444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The USA travelers insurance market represents a dynamic and rapidly evolving sector within the broader insurance industry, driven by increasing travel frequency, heightened awareness of travel risks, and evolving consumer preferences. This comprehensive market encompasses various insurance products designed to protect travelers against unforeseen circumstances during domestic and international trips. Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years, reflecting strong consumer demand and expanding coverage options.

Travel insurance adoption has witnessed significant momentum across diverse demographic segments, particularly among millennials and business travelers who prioritize comprehensive protection during their journeys. The market’s expansion is characterized by innovative product offerings, digital distribution channels, and enhanced customer service capabilities that cater to modern travelers’ evolving needs. Insurance penetration rates have reached approximately 37% among frequent travelers, indicating substantial room for market expansion and product diversification.

Technological advancement continues to reshape the travelers insurance landscape, with insurtech companies introducing streamlined claim processes, real-time assistance services, and personalized coverage options. The integration of artificial intelligence, mobile applications, and data analytics has transformed how insurance providers assess risks, price policies, and deliver customer experiences. Digital channel adoption accounts for nearly 65% of new policy purchases, demonstrating the market’s shift toward technology-driven solutions and customer-centric service delivery models.

The USA travelers insurance market refers to the comprehensive ecosystem of insurance products, services, and solutions specifically designed to protect individuals and groups against financial losses and risks associated with travel activities within the United States and internationally. This market encompasses various coverage types including trip cancellation, medical emergencies, baggage protection, travel delays, and specialized coverage for adventure activities and business travel.

Travelers insurance serves as a financial safety net that provides peace of mind and monetary protection against unexpected events that could disrupt or negatively impact travel experiences. The market includes traditional insurance carriers, specialized travel insurance companies, and emerging insurtech firms that offer innovative coverage solutions through digital platforms and partnerships with travel service providers.

Market participants range from established insurance giants to niche providers focusing on specific traveler segments or coverage types. The ecosystem includes insurance brokers, comparison platforms, travel agencies, and direct-to-consumer channels that facilitate policy distribution and customer acquisition across diverse market segments.

Strategic market analysis reveals the USA travelers insurance market as a high-growth sector characterized by increasing consumer awareness, expanding coverage options, and technological innovation. The market benefits from rising travel volumes, growing disposable income, and heightened risk consciousness among American travelers. Premium growth rates have consistently outpaced traditional insurance segments, with annual increases of 12.5% driven by enhanced coverage adoption and premium product offerings.

Competitive dynamics showcase a fragmented market with opportunities for both established players and new entrants to capture market share through differentiated value propositions. Leading companies are investing heavily in digital transformation, customer experience enhancement, and product innovation to maintain competitive advantages. Market consolidation trends indicate potential merger and acquisition activity as companies seek to expand their capabilities and market reach.

Consumer behavior patterns demonstrate increasing sophistication in insurance purchasing decisions, with travelers seeking comprehensive coverage, transparent pricing, and seamless claim experiences. The market’s future trajectory appears positive, supported by demographic trends, travel industry recovery, and evolving risk landscapes that create ongoing demand for innovative insurance solutions.

Market intelligence reveals several critical insights that shape the USA travelers insurance landscape and influence strategic decision-making across industry participants:

Primary growth drivers propelling the USA travelers insurance market forward include fundamental shifts in travel behavior, risk perception, and consumer expectations that create sustained demand for comprehensive coverage solutions.

Travel volume recovery following global disruptions has generated renewed interest in travel protection, with consumers demonstrating increased willingness to invest in insurance coverage. The resurgence of business travel, leisure tourism, and international trips creates expanding opportunities for insurance providers to capture market share through targeted product offerings and strategic partnerships.

Demographic trends significantly influence market growth, as younger generations prioritize experiential spending and adventure travel that requires specialized coverage. These travelers often engage in activities with higher risk profiles, driving demand for comprehensive medical coverage, adventure sports protection, and emergency evacuation services that traditional policies may not adequately address.

Digital adoption accelerates market expansion by reducing distribution costs, improving customer experiences, and enabling personalized coverage options. Technology-driven solutions appeal to modern consumers who expect seamless, mobile-optimized purchasing processes and instant policy delivery. Online penetration rates continue climbing, with digital channels accounting for 72% of new customer acquisitions among leading providers.

Risk awareness enhancement drives market growth as consumers become more conscious of potential travel disruptions, medical emergencies, and financial losses associated with trip cancellations or interruptions. Media coverage of travel-related incidents and global events reinforces the value proposition of comprehensive travel insurance coverage.

Market challenges present obstacles to growth and profitability within the USA travelers insurance sector, requiring strategic responses from industry participants to maintain competitive positioning and sustainable business models.

Price sensitivity remains a significant constraint, particularly among leisure travelers who view insurance as an optional expense rather than essential protection. Economic uncertainties and budget constraints can lead consumers to forgo coverage or select minimal protection levels, limiting premium growth and market penetration opportunities.

Regulatory complexity across different states creates compliance challenges and operational inefficiencies for insurance providers seeking to expand their geographic footprint. Varying regulatory requirements, licensing procedures, and consumer protection standards increase administrative costs and complicate product standardization efforts.

Claims fraud poses ongoing challenges that impact profitability and pricing strategies across the market. Fraudulent claims related to trip cancellations, medical emergencies, and baggage losses require sophisticated detection systems and investigation processes that increase operational costs and claim settlement times.

Market education gaps persist among potential customers who may not fully understand coverage benefits, exclusions, or claim procedures. Limited awareness of available protection options and misconceptions about coverage scope can restrict market growth and customer satisfaction levels.

Emerging opportunities within the USA travelers insurance market present significant potential for growth, innovation, and market expansion across diverse customer segments and coverage categories.

Insurtech innovation creates opportunities for new entrants and established players to differentiate their offerings through technology-driven solutions, personalized coverage options, and enhanced customer experiences. Artificial intelligence, machine learning, and data analytics enable more sophisticated risk assessment, dynamic pricing, and proactive customer service capabilities.

Partnership expansion with travel ecosystem participants offers mutual benefits through embedded insurance solutions, cross-selling opportunities, and enhanced customer value propositions. Collaborations with airlines, hotels, travel agencies, and booking platforms can significantly expand distribution reach and customer acquisition capabilities.

Niche market development presents opportunities to serve specialized traveler segments with tailored coverage solutions. Adventure travelers, business executives, medical tourists, and remote workers represent growing segments with specific insurance needs that may not be adequately addressed by standard policies.

International expansion opportunities exist for US-based providers to extend their services to American travelers visiting international destinations, potentially through partnerships with global assistance networks and local service providers. Cross-border travel recovery indicates 43% growth potential in international coverage demand.

Market forces shaping the USA travelers insurance landscape reflect complex interactions between consumer behavior, competitive pressures, regulatory requirements, and technological advancement that influence strategic decision-making and business performance.

Supply and demand dynamics demonstrate increasing consumer demand for comprehensive coverage options while insurance providers expand their product portfolios and distribution capabilities. The balance between coverage breadth, pricing competitiveness, and profitability requirements drives continuous product innovation and market positioning strategies.

Competitive intensity continues escalating as traditional insurers, specialized travel insurance companies, and insurtech startups compete for market share through differentiated value propositions, pricing strategies, and customer experience enhancements. Market fragmentation provides opportunities for niche players while creating challenges for achieving economies of scale.

Technology disruption transforms traditional business models and customer expectations, requiring significant investments in digital capabilities, data analytics, and automation technologies. Companies that successfully leverage technology to improve operational efficiency and customer satisfaction gain competitive advantages in market positioning and profitability.

Regulatory evolution influences product development, distribution strategies, and operational procedures across different jurisdictions. Compliance requirements and consumer protection standards shape market practices while creating barriers to entry for new participants without adequate regulatory expertise and resources.

Comprehensive research approach employed in analyzing the USA travelers insurance market combines quantitative data analysis, qualitative insights, and industry expertise to provide accurate market intelligence and strategic recommendations for stakeholders.

Primary research activities include extensive interviews with industry executives, insurance professionals, travel industry participants, and consumer focus groups to gather firsthand insights into market trends, challenges, and opportunities. These interactions provide valuable perspectives on competitive dynamics, customer preferences, and emerging market developments.

Secondary research sources encompass industry reports, regulatory filings, company financial statements, trade publications, and academic studies that provide comprehensive market data and analytical frameworks. This information supports quantitative analysis and trend identification across multiple market dimensions.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review procedures, and statistical analysis techniques that identify inconsistencies and verify market intelligence. MarkWide Research methodologies incorporate rigorous quality control measures to maintain research integrity and reliability.

Analytical frameworks utilize advanced statistical models, trend analysis, and forecasting techniques to project market developments and identify strategic implications for industry participants. These methodologies provide robust foundations for strategic planning and investment decision-making processes.

Geographic market distribution across the United States reveals significant variations in travelers insurance adoption rates, coverage preferences, and growth potential that influence strategic market approaches and resource allocation decisions.

Northeast region demonstrates the highest market penetration rates, accounting for approximately 28% of total market activity, driven by high-income demographics, frequent business travel, and international trip volumes. Major metropolitan areas including New York, Boston, and Washington D.C. represent concentrated demand centers with sophisticated insurance requirements and premium coverage preferences.

West Coast markets show strong growth momentum, particularly in California, Washington, and Oregon, where tech-savvy consumers embrace digital insurance solutions and comprehensive coverage options. The region’s market share of 24% reflects robust travel activity, adventure tourism, and international business connections that drive insurance demand.

Southeast region exhibits rapid growth potential, with Florida leading expansion due to its tourism industry, cruise departures, and retiree population with active travel lifestyles. The region’s 18% market share continues expanding as economic development and travel infrastructure improvements support increased travel activity.

Central regions including Texas, Illinois, and Colorado demonstrate steady growth patterns driven by business travel, outdoor recreation, and family vacation trends. These markets represent 30% combined market share with opportunities for increased penetration through targeted marketing and distribution strategies.

Market competition within the USA travelers insurance sector features diverse participants ranging from established insurance giants to innovative insurtech companies, each pursuing distinct strategies to capture market share and build sustainable competitive advantages.

Competitive strategies emphasize product differentiation, technology innovation, customer service excellence, and strategic partnerships to build market position and customer loyalty. Leading companies invest significantly in digital transformation, claims processing automation, and customer experience enhancement to maintain competitive advantages.

Market segmentation analysis reveals distinct customer categories and coverage types that drive strategic positioning and product development decisions across the USA travelers insurance market.

By Coverage Type:

By Traveler Type:

By Distribution Channel:

Coverage category analysis provides detailed insights into specific market segments and their unique characteristics, growth patterns, and strategic implications for industry participants.

Trip Cancellation Coverage represents the largest market segment, driven by increasing trip costs and consumer awareness of potential financial losses. This category benefits from clear value propositions and straightforward coverage benefits that resonate with risk-averse travelers. Segment growth rates indicate 9.3% annual expansion supported by premium trip bookings and enhanced coverage options.

Medical Coverage demonstrates strong growth momentum, particularly among international travelers and older demographics who prioritize health protection during travel. Rising healthcare costs and limited international coverage from domestic health plans drive demand for comprehensive medical travel insurance. The segment’s expansion reflects growing awareness of potential medical emergency costs abroad.

Adventure Travel Coverage represents a high-growth niche segment catering to travelers engaging in extreme sports, adventure activities, and remote destination travel. This specialized coverage commands premium pricing while serving a dedicated customer base willing to pay for comprehensive protection during high-risk activities.

Business Travel Coverage shows steady growth supported by corporate travel recovery and enhanced coverage requirements from risk-conscious employers. This segment benefits from group purchasing power, customized coverage options, and streamlined administration processes that appeal to corporate travel managers.

Strategic advantages available to industry participants and stakeholders within the USA travelers insurance market create opportunities for sustainable growth, competitive positioning, and value creation across the ecosystem.

Insurance Providers benefit from expanding market opportunities, diversified revenue streams, and technology-enabled operational efficiencies that enhance profitability and customer satisfaction. Digital transformation initiatives reduce operational costs while improving customer experiences and competitive positioning in the marketplace.

Travel Industry Partners gain additional revenue streams through insurance commissions, enhanced customer value propositions, and improved customer retention rates. Embedded insurance solutions create seamless customer experiences while generating incremental income from existing customer relationships.

Technology Vendors capitalize on growing demand for digital solutions, data analytics capabilities, and automation technologies that transform traditional insurance operations. Innovation opportunities exist across customer acquisition, underwriting, claims processing, and customer service functions.

Consumers benefit from expanded coverage options, competitive pricing, improved customer service, and simplified purchasing processes that enhance overall travel experiences. Technology-driven solutions provide greater transparency, faster claims processing, and personalized coverage recommendations that meet individual needs.

Regulatory Bodies achieve enhanced consumer protection through improved market oversight, standardized practices, and technology-enabled compliance monitoring. Market growth generates increased regulatory fees and supports consumer education initiatives that promote market stability and consumer confidence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the USA travelers insurance market reflect evolving consumer preferences, technological capabilities, and industry innovations that influence strategic planning and competitive positioning.

Personalization Enhancement drives product development as consumers increasingly expect customized coverage options tailored to their specific travel patterns, risk profiles, and budget requirements. Advanced data analytics enable insurers to offer personalized recommendations and dynamic pricing that reflects individual risk characteristics.

Mobile-First Strategies dominate customer acquisition and service delivery as travelers expect seamless mobile experiences for policy purchase, document access, and claims submission. Mobile applications with integrated assistance services and real-time communication capabilities become competitive differentiators in customer satisfaction and retention.

Embedded Insurance Solutions gain momentum as travel platforms integrate coverage options directly into booking processes, creating frictionless purchasing experiences and higher conversion rates. This trend benefits both insurance providers and travel companies through improved customer experiences and additional revenue streams.

Sustainability Focus emerges as environmentally conscious travelers seek insurance providers with sustainable business practices and carbon-neutral operations. Green initiatives and environmental responsibility become factors in consumer purchasing decisions and brand preference formation.

Real-Time Assistance becomes standard expectation as travelers demand immediate support during emergencies and travel disruptions. AI-powered chatbots, 24/7 assistance hotlines, and proactive communication systems enhance customer satisfaction and claim resolution efficiency.

Recent industry developments demonstrate the dynamic nature of the USA travelers insurance market and highlight significant changes that impact competitive positioning and strategic planning across industry participants.

Technology Integration Advances include the deployment of artificial intelligence for claims processing automation, machine learning algorithms for risk assessment, and blockchain technology for secure document management. These innovations reduce operational costs while improving accuracy and customer service quality.

Partnership Expansions between insurance providers and major travel platforms create new distribution channels and customer acquisition opportunities. Recent collaborations with airlines, hotel chains, and online travel agencies demonstrate the industry’s focus on embedded insurance solutions and seamless customer experiences.

Product Innovation Initiatives introduce specialized coverage for emerging travel trends including remote work travel, extended stays, and adventure tourism. These developments reflect industry responsiveness to changing consumer needs and market opportunities in niche segments.

Regulatory Developments across various states impact product offerings, distribution strategies, and operational procedures. Recent regulatory changes emphasize consumer protection, transparency requirements, and standardized disclosure practices that influence market practices and compliance costs.

Merger and Acquisition Activity demonstrates industry consolidation trends as companies seek to expand capabilities, geographic reach, and market share through strategic combinations. These transactions reshape competitive dynamics and create opportunities for enhanced service offerings and operational efficiencies.

Strategic recommendations for industry participants focus on sustainable growth strategies, competitive positioning, and operational excellence that support long-term success in the evolving USA travelers insurance market.

Digital Transformation Priority requires significant investment in technology infrastructure, customer-facing applications, and data analytics capabilities that enable competitive differentiation and operational efficiency. Companies should prioritize mobile-first strategies and seamless digital experiences that meet modern consumer expectations.

Partnership Strategy Development should focus on strategic alliances with travel ecosystem participants that provide mutual benefits and expanded market reach. MWR analysis suggests that embedded insurance solutions through travel platforms can increase conversion rates by 35% compared to standalone policy sales.

Product Portfolio Optimization requires continuous innovation and customization capabilities that address evolving traveler needs and market segments. Companies should develop specialized coverage options for niche markets while maintaining comprehensive solutions for mainstream travelers.

Customer Experience Enhancement should emphasize simplified purchasing processes, transparent coverage explanations, and efficient claims handling that build customer satisfaction and loyalty. Investment in customer service technology and training programs supports competitive positioning and retention rates.

Market Education Initiatives can expand market penetration by increasing consumer awareness of coverage benefits and value propositions. Educational content, comparison tools, and transparent pricing strategies help overcome consumer resistance and build market confidence.

Market projections for the USA travelers insurance sector indicate continued growth momentum supported by favorable demographic trends, technology advancement, and evolving consumer preferences that create sustained demand for comprehensive travel protection solutions.

Growth trajectory expectations suggest the market will maintain robust expansion rates driven by travel industry recovery, increased risk awareness, and product innovation initiatives. MarkWide Research forecasts indicate the market could achieve annual growth rates of 10.5% over the next five years, supported by digital transformation and expanded distribution channels.

Technology evolution will continue transforming market dynamics through artificial intelligence, automation, and data analytics that enhance operational efficiency and customer experiences. Future developments may include predictive analytics for risk assessment, blockchain for claims processing, and IoT integration for real-time travel monitoring and assistance.

Market consolidation trends suggest potential merger and acquisition activity as companies seek to achieve economies of scale, expand geographic reach, and enhance technological capabilities. This consolidation may create opportunities for specialized providers while challenging smaller players to differentiate their offerings.

Regulatory evolution will likely focus on consumer protection, data privacy, and standardization initiatives that shape market practices and operational requirements. Companies must maintain compliance readiness while adapting to changing regulatory landscapes across different jurisdictions.

Consumer behavior shifts toward personalized, on-demand coverage options will drive continued product innovation and service delivery enhancements. Future market success will depend on companies’ abilities to adapt to changing preferences while maintaining profitability and competitive positioning in an increasingly dynamic marketplace.

Market assessment reveals the USA travelers insurance market as a dynamic, high-growth sector with significant opportunities for expansion, innovation, and value creation across diverse stakeholder groups. The market benefits from favorable underlying trends including travel recovery, increased risk awareness, and technology-enabled service enhancements that support sustained growth momentum.

Strategic positioning requires companies to balance growth ambitions with operational excellence, customer satisfaction, and competitive differentiation in an increasingly crowded marketplace. Success factors include digital transformation capabilities, strategic partnerships, product innovation, and customer experience excellence that build sustainable competitive advantages.

Future success in the USA travelers insurance market will depend on companies’ abilities to adapt to evolving consumer preferences, leverage technology for operational efficiency, and maintain regulatory compliance while pursuing growth opportunities. The market’s positive outlook reflects strong fundamentals and expanding opportunities for industry participants who can execute effective strategies and deliver superior customer value in this dynamic and evolving sector.

What is Travelers Insurance?

Travelers Insurance refers to a type of insurance that provides coverage for individuals and families while traveling, including health, trip cancellation, and lost luggage protection.

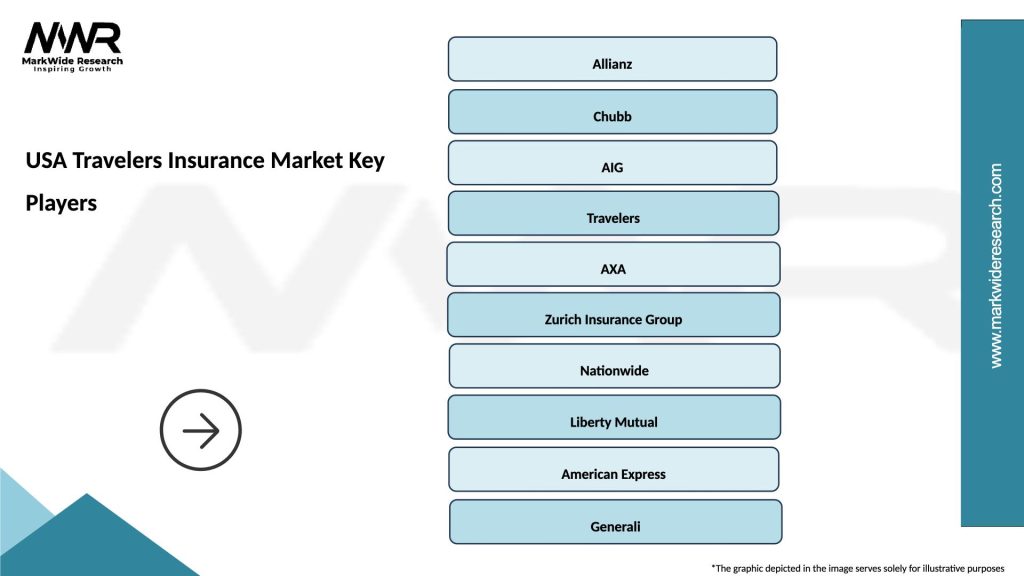

What are the key players in the USA Travelers Insurance Market?

Key players in the USA Travelers Insurance Market include Allianz Global Assistance, AIG Travel, and Travel Guard, among others.

What are the main drivers of growth in the USA Travelers Insurance Market?

The main drivers of growth in the USA Travelers Insurance Market include increasing travel frequency, rising awareness of travel risks, and the growing demand for comprehensive travel protection.

What challenges does the USA Travelers Insurance Market face?

Challenges in the USA Travelers Insurance Market include regulatory compliance issues, competition from alternative insurance products, and fluctuating travel patterns due to global events.

What opportunities exist in the USA Travelers Insurance Market?

Opportunities in the USA Travelers Insurance Market include the expansion of digital insurance platforms, the rise of adventure travel insurance, and the increasing popularity of personalized travel coverage options.

What trends are shaping the USA Travelers Insurance Market?

Trends shaping the USA Travelers Insurance Market include the integration of technology in policy management, the rise of on-demand insurance products, and a focus on customer-centric services.

USA Travelers Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Trip Cancellation, Medical Coverage, Baggage Insurance, Emergency Assistance |

| Customer Type | Business Travelers, Family Vacationers, Solo Adventurers, Senior Citizens |

| Distribution Channel | Online Platforms, Travel Agents, Direct Sales, Insurance Brokers |

| Coverage Type | Comprehensive, Basic, Annual, Short-Term |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the USA Travelers Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at