444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Used Car Loans Market is a vital segment within the broader automotive financing industry, facilitating the purchase of pre-owned vehicles through various lending and financial services. Used car loans enable consumers to acquire vehicles that have had previous owners, offering an affordable alternative to buying new cars. This market caters to diverse customer segments, including individuals, families, businesses, and organizations, seeking financing solutions for their transportation needs. With the growing demand for affordable and reliable transportation options, the used car loans market plays a significant role in facilitating vehicle ownership and driving economic activity.

Meaning

Used car loans, also known as pre-owned car financing or second-hand vehicle financing, refer to financial products and services offered by banks, credit unions, finance companies, and automotive lenders to facilitate the purchase of used or pre-owned vehicles. These loans enable borrowers to finance the acquisition of used cars, trucks, vans, and SUVs, typically with fixed or variable interest rates, repayment terms, and loan amounts based on the vehicle’s value and the borrower’s creditworthiness. Used car loans provide consumers with access to affordable financing options, making vehicle ownership more accessible and attainable for a wide range of individuals and businesses.

Executive Summary

The Used Car Loans Market is experiencing steady growth driven by factors such as increasing demand for affordable transportation, rising vehicle prices, changing consumer preferences, and favorable lending conditions. Used car loans offer consumers a cost-effective way to purchase vehicles with lower monthly payments, reduced depreciation, and flexible financing terms. While challenges such as credit risk, market volatility, and regulatory compliance exist, the market presents significant opportunities for lenders, dealerships, and automotive finance companies to expand their customer base, increase loan volumes, and drive revenue growth.

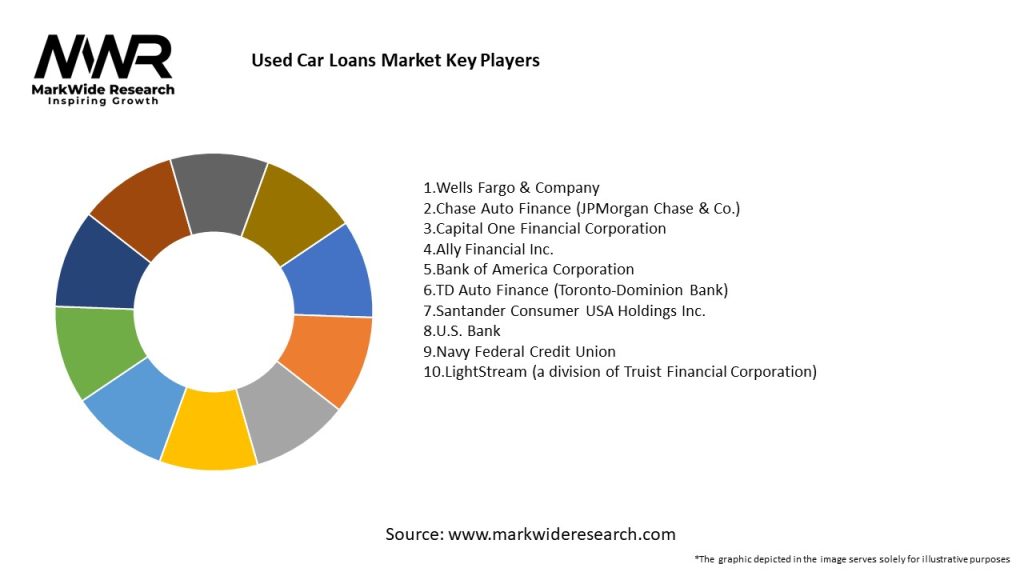

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Key insights shaping the Used Car Loans Market include:

Market Drivers

Drivers fueling the growth of the Used Car Loans Market include:

Market Restraints

Challenges restraining market growth include:

Market Opportunities

Opportunities for growth and innovation in the Used Car Loans Market include:

Market Dynamics

Dynamic factors shaping the Used Car Loans Market include changes in consumer preferences, economic conditions, regulatory environments, and competitive dynamics. Lenders, dealerships, and automotive finance companies must adapt to evolving market dynamics, borrower needs, and industry trends to remain competitive and capitalize on growth opportunities in the market.

Regional Analysis

Regional variations in economic conditions, vehicle sales volumes, consumer preferences, and regulatory environments influence the demand for used car loans and lending practices. While mature markets may exhibit high levels of consumer credit penetration and financing activity, emerging markets offer opportunities for growth driven by increasing vehicle ownership, rising income levels, and expanding credit availability.

Competitive Landscape

Leading Companies in the Used Car Loan Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

Segmentation of the Used Car Loans Market can be based on factors such as:

Category-wise Insight

Insights into specific categories within the Used Car Loans Market include:

Key Benefits for Industry Participants and Stakeholders

The Used Car Loans Market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the Used Car Loans Market reveals:

Market Key Trends

Key trends shaping the Used Car Loans Market include:

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Used Car Loans Market, leading to disruptions in lending activity, changes in borrower behavior, and shifts in market dynamics. While the pandemic initially resulted in reduced demand for used car loans due to economic uncertainty and consumer caution, the gradual recovery of the economy and the automotive industry is expected to drive renewed demand for financing solutions in the used car loans market as consumer confidence returns and vehicle sales rebound.

Key Industry Developments

Recent developments in the Used Car Loans Market include:

Analyst Suggestions

Recommendations for stakeholders in the Used Car Loans Market include:

Future Outlook

The Used Car Loans Market is poised for continued growth and evolution as consumer demand for affordable transportation, rising vehicle prices, and favorable lending conditions drive financing activity and innovation in the market. Key trends such as digital transformation, specialized financing programs, partnership collaborations, and risk management strategies will shape the future trajectory of the market, offering opportunities for growth, differentiation, and value creation for lenders, dealerships, and automotive finance companies.

Conclusion

The Used Car Loans Market plays a crucial role in facilitating vehicle ownership and driving economic activity by providing consumers with access to affordable financing solutions for pre-owned vehicles. Despite challenges such as credit risk, market volatility, and regulatory compliance, the market presents significant opportunities for lenders, dealerships, and automotive finance companies to expand their customer base, increase loan volumes, and drive revenue growth. By embracing digital transformation, developing specialized financing programs, fostering partnership collaborations, and implementing robust risk management strategies, stakeholders can capitalize on growth opportunities and enhance their competitive position in the dynamic and evolving Used Car Loans Market.

What is Used Car Loans?

Used car loans are financial products specifically designed to help consumers purchase pre-owned vehicles. These loans typically cover a portion of the vehicle’s price and can vary in terms of interest rates and repayment terms based on the borrower’s creditworthiness.

What are the key players in the Used Car Loans Market?

Key players in the used car loans market include banks, credit unions, and specialized auto finance companies such as CarMax, Capital One, and Ally Financial, among others.

What are the main drivers of growth in the Used Car Loans Market?

The growth of the used car loans market is driven by factors such as increasing consumer demand for affordable vehicles, the rising popularity of online car buying platforms, and favorable financing options that make purchasing used cars more accessible.

What challenges does the Used Car Loans Market face?

The used car loans market faces challenges such as fluctuating interest rates, the potential for increased loan defaults, and competition from alternative financing options like peer-to-peer lending.

What opportunities exist in the Used Car Loans Market?

Opportunities in the used car loans market include the expansion of digital lending platforms, partnerships with dealerships for streamlined financing, and the potential for tailored loan products that cater to specific consumer needs.

What trends are shaping the Used Car Loans Market?

Trends in the used car loans market include the rise of online loan applications, the integration of artificial intelligence in credit assessments, and an increasing focus on flexible repayment options to accommodate diverse borrower profiles.

Used Car Loans Market

| Segmentation Details | Description |

|---|---|

| Loan Type | Secured, Unsecured, Personal, Dealer Financing |

| Customer Type | First-Time Buyers, Repeat Buyers, Dealerships, Fleet Buyers |

| Credit Score Range | Excellent, Good, Fair, Poor |

| Loan Term | Short-Term, Medium-Term, Long-Term, Flexible |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Used Car Loan Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at