444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam plastic caps and closures market represents a dynamic and rapidly expanding segment within the country’s packaging industry. This market encompasses a comprehensive range of closure solutions including screw caps, snap-on lids, dispensing closures, and specialty caps designed for various applications across food and beverage, pharmaceutical, personal care, and industrial sectors. Vietnam’s strategic position in Southeast Asia, combined with its growing manufacturing capabilities and increasing consumer demand, has positioned the country as a significant player in the regional plastic caps and closures landscape.

Market dynamics indicate robust growth driven by expanding domestic consumption, rising export activities, and increasing adoption of modern packaging solutions. The market benefits from Vietnam’s competitive manufacturing costs, skilled workforce, and favorable government policies supporting industrial development. With the country experiencing sustained economic growth at approximately 6.8% annually, the demand for packaged goods continues to surge, directly impacting the plastic caps and closures market.

Manufacturing infrastructure in Vietnam has witnessed substantial improvements, with numerous international companies establishing production facilities to serve both domestic and regional markets. The market demonstrates strong potential for continued expansion, supported by increasing urbanization, changing consumer lifestyles, and growing awareness of product safety and quality standards.

The Vietnam plastic caps and closures market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of plastic-based closure solutions used across various packaging applications within Vietnam’s borders. This market encompasses all types of plastic caps, lids, closures, and sealing mechanisms designed to secure, preserve, and facilitate the dispensing of products ranging from beverages and food items to pharmaceuticals and personal care products.

Plastic caps and closures serve multiple critical functions including product protection, freshness preservation, tamper evidence, child resistance, and brand differentiation. These components are manufactured using various plastic materials such as polyethylene, polypropylene, polyethylene terephthalate, and specialized engineering plastics, each selected based on specific application requirements and performance characteristics.

The market includes both standard closure solutions and customized designs tailored to meet specific client requirements, regulatory compliance standards, and consumer preferences within the Vietnamese market context.

Vietnam’s plastic caps and closures market demonstrates exceptional growth potential driven by robust domestic demand and expanding export opportunities. The market benefits from the country’s strategic geographic location, competitive manufacturing costs, and increasingly sophisticated consumer preferences. Key growth drivers include rapid urbanization, rising disposable incomes, and growing demand for packaged goods across multiple sectors.

Manufacturing capabilities have expanded significantly, with both domestic and international companies investing in advanced production technologies and quality systems. The market shows strong diversification across application segments, with food and beverage applications accounting for approximately 45% of total demand, followed by personal care and pharmaceutical applications.

Technological advancement remains a critical factor, with manufacturers increasingly adopting automation, precision molding technologies, and sustainable materials to meet evolving market requirements. The market demonstrates resilience and adaptability, positioning Vietnam as an attractive destination for plastic caps and closures manufacturing and sourcing activities.

Strategic market insights reveal several critical factors shaping the Vietnam plastic caps and closures landscape:

Economic growth serves as the primary catalyst for Vietnam’s plastic caps and closures market expansion. The country’s sustained GDP growth, rising per capita income, and expanding middle class create favorable conditions for increased consumption of packaged goods. Urbanization trends contribute significantly to market growth, with urban populations demonstrating higher consumption rates of packaged products requiring quality closure solutions.

Manufacturing sector development drives substantial demand for plastic caps and closures. Vietnam’s emergence as a manufacturing hub for food processing, beverage production, pharmaceutical manufacturing, and personal care products creates consistent demand for reliable closure solutions. The government’s industrial development policies and infrastructure investments further support market expansion.

Export opportunities represent a crucial growth driver, with Vietnam’s competitive manufacturing costs and strategic location enabling companies to serve regional and global markets effectively. Trade agreements and improved logistics infrastructure facilitate market access and expansion opportunities.

Consumer behavior changes toward convenience, product safety, and quality drive demand for advanced closure solutions. Growing awareness of food safety, product authenticity, and environmental considerations influences purchasing decisions and market dynamics.

Raw material price volatility presents significant challenges for plastic caps and closures manufacturers in Vietnam. Fluctuations in petroleum-based plastic resin prices directly impact production costs and profit margins, requiring companies to implement effective cost management strategies and supply chain optimization.

Environmental regulations and sustainability concerns create compliance challenges and additional costs for manufacturers. Increasing restrictions on single-use plastics and growing consumer preference for eco-friendly alternatives require substantial investments in research, development, and production technology upgrades.

Competition from alternative materials such as metal closures, cork stoppers, and biodegradable materials poses challenges to traditional plastic closure applications. Companies must continuously innovate and differentiate their products to maintain market position and competitiveness.

Technical complexity in meeting diverse application requirements across different industries creates operational challenges. Manufacturers must maintain expertise in multiple technologies, materials, and quality standards while managing production efficiency and cost effectiveness.

Sustainable packaging solutions present substantial opportunities for innovation and market expansion. Growing environmental consciousness among consumers and regulatory pressure create demand for recyclable, biodegradable, and reduced-plastic closure solutions. Companies investing in sustainable technologies and materials can capture significant market share and premium pricing opportunities.

Smart packaging integration offers promising growth prospects through the development of intelligent closures incorporating RFID technology, QR codes, and tamper-evident features. These advanced solutions provide enhanced product security, traceability, and consumer engagement capabilities.

Regional export expansion represents a major opportunity, with Vietnam’s strategic location and competitive manufacturing capabilities positioning the country to serve growing Southeast Asian, Middle Eastern, and African markets. Trade facilitation initiatives and logistics improvements support export growth potential.

Value-added services including custom design, rapid prototyping, and integrated packaging solutions create opportunities for differentiation and higher margins. Companies offering comprehensive closure solutions with technical support and customization capabilities can establish strong competitive positions.

Supply chain dynamics in Vietnam’s plastic caps and closures market demonstrate increasing sophistication and integration. Manufacturers are establishing closer relationships with raw material suppliers, implementing just-in-time inventory systems, and developing regional distribution networks to optimize costs and service levels. Vertical integration strategies enable companies to control quality, reduce costs, and improve responsiveness to customer requirements.

Technology adoption patterns show accelerating investment in automation, precision molding equipment, and quality control systems. Advanced manufacturing technologies enable production efficiency improvements of approximately 25-30% while enhancing product consistency and quality. Digital transformation initiatives including IoT integration and data analytics optimize production processes and predictive maintenance.

Customer relationship dynamics evolve toward partnership-based models with increased collaboration on product development, sustainability initiatives, and supply chain optimization. Long-term contracts and strategic partnerships provide stability and growth opportunities for both manufacturers and customers.

Regulatory dynamics continue to strengthen, with enhanced food safety standards, pharmaceutical regulations, and environmental compliance requirements shaping product development and manufacturing processes. Companies must maintain robust quality systems and regulatory expertise to ensure market access and compliance.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, manufacturers, distributors, and end-users across Vietnam’s major industrial regions. Survey methodologies capture quantitative data on market trends, pricing dynamics, and growth projections from representative sample groups.

Secondary research incorporates analysis of government statistics, industry reports, trade data, and regulatory documentation to provide comprehensive market context. Financial analysis of key market participants provides insights into competitive positioning, performance trends, and strategic directions.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and identify growth opportunities. Cross-validation of findings through multiple data sources ensures reliability and reduces analytical bias.

Expert validation processes involve consultation with industry specialists, regulatory experts, and technology professionals to verify findings and enhance analytical depth. Continuous monitoring and updating of research findings ensure currency and relevance of market insights.

Northern Vietnam represents the largest regional market, anchored by the Hanoi metropolitan area and surrounding industrial zones. This region accounts for approximately 35% of national demand, driven by concentrated manufacturing activities, government institutions, and growing urban population. The region benefits from excellent transportation infrastructure and proximity to China, facilitating both domestic distribution and export activities.

Southern Vietnam, centered around Ho Chi Minh City, constitutes the second-largest market segment with roughly 40% market share. This region demonstrates the highest growth rates due to rapid industrialization, foreign investment concentration, and dynamic consumer markets. The presence of major ports and logistics infrastructure supports both domestic and international trade activities.

Central Vietnam shows emerging growth potential, particularly in coastal areas with developing industrial zones and tourism-related packaging demands. While representing a smaller market share currently, this region demonstrates above-average growth rates of 8-10% annually as infrastructure development and industrial investment accelerate.

Regional specialization patterns emerge with northern regions focusing on automotive and industrial applications, southern regions emphasizing food and beverage packaging, and central regions developing pharmaceutical and personal care market segments.

Market leadership in Vietnam’s plastic caps and closures sector features a mix of international corporations, regional players, and domestic manufacturers. The competitive environment demonstrates increasing consolidation as companies seek scale advantages and market expansion opportunities.

Competitive strategies emphasize technological innovation, sustainability initiatives, customer service excellence, and cost optimization. Companies invest heavily in research and development, automation technologies, and market expansion to maintain competitive advantages.

By Material Type:

By Application:

By Closure Type:

Food and beverage applications dominate the Vietnam plastic caps and closures market, driven by expanding domestic consumption and growing export activities. This segment benefits from increasing consumer preference for packaged foods, rising health consciousness, and convenience-oriented lifestyles. Innovation focus includes development of barrier-enhanced closures, easy-open features, and portion control solutions.

Pharmaceutical applications demonstrate the highest growth rates due to Vietnam’s expanding healthcare sector and aging population. This segment requires stringent quality standards, regulatory compliance, and specialized features such as child resistance and tamper evidence. Market opportunities include development of smart closures with dosage tracking and authentication capabilities.

Personal care applications show strong growth potential driven by rising disposable incomes, urbanization, and increasing beauty consciousness among Vietnamese consumers. This segment emphasizes aesthetic appeal, functionality, and sustainability, creating opportunities for premium closure solutions and innovative dispensing mechanisms.

Industrial applications provide stable demand from Vietnam’s growing manufacturing sector, including automotive, chemicals, and construction industries. This segment requires specialized closure solutions with enhanced chemical resistance, durability, and safety features.

Manufacturers benefit from Vietnam’s competitive cost structure, skilled workforce, and strategic geographic location for serving regional markets. Access to growing domestic demand provides stable revenue base while export opportunities enable scale economies and market diversification. Government support through industrial development policies and infrastructure investments creates favorable operating environment.

End-users gain access to high-quality closure solutions at competitive prices, enabling cost-effective packaging strategies and improved product protection. Local manufacturing capabilities ensure reliable supply chains, reduced lead times, and enhanced customer service. Customization capabilities allow for tailored solutions meeting specific application requirements.

Investors find attractive opportunities in Vietnam’s growing plastic caps and closures market, supported by strong economic fundamentals, expanding industrial base, and favorable demographic trends. Market growth potential offers promising returns while diversification across application segments reduces risk exposure.

Consumers benefit from improved product quality, safety, and convenience through advanced closure technologies and enhanced packaging solutions. Growing competition drives innovation and value improvement while maintaining affordable pricing levels.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping Vietnam’s plastic caps and closures market. Manufacturers increasingly invest in recyclable materials, biodegradable alternatives, and circular economy initiatives. Consumer awareness drives demand for environmentally responsible packaging solutions, creating opportunities for companies leading sustainability initiatives.

Smart packaging integration emerges as a key differentiator, with closures incorporating RFID tags, QR codes, and NFC technology for enhanced product authentication, traceability, and consumer engagement. These technologies address growing concerns about product counterfeiting and provide valuable data for supply chain optimization.

Automation advancement accelerates across manufacturing operations, with companies investing in robotic systems, AI-powered quality control, and IoT-enabled production monitoring. These technologies improve efficiency by approximately 20-25% while enhancing product consistency and reducing labor costs.

Customization demand increases as brands seek differentiation through unique closure designs, colors, and functionality. Mass customization capabilities enable manufacturers to serve diverse customer requirements while maintaining production efficiency and cost competitiveness.

Manufacturing capacity expansion continues across Vietnam, with both domestic and international companies investing in new production facilities and technology upgrades. Recent developments include establishment of advanced injection molding facilities, implementation of Industry 4.0 technologies, and development of specialized production lines for high-value applications.

Strategic partnerships reshape the competitive landscape, with manufacturers forming alliances for technology sharing, market access, and supply chain optimization. MarkWide Research indicates that strategic collaborations have increased by 18% annually as companies seek to enhance capabilities and market reach.

Regulatory developments include strengthened food safety standards, enhanced pharmaceutical packaging requirements, and new environmental regulations affecting plastic usage. These changes drive investment in compliance systems and sustainable technologies while creating barriers for non-compliant manufacturers.

Innovation initiatives focus on development of barrier-enhanced closures, child-resistant mechanisms, and smart packaging solutions. Research and development investments increase as companies seek to differentiate products and capture premium market segments.

Investment prioritization should focus on sustainable technologies and materials to address growing environmental concerns and regulatory requirements. Companies investing early in recyclable and biodegradable closure solutions will capture significant competitive advantages as market preferences shift toward sustainability.

Technology advancement through automation and digitalization offers substantial opportunities for efficiency improvement and quality enhancement. MWR analysis suggests that companies implementing comprehensive automation strategies achieve productivity improvements of 30-35% while reducing operational costs.

Market diversification across application segments and geographic regions reduces risk exposure and creates multiple growth opportunities. Companies should develop capabilities in high-growth segments such as pharmaceuticals and personal care while maintaining strength in traditional food and beverage applications.

Partnership strategies enable access to new technologies, markets, and capabilities without requiring substantial capital investment. Strategic alliances with technology providers, raw material suppliers, and distribution partners create competitive advantages and accelerate market expansion.

Long-term growth prospects for Vietnam’s plastic caps and closures market remain highly positive, supported by sustained economic development, expanding manufacturing sector, and growing consumer markets. The market is projected to maintain robust growth rates of 7-9% annually over the next five years, driven by both domestic consumption and export expansion.

Technology evolution will continue transforming the industry, with smart packaging, sustainable materials, and advanced manufacturing processes becoming standard requirements rather than competitive differentiators. Companies must invest continuously in innovation and technology adoption to maintain market position.

Sustainability imperative will reshape product development, manufacturing processes, and supply chain strategies. Environmental considerations will become primary factors in purchasing decisions, creating significant opportunities for companies leading sustainable innovation initiatives.

Regional integration through trade agreements and economic partnerships will enhance Vietnam’s position as a regional manufacturing hub, creating additional export opportunities and attracting foreign investment. MarkWide Research projects that export activities will account for approximately 55-60% of total production by 2028, reflecting Vietnam’s growing competitiveness in global markets.

Vietnam’s plastic caps and closures market presents exceptional opportunities for growth and development, supported by strong economic fundamentals, expanding industrial base, and favorable demographic trends. The market demonstrates resilience, adaptability, and significant potential for continued expansion across multiple application segments and geographic markets.

Strategic success factors include investment in sustainable technologies, automation and digitalization, market diversification, and strategic partnerships. Companies positioning themselves as leaders in sustainability, innovation, and customer service will capture the greatest opportunities in this dynamic and evolving market.

Future market leadership will belong to companies that successfully balance cost competitiveness with quality excellence, environmental responsibility with commercial viability, and local market expertise with global capabilities. Vietnam’s plastic caps and closures market offers a compelling investment proposition for companies seeking growth opportunities in one of Asia’s most dynamic economies.

What is Plastic Caps and Closures?

Plastic caps and closures are devices used to seal containers, ensuring the contents remain secure and uncontaminated. They are commonly used in various industries, including food and beverage, pharmaceuticals, and personal care products.

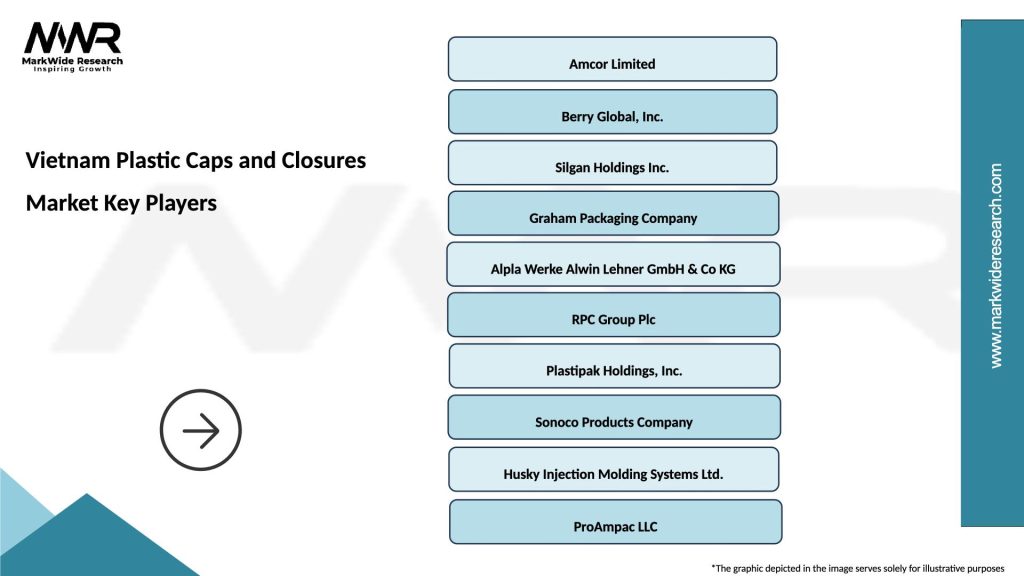

What are the key players in the Vietnam Plastic Caps and Closures Market?

Key players in the Vietnam Plastic Caps and Closures Market include companies like Amcor, Berry Global, and Silgan Holdings, which are known for their innovative packaging solutions and extensive product ranges, among others.

What are the growth factors driving the Vietnam Plastic Caps and Closures Market?

The growth of the Vietnam Plastic Caps and Closures Market is driven by increasing demand for packaged food and beverages, rising consumer awareness regarding product safety, and the expansion of the e-commerce sector.

What challenges does the Vietnam Plastic Caps and Closures Market face?

Challenges in the Vietnam Plastic Caps and Closures Market include environmental concerns related to plastic waste, regulatory pressures for sustainable packaging, and competition from alternative closure materials.

What opportunities exist in the Vietnam Plastic Caps and Closures Market?

Opportunities in the Vietnam Plastic Caps and Closures Market include the development of biodegradable and recyclable materials, innovations in design for enhanced user convenience, and the growing trend of personalized packaging solutions.

What trends are shaping the Vietnam Plastic Caps and Closures Market?

Trends in the Vietnam Plastic Caps and Closures Market include the increasing adoption of smart packaging technologies, a shift towards sustainable materials, and the rise of customization in packaging to meet consumer preferences.

Vietnam Plastic Caps and Closures Market

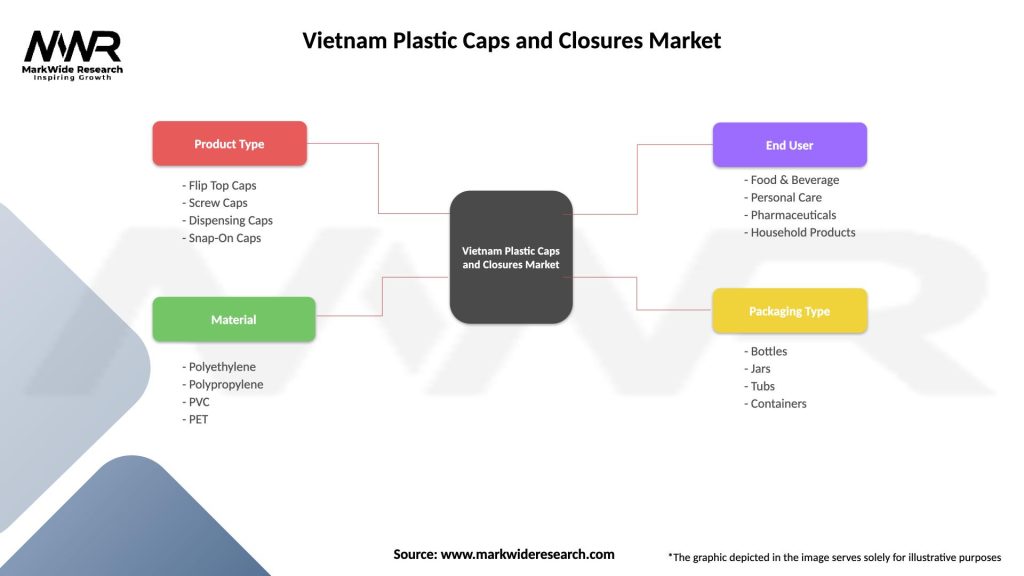

| Segmentation Details | Description |

|---|---|

| Product Type | Flip Top Caps, Screw Caps, Dispensing Caps, Snap-On Caps |

| Material | Polyethylene, Polypropylene, PVC, PET |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Bottles, Jars, Tubs, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Plastic Caps and Closures Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at