444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The vaccine contract development and manufacturing organization market represents a critical segment of the global pharmaceutical industry, providing specialized services for vaccine development, production, and commercialization. This market encompasses organizations that offer comprehensive solutions ranging from early-stage research and development to large-scale manufacturing and regulatory support for vaccine products. The industry has experienced unprecedented growth, particularly following the COVID-19 pandemic, which highlighted the essential role of contract development and manufacturing organizations (CDMOs) in rapid vaccine deployment.

Market dynamics indicate robust expansion driven by increasing demand for vaccines across various therapeutic areas, including infectious diseases, oncology, and autoimmune disorders. The sector benefits from growing pharmaceutical company preferences for outsourcing vaccine development and manufacturing activities to specialized providers. Industry analysis reveals that the market is experiencing a compound annual growth rate (CAGR) of 8.2%, reflecting strong investor confidence and expanding global vaccination programs.

Regional distribution shows significant concentration in North America and Europe, accounting for approximately 65% of global market activity. However, emerging markets in Asia-Pacific are demonstrating rapid growth potential, with several countries investing heavily in vaccine manufacturing capabilities. The market landscape includes both established pharmaceutical giants and specialized biotechnology companies offering diverse service portfolios.

The vaccine contract development and manufacturing organization market refers to the comprehensive ecosystem of specialized service providers that support pharmaceutical and biotechnology companies throughout the vaccine development lifecycle. These organizations offer integrated solutions encompassing research and development, process optimization, regulatory compliance, clinical trial support, and commercial-scale manufacturing services for various vaccine types including traditional inactivated vaccines, live attenuated vaccines, subunit vaccines, and next-generation platforms such as mRNA and viral vector technologies.

CDMO services typically include formulation development, analytical testing, quality assurance, supply chain management, and regulatory affairs support. These organizations serve as strategic partners for vaccine developers, providing access to specialized expertise, advanced manufacturing facilities, and established regulatory pathways. The model enables pharmaceutical companies to accelerate time-to-market while reducing capital investment requirements and operational risks associated with in-house vaccine production capabilities.

Market fundamentals demonstrate strong growth trajectory driven by increasing global vaccination requirements, emerging infectious disease threats, and expanding therapeutic applications for vaccine technologies. The industry benefits from favorable regulatory environments, government funding initiatives, and growing recognition of vaccines as essential public health tools. Key market drivers include rising healthcare expenditure, aging populations, and increased focus on preventive medicine approaches.

Technological advancement plays a crucial role in market evolution, with organizations investing heavily in next-generation manufacturing platforms, automation technologies, and digital solutions for process optimization. The sector demonstrates resilience through diversified service offerings and strategic partnerships with pharmaceutical companies, academic institutions, and government agencies. Market penetration rates indicate that approximately 42% of vaccine development projects now utilize CDMO services, representing significant growth from previous years.

Competitive dynamics reveal a fragmented market structure with opportunities for consolidation and strategic acquisitions. Leading organizations are expanding their capabilities through facility investments, technology acquisitions, and geographic expansion initiatives. The market outlook remains positive, supported by robust pipeline development, increasing vaccine complexity, and growing demand for specialized manufacturing expertise.

Strategic analysis reveals several critical insights shaping the vaccine CDMO market landscape:

Primary growth drivers propelling the vaccine CDMO market include increasing global disease burden, expanding vaccination programs, and growing pharmaceutical industry outsourcing trends. The COVID-19 pandemic significantly accelerated market growth by demonstrating the critical importance of flexible, scalable manufacturing capabilities for rapid vaccine deployment. Government initiatives supporting vaccine development and manufacturing infrastructure have created favorable market conditions.

Technological innovation serves as a fundamental driver, with advances in vaccine platforms enabling development of more effective and targeted immunization solutions. The emergence of personalized medicine approaches and cancer vaccines represents significant growth opportunities. Regulatory harmonization efforts across major markets are reducing development timelines and costs, making CDMO services more attractive to pharmaceutical companies.

Economic factors including rising healthcare costs and budget constraints are encouraging pharmaceutical companies to leverage CDMO expertise rather than maintaining extensive in-house capabilities. The model offers improved cost efficiency, reduced capital requirements, and access to specialized technologies. Market research indicates that outsourcing can reduce vaccine development costs by approximately 25-30% while accelerating time-to-market.

Significant challenges facing the vaccine CDMO market include complex regulatory requirements, high capital investment needs, and technical difficulties associated with vaccine manufacturing. Regulatory compliance represents a major constraint, as vaccine production requires adherence to stringent quality standards and extensive documentation requirements across multiple jurisdictions.

Technical complexity of vaccine manufacturing processes creates barriers to entry and limits the number of qualified service providers. Many vaccine platforms require specialized equipment, controlled environments, and highly trained personnel, resulting in substantial operational costs. Supply chain vulnerabilities have been highlighted by recent global disruptions, creating concerns about material availability and production continuity.

Intellectual property concerns and technology transfer challenges can complicate CDMO relationships, particularly for proprietary vaccine platforms. Companies may be reluctant to share sensitive information or manufacturing processes with external partners. Capacity constraints during peak demand periods can limit market growth and create bottlenecks in vaccine supply chains.

Emerging opportunities in the vaccine CDMO market include expansion into novel therapeutic areas, development of next-generation manufacturing technologies, and geographic market penetration. The growing focus on personalized vaccines and immunotherapies presents significant revenue potential for organizations with advanced capabilities.

Technology advancement opportunities include implementation of continuous manufacturing processes, artificial intelligence for process optimization, and advanced analytics for quality control. These innovations can improve efficiency, reduce costs, and enhance product quality. Market expansion into emerging economies offers substantial growth potential, driven by increasing healthcare infrastructure investment and growing vaccination awareness.

Strategic partnership opportunities with academic institutions, government agencies, and biotechnology companies can provide access to innovative technologies and funding sources. The development of platform technologies that can be applied across multiple vaccine programs represents a significant competitive advantage. MarkWide Research analysis suggests that organizations investing in flexible manufacturing platforms could capture 15-20% additional market share over the next five years.

Market dynamics reflect the complex interplay of technological advancement, regulatory evolution, and competitive pressures shaping the vaccine CDMO landscape. The industry demonstrates cyclical patterns influenced by disease outbreaks, seasonal vaccination campaigns, and regulatory approval timelines. Demand fluctuations require organizations to maintain flexible capacity and diversified service portfolios.

Competitive intensity is increasing as new entrants recognize market opportunities and existing players expand their capabilities. Price competition remains limited due to the specialized nature of services and high switching costs for pharmaceutical clients. Innovation cycles are accelerating, driven by advances in biotechnology and manufacturing technologies.

Supply and demand dynamics show growing demand outpacing capacity expansion in certain segments, creating opportunities for premium pricing and strategic partnerships. The market demonstrates resilience through economic cycles, supported by essential nature of vaccine products and government funding support. Efficiency improvements through technology adoption are enabling organizations to achieve 20-25% productivity gains while maintaining quality standards.

Comprehensive research methodology employed for this market analysis incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability. The approach combines primary research through industry expert interviews, secondary research from published sources, and quantitative analysis of market trends and patterns.

Primary research activities include structured interviews with CDMO executives, pharmaceutical company decision-makers, regulatory officials, and industry consultants. Survey methodologies capture quantitative data on market trends, pricing patterns, and service preferences. Secondary research encompasses analysis of company financial reports, regulatory filings, industry publications, and government databases.

Analytical frameworks include market sizing methodologies, competitive positioning analysis, and trend identification techniques. Data validation processes ensure consistency across multiple sources and analytical approaches. Market modeling incorporates scenario analysis and sensitivity testing to assess potential market outcomes under different conditions.

North American market maintains leadership position, accounting for approximately 38% of global market activity, driven by established pharmaceutical industry presence, advanced regulatory frameworks, and significant government investment in vaccine development infrastructure. The region benefits from strong academic research institutions, venture capital availability, and favorable intellectual property protection.

European market represents the second-largest regional segment with 27% market share, characterized by stringent regulatory standards, established manufacturing capabilities, and strong government support for vaccine development. Key markets include Germany, Switzerland, and the United Kingdom, with growing activity in Eastern European countries.

Asia-Pacific region demonstrates the highest growth potential, with CAGR exceeding 12%, driven by expanding healthcare infrastructure, increasing government investment, and growing pharmaceutical industry presence. China and India are emerging as significant manufacturing hubs, while Singapore and South Korea focus on high-value services and innovation.

Latin American markets show moderate growth supported by regional vaccination programs and increasing healthcare access. Brazil and Mexico represent the largest markets, with growing interest in local manufacturing capabilities. Middle East and Africa regions demonstrate emerging potential, particularly in countries investing in healthcare infrastructure and vaccine manufacturing capabilities.

Market leadership is distributed among several established organizations with complementary capabilities and geographic presence. The competitive landscape includes both large integrated pharmaceutical companies and specialized CDMO providers focusing exclusively on vaccine services.

Competitive strategies include capacity expansion, technology platform development, strategic acquisitions, and geographic market penetration. Organizations are differentiating through specialized capabilities, regulatory expertise, and customer service excellence.

Market segmentation analysis reveals diverse service categories and application areas driving growth across different market segments:

By Service Type:

By Vaccine Type:

By Application Area:

Development services segment represents the highest growth category, driven by increasing complexity of vaccine platforms and regulatory requirements. Organizations are investing in advanced analytical capabilities, process development expertise, and regulatory knowledge to support client needs. Service integration is becoming increasingly important as clients seek comprehensive solutions.

Manufacturing services demonstrate steady growth supported by capacity expansion initiatives and technology upgrades. The segment benefits from long-term contracts and recurring revenue streams. Flexible manufacturing platforms capable of producing multiple vaccine types are gaining competitive advantage.

Next-generation vaccine platforms show exceptional growth potential, with mRNA technology adoption rates increasing by 45% annually. These platforms require specialized expertise and equipment, creating opportunities for differentiation. Viral vector technologies are also experiencing strong demand, particularly for gene therapy and vaccine applications.

Therapeutic vaccine applications represent emerging high-value opportunities, with cancer immunotherapy leading growth. These applications typically command premium pricing due to complexity and specialized requirements. MWR analysis indicates that therapeutic vaccines could account for 18% of market revenue within five years.

Pharmaceutical companies benefit from reduced capital investment requirements, access to specialized expertise, and accelerated development timelines. CDMO partnerships enable focus on core competencies while leveraging external manufacturing capabilities. Risk mitigation through diversified supplier relationships and flexible capacity arrangements provides strategic advantages.

CDMO organizations benefit from recurring revenue streams, long-term client relationships, and opportunities for technology advancement. The model provides stable cash flows and growth opportunities across multiple therapeutic areas. Operational efficiency improvements through scale economies and specialized focus create competitive advantages.

Healthcare systems benefit from improved vaccine availability, reduced costs, and enhanced supply chain resilience. CDMO networks provide backup manufacturing capabilities and geographic diversification. Innovation acceleration through specialized expertise contributes to faster development of new vaccine solutions.

Investors benefit from attractive market fundamentals, growing demand, and defensive characteristics of vaccine markets. The sector demonstrates resilience through economic cycles and offers exposure to healthcare innovation trends. Government stakeholders benefit from enhanced vaccine security, reduced dependency on single suppliers, and improved pandemic preparedness capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping vaccine CDMO operations through implementation of advanced analytics, artificial intelligence, and automation technologies. Organizations are investing in digital manufacturing platforms to improve process control, reduce costs, and enhance quality assurance capabilities. Data integration across development and manufacturing processes is enabling better decision-making and faster problem resolution.

Sustainability initiatives are gaining importance as organizations focus on environmental responsibility and resource efficiency. Green manufacturing practices include waste reduction, energy efficiency improvements, and sustainable packaging solutions. These initiatives are becoming competitive differentiators and client selection criteria.

Platform technology development is accelerating, with organizations investing in flexible manufacturing systems capable of producing multiple vaccine types. Modular facility designs enable rapid reconfiguration for different products and production scales. Continuous manufacturing technologies are being implemented to improve efficiency and reduce production timelines.

Strategic partnership evolution shows movement toward long-term alliances and risk-sharing arrangements. Integrated service models combining development, manufacturing, and commercialization support are becoming preferred approaches. Geographic expansion strategies focus on establishing local presence in key growth markets.

Recent industry developments highlight the dynamic nature of the vaccine CDMO market and ongoing evolution of service capabilities. Major capacity expansion announcements demonstrate confidence in long-term market growth and commitment to meeting increasing demand.

Technology acquisitions are accelerating as organizations seek to enhance their platform capabilities and service offerings. Recent transactions focus on mRNA manufacturing technologies, viral vector platforms, and advanced analytics capabilities. These acquisitions enable rapid capability expansion and market positioning.

Regulatory milestone achievements include successful facility inspections, product approvals, and expanded manufacturing authorizations. These developments demonstrate organizational capabilities and enhance competitive positioning. Quality system certifications and compliance achievements provide market credibility and client confidence.

Strategic partnership announcements reveal growing collaboration between CDMOs, pharmaceutical companies, and government agencies. These partnerships often include long-term supply agreements, technology development collaborations, and capacity reservation arrangements. MarkWide Research tracking indicates that strategic partnerships have increased by 35% over the past two years.

Strategic recommendations for vaccine CDMO organizations include continued investment in technology advancement, geographic expansion, and service portfolio diversification. Organizations should focus on developing next-generation manufacturing capabilities while maintaining excellence in traditional vaccine platforms.

Capacity planning should incorporate flexible designs enabling rapid reconfiguration for different vaccine types and production scales. Digital transformation initiatives should prioritize process optimization, quality enhancement, and customer service improvements. Organizations should consider strategic acquisitions to accelerate capability development and market expansion.

Partnership strategies should focus on long-term relationships with pharmaceutical clients, academic institutions, and government agencies. Risk management approaches should address supply chain vulnerabilities, regulatory changes, and competitive pressures. Organizations should invest in talent development and retention to maintain specialized expertise.

Market positioning should emphasize unique capabilities, quality track record, and customer service excellence. Innovation investment should focus on emerging technologies with significant market potential and competitive differentiation opportunities.

Market projections indicate continued strong growth driven by expanding vaccine applications, increasing outsourcing trends, and technology advancement. The industry is expected to maintain robust growth rates, with CAGR projections of 8-10% over the next five years. Emerging markets are expected to contribute significantly to growth, with Asia-Pacific leading regional expansion.

Technology evolution will continue reshaping the industry, with next-generation platforms gaining market share and traditional vaccines maintaining stable demand. mRNA technology adoption is expected to accelerate, while viral vector platforms will expand into new therapeutic areas. Personalized vaccine approaches may emerge as significant growth drivers in specialized applications.

Regulatory environment evolution is expected to support market growth through streamlined approval processes and harmonized standards. Government investment in vaccine manufacturing capabilities will continue supporting industry development and pandemic preparedness initiatives.

Competitive landscape will likely experience consolidation as organizations seek scale advantages and expanded capabilities. Strategic partnerships will become increasingly important for market success and technology access. Organizations with flexible platforms and strong regulatory expertise are expected to capture disproportionate market share growth.

The vaccine contract development and manufacturing organization market represents a critical and rapidly evolving segment of the global pharmaceutical industry. Strong market fundamentals, driven by increasing vaccination requirements, technological advancement, and favorable regulatory environments, support continued robust growth prospects. The industry has demonstrated remarkable resilience and adaptability, particularly highlighted during the COVID-19 pandemic response.

Key success factors for market participants include maintaining technological leadership, developing flexible manufacturing capabilities, and building strong regulatory expertise. Organizations that can effectively combine traditional vaccine manufacturing excellence with next-generation platform capabilities are positioned for sustainable competitive advantage. Strategic partnerships and geographic expansion will remain essential for capturing growth opportunities and managing market risks.

Future market evolution will be shaped by continued technology innovation, expanding therapeutic applications, and evolving client needs. The industry outlook remains highly positive, supported by essential nature of vaccine products, growing global health awareness, and increasing pharmaceutical industry outsourcing trends. Organizations that invest strategically in capabilities, partnerships, and market expansion are well-positioned to benefit from the substantial growth opportunities ahead in this dynamic and essential market segment.

What is Vaccine Contract Development And Manufacturing Organization?

Vaccine Contract Development And Manufacturing Organization refers to companies that provide services for the development and manufacturing of vaccines on a contract basis. These organizations play a crucial role in the pharmaceutical industry by offering expertise in vaccine formulation, production, and regulatory compliance.

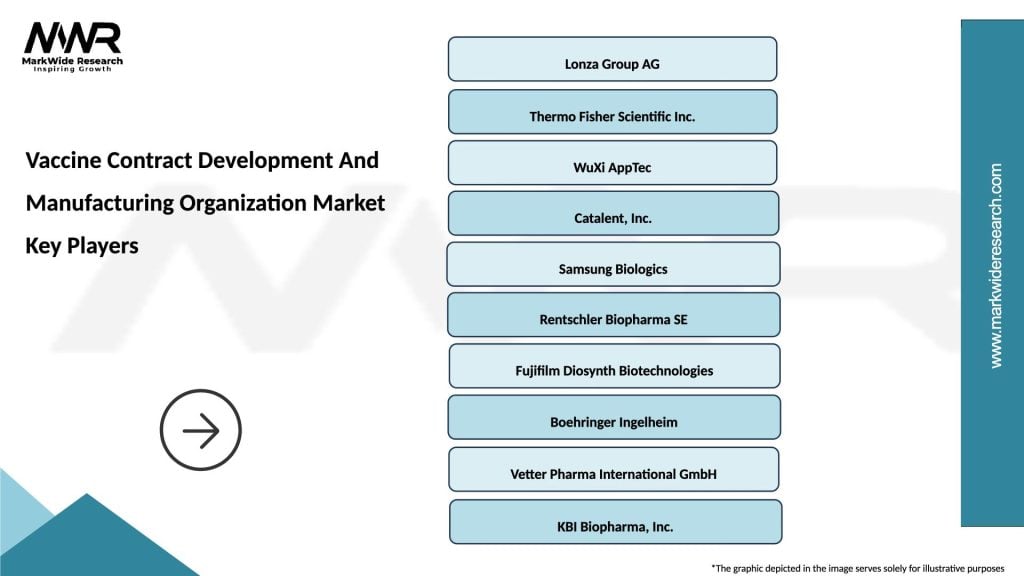

What are the key players in the Vaccine Contract Development And Manufacturing Organization Market?

Key players in the Vaccine Contract Development And Manufacturing Organization Market include companies such as Lonza Group, Catalent, and WuXi AppTec. These firms are known for their advanced manufacturing capabilities and extensive experience in vaccine development, among others.

What are the growth factors driving the Vaccine Contract Development And Manufacturing Organization Market?

The Vaccine Contract Development And Manufacturing Organization Market is driven by increasing demand for vaccines due to rising infectious diseases and the need for rapid vaccine development. Additionally, advancements in biotechnology and growing investments in healthcare infrastructure contribute to market growth.

What challenges does the Vaccine Contract Development And Manufacturing Organization Market face?

Challenges in the Vaccine Contract Development And Manufacturing Organization Market include stringent regulatory requirements and the complexity of vaccine production processes. Additionally, competition among contract manufacturers can lead to pricing pressures and capacity constraints.

What opportunities exist in the Vaccine Contract Development And Manufacturing Organization Market?

Opportunities in the Vaccine Contract Development And Manufacturing Organization Market include the expansion of personalized vaccines and the increasing focus on global vaccination programs. Furthermore, partnerships between biotech firms and contract manufacturers are expected to enhance innovation and efficiency.

What trends are shaping the Vaccine Contract Development And Manufacturing Organization Market?

Trends in the Vaccine Contract Development And Manufacturing Organization Market include the adoption of advanced technologies such as mRNA vaccine platforms and automation in manufacturing processes. Additionally, there is a growing emphasis on sustainability and reducing the environmental impact of vaccine production.

Vaccine Contract Development And Manufacturing Organization Market

| Segmentation Details | Description |

|---|---|

| Service Type | Process Development, Analytical Testing, Fill & Finish, Quality Control |

| End User | Pharmaceutical Companies, Biotech Firms, Research Institutions, Government Agencies |

| Technology | Cell Culture, Microbial Fermentation, Aseptic Processing, Lyophilization |

| Product Type | Vaccines, Therapeutics, Monoclonal Antibodies, Gene Therapies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Vaccine Contract Development And Manufacturing Organization Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at