444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The USA sports team and club market represents one of the most dynamic and influential sectors within the American entertainment and leisure industry. This comprehensive market encompasses professional sports franchises, amateur athletic clubs, recreational sports organizations, and community-based sporting facilities across the nation. Market dynamics indicate substantial growth driven by increasing consumer participation in sports activities, rising disposable income, and growing awareness of health and fitness benefits.

Professional sports leagues including the NFL, NBA, MLB, and NHL form the cornerstone of this market, generating significant revenue through ticket sales, broadcasting rights, merchandise, and sponsorship agreements. The market extends beyond professional athletics to include amateur sports clubs, youth leagues, collegiate athletics, and recreational facilities that serve millions of Americans seeking active lifestyle opportunities.

Digital transformation has revolutionized how sports teams and clubs operate, with technology integration enhancing fan engagement, operational efficiency, and revenue generation. The market demonstrates remarkable resilience, with participation rates showing consistent growth at approximately 4.2% annually across various sporting categories. Youth sports participation alone accounts for nearly 73% of children between ages 6-17 engaging in organized athletic activities.

Geographic distribution varies significantly, with major metropolitan areas hosting the majority of professional franchises while suburban and rural communities focus on amateur and recreational sports organizations. The market’s infrastructure includes stadiums, arenas, training facilities, and community sports centers that collectively support the diverse needs of American sports enthusiasts.

The USA sports team and club market refers to the comprehensive ecosystem of organized athletic organizations, recreational facilities, and sporting enterprises that provide competitive and leisure sports opportunities across the United States. This market encompasses professional sports franchises, amateur athletic clubs, youth leagues, adult recreational organizations, and community-based sports facilities that collectively serve the sporting needs of American consumers.

Professional sports teams represent the most visible segment, including franchises from major leagues such as the National Football League, National Basketball Association, Major League Baseball, and National Hockey League. These organizations generate revenue through multiple streams including ticket sales, broadcasting rights, merchandise, concessions, and corporate partnerships.

Amateur sports clubs constitute a significant portion of the market, providing organized athletic opportunities for participants of all skill levels. These organizations range from youth soccer leagues and little league baseball to adult recreational basketball and tennis clubs. Community sports centers and recreational facilities support these activities by providing venues, equipment, and professional instruction.

The market definition extends to include supporting infrastructure such as sports equipment retailers, athletic training facilities, sports medicine providers, and technology companies that serve the broader sports ecosystem. This comprehensive approach recognizes the interconnected nature of sports organizations and their supporting industries.

Market performance in the USA sports team and club sector demonstrates robust growth across multiple segments, driven by increasing consumer interest in active lifestyles and sports entertainment. The market benefits from strong demographic trends, including growing youth participation in organized sports and increasing adult engagement in recreational athletic activities.

Professional sports continue to dominate revenue generation, with major league franchises experiencing consistent growth in attendance, media rights, and corporate sponsorship. The sector has successfully adapted to changing consumer preferences through enhanced fan experiences, digital engagement platforms, and innovative marketing strategies. Broadcasting revenue has increased by approximately 8.5% annually over the past five years, reflecting the enduring popularity of sports content.

Amateur and recreational segments show particularly strong growth potential, with participation rates climbing steadily across age groups. Youth sports programs report enrollment increases of approximately 6.3% annually, while adult recreational leagues experience similar growth patterns. This expansion reflects broader societal trends toward health consciousness and community engagement.

Technology integration has emerged as a critical success factor, with organizations investing heavily in digital platforms, data analytics, and fan engagement tools. Mobile applications, streaming services, and social media platforms have transformed how teams and clubs interact with their audiences, creating new revenue opportunities and enhancing customer loyalty.

Regional variations present both opportunities and challenges, with urban markets showing higher professional sports concentration while suburban and rural areas demonstrate strong demand for amateur and recreational programs. This geographic diversity requires tailored approaches to market development and service delivery.

Consumer behavior analysis reveals several critical trends shaping the USA sports team and club market. Modern sports consumers demonstrate increased willingness to invest in premium experiences, with season ticket holders showing remarkable loyalty despite economic fluctuations. The market benefits from multigenerational appeal, attracting families seeking shared entertainment experiences.

Market segmentation reveals distinct consumer preferences across age groups, income levels, and geographic regions. Professional sports attract broad audiences seeking entertainment value, while amateur clubs focus on skill development and social interaction. Recreational programs emphasize fitness, fun, and community building.

Health consciousness trends represent the primary driver of growth in the USA sports team and club market. Americans increasingly recognize the physical and mental health benefits of regular athletic participation, leading to higher enrollment in organized sports programs. This trend spans all age groups, from youth development programs to senior recreational leagues.

Economic prosperity in key demographic segments provides consumers with disposable income to invest in sports participation and entertainment. Middle and upper-income families prioritize sports activities for their children, viewing athletic participation as essential for personal development and college preparation. Household spending on sports-related activities has grown consistently, reflecting the sector’s priority status in family budgets.

Technology advancement enhances the sports experience through improved training methods, performance analytics, and fan engagement platforms. Smart facilities, wearable technology, and data-driven coaching methods attract tech-savvy consumers seeking optimized athletic experiences. Digital platforms enable organizations to reach broader audiences and create personalized experiences.

Corporate wellness initiatives drive demand for adult recreational sports programs as employers recognize the benefits of employee fitness and team building. Many companies sponsor employee sports leagues or provide fitness facility memberships, expanding the market for adult recreational programs.

Community development priorities support sports facility construction and program expansion as local governments recognize sports’ role in community building and youth development. Public-private partnerships increasingly fund sports infrastructure projects, expanding access to quality athletic facilities.

Media coverage expansion through streaming services and social media platforms increases sports visibility and fan engagement. Enhanced broadcast quality and accessibility attract new audiences while deepening existing fan relationships.

High operational costs present significant challenges for sports teams and clubs across all market segments. Professional franchises face escalating player salaries, facility maintenance expenses, and technology infrastructure investments. Amateur organizations struggle with equipment costs, facility rental fees, and insurance requirements that can limit program accessibility.

Economic sensitivity affects consumer spending on discretionary sports activities during economic downturns. While professional sports demonstrate relative resilience, amateur and recreational programs often experience reduced participation when household budgets tighten. Membership retention becomes challenging during economic uncertainty.

Facility limitations constrain market growth in many regions, particularly in urban areas where land costs prohibit new construction. Existing facilities often require significant upgrades to meet modern standards, creating financial burdens for organizations. Scheduling conflicts and capacity constraints limit program expansion opportunities.

Safety concerns regarding contact sports and injury risks influence participation decisions, particularly in youth programs. Parents increasingly scrutinize sports safety protocols, leading to reduced enrollment in certain activities. Organizations must invest heavily in safety equipment, training, and insurance coverage.

Competition for leisure time intensifies as digital entertainment options proliferate. Video games, streaming services, and social media compete for consumer attention, particularly among younger demographics. Sports organizations must continuously innovate to maintain relevance and engagement.

Regulatory compliance requirements increase operational complexity and costs. Youth sports organizations face extensive background check requirements, safety regulations, and facility standards that can burden volunteer-based programs. Professional sports navigate complex labor relations and league regulations.

Digital transformation initiatives present substantial opportunities for sports teams and clubs to enhance fan engagement and generate new revenue streams. Virtual reality experiences, augmented reality applications, and interactive mobile platforms can create immersive experiences that extend beyond traditional game attendance. E-sports integration offers opportunities to engage younger demographics and create hybrid entertainment experiences.

Demographic expansion represents a significant growth opportunity as organizations develop programs targeting underserved populations. Women’s sports programs, senior recreational leagues, and adaptive sports for individuals with disabilities show strong growth potential. Cultural diversity initiatives can attract participants from various ethnic and socioeconomic backgrounds.

Corporate partnerships beyond traditional sponsorship arrangements offer mutual benefits for sports organizations and businesses. Employee wellness programs, team-building activities, and corporate entertainment packages create steady revenue streams while serving business community needs. B2B services including facility rental and event management expand market opportunities.

Health and wellness integration allows sports clubs to offer comprehensive lifestyle services including nutrition counseling, mental health support, and fitness training. This holistic approach attracts health-conscious consumers seeking complete wellness solutions rather than just athletic activities.

Technology monetization through data analytics, performance tracking, and personalized training programs creates new revenue opportunities. Sports organizations can leverage participant data to offer premium services and attract corporate partners interested in consumer insights.

Facility optimization through multi-use designs and flexible programming maximizes revenue potential from existing infrastructure. Sports facilities can host concerts, conferences, and community events during off-seasons, improving financial sustainability.

Supply and demand equilibrium in the USA sports team and club market varies significantly across segments and geographic regions. Professional sports maintain artificial scarcity through league structures and territorial rights, creating premium pricing opportunities. Amateur and recreational segments operate in more competitive environments where quality, convenience, and value determine success.

Seasonal fluctuations impact market dynamics as different sports peak during specific periods. Organizations increasingly develop year-round programming to maintain steady revenue streams and facility utilization. Cross-seasonal sports and indoor alternatives help stabilize demand patterns.

Consumer loyalty patterns demonstrate strong emotional connections to sports teams and clubs, creating sustainable competitive advantages for established organizations. However, new entrants can succeed by identifying underserved niches or offering innovative experiences. Brand loyalty in professional sports often spans generations, providing stable fan bases.

Price sensitivity varies across market segments, with professional sports commanding premium pricing while recreational programs must remain accessible to broad populations. Organizations balance revenue optimization with participation goals, often using tiered pricing strategies to serve diverse economic segments.

Innovation cycles drive continuous evolution in sports experiences, from facility design to training methodologies. Organizations that successfully adopt new technologies and programming concepts gain competitive advantages, while those resistant to change risk losing market share.

Regulatory influences shape market dynamics through safety requirements, facility standards, and youth protection policies. Organizations must balance compliance costs with operational efficiency while maintaining program quality and accessibility.

Comprehensive market analysis of the USA sports team and club market employs multiple research methodologies to ensure accurate and actionable insights. Primary research includes extensive surveys of sports organization administrators, participant interviews, and facility utilization studies across diverse geographic regions and market segments.

Data collection strategies incorporate both quantitative and qualitative research approaches. Quantitative methods include statistical analysis of participation rates, revenue trends, and demographic patterns using industry databases and government statistics. Survey instruments capture consumer preferences, spending patterns, and satisfaction levels across various sports categories.

Qualitative research involves in-depth interviews with industry executives, coaches, and participants to understand market dynamics, challenges, and opportunities. Focus groups provide insights into consumer decision-making processes and emerging trends that quantitative data might not reveal.

Secondary research analyzes industry reports, academic studies, and government publications to establish market context and validate primary research findings. MarkWide Research databases provide historical trend analysis and competitive intelligence across multiple market segments.

Geographic sampling ensures representation from urban, suburban, and rural markets across all major US regions. This approach captures regional variations in sports preferences, facility availability, and economic conditions that influence market dynamics.

Temporal analysis examines market trends over multiple years to identify cyclical patterns, growth trajectories, and emerging opportunities. Seasonal variations and economic cycle impacts receive particular attention to understand market resilience and volatility factors.

Northeast region demonstrates the highest concentration of professional sports franchises and established amateur programs. Major metropolitan areas including New York, Boston, and Philadelphia support multiple professional teams across all major leagues. The region benefits from high population density, strong economic conditions, and deep sports traditions. Market share in professional sports revenue accounts for approximately 28% of national totals.

Southeast region shows rapid growth in both professional and amateur sports participation. States like Florida, Georgia, and North Carolina experience population growth that drives demand for new sports facilities and programs. College sports maintain particularly strong followings, influencing amateur program development. Youth participation rates in organized sports reach 76% in suburban areas.

Midwest region maintains strong traditions in both professional and amateur sports, with particular strength in football, basketball, and baseball. The region benefits from community-oriented sports cultures and extensive high school athletic programs. Amateur sports clubs show consistent membership growth of approximately 4.8% annually.

West Coast leads in sports innovation and technology integration, with California organizations pioneering new fan engagement platforms and training methodologies. The region attracts significant investment in sports technology startups and facility modernization projects. Professional sports revenue growth outpaces national averages by 2.3 percentage points.

Southwest region experiences rapid market expansion driven by population growth and economic development. Texas and Arizona lead in new facility construction and program development. The region shows particular strength in youth soccer and recreational adult leagues.

Mountain West demonstrates strong outdoor sports participation and recreational program growth. The region benefits from favorable climate conditions and outdoor recreation culture that supports year-round athletic activities.

Professional sports leagues dominate the competitive landscape through established franchise systems and territorial exclusivity. These organizations compete primarily on entertainment value, fan experience, and championship success rather than direct market competition.

Regional competition varies significantly based on local sports preferences, facility availability, and demographic characteristics. Urban markets support multiple professional teams and extensive amateur programs, while rural areas focus on community-based recreational activities.

Competitive strategies increasingly emphasize fan experience enhancement, community engagement, and technology integration. Organizations invest heavily in facility upgrades, digital platforms, and personalized services to differentiate their offerings.

By Organization Type:

By Sport Category:

By Age Group:

By Geographic Scope:

Professional Sports Category demonstrates remarkable financial performance and cultural influence despite representing a small percentage of total participants. These organizations generate substantial revenue through multiple streams while serving as community focal points and economic drivers. Revenue diversification strategies increasingly include real estate development, entertainment venues, and corporate services.

Youth Sports Category shows the strongest growth potential with increasing parental investment in children’s athletic development. Programs emphasize skill development, character building, and college preparation. Specialization trends see families investing in year-round training for specific sports, creating opportunities for specialized facilities and coaching services.

Adult Recreational Category benefits from health consciousness trends and social networking desires. These programs often combine fitness goals with social interaction, creating strong community bonds. Corporate wellness initiatives drive significant participation as employers recognize employee health benefits.

Facility-Based Category includes sports clubs, fitness centers, and recreational facilities that provide infrastructure for various sports activities. These organizations often serve multiple sports and age groups, maximizing facility utilization and revenue potential. Multi-use facilities demonstrate superior financial performance through diversified programming.

Technology-Enhanced Category represents emerging opportunities in sports analytics, virtual training, and digital fan engagement. Organizations investing in technology solutions report improved participant satisfaction and operational efficiency. Data-driven programs attract tech-savvy consumers seeking optimized athletic experiences.

Community-Based Category emphasizes local engagement and grassroots development. These organizations often rely on volunteer support and community funding but provide essential services in underserved areas. Public-private partnerships increasingly support community sports development initiatives.

Economic benefits for industry participants include substantial revenue generation opportunities across multiple streams. Professional sports organizations create significant economic impact through job creation, tourism, and local business development. Amateur organizations benefit from community support, volunteer engagement, and potential growth into larger enterprises.

Brand building opportunities allow sports organizations to develop strong emotional connections with consumers that translate into long-term loyalty and premium pricing power. Community integration provides organizations with stable support bases and positive public relations benefits.

Health and wellness promotion creates positive social impact while building sustainable business models. Organizations contributing to community health often receive public support and partnership opportunities. Youth development programs generate particular community goodwill and support.

Technology advancement benefits include operational efficiency improvements, enhanced customer experiences, and new revenue stream development. Organizations investing in technology solutions often achieve competitive advantages and improved profitability.

Stakeholder benefits extend to participants, families, communities, and corporate partners. Participants gain health benefits, social connections, and skill development. Families find shared activities and child development opportunities. Communities benefit from economic development and social cohesion.

Corporate stakeholders including sponsors and partners gain marketing opportunities, employee wellness benefits, and community engagement platforms. Media partners benefit from content that attracts large, engaged audiences across demographic segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping how sports organizations operate and engage with audiences. Mobile applications, social media integration, and streaming platforms create new touchpoints for fan interaction while generating valuable data insights. Virtual reality experiences and augmented reality applications enhance training and entertainment value.

Health and wellness integration expands beyond traditional athletic training to include nutrition counseling, mental health support, and lifestyle coaching. Sports organizations increasingly position themselves as comprehensive wellness providers rather than just athletic activity coordinators. Holistic programming attracts health-conscious consumers seeking complete lifestyle solutions.

Sustainability initiatives gain importance as organizations respond to environmental concerns and community expectations. Green facility design, renewable energy adoption, and waste reduction programs demonstrate corporate responsibility while potentially reducing operational costs.

Personalization trends leverage data analytics to create customized experiences for participants and fans. Tailored training programs, personalized marketing messages, and individualized service offerings enhance customer satisfaction and loyalty. Data-driven decision making improves program effectiveness and resource allocation.

Community engagement strategies emphasize local impact and social responsibility. Organizations develop programs addressing community needs while building stronger stakeholder relationships. Youth development initiatives and educational partnerships create positive community impact.

Multi-generational programming recognizes diverse age group needs and preferences. Organizations develop age-appropriate activities while creating opportunities for family participation and intergenerational interaction.

Facility modernization projects across the industry focus on enhancing fan experiences through technology integration, improved amenities, and sustainable design features. Major professional sports venues invest heavily in upgrades that create premium revenue opportunities while improving operational efficiency.

League expansion initiatives in professional sports create new market opportunities and increase overall industry visibility. Major League Soccer continues aggressive expansion plans, while other leagues explore international opportunities and new market development.

Technology partnerships between sports organizations and tech companies accelerate innovation in fan engagement, performance analytics, and operational management. MarkWide Research analysis indicates that technology investments by sports organizations have increased significantly, with organizations reporting improved efficiency and fan satisfaction.

Youth sports safety initiatives address concussion concerns and injury prevention through improved equipment, training protocols, and medical support. Industry-wide efforts focus on maintaining participation levels while ensuring athlete safety across all age groups.

Corporate partnership evolution moves beyond traditional sponsorship toward integrated marketing relationships and experiential activations. Companies seek authentic connections with sports audiences through community engagement and shared value initiatives.

Diversity and inclusion programs expand opportunities for underrepresented groups in both participation and leadership roles. Organizations develop targeted outreach programs and modify traditional barriers to increase accessibility and representation.

Investment priorities should focus on technology infrastructure that enhances both participant experiences and operational efficiency. Organizations that successfully integrate digital platforms with traditional sports activities will achieve competitive advantages and improved financial performance. Data analytics capabilities represent particularly valuable investments for understanding consumer preferences and optimizing program delivery.

Diversification strategies help organizations reduce risk and maximize facility utilization. Multi-sport facilities and year-round programming create more stable revenue streams while serving broader community needs. Organizations should explore complementary services including fitness training, event hosting, and corporate team building.

Community partnership development creates sustainable competitive advantages through local support and shared resources. Successful organizations build strong relationships with schools, businesses, and government entities to expand programming and funding opportunities. Public-private partnerships offer particular potential for facility development and program expansion.

Safety protocol enhancement remains critical for maintaining participation levels and managing liability risks. Organizations should invest in current safety equipment, training programs, and medical support systems. Proactive safety measures protect participants while demonstrating organizational responsibility.

Market segmentation refinement allows organizations to better serve specific demographic groups and optimize resource allocation. Targeted programming for different age groups, skill levels, and interests creates more satisfying experiences while improving operational efficiency.

Financial management strategies should emphasize revenue diversification and cost control. Organizations should develop multiple income streams while maintaining focus on core mission and community service objectives.

Market growth prospects remain positive across most segments of the USA sports team and club market, driven by demographic trends, health consciousness, and technology advancement. Professional sports will continue benefiting from media rights growth and enhanced fan experiences, while amateur and recreational segments expand through increased participation and facility development.

Technology integration will accelerate, creating new opportunities for fan engagement, performance optimization, and operational efficiency. Artificial intelligence and machine learning applications will enhance coaching, injury prevention, and personalized experiences. Virtual and augmented reality technologies will create immersive training and entertainment opportunities.

Demographic shifts will reshape market dynamics as organizations adapt to changing population characteristics and preferences. Youth sports participation is projected to grow at 5.2% annually over the next five years, while adult recreational programs show similar growth potential. Senior participation in modified sports activities represents an emerging opportunity.

Facility development will emphasize multi-use designs, sustainability features, and technology integration. Smart facilities incorporating IoT sensors, automated systems, and data analytics will improve operational efficiency while enhancing user experiences. Community-focused designs will maximize public support and utilization.

Revenue model evolution will continue as organizations develop innovative income streams beyond traditional sources. MWR projections indicate that non-traditional revenue sources will account for an increasing percentage of total organizational income, driven by technology services, corporate partnerships, and experiential offerings.

Regulatory environment changes will influence market development through safety requirements, facility standards, and youth protection policies. Organizations must balance compliance costs with accessibility goals while maintaining program quality and community service missions.

The USA sports team and club market represents a dynamic and resilient sector with strong growth prospects across multiple segments. Professional sports organizations continue demonstrating financial strength and cultural influence, while amateur and recreational programs expand to serve growing demand for active lifestyle opportunities. Market fundamentals remain solid, supported by demographic trends, health consciousness, and technological advancement.

Key success factors include technology integration, community engagement, and diversified revenue strategies. Organizations that successfully balance entertainment value with community service while embracing innovation will achieve sustainable competitive advantages. Digital transformation initiatives create particular opportunities for enhanced fan engagement and operational efficiency.

Future growth will be driven by expanding participation across demographic segments, facility modernization, and new revenue stream development. The market’s ability to adapt to changing consumer preferences while maintaining core sports values positions it well for continued expansion. Investment opportunities exist across all market segments, from professional franchise development to community recreational facility enhancement.

The USA sports team and club market will continue serving as a cornerstone of American entertainment and community life, providing economic benefits, health promotion, and social cohesion. Organizations that prioritize participant satisfaction, community impact, and operational excellence will thrive in this evolving market landscape.

What is Sports Team And Club?

Sports Team And Club refers to organized groups of athletes who compete in various sports, often representing a community or institution. These teams and clubs can range from amateur to professional levels and include a variety of sports such as football, basketball, and soccer.

What are the key players in the USA Sports Team And Club Market?

Key players in the USA Sports Team And Club Market include major franchises like the New York Yankees, Los Angeles Lakers, and Dallas Cowboys. These organizations not only compete in their respective sports but also engage in extensive marketing and community outreach, influencing fan engagement and loyalty, among others.

What are the growth factors driving the USA Sports Team And Club Market?

The USA Sports Team And Club Market is driven by factors such as increasing fan engagement through digital platforms, the rise of e-sports, and the growing popularity of youth sports programs. Additionally, sponsorship deals and media rights agreements significantly contribute to revenue growth.

What challenges does the USA Sports Team And Club Market face?

Challenges in the USA Sports Team And Club Market include the high costs of operation, competition from alternative entertainment options, and the need to adapt to changing consumer preferences. Additionally, issues related to player health and safety are increasingly coming to the forefront.

What opportunities exist in the USA Sports Team And Club Market?

Opportunities in the USA Sports Team And Club Market include expanding into international markets, leveraging technology for enhanced fan experiences, and developing new revenue streams through merchandise and digital content. The growth of women’s sports also presents a significant opportunity for clubs to diversify their offerings.

What trends are shaping the USA Sports Team And Club Market?

Trends in the USA Sports Team And Club Market include the integration of advanced analytics in player performance and fan engagement, the rise of social media as a marketing tool, and a focus on sustainability initiatives within sports organizations. Additionally, the increasing popularity of fantasy sports is influencing how fans interact with teams.

USA Sports Team And Club Market

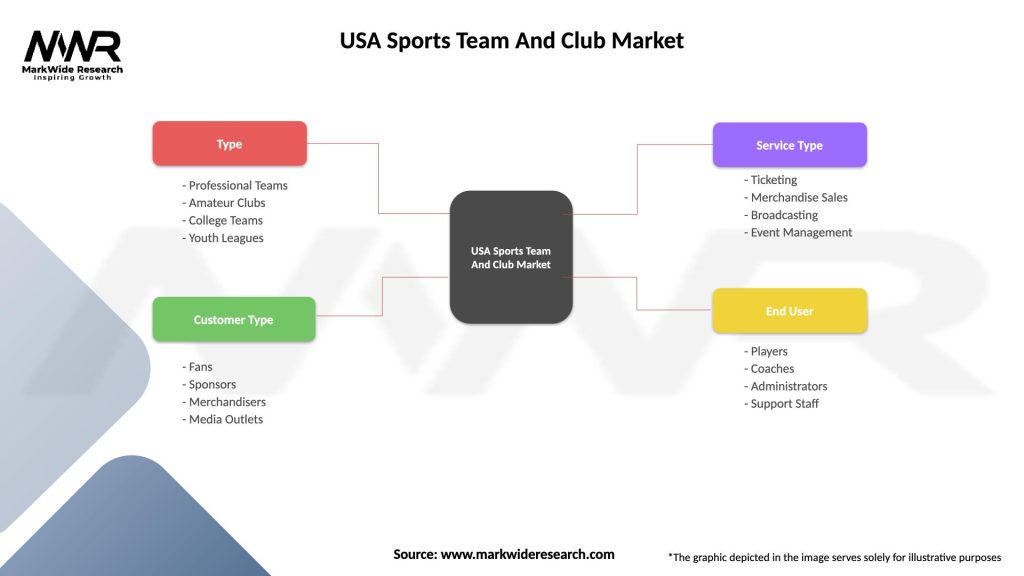

| Segmentation Details | Description |

|---|---|

| Type | Professional Teams, Amateur Clubs, College Teams, Youth Leagues |

| Customer Type | Fans, Sponsors, Merchandisers, Media Outlets |

| Service Type | Ticketing, Merchandise Sales, Broadcasting, Event Management |

| End User | Players, Coaches, Administrators, Support Staff |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the USA Sports Team And Club Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at