444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The USA virtual cards market represents a rapidly evolving segment of the digital payment ecosystem, transforming how businesses and consumers conduct financial transactions. Virtual cards have emerged as a critical component of modern payment infrastructure, offering enhanced security, improved expense management, and streamlined procurement processes across various industries. The market demonstrates remarkable growth momentum, driven by increasing digitization of financial services and growing demand for secure payment solutions.

Digital transformation initiatives across enterprises have accelerated virtual card adoption, with organizations recognizing the significant advantages these solutions provide over traditional payment methods. The market encompasses various virtual card types, including single-use cards, multi-use cards, and subscription-based virtual payment solutions. Financial institutions, fintech companies, and payment processors are actively expanding their virtual card offerings to capture the growing demand from both B2B and B2C segments.

Market penetration continues to expand across diverse sectors, including travel and hospitality, e-commerce, healthcare, and corporate procurement. The USA market benefits from advanced technological infrastructure, regulatory support for digital payments, and high smartphone penetration rates. Growth projections indicate sustained expansion at a compound annual growth rate of 18.5% through the forecast period, reflecting strong market fundamentals and increasing adoption across user segments.

The USA virtual cards market refers to the comprehensive ecosystem encompassing the development, distribution, and utilization of digital payment cards that exist only in electronic format without physical plastic counterparts. Virtual cards are generated digitally and contain all necessary payment information including card numbers, expiration dates, and security codes, enabling secure online and mobile transactions while providing enhanced control and security features.

These digital payment instruments serve multiple purposes across commercial and consumer applications, offering businesses improved expense management, fraud protection, and streamlined reconciliation processes. Virtual cards can be issued instantly, configured with specific spending limits, merchant restrictions, and expiration dates, providing unprecedented control over payment activities. The market encompasses various stakeholders including card issuers, payment processors, technology providers, and end-users across different industry verticals.

Virtual card solutions integrate with existing financial systems, expense management platforms, and procurement software, creating seamless payment experiences while maintaining robust security protocols. The technology leverages tokenization, encryption, and real-time monitoring to protect sensitive financial information and prevent unauthorized transactions.

The USA virtual cards market demonstrates exceptional growth potential, driven by accelerating digital transformation initiatives and increasing demand for secure, efficient payment solutions. Market dynamics indicate strong adoption across both business-to-business and business-to-consumer segments, with enterprises particularly embracing virtual cards for expense management, supplier payments, and employee reimbursements.

Key market drivers include rising cybersecurity concerns, regulatory compliance requirements, and the need for improved financial visibility and control. Organizations are increasingly recognizing virtual cards as essential tools for modernizing payment processes while reducing fraud risks and administrative overhead. Technology advancement in areas such as artificial intelligence, machine learning, and blockchain integration continues to enhance virtual card capabilities and user experiences.

Competitive landscape analysis reveals intense competition among established financial institutions, emerging fintech companies, and specialized payment technology providers. Market leaders are investing heavily in product innovation, strategic partnerships, and customer acquisition initiatives to maintain competitive advantages. Regional adoption patterns show particularly strong growth in metropolitan areas and technology-forward industries, with enterprise adoption rates reaching 42% among large corporations.

Future market prospects remain highly favorable, supported by continued digitization trends, evolving consumer preferences, and ongoing technological innovations that expand virtual card applications and capabilities.

Market research findings reveal several critical insights that shape the USA virtual cards landscape and influence strategic decision-making across the ecosystem:

Digital transformation initiatives across organizations serve as fundamental drivers propelling virtual card adoption throughout the USA market. Enterprise modernization efforts increasingly prioritize payment digitization as companies seek to eliminate manual processes, reduce operational costs, and improve financial visibility. The shift toward remote work arrangements has further accelerated demand for digital payment solutions that enable seamless expense management and supplier payments regardless of geographic location.

Cybersecurity considerations represent another critical driver as organizations face escalating fraud threats and data breach risks. Virtual cards provide enhanced security through tokenization technology, which replaces sensitive card information with unique digital tokens, significantly reducing fraud exposure. Real-time monitoring capabilities enable immediate detection of suspicious activities, while spending controls and merchant restrictions provide additional security layers that traditional payment methods cannot match.

Regulatory compliance requirements continue driving virtual card adoption as organizations seek automated solutions for maintaining detailed transaction records and generating comprehensive audit trails. Financial oversight mandates require enhanced visibility into corporate spending patterns, making virtual cards attractive for their ability to provide granular transaction data and automated reporting capabilities.

Cost optimization pressures motivate organizations to explore virtual card solutions that eliminate check processing fees, reduce administrative overhead, and streamline accounts payable operations. The ability to earn rebates on virtual card transactions while improving cash flow management creates compelling economic incentives for adoption across various industry sectors.

Implementation complexity presents significant challenges for organizations considering virtual card adoption, particularly those with legacy financial systems and established procurement processes. Integration requirements often involve substantial technical resources and extended implementation timelines, creating barriers for smaller organizations with limited IT capabilities. The need for comprehensive staff training and change management initiatives can further complicate adoption efforts and delay realization of expected benefits.

Merchant acceptance limitations continue constraining virtual card utility, as not all suppliers and service providers accept virtual payment methods. Industry-specific challenges exist in sectors such as construction, manufacturing, and hospitality where traditional payment preferences persist. Limited acceptance among smaller vendors and service providers can force organizations to maintain multiple payment systems, reducing operational efficiency gains.

Technology infrastructure requirements create barriers for organizations lacking robust IT systems and cybersecurity frameworks necessary to support virtual card implementations. Security concerns paradoxically serve as both drivers and restraints, as some organizations remain hesitant to adopt digital payment solutions due to perceived cybersecurity risks and data privacy considerations.

Regulatory uncertainty in emerging areas such as cryptocurrency integration and cross-border virtual card transactions creates hesitation among potential adopters. Compliance complexity across different jurisdictions and industry sectors can complicate implementation decisions and delay adoption timelines for multinational organizations.

Artificial intelligence integration presents substantial opportunities for virtual card providers to enhance fraud detection capabilities, optimize spending analytics, and provide predictive insights for financial planning. Machine learning algorithms can analyze transaction patterns to identify anomalies, suggest spending optimizations, and automate approval workflows, creating significant value propositions for enterprise customers seeking advanced financial management capabilities.

Small and medium enterprise penetration represents a largely untapped market segment with significant growth potential. SME-focused solutions that address unique requirements such as simplified implementation, affordable pricing models, and basic integration capabilities could unlock substantial market expansion opportunities. The development of industry-specific virtual card solutions tailored to sectors like healthcare, education, and professional services offers additional growth avenues.

Blockchain technology integration creates opportunities for enhanced transparency, improved security, and streamlined cross-border transactions. Cryptocurrency compatibility could expand virtual card utility and appeal to organizations embracing digital asset strategies. Smart contract integration could automate complex payment scenarios and enable innovative use cases across various industry applications.

Partnership ecosystem expansion offers opportunities for virtual card providers to collaborate with expense management platforms, accounting software providers, and industry-specific solution vendors. Strategic alliances can accelerate market penetration while providing comprehensive solutions that address broader organizational needs beyond basic payment processing capabilities.

Competitive intensity continues escalating as established financial institutions, emerging fintech companies, and specialized payment technology providers compete for market share. Innovation cycles are accelerating with providers investing heavily in product development, user experience enhancements, and advanced security features to differentiate their offerings. The market demonstrates characteristics of rapid evolution with frequent product launches, feature updates, and strategic partnerships reshaping competitive dynamics.

Customer expectations are evolving rapidly as organizations become more sophisticated in their virtual card requirements and demand increasingly comprehensive solutions. User experience standards continue rising with expectations for intuitive interfaces, mobile optimization, and seamless integration capabilities becoming baseline requirements rather than differentiating features.

Technology convergence creates dynamic market conditions as virtual cards increasingly integrate with broader financial technology ecosystems including expense management, procurement automation, and business intelligence platforms. API-first architectures enable flexible integration scenarios while supporting the development of custom solutions tailored to specific organizational requirements.

Regulatory evolution influences market dynamics as government agencies and industry bodies develop frameworks for digital payment oversight, consumer protection, and cybersecurity standards. Compliance requirements create both opportunities and challenges as providers must balance innovation with regulatory adherence while maintaining competitive positioning in rapidly evolving markets.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into USA virtual cards market dynamics. Primary research activities include extensive interviews with industry executives, technology providers, financial institutions, and end-user organizations across various sectors. Survey methodologies capture quantitative data on adoption rates, usage patterns, and satisfaction levels among current virtual card users.

Secondary research components involve analysis of industry reports, regulatory filings, company financial statements, and technology patent databases to understand market trends and competitive positioning. Data triangulation techniques validate findings across multiple sources while ensuring research accuracy and reliability. Market sizing methodologies incorporate bottom-up and top-down approaches to develop comprehensive market assessments.

Qualitative research methods include focus groups with key stakeholders, expert interviews with industry thought leaders, and case study development highlighting successful virtual card implementations. Quantitative analysis encompasses statistical modeling, trend analysis, and forecasting methodologies to project future market developments and growth trajectories.

Research validation processes involve peer review by industry experts, cross-verification of data sources, and sensitivity analysis to ensure robust findings. Continuous monitoring of market developments enables real-time updates to research findings and maintains relevance of insights for strategic decision-making purposes.

Geographic distribution of virtual card adoption across the USA reveals distinct regional patterns influenced by technology infrastructure, industry concentration, and regulatory environments. West Coast markets demonstrate the highest adoption rates at 38% penetration among target organizations, driven by technology sector concentration and early adopter mentality prevalent in Silicon Valley and surrounding areas.

Northeast corridor shows strong growth momentum with financial services hubs in New York and Boston leading enterprise adoption initiatives. The region benefits from established financial infrastructure and high concentration of large corporations with sophisticated payment requirements. Market penetration rates in the Northeast reach 32% among enterprise segments, reflecting strong demand for advanced payment solutions.

Southeast markets exhibit rapid growth trajectories as organizations embrace digital transformation initiatives and modernize legacy payment systems. Industry diversification across healthcare, logistics, and manufacturing sectors creates varied adoption patterns with regional penetration rates approaching 28% among target market segments.

Midwest and Southwest regions demonstrate steady adoption growth supported by expanding technology infrastructure and increasing awareness of virtual card benefits. Agricultural and energy sectors in these regions present unique opportunities for specialized virtual card solutions addressing industry-specific payment requirements and regulatory compliance needs.

Market leadership remains distributed among several key players, each leveraging distinct competitive advantages and strategic positioning approaches. Established financial institutions maintain significant market presence through existing customer relationships and comprehensive financial service offerings that integrate virtual card capabilities with broader banking solutions.

Competitive differentiation increasingly focuses on user experience, integration capabilities, and specialized industry solutions rather than basic virtual card functionality. Strategic partnerships between payment providers and software vendors create comprehensive solutions addressing broader organizational needs beyond payment processing.

Market segmentation analysis reveals distinct categories based on various criteria including card type, end-user segments, industry applications, and deployment models. Understanding segmentation dynamics enables stakeholders to identify specific opportunities and tailor solutions to meet diverse market requirements.

By Card Type:

By End-User Segment:

By Industry Application:

Enterprise segment analysis reveals sophisticated requirements for virtual card solutions that integrate seamlessly with existing financial systems and provide comprehensive reporting capabilities. Large organizations prioritize advanced security features, detailed analytics, and multi-level approval workflows that support complex organizational structures and compliance requirements.

Small business category demonstrates growing adoption driven by simplified implementation processes and affordable pricing models. SME-focused solutions emphasize ease of use, quick setup procedures, and basic integration capabilities that address fundamental payment needs without overwhelming technical complexity. This segment shows adoption growth rates of 25% annually as awareness increases and solutions become more accessible.

Consumer segment insights indicate increasing interest in virtual cards for online shopping security and subscription management. Individual users value convenience features such as instant card generation, spending notifications, and mobile app integration. The consumer category represents significant growth potential as digital payment preferences continue evolving.

Industry-specific categories reveal unique requirements and adoption patterns across different sectors. Healthcare organizations require specialized compliance features, while travel companies need solutions optimized for booking platforms and expense reconciliation. Manufacturing sectors prioritize supplier payment automation and procurement integration capabilities.

Financial institutions benefit from virtual card offerings through enhanced customer relationships, increased transaction volumes, and opportunities for cross-selling additional financial services. Revenue diversification occurs through interchange fees, subscription models, and value-added services that complement core banking operations. Virtual cards enable banks to demonstrate innovation leadership while addressing evolving customer payment preferences.

Enterprise customers realize substantial operational benefits including reduced administrative overhead, improved expense visibility, and enhanced fraud protection. Cost savings emerge through eliminated check processing fees, reduced manual reconciliation efforts, and streamlined accounts payable operations. Organizations report efficiency improvements of 35% in expense management processes following virtual card implementation.

Technology providers gain opportunities to expand market presence through strategic partnerships and integration capabilities that enhance existing software solutions. Fintech companies can leverage virtual card technology to create comprehensive financial management platforms addressing broader organizational needs beyond basic payment processing.

End users experience improved convenience through instant card issuance, mobile accessibility, and simplified expense reporting processes. Enhanced security features provide peace of mind while flexible spending controls enable better financial management and budget adherence across personal and business applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a dominant trend transforming virtual card capabilities through enhanced fraud detection, predictive analytics, and automated decision-making processes. Machine learning algorithms analyze transaction patterns to identify anomalies, optimize spending recommendations, and streamline approval workflows. This technological advancement enables more sophisticated virtual card solutions that provide greater value beyond basic payment processing.

Mobile-first design approaches reflect changing user expectations as organizations prioritize smartphone accessibility and responsive interfaces. Mobile optimization becomes essential for user adoption with mobile transaction volumes representing 58% of total virtual card usage. Applications featuring intuitive navigation, instant notifications, and offline capabilities gain competitive advantages in increasingly mobile-centric business environments.

Industry-specific customization trends toward specialized virtual card solutions tailored to unique sector requirements and regulatory frameworks. Vertical specialization enables providers to address specific pain points in industries such as healthcare, construction, and professional services. This trend creates opportunities for deeper market penetration while commanding premium pricing for specialized functionality.

Sustainability integration reflects growing corporate environmental responsibility initiatives as organizations seek virtual card solutions that support carbon footprint reduction and paperless operations. Green payment initiatives appeal to environmentally conscious organizations while aligning with broader corporate sustainability goals and stakeholder expectations.

Strategic partnership announcements continue reshaping the competitive landscape as virtual card providers collaborate with expense management platforms, accounting software vendors, and industry-specific solution providers. Integration partnerships enable comprehensive solutions that address broader organizational needs while accelerating market penetration through established customer relationships.

Regulatory framework evolution influences industry development as government agencies establish guidelines for digital payment oversight, consumer protection, and cybersecurity standards. Compliance requirements drive product development priorities while creating opportunities for providers that demonstrate regulatory expertise and adherence to emerging standards.

Technology advancement initiatives focus on blockchain integration, quantum-resistant encryption, and advanced biometric authentication methods. Innovation investments by major providers signal commitment to maintaining competitive advantages through technological leadership and enhanced security capabilities.

Market consolidation activities include strategic acquisitions and mergers as established players seek to expand capabilities and market presence. Acquisition strategies target specialized technology providers, regional market leaders, and complementary service offerings that enhance comprehensive solution portfolios.

MarkWide Research analysis indicates that organizations considering virtual card adoption should prioritize comprehensive needs assessment and stakeholder alignment before implementation. Strategic planning should encompass integration requirements, user training needs, and change management processes to ensure successful deployment and user adoption.

Technology evaluation criteria should emphasize security features, integration capabilities, and scalability potential rather than focusing solely on cost considerations. Long-term strategic value often justifies higher initial investments in comprehensive solutions that provide advanced features and growth accommodation capabilities.

Vendor selection processes should include thorough reference checking, pilot program implementation, and comprehensive security assessments. Due diligence activities must evaluate financial stability, technology roadmaps, and customer support capabilities to ensure sustainable partnerships that support long-term organizational objectives.

Implementation strategies should adopt phased approaches that begin with limited use cases and gradually expand functionality as user comfort and system integration mature. Change management programs require executive sponsorship, comprehensive training initiatives, and ongoing support structures to maximize adoption rates and operational benefits.

Market trajectory analysis indicates sustained growth momentum driven by continued digital transformation initiatives and evolving payment preferences across business and consumer segments. Adoption acceleration is expected to continue with penetration rates projected to reach 65% among large enterprises within the next five years, reflecting increasing recognition of virtual card benefits and improving technology maturity.

Technology evolution will likely focus on artificial intelligence integration, blockchain capabilities, and enhanced mobile experiences that provide greater functionality and user convenience. Innovation cycles are expected to accelerate as competitive pressures drive continuous product development and feature enhancement initiatives across the provider ecosystem.

Market expansion opportunities exist in underserved segments including small businesses, government agencies, and specialized industry verticals. Geographic expansion within the USA market shows potential in secondary metropolitan areas and rural regions as technology infrastructure continues improving and awareness increases.

Regulatory developments will likely influence market evolution through enhanced consumer protection requirements, cybersecurity standards, and cross-border transaction frameworks. MWR projections suggest that regulatory clarity will accelerate adoption by reducing implementation uncertainty and providing clearer compliance guidelines for organizations across various sectors.

The USA virtual cards market represents a dynamic and rapidly expanding segment of the digital payments ecosystem, characterized by strong growth momentum and increasing adoption across diverse industry sectors. Market fundamentals remain robust, supported by compelling value propositions including enhanced security, operational efficiency, and cost reduction benefits that address critical organizational needs in an increasingly digital business environment.

Competitive dynamics continue evolving as established financial institutions, innovative fintech companies, and specialized technology providers compete for market share through product differentiation, strategic partnerships, and customer-focused solutions. Technology advancement in areas such as artificial intelligence, mobile optimization, and blockchain integration creates opportunities for enhanced functionality and improved user experiences that drive continued market expansion.

Future prospects appear highly favorable with sustained growth expected across all market segments, driven by ongoing digital transformation initiatives, evolving regulatory frameworks, and increasing recognition of virtual card benefits among organizations of all sizes. Strategic opportunities exist for stakeholders who can effectively address implementation challenges while delivering comprehensive solutions that meet diverse organizational requirements and support long-term business objectives in the evolving digital payments landscape.

What is Virtual Cards?

Virtual cards are digital payment cards that allow users to make online transactions without the need for a physical card. They provide a secure way to shop online by generating a unique card number for each transaction, which helps protect against fraud and unauthorized use.

What are the key players in the USA Virtual Cards Market?

Key players in the USA Virtual Cards Market include companies like PayPal, Stripe, and Mastercard, which offer various virtual card solutions for consumers and businesses. These companies focus on enhancing security and convenience in online transactions, among others.

What are the growth factors driving the USA Virtual Cards Market?

The USA Virtual Cards Market is driven by the increasing demand for secure online transactions, the rise of e-commerce, and the growing adoption of digital wallets. Additionally, the need for enhanced privacy and control over spending is contributing to market growth.

What challenges does the USA Virtual Cards Market face?

The USA Virtual Cards Market faces challenges such as regulatory compliance issues, potential cybersecurity threats, and the need for consumer education regarding the use of virtual cards. These factors can hinder widespread adoption and trust in virtual card solutions.

What opportunities exist in the USA Virtual Cards Market?

Opportunities in the USA Virtual Cards Market include the expansion of fintech innovations, partnerships with e-commerce platforms, and the increasing trend of contactless payments. These developments can enhance user experience and drive further adoption of virtual cards.

What trends are shaping the USA Virtual Cards Market?

Trends shaping the USA Virtual Cards Market include the integration of artificial intelligence for fraud detection, the rise of subscription-based services, and the growing popularity of mobile payment solutions. These trends are influencing how consumers and businesses utilize virtual cards.

USA Virtual Cards Market

| Segmentation Details | Description |

|---|---|

| Product Type | Prepaid Cards, Virtual Debit Cards, Virtual Credit Cards, Corporate Cards |

| End User | Consumers, Small Businesses, Enterprises, Freelancers |

| Technology | Blockchain, Tokenization, Cloud-Based Solutions, Mobile Integration |

| Distribution Channel | Online Platforms, Banking Institutions, Fintech Companies, Payment Processors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

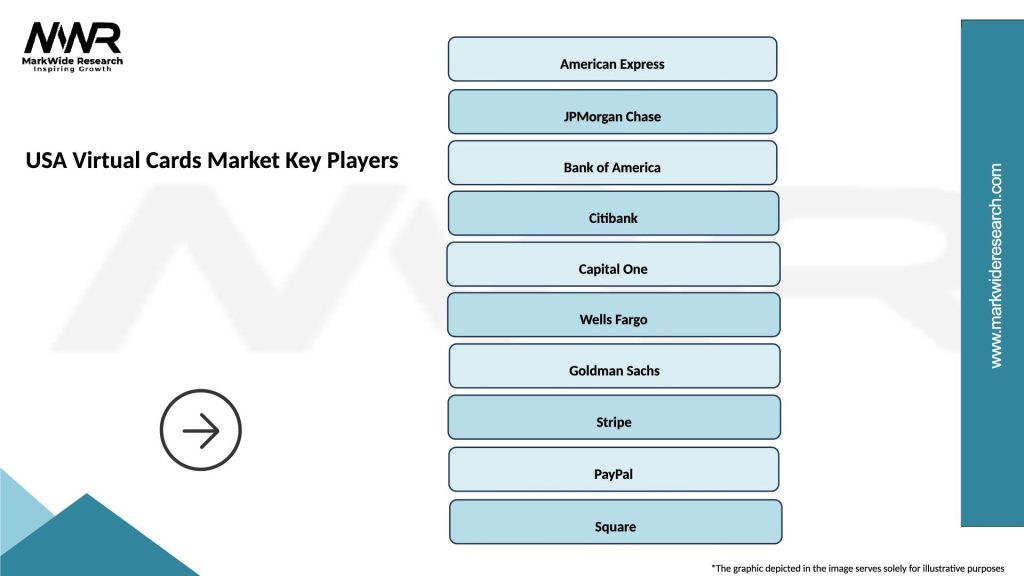

Leading companies in the USA Virtual Cards Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at