444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The USA life and non-life insurance market is a significant component of the country’s financial and risk management sector. Insurance, in general, provides individuals and businesses with a sense of security against unexpected events and potential losses. Life insurance covers risks related to an individual’s life, while non-life insurance, also known as general insurance, encompasses various types of coverage such as property, health, automobile, and liability insurance. This market has seen steady growth over the years, driven by factors like increasing awareness of insurance benefits, evolving consumer needs, and a focus on risk mitigation.

Meaning

Life insurance is a contract between the policyholder and the insurer, where the insurer promises to pay a designated sum to the beneficiary upon the death of the insured. Non-life insurance, on the other hand, covers risks that do not involve loss of life but encompass property damage, medical expenses, legal liabilities, and other non-life-threatening situations. These insurance policies are designed to safeguard individuals and businesses from potential financial hardships arising from unforeseen events.

Executive Summary

The USA life and non-life insurance market is a crucial component of the nation’s economy, providing financial security to millions of individuals and businesses. The market has witnessed sustained growth in recent years, owing to factors like rising disposable income, the expansion of insurance products, and the government’s initiatives to promote insurance coverage. While life insurance caters to the protection of family members and dependents in the event of the policyholder’s demise, non-life insurance shields against property damage, accidents, and liability claims.

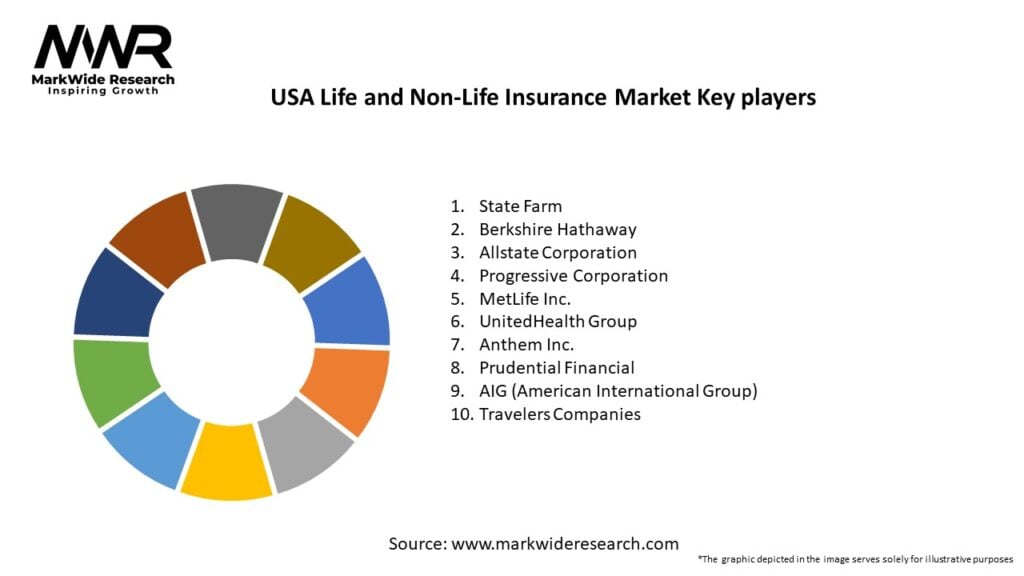

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The USA life and non-life insurance market is characterized by dynamic factors that influence its growth and direction. Economic fluctuations, consumer behavior, technological advancements, regulatory changes, and global events can impact the insurance industry’s landscape.

Regional Analysis

The USA life and non-life insurance market exhibit variations in demand and preferences across different regions. Certain areas might have a higher demand for life insurance, while others may lean towards specific non-life insurance products like property and casualty coverage. Regional analysis helps insurers tailor their offerings to cater to specific customer needs.

Competitive Landscape

Leading Companies USA Life and Non-Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

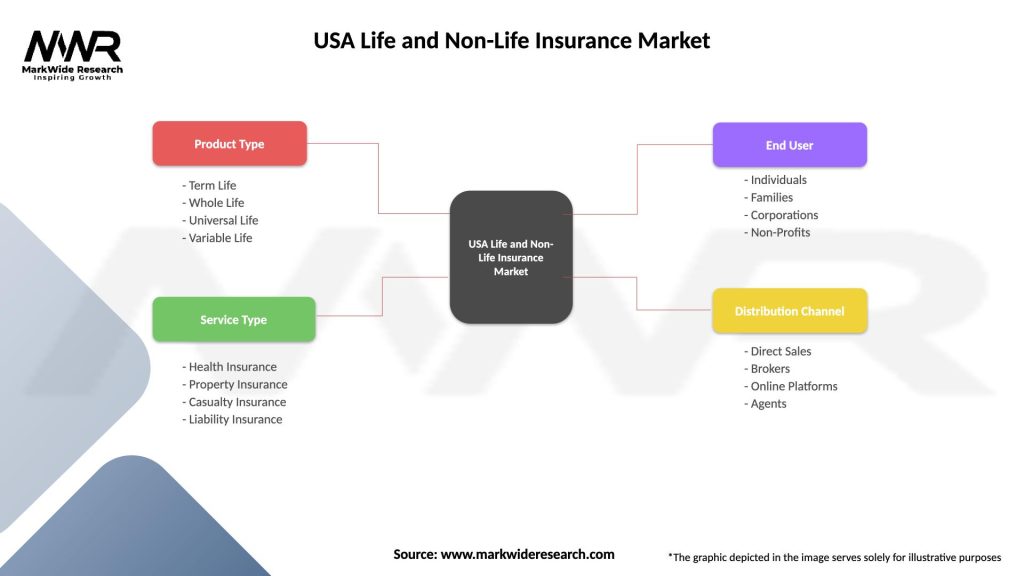

Segmentation

The USA life and non-life insurance market can be segmented based on various criteria, including product type, target audience, distribution channels, and premium size. Segmentation allows insurers to identify lucrative segments, develop targeted marketing strategies, and design specialized products.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the insurance industry. While life insurance claims surged, non-life insurance witnessed fluctuations in claims related to travel, health, and business interruptions. Insurers adapted by providing pandemic-specific policies and enhancing digital capabilities to cater to remote customer needs.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the USA life and non-life insurance market looks promising. Continued economic growth, advancements in technology, and evolving customer needs will drive the demand for insurance products. Insurers that can effectively adapt to changing trends and offer personalized, convenient, and relevant products will be well-positioned for success.

Conclusion

The USA life and non-life insurance market play a vital role in safeguarding individuals and businesses from various risks and uncertainties. As the market continues to grow, insurance companies must prioritize innovation, digitalization, and customer-centricity to meet evolving consumer expectations. By effectively addressing challenges and leveraging emerging opportunities, the insurance industry can foster sustained growth and provide financial security to millions of Americans.

What is Life and Non-Life Insurance?

Life and Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the USA Life and Non-Life Insurance Market?

Key players in the USA Life and Non-Life Insurance Market include companies like State Farm, Allstate, MetLife, and Prudential, among others. These companies offer a range of products catering to both individual and commercial clients.

What are the growth factors driving the USA Life and Non-Life Insurance Market?

The USA Life and Non-Life Insurance Market is driven by factors such as increasing awareness of financial security, a growing aging population, and advancements in technology that enhance customer service and product offerings.

What challenges does the USA Life and Non-Life Insurance Market face?

Challenges in the USA Life and Non-Life Insurance Market include regulatory compliance, rising claims costs, and competition from insurtech companies that are disrupting traditional business models.

What opportunities exist in the USA Life and Non-Life Insurance Market?

Opportunities in the USA Life and Non-Life Insurance Market include the expansion of digital insurance solutions, the development of personalized insurance products, and the increasing demand for sustainable insurance practices.

What trends are shaping the USA Life and Non-Life Insurance Market?

Trends in the USA Life and Non-Life Insurance Market include the integration of artificial intelligence for underwriting and claims processing, the rise of telematics in auto insurance, and a focus on customer-centric services that enhance user experience.

USA Life and Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Universal Life, Variable Life |

| Service Type | Health Insurance, Property Insurance, Casualty Insurance, Liability Insurance |

| End User | Individuals, Families, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies USA Life and Non-Life Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at