444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam energy drinks market represents one of the most dynamic and rapidly expanding beverage segments in Southeast Asia, characterized by robust consumer demand and increasing health consciousness among Vietnamese consumers. Market dynamics indicate significant growth potential driven by urbanization, changing lifestyle patterns, and rising disposable income levels across major Vietnamese cities including Ho Chi Minh City, Hanoi, and Da Nang.

Consumer preferences in Vietnam have evolved substantially, with energy drinks becoming integral to daily routines of working professionals, students, and athletes. The market demonstrates strong growth momentum with an estimated CAGR of 8.2% projected through the forecast period, reflecting increasing acceptance of functional beverages among Vietnamese consumers.

Regional distribution shows concentrated demand in urban centers, where approximately 72% of energy drink consumption occurs, while rural markets present emerging opportunities for market expansion. The competitive landscape features both international brands and domestic players, creating a diverse product portfolio that caters to varying consumer preferences and price points.

The Vietnam energy drinks market refers to the comprehensive ecosystem of caffeinated and functional beverages designed to provide energy enhancement, mental alertness, and physical performance benefits to Vietnamese consumers across various demographic segments and consumption occasions.

Energy drinks in the Vietnamese context encompass carbonated and non-carbonated beverages containing caffeine, taurine, B-vitamins, and other functional ingredients that deliver immediate energy boosts and sustained performance enhancement. These products serve multiple consumer needs including workplace productivity, academic performance, sports performance, and social consumption scenarios.

Market definition includes traditional energy drinks, natural energy beverages, organic formulations, and specialized sports drinks that target specific consumer segments. The Vietnamese market particularly emphasizes products that align with local taste preferences while delivering functional benefits expected from modern energy drink formulations.

Strategic analysis of the Vietnam energy drinks market reveals a rapidly maturing industry with substantial growth opportunities driven by demographic shifts, urbanization trends, and evolving consumer lifestyles. The market benefits from Vietnam’s young population profile, with approximately 65% of consumers falling within the 18-35 age demographic that represents the primary target audience for energy drink products.

Key market drivers include increasing work pressure in urban environments, growing fitness culture, expanding retail infrastructure, and rising awareness of functional beverages. Vietnamese consumers demonstrate strong brand loyalty while remaining price-sensitive, creating opportunities for both premium and value-oriented product positioning strategies.

Competitive dynamics feature intense rivalry between established international brands and emerging local players, with market share distribution showing 45% concentration among the top three brands. Innovation focuses on natural ingredients, reduced sugar formulations, and culturally relevant flavor profiles that resonate with Vietnamese taste preferences.

Future prospects indicate continued expansion driven by e-commerce growth, convenience store proliferation, and increasing health consciousness among Vietnamese consumers seeking functional beverage alternatives to traditional caffeinated drinks.

Consumer behavior analysis reveals distinct consumption patterns that differentiate the Vietnamese market from regional counterparts, with specific preferences for moderate caffeine content and natural ingredient formulations that align with traditional Vietnamese wellness concepts.

Economic development serves as the primary catalyst driving Vietnam energy drinks market expansion, with rising GDP per capita and increasing urbanization creating favorable conditions for premium beverage consumption. Vietnamese consumers demonstrate growing purchasing power and willingness to invest in functional beverages that support their active lifestyles.

Demographic advantages position Vietnam favorably for sustained market growth, with a young population increasingly exposed to global consumption trends and lifestyle patterns. The expanding middle class seeks convenient energy solutions that fit demanding work schedules and social activities prevalent in modern Vietnamese urban centers.

Infrastructure development supports market expansion through improved cold chain logistics, expanded retail networks, and enhanced distribution capabilities that ensure product availability across urban and emerging rural markets. Modern retail formats including convenience stores and supermarkets provide optimal platforms for energy drink merchandising and consumer engagement.

Cultural shifts toward Western lifestyle adoption, fitness consciousness, and productivity optimization create natural demand for energy-enhancing beverages. Vietnamese consumers increasingly view energy drinks as lifestyle accessories that support professional success and personal performance goals.

Digital connectivity enables effective marketing communication and brand building through social media platforms popular among Vietnamese youth, facilitating rapid brand awareness development and consumer education about energy drink benefits and usage occasions.

Regulatory challenges present significant constraints for Vietnam energy drinks market development, with government health authorities implementing stricter guidelines regarding caffeine content, marketing practices, and product labeling requirements that impact product formulation and promotional strategies.

Health concerns among Vietnamese consumers regarding excessive caffeine consumption, sugar content, and artificial ingredients create market resistance, particularly among health-conscious segments seeking natural alternatives. Growing awareness of energy drink-related health risks influences consumer purchasing decisions and brand preferences.

Price competition intensifies market pressure as numerous brands compete for market share through aggressive pricing strategies, potentially eroding profit margins and limiting investment in product innovation and marketing initiatives. Vietnamese consumers’ price sensitivity constrains premium positioning opportunities for many brands.

Cultural resistance from traditional Vietnamese consumers who prefer conventional beverages including tea and coffee presents adoption barriers, particularly in rural markets where modern beverage concepts face slower acceptance rates compared to urban centers.

Supply chain complexities including ingredient sourcing, quality control, and distribution logistics create operational challenges for both domestic and international brands seeking to establish sustainable market presence in Vietnam’s diverse geographic and economic landscape.

Rural market expansion represents substantial untapped potential for Vietnam energy drinks market growth, with improving infrastructure and rising rural incomes creating opportunities for brands to extend distribution networks beyond traditional urban strongholds. Rural Vietnamese consumers demonstrate increasing openness to modern beverage categories.

Product innovation opportunities focus on developing culturally relevant formulations that incorporate traditional Vietnamese ingredients, flavors, and wellness concepts while delivering modern energy drink functionality. Natural and organic product segments show particular promise for differentiation and premium positioning.

E-commerce growth enables direct consumer engagement and expanded market reach through online platforms increasingly popular among Vietnamese consumers. Digital channels provide cost-effective market entry strategies for new brands and enhanced customer relationship management for established players.

Sports and fitness market development creates specialized opportunities for performance-oriented energy drink formulations targeting Vietnam’s growing fitness culture and increasing participation in sports activities. Partnership opportunities with gyms, sports clubs, and fitness influencers enhance market penetration.

Export potential emerges as Vietnamese brands develop capabilities to serve regional markets, leveraging Vietnam’s strategic location and growing manufacturing expertise to capture opportunities in neighboring Southeast Asian countries with similar consumer preferences.

Competitive intensity characterizes the Vietnam energy drinks market landscape, with established international brands competing against emerging domestic players through differentiated positioning strategies, innovative product formulations, and targeted marketing approaches that resonate with specific Vietnamese consumer segments.

Innovation cycles accelerate as brands respond to evolving consumer preferences for healthier formulations, unique flavor profiles, and functional benefits beyond basic energy enhancement. Product development focuses on natural ingredients, reduced sugar content, and specialized formulations for specific usage occasions and demographic groups.

Distribution evolution transforms market dynamics through expanding modern retail networks, convenience store proliferation, and e-commerce platform development that enhance product accessibility and consumer convenience. Traditional trade channels remain important in rural markets while modern formats dominate urban consumption.

Consumer education initiatives drive market development as brands invest in awareness campaigns that communicate product benefits, usage occasions, and differentiation factors. Educational marketing helps overcome cultural barriers and builds consumer confidence in energy drink categories.

Regulatory adaptation requires continuous monitoring and compliance with evolving Vietnamese government policies regarding beverage industry standards, health claims, and marketing practices. Successful brands demonstrate agility in adapting to regulatory changes while maintaining market competitiveness.

Primary research methodologies employed comprehensive consumer surveys, focus group discussions, and in-depth interviews with Vietnamese energy drink consumers across major urban centers and emerging rural markets. Data collection encompassed diverse demographic segments to ensure representative market insights and consumption pattern analysis.

Secondary research incorporated extensive analysis of industry reports, government statistics, trade publications, and company financial statements to validate primary findings and provide comprehensive market context. Vietnamese government data sources and industry associations provided crucial market sizing and trend validation.

Market observation techniques included retail audit studies, point-of-sale analysis, and distribution channel mapping to understand product availability, pricing strategies, and competitive positioning across different retail formats and geographic regions throughout Vietnam.

Expert consultations with industry professionals, retail executives, and market analysts provided strategic insights into market dynamics, competitive landscapes, and future growth prospects. Vietnamese beverage industry experts contributed local market knowledge and cultural context essential for accurate market assessment.

Data validation processes ensured research accuracy through triangulation of multiple data sources, statistical verification, and peer review procedures that maintain research integrity and reliability standards expected in professional market analysis.

Northern Vietnam demonstrates distinct market characteristics centered around Hanoi and surrounding provinces, where energy drink consumption patterns reflect the region’s business-focused culture and government sector employment concentration. Northern consumers show preference for traditional flavors and moderate caffeine formulations, with 35% regional market share driven by steady urban professional demand.

Southern Vietnam leads market consumption with Ho Chi Minh City serving as the primary commercial hub, accounting for approximately 42% of national energy drink sales. Southern consumers demonstrate greater openness to international brands and innovative flavors, reflecting the region’s cosmopolitan culture and higher disposable income levels.

Central Vietnam represents emerging market opportunities with cities like Da Nang and Hue showing increasing energy drink adoption rates. The region’s growing tourism industry and expanding manufacturing sector create favorable conditions for market development, though consumption levels remain below northern and southern regions.

Rural markets across all regions present significant growth potential as infrastructure development and income growth enable greater access to modern beverage categories. Rural Vietnamese consumers increasingly adopt urban consumption patterns while maintaining preference for value-oriented product positioning.

Coastal regions benefit from tourism-driven demand and higher exposure to international consumption trends, creating opportunities for premium product positioning and seasonal consumption spikes during tourist seasons and local festivals.

Market leadership in Vietnam’s energy drinks sector reflects intense competition between established international brands and emerging domestic players, each pursuing differentiated strategies to capture and retain Vietnamese consumer loyalty through innovative products and targeted marketing approaches.

Competitive strategies emphasize brand differentiation through unique flavor profiles, targeted demographic positioning, and strategic partnerships with sports teams, entertainment venues, and educational institutions that enhance brand visibility and consumer engagement.

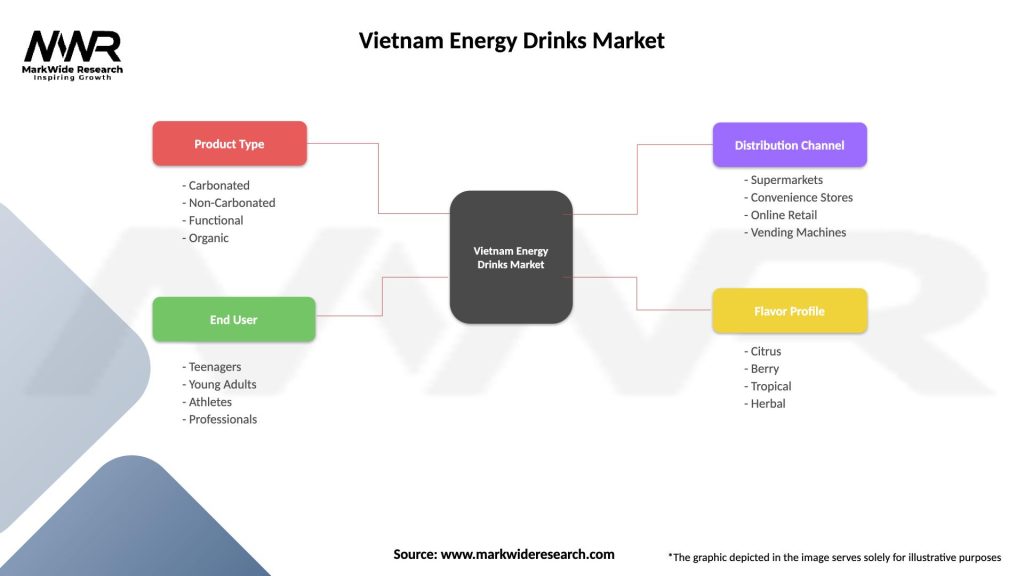

By Product Type: The Vietnam energy drinks market segments into traditional carbonated energy drinks, natural energy beverages, organic formulations, and functional sports drinks, each targeting specific consumer needs and usage occasions with tailored formulations and positioning strategies.

By Distribution Channel: Market segmentation reflects diverse retail landscapes across Vietnam, with modern trade formats gaining share while traditional channels remain important in rural markets and specific consumer segments.

By Consumer Demographics: Segmentation analysis reveals distinct consumption patterns across age groups, income levels, and lifestyle categories that influence product development and marketing strategies.

Premium Energy Drinks category demonstrates strong growth potential in Vietnam’s urban markets, where consumers increasingly seek high-quality formulations with natural ingredients and sophisticated flavor profiles. Premium products command higher margins while building brand loyalty through superior taste and perceived health benefits.

Value Energy Drinks segment serves price-sensitive Vietnamese consumers who prioritize affordability while seeking basic energy enhancement benefits. This category requires efficient manufacturing and distribution strategies to maintain profitability while delivering competitive pricing.

Functional Energy Drinks category expands rapidly as Vietnamese consumers become more health-conscious and seek beverages that provide specific benefits beyond energy enhancement. Products featuring vitamins, minerals, and herbal extracts appeal to wellness-focused consumer segments.

Natural Energy Drinks represent emerging opportunities for brands that can successfully communicate natural ingredient benefits while maintaining taste appeal and energy effectiveness. Vietnamese consumers show increasing interest in products that align with traditional wellness concepts.

Sports Energy Drinks category benefits from Vietnam’s growing fitness culture and increasing sports participation rates. Specialized formulations targeting pre-workout, during-workout, and recovery occasions create multiple product positioning opportunities within this expanding segment.

Manufacturers benefit from Vietnam’s favorable demographic profile, growing economy, and increasing consumer acceptance of energy drink categories. The market offers opportunities for both large-scale production and specialized niche products that cater to specific Vietnamese consumer preferences and cultural requirements.

Retailers gain from energy drinks’ high-margin characteristics, strong consumer demand, and frequent purchase patterns that drive store traffic and basket size. Modern retail formats particularly benefit from energy drinks’ impulse purchase nature and promotional effectiveness.

Distributors capitalize on expanding distribution networks, improving logistics infrastructure, and growing demand across urban and rural markets. Energy drinks provide reliable volume and revenue streams while supporting broader beverage portfolio development.

Consumers access convenient energy solutions that support active lifestyles, workplace productivity, and social consumption occasions. Vietnamese consumers benefit from increasing product variety, improved quality standards, and competitive pricing driven by market competition.

Investors find attractive opportunities in Vietnam’s energy drinks market through strong growth prospects, favorable demographics, and increasing market sophistication. The sector offers multiple investment approaches including manufacturing, distribution, and brand development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient adoption emerges as the dominant trend shaping Vietnam’s energy drinks market, with consumers increasingly seeking products that feature herbal extracts, natural caffeine sources, and traditional Vietnamese wellness ingredients. This trend reflects growing health consciousness and desire for products that align with cultural wellness concepts.

Premiumization trends drive market evolution as Vietnamese consumers demonstrate willingness to pay higher prices for perceived quality, unique flavors, and enhanced functional benefits. Premium positioning strategies focus on superior ingredients, innovative packaging, and exclusive distribution channels.

Digital marketing integration transforms brand communication strategies as Vietnamese consumers, particularly younger demographics, engage primarily through social media platforms and digital channels. Successful brands develop comprehensive digital strategies that include influencer partnerships, social media campaigns, and e-commerce integration.

Sustainability focus gains importance as environmentally conscious Vietnamese consumers seek brands that demonstrate commitment to sustainable packaging, responsible sourcing, and environmental protection. Eco-friendly initiatives become competitive differentiators in premium market segments.

Functional beverage convergence blurs traditional category boundaries as energy drinks incorporate additional health benefits including immunity support, stress reduction, and cognitive enhancement. Multi-functional products appeal to Vietnamese consumers seeking comprehensive wellness solutions.

Manufacturing investments by major international brands demonstrate confidence in Vietnam’s market potential, with several companies establishing local production facilities to serve domestic demand and regional export opportunities. These investments improve product freshness, reduce costs, and enhance supply chain reliability.

Strategic partnerships between international brands and local distributors accelerate market penetration while providing cultural insights essential for successful product positioning. Partnership strategies enable rapid distribution network expansion and consumer education initiatives.

Product launches featuring Vietnamese-specific flavors and formulations reflect increasing market sophistication and brand commitment to local consumer preferences. Successful launches incorporate traditional flavors including lychee, dragon fruit, and green tea variations.

Regulatory developments include updated labeling requirements, caffeine content guidelines, and marketing practice standards that influence product development and promotional strategies. Industry participants actively engage with regulatory authorities to ensure compliance while maintaining market competitiveness.

Technology adoption enhances manufacturing efficiency, quality control, and distribution optimization through advanced production equipment, digital inventory management, and consumer analytics platforms that improve market responsiveness and operational effectiveness.

Market entry strategies should prioritize understanding Vietnamese consumer preferences, cultural nuances, and local taste profiles before launching products. MarkWide Research analysis indicates that successful brands invest significantly in consumer research and product localization to achieve sustainable market penetration.

Distribution network development requires balanced approaches that leverage both modern retail formats and traditional trade channels to maximize market coverage. Brands should establish strong relationships with key retailers while building direct distribution capabilities for emerging markets.

Product portfolio optimization should include diverse price points and formulations that cater to Vietnam’s heterogeneous consumer base. Successful strategies combine premium offerings for urban consumers with value-oriented products for price-sensitive segments.

Marketing investment allocation should emphasize digital channels and social media platforms where Vietnamese consumers, particularly younger demographics, demonstrate highest engagement levels. Traditional advertising remains important for rural market penetration and brand awareness building.

Innovation priorities should focus on natural ingredients, reduced sugar formulations, and functional benefits that align with Vietnamese wellness concepts. Brands that successfully integrate traditional ingredients with modern energy drink functionality achieve strongest market acceptance.

Growth trajectory for Vietnam’s energy drinks market remains strongly positive, supported by favorable demographic trends, continued economic development, and increasing consumer acceptance of functional beverage categories. MWR projections indicate sustained expansion driven by urbanization and lifestyle modernization across Vietnamese society.

Market maturation will likely result in increased competition, product differentiation, and consumer sophistication that rewards brands capable of delivering superior value propositions. Successful companies will demonstrate agility in adapting to evolving consumer preferences while maintaining operational efficiency.

Innovation acceleration will drive product development toward healthier formulations, sustainable packaging, and enhanced functional benefits that address specific Vietnamese consumer needs. Natural and organic segments show particular promise for premium positioning and margin expansion.

Digital transformation will reshape marketing, distribution, and consumer engagement strategies as Vietnamese consumers increasingly adopt online purchasing behaviors and digital communication preferences. E-commerce integration becomes essential for market competitiveness.

Regional expansion opportunities will emerge as Vietnamese brands develop capabilities to serve broader Southeast Asian markets, leveraging local market knowledge and manufacturing expertise to capture regional growth opportunities.

Vietnam’s energy drinks market presents compelling opportunities for industry participants willing to invest in understanding local consumer preferences, cultural nuances, and market dynamics that differentiate Vietnam from other Southeast Asian markets. The combination of favorable demographics, economic growth, and increasing consumer sophistication creates an attractive investment environment for both established brands and new market entrants.

Success factors include product localization, effective distribution network development, digital marketing excellence, and commitment to quality and innovation that resonates with Vietnamese consumers’ evolving preferences. Brands that successfully balance international expertise with local market insights achieve sustainable competitive advantages in this dynamic market.

Future prospects remain positive despite challenges including regulatory uncertainty, intense competition, and evolving health consciousness among consumers. The market’s growth potential, supported by Vietnam’s young population and continued economic development, provides strong foundation for long-term business success and market expansion opportunities throughout the region.

What is Energy Drinks?

Energy drinks are beverages that contain ingredients designed to boost energy and mental alertness, often including caffeine, vitamins, and sugar. They are popular among consumers looking for quick energy boosts, especially in the context of busy lifestyles and increased physical activity.

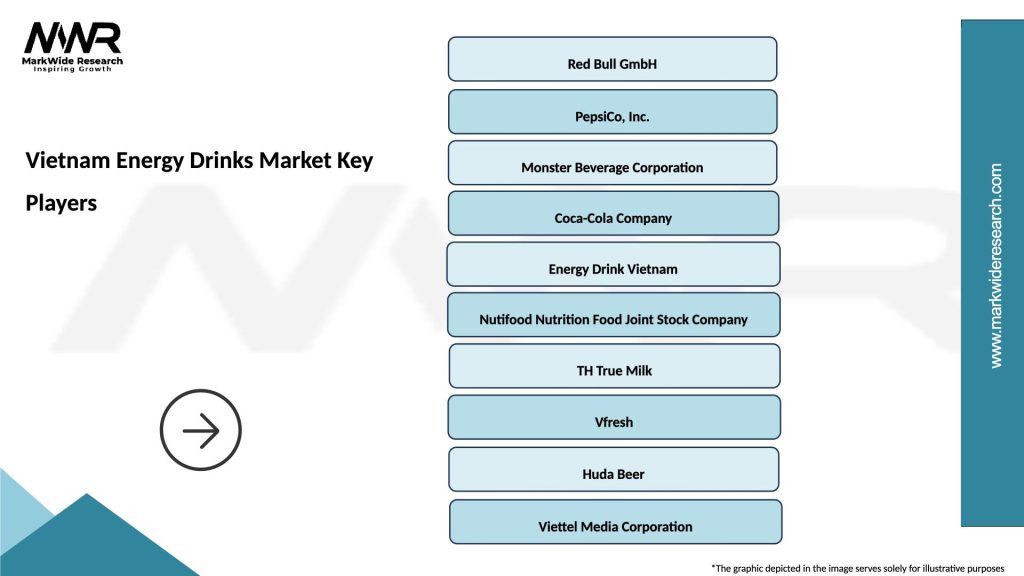

What are the key players in the Vietnam Energy Drinks Market?

Key players in the Vietnam Energy Drinks Market include Red Bull, Monster Beverage Corporation, and PepsiCo. These companies dominate the market with a variety of products targeting different consumer segments, including athletes and young adults, among others.

What are the growth factors driving the Vietnam Energy Drinks Market?

The Vietnam Energy Drinks Market is driven by increasing consumer demand for convenient energy sources, a growing fitness culture, and rising disposable incomes. Additionally, the popularity of energy drinks among younger demographics contributes to market growth.

What challenges does the Vietnam Energy Drinks Market face?

The Vietnam Energy Drinks Market faces challenges such as health concerns related to high caffeine and sugar content, regulatory scrutiny, and competition from alternative beverages like natural juices and teas. These factors can impact consumer preferences and market dynamics.

What opportunities exist in the Vietnam Energy Drinks Market?

Opportunities in the Vietnam Energy Drinks Market include the introduction of healthier formulations, such as low-sugar and organic options, and expanding distribution channels. Additionally, targeting niche markets, such as fitness enthusiasts and busy professionals, presents growth potential.

What trends are shaping the Vietnam Energy Drinks Market?

Trends in the Vietnam Energy Drinks Market include the rise of functional beverages that offer additional health benefits, innovative flavors, and eco-friendly packaging. Consumers are increasingly seeking products that align with their health and wellness goals.

Vietnam Energy Drinks Market

| Segmentation Details | Description |

|---|---|

| Product Type | Carbonated, Non-Carbonated, Functional, Organic |

| End User | Teenagers, Young Adults, Athletes, Professionals |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Vending Machines |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Energy Drinks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at