444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Used Serviceable Material (USM) market plays a pivotal role in the aviation industry, offering a sustainable and cost-effective alternative to new parts. USM refers to components that have been removed from retired or end-of-life aircraft but still possess airworthiness and serviceability. These components undergo rigorous testing and inspection, making them a reliable and viable option for airlines and MRO (Maintenance, Repair, and Overhaul) providers.

Meaning

Used Serviceable Material, also known as Used Serviceable Parts (USP), involves the procurement, testing, and distribution of aircraft parts from retired aircraft for reuse in active fleets. This practice significantly reduces operational costs and minimizes waste, contributing to the aviation sector’s sustainability efforts.

Executive Summary

The Used Serviceable Material (USM) market has witnessed remarkable growth over the past decade, driven by the increasing demand for cost-efficient aviation solutions and a rising emphasis on environmental sustainability. The sector has become a critical aspect of the aviation supply chain, providing reliable and certified components that meet the stringent safety standards set by aviation authorities.

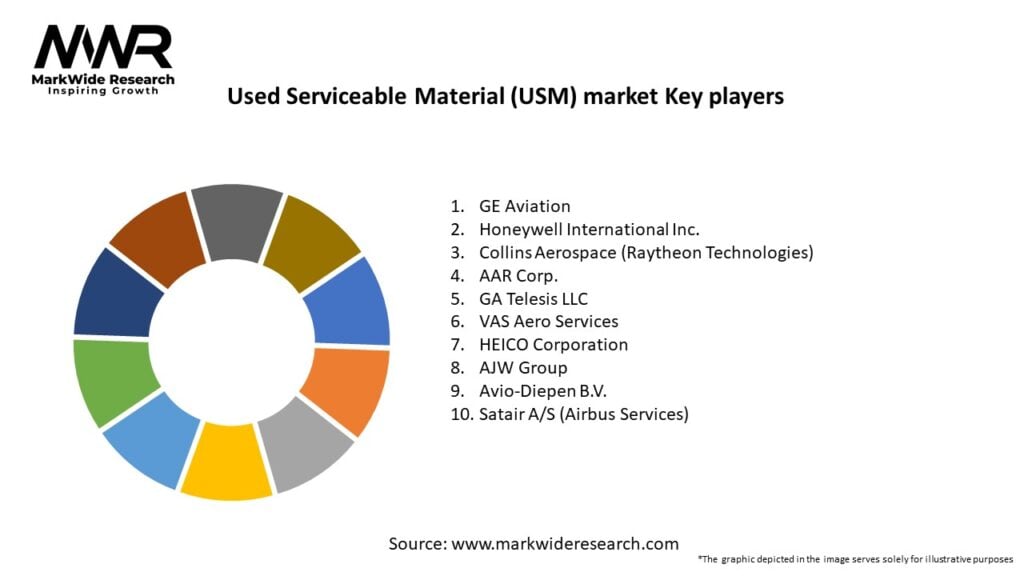

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The USM market operates in a dynamic environment, influenced by the interplay of various factors such as sustainability goals, market demand, regulatory frameworks, and technological advancements. Industry players must adapt to these dynamics to stay competitive and meet customer expectations.

Regional Analysis

The USM market demonstrates a global presence, with key players operating in various regions. North America and Europe lead the market due to their mature aviation industries and strong focus on sustainability. Asia-Pacific shows promising growth potential, driven by the burgeoning aviation sector in countries like China and India.

Competitive Landscape

Leading Companies in Used Serviceable Material (USM) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The USM market can be segmented based on various criteria, including component type, aircraft type, and end-user. This segmentation enables suppliers to target specific market niches and tailor their offerings accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the aviation industry, causing disruptions in aircraft operations and affecting USM demand. As the industry recovers, USM’s cost-saving benefits and sustainability advantages become even more critical for airlines looking to rebuild their operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Used Serviceable Material (USM) market is set to witness sustained growth as the aviation industry continues to prioritize sustainability and cost-effectiveness. Advancements in technology and the expansion of emerging markets will further drive the adoption of USM components.

Conclusion

The Used Serviceable Material (USM) market presents a win-win solution for the aviation industry, combining cost savings, sustainability, and reliability. As the sector continues to evolve, industry players must adapt to market dynamics, embrace innovation, and maintain compliance to thrive in the competitive landscape. With its promising outlook, USM is poised to play a crucial role in shaping the future of aviation sustainability.

What is Used Serviceable Material (USM)?

Used Serviceable Material (USM) refers to materials that have been previously utilized but can still be refurbished or repurposed for further use in various applications, such as manufacturing, construction, and automotive industries.

What are the key players in the Used Serviceable Material (USM) market?

Key players in the Used Serviceable Material (USM) market include companies like Boeing, General Electric, and Honeywell, which focus on the refurbishment and resale of used materials, among others.

What are the growth factors driving the Used Serviceable Material (USM) market?

The growth of the Used Serviceable Material (USM) market is driven by increasing sustainability efforts, rising demand for cost-effective materials, and the need for resource conservation in industries such as aerospace and automotive.

What challenges does the Used Serviceable Material (USM) market face?

Challenges in the Used Serviceable Material (USM) market include regulatory compliance issues, quality assurance concerns, and the potential for market saturation as more companies enter the sector.

What opportunities exist in the Used Serviceable Material (USM) market?

Opportunities in the Used Serviceable Material (USM) market include the expansion of recycling technologies, increasing partnerships between manufacturers and refurbishers, and growing awareness of environmental benefits among consumers.

What trends are shaping the Used Serviceable Material (USM) market?

Trends in the Used Serviceable Material (USM) market include the rise of circular economy practices, advancements in material recovery technologies, and a shift towards more sustainable supply chain practices.

Used Serviceable Material (USM) market

| Segmentation Details | Description |

|---|---|

| Product Type | Engines, Landing Gear, Avionics, Airframes |

| Application | Commercial Aviation, Military Aviation, Cargo, Private Jets |

| End User | Airlines, MRO Providers, OEMs, Leasing Companies |

| Distribution Channel | Direct Sales, Online Platforms, Distributors, Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Used Serviceable Material (USM) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at