444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Vanadium Redox Flow Battery (VRFB) Store Energy Market is witnessing rapid growth, driven by the increasing demand for energy storage solutions to support renewable energy integration, grid stability, and electricity market optimization. VRFBs offer a scalable, long-duration energy storage solution with high efficiency, deep cycling capability, and minimal degradation over time. With growing investments in renewable energy generation, grid modernization, and electrification efforts, the market for VRFBs is expanding globally.

Meaning

Vanadium Redox Flow Batteries (VRFBs) are advanced energy storage systems that utilize the redox reaction of vanadium ions to store and release electrical energy. VRFBs consist of two electrolyte tanks containing vanadium electrolyte solutions of different oxidation states, separated by a proton exchange membrane. During charging and discharging cycles, vanadium ions are oxidized and reduced, allowing the battery to store and release electrical energy efficiently. VRFBs offer several advantages, including scalability, long cycle life, rapid response time, and environmentally friendly chemistry.

Executive Summary

The Vanadium Redox Flow Battery (VRFB) Store Energy Market is experiencing rapid growth, driven by the need for reliable, flexible, and sustainable energy storage solutions to support the transition to renewable energy sources. VRFBs offer a unique combination of features, including high efficiency, long cycle life, and rapid response time, making them well-suited for a wide range of applications, from grid-scale energy storage to remote off-grid systems. With ongoing advancements in battery technology, materials, and manufacturing processes, the market for VRFBs is poised for continued expansion in the coming years.

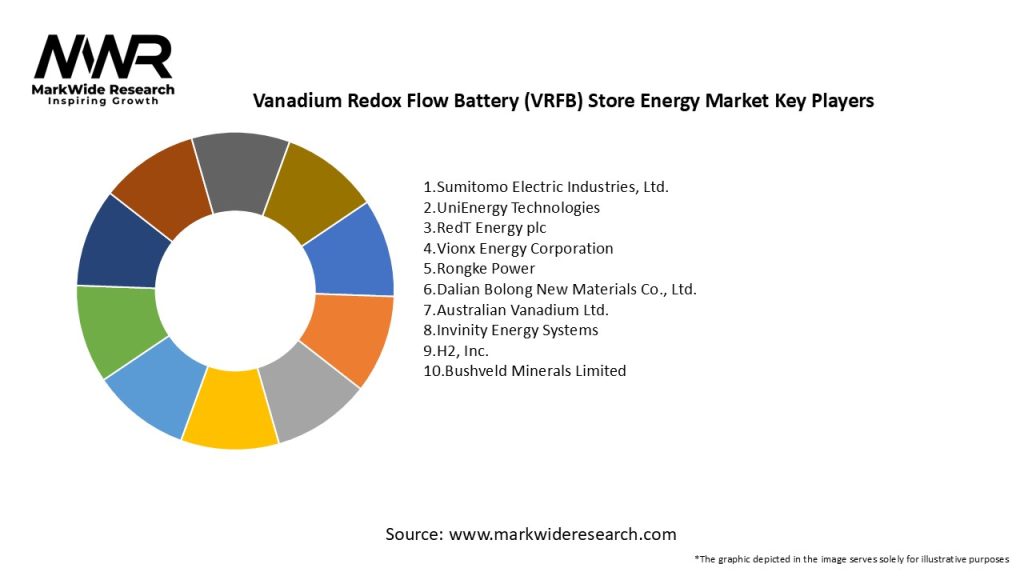

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The VRFB Store Energy Market is characterized by rapid innovation, collaboration, and investment as stakeholders seek to address challenges and capitalize on opportunities in the energy storage sector. VRFBs offer a unique combination of features, including high efficiency, long cycle life, and environmentally friendly chemistry, making them well-suited for a wide range of applications, from grid-scale energy storage to remote off-grid systems. However, challenges such as high costs, supply chain constraints, and regulatory uncertainties need to be addressed to unlock the full potential of VRFBs in the market.

Regional Analysis

The VRFB Store Energy Market is witnessing growth across regions, with developed markets such as North America, Europe, and Asia Pacific leading the market due to strong government support, favorable policies, and growing investments in renewable energy and energy storage infrastructure. Emerging economies in Latin America, Africa, and the Middle East are also important markets for VRFBs, driven by rapid urbanization, industrialization, and increasing energy demand.

Competitive Landscape

Leading Companies in the Vanadium Redox Flow Battery (VRFB) Store Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

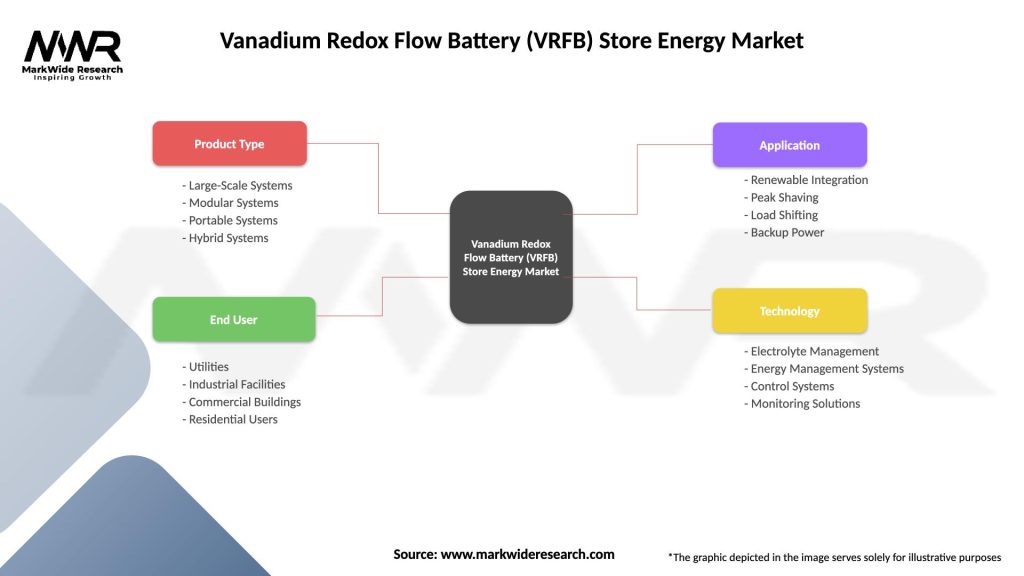

Segmentation

The VRFB Store Energy Market can be segmented based on application, capacity, end-user, and geographic region. Applications include grid-scale energy storage, renewable energy integration, backup power, off-grid electrification, and industrial applications. Capacities range from kilowatt-hour (kWh) to megawatt-hour (MWh) and gigawatt-hour (GWh), catering to various market segments and customer requirements. End-users of VRFBs include utilities, grid operators, renewable energy developers, industrial facilities, and remote communities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has highlighted the importance of resilient, reliable, and sustainable energy systems, driving interest and investment in VRFBs for grid-scale energy storage, renewable energy integration, and backup power applications. While the pandemic has led to temporary disruptions in supply chains, project delays, and budget constraints, it has also underscored the critical role of energy storage in supporting essential services, remote work, and economic recovery efforts. As economies recover and energy transition efforts accelerate, the market for VRFBs is expected to rebound and continue its growth trajectory.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Vanadium Redox Flow Battery (VRFB) Store Energy Market is expected to continue its rapid growth, driven by the increasing demand for reliable, flexible, and sustainable energy storage solutions worldwide. VRFBs offer a unique combination of features, including high efficiency, long cycle life, and minimal environmental impact, making them well-suited for a wide range of applications, from grid-scale energy storage to remote off-grid systems. By addressing technical challenges, market barriers, and customer requirements, stakeholders in the VRFB market can capitalize on emerging opportunities and contribute to the transition to a more sustainable and resilient energy future.

Conclusion

In conclusion, the Vanadium Redox Flow Battery (VRFB) Store Energy Market is witnessing rapid growth, driven by the increasing demand for reliable, flexible, and sustainable energy storage solutions worldwide. VRFBs offer a unique combination of features, including high efficiency, long cycle life, and minimal environmental impact, making them well-suited for a wide range of applications, from grid-scale energy storage to remote off-grid systems. By addressing technical challenges, market barriers, and customer requirements, stakeholders in the VRFB market can capitalize on emerging opportunities and contribute to the transition to a more sustainable and resilient energy future.

What is Vanadium Redox Flow Battery (VRFB)?

Vanadium Redox Flow Battery (VRFB) is a type of rechargeable flow battery that uses vanadium ions in different oxidation states to store and release energy. It is known for its scalability, long cycle life, and ability to provide large-scale energy storage solutions for renewable energy applications.

What are the key companies in the Vanadium Redox Flow Battery (VRFB) Store Energy Market?

Key companies in the Vanadium Redox Flow Battery (VRFB) Store Energy Market include Vionx Energy, RedT Energy, and Invinity Energy Systems, among others.

What are the growth factors driving the Vanadium Redox Flow Battery (VRFB) Store Energy Market?

The growth of the Vanadium Redox Flow Battery (VRFB) Store Energy Market is driven by the increasing demand for renewable energy storage, the need for grid stability, and advancements in battery technology that enhance efficiency and lifespan.

What challenges does the Vanadium Redox Flow Battery (VRFB) Store Energy Market face?

Challenges in the Vanadium Redox Flow Battery (VRFB) Store Energy Market include high initial capital costs, competition from other energy storage technologies, and the need for a reliable supply of vanadium.

What opportunities exist in the Vanadium Redox Flow Battery (VRFB) Store Energy Market?

Opportunities in the Vanadium Redox Flow Battery (VRFB) Store Energy Market include the growing integration of renewable energy sources, potential applications in electric vehicle charging infrastructure, and increasing investments in energy storage solutions.

What trends are shaping the Vanadium Redox Flow Battery (VRFB) Store Energy Market?

Trends in the Vanadium Redox Flow Battery (VRFB) Store Energy Market include the development of hybrid systems that combine VRFB with other storage technologies, innovations in vanadium electrolyte formulations, and a focus on sustainability and recycling of battery materials.

Vanadium Redox Flow Battery (VRFB) Store Energy Market

| Segmentation Details | Description |

|---|---|

| Product Type | Large-Scale Systems, Modular Systems, Portable Systems, Hybrid Systems |

| End User | Utilities, Industrial Facilities, Commercial Buildings, Residential Users |

| Application | Renewable Integration, Peak Shaving, Load Shifting, Backup Power |

| Technology | Electrolyte Management, Energy Management Systems, Control Systems, Monitoring Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Vanadium Redox Flow Battery (VRFB) Store Energy Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at