444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The vehicle traveling data recorder market plays a crucial role in enhancing vehicle safety and efficiency by recording critical data during travel. These recorders, also known as vehicle black boxes or event data recorders (EDRs), capture information such as vehicle speed, engine RPM, braking patterns, and impact force during collisions. They are integral to accident investigation, vehicle diagnostics, and fleet management.

Meaning

Vehicle traveling data recorders are electronic devices installed in vehicles to record and store data related to vehicle operation and performance. They serve as a critical tool for understanding vehicle behavior, driver habits, and ensuring compliance with safety regulations.

Executive Summary

The global market for vehicle traveling data recorders is experiencing significant growth driven by increasing safety concerns, regulatory mandates, and the need for efficient fleet management solutions. Key market players are focusing on technological advancements, integration with telematics systems, and expanding their product portfolios to cater to diverse automotive applications.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The market dynamics are influenced by technological advancements, regulatory frameworks, industry partnerships, and shifting consumer preferences towards vehicle safety and connectivity solutions. The competitive landscape is characterized by strategic collaborations, product innovations, and geographic expansions to gain a competitive edge.

Regional Analysis

Competitive Landscape

Key players in the vehicle traveling data recorder market include Bosch GmbH, Continental AG, Aptiv PLC, Valeo SA, and Visteon Corporation. These companies are focusing on product innovation, strategic partnerships, and mergers & acquisitions to strengthen their market presence and expand their technological capabilities.

Segmentation

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic disrupted global supply chains and automotive production, affecting market growth. However, the recovery in automotive sales and increasing emphasis on vehicle safety and connectivity solutions are expected to drive market resurgence post-pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the vehicle traveling data recorder market looks promising, driven by technological advancements, regulatory mandates, and increasing adoption of connected vehicle solutions. Manufacturers that innovate, collaborate, and adapt to evolving market trends are poised to capitalize on growth opportunities and strengthen their market position.

Conclusion

The vehicle traveling data recorder market is poised for robust growth, driven by advancements in vehicle safety technologies, regulatory mandates, and increasing demand for connected vehicle solutions. Continued focus on innovation, regulatory compliance, and strategic market expansion will be crucial for industry participants to navigate the evolving automotive landscape successfully.

Vehicle Traveling Data Recorder Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dash Cam, Fleet Tracker, GPS Logger, Telematics Device |

| Technology | Cloud-Based, Edge Computing, AI-Driven, Real-Time Analytics |

| End User | Logistics Companies, Public Transport, Emergency Services, Personal Use |

| Installation | Hardwired, Plug-and-Play, Wireless, Integrated Systems |

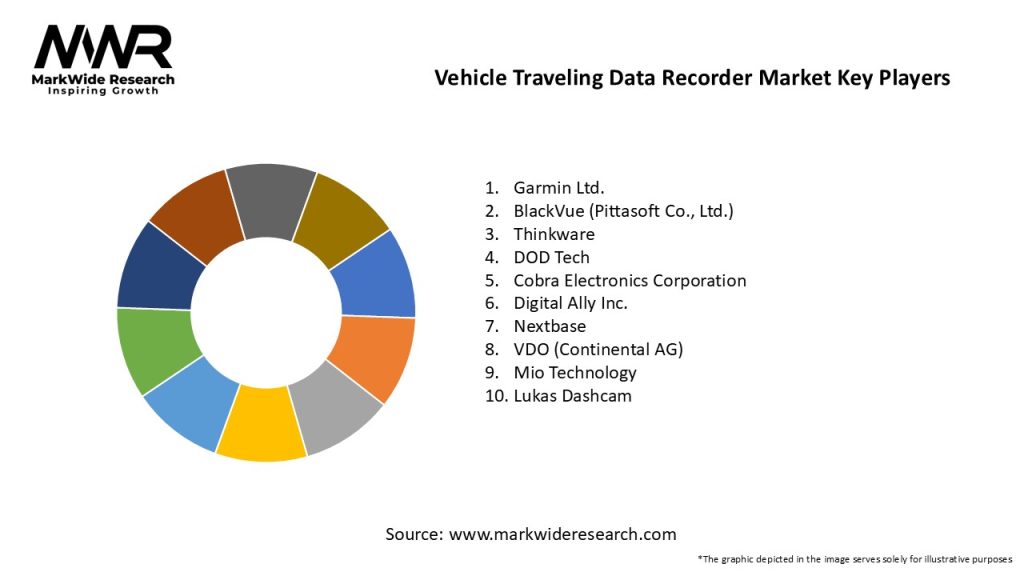

Leading Companies in Vehicle Traveling Data Recorder Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at