444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam electric vehicle market represents one of Southeast Asia’s most promising automotive transformation stories, driven by government initiatives, environmental consciousness, and rapid urbanization. Vietnam’s commitment to sustainable transportation has positioned the country as a regional leader in electric mobility adoption, with domestic manufacturers and international players competing for market share in this rapidly evolving landscape.

Market dynamics in Vietnam reflect a unique combination of local manufacturing capabilities, supportive government policies, and growing consumer awareness about environmental sustainability. The country’s strategic location and manufacturing expertise have attracted significant investments from global automotive companies, while domestic players like VinFast have emerged as formidable competitors in the electric vehicle space.

Growth trajectories indicate robust expansion across multiple vehicle categories, with electric motorcycles leading adoption rates at approximately 78% of total electric vehicle registrations, followed by passenger cars and commercial vehicles. The market demonstrates strong momentum driven by infrastructure development, battery technology improvements, and favorable regulatory frameworks that support electric vehicle adoption nationwide.

The Vietnam electric vehicle market refers to the comprehensive ecosystem of battery-powered transportation solutions, including electric motorcycles, passenger cars, commercial vehicles, and supporting infrastructure within Vietnam’s automotive sector. This market encompasses manufacturing, sales, distribution, charging infrastructure, and aftermarket services for vehicles powered entirely or partially by electric propulsion systems.

Electric vehicles in the Vietnamese context include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs), each serving different consumer segments and use cases. The market definition extends beyond vehicle sales to include charging infrastructure, battery technology, software solutions, and maintenance services that support the electric mobility ecosystem.

Market scope encompasses both domestic production and imports, with Vietnamese manufacturers increasingly focusing on local assembly and production to serve both domestic and export markets. The definition includes two-wheelers, three-wheelers, passenger cars, light commercial vehicles, and heavy-duty electric vehicles across urban and rural applications.

Vietnam’s electric vehicle market has emerged as a dynamic and rapidly expanding sector, characterized by strong government support, innovative domestic manufacturers, and increasing consumer acceptance of electric mobility solutions. The market demonstrates exceptional growth potential, driven by urbanization trends, environmental regulations, and technological advancements in battery and charging technologies.

Key market drivers include government incentives reducing import duties by 15-20% for electric vehicles, expanding charging infrastructure, and growing environmental awareness among Vietnamese consumers. Domestic manufacturers have gained significant traction, with local companies capturing approximately 45% market share in the electric motorcycle segment and expanding into passenger car markets.

Competitive landscape features a mix of established international brands and emerging Vietnamese companies, with VinFast, Honda Vietnam, Yamaha Motor Vietnam, and Piaggio Vietnam leading different market segments. The market shows strong potential for continued expansion, supported by infrastructure investments and favorable regulatory environments.

Strategic insights reveal several critical factors shaping Vietnam’s electric vehicle market development and future growth trajectory:

Government policy support serves as the primary catalyst for Vietnam’s electric vehicle market growth, with comprehensive incentive programs, regulatory frameworks, and infrastructure investments creating favorable conditions for market expansion. Vietnamese authorities have implemented reduced import duties, tax exemptions, and subsidies that make electric vehicles more accessible to consumers across different income segments.

Environmental consciousness among Vietnamese consumers continues driving electric vehicle adoption, particularly in urban areas where air quality concerns and traffic congestion motivate sustainable transportation choices. Growing awareness of climate change impacts and environmental sustainability has created strong consumer demand for cleaner transportation alternatives.

Urbanization trends accelerate electric vehicle adoption as Vietnamese cities expand and modernize their transportation infrastructure. Urban planning initiatives increasingly incorporate electric vehicle charging stations, dedicated lanes, and parking incentives that support electric mobility solutions in metropolitan areas.

Technological advancements in battery technology, charging infrastructure, and vehicle connectivity enhance electric vehicle appeal and practicality for Vietnamese consumers. Improvements in battery life, charging speed, and vehicle range address traditional concerns about electric vehicle limitations and performance.

Economic factors including lower operating costs, reduced maintenance requirements, and fuel savings make electric vehicles increasingly attractive to cost-conscious Vietnamese consumers. Total cost of ownership advantages become more apparent as electric vehicle prices decline and fuel costs remain volatile.

High initial costs remain a significant barrier for many Vietnamese consumers, despite government incentives and declining battery prices. Electric vehicles typically require higher upfront investments compared to conventional vehicles, limiting adoption among price-sensitive consumer segments and rural markets with lower income levels.

Charging infrastructure limitations continue constraining electric vehicle adoption, particularly in rural areas and smaller cities where charging stations remain sparse. Range anxiety and charging time concerns affect consumer confidence, especially for long-distance travel and commercial vehicle applications.

Battery technology challenges including limited lifespan, replacement costs, and performance degradation in tropical climates create ongoing concerns for Vietnamese consumers. Battery disposal and recycling infrastructure remains underdeveloped, raising environmental and cost considerations for long-term electric vehicle ownership.

Grid capacity constraints in some regions may limit rapid charging infrastructure expansion and create potential strain on electrical systems during peak charging periods. Power generation mix and grid stability considerations affect the overall environmental benefits and reliability of electric vehicle charging networks.

Consumer awareness gaps persist regarding electric vehicle benefits, maintenance requirements, and total cost of ownership, particularly in rural markets where traditional vehicle preferences remain strong. Educational initiatives and demonstration programs are needed to address misconceptions and build consumer confidence.

Export market potential presents significant opportunities for Vietnamese electric vehicle manufacturers to leverage competitive production costs and growing regional demand for sustainable transportation solutions. ASEAN market integration and trade agreements create favorable conditions for Vietnamese electric vehicle exports to neighboring countries with similar climate and infrastructure conditions.

Rural market expansion offers substantial growth opportunities as charging infrastructure extends beyond urban centers and electric vehicle prices become more accessible to rural consumers. Agricultural and rural transportation applications present unique opportunities for specialized electric vehicle solutions tailored to local needs and conditions.

Commercial vehicle electrification represents a major opportunity as businesses seek to reduce operating costs and meet environmental compliance requirements. Delivery services, ride-sharing platforms, and logistics companies increasingly adopt electric vehicles to improve operational efficiency and brand sustainability credentials.

Battery manufacturing localization could significantly reduce electric vehicle costs and create new industrial opportunities within Vietnam’s manufacturing sector. Local battery production would enhance supply chain security and support the development of a complete electric vehicle ecosystem.

Smart city integration opportunities emerge as Vietnamese cities implement intelligent transportation systems, connected infrastructure, and data-driven mobility solutions. Electric vehicles can serve as integral components of smart city initiatives, providing grid services and transportation optimization benefits.

Supply chain evolution in Vietnam’s electric vehicle market reflects increasing localization of component manufacturing and assembly operations. Domestic suppliers are developing capabilities in electric motors, battery packs, charging equipment, and electronic systems, reducing dependence on imports and improving cost competitiveness.

Competitive intensity continues escalating as international brands establish local operations and domestic manufacturers expand their product portfolios. Market competition drives innovation, improves product quality, and accelerates price reductions that benefit Vietnamese consumers across all market segments.

Technology adoption rates vary significantly between urban and rural markets, with cities showing faster acceptance of advanced features like connected services, autonomous driving capabilities, and smart charging solutions. Rural markets prioritize reliability, affordability, and basic functionality over advanced technological features.

Regulatory evolution shapes market dynamics through evolving safety standards, environmental regulations, and import policies that affect product development and market entry strategies. Vietnamese authorities continue refining regulations to balance market growth with safety, environmental, and economic objectives.

Consumer behavior patterns demonstrate increasing sophistication in electric vehicle evaluation criteria, with buyers considering total cost of ownership, environmental impact, and technology features alongside traditional factors like price and brand reputation. MarkWide Research analysis indicates that consumer decision-making processes are becoming more complex and informed.

Primary research activities encompassed comprehensive surveys of Vietnamese electric vehicle consumers, dealers, manufacturers, and industry stakeholders to gather firsthand insights into market trends, preferences, and challenges. Structured interviews with key industry participants provided qualitative insights into market dynamics and future development prospects.

Secondary research sources included government publications, industry reports, trade association data, and academic studies focusing on Vietnam’s automotive sector and electric vehicle adoption patterns. Regulatory documents, policy announcements, and statistical databases provided quantitative foundation for market analysis and projections.

Data collection methods utilized multiple channels including online surveys, telephone interviews, focus groups, and field observations across different Vietnamese regions and market segments. Geographic coverage ensured representative sampling from urban centers, suburban areas, and rural communities with varying electric vehicle adoption levels.

Analytical frameworks employed statistical modeling, trend analysis, and comparative assessments to evaluate market size, growth patterns, and competitive positioning. Cross-validation techniques ensured data accuracy and reliability across different sources and methodologies.

Quality assurance processes included peer review, expert validation, and cross-referencing with multiple data sources to ensure research findings accurately reflect Vietnam’s electric vehicle market conditions and trends.

Northern Vietnam leads electric vehicle adoption with Hanoi and surrounding provinces showing the highest concentration of charging infrastructure and consumer acceptance. The region benefits from government proximity, higher income levels, and established automotive industry presence that supports electric vehicle market development and consumer education initiatives.

Southern Vietnam centered around Ho Chi Minh City demonstrates strong commercial electric vehicle adoption, particularly in delivery services, ride-sharing, and logistics applications. The region’s economic dynamism and international business presence drive demand for sustainable transportation solutions and advanced vehicle technologies.

Central Vietnam shows emerging electric vehicle interest, with cities like Da Nang and Hue developing charging infrastructure and attracting electric vehicle investments. Tourism industry requirements and environmental conservation priorities support electric vehicle adoption in this culturally and environmentally significant region.

Mekong Delta region presents unique opportunities for electric vehicle applications in agricultural and rural transportation, with specialized vehicles designed for local conditions and requirements. Rural electrification programs and agricultural modernization initiatives support electric vehicle infrastructure development in this important agricultural region.

Regional market share distribution indicates that northern and southern regions account for approximately 72% of total electric vehicle sales, while central and delta regions show rapid growth potential as infrastructure expands and consumer awareness increases.

Market leadership in Vietnam’s electric vehicle sector reflects a dynamic competitive environment with both domestic and international players competing across different vehicle segments and price points:

Competitive strategies emphasize local manufacturing, dealer network expansion, charging infrastructure partnerships, and consumer education programs to build market share and brand loyalty in Vietnam’s evolving electric vehicle landscape.

By Vehicle Type:

By Battery Type:

By End User:

Electric Motorcycle Segment dominates Vietnam’s electric vehicle market with approximately 85% market share, driven by affordability, practicality, and suitability for Vietnamese traffic conditions. Urban consumers particularly favor electric scooters for daily commuting, while rural markets show growing interest in electric motorcycles for agricultural and transportation applications.

Passenger Car Category demonstrates rapid growth potential as Vietnamese consumers increasingly consider electric vehicles for family transportation. Premium and mid-range segments show strongest adoption rates, with consumers valuing advanced features, safety technologies, and environmental benefits alongside traditional automotive attributes.

Commercial Vehicle Applications present significant opportunities for fleet operators seeking to reduce operating costs and meet environmental regulations. Delivery services, logistics companies, and ride-sharing platforms increasingly adopt electric vehicles to improve operational efficiency and brand sustainability credentials.

Public Transportation Segment benefits from government support and urban planning initiatives promoting sustainable mass transit solutions. Electric buses and public transportation vehicles receive priority in infrastructure development and regulatory support programs.

Battery Technology Categories show clear preferences for lithium-ion solutions in premium segments, while cost-sensitive markets continue utilizing lead-acid batteries. Advanced battery technologies gain traction as prices decline and performance improves across different vehicle categories.

Manufacturers benefit from Vietnam’s growing electric vehicle market through expanded production opportunities, export potential, and access to government incentives supporting domestic manufacturing. Local production capabilities reduce costs, improve supply chain control, and enable customization for Vietnamese market preferences and conditions.

Consumers gain significant advantages including reduced operating costs, lower maintenance requirements, environmental benefits, and access to government incentives and preferential policies. Electric vehicle ownership provides long-term cost savings, improved urban mobility, and contribution to environmental sustainability goals.

Government stakeholders achieve multiple objectives through electric vehicle market development, including reduced emissions, energy security improvements, industrial development, and technological advancement. Electric vehicle adoption supports Vietnam’s climate commitments and sustainable development goals.

Infrastructure providers benefit from expanding opportunities in charging station development, grid services, and energy management solutions. Growing electric vehicle adoption creates demand for comprehensive charging networks and supporting infrastructure across urban and rural areas.

Financial institutions find new business opportunities in electric vehicle financing, leasing programs, and insurance products tailored to electric vehicle characteristics and consumer needs. Specialized financial products support market growth and consumer adoption.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as a defining trend in Vietnam’s electric vehicle market, with manufacturers incorporating advanced telematics, mobile applications, and IoT connectivity to enhance user experience and vehicle functionality. Connected features enable remote monitoring, predictive maintenance, and integrated mobility services that differentiate electric vehicles from conventional alternatives.

Battery technology advancement continues driving market evolution through improved energy density, faster charging capabilities, and extended lifespan. Vietnamese consumers increasingly prioritize battery performance and warranty terms when evaluating electric vehicle options, influencing manufacturer development priorities and marketing strategies.

Charging infrastructure expansion accelerates across Vietnam with both public and private sector investments supporting comprehensive charging networks. Fast-charging stations, workplace charging, and residential charging solutions become standard infrastructure components supporting electric vehicle adoption and consumer confidence.

Subscription and mobility services gain traction as alternative ownership models, with companies offering electric vehicle subscriptions, battery leasing, and integrated mobility packages. These innovative business models address cost concerns and provide flexible transportation solutions for different consumer segments.

Sustainability focus intensifies throughout the electric vehicle value chain, with manufacturers emphasizing recyclable materials, renewable energy integration, and circular economy principles. Environmental sustainability becomes a key differentiator and marketing message for Vietnamese electric vehicle brands.

Manufacturing expansion continues across Vietnam’s electric vehicle sector, with both domestic and international companies investing in production facilities and assembly operations. VinFast has established comprehensive manufacturing capabilities while international brands develop local assembly partnerships to serve Vietnamese and regional markets.

Technology partnerships between Vietnamese companies and international technology providers accelerate innovation and capability development. Collaborations in battery technology, autonomous driving, and connected services enhance Vietnamese manufacturers’ competitive positioning and technological capabilities.

Infrastructure investments by government agencies and private companies expand charging networks across major cities and transportation corridors. Public-private partnerships support comprehensive charging infrastructure development that addresses range anxiety and supports long-distance electric vehicle travel.

Regulatory developments continue refining Vietnam’s electric vehicle policy framework, with updated safety standards, environmental regulations, and import policies affecting market dynamics. Government initiatives increasingly focus on supporting domestic manufacturing while maintaining market competition and consumer choice.

International expansion by Vietnamese electric vehicle manufacturers demonstrates growing confidence and capability, with companies targeting regional markets and developing export strategies. MWR analysis indicates that Vietnamese manufacturers are increasingly competitive in regional markets with similar conditions and requirements.

Infrastructure development should remain a priority for government and private sector stakeholders, with particular focus on rural areas and inter-city corridors that currently limit electric vehicle adoption. Comprehensive charging networks will address range anxiety and support market expansion beyond urban centers.

Consumer education programs require expansion to address misconceptions about electric vehicle performance, maintenance, and total cost of ownership. Demonstration programs, test drive opportunities, and educational campaigns can build consumer confidence and accelerate adoption rates across different market segments.

Technology localization presents strategic opportunities for Vietnam to develop domestic capabilities in battery manufacturing, charging equipment, and electronic systems. Local production would reduce costs, improve supply chain security, and create additional industrial development opportunities.

Market segmentation strategies should recognize diverse consumer needs across urban and rural markets, with different product offerings and pricing strategies for various income levels and use cases. Tailored approaches can maximize market penetration and consumer satisfaction.

International collaboration in technology development, manufacturing, and market access can accelerate Vietnam’s electric vehicle industry development while maintaining competitive positioning. Strategic partnerships should balance technology transfer with domestic capability development.

Market expansion in Vietnam’s electric vehicle sector appears robust, with growth projections indicating continued acceleration across all vehicle categories and geographic regions. Government support, infrastructure development, and technological advancement create favorable conditions for sustained market growth and industry development.

Technology evolution will continue driving market transformation through improved battery performance, autonomous driving capabilities, and integrated mobility services. Vietnamese manufacturers and consumers will benefit from global technology advancement while developing local capabilities and preferences.

Export opportunities for Vietnamese electric vehicle manufacturers show significant potential, with regional markets offering growth opportunities for companies that achieve competitive positioning and quality standards. ASEAN integration and trade agreements support export market development and regional industry cooperation.

Infrastructure maturation will address current limitations and support comprehensive electric vehicle adoption across Vietnam’s diverse geographic and economic landscape. Charging networks, grid capacity, and supporting services will reach levels that eliminate barriers to electric vehicle ownership and operation.

Market sophistication will increase as consumers become more knowledgeable about electric vehicle technologies and benefits, driving demand for advanced features and higher-quality products. This evolution will support premium market development and technological innovation throughout the industry.

Vietnam’s electric vehicle market represents a compelling growth story characterized by strong government support, innovative domestic manufacturers, and increasing consumer acceptance of sustainable transportation solutions. The market demonstrates exceptional potential across multiple vehicle categories, with electric motorcycles leading current adoption while passenger cars and commercial vehicles show rapid growth trajectories.

Key success factors include continued infrastructure development, consumer education, technology advancement, and supportive regulatory frameworks that balance market growth with safety and environmental objectives. Vietnamese manufacturers have established strong competitive positions while international brands contribute technology and market development expertise.

Future prospects remain highly positive, with Vietnam positioned to become a regional leader in electric vehicle adoption and manufacturing. The combination of domestic market growth and export opportunities creates sustainable foundation for industry development and economic contribution. MarkWide Research projects that Vietnam’s electric vehicle market will continue expanding as infrastructure matures and consumer preferences increasingly favor sustainable transportation solutions.

What is Electric Vehicle?

Electric vehicles (EVs) are automobiles that are powered by electric motors instead of internal combustion engines. They include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), which are gaining popularity due to their environmental benefits and lower operating costs.

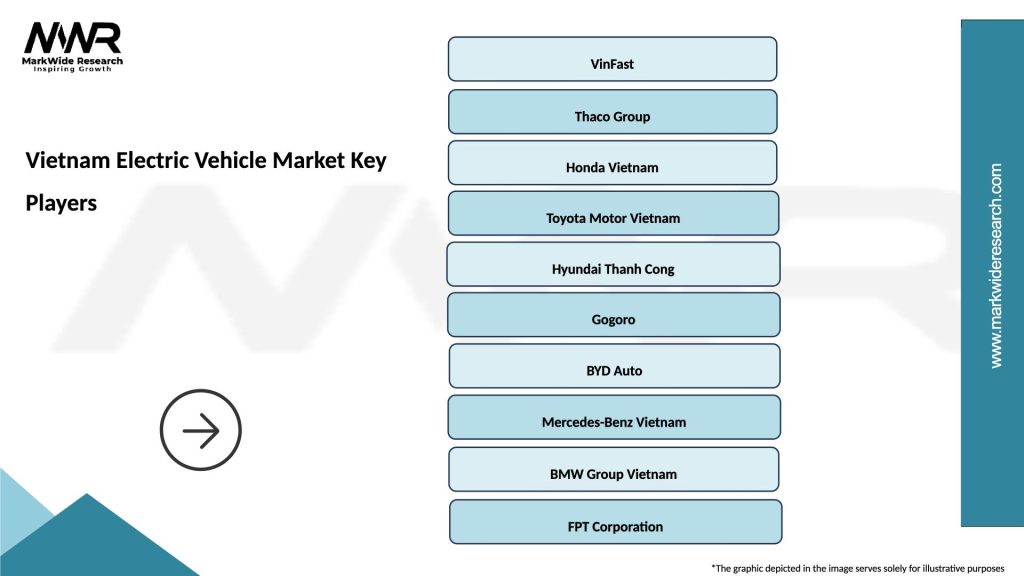

What are the key players in the Vietnam Electric Vehicle Market?

Key players in the Vietnam Electric Vehicle Market include VinFast, a prominent local manufacturer, and international companies like Tesla and Nissan, which are exploring opportunities in the region. These companies are focusing on expanding their electric vehicle offerings and infrastructure.

What are the growth factors driving the Vietnam Electric Vehicle Market?

The Vietnam Electric Vehicle Market is driven by increasing government support for EV adoption, rising fuel prices, and growing environmental awareness among consumers. Additionally, advancements in battery technology and charging infrastructure are enhancing the market’s growth potential.

What challenges does the Vietnam Electric Vehicle Market face?

The Vietnam Electric Vehicle Market faces challenges such as limited charging infrastructure, high initial costs of electric vehicles, and consumer skepticism regarding battery life and performance. These factors can hinder widespread adoption and market growth.

What opportunities exist in the Vietnam Electric Vehicle Market?

Opportunities in the Vietnam Electric Vehicle Market include the potential for government incentives to promote EV adoption, the development of local manufacturing capabilities, and the growing interest in sustainable transportation solutions. These factors can attract investments and foster innovation.

What trends are shaping the Vietnam Electric Vehicle Market?

Trends in the Vietnam Electric Vehicle Market include the rise of smart EV technologies, increased collaboration between automakers and tech companies, and a shift towards sustainable urban mobility solutions. These trends are influencing consumer preferences and shaping the future of transportation.

Vietnam Electric Vehicle Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Passenger Cars, Buses, Motorcycles, Trucks |

| Propulsion | Battery Electric, Plug-in Hybrid, Fuel Cell, Hybrid |

| End User | Government, Corporations, Individuals, Fleet Operators |

| Charging Infrastructure | Public Stations, Home Chargers, Fast Chargers, Workplace Chargers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Electric Vehicle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at