444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Vietnam motor insurance market is a rapidly growing sector within the insurance industry. Motor insurance, also known as auto insurance, provides financial protection to vehicle owners against any physical damage or loss resulting from accidents, theft, or natural calamities. With the increasing number of vehicles on the road and the rising awareness about the importance of insurance coverage, the motor insurance market in Vietnam has witnessed significant growth in recent years.

Meaning

Motor insurance plays a crucial role in ensuring the financial security of vehicle owners and drivers in Vietnam. It provides coverage for both third-party liability and own damage. Third-party liability coverage protects the insured against any legal liabilities arising from injuries or damages caused to third parties, while own damage coverage provides protection against damages to the insured vehicle itself.

Executive Summary

The Vietnam motor insurance market has experienced robust growth in recent years, driven by several factors such as increasing vehicle sales, rising disposable incomes, and growing awareness about insurance among the population. The market has attracted both domestic and international insurance companies, leading to intense competition and innovative product offerings.

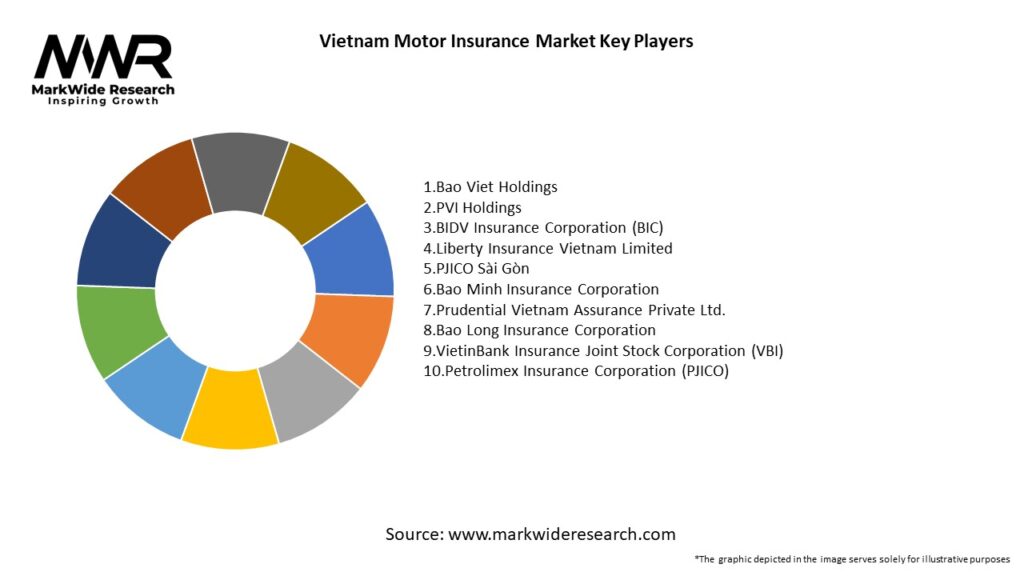

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Vietnam motor insurance market is driven by various dynamic factors that shape its growth trajectory. These dynamics include changing consumer preferences, regulatory developments, market competition, technological advancements, and macroeconomic factors.

Consumer preferences play a crucial role as individuals increasingly recognize the importance of motor insurance in protecting their assets and financial well-being. Regulatory developments, such as stricter enforcement of insurance regulations and government initiatives promoting insurance coverage, create a conducive environment for market growth.

The market’s competitive landscape, characterized by the presence of both domestic and international insurance players, drives innovation and customer-centric product offerings. Technological advancements, such as telematics devices and online insurance platforms, have transformed the way insurers interact with customers and underwrite policies.

Macroeconomic factors, including GDP growth, employment rates, and disposable incomes, influence the purchasing power and demand for motor insurance. Overall, the Vietnam motor insurance market is poised for substantial growth, driven by a combination of these market dynamics.

Regional Analysis

The Vietnam motor insurance market exhibits regional variations in terms of market size, vehicle density, and insurance penetration. Major urban centers such as Ho Chi Minh City and Hanoi account for a significant share of the market due to their higher vehicle density and population.

The southern region, including Ho Chi Minh City, presents a lucrative market due to its rapid economic growth, urbanization, and high vehicle ownership. The northern region, primarily centered around Hanoi, also contributes significantly to the market’s growth.

Rural areas, although less developed in terms of insurance penetration, offer untapped potential for motor insurance companies. As economic development spreads across the country, these regions are expected to witness increased vehicle ownership and insurance demand, creating opportunities for insurers to expand their presence.

Competitive Landscape

Leading Companies in Vietnam Motor Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Vietnam motor insurance market can be segmented based on several factors, including insurance type, vehicle type, and distribution channel.

Based on insurance type, the market can be categorized into third-party liability insurance and comprehensive insurance. Third-party liability insurance provides coverage for damages caused to third parties, while comprehensive insurance offers broader coverage, including own vehicle damages and theft.

Vehicle type segmentation includes private cars, commercial vehicles, motorcycles, and others. Private cars account for a significant share of the market, followed by motorcycles due to their high ownership rates in Vietnam.

Distribution channels in the motor insurance market include insurance agents/brokers, direct sales, bancassurance, and online platforms. Traditional channels such as agents/brokers and bancassurance still play a crucial role, although online platforms are gaining popularity due to their convenience and accessibility.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Vietnam motor insurance market. During the initial phases of the pandemic, the market experienced a decline in demand due to restrictions on movement and reduced vehicle usage. However, as the situation improved and economic activities resumed, the market witnessed a rebound in demand.

The pandemic highlighted the importance of insurance coverage, leading to increased awareness among vehicle owners about the financial risks associated with accidents and damages. Insurers adapted to the changing circumstances by offering flexible payment options, extending policy renewal deadlines, and enhancing digital capabilities for contactless services.

The pandemic also accelerated the adoption of digital technologies in the motor insurance sector. Insurers ramped up their digital platforms, enabling customers to purchase policies, submit claims, and access services online. This digital transformation facilitated business continuity and improved operational efficiency.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Vietnam motor insurance market is promising, driven by factors such as economic growth, increasing vehicle ownership, and rising awareness about insurance coverage. The market is expected to witness sustained growth, with a focus on personalized insurance, digitalization, and value-added services.

Insurance companies will continue to invest in technological advancements and data analytics to offer tailored insurance solutions and improve risk assessment. The growing middle-class population, expanding urbanization, and rising disposable incomes will further fuel the demand for motor insurance.

Government support, stricter enforcement of insurance regulations, and initiatives to enhance road safety will play a crucial role in shaping the market’s future. Insurers that adapt to changing customer expectations, embrace digital transformation, and provide excellent customer service are likely to thrive in this evolving market.

Conclusion

The Vietnam motor insurance market is experiencing robust growth, driven by factors such as increasing vehicle ownership, rising awareness about insurance, and government initiatives promoting insurance coverage. The market offers significant opportunities for insurers to tap into the growing demand and expand their customer base.

However, challenges such as intense competition, fraudulent activities, and lack of awareness among certain population segments need to be addressed. By leveraging technological advancements, offering innovative products, and enhancing customer-centric approaches, insurers can navigate the market dynamics and secure a competitive advantage.

The future outlook for the Vietnam motor insurance market is optimistic, with continued growth expected. Insurers that adapt to changing customer preferences, embrace digitalization, and focus on personalized coverage and value-added services are well-positioned to capitalize on the market’s potential and cater to the evolving needs of vehicle owners in Vietnam.

What is Motor Insurance?

Motor insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise therefrom. It typically covers vehicles, drivers, and passengers, ensuring safety on the roads.

What are the key players in the Vietnam Motor Insurance Market?

Key players in the Vietnam Motor Insurance Market include companies like Bao Viet Insurance, PVI Insurance, and Liberty Insurance. These companies offer a range of motor insurance products tailored to meet the needs of consumers and businesses, among others.

What are the growth factors driving the Vietnam Motor Insurance Market?

The growth of the Vietnam Motor Insurance Market is driven by increasing vehicle ownership, rising awareness of insurance benefits, and government regulations promoting mandatory insurance coverage. Additionally, urbanization and economic growth contribute to higher demand for motor insurance.

What challenges does the Vietnam Motor Insurance Market face?

The Vietnam Motor Insurance Market faces challenges such as intense competition among insurers, low penetration rates, and consumer skepticism regarding insurance products. Additionally, regulatory changes can impact market dynamics and profitability.

What opportunities exist in the Vietnam Motor Insurance Market?

Opportunities in the Vietnam Motor Insurance Market include the potential for digital transformation, the introduction of innovative insurance products, and the expansion of coverage options for electric and hybrid vehicles. These trends can attract a broader customer base and enhance service delivery.

What trends are shaping the Vietnam Motor Insurance Market?

Trends shaping the Vietnam Motor Insurance Market include the increasing adoption of telematics for personalized insurance premiums, the rise of online insurance platforms, and a growing focus on customer experience. These innovations are transforming how consumers interact with insurance providers.

Vietnam Motor Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Comprehensive, Third-Party Liability, Collision, Personal Injury Protection |

| Distribution Channel | Agents, Brokers, Direct, Online Platforms |

| Customer Type | Individual, Fleet Owners, Corporates, Government Entities |

| Vehicle Type | Passenger Cars, Motorcycles, Commercial Vehicles, Electric Vehicles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Vietnam Motor Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at