444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The veterinary in vitro fertilization market represents a rapidly evolving segment within the broader animal healthcare industry, driven by increasing demand for advanced reproductive technologies in livestock breeding and companion animal care. Veterinary IVF procedures have gained significant traction as farmers, breeders, and veterinary professionals seek to optimize genetic outcomes and improve breeding efficiency across various animal species.

Market dynamics indicate substantial growth potential, with the sector experiencing a 12.4% CAGR over recent years. This expansion reflects growing awareness of reproductive biotechnology benefits, including enhanced genetic diversity, improved breeding success rates, and reduced breeding-related complications. Technological advancements in embryo transfer techniques, cryopreservation methods, and laboratory equipment have made veterinary IVF more accessible and cost-effective for various applications.

Regional adoption patterns show North America and Europe leading market penetration, accounting for approximately 68% of global market share. However, emerging markets in Asia-Pacific and Latin America demonstrate accelerating growth rates as agricultural modernization initiatives drive demand for advanced breeding technologies. Species-specific applications span cattle, horses, sheep, goats, and companion animals, with bovine IVF representing the largest segment due to commercial dairy and beef production requirements.

Industry stakeholders include specialized veterinary clinics, agricultural research institutions, pharmaceutical companies, and equipment manufacturers. The market benefits from increasing investment in animal genetics research, government support for agricultural innovation, and growing consumer demand for high-quality animal products. Regulatory frameworks continue evolving to ensure safety standards while promoting technological advancement in veterinary reproductive medicine.

The veterinary in vitro fertilization market refers to the commercial sector encompassing products, services, and technologies used for artificial reproduction in animals through laboratory-based fertilization procedures. This specialized field combines advanced reproductive biology techniques with veterinary medicine to achieve controlled breeding outcomes outside the natural mating process.

Core components of veterinary IVF include oocyte collection, sperm preparation, fertilization procedures, embryo culture, and transfer protocols. The process involves retrieving eggs from female animals, fertilizing them with selected sperm in controlled laboratory conditions, and transferring resulting embryos to recipient females or storing them for future use. Technical expertise requires specialized training in reproductive physiology, laboratory techniques, and species-specific protocols.

Applications extend across multiple animal categories, from large livestock operations seeking genetic improvement to endangered species conservation programs. The technology enables precise genetic selection, overcomes natural breeding limitations, and facilitates rapid genetic progress in animal populations. Commercial benefits include improved offspring quality, reduced breeding costs, enhanced genetic diversity, and accelerated breeding programs.

Market participants provide comprehensive solutions including laboratory equipment, consumables, pharmaceuticals, training services, and technical support. The sector integrates with broader veterinary services, agricultural technology, and animal genetics industries to deliver complete reproductive management solutions for various stakeholders in animal agriculture and companion animal care.

Market expansion in veterinary in vitro fertilization reflects growing recognition of reproductive biotechnology’s value in modern animal agriculture and veterinary practice. The sector demonstrates robust growth driven by technological innovation, increasing demand for genetic improvement, and expanding applications across diverse animal species and breeding objectives.

Key growth drivers include rising global protein demand, emphasis on sustainable agriculture practices, and advancement in reproductive technologies. Approximately 78% of market growth stems from commercial livestock applications, while companion animal and exotic species segments show emerging potential. Technology adoption accelerates as costs decrease and success rates improve through refined protocols and equipment innovations.

Competitive landscape features established veterinary pharmaceutical companies, specialized reproductive technology providers, and emerging biotechnology firms. Market leaders focus on developing integrated solutions combining equipment, consumables, and technical services to address diverse customer needs. Strategic partnerships between technology providers and veterinary institutions drive market penetration and knowledge transfer.

Regional dynamics show mature markets in developed countries emphasizing efficiency improvements and advanced applications, while developing regions focus on basic technology adoption and capacity building. Future prospects include expansion into new species applications, integration with genomic selection technologies, and development of automated systems reducing technical complexity and operational costs.

Market intelligence reveals several critical insights shaping the veterinary in vitro fertilization landscape. Understanding these key factors provides essential context for stakeholders evaluating market opportunities and strategic positioning within this specialized sector.

Market segmentation analysis indicates bovine applications dominate current demand, representing approximately 45% of total procedures. However, equine and small ruminant segments show accelerating growth as specialized protocols develop and economic benefits become apparent. Geographic distribution reflects agricultural intensity patterns, with dairy-intensive regions showing highest adoption rates.

Innovation trends focus on simplifying procedures, improving success rates, and reducing technical requirements. Emerging technologies include automated embryo assessment systems, improved cryopreservation methods, and species-specific protocol optimization. Market maturation drives consolidation among service providers while creating opportunities for specialized niche players.

Primary market drivers propelling veterinary in vitro fertilization adoption stem from fundamental changes in animal agriculture, technological advancement, and evolving consumer expectations. These factors create compelling value propositions for various stakeholder groups across the animal production and care spectrum.

Genetic improvement demands represent the strongest driver, as producers seek to accelerate genetic progress and optimize animal performance characteristics. Traditional breeding methods require multiple generations to achieve desired outcomes, while IVF enables rapid genetic advancement through precise selection and multiplication of superior genetics. Economic benefits include improved feed efficiency, disease resistance, and production traits that directly impact profitability.

Population growth and rising protein consumption create pressure for increased animal production efficiency. Veterinary IVF contributes to meeting these demands by maximizing reproductive potential of genetically superior animals and reducing generation intervals. Sustainability concerns drive adoption as producers seek to minimize environmental impact while maintaining production levels through genetic optimization.

Technological advancement makes veterinary IVF more accessible and cost-effective. Improved laboratory equipment, refined protocols, and enhanced success rates reduce barriers to adoption. Knowledge transfer through training programs and technical support services enables broader implementation across diverse geographic regions and production systems.

Regulatory support for agricultural innovation and animal welfare improvements encourages investment in advanced reproductive technologies. Government initiatives promoting sustainable agriculture and food security create favorable conditions for market expansion. Research funding accelerates technological development and clinical application refinement.

Market constraints affecting veterinary in vitro fertilization adoption include technical complexity, cost considerations, and regulatory challenges that limit widespread implementation across all potential applications and geographic regions.

Technical expertise requirements represent a significant barrier, as successful IVF procedures demand specialized knowledge in reproductive physiology, laboratory techniques, and species-specific protocols. The learning curve for veterinary professionals can be substantial, requiring extensive training and ongoing education. Equipment costs and facility requirements create additional barriers for smaller practices and operations with limited capital resources.

Success rate variability across different species, breeds, and individual animals creates uncertainty for potential adopters. While success rates continue improving, inconsistent outcomes can discourage investment, particularly in cost-sensitive applications. Seasonal limitations and biological constraints affect procedure timing and planning, creating operational challenges for some applications.

Regulatory complexity varies significantly across regions and species, creating compliance challenges for service providers and users. Evolving standards and approval processes can delay market entry for new technologies and applications. Ethical considerations surrounding animal reproduction and genetic manipulation may influence adoption in certain markets and applications.

Competition from alternative technologies including artificial insemination and natural breeding methods provides established, lower-cost options for many applications. Market education needs require ongoing investment to demonstrate value propositions and build awareness among potential users who may be unfamiliar with IVF benefits and applications.

Emerging opportunities in the veterinary in vitro fertilization market span technological innovation, geographic expansion, and application diversification that promise substantial growth potential for forward-thinking market participants.

Developing markets present significant expansion opportunities as agricultural modernization accelerates in Asia-Pacific, Latin America, and Africa. These regions demonstrate growing interest in advanced breeding technologies as livestock production intensifies and economic development drives demand for improved animal genetics. Infrastructure development and knowledge transfer initiatives create pathways for market entry and growth.

Technology integration with genomic selection, artificial intelligence, and automation systems offers opportunities to enhance efficiency and reduce costs. Digital platforms enabling remote monitoring, data analysis, and decision support can expand service delivery capabilities and improve outcomes. Advanced imaging and assessment technologies promise to increase success rates and reduce procedure complexity.

Species diversification beyond traditional livestock applications presents growth opportunities in companion animals, exotic species, and conservation programs. Aquaculture applications represent an emerging frontier as fish farming intensifies and genetic improvement becomes more important. Wildlife conservation programs increasingly utilize reproductive technologies for endangered species preservation.

Service model innovation including mobile laboratories, franchise systems, and technology-as-a-service offerings can expand market reach and accessibility. Partnership opportunities with agricultural cooperatives, veterinary networks, and research institutions enable market penetration and knowledge sharing. Educational institutions represent potential partners for training program development and market expansion.

Market dynamics in veterinary in vitro fertilization reflect complex interactions between technological advancement, economic factors, regulatory environments, and evolving customer needs that shape competitive positioning and growth trajectories.

Supply chain evolution demonstrates increasing integration between equipment manufacturers, pharmaceutical suppliers, and service providers. This consolidation creates opportunities for comprehensive solution offerings while potentially limiting supplier options for end users. Vertical integration strategies enable companies to control quality and costs while providing complete service packages.

Competitive intensity varies across market segments, with established players dominating equipment and pharmaceutical supplies while service delivery remains fragmented across numerous regional and specialized providers. Innovation cycles drive competitive advantage as companies invest in research and development to differentiate their offerings and improve performance outcomes.

Customer behavior patterns show increasing sophistication as users gain experience with IVF technologies and develop more specific requirements. Value-based purchasing decisions emphasize total cost of ownership and outcome achievement rather than initial price considerations. Long-term relationships between service providers and customers become increasingly important for market success.

Regulatory dynamics continue evolving as authorities balance innovation promotion with safety and ethical considerations. Standardization efforts across regions may facilitate market expansion while potentially creating barriers for smaller players unable to meet compliance requirements. International harmonization of standards could accelerate global market development.

Technology adoption curves vary significantly across regions and applications, with early adopters driving initial market development while mainstream adoption requires continued cost reduction and success rate improvement. Knowledge diffusion through professional networks and educational programs accelerates adoption rates and market maturation.

Comprehensive research methodology employed in analyzing the veterinary in vitro fertilization market combines primary and secondary research approaches to ensure accurate, reliable, and actionable market intelligence for stakeholders across the value chain.

Primary research activities include extensive interviews with industry experts, veterinary professionals, equipment manufacturers, and end users across multiple geographic regions. These discussions provide insights into market trends, technology adoption patterns, competitive dynamics, and future growth prospects. Survey methodologies capture quantitative data on market size, growth rates, and segmentation patterns while qualitative interviews reveal underlying market drivers and constraints.

Secondary research sources encompass industry publications, academic research, regulatory filings, company reports, and trade association data. Data triangulation methods ensure accuracy by cross-referencing multiple sources and validating findings through expert consultation. Market sizing calculations utilize bottom-up and top-down approaches to establish reliable baseline estimates and growth projections.

Geographic coverage spans major markets in North America, Europe, Asia-Pacific, Latin America, and other regions to capture global market dynamics and regional variations. Segmentation analysis examines market characteristics across species types, application areas, technology categories, and end-user segments to provide comprehensive market understanding.

Analytical frameworks include competitive landscape assessment, value chain analysis, and market opportunity evaluation. Forecasting methodologies incorporate historical trends, current market conditions, and future growth drivers to develop realistic market projections. Regular updates ensure research findings remain current and relevant for decision-making purposes.

Regional market dynamics in veterinary in vitro fertilization demonstrate significant variation based on agricultural development levels, regulatory environments, technological infrastructure, and economic conditions across major geographic markets.

North America maintains market leadership with approximately 42% of global market share, driven by advanced agricultural systems, strong research infrastructure, and high adoption rates of reproductive technologies. The United States and Canada demonstrate mature markets with emphasis on efficiency improvements and advanced applications. Technology integration with genomic selection and precision agriculture systems creates competitive advantages for regional producers.

Europe represents the second-largest market, accounting for roughly 26% of global demand. Strong regulatory frameworks ensure high safety standards while promoting innovation through research funding and industry collaboration. Sustainability initiatives drive adoption as producers seek to reduce environmental impact while maintaining production efficiency. Nordic countries show particularly high adoption rates due to advanced dairy industries and government support.

Asia-Pacific demonstrates the fastest growth rates, with market expansion exceeding 15% annually in several countries. China, India, and Australia lead regional development as agricultural modernization accelerates and protein consumption increases. Investment in infrastructure and technology transfer programs facilitate market development, while government initiatives support agricultural innovation and food security objectives.

Latin America shows emerging market potential, particularly in Brazil and Argentina where large-scale livestock operations drive demand for genetic improvement technologies. Export-oriented agriculture creates incentives for adopting advanced breeding technologies to meet international quality standards. Regional growth rates approach 12% annually as economic development supports agricultural investment.

Other regions including Middle East, Africa, and smaller markets demonstrate growing interest as economic development and agricultural modernization create opportunities for technology adoption. Development programs and international cooperation initiatives facilitate knowledge transfer and capacity building in emerging markets.

Competitive dynamics in the veterinary in vitro fertilization market feature a mix of established multinational corporations, specialized biotechnology companies, and regional service providers competing across different market segments and geographic regions.

Market positioning strategies vary among competitors, with some focusing on comprehensive solution offerings while others specialize in specific technology areas or species applications. Innovation investment remains critical for competitive advantage as companies develop next-generation technologies and improve existing product performance.

Strategic partnerships between technology providers, research institutions, and service organizations create competitive advantages through knowledge sharing and market access. Acquisition activity consolidates market participants and enables companies to expand capabilities and geographic reach. Emerging companies focus on niche applications and innovative technologies to establish market positions.

Service differentiation becomes increasingly important as technology commoditization occurs in some market segments. Companies emphasize technical support, training programs, and outcome guarantees to differentiate their offerings. Global expansion strategies target emerging markets with high growth potential and underserved customer segments.

Market segmentation in veterinary in vitro fertilization encompasses multiple dimensions including animal species, application types, technology categories, and end-user segments that define distinct market opportunities and competitive dynamics.

By Animal Species:

By Application Type:

By Technology Type:

By End User:

Bovine applications dominate the veterinary IVF market due to well-established protocols, high economic value, and significant industry investment in genetic improvement. Dairy operations particularly benefit from IVF technology as genetic progress directly impacts milk production efficiency and profitability. Success rates in bovine IVF exceed 35% per procedure, making it economically viable for commercial applications.

Equine segment demonstrates premium pricing and specialized requirements due to high-value breeding stock and performance considerations. Sport horse breeding drives demand as genetic traits for athletic performance become increasingly important. Technical challenges in equine IVF require specialized expertise and equipment, creating barriers to entry but also opportunities for specialized service providers.

Small ruminant applications in sheep and goats show growing adoption as producers seek to improve meat quality, milk production, and fiber characteristics. Seasonal breeding patterns create concentrated demand periods requiring careful capacity planning and resource allocation. Multiple embryo transfer capabilities enable rapid genetic multiplication in these species.

Companion animal IVF represents a niche but growing segment driven by purebred dog and cat breeding programs. Genetic health screening integration with IVF procedures enables selection against hereditary diseases while maintaining breed characteristics. Higher per-procedure pricing reflects specialized requirements and limited competition in this segment.

Technology categories show varying adoption patterns, with conventional IVF maintaining the largest share while advanced techniques like ICSI grow in specialized applications. Automation trends focus on reducing technical complexity and improving consistency across procedures. Integration with genomic testing enables more precise genetic selection and improved outcomes.

Industry participants across the veterinary in vitro fertilization value chain realize significant benefits through market participation, technology adoption, and strategic positioning within this growing sector.

Veterinary professionals benefit from expanded service offerings and revenue opportunities through IVF technology adoption. Specialized expertise in reproductive technologies creates competitive differentiation and enables premium pricing for advanced services. Professional development opportunities and continuing education enhance career prospects while building valuable technical skills.

Animal producers achieve accelerated genetic progress and improved production efficiency through IVF implementation. Genetic multiplication capabilities enable rapid dissemination of superior genetics throughout breeding populations. Risk reduction through genetic screening and embryo evaluation improves breeding success rates and reduces economic losses from genetic defects.

Technology providers access growing market opportunities through innovation and product development. Recurring revenue models from consumables and service contracts provide stable income streams while equipment sales generate initial market entry. Partnership opportunities with veterinary clinics and research institutions facilitate market penetration and technology adoption.

Research institutions advance scientific knowledge while generating revenue through technology licensing and commercial partnerships. Grant funding opportunities support research activities while industry collaboration provides practical application development. Student training programs create workforce development benefits while building industry relationships.

Regulatory agencies benefit from improved animal welfare outcomes and enhanced food safety through genetic improvement programs. Economic development in agricultural sectors supports rural communities and export competitiveness. Environmental benefits from improved production efficiency align with sustainability objectives and climate change mitigation goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological convergence represents a dominant trend as veterinary IVF integrates with genomic selection, artificial intelligence, and precision agriculture systems. Data analytics applications enable better prediction of breeding outcomes and optimization of genetic selection decisions. Machine learning algorithms improve embryo assessment accuracy and success rate predictions.

Automation advancement focuses on reducing technical complexity and improving procedure consistency. Robotic systems for embryo handling and assessment minimize human error while increasing throughput capacity. Automated monitoring systems provide real-time feedback on culture conditions and embryo development progress.

Sustainability emphasis drives adoption as producers seek to reduce environmental impact while maintaining production levels. Genetic improvement through IVF contributes to feed efficiency gains and reduced greenhouse gas emissions per unit of animal product. Carbon footprint reduction becomes an important consideration in breeding program design.

Global standardization efforts aim to harmonize protocols and quality standards across regions and applications. International cooperation facilitates technology transfer and knowledge sharing between developed and developing markets. Professional certification programs ensure consistent service quality and technical competency.

Personalized approaches emerge as genetic testing integration enables customized breeding strategies for specific production goals and environmental conditions. Precision breeding concepts apply individualized protocols based on genetic profiles and performance predictions. Customization extends to species-specific and breed-specific protocol optimization.

Service model evolution includes mobile laboratories, franchise systems, and technology-as-a-service offerings that expand market accessibility. Digital platforms enable remote consultation, monitoring, and decision support services. Subscription-based models provide ongoing technical support and protocol updates.

Recent industry developments demonstrate accelerating innovation and market expansion across multiple dimensions of the veterinary in vitro fertilization sector, reflecting growing investment and technological advancement.

Technology breakthroughs include development of improved culture media formulations that enhance embryo development rates and viability. Cryopreservation advances enable better long-term storage of genetic material with higher post-thaw survival rates. New assessment technologies using artificial intelligence improve embryo selection accuracy and predict transfer success rates.

Market expansion initiatives by major companies include establishment of new facilities in emerging markets and partnerships with local veterinary organizations. Training programs expand technical expertise availability while building market demand through education and awareness activities. Mobile laboratory services extend technology access to remote agricultural regions.

Regulatory developments include updated guidelines for reproductive technologies and harmonization efforts across international markets. Quality standards evolution ensures safety and efficacy while promoting innovation and market development. Approval processes for new technologies become more streamlined while maintaining appropriate oversight.

Research collaborations between industry and academic institutions accelerate technology development and clinical application refinement. Funding initiatives support innovation projects and market development activities in emerging regions. International cooperation programs facilitate knowledge transfer and capacity building.

Commercial partnerships create integrated solution offerings combining equipment, consumables, and services. Acquisition activity consolidates market participants while expanding capabilities and geographic reach. Strategic alliances enable companies to access new markets and technologies while sharing development costs and risks.

Strategic recommendations for veterinary in vitro fertilization market participants focus on positioning for sustainable growth while addressing current market challenges and capitalizing on emerging opportunities.

Technology companies should prioritize automation development and user-friendly system design to expand market accessibility. Investment in research and development activities should focus on improving success rates while reducing procedure complexity and costs. Partnership strategies with veterinary education institutions can accelerate market adoption through training and awareness programs.

Service providers should develop comprehensive solution offerings combining technology, training, and ongoing support services. Geographic expansion strategies should target emerging markets with high growth potential while building local partnerships for market entry and development. Specialization in specific species or applications can create competitive advantages and premium pricing opportunities.

Veterinary professionals should invest in reproductive technology training and certification to capture growing market opportunities. Equipment acquisition strategies should consider leasing and partnership options to reduce initial capital requirements. Collaboration with research institutions can provide access to latest technologies and protocols while building professional expertise.

Agricultural producers should evaluate IVF technology adoption based on specific genetic improvement objectives and economic analysis. Pilot programs can demonstrate value and build internal expertise before full-scale implementation. Cooperation with other producers can share costs and risks while building collective expertise and market power.

Investors should focus on companies with strong technology platforms, established market positions, and expansion capabilities. Market timing considerations should account for adoption curves and competitive dynamics in target regions and applications. Due diligence should emphasize technical capabilities, regulatory compliance, and management expertise.

Future market prospects for veterinary in vitro fertilization indicate continued strong growth driven by technological advancement, market expansion, and increasing recognition of economic and genetic benefits across diverse applications.

Market expansion is projected to accelerate with growth rates approaching 14% annually over the next five years. MarkWide Research analysis suggests emerging markets will contribute disproportionately to this growth as agricultural modernization and economic development create favorable conditions for technology adoption. Developed markets will focus on efficiency improvements and advanced applications.

Technological evolution will emphasize automation, artificial intelligence integration, and simplified protocols that reduce technical barriers to adoption. Success rate improvements through better understanding of reproductive biology and optimized procedures will enhance economic viability across more applications. Integration with genomic technologies will enable more precise genetic selection and improved breeding outcomes.

Application diversification beyond traditional livestock will create new market segments in aquaculture, wildlife conservation, and companion animals. Species-specific protocol development will expand addressable markets while creating opportunities for specialized service providers. Conservation applications may receive increased funding and support as biodiversity concerns grow.

Geographic expansion will accelerate as infrastructure development and knowledge transfer programs facilitate technology adoption in emerging markets. Regional market development will create opportunities for local service providers and equipment suppliers while driving global market growth. International cooperation and technology transfer initiatives will support market development in underserved regions.

Industry consolidation may accelerate as companies seek to achieve scale economies and expand capabilities through acquisitions and partnerships. Service model innovation will create new business opportunities while improving market accessibility and customer value propositions. Technology-as-a-service models may become more prevalent as markets mature and competition intensifies.

The veterinary in vitro fertilization market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, increasing demand for genetic improvement, and expanding applications across diverse animal species and geographic regions. Market fundamentals remain strong as agricultural modernization, population growth, and sustainability concerns create compelling drivers for advanced reproductive technology adoption.

Key success factors for market participants include technological innovation, comprehensive service offerings, strategic partnerships, and geographic expansion capabilities. Companies that can effectively address current market challenges while capitalizing on emerging opportunities will be well-positioned for sustainable growth and competitive advantage. Investment in research and development, training programs, and market education will be critical for long-term success.

Market outlook remains positive with strong growth projections and expanding opportunities across multiple dimensions. Emerging markets present significant potential while developed markets offer opportunities for advanced applications and efficiency improvements. Technology convergence with genomics, artificial intelligence, and automation will create new value propositions and competitive dynamics.

Stakeholder benefits from market participation extend beyond immediate economic returns to include contributions to food security, agricultural sustainability, and animal welfare improvements. The veterinary in vitro fertilization market will continue playing an increasingly important role in modern animal agriculture and veterinary medicine as technology advancement and market adoption accelerate globally.

What is Veterinary In Vitro Fertilization?

Veterinary In Vitro Fertilization refers to the process of fertilizing animal eggs with sperm outside the body, typically in a laboratory setting. This technique is used to assist in breeding programs for various species, including livestock and companion animals.

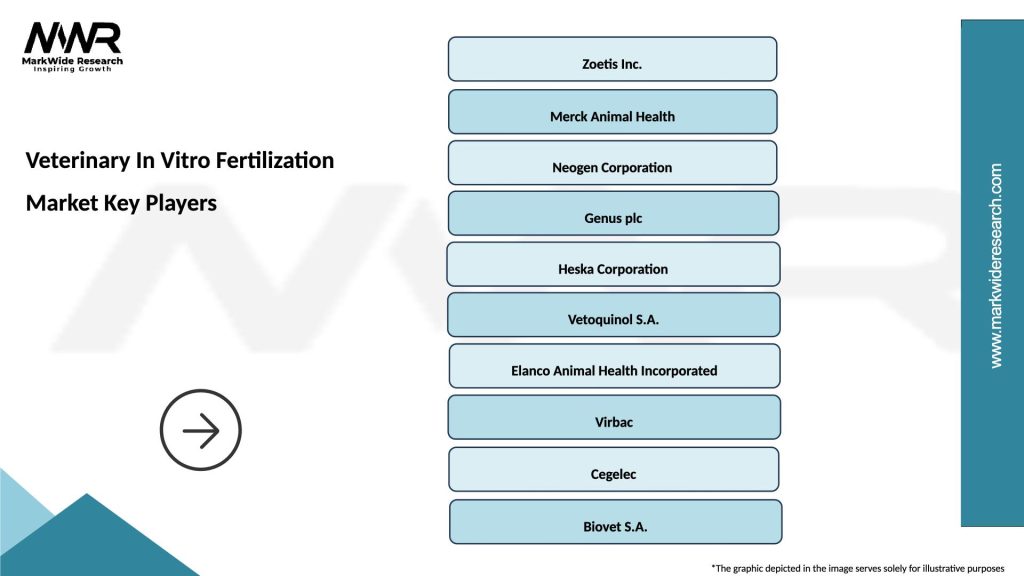

What are the key players in the Veterinary In Vitro Fertilization Market?

Key players in the Veterinary In Vitro Fertilization Market include companies such as Neogen Corporation, Genus PLC, and Zoetis, which are involved in providing reproductive technologies and solutions for animal breeding, among others.

What are the growth factors driving the Veterinary In Vitro Fertilization Market?

The Veterinary In Vitro Fertilization Market is driven by factors such as the increasing demand for high-quality livestock, advancements in reproductive technologies, and the growing focus on genetic improvement in animal breeding.

What challenges does the Veterinary In Vitro Fertilization Market face?

Challenges in the Veterinary In Vitro Fertilization Market include high costs associated with the procedures, ethical concerns regarding animal welfare, and the need for skilled professionals to perform these techniques.

What opportunities exist in the Veterinary In Vitro Fertilization Market?

Opportunities in the Veterinary In Vitro Fertilization Market include the potential for expanding applications in endangered species conservation, increasing adoption of these technologies in developing regions, and innovations in cryopreservation techniques.

What trends are shaping the Veterinary In Vitro Fertilization Market?

Trends in the Veterinary In Vitro Fertilization Market include the integration of artificial intelligence in embryo selection, the rise of personalized breeding programs, and the growing emphasis on sustainable practices in animal agriculture.

Veterinary In Vitro Fertilization Market

| Segmentation Details | Description |

|---|---|

| Product Type | Embryo Transfer Kits, Insemination Devices, Culture Media, Cryopreservation Solutions |

| End User | Veterinary Clinics, Research Institutions, Animal Breeding Farms, Zoos |

| Technology | Intracytoplasmic Sperm Injection, In Vitro Maturation, In Vitro Fertilization, Embryo Freezing |

| Application | Livestock Reproduction, Companion Animal Breeding, Genetic Research, Wildlife Conservation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Veterinary In Vitro Fertilization Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at