure accuracy by cross-referencing multiple sources and validating findings through different analytical approaches.

Market modeling techniques incorporate economic indicators, construction activity data, and industry growth patterns to develop comprehensive market assessments. Quantitative analysis examines market size, growth rates, and segmentation patterns while qualitative analysis explores market dynamics, competitive landscapes, and future trends.

Expert consultation with construction industry specialists, technology providers, and market analysts provides additional validation and insights into market developments. MarkWide Research methodologies ensure comprehensive coverage of all market aspects while maintaining analytical rigor and objectivity throughout the research process.

Regional market analysis reveals distinct patterns and opportunities across Vietnam’s diverse geographic and economic landscape, with each region contributing uniquely to the prefabricated buildings market development.

Southern Vietnam leads market development, centered around Ho Chi Minh City and surrounding provinces. This region accounts for approximately 45% of national prefabricated building demand, driven by intense urbanization, foreign investment concentration, and advanced manufacturing sector growth. The region’s established industrial zones and export-oriented manufacturing facilities create sustained demand for prefabricated industrial buildings.

Northern Vietnam represents approximately 35% of market activity, with Hanoi serving as the political and economic center driving government infrastructure projects and commercial development. The region benefits from proximity to China and established manufacturing capabilities, supporting both domestic demand and export opportunities for prefabricated building components.

Central Vietnam accounts for the remaining 20% of market share, with growing importance due to government development initiatives and emerging industrial zones. Cities like Da Nang and coastal provinces show increasing adoption of prefabricated construction for tourism infrastructure and manufacturing facilities.

Regional specialization emerges with different areas focusing on specific prefabrication applications – southern regions emphasizing industrial and commercial buildings, northern areas concentrating on residential and infrastructure projects, and central regions developing tourism and mixed-use applications.

Competitive landscape analysis reveals a dynamic market structure with diverse participants ranging from international corporations to specialized local manufacturers, each contributing unique capabilities to Vietnam’s prefabricated buildings market.

International players bring advanced technologies and global expertise to the Vietnamese market:

Local market leaders demonstrate growing capabilities and market presence:

Competitive strategies focus on technology advancement, local partnership development, and specialized market segment targeting to establish sustainable competitive advantages in Vietnam’s evolving construction market.

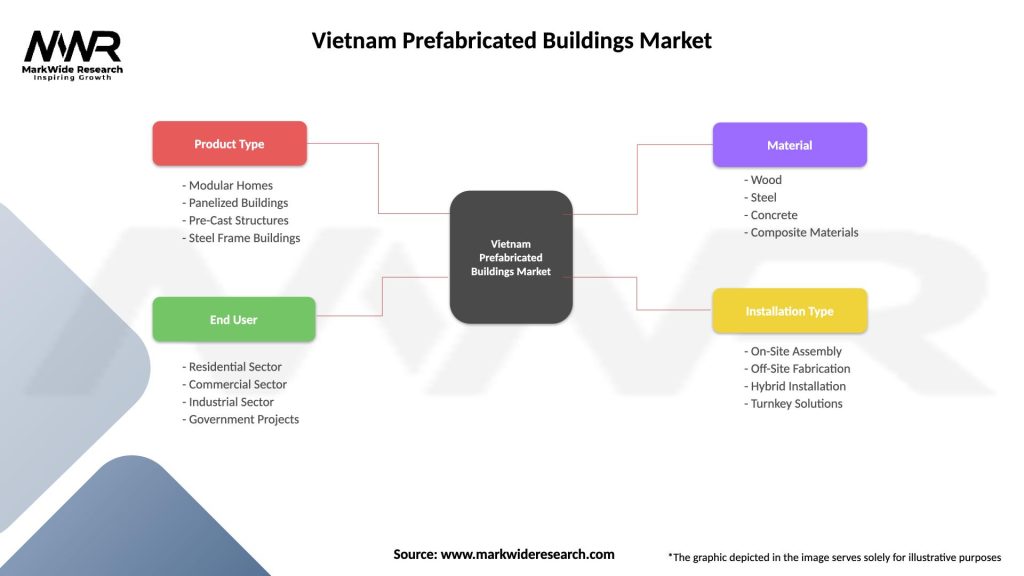

Market segmentation analysis provides comprehensive understanding of Vietnam’s prefabricated buildings market structure across multiple dimensions including technology type, application sector, and end-user categories.

By Technology Type:

By Application Sector:

By End-User Category:

Category-specific insights reveal distinct market dynamics and growth patterns across different segments of Vietnam’s prefabricated buildings market, each presenting unique opportunities and challenges.

Industrial Buildings Category demonstrates the strongest growth momentum, driven by Vietnam’s expanding manufacturing sector and foreign investment influx. Pre-engineered steel buildings dominate this segment due to their rapid deployment capabilities and cost-effectiveness for large-span structures. International manufacturers establishing operations in Vietnam particularly favor prefabricated industrial buildings for their speed-to-market advantages and quality consistency.

Residential Buildings Category shows increasing adoption, particularly in urban areas where housing demand exceeds supply. Modular construction gains traction for affordable housing projects, while panelized systems appeal to middle-income homebuyers seeking customization options. Government social housing initiatives significantly drive this segment’s growth potential.

Commercial Buildings Category exhibits steady expansion as Vietnam’s service sector grows and urbanization creates demand for modern office and retail facilities. Hybrid construction approaches combining traditional and prefabricated elements become popular, allowing developers to balance cost efficiency with architectural flexibility.

Infrastructure Category benefits from government investment in education, healthcare, and transportation facilities. Precast concrete systems dominate this segment due to durability requirements and standardization benefits. The category shows particular strength in educational facility construction where rapid deployment meets urgent capacity needs.

Industry participants and stakeholders realize substantial benefits from Vietnam’s prefabricated buildings market development, creating value across the entire construction ecosystem.

For Manufacturers:

For Developers and Contractors:

For End Users:

Comprehensive SWOT analysis provides strategic insights into Vietnam’s prefabricated buildings market position and future development potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Vietnam’s prefabricated buildings sector reflect broader construction industry evolution and specific local market dynamics that influence future development directions.

Digital Integration Trend accelerates as companies adopt Building Information Modeling (BIM), automated design systems, and digital manufacturing processes. Smart building technologies increasingly integrate with prefabricated systems, creating intelligent structures that optimize energy efficiency and operational performance. This trend enhances design precision while reducing errors and improving project coordination.

Sustainability Focus intensifies as environmental consciousness grows among developers and end-users. Green prefabrication incorporates sustainable materials, energy-efficient systems, and waste reduction strategies throughout the manufacturing and construction process. This trend aligns with Vietnam’s environmental goals and international sustainability standards.

Customization Capabilities expand as manufacturers develop flexible production systems that accommodate diverse customer requirements while maintaining efficiency benefits. Mass customization approaches enable personalized building solutions without sacrificing the cost and speed advantages of prefabrication.

Hybrid Construction Methods emerge as developers combine prefabricated components with traditional construction techniques to optimize project outcomes. This trend allows leveraging prefabrication benefits while accommodating specific design requirements and local construction practices.

Regional Integration develops as Vietnamese prefabrication companies expand into neighboring Southeast Asian markets, creating regional supply chains and service networks that enhance market opportunities and operational efficiency.

Significant industry developments demonstrate the dynamic evolution of Vietnam’s prefabricated buildings market through technological advancement, strategic partnerships, and market expansion initiatives.

Manufacturing Facility Expansion occurs as both local and international companies establish new production capabilities in Vietnam. Major steel producers like Hoa Phat Group invest in prefabricated building manufacturing lines, while international companies establish local operations to serve regional markets. These developments enhance supply capacity and reduce costs through local production.

Technology Transfer Partnerships facilitate knowledge sharing between international prefabrication leaders and Vietnamese companies. Joint ventures and licensing agreements enable local firms to access advanced technologies while international partners gain market access and cost advantages. These partnerships accelerate market development and capability building.

Government Policy Support includes revised building codes accommodating prefabricated construction methods and incentive programs promoting sustainable building practices. Regulatory streamlining reduces approval times for prefabricated building projects while maintaining safety and quality standards.

Educational Initiative Development addresses skill shortages through specialized training programs and university curricula focused on prefabrication technologies. Industry-academia collaboration ensures workforce development aligns with market needs and technological advancement.

Digital Platform Integration enables online design, ordering, and project management systems that streamline prefabricated building delivery. These platforms improve customer experience while enhancing operational efficiency for manufacturers and contractors.

Strategic analyst recommendations provide actionable insights for stakeholders seeking to optimize their position and performance in Vietnam’s evolving prefabricated buildings market.

For Market Entrants: Focus on establishing strong local partnerships and understanding Vietnamese construction practices and regulatory requirements. Technology localization strategies should adapt international prefabrication solutions to local climate conditions, cultural preferences, and economic constraints. Investment in local manufacturing capabilities provides cost advantages and market responsiveness.

For Existing Players: Prioritize capability expansion through technology upgrades and workforce development initiatives. Diversification strategies should explore multiple application sectors to reduce market risk and capture growth opportunities across residential, commercial, and industrial segments. MarkWide Research analysis suggests focusing on hybrid solutions that combine prefabrication efficiency with customization flexibility.

For Investors: Consider long-term market potential while acknowledging near-term challenges related to skill development and regulatory adaptation. Investment priorities should emphasize companies with strong technology capabilities, established market presence, and clear growth strategies. Due diligence should assess manufacturing capacity, quality systems, and management expertise.

For Policymakers: Continue regulatory modernization efforts while ensuring safety and quality standards. Infrastructure development supporting prefabrication logistics and workforce training programs will enhance market development and competitiveness.

Future market outlook for Vietnam’s prefabricated buildings sector indicates sustained growth potential driven by fundamental economic and social trends that support continued market expansion and development.

Growth trajectory projections suggest the market will maintain robust expansion over the next decade, with penetration rates expected to reach 25-30% of total construction activity by 2030. This growth reflects increasing market acceptance, improved capabilities, and supportive policy environments that favor prefabricated construction adoption across all major sectors.

Technology evolution will drive market transformation through advanced manufacturing systems, digital integration, and sustainable building solutions. Industry 4.0 technologies including robotics, artificial intelligence, and Internet of Things integration will enhance manufacturing efficiency and product capabilities. These technological advances will enable more sophisticated and customized prefabricated building solutions.

Market maturation will bring increased standardization, improved quality systems, and enhanced service capabilities. Supply chain development will create more efficient and reliable component delivery systems, while workforce development initiatives will address skill shortages and improve project execution capabilities.

Regional expansion opportunities will emerge as Vietnamese companies leverage cost advantages and growing expertise to serve broader Southeast Asian markets. Export potential for prefabricated components and complete building systems will create additional growth avenues beyond domestic demand.

Sustainability integration will become increasingly important as environmental regulations strengthen and market demand for green building solutions grows. MWR forecasts indicate that sustainable prefabrication technologies will capture 60% of market share by 2028, driven by both regulatory requirements and customer preferences.

Vietnam’s prefabricated buildings market represents a transformative opportunity within the country’s rapidly evolving construction sector. The market demonstrates strong fundamentals driven by economic growth, urbanization pressures, and increasing recognition of prefabrication benefits among industry stakeholders. Government support for sustainable construction practices and modern building technologies creates a favorable environment for continued market development.

Market dynamics indicate substantial growth potential as adoption rates increase across residential, commercial, industrial, and infrastructure sectors. The combination of cost efficiency, quality improvement, and construction speed advantages positions prefabricated buildings as essential solutions for Vietnam’s development needs. Technology advancement and international partnerships further enhance market competitiveness and capability development.

Strategic opportunities exist for both local and international participants willing to invest in manufacturing capabilities, workforce development, and technology advancement. The market’s evolution toward greater sophistication and customization creates differentiation opportunities while maintaining core efficiency benefits. Regional expansion potential adds another dimension of growth opportunity for successful market participants.

Future success in Vietnam’s prefabricated buildings market will depend on understanding local requirements, developing appropriate technology solutions, and building strong partnerships across the construction value chain. Companies that effectively combine international expertise with local market knowledge will be best positioned to capture the significant opportunities presented by this dynamic and growing market sector.

What is Prefabricated Buildings?

Prefabricated buildings are structures that are manufactured off-site in advance, typically in standard sections that can be easily transported and assembled. They are commonly used in residential, commercial, and industrial applications due to their efficiency and cost-effectiveness.

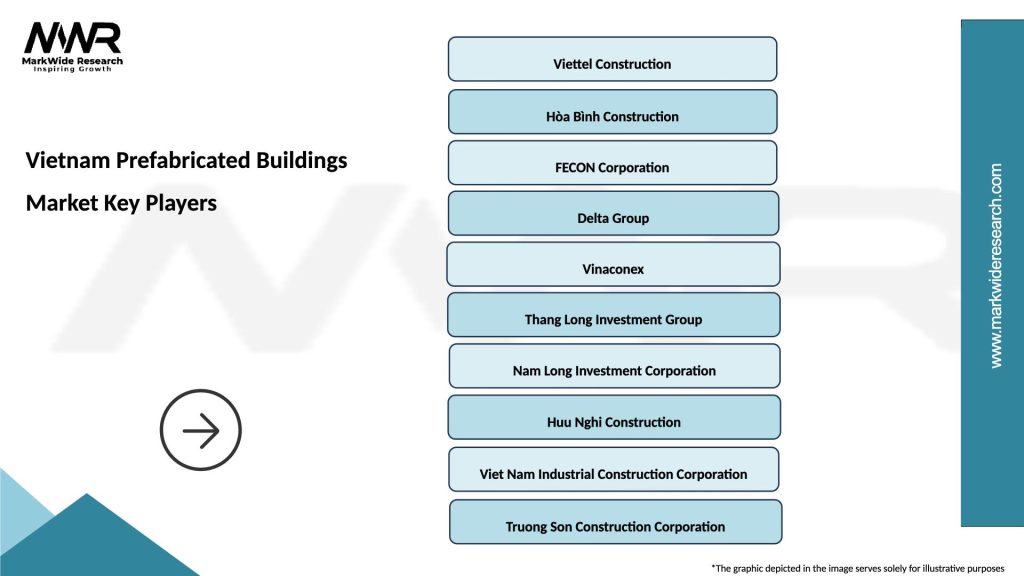

What are the key players in the Vietnam Prefabricated Buildings Market?

Key players in the Vietnam Prefabricated Buildings Market include companies like Hòa Bình Construction Group, Coteccons, and Hanco 2. These companies are known for their innovative designs and contributions to the construction sector, among others.

What are the growth factors driving the Vietnam Prefabricated Buildings Market?

The growth of the Vietnam Prefabricated Buildings Market is driven by factors such as rapid urbanization, increasing demand for affordable housing, and the need for sustainable construction practices. Additionally, the efficiency of prefabricated methods reduces construction time and labor costs.

What challenges does the Vietnam Prefabricated Buildings Market face?

Challenges in the Vietnam Prefabricated Buildings Market include regulatory hurdles, limited consumer awareness, and competition from traditional construction methods. These factors can hinder the adoption of prefabricated solutions in certain regions.

What opportunities exist in the Vietnam Prefabricated Buildings Market?

The Vietnam Prefabricated Buildings Market presents opportunities in sectors such as modular housing, commercial buildings, and disaster relief structures. As the government promotes infrastructure development, there is potential for increased investment in prefabricated technologies.

What trends are shaping the Vietnam Prefabricated Buildings Market?

Trends in the Vietnam Prefabricated Buildings Market include the integration of smart technologies, sustainable materials, and customization options for consumers. These innovations are enhancing the appeal of prefabricated buildings in various sectors.

Vietnam Prefabricated Buildings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Homes, Panelized Buildings, Pre-Cast Structures, Steel Frame Buildings |

| End User | Residential Sector, Commercial Sector, Industrial Sector, Government Projects |

| Material | Wood, Steel, Concrete, Composite Materials |

| Installation Type | On-Site Assembly, Off-Site Fabrication, Hybrid Installation, Turnkey Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Prefabricated Buildings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at