444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam fungicide market represents a rapidly expanding segment within the country’s agricultural sector, driven by increasing crop protection needs and modernization of farming practices. Vietnam’s agricultural landscape has experienced significant transformation as farmers adopt advanced crop protection solutions to enhance productivity and ensure food security. The market demonstrates robust growth potential, with agricultural modernization initiatives supporting increased adoption of fungicide products across diverse crop segments.

Market dynamics indicate substantial expansion opportunities as Vietnam’s agricultural sector continues to evolve. The country’s tropical climate and intensive farming practices create favorable conditions for fungal diseases, necessitating effective crop protection solutions. Agricultural producers increasingly recognize the importance of integrated pest management approaches, incorporating fungicide applications as essential components of sustainable farming strategies.

Growth projections suggest the market will experience a compound annual growth rate of 6.2% over the forecast period, reflecting strong demand from key agricultural segments. The expansion is supported by government initiatives promoting agricultural productivity, increasing awareness of crop protection benefits, and growing adoption of modern farming techniques throughout Vietnam’s agricultural regions.

The Vietnam fungicide market refers to the comprehensive ecosystem of antifungal agricultural chemicals designed to prevent, control, and eliminate fungal diseases affecting crops throughout Vietnam’s diverse agricultural landscape. Fungicides serve as critical crop protection tools that help farmers maintain healthy crops, prevent yield losses, and ensure consistent agricultural productivity in Vietnam’s challenging tropical growing conditions.

Market scope encompasses various fungicide formulations including contact fungicides, systemic fungicides, and combination products tailored to address specific fungal threats prevalent in Vietnamese agriculture. The market includes both synthetic and biological fungicide solutions, catering to conventional and organic farming practices across the country’s agricultural sectors.

Agricultural applications span major crop categories including rice, vegetables, fruits, coffee, and other specialty crops that form the backbone of Vietnam’s agricultural economy. The market serves diverse stakeholder groups including large-scale commercial farmers, smallholder producers, agricultural cooperatives, and specialty crop growers seeking effective disease management solutions.

Vietnam’s fungicide market demonstrates exceptional growth momentum driven by agricultural modernization, increasing crop protection awareness, and expanding commercial farming operations. The market benefits from favorable agricultural policies, growing export demands, and rising adoption of integrated pest management practices across Vietnam’s diverse farming communities.

Key market drivers include Vietnam’s tropical climate conditions that favor fungal disease development, increasing agricultural productivity requirements, and growing emphasis on food quality and safety standards. The market experiences strong demand from rice cultivation, which represents approximately 45% of total fungicide consumption, followed by vegetable and fruit production segments.

Technological advancement plays a crucial role in market development, with manufacturers introducing innovative formulations, improved application methods, and environmentally sustainable solutions. The market shows increasing preference for systemic fungicides that provide longer-lasting protection and reduced application frequency, supporting farmer productivity and cost-effectiveness.

Regional distribution indicates strong market presence in the Mekong Delta region, Red River Delta, and Central Highlands, where intensive agricultural activities drive consistent fungicide demand. Market expansion continues into emerging agricultural areas as farming practices modernize and crop protection awareness increases throughout Vietnam’s agricultural landscape.

Market segmentation reveals diverse opportunities across multiple agricultural applications and product categories. The following key insights highlight critical market dynamics:

Agricultural intensification serves as a primary driver for Vietnam’s fungicide market growth. The country’s transition toward more intensive farming practices, higher crop yields, and improved agricultural productivity creates substantial demand for effective crop protection solutions. Farmers increasingly recognize that fungicide applications represent essential investments in crop security and economic returns.

Climate conditions in Vietnam create favorable environments for fungal disease development, necessitating consistent fungicide applications across major crop categories. The country’s tropical and subtropical climate zones, combined with high humidity levels and intensive rainfall patterns, contribute to persistent fungal disease pressure throughout growing seasons.

Export market demands drive quality requirements that necessitate comprehensive crop protection programs. Vietnam’s growing agricultural exports, particularly rice, coffee, fruits, and vegetables, require adherence to international quality standards and phytosanitary regulations that mandate effective disease management practices.

Government support through agricultural modernization programs, subsidies, and extension services facilitates increased fungicide adoption. Policy initiatives promoting agricultural productivity, food security, and rural development create supportive environments for crop protection technology adoption throughout Vietnam’s farming communities.

Economic development enables farmers to invest in advanced agricultural inputs, including fungicides, as rural incomes increase and access to agricultural credit improves. Growing prosperity in agricultural regions supports transition from subsistence farming to commercial agriculture, driving demand for professional crop protection products.

Cost considerations present significant challenges for smallholder farmers who comprise a substantial portion of Vietnam’s agricultural sector. High fungicide costs relative to farm incomes can limit adoption rates, particularly among resource-constrained producers who may prioritize immediate economic needs over long-term crop protection investments.

Regulatory complexities surrounding fungicide registration, approval, and usage create barriers for market participants. Evolving regulatory frameworks, changing safety standards, and compliance requirements can delay product introductions and increase operational costs for fungicide manufacturers and distributors.

Environmental concerns regarding fungicide residues, ecological impact, and sustainability create challenges for market growth. Increasing awareness of environmental protection, water quality issues, and biodiversity conservation influences farmer attitudes toward chemical crop protection products and regulatory approaches.

Technical knowledge gaps among farmers regarding proper fungicide selection, application timing, and resistance management can limit product effectiveness and market development. Insufficient extension services and technical support may result in suboptimal fungicide utilization and reduced farmer confidence in crop protection solutions.

Market fragmentation across Vietnam’s diverse agricultural regions creates distribution challenges and limits economies of scale. Geographic dispersion, infrastructure limitations, and varying agricultural practices complicate market penetration strategies and increase distribution costs for fungicide suppliers.

Biological fungicides represent emerging opportunities as Vietnam’s agricultural sector increasingly embraces sustainable farming practices. Growing environmental consciousness, organic certification requirements, and consumer preferences for residue-free produce create expanding markets for biological crop protection solutions that offer effective disease control with reduced environmental impact.

Precision agriculture adoption creates opportunities for advanced fungicide application technologies and data-driven crop protection strategies. Integration of digital farming tools, weather monitoring systems, and disease prediction models enables more targeted and efficient fungicide applications, improving cost-effectiveness and environmental sustainability.

Specialty crops expansion, including high-value fruits, vegetables, and export-oriented crops, generates demand for specialized fungicide solutions. Growing cultivation of premium agricultural products requires sophisticated disease management programs that justify higher-value fungicide investments and create opportunities for innovative product development.

Cooperative farming models and agricultural consolidation create opportunities for bulk fungicide sales and professional application services. As farming operations scale up and organize into cooperatives, demand increases for comprehensive crop protection programs and technical support services that enhance agricultural productivity.

Technology transfer and knowledge sharing initiatives create opportunities for fungicide education, training programs, and extension services. Partnerships between manufacturers, government agencies, and agricultural organizations can accelerate fungicide adoption and improve application practices throughout Vietnam’s farming communities.

Supply chain evolution significantly influences Vietnam’s fungicide market dynamics, with distribution networks expanding to reach remote agricultural areas and improve product accessibility. Modern distribution channels, including agricultural retailers, cooperatives, and direct sales programs, enhance market penetration and provide farmers with convenient access to fungicide products and technical support services.

Competitive landscape dynamics reflect increasing participation from both international and domestic manufacturers seeking to capture market opportunities. Competition drives innovation in product formulations, application technologies, and service offerings, resulting in improved fungicide effectiveness and farmer value propositions throughout the market.

Seasonal demand patterns create cyclical market dynamics aligned with Vietnam’s agricultural calendar and disease pressure cycles. Peak demand periods correspond to critical crop protection windows, requiring efficient supply chain management and inventory planning to meet farmer needs during high-demand seasons.

Price sensitivity among farmers influences market dynamics, with cost-effectiveness serving as a key decision factor in fungicide selection. Market participants must balance product quality, efficacy, and pricing to maintain competitive positions while ensuring farmer profitability and sustainable market growth.

Technology adoption rates vary across different agricultural regions and crop segments, creating diverse market dynamics that require tailored approaches. MarkWide Research analysis indicates that technology adoption rates reach 85% in commercial farming areas compared to lower rates in traditional farming regions, highlighting opportunities for targeted market development strategies.

Primary research methodologies employed in analyzing Vietnam’s fungicide market include comprehensive surveys of agricultural stakeholders, in-depth interviews with farmers, distributors, and industry experts, and field studies across major agricultural regions. Direct engagement with market participants provides valuable insights into usage patterns, preferences, and emerging trends that shape market development.

Secondary research incorporates analysis of government agricultural statistics, trade data, regulatory documents, and industry publications to establish market foundations and validate primary research findings. Comprehensive review of agricultural policies, crop protection regulations, and economic indicators provides context for market analysis and future projections.

Data collection processes utilize multiple sources including agricultural cooperatives, extension services, research institutions, and commercial distributors to ensure comprehensive market coverage. Systematic data gathering approaches capture regional variations, seasonal patterns, and segment-specific dynamics that influence fungicide market development throughout Vietnam.

Analytical frameworks employ quantitative and qualitative research methods to assess market size, growth trends, competitive dynamics, and future opportunities. Statistical analysis, trend modeling, and scenario planning techniques provide robust foundations for market projections and strategic recommendations.

Validation procedures include cross-referencing multiple data sources, expert review processes, and market participant feedback to ensure research accuracy and reliability. Rigorous validation methodologies enhance confidence in research findings and support informed decision-making by market participants and stakeholders.

Mekong Delta region represents the largest fungicide market segment, accounting for approximately 38% of national consumption, driven by intensive rice cultivation and diverse crop production. The region’s extensive agricultural activities, favorable growing conditions, and established distribution networks create strong demand for comprehensive crop protection solutions across multiple crop categories.

Red River Delta demonstrates significant market presence with 22% market share, supported by intensive vegetable production, fruit cultivation, and proximity to major urban markets. The region’s agricultural modernization initiatives and higher farmer incomes facilitate adoption of advanced fungicide technologies and integrated pest management practices.

Central Highlands region shows growing market importance, representing 18% of fungicide consumption, driven by coffee production, specialty crops, and expanding commercial agriculture. The region’s unique climate conditions and crop specialization create demand for targeted disease management solutions and specialized fungicide formulations.

Southeast region contributes 15% of market demand, supported by diverse agricultural activities, industrial crop production, and proximity to Ho Chi Minh City’s distribution networks. The region benefits from agricultural investment, technology adoption, and access to modern crop protection products and services.

Northern mountains and other regions account for the remaining 7% of market share, with growth potential as agricultural development programs expand and farming practices modernize. These areas represent emerging opportunities for fungicide market expansion as infrastructure development and agricultural extension services improve accessibility and adoption rates.

Market leadership in Vietnam’s fungicide sector reflects participation from established international companies and emerging domestic manufacturers. The competitive environment demonstrates increasing innovation, product differentiation, and service enhancement as companies seek to capture market opportunities and build sustainable competitive advantages.

Competitive strategies emphasize product innovation, farmer education, distribution network expansion, and strategic partnerships with local agricultural organizations. Companies invest in research and development, regulatory compliance, and market access initiatives to strengthen their positions in Vietnam’s evolving fungicide market landscape.

By Product Type:

By Crop Application:

By Formulation:

Contact fungicides maintain strong market presence due to their immediate protective action and cost-effectiveness for preventive disease management. These products serve as foundation treatments in integrated pest management programs, offering broad-spectrum protection against multiple fungal pathogens. Farmer preference for contact fungicides reflects their reliability, established efficacy, and compatibility with existing application practices.

Systemic fungicides demonstrate growing market adoption as farmers recognize their superior disease control capabilities and extended protection periods. These products provide curative action against established infections and offer longer-lasting protection, reducing application frequency and labor requirements. Market growth in systemic products reflects increasing agricultural sophistication and emphasis on cost-effective crop protection strategies.

Rice applications dominate fungicide consumption patterns, driven by Vietnam’s position as a major rice producer and the crop’s susceptibility to various fungal diseases. Disease pressure from rice blast, sheath blight, and brown spot creates consistent demand for effective fungicide solutions throughout rice-growing regions. Specialized formulations for rice cultivation continue to drive product innovation and market development.

Vegetable production represents a rapidly growing market segment as domestic consumption increases and export opportunities expand. Intensive cultivation practices, high disease pressure, and quality requirements drive demand for advanced fungicide solutions. The segment benefits from increasing farmer awareness of crop protection benefits and willingness to invest in premium products.

Biological fungicides emerge as a significant growth category, reflecting increasing environmental consciousness and sustainable agriculture trends. MWR analysis indicates that biological product adoption rates have increased by 12% annually as farmers seek environmentally friendly alternatives that maintain crop protection effectiveness while supporting sustainable farming practices.

Farmers benefit from enhanced crop protection, improved yields, and reduced economic losses through effective fungicide applications. Disease management programs enable consistent agricultural productivity, quality improvement, and access to premium markets that reward high-quality produce. Farmers gain confidence in crop investments and can pursue more intensive cultivation practices that maximize land productivity.

Manufacturers gain access to expanding market opportunities, revenue growth potential, and platform for innovation in crop protection technologies. The Vietnam market provides opportunities for product development, market expansion, and establishment of long-term customer relationships. Market participation enables companies to contribute to agricultural development while building sustainable business operations.

Distributors benefit from growing product demand, expanding customer base, and opportunities for value-added services including technical support and farmer education. Distribution networks can leverage fungicide sales to build comprehensive agricultural input businesses and strengthen relationships with farming communities throughout Vietnam.

Agricultural cooperatives gain access to bulk purchasing opportunities, technical expertise, and comprehensive crop protection programs that benefit member farmers. Cooperative participation in fungicide procurement enables cost savings, quality assurance, and professional application services that enhance member productivity and profitability.

Government stakeholders benefit from improved agricultural productivity, food security enhancement, and rural economic development. Fungicide adoption supports national agricultural objectives, export competitiveness, and sustainable rural livelihoods that contribute to overall economic development and social stability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable agriculture trends drive increasing adoption of biological fungicides, integrated pest management practices, and environmentally responsible crop protection strategies. Farmer awareness of sustainability benefits, consumer preferences for residue-free produce, and regulatory emphasis on environmental protection support market transition toward more sustainable fungicide solutions.

Digital agriculture integration creates opportunities for precision fungicide applications, disease prediction systems, and data-driven crop protection decisions. Technology adoption enables more targeted treatments, reduced environmental impact, and improved cost-effectiveness through optimized application timing and product selection.

Product innovation focuses on developing more effective formulations, extended protection periods, and multi-mode action products that address resistance management concerns. Research and development investments by manufacturers result in advanced fungicide technologies that offer superior performance and environmental compatibility.

Distribution modernization includes expansion of agricultural retail networks, development of e-commerce platforms, and enhancement of technical support services. Market access improvements enable better farmer education, product availability, and application support that drive fungicide adoption throughout Vietnam’s agricultural regions.

Regulatory evolution emphasizes safety standards, environmental protection, and sustainable agriculture practices that influence product registration and market access. Compliance requirements drive industry adaptation toward safer, more environmentally compatible fungicide solutions that meet evolving regulatory expectations.

Product launches by major manufacturers introduce innovative fungicide formulations designed specifically for Vietnam’s agricultural conditions and crop requirements. New product development focuses on addressing local disease challenges, improving application convenience, and enhancing environmental compatibility to meet farmer needs and regulatory requirements.

Strategic partnerships between international companies and local distributors expand market reach and improve technical support capabilities. Collaboration initiatives enable better farmer education, product accessibility, and application training that support market development and customer satisfaction.

Manufacturing investments include establishment of local production facilities and formulation plants that reduce costs and improve product availability. Local manufacturing capabilities enable companies to better serve Vietnam’s market while contributing to economic development and employment creation.

Research collaborations with Vietnamese agricultural institutions advance understanding of local disease challenges and develop targeted solutions. Scientific partnerships support product development, efficacy validation, and resistance management strategies that enhance fungicide effectiveness in Vietnam’s agricultural environment.

Digital initiatives include development of mobile applications, online platforms, and digital tools that support farmer education and product selection. Technology integration improves market access, technical support delivery, and customer engagement throughout Vietnam’s agricultural communities.

Market participants should prioritize development of cost-effective fungicide solutions that address price sensitivity among Vietnamese farmers while maintaining efficacy standards. Value proposition strategies should emphasize return on investment, yield protection benefits, and long-term economic advantages of proper fungicide applications.

Distribution strategy enhancement should focus on expanding rural market access, strengthening technical support capabilities, and developing comprehensive farmer education programs. Market penetration success requires understanding local agricultural practices, building trust with farming communities, and providing ongoing technical assistance.

Product portfolio diversification should include biological fungicides, combination products, and specialized formulations that address specific crop and disease challenges in Vietnam. Innovation focus should align with sustainability trends, regulatory requirements, and farmer preferences for environmentally responsible solutions.

Partnership development with agricultural cooperatives, extension services, and research institutions can accelerate market adoption and improve customer relationships. Collaborative approaches enable better market understanding, product development insights, and effective farmer outreach programs.

Regulatory compliance preparation should anticipate evolving environmental standards and safety requirements that may affect product registration and market access. Proactive compliance strategies ensure continued market participation and support long-term business sustainability in Vietnam’s fungicide market.

Market expansion prospects remain highly favorable as Vietnam’s agricultural sector continues modernizing and farmers increasingly adopt professional crop protection practices. Growth projections indicate sustained market development driven by agricultural intensification, export market demands, and increasing awareness of fungicide benefits among farming communities.

Technology advancement will continue shaping market evolution through introduction of more effective formulations, precision application systems, and integrated crop protection solutions. Innovation trends suggest increasing focus on biological products, combination formulations, and environmentally sustainable technologies that meet evolving farmer and regulatory requirements.

Regional development patterns indicate expanding opportunities in emerging agricultural areas as infrastructure improves and farming practices modernize. Market penetration is expected to increase in currently underserved regions, driven by agricultural development programs and improved distribution networks.

Sustainability integration will become increasingly important as environmental consciousness grows and regulatory frameworks evolve. MarkWide Research projects that sustainable fungicide solutions will capture 25% market share within the next five years, reflecting growing demand for environmentally responsible crop protection options.

Competitive dynamics will intensify as market opportunities attract additional participants and existing companies expand their Vietnam operations. Market competition will drive continued innovation, service enhancement, and customer value creation that benefits Vietnamese farmers and agricultural development objectives.

Vietnam’s fungicide market presents exceptional growth opportunities driven by agricultural modernization, increasing crop protection awareness, and favorable market conditions. The market benefits from strong fundamentals including diverse agricultural production, supportive government policies, and growing farmer recognition of fungicide benefits for crop productivity and quality.

Market development continues to accelerate as distribution networks expand, technical support improves, and product innovation addresses specific Vietnamese agricultural challenges. The combination of traditional crop protection needs and emerging sustainability requirements creates diverse opportunities for market participants to develop comprehensive solutions that serve farmer needs while supporting environmental objectives.

Future success in Vietnam’s fungicide market will depend on understanding local agricultural practices, building strong farmer relationships, and developing products that balance efficacy, cost-effectiveness, and environmental responsibility. Companies that invest in market education, technical support, and sustainable innovation will be best positioned to capture the significant opportunities presented by Vietnam’s evolving agricultural landscape and growing fungicide market.

What is Fungicide?

Fungicide refers to a type of pesticide specifically designed to kill or inhibit the growth of fungi that can harm crops and plants. In the context of the Vietnam Fungicide Market, these products are essential for protecting agricultural yields and ensuring food security.

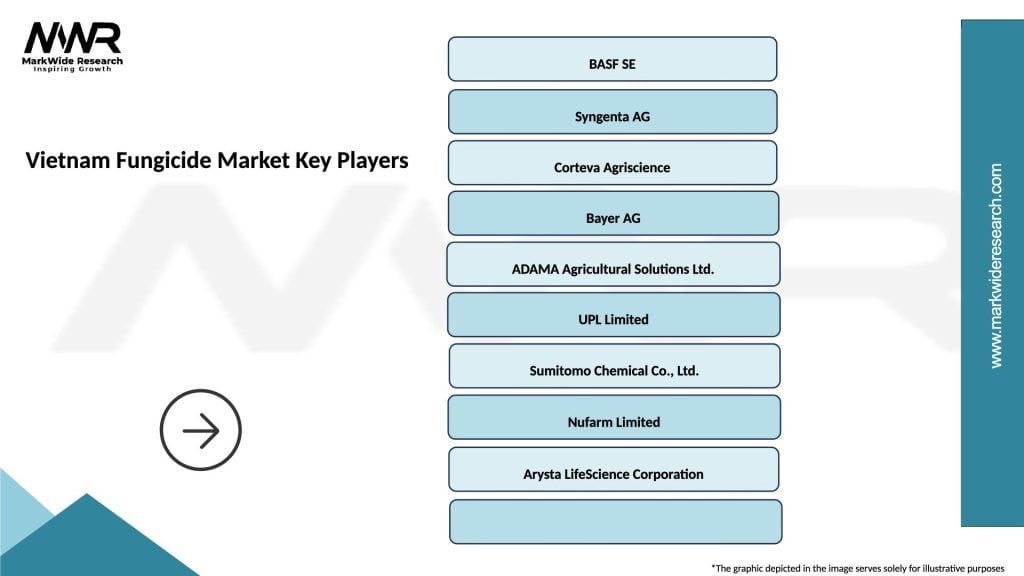

What are the key players in the Vietnam Fungicide Market?

Key players in the Vietnam Fungicide Market include companies such as BASF, Syngenta, and Bayer, which offer a range of fungicidal products for various crops. These companies are known for their innovative solutions and extensive distribution networks, among others.

What are the growth factors driving the Vietnam Fungicide Market?

The Vietnam Fungicide Market is driven by factors such as the increasing demand for high-quality agricultural produce, the rise in crop diseases, and the adoption of modern farming practices. Additionally, government initiatives to enhance agricultural productivity contribute to market growth.

What challenges does the Vietnam Fungicide Market face?

Challenges in the Vietnam Fungicide Market include regulatory hurdles regarding pesticide use, environmental concerns related to chemical residues, and the emergence of fungicide-resistant strains of pathogens. These factors can hinder the effectiveness of fungicides and impact agricultural practices.

What opportunities exist in the Vietnam Fungicide Market?

Opportunities in the Vietnam Fungicide Market include the development of bio-based fungicides and integrated pest management solutions. As farmers seek sustainable practices, there is a growing interest in environmentally friendly products that can effectively manage fungal diseases.

What trends are shaping the Vietnam Fungicide Market?

Trends in the Vietnam Fungicide Market include the increasing use of precision agriculture technologies and the rise of digital farming solutions. These innovations help farmers optimize fungicide application, reduce waste, and improve crop health.

Vietnam Fungicide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Systemic, Contact, Biological, Residual |

| Application | Agricultural, Horticultural, Turf, Ornamental |

| End User | Farmers, Agricultural Cooperatives, Nurseries, Landscapers |

| Formulation | Granules, Liquids, Powders, Emulsifiable Concentrates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Fungicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at