444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam pet industry market has emerged as one of the most dynamic and rapidly expanding sectors in Southeast Asia, reflecting the country’s evolving socioeconomic landscape and changing consumer attitudes toward pet ownership. Vietnamese consumers are increasingly embracing pets as family members, driving unprecedented demand for premium pet products, veterinary services, and specialized pet care solutions. This transformation represents a significant shift from traditional views of animals as primarily functional to companions deserving quality care and attention.

Market dynamics in Vietnam’s pet industry are characterized by robust growth across multiple segments, with pet food representing the largest category, followed by veterinary services and pet accessories. The market demonstrates exceptional resilience and growth potential, supported by rising disposable incomes, urbanization trends, and increasing awareness of pet health and wellness. Growth rates consistently exceed regional averages, with the industry experiencing a remarkable 15.2% annual growth rate over the past three years.

Consumer behavior patterns reveal a strong preference for premium and imported pet products, particularly among urban millennials and Gen Z demographics who prioritize quality and brand reputation. The market’s expansion is further accelerated by digital transformation, with e-commerce platforms and social media significantly influencing purchasing decisions and brand awareness. Pet ownership rates have increased by approximately 23% annually in major Vietnamese cities, indicating sustained market momentum.

The Vietnam pet industry market refers to the comprehensive ecosystem of businesses, products, and services dedicated to companion animal care and welfare within Vietnam’s borders. This market encompasses pet food manufacturing and distribution, veterinary healthcare services, pet accessories and toys, grooming services, pet insurance, boarding facilities, and emerging segments such as pet technology and wellness products.

Industry scope extends beyond traditional pet care to include specialized services such as pet training, behavioral consultation, luxury pet hotels, and premium nutrition solutions. The market represents the economic value generated through the ownership, care, and maintenance of companion animals, primarily dogs and cats, though increasingly including exotic pets, birds, and aquatic species. Market participants range from multinational corporations to local entrepreneurs, creating a diverse and competitive landscape that serves Vietnam’s growing pet-owning population.

Vietnam’s pet industry stands at the forefront of the country’s consumer market transformation, driven by demographic shifts, economic prosperity, and evolving lifestyle preferences. The market demonstrates exceptional growth momentum, with pet food dominating revenue generation while veterinary services and premium accessories experience rapid expansion. Urban centers including Ho Chi Minh City and Hanoi lead market development, accounting for approximately 68% of total industry activity.

Key market drivers include increasing pet humanization trends, rising disposable incomes among middle-class consumers, and growing awareness of pet health and nutrition. The industry benefits from favorable demographic trends, with younger generations showing higher propensity for pet ownership and premium spending. Digital adoption accelerates market growth, with online sales channels experiencing 42% year-over-year growth and social media platforms driving brand engagement and product discovery.

Competitive landscape features a mix of international brands and emerging local players, with foreign companies leveraging brand recognition while domestic enterprises capitalize on local market knowledge and cost advantages. The market’s future trajectory appears highly promising, supported by continued urbanization, income growth, and evolving consumer preferences toward premium pet care solutions.

Strategic market insights reveal several critical trends shaping Vietnam’s pet industry landscape. The market demonstrates strong segmentation patterns, with distinct consumer preferences emerging across different demographic groups and geographic regions. Premium product adoption accelerates among affluent urban consumers, while price-sensitive segments drive demand for value-oriented offerings.

Economic prosperity serves as the primary catalyst for Vietnam’s pet industry expansion, with rising disposable incomes enabling consumers to allocate greater resources toward pet care and premium products. The country’s sustained economic growth creates favorable conditions for discretionary spending, with pet-related expenses increasingly viewed as essential rather than luxury expenditures. Middle-class expansion particularly drives market growth, as this demographic demonstrates highest propensity for pet ownership and premium spending.

Urbanization trends significantly influence market dynamics, with city dwellers more likely to own pets and invest in quality pet care products and services. Urban environments create demand for convenient pet care solutions, specialized services, and premium products that align with modern lifestyles. Demographic shifts toward smaller family sizes and delayed marriage contribute to pet adoption as emotional companions, driving sustained market demand.

Cultural evolution represents another crucial driver, with Vietnamese society increasingly embracing Western attitudes toward pet ownership and animal welfare. Social media influence and exposure to international pet care standards elevate consumer expectations and willingness to invest in pet health and happiness. Health consciousness extends to pet care, with owners increasingly prioritizing preventive healthcare, premium nutrition, and wellness products for their companions.

Digital transformation accelerates market accessibility and growth, with e-commerce platforms, mobile applications, and social media marketing expanding reach and convenience for consumers. Online channels enable access to international brands and specialized products previously unavailable in traditional retail environments, driving market sophistication and consumer education.

Economic sensitivity poses significant challenges for Vietnam’s pet industry, as pet-related expenses remain discretionary for many consumers despite growing acceptance. Economic downturns or income instability can quickly impact spending on premium pet products and non-essential services, creating market volatility. Price consciousness among Vietnamese consumers limits adoption of high-priced imported products and specialized services, particularly in price-sensitive segments.

Regulatory challenges create barriers for market participants, with complex import regulations, licensing requirements, and quality standards potentially limiting product availability and increasing operational costs. Inconsistent enforcement and evolving regulatory frameworks create uncertainty for businesses seeking to enter or expand within the Vietnamese market. Infrastructure limitations in rural areas and secondary cities restrict market penetration and service delivery capabilities.

Cultural barriers persist in certain demographic segments and regions, where traditional attitudes toward animals may conflict with modern pet care concepts. Older generations and rural populations may demonstrate resistance to premium pet spending, limiting market expansion potential. Limited veterinary infrastructure in some regions constrains access to professional pet healthcare services, potentially impacting overall market development.

Supply chain complexities affect product availability and pricing, particularly for imported goods subject to customs procedures, quality inspections, and distribution challenges. Limited local manufacturing capabilities for specialized pet products create dependency on imports, potentially affecting pricing competitiveness and supply reliability.

Untapped market segments present substantial growth opportunities, particularly in secondary cities and affluent rural areas where pet ownership rates remain below urban centers. Expanding distribution networks and tailored marketing strategies could unlock significant market potential in these underserved regions. Product innovation opportunities exist in developing locally-manufactured premium pet foods and accessories that combine international quality standards with competitive pricing.

Service sector expansion offers promising growth avenues, with pet grooming, training, boarding, and specialized healthcare services experiencing strong demand growth. Professional pet services remain underdeveloped relative to market demand, creating opportunities for both domestic and international service providers. Technology integration presents emerging opportunities in smart pet products, health monitoring devices, and digital platforms for pet care management.

E-commerce development continues to offer substantial growth potential, with online penetration rates still below developed markets despite rapid growth. Mobile commerce and social commerce platforms provide additional channels for reaching tech-savvy consumers and expanding market access. Subscription services for pet food delivery, healthcare monitoring, and regular grooming represent innovative business models with strong growth potential.

Export opportunities may emerge as Vietnamese pet product manufacturers develop capabilities and quality standards suitable for regional markets. Local companies could leverage cost advantages and regional market knowledge to compete in neighboring Southeast Asian countries. Partnership opportunities exist between international brands and local distributors or manufacturers, combining global expertise with local market access.

Supply and demand dynamics in Vietnam’s pet industry reflect the market’s rapid evolution and growing sophistication. Demand consistently outpaces supply in premium segments, creating opportunities for new entrants and product innovations. Consumer preferences shift toward higher-quality products and specialized services, driving market premiumization and value chain development.

Competitive dynamics intensify as both international and domestic players vie for market share across different segments and price points. International brands leverage superior product quality and brand recognition, while local companies compete through pricing advantages and market accessibility. Market consolidation trends emerge in certain segments, with successful companies acquiring smaller players to expand market presence and capabilities.

Innovation cycles accelerate as companies invest in product development, service enhancement, and technology integration to differentiate offerings and capture consumer attention. Distribution evolution transforms market access, with traditional retail channels complemented by e-commerce platforms, specialty pet stores, and direct-to-consumer models.

Pricing dynamics reflect market segmentation, with premium products commanding higher margins while value segments remain price-competitive. Currency fluctuations and import costs influence pricing strategies for international brands, while local manufacturers benefit from cost stability and competitive positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes consumer surveys, industry interviews, and focus groups conducted across major Vietnamese cities to capture diverse perspectives and market insights. Secondary research incorporates industry reports, government statistics, trade association data, and company financial information to provide comprehensive market understanding.

Data collection methods combine quantitative and qualitative approaches, utilizing structured questionnaires for statistical analysis and in-depth interviews for nuanced market insights. Consumer behavior analysis examines purchasing patterns, brand preferences, and spending habits across different demographic segments. Industry expert consultations provide professional perspectives on market trends, challenges, and future opportunities.

Market sizing methodologies employ multiple approaches including top-down analysis using macroeconomic indicators and bottom-up calculations based on consumer spending patterns and industry participation rates. Forecasting models incorporate historical trends, economic projections, and demographic changes to project future market development scenarios.

Quality assurance measures include data triangulation, expert validation, and cross-referencing with multiple sources to ensure research accuracy and reliability. Regular market monitoring and updates maintain research currency and relevance for strategic decision-making purposes.

Ho Chi Minh City dominates Vietnam’s pet industry landscape, accounting for approximately 35% of total market activity and serving as the primary hub for premium pet products and services. The city’s affluent consumer base, international exposure, and developed retail infrastructure create ideal conditions for market growth and innovation. Consumer sophistication in Ho Chi Minh City drives demand for imported brands, specialized services, and premium pet care solutions.

Hanoi region represents the second-largest market concentration, contributing roughly 28% of industry revenue with strong growth in veterinary services and pet accessories. The capital’s educated population and government employee base demonstrate consistent spending patterns and brand loyalty. Northern Vietnam markets show increasing adoption of modern pet care practices, though at slower rates than southern regions.

Da Nang and central Vietnam emerge as growth markets, with rising disposable incomes and urbanization driving pet ownership rates higher. These regions demonstrate preference for value-oriented products while gradually embracing premium offerings. Coastal cities show particular strength in pet services and grooming sectors, reflecting lifestyle-oriented consumer preferences.

Rural and secondary urban markets present significant untapped potential, with traditional attitudes toward pets gradually evolving toward companion animal concepts. These regions require tailored marketing approaches and distribution strategies to overcome infrastructure and cultural barriers. Regional expansion strategies focus on education, accessibility, and value proposition development to capture emerging market opportunities.

Market leadership in Vietnam’s pet industry features a diverse mix of international corporations, regional players, and emerging local companies competing across multiple segments and price points. The competitive environment demonstrates healthy rivalry with opportunities for differentiation through product quality, service excellence, and market positioning strategies.

Competitive strategies vary significantly across market segments, with premium brands emphasizing quality, health benefits, and brand heritage, while value-oriented players focus on accessibility, pricing, and broad distribution. Innovation competition intensifies in product development, packaging, and marketing approaches to capture consumer attention and loyalty.

Product-based segmentation reveals distinct market categories with varying growth rates and competitive dynamics. Pet food represents the largest segment, followed by veterinary services, pet accessories, and emerging categories such as pet technology and wellness products. Consumer segmentation identifies key demographic groups with distinct preferences, spending patterns, and brand loyalties.

By Product Category:

By Pet Type:

Pet food category demonstrates the strongest market performance with consistent growth across all price segments and product types. Premium and super-premium segments experience the fastest growth rates, driven by increasing health consciousness and willingness to invest in quality nutrition. Dry food products dominate sales volume while wet food and treats show higher growth rates and profit margins.

Veterinary services sector experiences rapid expansion with new clinics opening regularly in urban centers and growing acceptance of preventive healthcare concepts. Specialized services including dental care, surgery, and diagnostic imaging become increasingly available and utilized by pet owners. Mobile veterinary services and telemedicine consultations emerge as innovative service delivery models.

Pet accessories market shows strong growth in fashion and lifestyle products, reflecting the humanization of pets and desire for self-expression through pet ownership. Functional accessories such as carriers, leashes, and safety products maintain steady demand while luxury items experience higher growth rates among affluent consumers.

Grooming segment transitions from basic hygiene services to comprehensive wellness and beauty treatments, with professional grooming salons becoming social destinations for pet owners. DIY grooming products gain popularity among cost-conscious consumers seeking to maintain pet appearance between professional sessions.

Market participants benefit from Vietnam’s pet industry growth through multiple value creation opportunities and competitive advantages. The expanding market provides revenue growth potential, brand building opportunities, and platform for innovation and market leadership development. Manufacturers gain access to a rapidly growing consumer base with increasing purchasing power and sophistication.

Retailers and distributors benefit from expanding product categories, higher margin opportunities, and growing consumer engagement in pet-related purchases. The market’s growth creates opportunities for specialization, premium positioning, and customer relationship development. Service providers capitalize on increasing demand for professional pet care, creating sustainable business models and community connections.

International companies gain entry to a high-growth emerging market with favorable demographic trends and increasing consumer sophistication. Vietnam’s strategic location provides potential regional expansion opportunities and manufacturing cost advantages. Local entrepreneurs benefit from market knowledge advantages, cost competitiveness, and ability to serve underserved market segments.

Consumers benefit from increasing product variety, service availability, and competitive pricing as market competition intensifies. Pet welfare improves through better nutrition, healthcare access, and professional services availability, contributing to longer, healthier pet lives and stronger human-animal bonds.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trend dominates Vietnam’s pet industry evolution, with consumers increasingly willing to invest in higher-quality products and services for their pets. This trend reflects growing pet humanization and recognition of pets as family members deserving quality care. Health and wellness focus drives demand for organic, natural, and specialized nutrition products, creating opportunities for premium brand positioning.

Digital transformation reshapes market dynamics through e-commerce growth, social media marketing, and mobile commerce adoption. Online platforms provide access to international brands and specialized products while enabling convenient purchasing and delivery services. Social media influence significantly impacts brand awareness and purchasing decisions, particularly among younger demographics.

Service sector expansion reflects evolving consumer expectations and willingness to outsource pet care responsibilities to professionals. Pet grooming, training, boarding, and healthcare services experience strong growth as urban lifestyles create demand for convenient, professional solutions. Subscription services emerge as popular business models for regular pet food delivery and healthcare monitoring.

Sustainability consciousness begins influencing consumer preferences, with environmentally-friendly products and packaging gaining traction among educated consumers. Technology integration accelerates with smart pet products, health monitoring devices, and mobile applications becoming mainstream adoption categories.

Market consolidation activities increase as successful companies acquire smaller players to expand market presence and capabilities. International brands strengthen their Vietnam presence through strategic partnerships, local manufacturing investments, and distribution network expansion. Retail evolution includes the opening of specialized pet superstores and premium boutiques catering to affluent consumers.

Regulatory developments include updated import standards, quality requirements, and business licensing procedures affecting market participants. Government initiatives to improve animal welfare standards and veterinary service quality create opportunities for professional service providers. Infrastructure investments in veterinary education and clinic development support market professionalization.

Technology adoption accelerates with companies investing in e-commerce platforms, mobile applications, and digital marketing capabilities. MarkWide Research indicates that digital channel investments have increased by 38% annually among leading market participants. Innovation in product development focuses on health monitoring, convenience features, and sustainability attributes.

International expansion by Vietnamese companies begins emerging as successful local players explore regional market opportunities. Export development initiatives support local manufacturers in achieving international quality standards and market access capabilities.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and distribution channel dynamics. Companies entering Vietnam’s pet market benefit from partnering with established local distributors or retailers who possess market knowledge and customer relationships. Product localization strategies should balance international quality standards with local taste preferences and pricing expectations.

Investment priorities should focus on building strong distribution networks, establishing brand recognition, and developing customer loyalty through quality and service excellence. Digital marketing investments prove essential for reaching younger demographics and building brand awareness in competitive market conditions. E-commerce capabilities become increasingly critical for market success and customer convenience.

Differentiation strategies should emphasize unique value propositions such as superior quality, specialized benefits, or exceptional service delivery. Companies should consider developing premium product lines for affluent consumers while maintaining accessible options for price-sensitive segments. Innovation investments in product development, packaging, and service delivery create competitive advantages and customer loyalty.

Risk management approaches should address regulatory compliance, supply chain reliability, and economic sensitivity through diversified strategies and contingency planning. MWR analysis suggests that companies with flexible business models and multiple market segments demonstrate greater resilience during economic fluctuations.

Long-term growth prospects for Vietnam’s pet industry remain exceptionally positive, supported by favorable demographic trends, continued economic development, and evolving consumer attitudes toward pet ownership. The market is projected to maintain robust growth rates exceeding 12% annually over the next five years, driven by increasing pet ownership rates and premiumization trends.

Market evolution will likely feature continued consolidation, increased professionalization, and greater product sophistication as consumer expectations rise and competition intensifies. Technology integration will accelerate, with smart products, health monitoring, and digital services becoming standard market offerings rather than premium features.

Geographic expansion will extend market benefits beyond major urban centers to secondary cities and affluent rural areas as infrastructure development and income growth create new opportunities. Service sector growth will outpace product sales as consumers increasingly value convenience, expertise, and specialized care for their pets.

International integration will deepen as Vietnamese companies develop export capabilities while foreign brands increase local presence through manufacturing and partnership strategies. The market’s maturation will create opportunities for specialized niches, premium positioning, and innovative business models that serve evolving consumer needs and preferences.

Vietnam’s pet industry market represents one of Southeast Asia’s most promising growth opportunities, characterized by strong fundamentals, favorable demographics, and evolving consumer preferences that support sustained expansion. The market’s transformation from traditional animal keeping to modern pet ownership creates substantial opportunities for both international and domestic companies across multiple product and service categories.

Strategic success factors include understanding local market dynamics, building strong distribution networks, investing in brand development, and maintaining flexibility to adapt to rapidly changing consumer preferences. Companies that combine international expertise with local market knowledge while prioritizing quality and customer service are best positioned to capture market opportunities and build sustainable competitive advantages.

Future market development will be shaped by continued urbanization, income growth, digital transformation, and evolving attitudes toward pet care and welfare. The industry’s growth trajectory appears sustainable and robust, supported by fundamental demographic and economic trends that favor increased pet ownership and premium spending. MarkWide Research projects that Vietnam’s pet industry will continue outperforming regional averages, making it an attractive market for investment and expansion strategies across the pet care value chain.

What is Vietnam Pet Industry?

The Vietnam Pet Industry encompasses the market for pet products and services, including pet food, grooming, veterinary care, and pet accessories. It reflects the growing trend of pet ownership and the increasing demand for high-quality pet care in Vietnam.

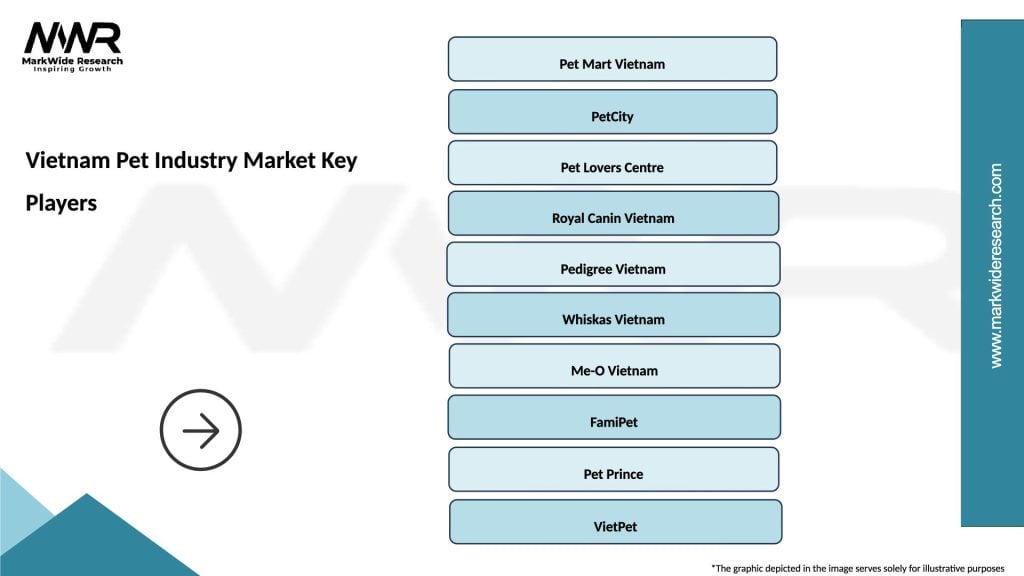

What are the key players in the Vietnam Pet Industry Market?

Key players in the Vietnam Pet Industry Market include Pet Mart, An Phu Pet, and Thang Long Pet, which offer a range of products and services for pet owners. These companies are known for their retail outlets and online platforms, catering to the diverse needs of pet lovers in Vietnam, among others.

What are the growth factors driving the Vietnam Pet Industry Market?

The growth of the Vietnam Pet Industry Market is driven by increasing disposable incomes, a rising trend in pet adoption, and a growing awareness of pet health and wellness. Additionally, the expansion of e-commerce platforms has made pet products more accessible to consumers.

What challenges does the Vietnam Pet Industry Market face?

The Vietnam Pet Industry Market faces challenges such as regulatory hurdles, limited access to high-quality veterinary care in rural areas, and competition from unregulated pet product suppliers. These factors can impact the overall growth and sustainability of the market.

What opportunities exist in the Vietnam Pet Industry Market?

Opportunities in the Vietnam Pet Industry Market include the potential for premium pet food products, the growth of pet grooming services, and the rise of pet-related technology solutions. As consumer preferences evolve, businesses can innovate to meet the changing demands of pet owners.

What trends are shaping the Vietnam Pet Industry Market?

Trends shaping the Vietnam Pet Industry Market include the increasing popularity of organic and natural pet foods, the rise of pet wellness products, and the growing influence of social media on pet ownership. These trends reflect a shift towards more informed and health-conscious pet care practices.

Vietnam Pet Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Pet Food, Pet Accessories, Pet Grooming, Pet Healthcare |

| Customer Type | Pet Owners, Pet Retailers, Veterinary Clinics, Pet Service Providers |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Veterinary Clinics |

| End User | Households, Animal Shelters, Breeders, Pet Training Centers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Pet Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at