444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Uzbekistan container glass market represents a dynamic and rapidly evolving segment within the country’s manufacturing landscape, driven by increasing demand from food and beverage industries, pharmaceutical applications, and cosmetic packaging requirements. Container glass manufacturing in Uzbekistan has experienced significant transformation over recent years, with modernization efforts and technological upgrades positioning the market for sustained growth. The industry benefits from abundant raw material availability, including high-quality silica sand deposits and limestone reserves essential for glass production.

Market dynamics indicate robust expansion potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by domestic consumption increases and export opportunities to neighboring Central Asian markets. The food and beverage segment dominates market demand, accounting for approximately 72% of total container glass consumption in Uzbekistan. Local manufacturers have invested heavily in energy-efficient furnace technologies and automated production lines to enhance competitiveness and meet international quality standards.

Government initiatives supporting industrial modernization and import substitution policies have created favorable conditions for container glass market expansion. The sector benefits from strategic geographic positioning along major trade routes, facilitating access to both regional and international markets. Sustainability trends and increasing environmental awareness among consumers have further boosted demand for recyclable glass packaging solutions across various industries.

The Uzbekistan container glass market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of glass containers used for packaging applications across various industries within Uzbekistan’s borders. This market includes manufacturing facilities producing bottles, jars, vials, and other glass packaging solutions primarily serving food and beverage, pharmaceutical, cosmetic, and chemical industries.

Container glass production involves the transformation of raw materials including silica sand, soda ash, limestone, and cullet through high-temperature melting processes to create durable, transparent, and recyclable packaging solutions. The market encompasses both primary production facilities and secondary processing operations that customize glass containers according to specific customer requirements and industry standards.

Market participants include domestic glass manufacturers, international suppliers, raw material providers, equipment manufacturers, and end-user industries that rely on glass packaging for product protection, preservation, and marketing purposes. The sector plays a crucial role in supporting Uzbekistan’s broader economic development objectives while contributing to sustainable packaging solutions and circular economy principles.

Strategic analysis of the Uzbekistan container glass market reveals a sector positioned for substantial growth, supported by favorable demographic trends, industrial development initiatives, and increasing consumer preference for sustainable packaging solutions. The market demonstrates strong fundamentals with domestic production capacity expanding to meet growing demand from key end-user industries.

Key growth drivers include rapid urbanization, rising disposable incomes, expanding food processing industry, and government policies promoting local manufacturing capabilities. The pharmaceutical sector represents a particularly promising growth avenue, with demand increasing by 15% annually as healthcare infrastructure development accelerates across the country.

Competitive landscape features a mix of established domestic manufacturers and emerging players investing in modern production technologies. Market consolidation trends indicate opportunities for strategic partnerships and technology transfer agreements that could enhance production efficiency and product quality standards.

Future prospects remain highly favorable, with projected growth supported by infrastructure development, export market expansion, and continued investment in manufacturing modernization. The sector’s alignment with sustainability objectives and circular economy principles positions it advantageously for long-term success in both domestic and regional markets.

Market intelligence reveals several critical insights shaping the Uzbekistan container glass industry’s trajectory and competitive dynamics:

Economic development serves as the primary catalyst driving container glass market expansion in Uzbekistan, with sustained GDP growth creating favorable conditions for industrial investment and consumer spending increases. The country’s strategic focus on import substitution has encouraged domestic glass manufacturing development while reducing dependence on foreign suppliers.

Demographic trends significantly influence market dynamics, with urbanization rates increasing and a growing middle class driving demand for packaged goods across food, beverage, and consumer product categories. Population growth combined with changing consumption patterns has created substantial market opportunities for container glass manufacturers.

Industrial modernization initiatives supported by government policies have facilitated technology upgrades and production capacity expansion among domestic manufacturers. These investments have improved product quality, reduced production costs, and enhanced competitiveness in both domestic and export markets.

Sustainability considerations increasingly drive packaging decisions across industries, with glass containers offering superior recyclability and environmental benefits compared to alternative packaging materials. Consumer awareness of environmental issues has strengthened demand for sustainable packaging solutions.

Food processing industry expansion creates substantial demand for glass packaging solutions, particularly in segments requiring product preservation, quality maintenance, and premium presentation. The growing emphasis on food safety and quality standards further supports glass container adoption.

Energy costs represent a significant challenge for container glass manufacturers, with high-temperature production processes requiring substantial energy inputs that impact overall production economics. Fluctuating energy prices can affect profit margins and competitive positioning in price-sensitive market segments.

Capital intensity of glass manufacturing operations creates barriers to entry for new market participants, requiring substantial initial investments in furnace technology, production equipment, and quality control systems. These high capital requirements limit market accessibility and competitive dynamics.

Transportation costs affect market reach and competitiveness, particularly for export-oriented manufacturers seeking to access regional markets. The weight and fragility of glass containers increase logistics expenses compared to alternative packaging materials.

Raw material quality variations can impact production consistency and product quality, requiring careful supplier management and quality control processes. Ensuring consistent raw material specifications remains crucial for maintaining production standards and customer satisfaction.

Skilled workforce availability presents ongoing challenges, with specialized technical expertise required for modern glass manufacturing operations. Training and development programs are essential for maintaining operational efficiency and supporting technology adoption initiatives.

Export market expansion presents substantial growth opportunities, with neighboring Central Asian countries offering significant demand potential for Uzbekistan’s container glass products. Regional trade agreements and improving transportation infrastructure facilitate market access and competitive positioning.

Pharmaceutical sector growth creates specialized market opportunities for high-quality glass containers meeting stringent regulatory requirements. The expanding healthcare infrastructure and pharmaceutical manufacturing capabilities in Uzbekistan drive demand for specialized glass packaging solutions.

Premium packaging segments offer higher value opportunities, with luxury goods, premium beverages, and cosmetic products requiring sophisticated glass container designs and superior quality standards. These segments typically command premium pricing and improved profit margins.

Technology partnerships with international glass manufacturers can facilitate knowledge transfer, production efficiency improvements, and access to advanced manufacturing technologies. Strategic alliances enable capability enhancement and market competitiveness improvements.

Circular economy initiatives create opportunities for glass recycling and sustainability-focused business models. Developing comprehensive recycling infrastructure and closed-loop systems can enhance environmental credentials while reducing raw material costs.

Supply-demand equilibrium in the Uzbekistan container glass market reflects balanced growth between production capacity expansion and market demand increases. Domestic manufacturers have strategically aligned capacity investments with projected demand growth, maintaining healthy utilization rates while avoiding oversupply conditions.

Competitive intensity has increased as market participants invest in modernization and capacity expansion initiatives. This competition drives innovation, quality improvements, and cost optimization efforts that ultimately benefit end-user industries and consumers through enhanced product offerings and competitive pricing.

Value chain integration trends demonstrate manufacturers’ efforts to optimize operations through vertical integration strategies. These approaches enhance supply chain control, reduce costs, and improve responsiveness to customer requirements while strengthening competitive positioning.

Market segmentation continues evolving as manufacturers develop specialized products for distinct end-user applications. This specialization enables premium positioning and improved customer relationships while supporting market expansion into higher-value segments.

Regulatory environment influences market dynamics through quality standards, environmental regulations, and trade policies. Compliance requirements drive investment in quality systems and environmental management while creating competitive advantages for well-prepared manufacturers.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Uzbekistan container glass market. Primary research activities included structured interviews with industry executives, manufacturers, suppliers, and key stakeholders across the value chain.

Secondary research encompassed extensive analysis of industry reports, government statistics, trade publications, and company financial statements to validate primary findings and establish market context. Data triangulation techniques ensured consistency and reliability across multiple information sources.

Market sizing methodologies utilized both top-down and bottom-up approaches, analyzing production capacity, consumption patterns, trade flows, and end-user demand to establish comprehensive market understanding. Statistical analysis techniques validated growth projections and trend identification.

Expert consultations with industry specialists, technology providers, and market analysts provided valuable insights into market dynamics, competitive positioning, and future development prospects. These discussions enhanced understanding of complex market relationships and emerging trends.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews, and applying statistical verification techniques to ensure accuracy and reliability of market intelligence and forecasting models.

Tashkent region dominates the Uzbekistan container glass market, accounting for approximately 45% of total production capacity due to its industrial infrastructure, transportation connectivity, and proximity to major consumer markets. The region benefits from established manufacturing clusters and skilled workforce availability.

Samarkand province represents the second-largest production center, contributing 28% of national output with several major manufacturing facilities serving both domestic and export markets. The region’s strategic location along international trade routes enhances export competitiveness and market access.

Fergana Valley demonstrates significant growth potential with expanding industrial development and increasing investment in manufacturing infrastructure. The region’s agricultural processing industries create substantial demand for glass packaging solutions, supporting local market development.

Bukhara region shows emerging importance in specialized glass production, focusing on pharmaceutical and cosmetic applications that require higher quality standards and specialized manufacturing capabilities. Investment in advanced production technologies has enhanced the region’s competitive positioning.

Regional distribution patterns reflect transportation infrastructure development and market accessibility, with manufacturers strategically locating facilities to optimize logistics costs and customer service capabilities. Continued infrastructure investment supports market expansion and regional development.

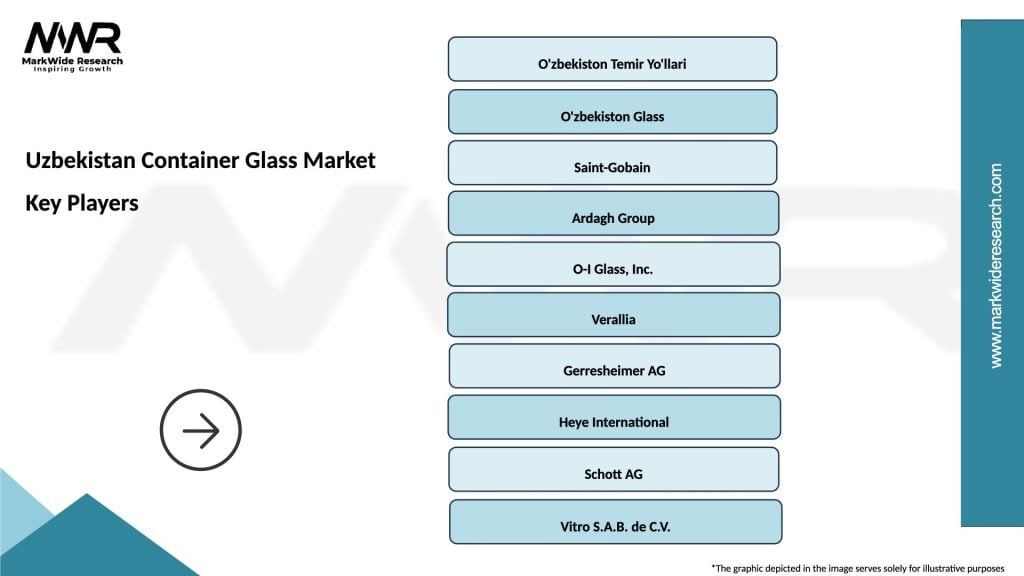

Market leadership in the Uzbekistan container glass sector features several key players with distinct competitive advantages and market positioning strategies:

Competitive strategies emphasize technology modernization, quality enhancement, and customer service improvements to differentiate market positioning. Leading manufacturers invest heavily in research and development, production efficiency, and sustainability initiatives to maintain competitive advantages.

Market consolidation trends indicate potential for strategic partnerships and mergers as companies seek to achieve economies of scale and enhance market coverage. These developments could reshape competitive dynamics and market structure over the medium term.

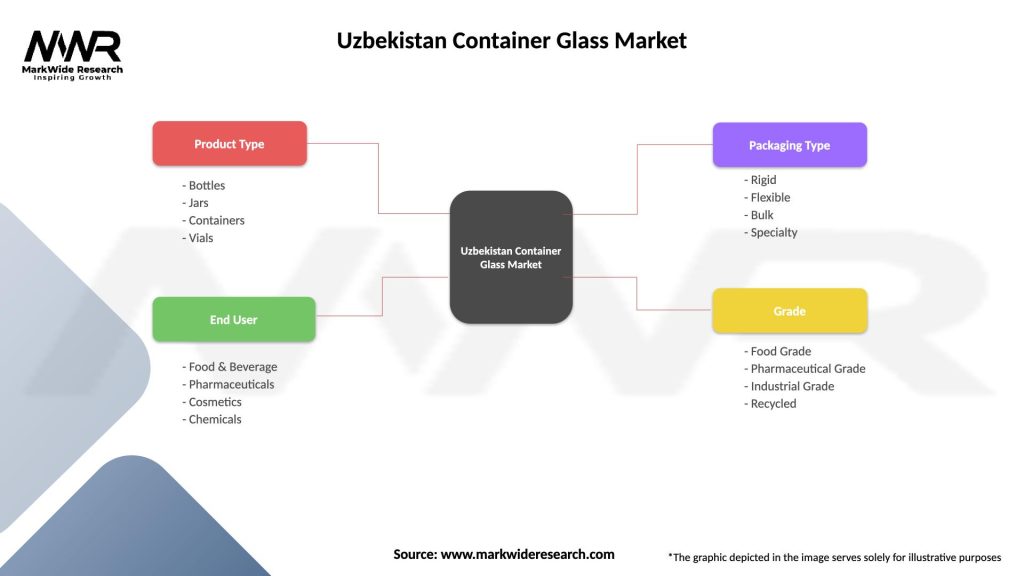

By Product Type:

By End-User Industry:

By Production Technology:

Food and Beverage Category demonstrates the strongest market performance, driven by expanding food processing industry and increasing consumer preference for glass packaging. Alcoholic beverage containers represent the highest-value subcategory, with premium positioning and export potential supporting market growth.

Pharmaceutical Category shows exceptional growth potential with annual demand increases of 18% reflecting healthcare sector expansion and regulatory requirements favoring glass packaging. Specialized manufacturing capabilities and quality certifications create competitive advantages in this segment.

Cosmetic Category emphasizes premium positioning and aesthetic appeal, with manufacturers investing in advanced forming technologies and surface treatment capabilities. This segment offers superior profit margins and brand differentiation opportunities for qualified suppliers.

Industrial Category provides stable demand base with long-term customer relationships and predictable order patterns. Chemical resistance requirements and safety standards create technical barriers that protect established suppliers from competitive pressure.

Specialty Applications including laboratory glassware and technical containers represent niche opportunities with specialized requirements and premium pricing. These segments require advanced manufacturing capabilities and strict quality control systems.

Manufacturers benefit from growing market demand, favorable raw material availability, and government support for industrial development. Investment opportunities in modern production technologies and capacity expansion offer attractive returns and competitive positioning advantages.

Suppliers of raw materials and equipment enjoy stable demand growth and long-term customer relationships with glass manufacturers. The industry’s capital-intensive nature creates predictable replacement cycles and ongoing service requirements.

End-users gain access to high-quality, locally-produced glass containers that meet international standards while offering competitive pricing and reliable supply. Domestic production reduces import dependence and supply chain risks.

Government stakeholders achieve economic development objectives through industrial growth, employment creation, export revenue generation, and import substitution. The sector contributes to broader manufacturing competitiveness and economic diversification goals.

Investors find attractive opportunities in a growing market with strong fundamentals, government support, and export potential. The industry’s essential nature and sustainable characteristics provide defensive investment qualities with growth upside.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration represents the most significant trend shaping market development, with manufacturers investing in energy-efficient technologies, recycling capabilities, and environmental management systems. MarkWide Research analysis indicates that sustainability initiatives have improved operational efficiency by 12% annually while enhancing market positioning.

Technology Modernization continues driving industry transformation through advanced furnace designs, automated production systems, and quality control technologies. These investments improve product consistency, reduce waste, and enhance competitive positioning in both domestic and export markets.

Product Customization trends reflect increasing customer demands for specialized container designs, unique shapes, and branded packaging solutions. Manufacturers are developing flexible production capabilities to accommodate smaller batch sizes and customized requirements.

Digital Integration encompasses production monitoring, quality control, and customer service systems that enhance operational efficiency and customer satisfaction. Industry 4.0 technologies are gradually being adopted to optimize production processes and reduce costs.

Market Consolidation tendencies indicate potential for strategic partnerships, mergers, and acquisitions as companies seek economies of scale and enhanced market coverage. These developments could reshape competitive dynamics and market structure.

Infrastructure Investment initiatives have significantly enhanced production capabilities across the Uzbekistan container glass sector, with major manufacturers completing facility expansions and technology upgrades. These developments have increased overall industry capacity and improved product quality standards.

International Partnerships have facilitated technology transfer and knowledge sharing, enabling domestic manufacturers to adopt advanced production techniques and quality management systems. These collaborations have enhanced competitive positioning and market access capabilities.

Regulatory Developments including updated quality standards and environmental regulations have driven industry modernization and compliance investments. These changes have improved overall industry standards while creating competitive advantages for well-prepared manufacturers.

Export Market Development has expanded significantly with improved trade relationships and transportation infrastructure connecting Uzbekistan to regional markets. Several manufacturers have established distribution networks in neighboring countries to capitalize on export opportunities.

Sustainability Initiatives have gained momentum with manufacturers implementing recycling programs, energy efficiency improvements, and environmental management systems. These efforts align with global sustainability trends while reducing operational costs and environmental impact.

Strategic Focus should prioritize technology modernization and production efficiency improvements to maintain competitive advantages in both domestic and export markets. Investment in advanced manufacturing systems and quality control technologies will support long-term market positioning and profitability.

Market Diversification efforts should target high-value segments including pharmaceuticals, cosmetics, and specialty applications that offer superior profit margins and growth potential. Developing specialized capabilities and certifications will enable access to these premium market segments.

Export Development represents a critical growth strategy, with manufacturers encouraged to establish distribution networks and customer relationships in regional markets. Strategic partnerships and joint ventures could facilitate market entry and competitive positioning in target countries.

Sustainability Integration should become a core business strategy, encompassing energy efficiency, recycling capabilities, and environmental management systems. These initiatives will enhance market positioning while reducing operational costs and regulatory compliance risks.

Workforce Development programs are essential for supporting technology adoption and operational excellence. Investment in training and skill development will ensure adequate technical expertise for modern manufacturing operations and continuous improvement initiatives.

Growth Projections for the Uzbekistan container glass market remain highly favorable, with sustained expansion expected across all major end-user segments. MWR analysis indicates the market will maintain robust growth momentum, supported by demographic trends, industrial development, and export opportunities.

Technology Evolution will continue driving industry transformation through advanced manufacturing systems, automation technologies, and digital integration. These developments will enhance production efficiency, product quality, and competitive positioning while supporting sustainable growth objectives.

Market Expansion into regional export markets presents substantial growth opportunities, with improving trade relationships and transportation infrastructure facilitating market access. Strategic positioning in Central Asian markets could significantly enhance industry growth prospects and revenue potential.

Sustainability Leadership will become increasingly important for market success, with environmental considerations influencing customer decisions and regulatory requirements. Manufacturers investing in sustainable practices and circular economy principles will achieve competitive advantages and market differentiation.

Industry Consolidation trends may accelerate as companies seek economies of scale and enhanced market coverage through strategic partnerships and acquisitions. These developments could create more efficient market structure while maintaining healthy competition and innovation incentives.

Market Assessment reveals the Uzbekistan container glass market as a dynamic and rapidly growing sector with substantial potential for continued expansion and development. Strong fundamentals including abundant raw materials, strategic geographic positioning, and supportive government policies create favorable conditions for sustained growth across multiple market segments.

Strategic Opportunities abound for industry participants, with export market development, technology modernization, and specialty segment expansion offering attractive growth avenues. The market’s alignment with sustainability trends and circular economy principles positions it advantageously for long-term success in evolving global markets.

Investment Attractiveness remains high, supported by growing domestic demand, export potential, and government initiatives promoting industrial development. The sector offers compelling opportunities for both domestic and international investors seeking exposure to emerging market growth and industrial development themes.

Future Success will depend on continued investment in technology modernization, quality enhancement, and market development initiatives. Companies that successfully navigate these priorities while maintaining operational excellence and customer focus will achieve sustainable competitive advantages and market leadership positions in the expanding Uzbekistan container glass market.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Uzbekistan Container Glass Market?

Key players in the Uzbekistan Container Glass Market include companies like Uzbekistan Glass Industry, O’zbekiston Temir Yullari, and Artel, which are involved in the production and distribution of container glass products, among others.

What are the growth factors driving the Uzbekistan Container Glass Market?

The growth of the Uzbekistan Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and the growing trend of eco-friendly consumer behavior.

What challenges does the Uzbekistan Container Glass Market face?

Challenges in the Uzbekistan Container Glass Market include high production costs, competition from alternative packaging materials, and the need for advanced manufacturing technologies to meet quality standards.

What opportunities exist in the Uzbekistan Container Glass Market?

Opportunities in the Uzbekistan Container Glass Market include expanding export potential, increasing investments in manufacturing facilities, and the growing trend of using glass for premium packaging in various sectors.

What trends are shaping the Uzbekistan Container Glass Market?

Trends in the Uzbekistan Container Glass Market include a shift towards lightweight glass containers, innovations in glass recycling technologies, and the increasing use of decorative glass packaging in the food and beverage industry.

Uzbekistan Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Chemicals |

| Packaging Type | Rigid, Flexible, Bulk, Specialty |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Recycled |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Uzbekistan Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at