444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Vietnam bike-sharing market has emerged as a transformative force in the country’s urban mobility landscape, representing a significant shift towards sustainable transportation solutions. Vietnam’s rapidly urbanizing cities are experiencing unprecedented growth in bike-sharing adoption, driven by increasing environmental consciousness, traffic congestion challenges, and government initiatives promoting green transportation alternatives.

Market penetration has accelerated dramatically across major Vietnamese cities including Ho Chi Minh City, Hanoi, Da Nang, and Can Tho. The sector demonstrates robust expansion with annual growth rates exceeding 15%, positioning Vietnam as one of Southeast Asia’s most promising bike-sharing markets. Urban commuters increasingly embrace shared mobility solutions as viable alternatives to traditional transportation methods.

Technology integration plays a pivotal role in market development, with smartphone-based applications, GPS tracking systems, and IoT-enabled bicycles becoming standard features. Vietnamese consumers show strong adoption rates for digital payment systems integrated with bike-sharing platforms, contributing to seamless user experiences and operational efficiency improvements.

Government support through favorable policies, infrastructure development, and environmental initiatives creates conducive conditions for market expansion. Smart city initiatives across Vietnam increasingly incorporate bike-sharing systems as integral components of comprehensive urban mobility strategies, fostering sustainable transportation ecosystems.

The Vietnam bike-sharing market refers to the comprehensive ecosystem of shared bicycle services operating across Vietnamese urban centers, encompassing station-based and dockless bike-sharing systems that provide on-demand access to bicycles through digital platforms and mobile applications.

Bike-sharing systems in Vietnam typically involve fleets of bicycles strategically distributed throughout cities, accessible through smartphone applications that enable users to locate, unlock, and rent bicycles for short-term transportation needs. Service models range from traditional docking station systems to innovative free-floating dockless solutions that offer greater flexibility and convenience.

Market participants include both domestic Vietnamese companies and international operators who provide comprehensive bike-sharing services including bicycle maintenance, technology platforms, customer support, and fleet management. Revenue generation occurs through various pricing models including per-ride fees, subscription plans, and corporate partnerships.

Integration capabilities with existing transportation infrastructure, mobile payment systems, and urban planning initiatives define the market’s scope and operational effectiveness. Environmental impact and sustainable mobility objectives drive market development and stakeholder engagement across Vietnam’s evolving transportation landscape.

Vietnam’s bike-sharing market demonstrates exceptional growth momentum, establishing itself as a cornerstone of the country’s sustainable transportation revolution. Market dynamics reveal strong consumer adoption, technological advancement, and supportive regulatory frameworks that collectively drive sector expansion across multiple Vietnamese cities.

Key market drivers include increasing urbanization rates, rising environmental awareness, traffic congestion mitigation needs, and government initiatives promoting sustainable mobility solutions. Consumer behavior patterns show growing preference for flexible, cost-effective transportation alternatives that align with modern lifestyle requirements and environmental consciousness.

Technology adoption accelerates market development through advanced mobile applications, GPS tracking systems, smart lock mechanisms, and integrated payment solutions. Operational efficiency improvements of approximately 25-30% result from technological innovations and data-driven fleet management strategies implemented by leading market participants.

Competitive landscape features diverse market participants ranging from established international operators to innovative local startups, creating dynamic market conditions that foster innovation and service quality improvements. Strategic partnerships between bike-sharing operators, technology providers, and government entities strengthen market foundations and expansion capabilities.

Future prospects indicate continued market growth driven by expanding urban populations, infrastructure development, and increasing integration with comprehensive smart city initiatives across Vietnam’s major metropolitan areas.

Market penetration analysis reveals significant growth opportunities across Vietnam’s urban centers, with user adoption rates increasing by approximately 40% annually in major cities. Consumer demographics show strong participation among young professionals, students, and environmentally conscious urban residents who prioritize sustainable transportation options.

Market maturation progresses through enhanced service quality, expanded coverage areas, and improved operational efficiency. Data analytics and artificial intelligence applications optimize fleet distribution, maintenance scheduling, and demand forecasting capabilities.

Urbanization acceleration across Vietnam creates substantial demand for efficient, flexible transportation solutions that address growing mobility needs in densely populated urban areas. Population growth in major cities generates increased transportation demand that traditional infrastructure struggles to accommodate effectively.

Environmental consciousness among Vietnamese consumers drives adoption of sustainable transportation alternatives that reduce carbon emissions and support environmental protection goals. Government environmental initiatives promote clean transportation solutions through policy support, infrastructure investment, and public awareness campaigns.

Traffic congestion challenges in major Vietnamese cities motivate consumers and policymakers to seek alternative transportation solutions that reduce road congestion and improve urban mobility efficiency. Economic benefits of bike-sharing systems include reduced transportation costs for users and decreased infrastructure burden on municipal governments.

Technology advancement enables sophisticated bike-sharing platforms that offer convenient, user-friendly experiences through mobile applications, digital payment integration, and real-time bicycle availability information. Smartphone penetration exceeding 70% in urban Vietnam facilitates widespread adoption of app-based bike-sharing services.

Health and wellness trends encourage active transportation methods that provide physical exercise benefits while addressing daily mobility needs. Corporate sustainability initiatives drive enterprise adoption of bike-sharing programs as employee benefits and environmental responsibility measures.

Tourism development creates additional demand for bike-sharing services as tourists seek convenient, affordable methods to explore Vietnamese cities and attractions. Infrastructure investment in cycling lanes and bicycle-friendly urban design supports market growth and user safety improvements.

Infrastructure limitations in certain Vietnamese cities present challenges for bike-sharing system deployment and user safety, particularly regarding dedicated cycling lanes and secure parking facilities. Weather conditions during monsoon seasons and extreme heat periods can significantly impact user demand and operational efficiency.

Regulatory uncertainties and evolving policy frameworks create operational challenges for bike-sharing operators seeking to establish long-term business strategies and investment plans. Licensing requirements and municipal approval processes may vary across different Vietnamese cities, complicating multi-city expansion efforts.

Vandalism and theft concerns affect operational costs and service reliability, requiring significant investment in security measures, bicycle durability, and replacement inventory. Maintenance challenges in tropical climates necessitate frequent bicycle servicing and component replacement, impacting operational efficiency.

Cultural adaptation requirements involve educating users about proper bicycle sharing etiquette, safety practices, and system usage protocols. Competition from motorbikes and other traditional transportation methods presents market share challenges in certain demographic segments and geographic areas.

Technology infrastructure dependencies require reliable internet connectivity, mobile network coverage, and digital payment system integration across all service areas. Initial capital investment requirements for fleet acquisition, technology development, and operational infrastructure may limit market entry for smaller operators.

Smart city initiatives across Vietnam present substantial opportunities for bike-sharing integration with comprehensive urban mobility platforms and intelligent transportation systems. Government partnerships offer potential for large-scale deployment projects and long-term service contracts that ensure market stability and growth.

Corporate market expansion through enterprise partnerships, employee transportation programs, and campus-based bike-sharing systems represents significant untapped market potential. Educational institution partnerships with universities and schools create dedicated user bases and promote sustainable transportation habits among young demographics.

Tourism sector integration offers opportunities for specialized bike-sharing services targeting international and domestic tourists visiting Vietnamese destinations. Rural market expansion into smaller cities and tourist areas presents growth opportunities as infrastructure development progresses.

Technology innovation opportunities include electric bike integration, advanced analytics platforms, and artificial intelligence applications for demand prediction and fleet optimization. Subscription model development can create stable revenue streams and enhance customer loyalty through comprehensive mobility packages.

Environmental program integration with carbon offset initiatives, corporate sustainability programs, and green certification systems creates additional value propositions and revenue opportunities. Data monetization through anonymized user behavior analytics and urban mobility insights offers supplementary revenue streams.

International expansion opportunities exist for successful Vietnamese bike-sharing operators to export proven business models and technologies to other Southeast Asian markets with similar characteristics and challenges.

Competitive dynamics in Vietnam’s bike-sharing market reflect intense competition among domestic and international operators seeking to establish market leadership through service quality, technology innovation, and strategic partnerships. Market consolidation trends indicate potential merger and acquisition activities as operators seek economies of scale and expanded market coverage.

Technology evolution drives continuous market transformation through enhanced mobile applications, improved bicycle designs, and advanced fleet management systems. User experience improvements of approximately 35% result from technological upgrades and service optimization initiatives implemented by leading market participants.

Regulatory evolution shapes market development through updated policies, safety requirements, and operational standards that influence operator strategies and investment decisions. Public-private partnerships emerge as preferred models for sustainable market development and infrastructure integration.

Seasonal demand variations require flexible operational strategies and dynamic pricing models that accommodate weather-related usage patterns and tourist influx cycles. Economic factors including disposable income levels, fuel prices, and transportation cost comparisons influence consumer adoption rates and market growth trajectories.

Innovation cycles accelerate through continuous technology development, user feedback integration, and competitive pressure to deliver superior service experiences. Market maturation progresses toward standardized service quality, interoperable systems, and comprehensive urban mobility integration.

Comprehensive market analysis employs multiple research methodologies including primary data collection, secondary source analysis, and expert interviews to ensure accurate market insights and trend identification. Data collection encompasses operator interviews, user surveys, government official consultations, and industry expert discussions.

Primary research activities include structured interviews with bike-sharing operators, technology providers, government officials, and end-users across major Vietnamese cities. Survey methodologies capture consumer behavior patterns, usage preferences, and satisfaction levels through statistically representative sampling approaches.

Secondary research incorporates analysis of government publications, industry reports, company financial statements, and academic studies related to bike-sharing market development in Vietnam and comparable markets. Market sizing methodologies combine top-down and bottom-up approaches to ensure accuracy and reliability.

Qualitative analysis techniques examine market trends, competitive dynamics, regulatory developments, and technology evolution through expert opinion synthesis and industry observation. Quantitative analysis employs statistical modeling, trend analysis, and forecasting methodologies to project market development scenarios.

Validation processes include cross-referencing multiple data sources, expert review panels, and market participant feedback to ensure research accuracy and reliability. Continuous monitoring systems track market developments, policy changes, and competitive activities to maintain current market intelligence.

Ho Chi Minh City represents Vietnam’s largest bike-sharing market, accounting for approximately 45% of national market share due to high population density, extensive urban development, and strong consumer adoption rates. Market penetration in the southern metropolis benefits from favorable infrastructure, technology-savvy demographics, and supportive municipal policies.

Hanoi market demonstrates rapid growth with approximately 30% market share, driven by government presence, educational institutions, and increasing environmental awareness among residents. Northern region dynamics reflect strong government support for sustainable transportation initiatives and smart city development projects.

Da Nang emerges as a significant regional market with 12% market share, benefiting from tourism development, compact urban layout, and progressive municipal policies supporting bike-sharing adoption. Central Vietnam opportunities expand through tourism integration and coastal city development initiatives.

Can Tho and other Mekong Delta cities represent approximately 8% market share, with growth potential driven by urban development, university presence, and increasing transportation needs. Secondary city expansion offers substantial growth opportunities as infrastructure development progresses.

Coastal cities including Nha Trang, Hoi An, and Vung Tau demonstrate strong tourism-driven demand for bike-sharing services, contributing approximately 5% market share. Regional development strategies focus on tourism integration and sustainable transportation promotion.

MarkWide Research analysis indicates that regional market distribution reflects urbanization patterns, economic development levels, and infrastructure readiness across Vietnam’s diverse geographic regions.

Market leadership in Vietnam’s bike-sharing sector features diverse participants including international operators, domestic startups, and technology companies that bring varied expertise and strategic approaches to market development.

Competitive strategies encompass technology innovation, strategic partnerships, pricing optimization, and service quality enhancement. Market differentiation occurs through specialized services, target market focus, and unique value propositions that address specific user needs and preferences.

Strategic alliances between operators, technology providers, and government entities create competitive advantages through resource sharing, market access, and operational efficiency improvements. Innovation competition drives continuous service enhancement and technology advancement across the market.

By Technology:

By Application:

By User Demographics:

By Pricing Model:

Dockless bike-sharing dominates Vietnam’s market with approximately 65% adoption rate due to user convenience, operational flexibility, and lower infrastructure requirements. Technology advantages include GPS tracking, mobile app integration, and flexible parking options that appeal to urban consumers seeking maximum convenience.

Station-based systems maintain approximately 25% market share through structured operations, predictable bicycle availability, and integration with existing transportation infrastructure. Operational benefits include organized fleet management, reduced vandalism risks, and municipal partnership opportunities.

Electric bike-sharing represents emerging segment with 10% market penetration, driven by user demand for assisted pedaling, longer-distance capability, and enhanced user experience. Growth potential exists through technology cost reduction and infrastructure development supporting e-bike operations.

Commuter segment generates approximately 55% of total usage, reflecting strong demand for daily transportation solutions that complement existing public transit systems. Usage patterns show peak demand during morning and evening commute hours with consistent weekday utilization.

Tourism applications contribute approximately 30% of usage, particularly in coastal cities and cultural destinations where visitors seek convenient exploration methods. Seasonal variations align with tourism cycles and weather patterns affecting outdoor activities.

Campus mobility represents specialized segment with 15% usage share, driven by educational institution partnerships and student transportation needs. Growth opportunities exist through expanded university partnerships and dedicated campus systems.

Operators benefit from scalable business models, technology-enabled efficiency improvements, and diverse revenue stream opportunities through subscription services, corporate partnerships, and data monetization. Operational advantages include reduced infrastructure costs compared to traditional transportation systems and flexible deployment capabilities.

Users gain convenient, affordable transportation options that provide health benefits, environmental impact reduction, and flexible mobility solutions. Cost savings compared to private vehicle ownership and traditional transportation methods create significant value propositions for diverse user segments.

Government stakeholders achieve sustainable transportation objectives, reduced traffic congestion, and enhanced urban mobility without substantial infrastructure investment. Environmental benefits support national sustainability goals and international climate commitments through reduced carbon emissions.

Technology providers access growing market opportunities for mobile applications, IoT devices, GPS tracking systems, and data analytics platforms. Innovation opportunities drive continuous technology development and market expansion possibilities.

Urban planners integrate bike-sharing systems with comprehensive transportation strategies, smart city initiatives, and sustainable development goals. Infrastructure optimization occurs through data-driven insights and user behavior analysis.

Tourism industry benefits from enhanced visitor mobility options, sustainable tourism promotion, and improved destination accessibility. Economic impact includes increased visitor satisfaction and extended exploration capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electric bike integration emerges as dominant trend with operators increasingly incorporating e-bikes to address longer-distance transportation needs and challenging terrain. Technology advancement in battery efficiency and cost reduction accelerates e-bike adoption across Vietnamese markets.

Artificial intelligence applications transform fleet management through predictive maintenance, demand forecasting, and optimal bicycle distribution strategies. Data analytics enable operators to achieve operational efficiency improvements of 20-25% through intelligent system optimization.

Subscription model evolution toward comprehensive mobility packages that integrate bike-sharing with other transportation services creates enhanced user value and operator revenue stability. Corporate partnership expansion drives B2B market development and enterprise mobility solutions.

Sustainability focus intensifies through carbon-neutral operations, renewable energy integration, and environmental impact measurement systems. Green certification programs become competitive differentiators and corporate partnership requirements.

Smart city integration accelerates through API connectivity, data sharing agreements, and comprehensive urban mobility platform development. Interoperability standards emerge to facilitate seamless user experiences across multiple transportation modes.

Tourism specialization develops through dedicated tourist packages, multilingual applications, and integration with destination marketing platforms. Cultural adaptation includes localized service features and community engagement initiatives.

Government policy initiatives include updated regulations supporting bike-sharing operations, infrastructure investment programs, and environmental incentive frameworks. Municipal partnerships expand through formal agreements integrating bike-sharing with public transportation systems and urban planning initiatives.

Technology partnerships between bike-sharing operators and Vietnamese technology companies accelerate platform development, payment system integration, and mobile application enhancement. Innovation hubs emerge in major cities fostering startup development and technology advancement.

Infrastructure development projects include dedicated cycling lane construction, secure parking facility installation, and bicycle-friendly urban design implementation. Investment commitments from government and private sectors support comprehensive cycling infrastructure expansion.

International expansion activities involve Vietnamese operators exploring regional markets and international companies establishing local operations. Knowledge transfer accelerates through international partnerships and best practice sharing initiatives.

Corporate adoption increases through employee transportation programs, campus mobility solutions, and corporate sustainability initiatives. Enterprise partnerships create stable revenue streams and market expansion opportunities.

MWR analysis indicates that industry developments reflect market maturation, technology advancement, and increasing integration with broader transportation ecosystems across Vietnam.

Market entry strategies should prioritize partnership development with local governments, technology providers, and established transportation companies to ensure regulatory compliance and market acceptance. Localization efforts must address cultural preferences, payment system integration, and community engagement requirements.

Technology investment priorities include mobile application development, GPS tracking systems, and data analytics platforms that enable competitive differentiation and operational efficiency. User experience optimization through intuitive interfaces and reliable service delivery creates sustainable competitive advantages.

Operational excellence requires robust maintenance systems, efficient fleet management, and responsive customer service capabilities adapted to Vietnamese market conditions. Quality control measures ensure service reliability and user satisfaction across diverse operating environments.

Partnership strategies should encompass government entities, educational institutions, tourism organizations, and corporate clients to create diverse revenue streams and market stability. Strategic alliances enable resource sharing, market access, and operational efficiency improvements.

Sustainability initiatives including environmental impact measurement, carbon offset programs, and green technology adoption align with government objectives and consumer preferences. Corporate responsibility programs enhance brand reputation and stakeholder relationships.

Market expansion should follow phased approaches prioritizing high-potential cities with supportive infrastructure and favorable demographics. Scalability planning ensures sustainable growth and operational efficiency as market presence expands.

Market growth trajectory indicates continued expansion with annual growth rates projected at 18-22% over the next five years, driven by urbanization, environmental consciousness, and government support for sustainable transportation. Market maturation will progress through service standardization, technology advancement, and comprehensive urban integration.

Technology evolution will emphasize artificial intelligence, electric bike integration, and smart city connectivity that enhance user experiences and operational efficiency. Innovation cycles will accelerate through competitive pressure and consumer demand for advanced features and services.

Geographic expansion will extend beyond major cities to secondary urban centers and tourist destinations as infrastructure development progresses. Market penetration in rural areas and smaller cities represents significant long-term growth opportunities.

Regulatory framework development will provide clearer operational guidelines, safety standards, and licensing requirements that support sustainable market development. Policy support will continue through environmental initiatives and smart city development programs.

Integration opportunities with public transportation, ride-sharing services, and comprehensive mobility platforms will create seamless user experiences and enhanced market value. Ecosystem development will foster collaboration among transportation providers and technology companies.

MarkWide Research projects that Vietnam’s bike-sharing market will establish itself as a regional leader in sustainable urban mobility, setting standards for technology innovation and operational excellence across Southeast Asia.

Vietnam’s bike-sharing market represents a transformative force in the country’s urban mobility landscape, demonstrating exceptional growth potential and strategic importance for sustainable transportation development. Market dynamics reveal strong consumer adoption, supportive government policies, and technological advancement that collectively drive sector expansion across Vietnamese cities.

Key success factors include technology innovation, strategic partnerships, operational excellence, and cultural adaptation that address local market requirements and user preferences. Competitive advantages emerge through service quality, user experience optimization, and comprehensive market understanding that enables sustainable business development.

Future prospects indicate continued market growth driven by urbanization trends, environmental consciousness, and integration with smart city initiatives. Strategic opportunities exist for market participants who can effectively combine technology innovation, operational efficiency, and stakeholder collaboration to capture emerging market potential.

The Vietnam bike-sharing market stands positioned to become a cornerstone of the country’s sustainable transportation ecosystem, offering significant value creation opportunities for operators, users, and society while contributing to environmental protection and urban mobility enhancement goals.

What is Bike-Sharing?

Bike-sharing refers to a service that allows individuals to rent bicycles for short periods, typically through a network of docking stations. This system promotes eco-friendly transportation and is gaining popularity in urban areas.

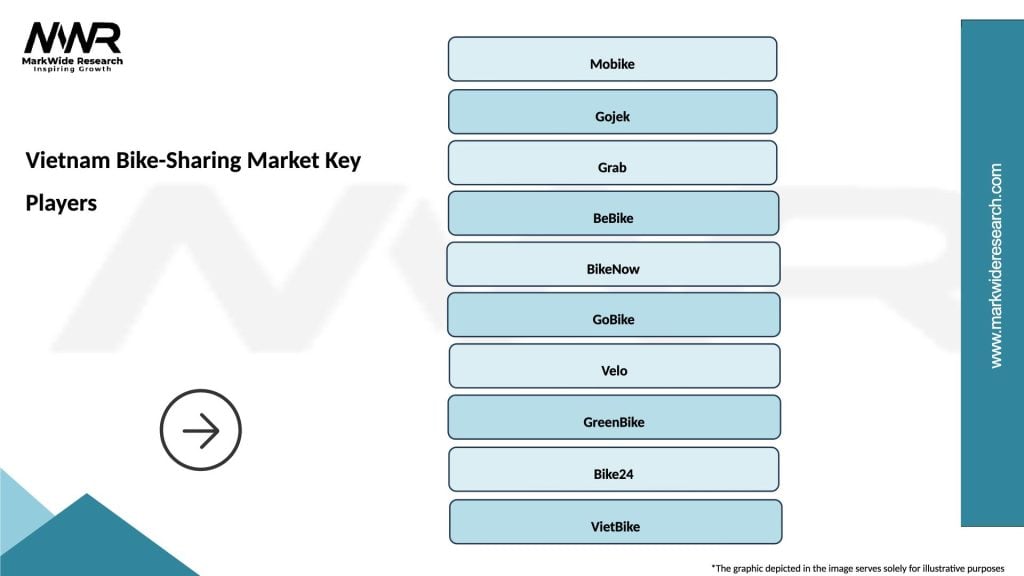

What are the key players in the Vietnam Bike-Sharing Market?

Key players in the Vietnam Bike-Sharing Market include companies like Mobike, GrabBike, and GoBike, which offer various bike-sharing services across major cities. These companies compete on pricing, availability, and user experience, among others.

What are the growth factors driving the Vietnam Bike-Sharing Market?

The Vietnam Bike-Sharing Market is driven by increasing urbanization, rising environmental awareness, and the need for affordable transportation options. Additionally, government initiatives promoting sustainable transport contribute to market growth.

What challenges does the Vietnam Bike-Sharing Market face?

Challenges in the Vietnam Bike-Sharing Market include issues related to bike maintenance, theft, and competition from other forms of transportation. Additionally, regulatory hurdles can impact the expansion of bike-sharing services.

What opportunities exist in the Vietnam Bike-Sharing Market?

The Vietnam Bike-Sharing Market presents opportunities for expansion into smaller cities, integration with public transport systems, and the development of electric bike-sharing options. These innovations can enhance user convenience and attract more riders.

What trends are shaping the Vietnam Bike-Sharing Market?

Trends in the Vietnam Bike-Sharing Market include the adoption of mobile apps for seamless rentals, the introduction of electric bikes, and partnerships with local businesses for promotions. These trends aim to improve user engagement and service efficiency.

Vietnam Bike-Sharing Market

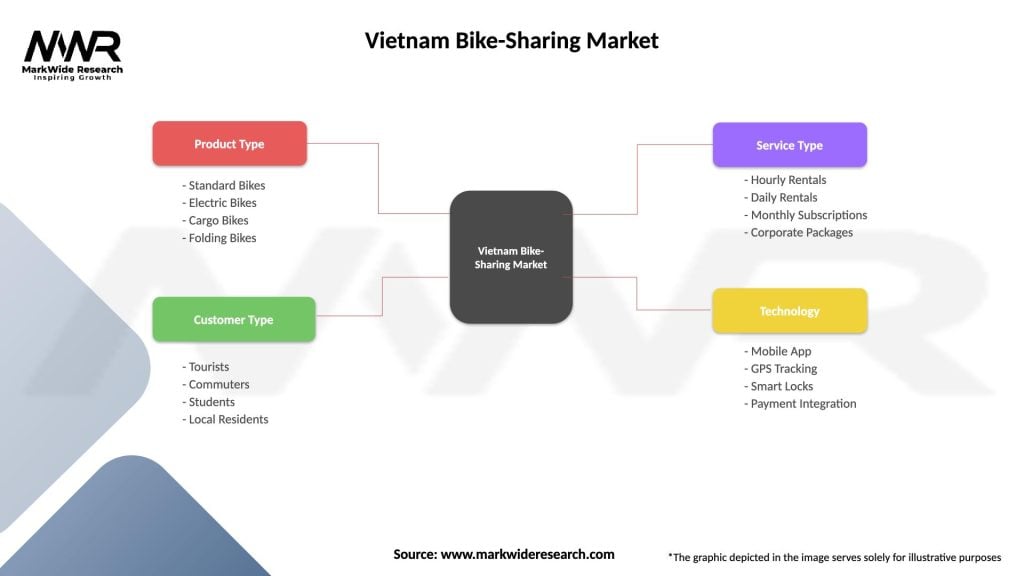

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Bikes, Electric Bikes, Cargo Bikes, Folding Bikes |

| Customer Type | Tourists, Commuters, Students, Local Residents |

| Service Type | Hourly Rentals, Daily Rentals, Monthly Subscriptions, Corporate Packages |

| Technology | Mobile App, GPS Tracking, Smart Locks, Payment Integration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vietnam Bike-Sharing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at