444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The USA organic fertilizers market represents a rapidly expanding segment within the broader agricultural inputs industry, driven by increasing consumer demand for sustainable farming practices and environmentally conscious food production. Organic fertilizers have gained significant traction among American farmers and agricultural producers who are seeking alternatives to synthetic chemical fertilizers while maintaining crop productivity and soil health.

Market dynamics indicate that the organic fertilizers sector is experiencing robust growth, with adoption rates increasing by approximately 12.5% annually across various agricultural applications. The shift toward sustainable agriculture has been accelerated by regulatory support, consumer preferences for organic produce, and growing awareness of environmental sustainability among farming communities.

Regional distribution shows that states with intensive agricultural activities, including California, Iowa, Illinois, and Texas, account for nearly 58% of organic fertilizer consumption in the United States. The market encompasses various product categories, from compost-based fertilizers to specialized biofertilizers and organic soil amendments, each serving specific crop requirements and soil conditions.

Technology advancement in organic fertilizer production has enhanced product efficacy and application methods, making these solutions more attractive to conventional farmers considering the transition to organic or sustainable farming practices. The integration of precision agriculture techniques with organic fertilizer applications has further improved adoption rates and operational efficiency.

The USA organic fertilizers market refers to the comprehensive ecosystem of naturally-derived soil nutrients and amendments that enhance crop growth without synthetic chemicals or artificial additives. Organic fertilizers are produced from natural sources including animal manure, plant residues, compost materials, and beneficial microorganisms that improve soil fertility and structure.

Product categories within this market include various formulations designed to meet specific agricultural needs. Compost fertilizers provide slow-release nutrients while improving soil organic matter content. Biofertilizers contain living microorganisms that enhance nutrient availability and plant uptake efficiency. Organic soil conditioners focus primarily on improving soil structure, water retention, and microbial activity.

Application methods for organic fertilizers range from traditional broadcasting and incorporation techniques to modern precision application systems that optimize nutrient placement and timing. The market also encompasses specialty organic fertilizers formulated for specific crops, including vegetables, fruits, grains, and specialty crops like herbs and medicinal plants.

Regulatory framework governing organic fertilizers includes certification requirements from organizations such as the Organic Materials Review Institute (OMRI) and compliance with USDA National Organic Program standards, ensuring product quality and organic integrity throughout the supply chain.

Market performance in the USA organic fertilizers sector demonstrates exceptional growth momentum, with increasing adoption across diverse agricultural segments and geographic regions. The transition from conventional to sustainable farming practices has created substantial opportunities for organic fertilizer manufacturers and distributors throughout the country.

Key growth drivers include rising consumer demand for organic food products, which has increased by approximately 8.4% annually over recent years, creating downstream pressure for organic agricultural inputs. Environmental regulations and sustainability initiatives have further accelerated market expansion, with many states implementing programs that incentivize organic farming practices.

Product innovation continues to drive market evolution, with manufacturers developing enhanced formulations that deliver improved nutrient release profiles and application convenience. Biofertilizer technologies incorporating beneficial bacteria and fungi have gained particular traction, offering farmers solutions that enhance both crop productivity and soil health.

Competitive landscape features a mix of established agricultural companies and specialized organic fertilizer producers, creating a dynamic market environment that fosters innovation and competitive pricing. Distribution channels have expanded to include traditional agricultural retailers, specialty organic suppliers, and direct-to-farm sales programs.

Future prospects remain highly favorable, with market analysts projecting continued growth driven by expanding organic acreage, technological advancement, and increasing integration of sustainable agriculture practices into mainstream farming operations across the United States.

Market segmentation reveals distinct patterns in organic fertilizer adoption and usage across different agricultural sectors and geographic regions. Understanding these insights provides valuable perspective on market dynamics and growth opportunities.

Emerging trends indicate increasing sophistication in organic fertilizer formulations, with manufacturers developing products tailored to specific soil types, crop requirements, and regional growing conditions. Custom blending services are becoming more prevalent, allowing farmers to obtain fertilizer formulations optimized for their unique agricultural situations.

Consumer demand transformation represents the primary catalyst driving organic fertilizer market expansion across the United States. The growing preference for organic food products has created substantial downstream pressure on agricultural producers to adopt organic and sustainable farming practices, directly increasing demand for organic fertilizer solutions.

Environmental consciousness among farmers and agricultural stakeholders has intensified focus on sustainable production methods that minimize environmental impact while maintaining crop productivity. Soil health initiatives promoted by government agencies and agricultural organizations emphasize the long-term benefits of organic fertilizers in building soil organic matter and improving overall ecosystem health.

Regulatory support through various federal and state programs provides financial incentives for farmers transitioning to organic production systems. Conservation programs offered by the USDA and state agricultural departments often include cost-sharing opportunities for organic fertilizer applications, reducing the economic barriers to adoption.

Technological advancement in organic fertilizer production and application has improved product performance and user convenience, making these solutions more competitive with conventional fertilizers. Enhanced formulations provide more predictable nutrient release patterns and improved handling characteristics, addressing historical concerns about organic fertilizer consistency and effectiveness.

Market premiums for organically produced crops continue to provide economic incentives for farmers to invest in organic fertilizer programs. The price differential between organic and conventional products often justifies the additional costs associated with organic fertilizer applications, particularly in high-value crop segments.

Cost considerations represent the most significant barrier to widespread organic fertilizer adoption, as these products typically command premium prices compared to conventional synthetic fertilizers. The higher per-unit cost of organic fertilizers can create economic challenges for farmers operating on tight margins, particularly in commodity crop production where profit margins are constrained.

Supply chain limitations affect organic fertilizer availability and consistency, especially during peak application seasons. Raw material sourcing for organic fertilizer production can be subject to seasonal variations and quality fluctuations, impacting product availability and pricing stability throughout the agricultural calendar.

Application complexity associated with organic fertilizers requires different management approaches compared to conventional fertilizers. Timing considerations for organic fertilizer applications often require more precise planning due to slower nutrient release characteristics, which can complicate farm management operations and require additional expertise.

Performance variability in organic fertilizer products can create uncertainty for farmers accustomed to the predictable performance of synthetic fertilizers. Nutrient content variations and release rate differences between batches may require more intensive monitoring and adjustment of application programs.

Storage and handling challenges associated with organic fertilizers, including bulk density variations and potential odor issues, can create logistical complications for farm operations. Equipment modifications may be necessary to accommodate organic fertilizer characteristics, representing additional investment requirements for agricultural producers.

Precision agriculture integration presents substantial opportunities for organic fertilizer market expansion through the development of smart application systems that optimize organic fertilizer placement and timing. The combination of GPS guidance, soil mapping, and variable rate application technologies can significantly improve organic fertilizer efficiency and economic viability.

Specialty crop expansion offers high-growth potential as organic production in vegetables, fruits, and herbs continues to expand rapidly. Premium crop applications can justify higher fertilizer costs while providing opportunities for specialized product development and enhanced profit margins for manufacturers and distributors.

Biofertilizer innovation represents a rapidly evolving opportunity segment, with advances in microbial technology creating new possibilities for enhanced nutrient efficiency and crop performance. The development of crop-specific microbial formulations and improved delivery systems could significantly expand market potential.

Regional market development in areas with lower current adoption rates provides expansion opportunities for organic fertilizer companies. Educational initiatives and demonstration programs can help build awareness and confidence in organic fertilizer performance among farmers in these emerging markets.

Value-added services including soil testing, custom blending, and agronomic support create opportunities for market participants to differentiate their offerings and build stronger customer relationships. Integrated solutions that combine products with technical expertise can command premium pricing and improve customer retention.

Supply and demand equilibrium in the USA organic fertilizers market reflects the complex interplay between growing agricultural demand and evolving production capabilities. Demand growth continues to outpace supply expansion in many regions, creating favorable pricing conditions for manufacturers while highlighting the need for increased production capacity.

Seasonal fluctuations significantly impact market dynamics, with peak demand periods during spring planting seasons creating supply chain pressures and price volatility. Inventory management strategies employed by manufacturers and distributors play crucial roles in maintaining market stability and meeting customer requirements throughout the agricultural calendar.

Raw material availability influences market dynamics through its impact on production costs and product quality consistency. Organic waste streams from agricultural, municipal, and industrial sources provide the foundation for organic fertilizer production, with availability and quality variations affecting market supply and pricing patterns.

Competitive pressures drive continuous innovation and improvement in organic fertilizer formulations and delivery systems. Market consolidation trends among manufacturers create opportunities for operational efficiency improvements while potentially reducing competition in certain market segments.

Regulatory evolution continues to shape market dynamics through changing certification requirements, environmental regulations, and agricultural policy initiatives. Policy support for sustainable agriculture practices generally favors organic fertilizer market growth, while regulatory complexity can create barriers for smaller market participants.

Comprehensive market analysis for the USA organic fertilizers market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, agricultural retailers, and end-user farmers across diverse geographic regions and crop production systems.

Secondary research encompasses analysis of government agricultural statistics, industry association reports, academic research publications, and regulatory documentation. Data triangulation methods validate findings across multiple sources to ensure reliability and accuracy of market assessments and projections.

Market sizing methodologies utilize bottom-up and top-down approaches to validate market scope and growth projections. Statistical analysis of agricultural production data, organic acreage trends, and fertilizer consumption patterns provides quantitative foundation for market assessments.

Qualitative research techniques including focus groups and expert panel discussions provide insights into market trends, competitive dynamics, and future development prospects. Industry expert interviews contribute specialized knowledge about technological developments, regulatory changes, and market evolution patterns.

Continuous monitoring of market developments through ongoing research activities ensures that analysis remains current and relevant to rapidly evolving market conditions. Update protocols incorporate new information and changing market dynamics into analytical frameworks and projections.

Geographic distribution of the USA organic fertilizers market reveals distinct regional patterns influenced by agricultural production systems, crop types, and adoption rates of sustainable farming practices. Regional analysis provides essential insights into market opportunities and competitive dynamics across different areas of the country.

Midwest Region dominates organic fertilizer consumption, accounting for approximately 38% of national market share, driven by extensive corn and soybean production systems. States including Iowa, Illinois, Indiana, and Minnesota represent key markets where organic grain production continues to expand, creating substantial demand for organic fertilizer solutions.

California Market represents the second-largest regional segment at roughly 22% market share, characterized by diverse specialty crop production and intensive organic farming operations. The state’s leadership in organic vegetable and fruit production drives demand for specialized organic fertilizer formulations tailored to high-value crop applications.

Great Plains States including Kansas, Nebraska, and Texas collectively account for 18% of market demand, with growing adoption of organic fertilizers in wheat, cotton, and livestock-integrated farming systems. Sustainable agriculture initiatives in this region focus on soil health improvement and water conservation benefits provided by organic fertilizers.

Eastern Seaboard markets from Florida to Maine represent approximately 15% of national consumption, with particular strength in organic vegetable production and specialty crop applications. Urban agriculture and local food system development in this region create unique market opportunities for organic fertilizer suppliers.

Western States beyond California, including Washington, Oregon, and Idaho, account for the remaining 7% of market share, with growth driven by organic potato, apple, and wine grape production. Sustainable viticulture practices in particular have increased demand for specialized organic fertilizer products.

Market structure in the USA organic fertilizers sector features a diverse competitive environment with participants ranging from large multinational agricultural companies to specialized organic fertilizer manufacturers and regional suppliers. Competitive dynamics are shaped by product innovation, distribution capabilities, and customer service excellence.

Strategic positioning among competitors varies significantly, with some companies focusing on mass market distribution through retail channels while others emphasize direct-to-farm sales and specialized agricultural applications. Product differentiation strategies include organic certification, enhanced formulations, and value-added services.

Innovation leadership drives competitive advantage through development of improved organic fertilizer formulations, application technologies, and integrated crop management solutions. Research and development investments focus on enhancing nutrient efficiency, improving handling characteristics, and developing crop-specific formulations.

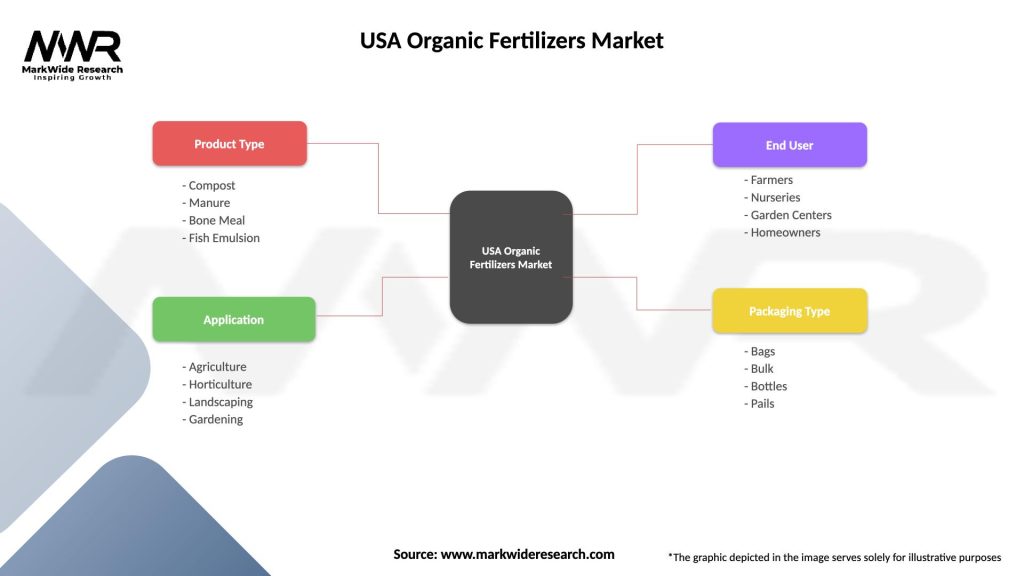

Market segmentation analysis reveals the diverse structure of the USA organic fertilizers market across multiple dimensions, providing insights into growth opportunities and competitive dynamics within specific market segments.

By Product Type:

By Application Method:

By Crop Application:

Compost-based fertilizers maintain market leadership through their versatility and proven performance across diverse agricultural applications. These products offer balanced nutrient profiles with excellent soil conditioning properties, making them suitable for both transitioning and established organic farming operations. Municipal compost programs provide consistent raw material supplies while supporting waste diversion initiatives.

Biofertilizer technologies represent the fastest-growing category, with adoption rates increasing by approximately 18.7% annually as farmers recognize the benefits of microbial enhancement. Nitrogen-fixing bacteria and phosphorus-solubilizing microorganisms provide targeted nutrient benefits while improving overall soil biological activity and plant health.

Animal-based organic fertilizers continue to serve important market segments, particularly in regions with concentrated livestock production. Processed poultry manure and composted dairy waste provide high-nutrient organic fertilizer options, though transportation costs can limit market reach in some geographic areas.

Liquid organic fertilizers are gaining market share through their compatibility with modern application equipment and precision agriculture systems. Foliar feeding programs using liquid organic fertilizers provide rapid nutrient uptake and can complement soil-applied organic fertilizer programs.

Specialty formulations for specific crops and growing conditions create premium market opportunities. Organic starter fertilizers for seedling production and slow-release organic formulations for container growing applications command higher prices while serving specialized market needs.

Agricultural producers benefit from organic fertilizer adoption through improved soil health outcomes that enhance long-term productivity and sustainability. Organic matter enhancement provided by organic fertilizers improves soil structure, water retention, and nutrient cycling capacity, creating lasting benefits that extend beyond individual growing seasons.

Economic advantages for farmers include access to premium organic markets that provide price premiums for certified organic products. Cost-sharing programs and sustainability incentives offered by government agencies and private organizations can offset the higher costs associated with organic fertilizer applications.

Environmental benefits include reduced synthetic chemical inputs and improved ecosystem health through enhanced biodiversity and reduced environmental impact. Carbon sequestration potential of organic fertilizers contributes to climate change mitigation efforts while improving soil organic matter content.

Supply chain participants benefit from growing market demand and opportunities for value-added services including custom blending, application services, and agronomic support. Distribution partnerships with organic fertilizer manufacturers create new revenue streams for agricultural retailers and service providers.

Technology companies find opportunities in developing precision application equipment and monitoring systems specifically designed for organic fertilizer characteristics. Digital agriculture platforms that integrate organic fertilizer management with overall crop production systems create additional value propositions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture integration represents a transformative trend in organic fertilizer applications, with farmers increasingly adopting GPS-guided application systems and variable rate technologies to optimize organic fertilizer placement and efficiency. This trend enhances the economic viability of organic fertilizers by reducing waste and improving crop response.

Biofertilizer advancement continues to drive market evolution through the development of more sophisticated microbial formulations and improved delivery systems. Consortium inoculants containing multiple beneficial microorganisms provide enhanced crop benefits while addressing various soil and plant health challenges simultaneously.

Sustainability certification is becoming increasingly important as farmers and consumers demand greater transparency in agricultural production methods. Carbon footprint labeling and regenerative agriculture certifications create additional market differentiation opportunities for organic fertilizer products.

Local sourcing initiatives are gaining momentum as farmers and fertilizer manufacturers seek to reduce transportation costs and environmental impact. Regional composting programs and agricultural waste utilization projects create localized organic fertilizer supply chains that benefit both producers and users.

Digital agriculture platforms are incorporating organic fertilizer management into comprehensive farm management systems, providing farmers with integrated tools for planning, application, and monitoring of organic fertilizer programs. Data-driven decision making enhances the precision and effectiveness of organic fertilizer applications.

Product innovation continues to drive industry evolution with manufacturers developing enhanced organic fertilizer formulations that address specific crop needs and application challenges. Recent developments include pelleted organic fertilizers that improve handling characteristics and slow-release formulations that provide more controlled nutrient delivery.

Strategic partnerships between organic fertilizer manufacturers and agricultural technology companies are creating integrated solutions that combine products with precision application systems and monitoring technologies. These collaborations enhance the value proposition of organic fertilizers while improving adoption rates.

Capacity expansion initiatives by major manufacturers reflect growing market confidence and demand projections. New production facilities and processing technology upgrades are increasing supply capacity while improving product quality and consistency across the industry.

Research collaborations between industry participants and academic institutions are advancing understanding of organic fertilizer performance and developing new application technologies. University extension programs play crucial roles in farmer education and demonstration of organic fertilizer benefits.

Regulatory developments including updated organic certification standards and new environmental regulations continue to shape industry practices and product development priorities. Compliance initiatives ensure that organic fertilizer products meet evolving quality and safety requirements.

Market participants should focus on product differentiation through enhanced formulations and value-added services to maintain competitive advantage in an increasingly crowded marketplace. MarkWide Research analysis indicates that companies offering integrated solutions combining products with technical support achieve higher customer retention rates and premium pricing.

Investment priorities should emphasize production capacity expansion and supply chain optimization to meet growing demand while controlling costs. Vertical integration strategies that secure raw material supplies can provide competitive advantages and improve profit margins in volatile market conditions.

Technology adoption represents a critical success factor, with companies that invest in precision application technologies and digital agriculture platforms better positioned to serve evolving customer needs. Partnership strategies with technology providers can accelerate innovation while sharing development costs and risks.

Geographic expansion into underserved markets offers significant growth opportunities, particularly in regions where organic agriculture adoption is accelerating. Regional distribution partnerships and local sourcing initiatives can facilitate market entry while building customer relationships.

Sustainability initiatives should be integrated into business strategies to align with growing environmental consciousness among customers and stakeholders. Carbon footprint reduction and circular economy principles can create additional value propositions while supporting long-term market positioning.

Long-term growth prospects for the USA organic fertilizers market remain highly favorable, driven by sustained consumer demand for organic food products and increasing adoption of sustainable agriculture practices across diverse farming operations. Market expansion is expected to continue at robust rates, with growth projections indicating annual increases of 11.3% over the next five years.

Technology integration will play an increasingly important role in market development, with precision agriculture systems and digital farming platforms enhancing the efficiency and attractiveness of organic fertilizer applications. Smart application technologies will help address cost concerns while improving crop response and environmental benefits.

Product innovation will continue to drive market evolution through development of specialized formulations and enhanced delivery systems that meet specific crop and soil requirements. Biofertilizer technologies are expected to capture increasing market share as microbial enhancement becomes more sophisticated and reliable.

Regional market development will create new opportunities as organic agriculture expands into areas with historically lower adoption rates. Educational initiatives and demonstration programs will support market development by building farmer confidence in organic fertilizer performance and economic benefits.

Regulatory evolution is expected to continue supporting market growth through sustainability incentives and environmental protection measures that favor organic fertilizer adoption. Climate change mitigation policies may create additional drivers for organic fertilizer use through carbon sequestration and soil health benefits.

The USA organic fertilizers market represents a dynamic and rapidly expanding sector within the broader agricultural inputs industry, characterized by strong growth fundamentals and favorable long-term prospects. Market drivers including consumer demand for organic products, environmental sustainability concerns, and regulatory support create a robust foundation for continued expansion across diverse agricultural applications and geographic regions.

Competitive dynamics in the market favor companies that can successfully combine product innovation with effective distribution strategies and value-added services. The integration of precision agriculture technologies and digital farming platforms presents significant opportunities for market participants to differentiate their offerings and improve customer value propositions.

Regional opportunities remain substantial, particularly in areas where organic agriculture adoption is accelerating and infrastructure development is creating new market access points. Product diversification through specialized formulations and biofertilizer technologies offers pathways for premium positioning and enhanced profit margins.

Future success in the USA organic fertilizers market will depend on companies’ ability to adapt to evolving customer needs, integrate new technologies, and maintain competitive cost structures while delivering superior product performance. Sustainability initiatives and environmental stewardship will become increasingly important differentiators as the market matures and customer sophistication increases.

The overall market outlook remains highly positive, with sustained growth expected across all major segments and regions, supported by fundamental shifts toward sustainable agriculture and increasing recognition of the long-term benefits provided by organic fertilizer applications in modern farming systems.

What is Organic Fertilizers?

Organic fertilizers are natural substances derived from plant or animal matter that are used to enhance soil fertility and promote plant growth. They include materials such as compost, manure, and bone meal, which improve soil structure and provide essential nutrients to crops.

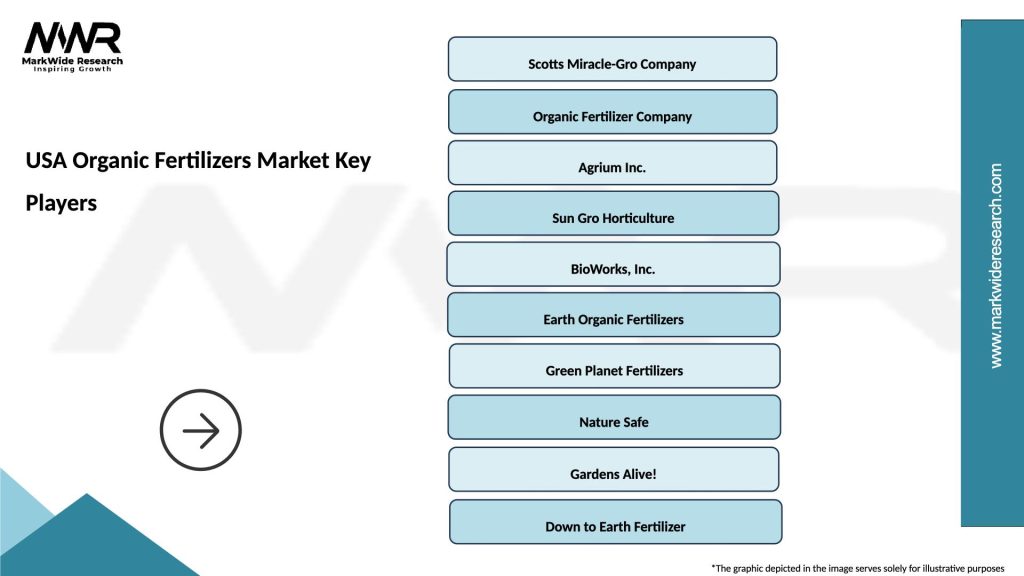

What are the key players in the USA Organic Fertilizers Market?

Key players in the USA Organic Fertilizers Market include companies like Scotts Miracle-Gro, Sustane Natural Fertilizer, and Organic Fertilizer Company, among others. These companies are known for their innovative products and commitment to sustainable agricultural practices.

What are the growth factors driving the USA Organic Fertilizers Market?

The USA Organic Fertilizers Market is driven by increasing consumer demand for organic produce, growing awareness of sustainable farming practices, and the need for soil health improvement. Additionally, government initiatives promoting organic farming contribute to market growth.

What challenges does the USA Organic Fertilizers Market face?

Challenges in the USA Organic Fertilizers Market include the higher cost of organic fertilizers compared to synthetic options and the limited availability of raw materials. Additionally, inconsistent product quality and regulatory hurdles can hinder market expansion.

What opportunities exist in the USA Organic Fertilizers Market?

Opportunities in the USA Organic Fertilizers Market include the rising trend of urban gardening and the increasing adoption of organic farming practices. Furthermore, advancements in technology for organic fertilizer production present new avenues for growth.

What trends are shaping the USA Organic Fertilizers Market?

Trends in the USA Organic Fertilizers Market include a shift towards bio-based fertilizers, increased research on microbial fertilizers, and a growing emphasis on sustainable agriculture. These trends reflect a broader movement towards environmentally friendly farming solutions.

USA Organic Fertilizers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Compost, Manure, Bone Meal, Fish Emulsion |

| Application | Agriculture, Horticulture, Landscaping, Gardening |

| End User | Farmers, Nurseries, Garden Centers, Homeowners |

| Packaging Type | Bags, Bulk, Bottles, Pails |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the USA Organic Fertilizers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at