444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam herbicide market represents a dynamic and rapidly evolving sector within the country’s agricultural landscape, driven by increasing modernization of farming practices and growing demand for enhanced crop productivity. Vietnam’s agricultural sector has undergone significant transformation in recent years, with herbicides playing a crucial role in supporting the nation’s food security objectives and export-oriented agricultural economy.

Market dynamics in Vietnam’s herbicide sector reflect the country’s transition from traditional farming methods to more mechanized and chemical-intensive agricultural practices. The market encompasses various herbicide formulations, including selective and non-selective products, designed to address the diverse weed management challenges faced by Vietnamese farmers across different crop types and growing conditions.

Agricultural modernization initiatives supported by government policies have contributed to increased herbicide adoption rates, with current penetration reaching approximately 68% among commercial farmers. The market demonstrates strong growth potential, particularly in the Mekong Delta region, which accounts for nearly 45% of national herbicide consumption due to its intensive rice cultivation and diverse cropping systems.

Regional distribution patterns show concentrated demand in key agricultural provinces, with Ho Chi Minh City, Can Tho, and Hanoi serving as primary distribution hubs. The market’s growth trajectory reflects Vietnam’s broader economic development and increasing integration into global agricultural value chains, positioning herbicides as essential inputs for maintaining competitive crop production.

The Vietnam herbicide market refers to the comprehensive ecosystem of chemical weed control products, distribution networks, and application services operating within Vietnam’s agricultural sector to support crop protection and yield optimization objectives.

Herbicide products in the Vietnamese context encompass a wide range of chemical formulations designed to control unwanted vegetation that competes with crops for nutrients, water, and sunlight. These products include pre-emergence and post-emergence herbicides, systemic and contact herbicides, and specialized formulations tailored to specific crop-weed combinations prevalent in Vietnamese agriculture.

Market participants include international agrochemical companies, domestic manufacturers, distributors, retailers, and end-users ranging from smallholder farmers to large-scale agricultural enterprises. The market structure reflects Vietnam’s unique agricultural landscape, characterized by fragmented land holdings alongside emerging commercial farming operations.

Regulatory framework governing the herbicide market involves multiple government agencies, including the Ministry of Agriculture and Rural Development, which oversees product registration, safety standards, and usage guidelines. This regulatory environment shapes market access, product availability, and adoption patterns across different regions and crop types.

Vietnam’s herbicide market demonstrates robust growth momentum driven by agricultural modernization, increasing crop intensification, and evolving farming practices across the country’s diverse agricultural regions. The market benefits from strong government support for agricultural development and growing recognition among farmers of herbicides’ role in improving productivity and reducing labor costs.

Key growth drivers include expanding commercial agriculture, rising labor costs that encourage mechanization and chemical inputs, and increasing adoption of high-yielding crop varieties that require intensive weed management. The market shows particular strength in rice cultivation, which represents approximately 55% of total herbicide usage, followed by vegetable crops and industrial crops such as coffee and rubber.

Market segmentation reveals diverse product categories, with glyphosate-based herbicides maintaining dominant market share due to their broad-spectrum effectiveness and cost-efficiency. Selective herbicides for rice cultivation represent another significant segment, reflecting the crop’s importance in Vietnamese agriculture and the specific weed management challenges associated with paddy cultivation systems.

Competitive landscape features both international and domestic players, with multinational corporations leveraging advanced product portfolios and technical expertise, while local companies compete through cost advantages and deep understanding of regional farming practices. Distribution networks continue to evolve, with increasing emphasis on technical support services and integrated crop management solutions.

Strategic market insights reveal several critical factors shaping Vietnam’s herbicide market development and future growth prospects:

Primary market drivers propelling Vietnam’s herbicide market growth stem from fundamental changes in the country’s agricultural sector and broader economic development patterns. These drivers create sustained demand for effective weed management solutions across diverse farming systems.

Agricultural modernization represents the most significant driver, as Vietnam continues its transition from traditional farming methods to more intensive, technology-driven agricultural practices. Government initiatives promoting agricultural mechanization and productivity improvements directly support herbicide adoption, with mechanized farms showing 75% higher herbicide usage rates compared to traditional operations.

Labor shortage challenges in rural areas, driven by urbanization and industrial development, compel farmers to seek alternatives to labor-intensive manual weeding practices. Rising agricultural wages make chemical weed control increasingly cost-effective, particularly for labor-intensive crops such as rice and vegetables where manual weeding traditionally required significant workforce deployment.

Crop intensification trends drive herbicide demand as farmers adopt multiple cropping systems and shorter fallow periods to maximize land productivity. Intensive cropping systems create more complex weed management challenges, requiring sophisticated herbicide programs to maintain crop yields and quality standards.

Export market opportunities motivate farmers to adopt international quality standards and production practices, including integrated pest and weed management programs that rely heavily on herbicide inputs. Vietnam’s growing agricultural exports, particularly rice, coffee, and vegetables, require consistent quality and productivity that herbicides help ensure.

Market restraints affecting Vietnam’s herbicide sector include regulatory challenges, environmental concerns, and structural limitations within the agricultural system that may limit growth potential and market development.

Regulatory complexities present significant challenges for market participants, particularly regarding product registration processes, safety requirements, and usage restrictions. Lengthy approval procedures for new herbicide products can delay market entry and limit farmers’ access to advanced weed management solutions, potentially constraining market growth and innovation adoption.

Environmental sustainability concerns increasingly influence herbicide market dynamics, with growing awareness of potential impacts on soil health, water quality, and non-target organisms. Stricter environmental regulations and sustainability requirements may limit certain herbicide applications and drive demand for more expensive, environmentally-friendly alternatives.

Farmer education limitations regarding proper herbicide selection, application techniques, and safety practices can lead to suboptimal usage patterns and potential resistance development. Limited technical support and extension services in remote agricultural areas may restrict effective herbicide adoption and proper integrated weed management practices.

Economic constraints among smallholder farmers, who represent a significant portion of Vietnam’s agricultural sector, may limit herbicide adoption despite proven benefits. High upfront costs for quality herbicide products and application equipment can present barriers for resource-constrained farmers, particularly during economic downturns or crop price volatility periods.

Emerging opportunities in Vietnam’s herbicide market reflect evolving agricultural practices, technological advancement, and changing consumer preferences that create new avenues for market expansion and product innovation.

Precision agriculture adoption presents significant opportunities for advanced herbicide formulations and application technologies. Integration of GPS guidance systems, variable rate application equipment, and drone technology enables more targeted and efficient herbicide use, creating demand for specialized products and services that support precision weed management strategies.

Organic and sustainable farming trends drive opportunities for bio-based herbicides and integrated weed management solutions that align with environmental sustainability objectives. Growing consumer demand for organic and sustainably-produced agricultural products creates market niches for alternative weed control technologies and reduced-risk herbicide formulations.

Crop diversification initiatives supported by government policies create opportunities for specialized herbicide products tailored to emerging crops and cropping systems. Expansion of high-value crops including fruits, vegetables, and industrial crops requires specific weed management solutions that address unique challenges and regulatory requirements.

Digital agriculture platforms offer opportunities for herbicide companies to develop integrated solutions combining products with digital advisory services, weather monitoring, and crop management recommendations. These platforms can enhance farmer decision-making and optimize herbicide usage while building stronger customer relationships and brand loyalty.

Market dynamics in Vietnam’s herbicide sector reflect complex interactions between supply-side factors, demand patterns, regulatory influences, and competitive forces that shape market structure and growth trajectories.

Supply chain evolution demonstrates increasing sophistication, with major international companies establishing local manufacturing and distribution capabilities to serve the Vietnamese market more effectively. Local production facilities reduce costs and improve product availability while enabling companies to develop formulations specifically adapted to local conditions and requirements.

Demand patterns show seasonal variations aligned with Vietnam’s agricultural calendar, with peak herbicide usage during land preparation and early crop establishment periods. Regional demand variations reflect different cropping systems, with the Mekong Delta region showing consistently high demand due to intensive rice cultivation and year-round cropping activities.

Competitive dynamics feature intense competition between international and domestic players, with market share battles focused on product efficacy, pricing strategies, and technical support services. MarkWide Research analysis indicates that successful companies combine competitive pricing with comprehensive farmer education programs and reliable distribution networks.

Technology integration increasingly influences market dynamics, with companies investing in digital platforms, precision application technologies, and data analytics capabilities to differentiate their offerings and provide enhanced value to customers. These technological advances create opportunities for premium pricing and stronger customer relationships.

Research methodology employed for analyzing Vietnam’s herbicide market incorporates comprehensive primary and secondary research approaches designed to provide accurate, reliable, and actionable market intelligence for industry stakeholders and decision-makers.

Primary research activities include extensive interviews with key market participants across the value chain, including herbicide manufacturers, distributors, retailers, agricultural extension agents, and end-user farmers representing different farm sizes and cropping systems. These interviews provide insights into market trends, challenges, opportunities, and competitive dynamics from multiple perspectives.

Secondary research components encompass analysis of government statistics, industry reports, trade publications, regulatory documents, and academic research relevant to Vietnam’s agricultural sector and herbicide market. This secondary research provides historical context, market sizing data, and trend analysis that supports primary research findings.

Data validation processes ensure research accuracy through triangulation of information sources, cross-verification of key findings, and validation of quantitative data through multiple independent sources. Regional analysis incorporates province-level agricultural statistics and local market intelligence to provide granular insights into market dynamics across Vietnam’s diverse agricultural regions.

Market modeling approaches utilize statistical analysis and forecasting techniques to project future market trends, growth rates, and segment development patterns. These models incorporate economic indicators, agricultural policy changes, and demographic trends that influence herbicide market development in Vietnam.

Regional analysis of Vietnam’s herbicide market reveals significant geographical variations in demand patterns, product preferences, and market development levels across the country’s major agricultural regions.

Mekong Delta region dominates herbicide consumption, accounting for approximately 42% of national market share due to its intensive agricultural activities and year-round cropping systems. This region’s extensive rice cultivation, combined with diversified cropping including vegetables and fruits, creates sustained demand for various herbicide products throughout the agricultural calendar.

Red River Delta represents another significant market, characterized by smaller farm sizes but intensive cultivation practices that require effective weed management solutions. This region shows growing adoption of selective herbicides for rice cultivation and increasing interest in herbicide products for vegetable and flower production systems.

Central Highlands region demonstrates unique market characteristics driven by coffee and rubber cultivation, creating demand for specialized herbicide products adapted to perennial crop systems. The region’s mountainous terrain and distinct climate conditions require herbicide formulations specifically designed for these challenging growing environments.

Northern mountainous regions show emerging market potential as agricultural development programs promote crop intensification and modernization. These areas present opportunities for herbicide companies willing to invest in distribution infrastructure and farmer education programs tailored to local conditions and farming practices.

Competitive landscape in Vietnam’s herbicide market features a diverse mix of international corporations, regional players, and domestic companies competing across different market segments and geographical regions.

Market competition intensifies through product innovation, pricing strategies, distribution network expansion, and technical support services. Companies increasingly focus on developing integrated solutions that combine herbicide products with digital advisory services and precision application technologies.

Strategic partnerships between international companies and local distributors enhance market penetration and customer service capabilities. These partnerships leverage international expertise in product development and manufacturing with local knowledge of farming practices and market conditions.

Market segmentation analysis reveals distinct product categories, application methods, and end-user segments that define Vietnam’s herbicide market structure and growth opportunities.

By Product Type:

By Application Method:

By Crop Type:

Category-wise analysis provides detailed insights into specific herbicide segments and their unique market characteristics, growth drivers, and development prospects within Vietnam’s agricultural context.

Glyphosate Category: Maintains market leadership through proven effectiveness, cost advantages, and broad-spectrum weed control capabilities. This category benefits from increasing adoption of no-till and conservation agriculture practices that rely heavily on glyphosate-based weed management systems. However, growing resistance concerns and environmental considerations may influence future growth patterns.

Rice Herbicides Category: Represents a specialized segment with products specifically formulated for paddy cultivation systems. This category shows steady growth driven by mechanization of rice farming and adoption of direct seeding practices that require effective weed control solutions. Selective herbicides for rice demonstrate particular strength due to their ability to control weeds without damaging rice crops.

Vegetable Herbicides Category: Exhibits rapid growth potential as commercial vegetable production expands to meet domestic and export demand. This category requires specialized products that address the unique weed management challenges of intensive vegetable cultivation while meeting strict residue requirements for food safety.

Bio-based Herbicides Category: Emerging segment driven by increasing environmental awareness and organic farming trends. While currently representing a small market share, this category shows significant growth potential as regulatory support for sustainable agriculture increases and consumer demand for environmentally-friendly products grows.

Industry participants and stakeholders in Vietnam’s herbicide market realize multiple benefits from market development and expansion, creating value across the agricultural value chain.

For Farmers:

For Manufacturers:

For Distributors and Retailers:

SWOT analysis provides comprehensive evaluation of Vietnam’s herbicide market strengths, weaknesses, opportunities, and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Vietnam’s herbicide sector reflect broader agricultural transformation, technological advancement, and evolving stakeholder preferences that influence market development and competitive strategies.

Precision Application Technologies: Increasing adoption of GPS-guided sprayers, drone application systems, and variable-rate application equipment enhances herbicide efficiency and reduces environmental impact. These technologies enable farmers to apply herbicides more precisely, reducing waste and improving cost-effectiveness while addressing environmental concerns.

Integrated Weed Management: Growing emphasis on combining herbicide applications with cultural, mechanical, and biological weed control methods creates demand for comprehensive weed management programs. This trend reflects increasing awareness of resistance management and sustainable agriculture practices among progressive farmers and agricultural advisors.

Digital Advisory Services: Development of mobile applications and digital platforms providing herbicide selection guidance, application timing recommendations, and weed identification tools enhances farmer decision-making capabilities. MWR analysis indicates that farmers using digital advisory services achieve 15-20% better weed control results compared to traditional approaches.

Sustainable Formulations: Increasing demand for environmentally-friendly herbicide formulations with reduced environmental persistence and lower toxicity profiles. This trend drives product innovation toward bio-based active ingredients and improved formulation technologies that maintain effectiveness while addressing sustainability concerns.

Supply Chain Digitization: Implementation of digital supply chain management systems improves product traceability, inventory management, and distribution efficiency. These systems enable better coordination between manufacturers, distributors, and retailers while providing enhanced customer service and market intelligence capabilities.

Industry developments in Vietnam’s herbicide market reflect ongoing innovation, regulatory changes, and strategic initiatives that shape market structure and competitive dynamics.

Regulatory Framework Updates: Vietnam’s Ministry of Agriculture and Rural Development continues updating herbicide registration requirements and safety standards to align with international best practices. Recent regulatory changes emphasize environmental safety assessments and residue monitoring programs that influence product development and market access strategies.

Local Manufacturing Expansion: Several international companies have established or expanded local manufacturing facilities to serve the Vietnamese market more effectively. These investments reduce costs, improve product availability, and enable development of formulations specifically adapted to local conditions and requirements.

Technology Transfer Initiatives: Collaborative programs between international companies and Vietnamese research institutions promote technology transfer and local innovation capabilities. These initiatives focus on developing herbicide products and application technologies suited to Vietnam’s unique agricultural conditions and farming systems.

Distribution Network Enhancement: Companies continue investing in distribution infrastructure, including regional warehouses, retail networks, and technical support centers. These investments improve product accessibility and customer service while enabling more effective market penetration in rural areas.

Sustainability Programs: Industry initiatives promoting responsible herbicide use, environmental stewardship, and integrated pest management practices gain momentum. These programs address growing environmental concerns while supporting sustainable agricultural development objectives.

Strategic recommendations for market participants in Vietnam’s herbicide sector focus on leveraging growth opportunities while addressing market challenges and competitive pressures.

Market Entry Strategies: Companies entering Vietnam’s herbicide market should prioritize understanding local agricultural practices, regulatory requirements, and farmer preferences. Successful market entry requires partnerships with established local distributors and investment in farmer education programs that demonstrate product value and proper usage techniques.

Product Development Focus: Innovation efforts should emphasize developing herbicide formulations specifically adapted to Vietnam’s tropical climate, diverse cropping systems, and prevalent weed species. Products addressing rice cultivation challenges and emerging high-value crops present particular opportunities for differentiation and premium pricing.

Distribution Strategy: Building comprehensive distribution networks that reach smallholder farmers in remote areas requires innovative approaches combining traditional retail channels with digital platforms and mobile services. Companies should invest in training programs for distributors and retailers to enhance technical support capabilities.

Technology Integration: Incorporating digital technologies into product offerings and customer services creates competitive advantages and enhances customer relationships. MarkWide Research recommends developing integrated solutions that combine herbicide products with precision application technologies and digital advisory services.

Sustainability Positioning: Emphasizing environmental stewardship and sustainable agriculture practices in marketing and product development strategies addresses growing stakeholder concerns while positioning companies for long-term success in an increasingly environmentally-conscious market.

Future outlook for Vietnam’s herbicide market indicates continued growth driven by agricultural modernization, technological advancement, and evolving farming practices that support increased herbicide adoption and market expansion.

Growth Projections: The market is expected to maintain robust growth momentum, with projected compound annual growth rates of 6-8% over the next five years. This growth reflects continued agricultural development, increasing crop intensification, and expanding commercial farming operations across Vietnam’s diverse agricultural regions.

Technology Evolution: Advancement in precision agriculture technologies, including GPS-guided application systems, drone technology, and artificial intelligence-based weed detection systems, will transform herbicide application practices. These technologies promise to improve application efficiency, reduce environmental impact, and enhance cost-effectiveness for farmers.

Market Segmentation Changes: Emerging crop segments, including organic agriculture and specialty crops, will create new market opportunities for innovative herbicide products and alternative weed management solutions. The rice herbicide segment will remain dominant but may face increased competition from diversified cropping systems.

Regulatory Development: Strengthening regulatory framework will continue emphasizing environmental safety and sustainable agriculture practices, influencing product development priorities and market access requirements. Companies must adapt to evolving regulatory standards while maintaining product effectiveness and commercial viability.

Competitive Landscape Evolution: Market consolidation may occur as smaller players struggle to meet increasing regulatory requirements and investment needs for technology development. Successful companies will differentiate through innovation, technical support services, and integrated solutions that address farmers’ comprehensive weed management needs.

Vietnam’s herbicide market represents a dynamic and rapidly evolving sector with significant growth potential driven by agricultural modernization, increasing crop intensification, and evolving farming practices. The market benefits from strong government support for agricultural development and growing recognition among farmers of herbicides’ role in improving productivity and reducing labor costs.

Market fundamentals remain strong, with diverse growth drivers including labor shortage challenges, export agriculture expansion, and adoption of advanced farming technologies. While challenges exist regarding regulatory complexity, environmental concerns, and farmer education needs, these obstacles create opportunities for companies that can provide innovative solutions and comprehensive support services.

Strategic success in Vietnam’s herbicide market requires understanding local agricultural conditions, building effective distribution networks, and investing in farmer education and technical support programs. Companies that combine high-quality products with digital technologies and sustainability initiatives are best positioned to capture market opportunities and build lasting competitive advantages.

Future prospects indicate continued market expansion supported by Vietnam’s agricultural transformation and integration into global value chains. The Vietnam herbicide market will continue evolving toward more sophisticated, environmentally-responsible, and technology-enabled solutions that support sustainable agricultural development while meeting farmers’ productivity and profitability objectives.

What is Herbicide?

Herbicides are chemical substances used to control or eliminate unwanted plants, commonly known as weeds. They play a crucial role in agriculture by enhancing crop yields and managing vegetation in various settings.

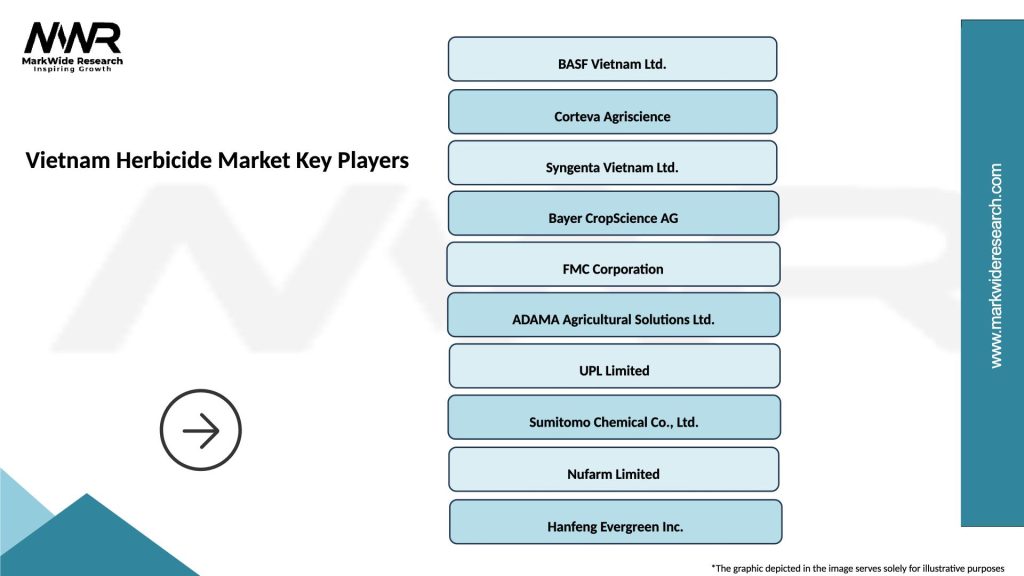

What are the key players in the Vietnam Herbicide Market?

Key players in the Vietnam Herbicide Market include companies like Bayer CropScience, Syngenta, and BASF. These companies are involved in the development and distribution of various herbicide products tailored for local agricultural needs, among others.

What are the growth factors driving the Vietnam Herbicide Market?

The Vietnam Herbicide Market is driven by factors such as the increasing demand for food production, the adoption of modern agricultural practices, and the need for effective weed management solutions. Additionally, the rise in crop cultivation areas contributes to market growth.

What challenges does the Vietnam Herbicide Market face?

The Vietnam Herbicide Market faces challenges such as regulatory restrictions on chemical usage, environmental concerns regarding herbicide application, and the emergence of herbicide-resistant weed species. These factors can hinder market growth and product effectiveness.

What opportunities exist in the Vietnam Herbicide Market?

Opportunities in the Vietnam Herbicide Market include the development of bio-based herbicides and innovative formulations that minimize environmental impact. Additionally, increasing investment in agricultural technology presents avenues for growth and product diversification.

What trends are shaping the Vietnam Herbicide Market?

Trends in the Vietnam Herbicide Market include a shift towards integrated pest management practices and the increasing use of precision agriculture technologies. These trends aim to enhance efficiency in herbicide application and reduce overall chemical usage.

Vietnam Herbicide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Glyphosate, Atrazine, 2,4-D, Paraquat |

| Application | Agricultural, Horticultural, Turf Management, Forestry |

| End User | Farmers, Agricultural Cooperatives, Landscaping Companies, Government Agencies |

| Packaging Type | Bulk, Sachets, Bottles, Drums |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Herbicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at