444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam mobile banking market represents one of Southeast Asia’s most dynamic and rapidly evolving financial technology landscapes. Digital transformation has fundamentally reshaped how Vietnamese consumers interact with banking services, with mobile platforms becoming the primary channel for financial transactions. The market demonstrates exceptional growth momentum, driven by increasing smartphone penetration, government digitization initiatives, and changing consumer preferences toward contactless financial services.

Market dynamics indicate that Vietnam’s mobile banking sector is experiencing unprecedented expansion, with adoption rates reaching 78% among urban populations and showing strong penetration in rural areas. The convergence of traditional banking institutions with fintech innovations has created a competitive ecosystem that prioritizes user experience, security, and accessibility. Financial inclusion remains a key driver, as mobile banking platforms bridge the gap between formal banking services and previously underserved populations.

Technological advancement continues to accelerate market growth, with artificial intelligence, blockchain technology, and biometric authentication becoming standard features across leading platforms. The integration of super app ecosystems has transformed mobile banking from simple transaction tools into comprehensive lifestyle platforms, encompassing payments, investments, insurance, and merchant services.

The Vietnam mobile banking market refers to the comprehensive ecosystem of financial services delivered through mobile applications and platforms, enabling users to conduct banking transactions, payments, and financial management activities via smartphones and tablets. This market encompasses traditional bank-operated mobile applications, digital-only banking platforms, fintech payment solutions, and integrated financial services within broader mobile ecosystems.

Mobile banking services in Vietnam include core functionalities such as account management, fund transfers, bill payments, loan applications, investment services, and merchant payment solutions. The market extends beyond basic banking to include value-added services like financial planning tools, credit scoring, insurance products, and cross-border remittance services, creating comprehensive digital financial experiences for Vietnamese consumers.

Platform diversity characterizes the Vietnamese mobile banking landscape, featuring established commercial banks’ mobile applications, emerging digital banks, e-wallet platforms, and integrated financial services within super apps. This multifaceted approach ensures broad market coverage and caters to diverse consumer preferences and financial needs across different demographic segments.

Vietnam’s mobile banking market stands as a testament to the country’s rapid digital transformation and financial modernization efforts. The sector has evolved from basic transaction services to sophisticated financial ecosystems that integrate seamlessly with consumers’ daily lives. Growth acceleration has been particularly notable in recent years, with mobile banking transactions increasing by 65% annually and user engagement reaching unprecedented levels.

Market leadership is distributed among traditional banking institutions that have successfully digitized their services, innovative fintech companies introducing disruptive solutions, and technology giants expanding into financial services. This competitive landscape has fostered innovation while maintaining service quality and security standards. Consumer adoption patterns reveal strong preferences for integrated platforms that combine banking, payments, and lifestyle services within single applications.

Regulatory support from the State Bank of Vietnam has created a conducive environment for market growth while ensuring consumer protection and financial stability. The introduction of comprehensive digital banking regulations and open banking frameworks has encouraged innovation while maintaining systemic security. Future prospects indicate continued expansion driven by emerging technologies, increasing financial literacy, and growing demand for sophisticated digital financial services.

Strategic insights from the Vietnam mobile banking market reveal several critical trends shaping the industry’s trajectory:

Smartphone proliferation serves as the fundamental driver of Vietnam’s mobile banking market expansion. With smartphone penetration exceeding 75% of the population, the technological infrastructure necessary for widespread mobile banking adoption is firmly established. Internet connectivity improvements and 4G network expansion have eliminated traditional barriers to digital financial service access, particularly in previously underserved rural areas.

Government digitization initiatives have created a supportive regulatory environment that encourages financial technology innovation while maintaining consumer protection standards. The National Digital Transformation Program and related policies have accelerated the adoption of digital financial services across all sectors of the economy. Regulatory sandboxes have enabled fintech companies to test innovative solutions while working within established financial frameworks.

Changing consumer behavior patterns, particularly among younger demographics, have driven demand for convenient, accessible, and integrated financial services. The COVID-19 pandemic significantly accelerated this trend, with contactless payment preferences becoming permanent behavioral changes. Financial inclusion objectives have motivated both government and private sector initiatives to extend banking services to previously unbanked populations through mobile platforms.

Competitive innovation among financial service providers has resulted in continuous platform improvements, enhanced user experiences, and expanded service offerings. The integration of artificial intelligence, machine learning, and blockchain technologies has enabled more sophisticated financial products and improved risk management capabilities.

Cybersecurity concerns represent the most significant restraint affecting Vietnam’s mobile banking market growth. Despite advanced security measures, consumer apprehension regarding digital fraud, data breaches, and identity theft continues to limit adoption among certain demographic segments. Security incidents in the broader digital ecosystem have heightened awareness of potential risks associated with mobile financial services.

Digital literacy gaps particularly affect older populations and rural communities, creating barriers to mobile banking adoption. While smartphone ownership is widespread, the technical skills required to navigate complex financial applications remain challenging for some user segments. Educational initiatives are ongoing, but progress requires sustained effort and resources from both public and private sectors.

Infrastructure limitations in remote areas continue to impact service quality and reliability. While urban centers enjoy robust internet connectivity, rural regions may experience intermittent service that affects user confidence in mobile banking platforms. Network reliability concerns can discourage users from conducting important financial transactions through mobile channels.

Regulatory complexity surrounding cross-border transactions, cryptocurrency integration, and emerging financial products creates uncertainty for both service providers and consumers. Compliance requirements can slow innovation and increase operational costs, potentially limiting the introduction of new services and features.

Financial inclusion expansion presents substantial opportunities for mobile banking providers to serve Vietnam’s remaining unbanked and underbanked populations. Rural communities and small business owners represent significant untapped markets that could benefit from accessible digital financial services. Microfinance integration through mobile platforms could revolutionize small-scale lending and savings services.

Cross-border payment services offer tremendous growth potential given Vietnam’s significant overseas worker population and increasing international trade activities. Enhanced remittance services, international money transfers, and multi-currency capabilities could capture substantial market share. Regional integration with ASEAN financial systems could position Vietnamese mobile banking platforms as regional leaders.

Artificial intelligence implementation creates opportunities for personalized financial services, improved risk assessment, and enhanced customer support capabilities. Machine learning algorithms can enable more sophisticated credit scoring, fraud detection, and investment advisory services. Blockchain technology integration could revolutionize transaction security, smart contracts, and decentralized financial services.

Small business banking represents an underserved market segment with significant growth potential. Mobile banking platforms specifically designed for SME needs, including inventory financing, supply chain payments, and business analytics, could capture substantial market share. E-commerce integration opportunities continue expanding as online retail grows throughout Vietnam.

Competitive dynamics in Vietnam’s mobile banking market reflect a complex interplay between traditional financial institutions, innovative fintech companies, and technology giants expanding into financial services. Market consolidation trends indicate that successful platforms are those offering comprehensive ecosystems rather than single-purpose applications. The integration of banking services within super apps has fundamentally altered competitive landscapes.

Consumer expectations continue evolving toward seamless, integrated experiences that combine financial services with lifestyle applications. Users increasingly demand platforms that offer banking, payments, shopping, transportation, and entertainment services within unified interfaces. User experience optimization has become a critical differentiator among competing platforms.

Technology adoption cycles demonstrate rapid integration of emerging technologies into mobile banking platforms. Artificial intelligence, biometric authentication, and blockchain solutions are becoming standard features rather than competitive advantages. Innovation velocity requires continuous investment in research and development to maintain market position.

Regulatory evolution continues shaping market dynamics through new guidelines for digital banking, open banking initiatives, and consumer protection measures. Policy changes can significantly impact competitive positioning and operational requirements for market participants.

Comprehensive market analysis for Vietnam’s mobile banking sector employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive surveys of mobile banking users across urban and rural areas, in-depth interviews with industry executives, and focus groups representing diverse demographic segments. This approach provides direct insights into consumer behavior, preferences, and adoption patterns.

Secondary research encompasses analysis of regulatory documents, financial institution reports, technology provider publications, and government statistics related to digital financial services. Data triangulation methods ensure consistency and validate findings across multiple information sources. Industry reports, academic studies, and market intelligence databases contribute to comprehensive market understanding.

Quantitative analysis utilizes statistical modeling to identify market trends, growth patterns, and correlation factors affecting mobile banking adoption. Qualitative assessment provides contextual understanding of market dynamics, competitive positioning, and emerging opportunities. Combined methodologies deliver balanced perspectives on market conditions and future prospects.

Expert consultation with banking executives, fintech entrepreneurs, regulatory officials, and technology specialists ensures professional validation of research findings. Continuous monitoring of market developments enables real-time updates to analysis and projections.

Ho Chi Minh City dominates Vietnam’s mobile banking landscape, accounting for approximately 35% of total mobile banking transactions and serving as the primary hub for fintech innovation. The city’s concentration of financial institutions, technology companies, and affluent consumers creates ideal conditions for mobile banking growth. Digital payment adoption in Ho Chi Minh City exceeds national averages, with sophisticated users demanding advanced features and integrated services.

Hanoi region represents the second-largest mobile banking market, capturing 28% of national transaction volume and demonstrating strong growth in government-related digital payments. The capital’s role as the administrative center has accelerated adoption of digital financial services for tax payments, licensing fees, and public service transactions. Corporate banking through mobile platforms shows particular strength in the Hanoi region.

Mekong Delta provinces have experienced remarkable mobile banking growth, with adoption rates increasing by 140% over two years as agricultural communities embrace digital financial services. Rural banking initiatives and agricultural financing through mobile platforms have transformed traditional farming economies. Microfinance services delivered through mobile banking have particularly benefited small-scale farmers and rural entrepreneurs.

Central coastal regions demonstrate growing mobile banking penetration, particularly in tourism-dependent areas where digital payments facilitate international visitor transactions. Cross-border commerce with neighboring countries has driven demand for multi-currency mobile banking capabilities in border provinces.

Market leadership in Vietnam’s mobile banking sector is distributed among several key player categories, each bringing distinct competitive advantages:

Competitive differentiation increasingly focuses on user experience, service integration, and technological innovation rather than traditional banking metrics. Platform ecosystems that combine financial services with lifestyle applications demonstrate superior user engagement and retention rates.

By Service Type:

By User Demographics:

By Technology Platform:

Traditional Bank Mobile Apps maintain strong market positions through established customer relationships, regulatory compliance, and comprehensive service offerings. These platforms excel in security, reliability, and full-service banking capabilities. Customer trust remains a significant competitive advantage, particularly among conservative users prioritizing financial security over innovative features.

E-wallet Platforms have captured substantial market share by focusing on user experience, rapid transaction processing, and merchant network development. Payment convenience and promotional campaigns have driven widespread adoption, particularly among younger demographics. Integration with e-commerce platforms and lifestyle services has expanded their utility beyond simple payments.

Super App Ecosystems represent the fastest-growing category, combining financial services with transportation, food delivery, entertainment, and shopping within unified platforms. User engagement benefits from frequent platform interaction across multiple service categories. Cross-selling opportunities and data analytics capabilities provide competitive advantages in personalized service delivery.

Specialized Fintech Solutions address specific market niches with innovative approaches to lending, investment, insurance, and cross-border payments. Technology innovation and agile development processes enable rapid response to emerging market needs. Partnerships with traditional financial institutions often provide regulatory compliance and market access.

Financial Institutions benefit from reduced operational costs, expanded market reach, and enhanced customer engagement through mobile banking platforms. Digital transformation enables banks to serve more customers with fewer physical branches while providing 24/7 service availability. Data analytics capabilities improve risk management, customer segmentation, and product development processes.

Consumers gain unprecedented convenience, accessibility, and control over their financial activities through mobile banking services. Time savings and reduced transaction costs make financial management more efficient. Access to previously unavailable financial products and services expands economic opportunities for individuals and small businesses.

Small and Medium Enterprises benefit from streamlined payment processing, improved cash flow management, and access to digital lending solutions. Business efficiency improves through automated accounting integration and real-time financial monitoring. Digital payment acceptance capabilities expand customer bases and reduce cash handling costs.

Government Agencies achieve improved tax collection, reduced administrative costs, and enhanced financial transparency through digital payment systems. Financial inclusion objectives are advanced as mobile banking extends formal financial services to previously underserved populations. Economic development benefits from increased financial system efficiency and reduced informal economy participation.

Technology Providers find expanding opportunities in security solutions, infrastructure development, and innovative financial technology applications. Market growth drives demand for cloud computing, cybersecurity, and artificial intelligence solutions supporting mobile banking platforms.

Strengths:

Weaknesses:

Opportunities:

Threats:

Super App Integration continues reshaping Vietnam’s mobile banking landscape as platforms combine financial services with lifestyle applications. Ecosystem development enables users to access banking, payments, shopping, transportation, and entertainment through unified interfaces. This trend reflects consumer preferences for consolidated digital experiences and creates opportunities for increased user engagement and cross-selling.

Artificial Intelligence Implementation is transforming mobile banking through personalized recommendations, automated customer service, and enhanced fraud detection capabilities. Machine learning algorithms enable more sophisticated credit scoring, risk assessment, and investment advisory services. Chatbots and virtual assistants are becoming standard features for customer support and transaction assistance.

Biometric Authentication adoption accelerates as security concerns drive demand for advanced user verification methods. Fingerprint recognition, facial recognition, and voice authentication technologies improve security while enhancing user convenience. Multi-factor authentication combining biometrics with traditional methods provides optimal security-convenience balance.

Open Banking Initiatives are gaining momentum as regulatory frameworks encourage financial service innovation and competition. API integration enables third-party developers to create innovative applications using banking data and services. This trend promotes financial service democratization and encourages fintech innovation.

Blockchain Technology integration explores applications in cross-border payments, smart contracts, and decentralized finance services. Cryptocurrency support and digital asset management capabilities are emerging features among progressive mobile banking platforms. Blockchain solutions address security, transparency, and efficiency challenges in financial transactions.

Regulatory Framework Evolution has significantly impacted Vietnam’s mobile banking market through comprehensive digital banking guidelines and consumer protection measures. The State Bank of Vietnam has introduced regulations governing mobile payment services, digital lending, and cybersecurity requirements. Open banking initiatives encourage innovation while maintaining financial system stability and consumer protection.

Strategic Partnerships between traditional banks and fintech companies have accelerated innovation and market expansion. Collaboration models enable banks to leverage fintech agility while providing regulatory compliance and market access to technology companies. These partnerships have resulted in improved user experiences and expanded service offerings across the market.

International Expansion efforts by Vietnamese mobile banking platforms reflect growing confidence and market maturity. Regional integration initiatives target neighboring ASEAN markets with similar demographic and economic characteristics. Cross-border payment capabilities and multi-currency support have become competitive differentiators.

Technology Infrastructure Investments by telecommunications companies and cloud service providers have improved mobile banking platform reliability and performance. 5G network deployment promises enhanced user experiences through faster transaction processing and improved application responsiveness. Data center expansion ensures adequate infrastructure support for growing user bases.

Cybersecurity Enhancement initiatives have become industry priorities as platforms invest in advanced threat detection, encryption technologies, and user education programs. Industry collaboration on security standards and best practices helps maintain consumer confidence and market stability.

MarkWide Research analysis indicates that successful mobile banking platforms in Vietnam must prioritize user experience optimization while maintaining robust security measures. Platform differentiation increasingly depends on integrated service offerings rather than traditional banking features alone. Companies should focus on developing comprehensive ecosystems that address multiple consumer needs within unified interfaces.

Investment priorities should emphasize artificial intelligence capabilities, biometric authentication systems, and blockchain technology integration to maintain competitive advantages. Data analytics capabilities become crucial for personalized service delivery and risk management optimization. Platforms must balance innovation with regulatory compliance and security requirements.

Market expansion strategies should target underserved segments including rural communities, small businesses, and senior citizens through tailored product offerings and simplified user interfaces. Financial inclusion initiatives can drive sustainable growth while contributing to national economic development objectives. Cross-border service capabilities present significant opportunities for platforms serving Vietnam’s overseas worker population.

Partnership development with e-commerce platforms, telecommunications companies, and government agencies can accelerate user acquisition and service integration. Ecosystem building through strategic alliances enables platforms to offer comprehensive value propositions without developing all capabilities internally. Collaboration with traditional financial institutions provides regulatory expertise and market credibility.

Cybersecurity investment must remain a top priority as platforms scale and attract more sophisticated threats. User education programs can improve security awareness and reduce fraud risks while building consumer confidence in digital financial services.

Market evolution in Vietnam’s mobile banking sector points toward continued rapid growth driven by technological advancement, regulatory support, and changing consumer behaviors. MWR projections indicate that mobile banking adoption will reach near-universal levels among smartphone users within the next five years, with rural penetration accelerating significantly.

Technology integration will deepen as artificial intelligence, blockchain, and Internet of Things capabilities become standard platform features. Personalization through machine learning algorithms will enable highly customized financial services tailored to individual user needs and preferences. Voice-activated banking and augmented reality interfaces may emerge as next-generation user interaction methods.

Financial service expansion will continue beyond traditional banking toward comprehensive wealth management, insurance, and investment services. Robo-advisory capabilities and automated investment management will democratize sophisticated financial services previously available only to high-net-worth individuals. Cryptocurrency integration and digital asset management may become mainstream features.

Regional integration opportunities will expand as ASEAN financial harmonization initiatives progress. Cross-border capabilities will become competitive necessities rather than differentiators, enabling seamless financial services across Southeast Asian markets. Vietnamese platforms may emerge as regional leaders given their technological sophistication and market experience.

Regulatory evolution will continue shaping market dynamics through open banking frameworks, consumer protection enhancements, and innovation-friendly policies. Government digitization initiatives will drive adoption of mobile banking for public service payments and tax transactions, further integrating digital financial services into daily life.

Vietnam’s mobile banking market represents one of Southeast Asia’s most dynamic and promising financial technology sectors, characterized by rapid growth, innovative solutions, and strong consumer adoption. The convergence of favorable demographics, supportive government policies, and technological advancement has created ideal conditions for sustained market expansion and innovation.

Market maturation continues as platforms evolve from basic transaction services toward comprehensive financial ecosystems that integrate banking, payments, investments, and lifestyle services. The success of super app models demonstrates consumer preferences for unified digital experiences that address multiple needs through single platforms. Competitive dynamics favor organizations that can balance innovation with security, convenience with compliance, and growth with sustainability.

Future prospects remain exceptionally positive as emerging technologies enable new service capabilities while expanding market reach to previously underserved populations. The combination of artificial intelligence, blockchain technology, and enhanced mobile infrastructure will drive the next phase of market evolution. Financial inclusion objectives align with commercial opportunities, creating sustainable growth models that benefit both businesses and society.

Strategic success in Vietnam’s mobile banking market requires continuous innovation, robust security measures, and deep understanding of local consumer needs and preferences. Organizations that can effectively combine technological sophistication with user-friendly design while maintaining regulatory compliance will capture the greatest opportunities in this rapidly expanding market. The Vietnam mobile banking market stands poised for continued growth and innovation, establishing itself as a regional leader in digital financial services.

What is Mobile Banking?

Mobile banking refers to the use of mobile devices to access banking services, allowing users to perform transactions, check balances, and manage accounts remotely. It has become increasingly popular due to its convenience and accessibility.

Who are the key players in the Vietnam Mobile Banking Market?

Key players in the Vietnam Mobile Banking Market include Vietcombank, Techcombank, and BIDV, which offer a range of mobile banking services to their customers. These companies are competing to enhance user experience and expand their service offerings, among others.

What are the main drivers of growth in the Vietnam Mobile Banking Market?

The main drivers of growth in the Vietnam Mobile Banking Market include the increasing smartphone penetration, a growing preference for digital transactions, and the government’s push for cashless payments. These factors are contributing to a more tech-savvy banking environment.

What challenges does the Vietnam Mobile Banking Market face?

The Vietnam Mobile Banking Market faces challenges such as cybersecurity threats, regulatory compliance issues, and the need for continuous technological upgrades. These challenges can hinder the growth and adoption of mobile banking services.

What opportunities exist in the Vietnam Mobile Banking Market?

Opportunities in the Vietnam Mobile Banking Market include the potential for partnerships with fintech companies, the expansion of digital financial services, and the increasing demand for personalized banking experiences. These factors can drive innovation and growth in the sector.

What trends are shaping the Vietnam Mobile Banking Market?

Trends shaping the Vietnam Mobile Banking Market include the rise of contactless payments, the integration of AI for customer service, and the development of blockchain technology for secure transactions. These trends are transforming how consumers interact with banking services.

Vietnam Mobile Banking Market

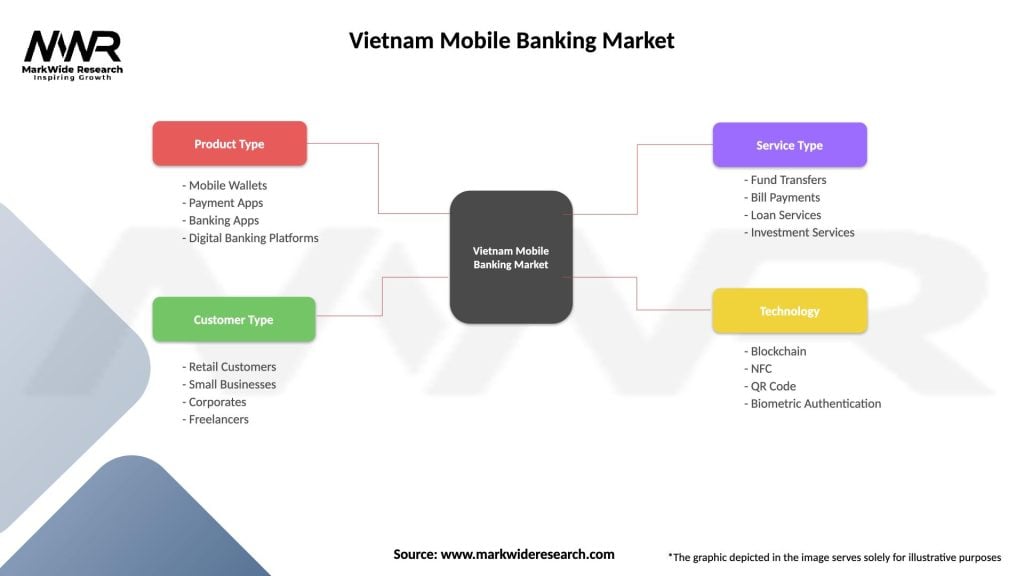

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Wallets, Payment Apps, Banking Apps, Digital Banking Platforms |

| Customer Type | Retail Customers, Small Businesses, Corporates, Freelancers |

| Service Type | Fund Transfers, Bill Payments, Loan Services, Investment Services |

| Technology | Blockchain, NFC, QR Code, Biometric Authentication |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Mobile Banking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at