444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam data center cooling market represents a rapidly expanding segment within the country’s digital infrastructure landscape, driven by increasing digitalization and cloud adoption across various industries. Data center cooling systems have become critical components for maintaining optimal operating temperatures and ensuring reliable performance of IT equipment in Vietnam’s tropical climate conditions.

Market dynamics indicate substantial growth potential as Vietnam continues its digital transformation journey, with enterprises and service providers investing heavily in modern data center facilities. The market encompasses various cooling technologies including air-based cooling, liquid cooling, and hybrid cooling solutions designed to address the unique challenges of operating data centers in Southeast Asia’s humid environment.

Growth projections suggest the market is expanding at a 12.5% CAGR through the forecast period, supported by increasing demand for cloud services, e-commerce platforms, and digital banking solutions. Foreign investment in Vietnam’s technology sector has accelerated the deployment of hyperscale data centers, creating significant opportunities for cooling system providers.

Regional factors including government support for digital economy initiatives, improving telecommunications infrastructure, and Vietnam’s strategic position as a manufacturing hub contribute to the market’s positive outlook. The country’s commitment to becoming a regional technology center has attracted major cloud service providers and telecommunications companies to establish data center operations.

The Vietnam data center cooling market refers to the comprehensive ecosystem of technologies, systems, and services designed to maintain optimal temperature and humidity conditions within data center facilities across Vietnam. This market encompasses various cooling methodologies including traditional computer room air conditioning (CRAC) systems, advanced precision cooling units, and innovative liquid cooling solutions.

Cooling infrastructure represents a critical component of data center operations, typically accounting for approximately 40% of total energy consumption in traditional facilities. The market includes hardware components such as chillers, cooling towers, air handling units, and distribution systems, alongside software solutions for monitoring and optimization.

Technological scope covers both direct and indirect cooling approaches, with increasing adoption of energy-efficient solutions designed to reduce operational costs while maintaining equipment reliability. The market also encompasses specialized services including installation, maintenance, and performance optimization tailored to Vietnam’s specific climate conditions and regulatory requirements.

Vietnam’s data center cooling market is experiencing unprecedented growth driven by the country’s rapid digital transformation and increasing demand for cloud-based services. The market benefits from strong government support for technology infrastructure development and significant foreign investment in the telecommunications and IT sectors.

Key market drivers include the expansion of e-commerce platforms, growing adoption of digital banking services, and increasing demand for content delivery networks to serve Vietnam’s young, tech-savvy population. Energy efficiency has emerged as a primary concern, with operators seeking cooling solutions that can reduce power consumption by up to 30% compared to traditional systems.

Competitive landscape features a mix of international cooling technology providers and local system integrators, with increasing collaboration between global vendors and Vietnamese partners. The market is characterized by rapid technology adoption, with operators showing strong interest in advanced cooling solutions including immersion cooling and direct-to-chip cooling technologies.

Future prospects remain highly positive, supported by Vietnam’s strategic position in the ASEAN region and continued investment in digital infrastructure. The market is expected to benefit from increasing adoption of artificial intelligence and machine learning applications, which require high-density computing environments with sophisticated cooling requirements.

Strategic insights reveal several critical factors shaping Vietnam’s data center cooling market development and competitive dynamics:

Digital transformation initiatives across Vietnam’s economy serve as the primary catalyst for data center cooling market expansion. Government programs promoting digitalization in banking, healthcare, education, and public services are driving substantial investment in IT infrastructure, creating increased demand for reliable cooling solutions.

Cloud adoption acceleration represents another significant driver, with Vietnamese enterprises increasingly migrating to cloud-based platforms to improve operational efficiency and reduce IT costs. This trend has attracted major international cloud service providers to establish local data center facilities, requiring sophisticated cooling infrastructure to support their operations.

E-commerce growth continues to fuel market expansion, with online retail platforms experiencing rapid user base growth and transaction volume increases. These platforms require robust data center infrastructure to handle peak traffic loads and ensure consistent service availability, driving demand for reliable cooling systems.

Foreign direct investment in Vietnam’s technology sector has accelerated significantly, with multinational corporations establishing regional headquarters and manufacturing facilities. These investments often include substantial IT infrastructure components, contributing to increased demand for data center cooling solutions.

5G network deployment is creating new requirements for edge computing infrastructure, necessitating distributed data center facilities with efficient cooling systems. Telecommunications operators are investing heavily in network modernization, creating opportunities for cooling system providers to support next-generation network infrastructure.

High initial investment costs represent a significant barrier for many organizations considering data center infrastructure deployment. Advanced cooling systems require substantial capital expenditure, which can be challenging for smaller enterprises and local service providers with limited financial resources.

Technical expertise shortage poses ongoing challenges for market development, as sophisticated cooling systems require specialized knowledge for design, installation, and maintenance. Vietnam’s developing technology sector faces skills gaps in data center engineering and cooling system management, potentially limiting market growth.

Energy infrastructure limitations in certain regions of Vietnam can constrain data center development and cooling system deployment. Reliable power supply and grid stability are essential for cooling system operation, and infrastructure limitations may restrict facility locations and capacity expansion.

Regulatory complexity surrounding environmental standards and energy efficiency requirements can create challenges for cooling system selection and deployment. Evolving regulations and compliance requirements may increase project complexity and implementation timelines.

Climate-related challenges including extreme weather events and seasonal variations can impact cooling system performance and reliability. Vietnam’s tropical climate with high humidity and temperature fluctuations requires specialized cooling solutions, potentially increasing system complexity and costs.

Green data center initiatives present substantial opportunities for energy-efficient cooling technology providers. Vietnamese organizations are increasingly focused on sustainability and carbon footprint reduction, creating demand for cooling solutions that can achieve PUE ratios below 1.3 while maintaining optimal performance.

Edge computing expansion offers significant growth potential as 5G networks and IoT applications drive demand for distributed computing infrastructure. Edge data centers require compact, efficient cooling solutions that can operate reliably in diverse environmental conditions, creating new market segments for specialized providers.

Retrofit and modernization projects represent substantial opportunities as existing data centers seek to improve energy efficiency and reduce operational costs. Upgrading legacy cooling systems with modern, efficient technologies can provide immediate benefits and create recurring revenue streams for service providers.

Smart cooling solutions incorporating artificial intelligence and machine learning technologies offer opportunities for differentiation and value creation. Advanced monitoring and optimization capabilities can help data center operators reduce energy consumption by up to 25% while improving system reliability.

Regional expansion opportunities exist as Vietnam serves as a gateway to other Southeast Asian markets. Successful cooling system deployments in Vietnam can provide references and experience for expansion into neighboring countries with similar climate conditions and infrastructure requirements.

Competitive intensity in Vietnam’s data center cooling market is increasing as both international vendors and local providers compete for market share. This competition is driving innovation and price optimization, benefiting end users through improved technology offerings and competitive pricing structures.

Technology evolution continues to reshape market dynamics, with liquid cooling and immersion cooling technologies gaining traction for high-density computing applications. These advanced cooling methods can improve energy efficiency by up to 35% compared to traditional air-cooling systems, creating new competitive advantages.

Partnership strategies are becoming increasingly important as international cooling vendors collaborate with local system integrators and service providers. These partnerships enable better market penetration, improved customer service, and enhanced technical support capabilities tailored to Vietnamese market requirements.

Customer expectations are evolving toward comprehensive solutions that include not only cooling hardware but also design services, installation support, ongoing maintenance, and performance optimization. This trend is driving market participants to develop integrated service offerings and expand their capabilities.

Regulatory influence on market dynamics is growing as government agencies implement energy efficiency standards and environmental regulations. These requirements are shaping product development priorities and influencing customer selection criteria for cooling system investments.

Primary research activities for analyzing Vietnam’s data center cooling market included comprehensive interviews with key industry stakeholders, including data center operators, cooling system vendors, system integrators, and technology consultants. These interviews provided insights into market trends, competitive dynamics, and customer requirements specific to the Vietnamese market.

Secondary research encompassed analysis of industry reports, government publications, company financial statements, and technology trend analyses to understand market size, growth patterns, and competitive landscape. MarkWide Research utilized multiple data sources to ensure comprehensive market coverage and validate findings through triangulation methods.

Market segmentation analysis involved detailed examination of cooling technologies, application segments, and customer categories to identify growth opportunities and competitive positioning. This analysis included evaluation of technology adoption rates, price trends, and customer preferences across different market segments.

Competitive intelligence activities focused on analyzing major market participants, their product portfolios, market strategies, and competitive positioning. This research included assessment of market share distribution, strategic partnerships, and technology development initiatives among key players.

Validation processes included cross-referencing data from multiple sources, conducting follow-up interviews with industry experts, and analyzing market trends against broader technology and economic indicators to ensure accuracy and reliability of research findings.

Ho Chi Minh City dominates Vietnam’s data center cooling market, accounting for approximately 45% of total market activity. The city’s status as the country’s economic center, combined with high concentrations of enterprises and technology companies, drives substantial demand for data center infrastructure and associated cooling systems.

Hanoi region represents the second-largest market segment, capturing roughly 30% market share due to its role as the political and administrative capital. Government digitalization initiatives and the presence of major telecommunications operators contribute to strong demand for data center cooling solutions in the northern region.

Da Nang and central Vietnam are emerging as significant growth markets, benefiting from government initiatives to develop technology hubs outside the major metropolitan areas. The region’s strategic location and improving infrastructure are attracting data center investments, creating new opportunities for cooling system providers.

Coastal regions present unique opportunities and challenges for data center cooling systems due to high humidity levels and salt air exposure. These environmental factors require specialized cooling solutions with enhanced corrosion resistance and humidity management capabilities.

Industrial zones across Vietnam are increasingly incorporating data center facilities to support manufacturing and logistics operations. These deployments often require cooling solutions integrated with existing industrial infrastructure, creating specialized market segments for cooling system providers.

Market leadership in Vietnam’s data center cooling sector is characterized by a mix of international technology vendors and local system integrators, each bringing distinct capabilities and market approaches:

Competitive strategies focus on technology innovation, energy efficiency improvements, and comprehensive service offerings. Market participants are investing in research and development to create cooling solutions specifically optimized for Vietnam’s climate conditions and operational requirements.

Partnership development has become a key competitive differentiator, with international vendors establishing strategic relationships with local partners to enhance market penetration and customer service capabilities. These partnerships enable better understanding of local requirements and more effective project execution.

By Technology:

By Application:

By End User:

Air-based cooling systems continue to dominate the Vietnamese market, representing approximately 70% of total installations due to their proven reliability and lower initial investment requirements. However, energy efficiency concerns are driving increased interest in advanced air cooling technologies with improved performance characteristics.

Liquid cooling adoption is accelerating, particularly in high-density computing environments where traditional air cooling becomes inadequate. Early adopters report energy efficiency improvements of up to 40% compared to conventional cooling systems, driving broader market interest in liquid cooling technologies.

Precision cooling units designed specifically for data center applications are gaining market share due to their superior temperature and humidity control capabilities. These systems offer better reliability and energy efficiency compared to traditional comfort cooling systems adapted for data center use.

Modular cooling solutions are becoming increasingly popular as they offer scalability and flexibility for growing data center operations. These systems allow operators to add cooling capacity incrementally as computing loads increase, optimizing capital expenditure and operational efficiency.

Smart cooling technologies incorporating IoT sensors and AI-driven optimization are emerging as key differentiators. These advanced systems can automatically adjust cooling parameters based on real-time conditions, potentially reducing energy consumption by 20-25% while maintaining optimal operating conditions.

Data center operators benefit from advanced cooling solutions through reduced energy costs, improved equipment reliability, and enhanced operational efficiency. Modern cooling systems can significantly lower total cost of ownership while providing better performance and environmental control.

Technology vendors gain access to a rapidly growing market with substantial long-term potential. Vietnam’s digital transformation creates sustained demand for cooling infrastructure, providing opportunities for revenue growth and market expansion throughout the region.

System integrators benefit from increasing demand for specialized installation and maintenance services. The complexity of modern cooling systems creates opportunities for value-added services and long-term customer relationships through ongoing support contracts.

End-user organizations achieve improved IT infrastructure reliability and performance through optimized cooling solutions. Better cooling systems enable higher equipment density, improved energy efficiency, and reduced operational risks associated with temperature-related equipment failures.

Government stakeholders benefit from improved digital infrastructure supporting economic development and competitiveness. Efficient data center cooling contributes to energy conservation goals and environmental sustainability objectives while enabling digital transformation initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has emerged as a dominant trend, with data center operators increasingly prioritizing cooling solutions that minimize environmental impact and reduce carbon footprint. This focus is driving adoption of energy-efficient technologies and renewable energy integration for cooling systems.

AI-powered optimization is transforming cooling system management through predictive analytics and automated control systems. These technologies enable real-time optimization of cooling parameters, potentially reducing energy consumption while maintaining optimal operating conditions for IT equipment.

Liquid cooling mainstream adoption is accelerating as high-density computing requirements make traditional air cooling insufficient. MWR analysis indicates growing interest in direct-to-chip cooling and immersion cooling technologies for next-generation data center deployments.

Edge computing proliferation is creating demand for compact, efficient cooling solutions suitable for distributed deployment scenarios. These systems must operate reliably in diverse environmental conditions while maintaining energy efficiency and cost-effectiveness.

Service-centric business models are gaining traction as customers seek comprehensive solutions including design, installation, maintenance, and optimization services. This trend is driving cooling system providers to expand their service capabilities and develop long-term customer relationships.

Major cloud providers have announced significant investments in Vietnamese data center infrastructure, including state-of-the-art cooling systems designed for tropical climate operations. These deployments are establishing new benchmarks for cooling efficiency and reliability in the region.

Technology partnerships between international cooling vendors and Vietnamese system integrators are expanding, creating enhanced local capabilities for advanced cooling system deployment and support. These collaborations are improving market access and customer service quality.

Government initiatives promoting green data centers and energy efficiency standards are influencing cooling system selection criteria and driving adoption of advanced technologies. New regulations are expected to accelerate the transition toward more efficient cooling solutions.

Innovation centers focused on tropical climate cooling solutions are being established, bringing together technology vendors, research institutions, and end users to develop optimized cooling technologies for Southeast Asian markets.

Investment funding for data center infrastructure projects has increased substantially, with several major facilities under construction incorporating advanced cooling technologies. These projects are creating significant opportunities for cooling system providers and establishing new market standards.

Market entry strategies should focus on partnership development with established local system integrators who understand Vietnamese market dynamics and customer requirements. International vendors should prioritize building strong local relationships to enhance market penetration and service capabilities.

Technology positioning should emphasize energy efficiency and tropical climate optimization, as these factors are critical for success in the Vietnamese market. Cooling solutions specifically designed for high humidity and temperature conditions will have competitive advantages over generic products.

Service capability development is essential for long-term success, as customers increasingly value comprehensive solutions including design, installation, maintenance, and optimization services. Companies should invest in local technical expertise and service infrastructure to support growing market demand.

Sustainability focus should be integrated into product development and marketing strategies, as environmental considerations are becoming increasingly important for Vietnamese data center operators. Energy-efficient cooling solutions with demonstrable environmental benefits will have market advantages.

Regional expansion planning should consider Vietnam as a gateway to broader Southeast Asian markets, leveraging successful local deployments as references for expansion into neighboring countries with similar climate conditions and infrastructure requirements.

Market expansion is expected to continue at an accelerated pace, driven by ongoing digital transformation initiatives and increasing cloud adoption across Vietnamese enterprises. MarkWide Research projects sustained growth as the country strengthens its position as a regional technology hub.

Technology evolution will favor advanced cooling solutions offering superior energy efficiency and environmental performance. Liquid cooling and hybrid systems are expected to gain significant market share, particularly in high-density computing applications and hyperscale data centers.

Geographic distribution of data center facilities is expected to expand beyond major metropolitan areas, creating opportunities for cooling system providers in secondary cities and industrial zones. This expansion will require flexible, scalable cooling solutions suitable for diverse deployment scenarios.

Integration trends will drive demand for cooling solutions that seamlessly integrate with broader data center infrastructure management systems. Smart cooling technologies with advanced monitoring and optimization capabilities will become standard requirements rather than premium features.

Market maturation is expected to bring increased focus on total cost of ownership and long-term performance rather than initial purchase price. This shift will favor cooling system providers offering comprehensive value propositions including energy efficiency, reliability, and ongoing support services.

Vietnam’s data center cooling market presents exceptional growth opportunities driven by rapid digitalization, increasing cloud adoption, and substantial foreign investment in technology infrastructure. The market’s expansion is supported by favorable government policies, strategic geographic positioning, and growing demand for digital services across all economic sectors.

Technology trends favor energy-efficient cooling solutions optimized for tropical climate conditions, with increasing adoption of advanced technologies including liquid cooling and AI-powered optimization systems. Market participants who can deliver comprehensive solutions addressing Vietnam’s unique environmental and operational requirements will achieve competitive advantages.

Success factors in this dynamic market include strong local partnerships, specialized technical expertise, and comprehensive service capabilities. The evolution toward sustainability and energy efficiency creates opportunities for innovative cooling technologies while challenging providers to continuously improve their offerings.

Future prospects remain highly positive as Vietnam continues its transformation into a regional technology hub, creating sustained demand for advanced data center infrastructure and sophisticated cooling solutions. Market participants who establish strong positions now will benefit from long-term growth opportunities throughout Southeast Asia.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data center operations.

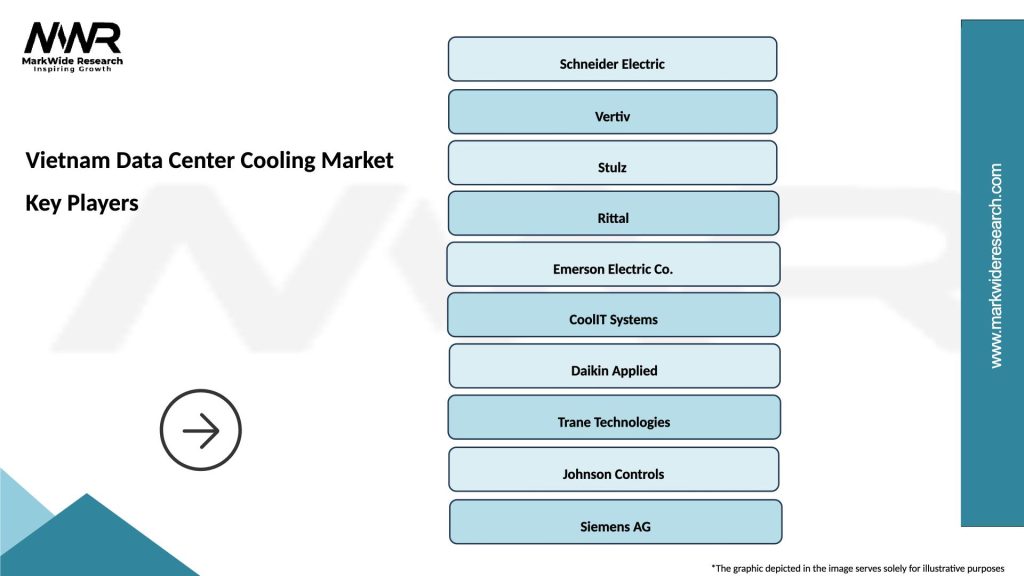

What are the key players in the Vietnam Data Center Cooling Market?

Key players in the Vietnam Data Center Cooling Market include companies like Schneider Electric, Vertiv, and STULZ, which provide innovative cooling solutions and technologies. These companies focus on energy efficiency and advanced cooling systems to meet the growing demands of data centers, among others.

What are the main drivers of the Vietnam Data Center Cooling Market?

The main drivers of the Vietnam Data Center Cooling Market include the rapid growth of data centers due to increased digitalization, the rising demand for cloud services, and the need for energy-efficient cooling solutions. Additionally, the expansion of IT infrastructure in various sectors fuels market growth.

What challenges does the Vietnam Data Center Cooling Market face?

Challenges in the Vietnam Data Center Cooling Market include high initial investment costs for advanced cooling technologies and the need for skilled personnel to manage these systems. Furthermore, fluctuating energy prices can impact operational costs for data center operators.

What opportunities exist in the Vietnam Data Center Cooling Market?

Opportunities in the Vietnam Data Center Cooling Market include the increasing adoption of green technologies and sustainable cooling solutions. As businesses seek to reduce their carbon footprint, there is a growing demand for innovative cooling systems that utilize renewable energy sources.

What trends are shaping the Vietnam Data Center Cooling Market?

Trends shaping the Vietnam Data Center Cooling Market include the integration of artificial intelligence for predictive maintenance and the use of liquid cooling technologies. Additionally, there is a shift towards modular cooling solutions that offer scalability and flexibility for evolving data center needs.

Vietnam Data Center Cooling Market

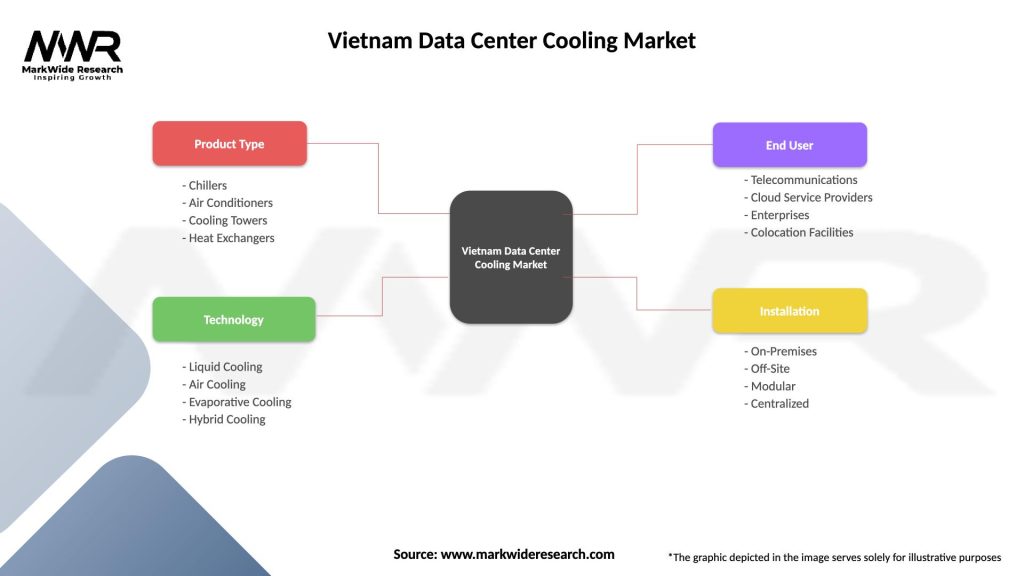

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Air Conditioners, Cooling Towers, Heat Exchangers |

| Technology | Liquid Cooling, Air Cooling, Evaporative Cooling, Hybrid Cooling |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Colocation Facilities |

| Installation | On-Premises, Off-Site, Modular, Centralized |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at