444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam infrastructure market represents one of Southeast Asia’s most dynamic and rapidly evolving sectors, driven by ambitious government initiatives and substantial foreign investment commitments. Vietnam’s infrastructure development has emerged as a critical component of the nation’s economic transformation strategy, encompassing transportation networks, energy systems, telecommunications, and urban development projects. The market demonstrates remarkable resilience and growth potential, with infrastructure investments accounting for approximately 6.2% of GDP annually, reflecting the government’s commitment to modernizing the country’s foundational systems.

Strategic positioning within the Association of Southeast Asian Nations (ASEAN) has positioned Vietnam as a regional hub for infrastructure development, attracting international contractors, technology providers, and financial institutions. The market encompasses diverse segments including road and highway construction, railway modernization, port development, airport expansion, power generation facilities, and smart city initiatives. Government policies under the National Master Plan 2021-2030 prioritize sustainable infrastructure development, with particular emphasis on green technologies and climate-resilient construction practices.

Foreign direct investment continues to play a pivotal role in Vietnam’s infrastructure expansion, with international partnerships facilitating technology transfer and expertise sharing. The market benefits from Vietnam’s strategic location along major shipping routes, making it an attractive destination for logistics and transportation infrastructure investments. Digital infrastructure development has gained significant momentum, with 5G network deployment and fiber optic expansion supporting the country’s digital transformation objectives.

The Vietnam infrastructure market refers to the comprehensive ecosystem of physical and organizational structures, facilities, and systems that support the country’s economic activities and social development. This market encompasses the planning, financing, construction, operation, and maintenance of essential infrastructure assets including transportation networks, energy systems, water and sanitation facilities, telecommunications infrastructure, and urban development projects across Vietnam’s diverse geographical regions.

Infrastructure development in Vietnam represents a multifaceted approach to nation-building that integrates traditional construction methodologies with modern sustainable practices and smart technology solutions. The market includes both public sector initiatives funded through government budgets and international development assistance, as well as private sector investments through public-private partnerships and foreign direct investment mechanisms. Sustainable infrastructure principles increasingly guide project development, emphasizing environmental protection, social inclusion, and long-term economic viability.

Vietnam’s infrastructure market continues to experience robust expansion driven by government modernization initiatives, urbanization trends, and increasing foreign investment participation. The market demonstrates strong fundamentals with infrastructure spending representing a significant portion of national budget allocations and attracting substantial international development financing. Transportation infrastructure remains the largest segment, followed by energy and telecommunications, with emerging opportunities in smart city development and green infrastructure solutions.

Key market drivers include rapid economic growth, urban population expansion, and the government’s commitment to achieving middle-income country status by 2030. The market benefits from Vietnam’s strategic position in global supply chains and its role as a manufacturing hub for multinational corporations. Digital transformation initiatives are creating new opportunities for telecommunications infrastructure and smart city technologies, while environmental sustainability requirements are driving demand for green building practices and renewable energy infrastructure.

Market challenges include funding constraints, regulatory complexities, and the need for skilled workforce development. However, these challenges are being addressed through international partnerships, capacity building programs, and policy reforms designed to streamline project approval processes. Growth projections indicate continued expansion with infrastructure development remaining a national priority across multiple government planning cycles.

Strategic market insights reveal several critical trends shaping Vietnam’s infrastructure development landscape:

Economic growth momentum serves as the primary driver for Vietnam’s infrastructure market expansion, with sustained GDP growth creating demand for enhanced transportation, energy, and telecommunications systems. The country’s transformation from an agricultural economy to a manufacturing and services hub requires substantial infrastructure investments to support industrial development and urban expansion. Population urbanization trends, with urban population growing at approximately 3.2% annually, create pressing needs for housing, transportation, and utility infrastructure development.

Government policy initiatives under the National Master Plan provide clear direction for infrastructure development priorities, establishing frameworks for sustainable growth and regional connectivity enhancement. The plan emphasizes balanced development across regions, requiring significant infrastructure investments in both urban centers and rural areas. Foreign direct investment attraction strategies position infrastructure development as a key component of Vietnam’s economic competitiveness, with improved connectivity and modern facilities supporting manufacturing and export activities.

Regional integration objectives drive cross-border infrastructure projects that enhance Vietnam’s connectivity with neighboring countries and strengthen its position within ASEAN economic frameworks. These initiatives include transportation corridors, energy interconnections, and telecommunications networks that facilitate trade and economic cooperation. Digital transformation requirements across industries create demand for advanced telecommunications infrastructure, data centers, and smart city technologies that support the country’s modernization goals.

Funding constraints represent a significant challenge for Vietnam’s infrastructure market, with the scale of required investments exceeding available government resources and necessitating creative financing solutions. Limited domestic capital markets and reliance on foreign funding sources can create vulnerabilities to external economic conditions and currency fluctuations. Regulatory complexities in project approval processes can delay implementation timelines and increase development costs, particularly for large-scale infrastructure initiatives requiring multiple government approvals.

Technical capacity limitations in specialized infrastructure sectors may require extensive technology transfer and workforce development programs, potentially slowing project implementation and increasing costs. The need for skilled engineers, project managers, and technical specialists creates bottlenecks in project execution capabilities. Environmental compliance requirements add complexity and costs to infrastructure projects, requiring comprehensive environmental impact assessments and mitigation measures.

Land acquisition challenges can significantly impact project timelines and costs, particularly in densely populated urban areas where infrastructure development requires extensive property acquisition and resettlement programs. Coordination difficulties between different government levels and agencies can create inefficiencies in project planning and implementation, requiring improved governance mechanisms and inter-agency collaboration frameworks.

Smart city development presents substantial opportunities for technology integration and innovative infrastructure solutions that improve urban efficiency and quality of life. Vietnamese cities are increasingly adopting intelligent transportation systems, smart energy grids, and digital governance platforms that create demand for advanced infrastructure technologies. Green infrastructure initiatives offer opportunities for sustainable construction practices, renewable energy integration, and environmentally friendly transportation solutions that align with global sustainability trends.

Public-private partnerships create opportunities for private sector participation in infrastructure development, enabling risk sharing, expertise transfer, and innovative financing mechanisms. These partnerships can accelerate project implementation while reducing government funding requirements and improving operational efficiency. Regional connectivity projects offer opportunities for Vietnam to strengthen its position as a regional hub through enhanced transportation links, energy interconnections, and telecommunications networks.

Digital infrastructure expansion opportunities include 5G network deployment, fiber optic expansion, and data center development that support the country’s digital economy objectives. Climate adaptation infrastructure presents opportunities for resilient design solutions that address environmental challenges while supporting long-term economic development. Industrial zone development creates opportunities for specialized infrastructure that supports manufacturing activities and export-oriented industries.

Market dynamics in Vietnam’s infrastructure sector reflect the complex interplay between government policy initiatives, economic development requirements, and international investment flows. The market demonstrates strong momentum driven by sustained economic growth and urbanization trends, while facing challenges related to funding constraints and technical capacity limitations. Policy stability and long-term planning frameworks provide confidence for investors and contractors, supporting sustained market development.

Competitive dynamics involve both domestic and international players, with foreign contractors and technology providers playing significant roles in large-scale projects while local companies focus on smaller-scale and maintenance activities. Technology adoption is accelerating across infrastructure sectors, with digital solutions, automation, and sustainable practices becoming increasingly important differentiators in project development and operations.

Financing dynamics continue to evolve with increasing private sector participation and innovative funding mechanisms, including green bonds, development finance, and blended financing approaches. According to MarkWide Research analysis, the market demonstrates resilience to external economic pressures while maintaining growth momentum through diversified funding sources and strong government commitment to infrastructure development priorities.

Comprehensive research methodology employed for analyzing Vietnam’s infrastructure market combines primary and secondary research approaches to provide accurate and actionable market insights. Primary research includes extensive interviews with government officials, industry executives, contractors, and technology providers to gather firsthand perspectives on market trends, challenges, and opportunities. Secondary research encompasses analysis of government policy documents, statistical databases, industry reports, and academic studies to establish market fundamentals and historical trends.

Data collection methods include structured surveys of market participants, focus group discussions with industry stakeholders, and expert consultations with infrastructure specialists and policy analysts. Market segmentation analysis examines different infrastructure sectors, geographical regions, and project types to provide detailed insights into market dynamics and growth patterns. Quantitative analysis incorporates statistical modeling and trend analysis to project market developments and identify key growth drivers.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert review panels, and consistency checks across different research methodologies. Quality assurance measures include peer review processes, data verification protocols, and regular updates to maintain research relevance and accuracy in the rapidly evolving infrastructure market environment.

Northern Vietnam leads infrastructure development activities with Hanoi serving as the political and economic center requiring extensive transportation, energy, and telecommunications infrastructure. The region benefits from proximity to China and established industrial zones that drive demand for logistics and manufacturing support infrastructure. Red River Delta urbanization creates opportunities for smart city development and integrated infrastructure solutions that support population growth and economic activities.

Southern Vietnam anchored by Ho Chi Minh City represents the country’s economic powerhouse with the highest concentration of infrastructure investments and foreign direct investment projects. The region accounts for approximately 35% of national infrastructure spending, reflecting its economic importance and development priorities. Mekong Delta infrastructure development focuses on flood protection, transportation connectivity, and agricultural support systems that enhance regional economic resilience.

Central Vietnam presents significant infrastructure development opportunities with major port cities like Da Nang and Hai Phong requiring enhanced connectivity and logistics capabilities. The region benefits from tourism development and manufacturing expansion that drive demand for transportation, hospitality, and utility infrastructure. Coastal areas require specialized infrastructure for climate resilience and maritime activities, creating opportunities for innovative engineering solutions and sustainable development practices.

International contractors dominate large-scale infrastructure projects in Vietnam, bringing advanced technology, financing capabilities, and project management expertise to complex development initiatives. The competitive landscape includes major global construction and engineering firms that partner with local companies to meet regulatory requirements and leverage local market knowledge.

Domestic players include Vietnamese construction companies that focus on smaller-scale projects, maintenance activities, and subcontracting arrangements with international firms. Technology providers from various countries supply specialized equipment, software solutions, and technical services that support infrastructure development across different sectors.

By Infrastructure Type:

By Funding Source:

By Project Scale:

Transportation Infrastructure dominates the Vietnam infrastructure market with road and highway development receiving the highest investment priority. The sector benefits from government commitment to improving connectivity between major economic centers and rural areas. Railway modernization projects focus on high-speed rail development and urban transit systems that support sustainable transportation objectives. Port development initiatives enhance Vietnam’s position as a regional logistics hub with expanded capacity and modern facilities.

Energy Infrastructure development emphasizes both traditional power generation expansion and renewable energy integration to meet growing electricity demand. Coal-fired power plants continue to play a significant role while renewable energy projects gain momentum through favorable government policies and international financing support. Grid modernization initiatives improve transmission efficiency and support distributed energy resources integration.

Telecommunications Infrastructure expansion focuses on 5G network deployment and fiber optic connectivity enhancement to support digital economy development. Data center construction accelerates to meet growing demand for cloud services and digital applications. Smart city technologies create opportunities for integrated infrastructure solutions that improve urban efficiency and quality of life through intelligent systems and data analytics.

Government stakeholders benefit from infrastructure development through enhanced economic competitiveness, improved quality of life for citizens, and strengthened regional connectivity that supports trade and investment attraction. Infrastructure development creates employment opportunities, stimulates economic growth, and provides essential services that support social development objectives. Tax revenue generation from infrastructure-enabled economic activities provides sustainable funding for continued public investment in development priorities.

Private sector participants gain access to substantial market opportunities through infrastructure development contracts, technology supply arrangements, and operational service agreements. International contractors benefit from market entry opportunities and long-term project pipelines that support business expansion and revenue growth. Local companies develop capabilities through technology transfer and partnership arrangements with international firms.

Financial institutions benefit from infrastructure financing opportunities that provide stable, long-term returns while supporting sustainable development objectives. Equipment suppliers and technology providers gain access to growing markets for construction machinery, telecommunications equipment, and smart infrastructure solutions. Citizens and communities benefit from improved infrastructure services that enhance quality of life, economic opportunities, and access to essential services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation integration emerges as a dominant trend across all infrastructure sectors, with smart technologies becoming essential components of modern infrastructure development. Internet of Things (IoT) applications enable intelligent monitoring and management of infrastructure assets, improving operational efficiency and reducing maintenance costs. Artificial intelligence and machine learning technologies support predictive maintenance, traffic optimization, and energy management in infrastructure systems.

Sustainability focus drives adoption of green building practices, renewable energy integration, and environmentally friendly construction materials across infrastructure projects. Circular economy principles influence infrastructure design and construction practices, emphasizing resource efficiency and waste reduction. Climate resilience considerations become mandatory elements in infrastructure planning and design, addressing long-term environmental challenges.

Public-private partnership expansion continues to grow as governments seek innovative financing mechanisms and private sector expertise for infrastructure development. MWR data indicates that PPP projects account for approximately 30% of new infrastructure initiatives, reflecting increased confidence in collaborative development models. Performance-based contracting models gain popularity, linking contractor compensation to infrastructure performance and service delivery outcomes.

Major transportation projects include the North-South Expressway expansion, Long Thanh International Airport development, and urban metro system construction in major cities. These initiatives demonstrate Vietnam’s commitment to modernizing transportation infrastructure and improving connectivity. Energy sector developments focus on renewable energy expansion with significant solar and wind power projects receiving government approval and international financing support.

Smart city initiatives in Ho Chi Minh City and Hanoi showcase integration of digital technologies in urban infrastructure, including intelligent transportation systems, smart energy grids, and digital governance platforms. Port modernization projects enhance Vietnam’s logistics capabilities with automated container handling systems and expanded capacity at major ports. Telecommunications infrastructure development accelerates with 5G network deployment and fiber optic expansion supporting digital economy objectives.

International partnerships continue to expand with new agreements for technology transfer, financing arrangements, and joint venture projects between Vietnamese and foreign companies. Regulatory reforms streamline project approval processes and improve investment climate for infrastructure development. Workforce development programs address skills gaps in infrastructure sectors through training initiatives and educational partnerships.

Strategic recommendations for infrastructure market participants emphasize the importance of long-term planning and sustainable development practices. Technology integration should be prioritized to ensure infrastructure systems remain competitive and efficient throughout their operational lifecycles. Partnership development with local companies and government agencies facilitates market entry and project success for international participants.

Risk management strategies should address regulatory compliance, environmental requirements, and financing stability to ensure project success. Capacity building investments in local workforce development and technology transfer create long-term competitive advantages and support sustainable market participation. Sustainability integration becomes essential for meeting government requirements and international financing standards.

Market entry strategies should consider regional development priorities and government policy objectives to align with national infrastructure development plans. Innovation adoption in construction methods, materials, and technologies provides competitive differentiation and operational efficiency improvements. Stakeholder engagement with government agencies, communities, and development partners ensures project alignment with local needs and priorities.

Long-term growth prospects for Vietnam’s infrastructure market remain highly positive, supported by continued economic development, urbanization trends, and government commitment to modernization objectives. Infrastructure investment is projected to maintain strong growth momentum with increasing private sector participation and international financing support. Technology adoption will accelerate across all infrastructure sectors, with smart solutions becoming standard components of new development projects.

Sustainable development principles will increasingly influence infrastructure planning and implementation, with green technologies and climate resilience becoming mandatory requirements. Regional connectivity projects will strengthen Vietnam’s position as a regional hub through enhanced transportation links and energy interconnections with neighboring countries. Digital infrastructure expansion will support the country’s transformation into a digital economy with advanced telecommunications and data processing capabilities.

MarkWide Research projections indicate that infrastructure development will continue to receive priority government support with budget allocations maintaining approximately 6-7% of GDP annually through 2030. Private sector participation is expected to increase significantly, with public-private partnerships potentially accounting for 40% of infrastructure financing by 2030. Innovation integration will drive efficiency improvements and cost reductions across infrastructure sectors, supporting sustainable long-term market growth.

Vietnam’s infrastructure market represents one of Southeast Asia’s most dynamic and promising sectors, driven by strong government commitment, sustained economic growth, and increasing international investment participation. The market demonstrates remarkable resilience and growth potential across multiple infrastructure segments, from transportation and energy to telecommunications and smart city development. Strategic positioning within regional economic frameworks and commitment to sustainable development practices create substantial opportunities for both domestic and international market participants.

Market fundamentals remain strong with continued government prioritization of infrastructure development, stable policy frameworks, and growing private sector participation through innovative financing mechanisms. Technology integration and sustainability focus are transforming traditional infrastructure development approaches, creating opportunities for advanced solutions and environmentally responsible practices. The market’s evolution toward smart, sustainable, and resilient infrastructure systems positions Vietnam for long-term economic competitiveness and social development success.

Future prospects indicate sustained growth momentum supported by urbanization trends, digital transformation requirements, and regional connectivity initiatives that strengthen Vietnam’s role as a regional economic hub. Infrastructure development will continue to serve as a cornerstone of Vietnam’s economic development strategy, providing essential foundations for sustained prosperity and improved quality of life for Vietnamese citizens while creating substantial opportunities for industry participants and stakeholders across the infrastructure value chain.

What is Vietnam Infrastructure?

Vietnam Infrastructure refers to the fundamental facilities and systems serving the country, including transportation, utilities, and communication systems that support economic activities and improve quality of life.

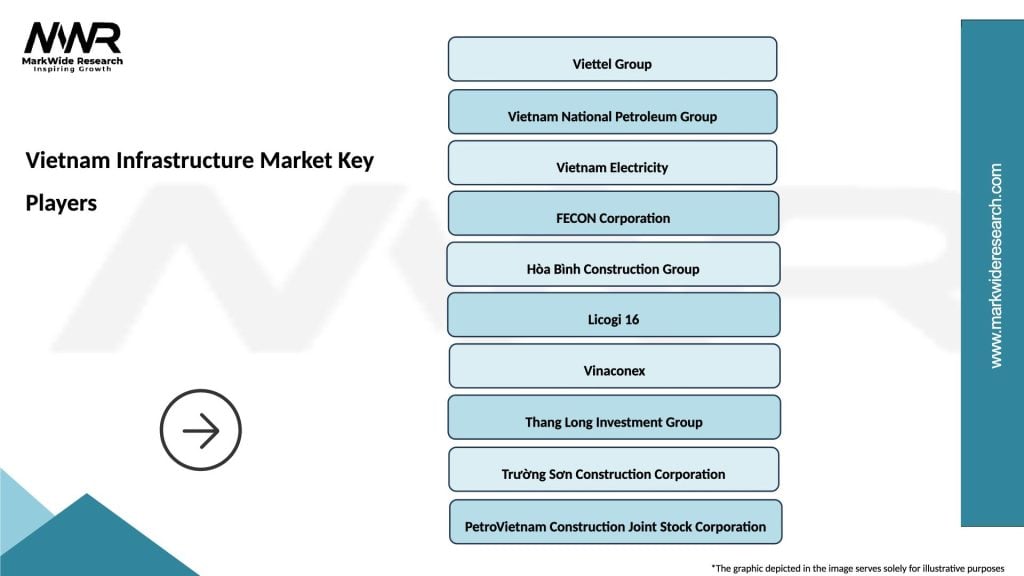

What are the key players in the Vietnam Infrastructure Market?

Key players in the Vietnam Infrastructure Market include companies like VinGroup, Ho Chi Minh City Infrastructure Investment JSC, and Coteccons, among others.

What are the main drivers of growth in the Vietnam Infrastructure Market?

The main drivers of growth in the Vietnam Infrastructure Market include rapid urbanization, increasing foreign investment, and government initiatives aimed at improving transportation and utility services.

What challenges does the Vietnam Infrastructure Market face?

Challenges in the Vietnam Infrastructure Market include funding constraints, regulatory hurdles, and the need for sustainable development practices to address environmental concerns.

What opportunities exist in the Vietnam Infrastructure Market?

Opportunities in the Vietnam Infrastructure Market include the development of smart city projects, expansion of renewable energy infrastructure, and enhancements in public transportation systems.

What trends are shaping the Vietnam Infrastructure Market?

Trends shaping the Vietnam Infrastructure Market include the adoption of digital technologies for project management, increased focus on sustainability, and the integration of public-private partnerships in infrastructure development.

Vietnam Infrastructure Market

| Segmentation Details | Description |

|---|---|

| Type | Roads, Bridges, Railways, Airports |

| Technology | Smart Grids, Renewable Energy, IoT Solutions, Construction Tech |

| End User | Government, Private Sector, Contractors, Developers |

| Service Type | Consulting, Project Management, Maintenance, Design |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Infrastructure Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at