444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The USA wine market represents one of the most dynamic and sophisticated beverage sectors in North America, characterized by exceptional diversity, premium quality offerings, and evolving consumer preferences. American wine production has experienced remarkable transformation over recent decades, establishing the United States as a global leader in both wine consumption and production innovation. The market encompasses traditional wine regions alongside emerging viticultural areas, creating a comprehensive ecosystem that serves domestic demand while competing internationally.

Market dynamics indicate robust growth potential driven by premiumization trends, sustainable winemaking practices, and expanding consumer demographics. The sector demonstrates resilience through economic cycles while adapting to changing lifestyle preferences, health consciousness, and digital commerce integration. Regional diversity across American wine regions contributes to market strength, with California maintaining dominance while states like Washington, Oregon, and New York expand their market presence significantly.

Consumer behavior patterns reveal increasing sophistication in wine selection, with millennials and Generation Z driving demand for authentic, sustainable, and innovative wine experiences. The market benefits from growing wine tourism, direct-to-consumer sales channels, and premium positioning strategies that differentiate American wines in competitive global markets. Growth projections suggest continued expansion at approximately 4.2% CAGR through the forecast period, supported by domestic consumption growth and export opportunities.

The USA wine market refers to the comprehensive ecosystem encompassing wine production, distribution, retail, and consumption within the United States, including domestic wineries, imported wine brands, and associated service industries. This market represents the complete value chain from grape cultivation and wine production to consumer purchase and consumption, incorporating traditional wine regions, emerging viticultural areas, and diverse distribution channels serving American consumers.

Market scope includes all wine categories from premium artisanal offerings to mass-market brands, encompassing still wines, sparkling wines, fortified wines, and specialty wine products. The definition extends beyond production to include wine tourism, hospitality services, retail operations, and digital commerce platforms that facilitate wine discovery and purchase. Geographic coverage spans all fifty states, with concentrated production in key wine regions while consumption occurs nationwide through diverse retail and hospitality channels.

Strategic analysis reveals the USA wine market positioned for sustained growth driven by premiumization trends, demographic shifts, and evolving consumption patterns. The market demonstrates remarkable resilience and adaptability, with domestic producers gaining market share while imported wines maintain significant presence. Key growth drivers include increasing wine appreciation among younger demographics, expanding direct-to-consumer sales channels, and growing emphasis on sustainable and organic wine production practices.

Market leadership remains concentrated among established wine regions, particularly California, which accounts for approximately 85% of domestic production. However, emerging regions demonstrate rapid growth potential, contributing to overall market diversification and innovation. Consumer preferences increasingly favor premium and super-premium wine categories, driving revenue growth despite moderate volume increases.

Competitive dynamics feature both consolidation among large wine companies and proliferation of boutique wineries serving niche markets. The market benefits from strong domestic consumption, growing export opportunities, and increasing integration of technology in production, marketing, and sales processes. Future prospects indicate continued market expansion supported by demographic trends, lifestyle changes, and strategic positioning of American wines in global markets.

Market intelligence reveals several critical insights shaping the USA wine market landscape and future development trajectory:

Primary growth drivers propelling the USA wine market include demographic shifts toward wine-appreciating consumer segments and increasing disposable income allocated to premium beverage experiences. Millennial consumers demonstrate strong wine adoption rates, driving demand for authentic, sustainable, and innovative wine products that align with their lifestyle values and social consciousness.

Premiumization trends significantly impact market dynamics as consumers increasingly select higher-quality wines for both everyday consumption and special occasions. This trend supports revenue growth while encouraging domestic producers to focus on quality improvement and brand differentiation strategies. Health consciousness among consumers drives interest in organic wines, low-sulfite options, and wines produced through sustainable agricultural practices.

Digital transformation accelerates market growth through enhanced consumer access to wine education, reviews, and purchasing options. E-commerce platforms, social media marketing, and direct-to-consumer sales channels create new opportunities for wine discovery and brand engagement. Wine tourism expansion contributes to market growth by creating experiential consumption opportunities that build brand loyalty and justify premium pricing strategies.

Regulatory complexity presents significant challenges for wine market participants, with varying state-level regulations governing production, distribution, and sales creating operational complications and market access barriers. Three-tier distribution systems in many states limit direct-to-consumer sales opportunities and increase distribution costs for smaller producers seeking market access.

Climate change impacts pose increasing risks to wine production through altered growing conditions, extreme weather events, and shifting optimal growing regions. These environmental challenges require significant adaptation investments and may affect production consistency and quality. Labor shortages in agricultural and hospitality sectors impact both wine production and service delivery, potentially constraining market growth.

Economic sensitivity affects wine consumption patterns during economic downturns, as consumers may reduce discretionary spending on premium wine categories. Competition from alternative beverages including craft beer, spirits, and non-alcoholic options creates market share pressure, particularly among younger consumer demographics exploring diverse beverage experiences.

Export market expansion presents substantial growth opportunities as American wines gain international recognition and acceptance. Emerging markets in Asia, particularly China and Southeast Asian countries, demonstrate growing appreciation for American wine quality and innovation, creating significant revenue potential for domestic producers.

Sustainable wine production offers differentiation opportunities as environmentally conscious consumers increasingly prioritize sustainable and organic wine options. Carbon-neutral wineries and regenerative agriculture practices provide competitive advantages while appealing to sustainability-focused consumer segments driving market premiumization.

Technology integration opportunities include precision viticulture, artificial intelligence in wine production, and blockchain technology for supply chain transparency. Digital marketing innovations through virtual tastings, augmented reality wine experiences, and personalized recommendation systems create new consumer engagement channels and market expansion possibilities.

Wine tourism development in emerging regions presents opportunities for economic development and brand building. Culinary tourism integration combining wine experiences with local food culture creates comprehensive destination experiences that support premium positioning and customer loyalty development.

Supply chain evolution characterizes current market dynamics as producers adapt to changing distribution patterns and consumer purchasing behaviors. Direct-to-consumer sales continue expanding, representing approximately 12% of total wine sales and growing rapidly through online platforms and winery tasting rooms. This shift enables producers to capture higher margins while building direct customer relationships.

Consolidation trends among large wine companies contrast with proliferation of small-scale boutique wineries, creating a bifurcated market structure. Large producers focus on efficiency, brand portfolio management, and distribution scale, while small wineries emphasize artisanal quality, unique varietals, and personalized customer experiences.

Consumer education initiatives drive market sophistication as wine appreciation programs, sommelier certifications, and digital wine education platforms increase consumer knowledge and confidence. MarkWide Research indicates that educated consumers demonstrate higher spending per bottle and greater brand loyalty, supporting market premiumization trends.

Seasonal consumption patterns influence production planning and marketing strategies, with holiday periods driving significant sales volumes while summer months favor lighter wine styles and outdoor consumption occasions. Weather impacts on both production and consumption create market volatility requiring adaptive business strategies and risk management approaches.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the USA wine market. Primary research includes extensive surveys of wine consumers, interviews with industry executives, winery owners, distributors, and retail partners to gather firsthand market intelligence and trend identification.

Secondary research incorporates analysis of industry reports, trade publications, government statistics, and academic studies related to wine production, consumption patterns, and market trends. Data triangulation methods validate findings across multiple sources to ensure research accuracy and reliability.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and growth projections. Regional analysis examines state-level production data, consumption patterns, and regulatory environments to provide comprehensive geographic market understanding.

Industry expert consultations with winemakers, sommeliers, wine critics, and retail specialists provide qualitative insights complementing quantitative data analysis. Consumer behavior studies examine purchasing patterns, brand preferences, and consumption occasions to understand market demand drivers and future trends.

California dominance continues defining USA wine market geography, with the state producing approximately 85% of American wine and hosting world-renowned wine regions including Napa Valley, Sonoma County, and Central Coast. Premium positioning of California wines drives national market reputation while diverse microclimates enable production of virtually all wine styles and varietals.

Pacific Northwest emergence demonstrates significant growth potential, with Washington State and Oregon establishing strong reputations for specific varietals and sustainable production practices. Washington wine production focuses on Bordeaux varietals and Riesling, while Oregon specializes in Pinot Noir and cool-climate varietals, contributing approximately 8% of national production.

East Coast expansion includes established regions like New York’s Finger Lakes and emerging areas in Virginia, North Carolina, and other southeastern states. New York wine industry benefits from proximity to major metropolitan markets while developing unique wine styles adapted to regional climate conditions.

Emerging wine regions across Texas, Colorado, Arizona, and other states contribute to market diversification and geographic expansion. Texas wine production demonstrates rapid growth, leveraging large-scale vineyard development and increasing consumer acceptance of regional wine quality and distinctiveness.

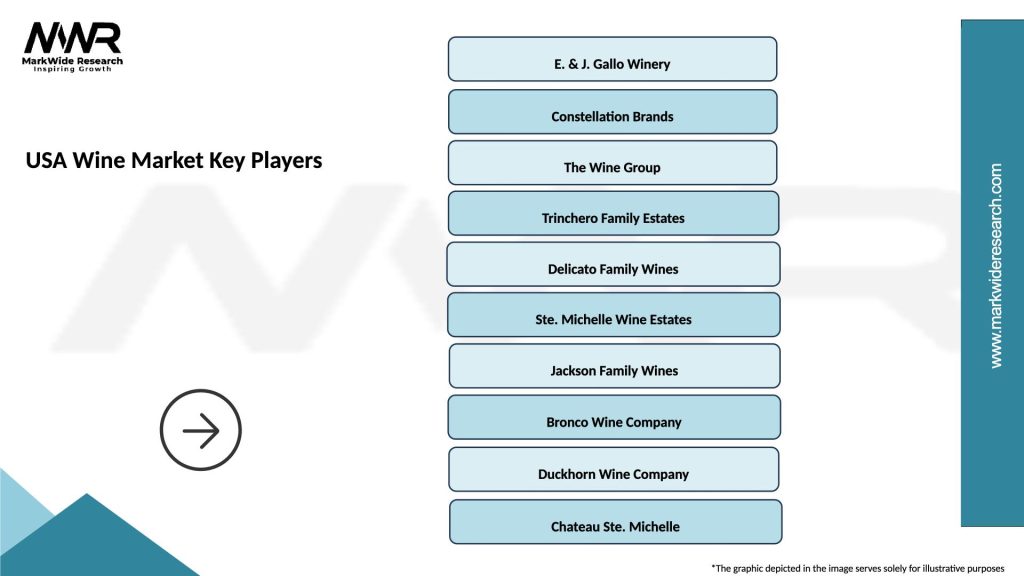

Market leadership features a diverse competitive landscape combining large multinational wine companies, regional producers, and boutique wineries serving different market segments and consumer preferences:

Competitive strategies emphasize brand differentiation, quality improvement, sustainable practices, and direct-to-consumer sales channel development. Innovation focus includes new product development, packaging innovations, and digital marketing initiatives to reach evolving consumer demographics and preferences.

By Wine Type:

By Price Category:

By Distribution Channel:

Red Wine Segment maintains market leadership driven by consumer preference for full-bodied wines and health-conscious consumption patterns. Cabernet Sauvignon dominates premium red wine sales while Pinot Noir demonstrates strong growth among sophisticated wine consumers seeking elegant, food-friendly options.

White Wine Categories show increasing diversification with Chardonnay maintaining traditional leadership while Sauvignon Blanc and Pinot Grigio gain market share among younger consumers. Rosé wines experience exceptional growth, representing approximately 11% of total wine consumption and appealing particularly to millennial demographics.

Sparkling Wine Growth accelerates driven by celebration culture and premium positioning strategies. American sparkling wines compete effectively with imported options while offering distinctive regional characteristics and value propositions. Prosecco-style wines and traditional method sparkling wines both demonstrate strong market acceptance.

Organic and Sustainable Wines represent the fastest-growing category segment, with organic wine sales increasing at approximately 15% annually. Biodynamic wines and natural wines appeal to environmentally conscious consumers while supporting premium pricing strategies and brand differentiation.

Wine Producers benefit from expanding market opportunities through premiumization trends, direct-to-consumer sales growth, and increasing consumer sophistication. Revenue optimization occurs through brand building, quality improvement, and sustainable production practices that justify premium pricing and build customer loyalty.

Distributors and Retailers capitalize on growing wine consumption and category expansion through portfolio diversification, education programs, and omnichannel sales strategies. Margin improvement opportunities exist through premium product focus and value-added services including wine storage, education, and consultation.

Hospitality Industry benefits from wine tourism growth, enhanced dining experiences, and beverage program differentiation. Revenue enhancement through wine pairing programs, sommelier services, and exclusive wine offerings creates competitive advantages and customer satisfaction improvements.

Technology Providers find opportunities in precision viticulture, e-commerce platforms, inventory management systems, and consumer engagement technologies. Innovation partnerships with wineries and retailers create mutual value through efficiency improvements and enhanced customer experiences.

Tourism and Hospitality sectors benefit from wine tourism expansion, creating economic development opportunities in wine regions while supporting local businesses and community development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with wineries implementing comprehensive environmental programs including organic farming, carbon neutrality, and regenerative agriculture practices. Consumer demand for environmentally responsible wine production drives competitive differentiation and premium positioning opportunities.

Digital Transformation accelerates across all market segments through e-commerce platform adoption, virtual tasting experiences, and social media marketing strategies. Direct-to-consumer sales continue expanding, with online wine sales growing at approximately 20% annually and representing increasing market share.

Premiumization Momentum continues driving revenue growth as consumers increasingly select higher-quality wines for both everyday consumption and special occasions. Super-premium segments demonstrate strongest growth rates while value segments face pricing pressure and margin compression.

Health-Conscious Consumption influences product development with increasing demand for organic wines, lower-alcohol options, and wines produced without synthetic additives. Wellness trends support moderate consumption patterns while encouraging quality over quantity purchasing decisions.

Experience Economy Integration drives wine tourism growth, immersive tasting experiences, and educational programs that build brand loyalty and justify premium pricing. MarkWide Research analysis indicates experiential wine consumption creates stronger emotional connections and higher lifetime customer value.

Consolidation Activity continues among large wine companies seeking scale advantages and portfolio diversification, while boutique wineries proliferate to serve niche markets and specialized consumer preferences. Strategic acquisitions focus on premium brands, sustainable producers, and emerging wine regions with growth potential.

Technology Adoption accelerates across production, marketing, and sales functions with precision viticulture, artificial intelligence applications, and blockchain supply chain transparency gaining industry acceptance. Innovation investments focus on efficiency improvement, quality enhancement, and consumer engagement capabilities.

Regulatory Evolution includes gradual modernization of distribution laws, expanded direct-to-consumer shipping permissions, and simplified licensing procedures in various states. Industry advocacy continues promoting regulatory reforms that enhance market access and operational efficiency.

Sustainability Certifications proliferate as third-party verification programs gain consumer recognition and market credibility. Certification programs including organic, biodynamic, and sustainable winegrowing practices provide competitive differentiation and premium positioning opportunities.

International Recognition grows for American wine quality and innovation through competition victories, critical acclaim, and export market expansion. Brand building initiatives promote American wine regions and varietals in global markets while supporting domestic premium positioning.

Strategic Recommendations for wine industry participants emphasize sustainability integration, digital transformation, and premium positioning strategies to capitalize on evolving market dynamics. Investment priorities should focus on brand building, direct-to-consumer capabilities, and sustainable production practices that align with consumer values and market trends.

Market Entry Strategies for new participants should emphasize differentiation through unique varietals, sustainable practices, or innovative marketing approaches. Geographic expansion opportunities exist in emerging wine regions with favorable growing conditions and developing tourism infrastructure.

Technology Integration recommendations include e-commerce platform development, customer relationship management systems, and precision viticulture technologies that improve efficiency and quality. Digital marketing investments should focus on social media engagement, content marketing, and personalized customer experiences.

Partnership Development opportunities include collaborations with hospitality providers, tourism organizations, and technology companies to create comprehensive wine experiences and market access. Distribution partnerships should emphasize premium positioning and brand building rather than volume-focused strategies.

Risk Management strategies should address climate change adaptation, regulatory compliance, and economic sensitivity through diversification, insurance programs, and flexible business models. MWR analysis suggests successful wine companies maintain adaptability while focusing on long-term brand building and customer relationship development.

Growth Projections indicate continued market expansion driven by demographic trends, premiumization, and export opportunities. Market evolution will likely favor producers emphasizing sustainability, innovation, and direct customer relationships while adapting to changing consumption patterns and distribution channels.

Consumer Demographics will continue shifting toward younger, more diverse wine consumers with different preferences and purchasing behaviors. Millennial and Generation Z consumers will drive demand for authentic, sustainable, and innovative wine experiences while embracing digital commerce and social media engagement.

Technology Integration will accelerate across all market segments, from precision viticulture and production optimization to marketing automation and customer engagement platforms. Artificial intelligence applications will enhance quality control, inventory management, and personalized marketing capabilities.

Sustainability Requirements will become increasingly important for market success as environmental consciousness grows among consumers and regulatory requirements evolve. Carbon neutrality and regenerative agriculture practices will transition from competitive advantages to market necessities.

Export Market Development will provide significant growth opportunities as American wine quality recognition expands globally. International expansion will require strategic brand building, cultural adaptation, and distribution partnership development in key target markets.

The USA wine market demonstrates exceptional resilience and growth potential, supported by strong domestic consumption, increasing quality recognition, and evolving consumer preferences toward premium and sustainable wine options. Market dynamics favor producers who embrace innovation, sustainability, and direct customer engagement while adapting to changing distribution patterns and demographic shifts.

Strategic success factors include brand differentiation, quality consistency, sustainable production practices, and effective digital marketing strategies that resonate with evolving consumer values. Future opportunities exist in export market expansion, wine tourism development, and technology integration that enhances both production efficiency and customer experiences.

Industry participants who invest in long-term brand building, sustainable practices, and customer relationship development will be best positioned to capitalize on continued market growth and premiumization trends. The USA wine market represents a dynamic and evolving sector with substantial potential for continued expansion and innovation in the years ahead.

What is Wine?

Wine is an alcoholic beverage made from fermented grapes or other fruits. The fermentation process involves the conversion of sugars in the fruit into alcohol, resulting in a wide variety of flavors and styles, including red, white, rosé, and sparkling wines.

What are the key players in the USA Wine Market?

Key players in the USA Wine Market include Constellation Brands, E. & J. Gallo Winery, and Treasury Wine Estates, among others. These companies dominate the market through a diverse portfolio of wine brands and extensive distribution networks.

What are the growth factors driving the USA Wine Market?

The USA Wine Market is driven by factors such as increasing consumer interest in premium wines, the rise of wine tourism, and the growing popularity of wine pairings with food. Additionally, the trend towards health-conscious drinking is influencing wine consumption patterns.

What challenges does the USA Wine Market face?

The USA Wine Market faces challenges such as regulatory hurdles, competition from other alcoholic beverages, and changing consumer preferences. Additionally, climate change poses risks to grape production and quality, impacting supply.

What opportunities exist in the USA Wine Market?

Opportunities in the USA Wine Market include the expansion of organic and sustainable wine production, the growth of online wine sales, and the increasing demand for unique and artisanal wines. These trends present avenues for innovation and market entry.

What trends are shaping the USA Wine Market?

Trends shaping the USA Wine Market include the rise of low-alcohol and non-alcoholic wines, the popularity of wine subscription services, and the increasing focus on sustainability in wine production. These trends reflect changing consumer preferences and a shift towards more responsible consumption.

USA Wine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Red Wine, White Wine, Sparkling Wine, Rosé Wine |

| Price Tier | Premium, Mid-Range, Budget, Super Premium |

| Distribution Channel | Retail Stores, Online Sales, Wine Clubs, Restaurants |

| Customer Type | Millennials, Gen X, Baby Boomers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the USA Wine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at