444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam fertilizer industry market represents a critical component of the nation’s agricultural infrastructure, supporting the country’s position as one of Southeast Asia’s leading agricultural producers. Vietnam’s fertilizer sector has experienced remarkable transformation over the past decade, driven by increasing agricultural productivity demands and government initiatives to enhance food security. The market encompasses various fertilizer types including nitrogen-based, phosphate, potash, and specialty fertilizers, serving both domestic consumption and export markets across the region.

Agricultural modernization has become a cornerstone of Vietnam’s economic development strategy, with the fertilizer industry playing a pivotal role in supporting crop yield improvements. The sector demonstrates robust growth potential, with industry analysts projecting a compound annual growth rate (CAGR) of 6.2% through the forecast period. This growth trajectory reflects the increasing adoption of advanced farming techniques and the government’s commitment to sustainable agricultural practices.

Market dynamics indicate strong domestic demand coupled with expanding export opportunities to neighboring countries. Vietnam’s strategic geographic position and improving manufacturing capabilities have positioned the country as an emerging hub for fertilizer production and distribution in the ASEAN region. The industry benefits from abundant raw material availability and government support for agricultural sector development.

The Vietnam fertilizer industry market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of various fertilizer products within Vietnam’s agricultural sector. This market includes manufacturers, distributors, retailers, and end-users involved in the supply chain of essential nutrients required for crop cultivation and soil enhancement.

Fertilizer products in this context encompass organic and inorganic compounds designed to improve soil fertility and plant nutrition. The Vietnamese market specifically focuses on products tailored to local soil conditions and crop requirements, including rice, coffee, rubber, and various cash crops that form the backbone of the country’s agricultural economy.

Industry scope extends beyond simple product manufacturing to include research and development activities, quality control measures, environmental compliance, and sustainable production practices. The market also encompasses import and export activities, with Vietnam serving both as a consumer of international fertilizer products and an emerging exporter to regional markets.

Vietnam’s fertilizer industry stands at a pivotal juncture, characterized by rapid modernization and increasing integration with global supply chains. The market demonstrates exceptional resilience and growth potential, supported by strong government backing and rising agricultural productivity requirements. Domestic production capacity has expanded significantly, with local manufacturers investing heavily in advanced production technologies and sustainable manufacturing processes.

Key market drivers include the government’s agricultural modernization initiatives, increasing crop diversification, and growing emphasis on sustainable farming practices. The industry benefits from Vietnam’s strategic location, abundant labor force, and improving infrastructure connectivity. Export opportunities continue to expand, with Vietnamese fertilizer products gaining recognition for quality and competitive pricing in regional markets.

Technological advancement represents a crucial factor in market evolution, with companies adopting precision agriculture techniques and developing specialized fertilizer formulations. The integration of digital technologies and data analytics is enhancing production efficiency and product customization capabilities. Environmental considerations are increasingly influencing market dynamics, with growing demand for eco-friendly and organic fertilizer solutions.

Market segmentation reveals diverse opportunities across different fertilizer categories and application areas. The following insights highlight critical market characteristics:

Consumer behavior patterns indicate increasing sophistication in fertilizer selection, with farmers prioritizing product quality, environmental impact, and long-term soil health benefits. The market demonstrates strong seasonal variations aligned with agricultural cycles and crop planting schedules.

Government policy support serves as a primary catalyst for market growth, with comprehensive agricultural development programs promoting fertilizer adoption and sustainable farming practices. The Vietnamese government’s commitment to food security and agricultural modernization creates favorable conditions for industry expansion. Subsidies and incentives for farmers encourage the adoption of quality fertilizer products and modern agricultural techniques.

Population growth and urbanization trends drive increasing food demand, necessitating higher agricultural productivity and intensive farming practices. The growing middle class demonstrates changing dietary preferences, requiring diversified crop production and specialized fertilizer applications. Export market opportunities continue expanding as Vietnam strengthens trade relationships with regional and international partners.

Technological advancement in agriculture promotes precision farming techniques and customized fertilizer solutions. The integration of digital technologies, soil testing capabilities, and data-driven decision-making enhances fertilizer efficiency and effectiveness. Climate change adaptation requirements drive demand for resilient crop varieties and specialized nutrition products.

Infrastructure development improves distribution networks and market accessibility, enabling better penetration of fertilizer products in rural areas. Enhanced transportation systems and storage facilities support efficient supply chain operations and reduce product losses.

Raw material dependency poses significant challenges for Vietnamese fertilizer manufacturers, with many essential inputs requiring importation from international suppliers. Price volatility in global commodity markets affects production costs and profit margins, creating uncertainty for both manufacturers and farmers. Currency fluctuations and international trade tensions can disrupt supply chains and impact market stability.

Environmental regulations increasingly restrict certain fertilizer types and production processes, requiring substantial investments in cleaner technologies and compliance measures. Soil degradation concerns and water pollution issues associated with excessive fertilizer use create regulatory pressures and consumer resistance to certain products.

Limited technical knowledge among smallholder farmers restricts optimal fertilizer utilization and reduces market penetration for advanced products. Credit constraints and financial limitations prevent many farmers from accessing quality fertilizer products, particularly during peak agricultural seasons.

Competition from imports challenges domestic manufacturers, especially in specialized fertilizer segments where international brands maintain technological advantages. Infrastructure limitations in remote agricultural areas hinder distribution efficiency and increase logistics costs.

Organic fertilizer development presents substantial growth opportunities as consumer awareness of sustainable agriculture increases. The growing demand for organic and eco-friendly products creates market space for innovative fertilizer solutions that support environmental conservation goals. Precision agriculture adoption opens new avenues for specialized fertilizer formulations and application technologies.

Export market expansion offers significant potential, particularly in ASEAN countries with similar agricultural profiles and growing fertilizer demand. Vietnam’s competitive manufacturing costs and improving product quality position the country favorably for regional market penetration. Value-added products such as slow-release fertilizers and micronutrient formulations represent high-margin opportunities.

Digital integration enables the development of smart fertilizer solutions combined with monitoring systems and data analytics platforms. Partnership opportunities with international technology providers can accelerate innovation and market development. The growing aquaculture sector presents new application areas for specialized fertilizer products.

Rural development initiatives create opportunities for expanded market reach and farmer education programs. Climate-smart agriculture trends drive demand for fertilizers that enhance crop resilience and reduce environmental impact.

Supply chain evolution characterizes the current market landscape, with manufacturers investing in vertical integration and direct farmer relationships. Distribution networks are becoming more sophisticated, incorporating digital platforms and mobile applications to improve farmer access and product information. The traditional dealer-based system is gradually complemented by direct-to-farmer sales channels and cooperative purchasing arrangements.

Competitive intensity continues increasing as both domestic and international players vie for market share. Product differentiation strategies focus on specialized formulations, application techniques, and value-added services. Companies are investing heavily in research and development to create innovative solutions tailored to Vietnamese agricultural conditions.

Regulatory landscape evolution impacts market dynamics through environmental standards, quality requirements, and safety regulations. MarkWide Research analysis indicates that regulatory compliance costs represent approximately 8% of total production expenses for major manufacturers. The government’s emphasis on sustainable agriculture drives regulatory changes that favor environmentally friendly products.

Price dynamics reflect global commodity trends, local supply-demand balances, and seasonal agricultural patterns. Market consolidation trends are emerging as smaller players seek partnerships or acquisition opportunities to remain competitive.

Comprehensive market analysis employs multiple research approaches to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, farmers, and government officials. Field surveys and on-site visits to production facilities and agricultural areas provide firsthand insights into market conditions and operational challenges.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and academic studies. Data triangulation methods validate findings across multiple sources to ensure consistency and accuracy. Market sizing and forecasting utilize econometric models that incorporate historical trends, economic indicators, and industry-specific factors.

Stakeholder engagement includes participation in industry conferences, trade shows, and professional associations to gather current market intelligence. Expert consultations with agricultural specialists, economists, and policy makers provide contextual understanding of market dynamics and future trends.

Quantitative analysis employs statistical methods to identify correlations, trends, and market patterns. Qualitative assessment captures nuanced insights into market behavior, competitive strategies, and emerging opportunities that quantitative data alone cannot reveal.

Mekong Delta region dominates Vietnam’s fertilizer consumption, accounting for the largest share of national demand due to intensive rice cultivation and diverse agricultural activities. This region demonstrates the highest adoption rates for advanced fertilizer products and precision agriculture techniques. Infrastructure development in the delta supports efficient distribution networks and storage facilities.

Northern Vietnam shows strong growth potential, particularly in mountainous areas where crop diversification initiatives are expanding fertilizer applications beyond traditional rice farming. Red River Delta maintains steady demand patterns with increasing focus on sustainable agriculture practices and organic fertilizer adoption.

Central Vietnam presents unique opportunities in cash crop cultivation, including coffee, pepper, and rubber plantations that require specialized fertilizer formulations. Coastal regions demonstrate growing aquaculture-related fertilizer demand, creating new market segments for marine-based agriculture applications.

Regional distribution patterns indicate that southern provinces account for 40% of total consumption, while northern regions represent 35% of market demand. Central Vietnam contributes 25% of national fertilizer usage, with significant growth potential in specialty crop applications. Urban periphery areas show increasing adoption of intensive farming techniques and premium fertilizer products.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment combines established domestic manufacturers with international companies seeking to expand their presence in the Vietnamese market.

Competitive strategies focus on product innovation, cost optimization, and market penetration through improved distribution channels. Technology partnerships with international companies enable access to advanced production techniques and specialized formulations. Brand building efforts emphasize product quality, farmer education, and technical support services.

Market consolidation trends indicate potential mergers and acquisitions as companies seek to achieve economies of scale and expand market coverage. Strategic alliances between domestic and international players create opportunities for technology transfer and market development.

Product-based segmentation reveals distinct market characteristics and growth patterns across different fertilizer categories:

Application-based segmentation identifies key usage areas:

Distribution channel segmentation encompasses various sales and delivery mechanisms serving different customer segments and geographic regions.

Nitrogen fertilizer category maintains market dominance due to Vietnam’s extensive rice cultivation, with urea products representing the largest volume segment. Product preferences vary by region and crop type, with farmers increasingly seeking granulated formulations for improved application efficiency. Seasonal demand patterns align closely with rice planting cycles, creating predictable market rhythms.

Phosphate fertilizers demonstrate strong growth potential as farmers recognize the importance of balanced nutrition for crop productivity. Adoption rates are increasing particularly in cash crop cultivation where yield optimization is critical for profitability. Quality differentiation becomes increasingly important as farmers become more sophisticated in their fertilizer selection.

Organic fertilizer segment shows exceptional growth momentum, driven by environmental awareness and premium market opportunities. Consumer education initiatives are expanding farmer understanding of organic benefits and application techniques. Certification programs are developing to ensure product quality and authenticity in the organic segment.

Specialty fertilizers represent the highest-margin category, with customized formulations for specific crops and soil conditions. Technical support services become crucial differentiators in this segment, with successful companies providing comprehensive agronomic advice and application guidance.

Manufacturers benefit from Vietnam’s growing agricultural sector and expanding export opportunities. Production scale advantages enable cost optimization and competitive pricing in regional markets. Access to abundant labor resources and improving infrastructure supports efficient manufacturing operations. Government incentives for agricultural development create favorable business conditions and investment opportunities.

Distributors and retailers enjoy expanding market reach and diversified product portfolios. Digital transformation opportunities enable improved customer service and operational efficiency. Partnership arrangements with manufacturers provide access to technical training and marketing support programs.

Farmers gain access to improved fertilizer products that enhance crop yields and profitability. Technical assistance programs provide valuable knowledge and application guidance. Flexible payment terms and financing options improve affordability and cash flow management. Quality assurance measures ensure consistent product performance and reliability.

Government stakeholders achieve agricultural development objectives and food security goals. Export revenue generation contributes to economic growth and foreign exchange earnings. Rural development initiatives benefit from improved agricultural productivity and farmer incomes. Environmental benefits result from more efficient fertilizer use and sustainable farming practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable agriculture adoption represents the most significant trend shaping Vietnam’s fertilizer industry, with increasing emphasis on environmental stewardship and soil health preservation. Organic fertilizer demand continues expanding as farmers and consumers prioritize eco-friendly production methods. Precision agriculture technologies are gaining traction among progressive farmers seeking to optimize input efficiency and maximize returns.

Digital transformation is revolutionizing fertilizer distribution and application, with mobile applications and online platforms improving farmer access to products and information. Customized formulations are becoming more prevalent as manufacturers develop region-specific and crop-specific fertilizer solutions. Integrated pest management approaches are driving demand for fertilizers that support plant health and natural resistance.

Supply chain optimization trends focus on reducing costs and improving efficiency through direct farmer relationships and cooperative purchasing arrangements. Quality certification programs are expanding to ensure product authenticity and performance standards. Export market development continues as Vietnamese companies seek to diversify revenue sources and achieve economies of scale.

Research and development investments are increasing, with companies collaborating with agricultural universities and research institutions to develop innovative products. Regulatory compliance is becoming more stringent, driving industry-wide improvements in manufacturing standards and environmental practices.

Manufacturing capacity expansion projects are underway across Vietnam, with major producers investing in modern production facilities and advanced technologies. Strategic partnerships between domestic and international companies are facilitating technology transfer and market development initiatives. Government policy updates continue supporting agricultural modernization and sustainable farming practices.

Infrastructure improvements in rural areas are enhancing fertilizer distribution networks and farmer accessibility. Research collaborations between industry players and academic institutions are accelerating product innovation and development timelines. Export promotion initiatives are helping Vietnamese companies establish presence in international markets.

Digital platform launches are transforming farmer engagement and product distribution channels. Quality certification programs are being implemented to ensure product standards and build consumer confidence. Environmental compliance measures are driving industry-wide adoption of cleaner production technologies.

Market consolidation activities include mergers and acquisitions as companies seek to achieve competitive advantages and market expansion. Training programs for farmers are expanding to improve fertilizer application techniques and optimize crop productivity outcomes.

Investment priorities should focus on technology modernization and production capacity expansion to meet growing domestic and export demand. MWR analysis indicates that companies investing in advanced manufacturing technologies achieve 20% higher profit margins compared to traditional producers. Strategic partnerships with international technology providers can accelerate innovation and market development.

Market penetration strategies should emphasize farmer education and technical support services to build brand loyalty and product adoption. Distribution network expansion in underserved rural areas presents significant growth opportunities. Product diversification into specialty and organic fertilizer segments can capture premium market opportunities.

Export market development requires sustained investment in quality improvement and international certification programs. Digital transformation initiatives should prioritize customer engagement platforms and supply chain optimization systems. Sustainability initiatives will become increasingly important for long-term competitiveness and regulatory compliance.

Risk management strategies should address raw material price volatility and supply chain disruptions through diversified sourcing and strategic inventory management. Regulatory compliance investments are essential for maintaining market access and avoiding operational disruptions.

Market growth prospects remain positive, supported by Vietnam’s expanding agricultural sector and increasing food production requirements. MarkWide Research projections indicate the industry will maintain robust growth momentum, with compound annual growth rates exceeding 6% through the next decade. Export opportunities are expected to expand significantly as Vietnamese products gain international recognition for quality and competitive pricing.

Technology adoption will accelerate, with precision agriculture and digital farming techniques becoming mainstream practices. Sustainable agriculture trends will drive continued growth in organic and eco-friendly fertilizer segments. Product innovation will focus on specialized formulations and value-added solutions that address specific crop and soil requirements.

Market consolidation is likely to continue as companies seek economies of scale and competitive advantages. International expansion will become increasingly important for major players seeking to diversify revenue sources and achieve growth targets. Government support for agricultural modernization will continue providing favorable conditions for industry development.

Environmental regulations will become more stringent, requiring continued investment in cleaner production technologies and sustainable practices. Climate change adaptation will drive demand for resilient crop varieties and specialized fertilizer products that support agricultural sustainability.

Vietnam’s fertilizer industry market demonstrates exceptional potential for sustained growth and development, supported by strong fundamentals and favorable market conditions. The combination of expanding domestic demand, growing export opportunities, and government policy support creates an attractive investment environment for industry participants. Technological advancement and sustainable agriculture trends are reshaping market dynamics and creating new opportunities for innovation and differentiation.

Strategic positioning will be crucial for companies seeking to capitalize on market opportunities while navigating competitive challenges and regulatory requirements. Investment in technology, quality improvement, and market development will determine long-term success in this evolving industry landscape. The emphasis on sustainable practices and environmental stewardship will continue driving product innovation and market transformation.

Future success in Vietnam’s fertilizer industry will depend on companies’ ability to adapt to changing market conditions, embrace technological innovation, and build strong relationships with farmers and distribution partners. The industry’s contribution to Vietnam’s agricultural development and food security objectives ensures continued government support and favorable policy conditions for growth and expansion.

What is Fertilizer?

Fertilizer refers to substances that are added to soil or plants to supply essential nutrients, enhancing growth and productivity. In the context of the Vietnam Fertilizer Industry, these can include organic, inorganic, and bio-fertilizers used in various agricultural practices.

What are the key players in the Vietnam Fertilizer Industry Market?

Key players in the Vietnam Fertilizer Industry Market include Vinachem, Phu My Fertilizer, and Binh Dien Fertilizer, among others. These companies are involved in the production and distribution of various types of fertilizers to meet the growing agricultural demands.

What are the growth factors driving the Vietnam Fertilizer Industry Market?

The Vietnam Fertilizer Industry Market is driven by increasing agricultural production, rising demand for food security, and government initiatives to enhance crop yields. Additionally, the adoption of modern farming techniques contributes to the industry’s growth.

What challenges does the Vietnam Fertilizer Industry Market face?

The Vietnam Fertilizer Industry Market faces challenges such as fluctuating raw material prices, environmental regulations, and competition from imported fertilizers. These factors can impact production costs and market stability.

What opportunities exist in the Vietnam Fertilizer Industry Market?

Opportunities in the Vietnam Fertilizer Industry Market include the development of eco-friendly fertilizers, expansion into organic farming, and technological advancements in fertilizer application. These trends can enhance sustainability and efficiency in agriculture.

What trends are shaping the Vietnam Fertilizer Industry Market?

Trends shaping the Vietnam Fertilizer Industry Market include the increasing use of precision agriculture, the rise of bio-fertilizers, and a focus on sustainable farming practices. These trends reflect a shift towards more efficient and environmentally friendly agricultural methods.

Vietnam Fertilizer Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Urea, NPK, Ammonium Sulfate, Calcium Nitrate |

| Grade | Standard, Premium, Organic, Slow-Release |

| Application | Agricultural, Horticultural, Turf Management, Landscaping |

| End User | Farmers, Agricultural Cooperatives, Distributors, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

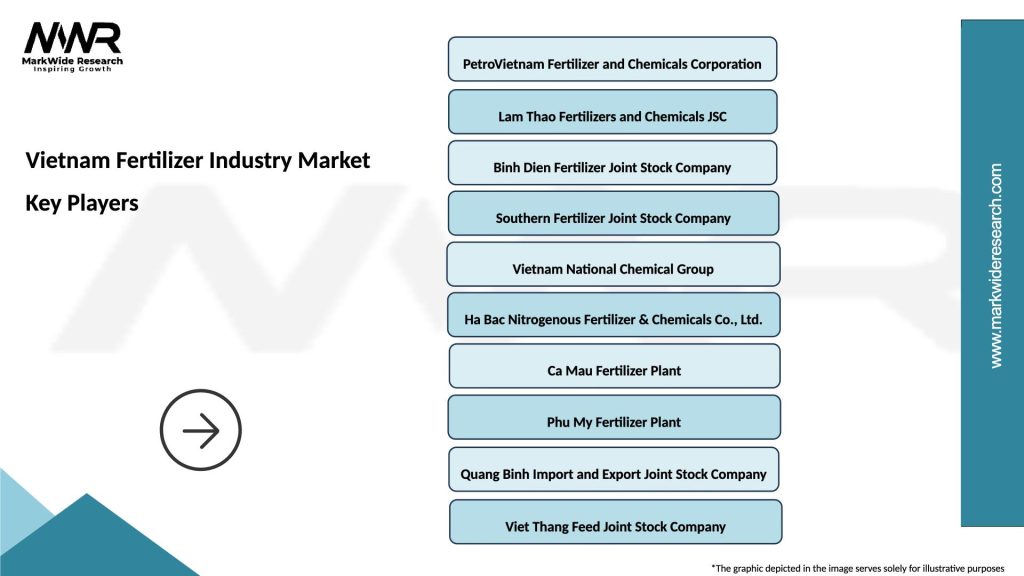

Leading companies in the Vietnam Fertilizer Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at