444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam hospitality industry market represents one of Southeast Asia’s most dynamic and rapidly evolving sectors, driven by robust economic growth, increasing tourism arrivals, and expanding domestic travel demand. Vietnam’s hospitality sector encompasses hotels, resorts, restaurants, travel services, and entertainment venues that collectively contribute significantly to the nation’s economic development. The industry has experienced remarkable transformation over the past decade, with international hotel chains establishing strong presence alongside emerging local brands.

Market growth has been particularly impressive, with the sector demonstrating resilience and adaptability in the face of global challenges. The industry benefits from Vietnam’s strategic location, rich cultural heritage, diverse landscapes, and increasingly affluent middle class. Tourism infrastructure development has accelerated across major destinations including Ho Chi Minh City, Hanoi, Da Nang, and emerging coastal regions, creating substantial opportunities for hospitality service providers.

Digital transformation has become a key differentiator, with hospitality businesses increasingly adopting technology-driven solutions to enhance guest experiences and operational efficiency. The sector is projected to maintain strong growth momentum, supported by government initiatives promoting tourism development and foreign investment incentives.

The Vietnam hospitality industry market refers to the comprehensive ecosystem of businesses and services dedicated to providing accommodation, dining, entertainment, and travel-related experiences to domestic and international visitors throughout Vietnam. This market encompasses traditional hotels and resorts, boutique accommodations, restaurants and food services, tour operators, event management companies, and ancillary services that support the broader tourism economy.

Hospitality services in Vietnam range from luxury international hotel chains and premium resorts to budget accommodations and local guesthouses, catering to diverse traveler preferences and spending capabilities. The industry includes both leisure and business travel segments, with increasing emphasis on experiential tourism, cultural immersion, and sustainable travel practices that showcase Vietnam’s unique heritage and natural beauty.

Vietnam’s hospitality industry stands as a cornerstone of the nation’s economic growth strategy, demonstrating exceptional resilience and innovation capacity. The sector has successfully navigated global challenges while maintaining its position as a preferred destination for international travelers and a growing domestic tourism market. Key performance indicators show sustained growth across multiple segments, with particular strength in mid-scale and luxury accommodation categories.

Strategic developments include significant infrastructure investments, technology adoption, and service quality improvements that have elevated Vietnam’s competitive position in the regional hospitality landscape. The industry benefits from strong government support, favorable regulatory environment, and increasing integration with global distribution systems and booking platforms.

Market dynamics indicate robust demand fundamentals, with growing business travel, leisure tourism, and domestic travel contributing to sustained occupancy rates and revenue growth. The sector’s evolution toward sustainable practices and authentic cultural experiences positions Vietnam favorably for long-term market expansion and international recognition.

Critical market insights reveal several transformative trends shaping Vietnam’s hospitality landscape:

Primary market drivers propelling Vietnam’s hospitality industry growth include robust economic fundamentals and favorable demographic trends. The country’s sustained GDP growth, estimated at approximately 6.5% annually, has created a expanding middle class with increased discretionary spending on travel and hospitality services. Foreign direct investment continues flowing into the tourism sector, bringing international expertise and capital for infrastructure development.

Government initiatives play a crucial role, with comprehensive tourism development policies, visa facilitation programs, and infrastructure investment creating an enabling environment for industry expansion. The National Tourism Development Strategy targets significant growth in international arrivals while promoting sustainable tourism practices and regional destination development.

Geographic advantages position Vietnam strategically within Southeast Asia’s growing tourism corridor, benefiting from proximity to major source markets including China, South Korea, Japan, and Australia. The country’s diverse attractions, from pristine beaches and mountain landscapes to historic cities and cultural sites, appeal to varied traveler preferences and support year-round tourism demand.

Digital connectivity improvements and smartphone penetration rates exceeding 75% have transformed booking behaviors and service expectations, driving hospitality businesses to invest in technology infrastructure and digital marketing capabilities.

Significant market restraints include infrastructure limitations in emerging destinations, where transportation networks, utilities, and communication systems may not meet international hospitality standards. Skilled workforce shortages present ongoing challenges, particularly for specialized roles requiring language skills, technical expertise, and international service standards knowledge.

Regulatory complexities can create barriers for foreign investors and operators, with licensing procedures, land use regulations, and operational compliance requirements varying across provinces and municipalities. Environmental concerns related to rapid tourism development, including waste management, water resources, and coastal preservation, require careful balance between growth and sustainability.

Seasonal demand fluctuations affect revenue stability, with peak tourist seasons creating capacity constraints while off-peak periods challenge profitability. Competition intensity from regional destinations offering similar attractions and potentially lower costs requires continuous investment in service quality and unique value propositions.

Currency exchange volatility and economic uncertainties in key source markets can impact international travel demand, while domestic economic fluctuations affect local travel spending patterns.

Substantial market opportunities emerge from Vietnam’s untapped tourism potential in secondary and tertiary destinations beyond traditional hotspots. Eco-tourism development presents significant prospects, with the country’s biodiversity, national parks, and natural landscapes attracting environmentally conscious travelers seeking authentic experiences.

MICE tourism (Meetings, Incentives, Conferences, and Exhibitions) represents a high-value growth segment, supported by improving conference facilities, transportation infrastructure, and Vietnam’s growing reputation as a business destination. Wellness tourism opportunities include spa resorts, health retreats, and traditional medicine experiences that leverage Vietnam’s cultural heritage and natural resources.

Digital innovation adoption creates opportunities for hospitality businesses to differentiate through personalized services, predictive analytics, and seamless guest experiences. Sustainable tourism initiatives can attract premium travelers willing to pay higher rates for environmentally responsible and culturally authentic experiences.

Regional integration through ASEAN tourism promotion and cross-border travel facilitation expands market reach and creates multi-destination itinerary opportunities. Luxury segment development remains underserved in many destinations, presenting opportunities for high-end resort and boutique hotel development.

Market dynamics in Vietnam’s hospitality industry reflect the interplay between rapid economic development, changing consumer preferences, and evolving global travel trends. Supply-demand equilibrium varies significantly across regions, with major cities experiencing strong demand growth while emerging destinations offer development opportunities with lower competition intensity.

Pricing dynamics demonstrate increasing sophistication, with revenue management systems and dynamic pricing strategies becoming standard practice among international hotel chains and progressive local operators. Service quality expectations continue rising, driven by international traveler experiences and domestic consumer sophistication, requiring continuous investment in staff training and facility upgrades.

Technology integration has accelerated, with approximately 60% of bookings now made through digital channels, fundamentally changing distribution strategies and customer relationship management approaches. Competitive dynamics intensify as international brands expand presence while local operators enhance service standards and market positioning.

Sustainability considerations increasingly influence operational decisions, with environmental impact assessments and community engagement becoming integral to development planning and ongoing operations.

Comprehensive research methodology employed for analyzing Vietnam’s hospitality industry market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, hotel operators, tourism officials, and key stakeholders across different market segments and geographic regions.

Secondary research encompasses analysis of government tourism statistics, industry reports, financial statements of publicly traded hospitality companies, and academic studies focusing on Vietnam’s tourism development. Market surveys conducted among domestic and international travelers provide insights into preferences, spending patterns, and satisfaction levels across different hospitality service categories.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends and correlations, and expert review panels to ensure findings accuracy and relevance. Quantitative analysis focuses on occupancy rates, average daily rates, revenue per available room, and other key performance indicators tracked across different property types and locations.

Qualitative assessment examines market trends, competitive positioning, regulatory developments, and strategic initiatives that influence industry dynamics and future growth prospects.

Regional analysis reveals distinct characteristics and growth patterns across Vietnam’s major hospitality markets. Ho Chi Minh City maintains its position as the country’s largest hospitality market, accounting for approximately 35% of total accommodation capacity, driven by strong business travel demand, international connectivity, and diverse entertainment options.

Hanoi region represents the second-largest market with roughly 25% market share, benefiting from its status as the capital city, cultural attractions, and government-related travel. The city’s historic charm and proximity to popular destinations like Halong Bay support both leisure and business travel segments.

Central Vietnam, including Da Nang, Hoi An, and Hue, has emerged as a rapidly growing hospitality hub, capturing approximately 20% of market activity through beach resorts, cultural tourism, and improved transportation infrastructure. The region’s UNESCO World Heritage sites and coastal attractions appeal to international leisure travelers.

Phu Quoc Island and southern coastal regions demonstrate exceptional growth potential, with luxury resort development and improved accessibility driving tourism expansion. Northern mountain regions including Sapa and Ha Giang offer adventure tourism and cultural experiences, representing emerging opportunities for boutique accommodations and eco-lodges.

Mekong Delta region presents unique opportunities for river cruise tourism and agritourism experiences, though infrastructure development remains a key requirement for realizing full potential.

Competitive landscape in Vietnam’s hospitality industry features a dynamic mix of international hotel chains, regional operators, and local hospitality companies competing across different market segments and price points.

Market competition intensifies as international brands expand presence while local operators enhance service standards and develop unique positioning strategies. Competitive advantages include location quality, service excellence, technology integration, and ability to provide authentic Vietnamese experiences.

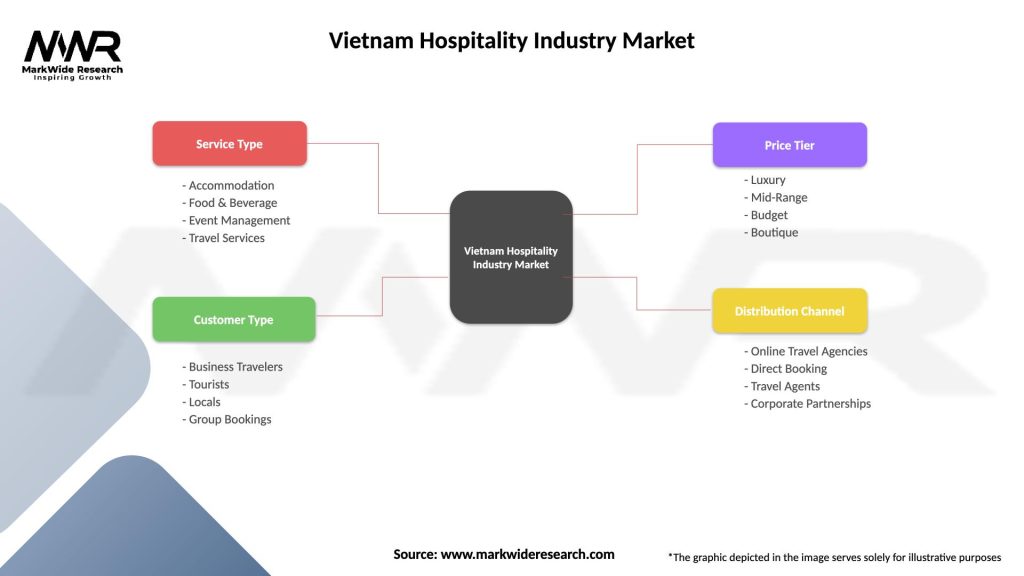

Market segmentation analysis reveals distinct categories within Vietnam’s hospitality industry, each with unique characteristics and growth dynamics.

By Property Type:

By Customer Segment:

Luxury segment insights indicate strong performance driven by increasing affluent traveler arrivals and domestic high-income consumer growth. Premium properties achieve average occupancy rates of approximately 72%, with international luxury brands commanding premium pricing through superior service standards and exclusive amenities.

Mid-scale category represents the largest segment by room inventory, appealing to business travelers and middle-income leisure guests seeking quality accommodations at reasonable rates. This segment demonstrates consistent performance with occupancy rates averaging 68% across major markets.

Economy segment serves price-sensitive travelers including backpackers, budget tourists, and domestic travelers, with properties focusing on essential amenities and competitive pricing strategies. Digital booking platforms significantly influence this segment’s distribution and marketing approaches.

Boutique properties gain popularity among travelers seeking unique experiences and personalized service, particularly in historic districts and cultural destinations. These properties often achieve higher guest satisfaction scores despite smaller scale operations.

Resort category benefits from Vietnam’s coastal and mountain destinations, with all-inclusive and leisure-focused properties attracting extended-stay guests and family travelers seeking comprehensive vacation experiences.

Industry participants benefit from Vietnam’s favorable business environment, growing market demand, and supportive government policies promoting tourism development. Hotel operators gain access to diverse market segments, from budget-conscious domestic travelers to affluent international guests, enabling portfolio diversification and revenue optimization strategies.

International investors benefit from attractive returns on investment, supported by strong tourism growth fundamentals and increasing property values in prime locations. Foreign hotel chains can leverage Vietnam’s strategic location for regional expansion while accessing a large and growing domestic market.

Local stakeholders including employees, suppliers, and communities benefit from job creation, skills development, and economic multiplier effects generated by hospitality industry growth. Government entities benefit from increased tax revenues, foreign exchange earnings, and enhanced international reputation as a tourist destination.

Technology providers find opportunities to supply innovative solutions for property management, guest services, and operational efficiency improvements. Service providers including food suppliers, laundry services, and maintenance companies benefit from growing demand for hospitality support services.

Financial institutions benefit from lending opportunities for hotel development, renovation projects, and working capital requirements of expanding hospitality businesses.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the most significant trend, with hospitality businesses adopting mobile check-in systems, contactless payment solutions, and artificial intelligence-powered guest services. Personalization technologies enable customized experiences based on guest preferences and historical data, enhancing satisfaction and loyalty.

Sustainable tourism practices gain momentum as travelers increasingly prioritize environmental responsibility and authentic cultural experiences. Green building certifications, waste reduction programs, and community engagement initiatives become competitive differentiators for hospitality properties.

Experiential travel trends drive demand for unique, immersive experiences that showcase Vietnamese culture, cuisine, and traditions. Culinary tourism particularly benefits from Vietnam’s renowned food culture, with cooking classes, street food tours, and farm-to-table dining experiences gaining popularity.

Wellness tourism expands beyond traditional spa services to include holistic health programs, meditation retreats, and traditional Vietnamese healing practices. Adventure tourism grows in mountain and coastal regions, appealing to active travelers seeking outdoor activities and nature experiences.

Bleisure travel combining business and leisure components influences hotel design and service offerings, with properties providing flexible spaces and extended-stay amenities.

Major industry developments include significant infrastructure investments improving accessibility to key destinations. Airport expansions in Ho Chi Minh City, Hanoi, and Da Nang enhance international connectivity, while new highway projects reduce travel times between major tourist areas.

International hotel chain expansions continue accelerating, with major brands announcing multiple property openings across different market segments and geographic regions. MarkWide Research analysis indicates that international brand penetration has increased by approximately 15% over the past three years.

Technology integration initiatives include widespread adoption of property management systems, revenue management software, and guest experience platforms. Smart room technologies and Internet of Things applications enhance operational efficiency while providing personalized guest services.

Sustainability certifications and green building standards adoption accelerate as properties seek to meet international environmental standards and attract eco-conscious travelers. Community-based tourism projects expand, creating authentic experiences while supporting local economic development.

Regulatory developments include streamlined licensing procedures for hospitality businesses and enhanced visa facilitation programs promoting international tourism growth.

Strategic recommendations for hospitality industry participants emphasize the importance of technology adoption and service differentiation in an increasingly competitive market. Investment priorities should focus on digital infrastructure, staff training, and sustainable operations that align with evolving traveler expectations and regulatory requirements.

Market positioning strategies should leverage Vietnam’s unique cultural assets and natural beauty while ensuring service quality meets international standards. Portfolio diversification across different property types and geographic locations can mitigate risks while capturing diverse market opportunities.

Partnership development with local suppliers, tour operators, and cultural organizations can enhance authentic experience offerings while supporting community development objectives. Revenue management optimization through advanced analytics and dynamic pricing strategies becomes essential for maintaining profitability in competitive markets.

Sustainability integration should be viewed as a strategic imperative rather than compliance requirement, with environmental and social responsibility programs creating competitive advantages and supporting long-term viability.

Human resource development requires significant investment in training programs, language skills, and career development opportunities to address skills shortages and improve service quality standards.

Future outlook for Vietnam’s hospitality industry remains highly positive, supported by strong economic fundamentals, favorable demographics, and continued government commitment to tourism development. MWR projections indicate sustained growth momentum with the industry expected to maintain expansion rates of approximately 8-10% annually over the next five years.

Infrastructure development will continue improving accessibility and service quality, with major transportation projects and utility upgrades supporting tourism expansion into previously underserved regions. Digital transformation will accelerate, with artificial intelligence, automation, and data analytics becoming standard operational tools.

Market sophistication will increase as domestic travelers develop more refined preferences and international visitors seek increasingly authentic and personalized experiences. Sustainable tourism will transition from trend to requirement, with environmental and social responsibility becoming fundamental business practices.

Regional integration through ASEAN tourism initiatives will create new opportunities for multi-destination travel and cross-border tourism development. Investment flows are expected to remain strong, with both international hotel chains and local developers pursuing expansion opportunities across different market segments.

Innovation adoption will differentiate successful operators, with technology-enabled personalization, operational efficiency, and guest engagement becoming critical competitive factors in the evolving hospitality landscape.

Vietnam’s hospitality industry stands at a pivotal moment of transformation and growth, positioned to capitalize on favorable market conditions, strong economic fundamentals, and increasing global recognition as a premier tourism destination. The industry’s evolution from a developing market to a sophisticated hospitality ecosystem demonstrates remarkable adaptability and strategic vision.

Key success factors include continued investment in service quality, technology integration, and sustainable practices that meet evolving traveler expectations while preserving Vietnam’s unique cultural and natural assets. The industry’s ability to balance rapid growth with environmental responsibility and community benefit will determine long-term sustainability and competitive positioning.

Strategic opportunities abound for industry participants who can effectively navigate market dynamics, leverage technology innovations, and create authentic experiences that showcase Vietnam’s distinctive appeal. The convergence of favorable government policies, infrastructure development, and growing market demand creates an environment conducive to sustained industry expansion and profitability.

Future success will depend on the industry’s collective ability to maintain service excellence, embrace innovation, and contribute positively to Vietnam’s broader economic development objectives while creating memorable experiences for the millions of travelers who choose Vietnam as their destination of choice.

What is Vietnam Hospitality Industry?

The Vietnam Hospitality Industry encompasses a range of services including accommodation, food and beverage, and tourism-related activities. It plays a crucial role in the country’s economy by attracting both domestic and international travelers.

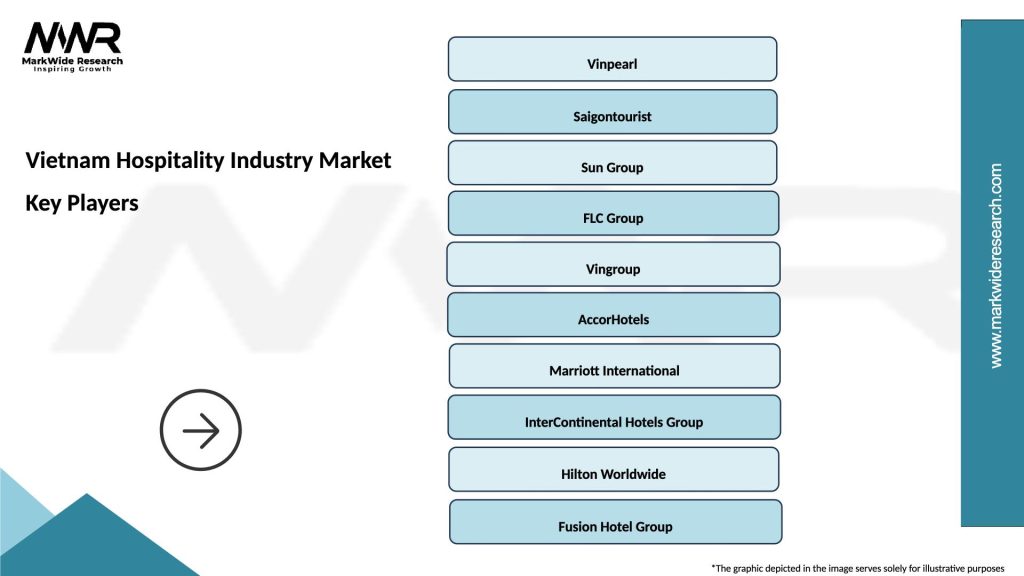

What are the key players in the Vietnam Hospitality Industry Market?

Key players in the Vietnam Hospitality Industry Market include major hotel chains like Accor, Marriott, and Hilton, as well as local companies such as Vinpearl and FLC Group, among others.

What are the growth factors driving the Vietnam Hospitality Industry Market?

The growth of the Vietnam Hospitality Industry Market is driven by increasing tourism, rising disposable incomes, and government initiatives to promote travel and investment in infrastructure. Additionally, the growing popularity of Vietnam as a travel destination contributes to this growth.

What challenges does the Vietnam Hospitality Industry Market face?

The Vietnam Hospitality Industry Market faces challenges such as intense competition, fluctuating demand due to global events, and the need for continuous improvement in service quality. Additionally, regulatory hurdles can impact operational efficiency.

What opportunities exist in the Vietnam Hospitality Industry Market?

Opportunities in the Vietnam Hospitality Industry Market include the expansion of eco-tourism, the development of luxury accommodations, and the rise of digital platforms for booking and customer engagement. These trends can enhance the overall travel experience.

What trends are shaping the Vietnam Hospitality Industry Market?

Trends shaping the Vietnam Hospitality Industry Market include the increasing focus on sustainability, the integration of technology in service delivery, and the growing demand for personalized travel experiences. These trends are influencing how businesses operate and attract customers.

Vietnam Hospitality Industry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Accommodation, Food & Beverage, Event Management, Travel Services |

| Customer Type | Business Travelers, Tourists, Locals, Group Bookings |

| Price Tier | Luxury, Mid-Range, Budget, Boutique |

| Distribution Channel | Online Travel Agencies, Direct Booking, Travel Agents, Corporate Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Hospitality Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at