444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Venezuela is a country located on the northern coast of South America, known for its rich reserves of oil and gas. The oil and gas industry plays a crucial role in the Venezuelan economy, contributing significantly to the country’s GDP and export earnings. Venezuela has one of the largest oil reserves in the world, making it an important player in the global energy market.

Meaning

The Venezuela oil and gas market refers to the exploration, production, refining, and distribution of oil and gas resources within the country. This market encompasses various activities and sectors related to the extraction and utilization of hydrocarbon resources, including upstream exploration and drilling, midstream transportation and storage, and downstream refining and marketing.

Executive Summary

The Venezuela oil and gas market is characterized by its vast reserves, which have attracted significant investments and international attention. However, the industry has faced numerous challenges in recent years, including political instability, economic crises, and declining production levels. Despite these hurdles, the potential for growth and development remains substantial, and the government has been taking steps to revitalize the sector.

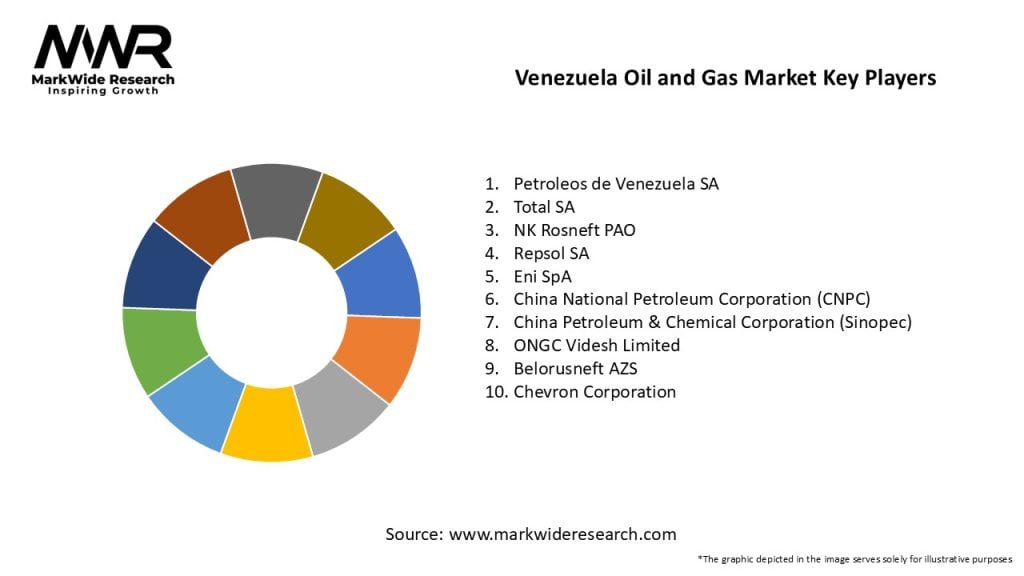

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Venezuela oil and gas market is influenced by a combination of factors, including global oil prices, geopolitical developments, government policies, and technological advancements. These dynamics shape investment decisions, production levels, and market competition.

Regional Analysis

Venezuela is divided into several oil-rich regions, with the Orinoco Belt being the most significant. This region holds vast reserves of heavy crude oil, requiring specialized extraction techniques. Other regions, such as Maracaibo Basin and Eastern Venezuela Basin, also contribute to the country’s oil and gas production.

Competitive Landscape

Leading Companies in Venezuela Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

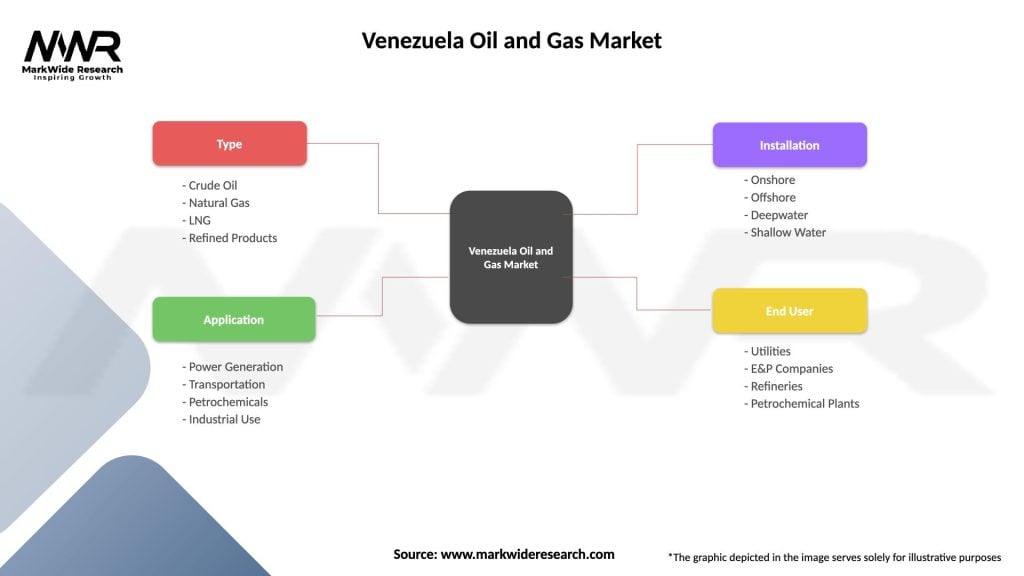

Segmentation

The Venezuela oil and gas market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the global oil and gas industry, including the Venezuela market. The demand for oil plummeted as travel restrictions and lockdown measures were implemented worldwide, leading to a sharp decline in oil prices. This downturn affected the revenue generation and investment climate in the industry, exacerbating the challenges faced by the Venezuela oil and gas sector.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Venezuela oil and gas market is closely tied to political stability, economic recovery, and the implementation of strategic reforms. Despite the challenges faced by the industry, the country’s abundant reserves and ongoing efforts to attract investments provide a positive outlook. The focus on infrastructure development, diversification, and sustainable practices will shape the industry’s growth trajectory in the coming years.

Conclusion

The Venezuela oil and gas market, fueled by its vast reserves, has immense potential for growth and development. Despite the challenges posed by political instability, economic crises, and sanctions, the industry continues to attract investments and opportunities. The government’s initiatives to revitalize the sector, along with the exploration and production potential, infrastructure development plans, and interest in renewable energy sources, indicate a positive future outlook. However, addressing key issues such as political stability, economic recovery, and environmental sustainability will be critical for the long-term success of the Venezuela oil and gas market.

What is Venezuela Oil and Gas?

Venezuela Oil and Gas refers to the exploration, extraction, and production of oil and natural gas resources in Venezuela, which is known for having some of the largest oil reserves in the world.

What are the key players in the Venezuela Oil and Gas Market?

Key players in the Venezuela Oil and Gas Market include Petróleos de Venezuela, S.A. (PDVSA), Chevron, and Rosneft, among others.

What are the main drivers of the Venezuela Oil and Gas Market?

The main drivers of the Venezuela Oil and Gas Market include the country’s vast oil reserves, the demand for energy in both domestic and international markets, and the potential for foreign investment in oil extraction technologies.

What challenges does the Venezuela Oil and Gas Market face?

The Venezuela Oil and Gas Market faces challenges such as political instability, economic sanctions, and aging infrastructure, which hinder production and investment opportunities.

What opportunities exist in the Venezuela Oil and Gas Market?

Opportunities in the Venezuela Oil and Gas Market include the potential for enhanced oil recovery techniques, partnerships with foreign companies for technology transfer, and the exploration of untapped reserves in the Orinoco Belt.

What trends are shaping the Venezuela Oil and Gas Market?

Trends shaping the Venezuela Oil and Gas Market include a shift towards sustainable practices, increased interest in natural gas as a cleaner energy source, and the adoption of advanced drilling technologies.

Venezuela Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Type | Crude Oil, Natural Gas, LNG, Refined Products |

| Application | Power Generation, Transportation, Petrochemicals, Industrial Use |

| Installation | Onshore, Offshore, Deepwater, Shallow Water |

| End User | Utilities, E&P Companies, Refineries, Petrochemical Plants |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Venezuela Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at