444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The USA customs brokerage market represents a critical component of America’s international trade infrastructure, facilitating the smooth flow of goods across borders while ensuring compliance with complex regulatory requirements. Customs brokers serve as essential intermediaries between importers, exporters, and government agencies, managing the intricate documentation and procedures required for international commerce. The market has experienced robust growth driven by expanding global trade volumes, increasing regulatory complexity, and the growing need for specialized expertise in customs compliance.

Digital transformation has emerged as a defining characteristic of the modern customs brokerage landscape, with traditional paper-based processes giving way to sophisticated electronic systems and automated workflows. The market encompasses a diverse range of service providers, from large multinational corporations offering comprehensive supply chain solutions to specialized boutique firms focusing on specific industries or trade corridors. Technology adoption has accelerated significantly, with artificial intelligence, machine learning, and blockchain technologies increasingly integrated into customs brokerage operations.

Market dynamics indicate sustained expansion driven by several key factors, including the growth of e-commerce, increasing complexity of international trade regulations, and the ongoing need for expert guidance in navigating customs procedures. The sector has demonstrated remarkable resilience, adapting to changing trade policies, evolving regulatory frameworks, and emerging challenges such as supply chain disruptions and security concerns.

The USA customs brokerage market refers to the comprehensive ecosystem of licensed professionals and companies that facilitate international trade by managing customs clearance procedures, ensuring regulatory compliance, and providing specialized expertise in import and export processes. Customs brokers act as authorized agents who prepare and submit required documentation, calculate duties and taxes, and coordinate with government agencies to ensure smooth cargo clearance.

Professional customs brokers must obtain federal licenses from U.S. Customs and Border Protection (CBP) and maintain current knowledge of constantly evolving trade regulations, tariff classifications, and compliance requirements. The market encompasses various service models, including traditional brokerage services, integrated logistics solutions, and technology-enabled platforms that streamline customs processes through automation and digital integration.

Core services within this market include tariff classification, duty calculation, documentation preparation, regulatory compliance consulting, and post-entry services such as duty drawback and reconciliation. Modern customs brokerage has evolved beyond basic clearance services to encompass comprehensive trade consulting, supply chain optimization, and strategic advisory services that help businesses navigate complex international trade environments.

Strategic analysis reveals the USA customs brokerage market as a dynamic and essential component of the nation’s trade infrastructure, characterized by steady growth, technological innovation, and increasing service sophistication. The market benefits from America’s position as a major global trading partner, with customs brokers handling millions of import and export transactions annually across diverse industry sectors.

Key market drivers include the continued expansion of international trade, growing regulatory complexity, and increasing demand for specialized expertise in customs compliance. The rise of e-commerce has created new opportunities for customs brokers, as online retailers and small businesses seek professional assistance in managing international shipments and regulatory requirements. Technology integration has become a critical differentiator, with leading firms investing heavily in digital platforms, automated processing systems, and data analytics capabilities.

Competitive landscape features a mix of large multinational service providers, regional specialists, and technology-focused startups, each offering unique value propositions to different market segments. The market has shown resilience in adapting to trade policy changes, regulatory updates, and evolving customer needs, positioning itself for continued growth as global trade volumes expand and complexity increases.

Market intelligence reveals several critical insights that define the current state and future trajectory of the USA customs brokerage sector:

Primary growth drivers propelling the USA customs brokerage market forward encompass both macroeconomic trends and industry-specific developments that create sustained demand for professional customs services.

International trade expansion remains the fundamental driver of market growth, with increasing volumes of imports and exports requiring professional customs clearance services. The complexity of modern supply chains, involving multiple countries, transportation modes, and regulatory jurisdictions, has elevated the importance of expert customs brokerage services. Globalization trends continue to drive demand as businesses of all sizes seek to access international markets and optimize their global supply chain operations.

Regulatory complexity has intensified significantly, with customs brokers navigating an increasingly intricate web of trade agreements, tariff schedules, security requirements, and compliance mandates. The implementation of new trade policies, evolving security protocols, and changing international agreements creates ongoing demand for specialized expertise that only licensed customs brokers can provide.

E-commerce growth has emerged as a transformative driver, with online retailers and digital marketplaces requiring specialized customs services to manage international shipments efficiently. The rise of cross-border e-commerce has created new service categories and delivery models, driving innovation and expansion within the customs brokerage sector.

Technology advancement serves as both a driver and enabler of market growth, with digital platforms, automated processing systems, and data analytics capabilities enhancing service quality while reducing costs. Investment in technology infrastructure has become essential for competitive positioning and operational efficiency.

Market challenges facing the USA customs brokerage sector include several structural and operational constraints that may limit growth potential or create competitive pressures within the industry.

Regulatory barriers present significant challenges, with strict licensing requirements, ongoing education mandates, and compliance obligations creating high barriers to entry for new market participants. The complex regulatory environment requires substantial investment in training, systems, and expertise, potentially limiting market expansion and innovation.

Technology investment costs represent a substantial constraint for smaller customs brokerage firms, as the need for sophisticated digital platforms, automated systems, and cybersecurity infrastructure requires significant capital investment. The rapid pace of technological change creates ongoing pressure to upgrade systems and capabilities, straining resources for smaller market participants.

Skilled labor shortage poses a growing challenge, with the industry facing difficulties in recruiting and retaining qualified customs professionals who possess the specialized knowledge and experience required for effective customs brokerage services. The aging workforce and limited pipeline of new professionals entering the field exacerbate this constraint.

Price competition intensifies pressure on profit margins, particularly in commodity services where differentiation is limited. The commoditization of basic customs clearance services has led to pricing pressures that may constrain profitability and limit investment in innovation and service enhancement.

Economic volatility and trade policy uncertainty create operational challenges, with fluctuating trade volumes, changing regulations, and geopolitical tensions affecting demand patterns and service requirements. These external factors can create unpredictable market conditions that complicate business planning and investment decisions.

Emerging opportunities within the USA customs brokerage market present significant potential for growth, innovation, and market expansion across multiple dimensions of the industry.

Digital service expansion offers substantial opportunities for customs brokers to develop new technology-enabled service offerings that provide enhanced value to clients. The integration of artificial intelligence, machine learning, and predictive analytics creates opportunities for more sophisticated trade optimization services, risk management solutions, and automated compliance monitoring.

Small business market penetration represents a significant growth opportunity, as increasing numbers of small and medium enterprises seek to enter international markets but lack the internal expertise to manage customs requirements effectively. Developing scalable service models and technology platforms specifically designed for smaller businesses could unlock substantial market potential.

Specialized industry focus creates opportunities for customs brokers to develop deep expertise in specific sectors such as pharmaceuticals, automotive, aerospace, or agricultural products. Industry specialization allows for premium pricing and stronger client relationships while reducing competitive pressure from generalist service providers.

Supply chain integration opportunities enable customs brokers to expand their service offerings beyond traditional clearance activities to encompass comprehensive logistics solutions, inventory management, and supply chain optimization services. This integration creates higher-value relationships and increased revenue per client.

Sustainability services present emerging opportunities as businesses increasingly focus on environmental responsibility and carbon footprint reduction. Customs brokers can develop specialized services related to green trade practices, carbon tracking, and sustainable supply chain management.

Market dynamics within the USA customs brokerage sector reflect the complex interplay of technological advancement, regulatory evolution, and changing customer expectations that shape competitive positioning and growth strategies.

Competitive intensity has increased significantly as traditional customs brokers face competition from technology-enabled platforms, integrated logistics providers, and specialized service companies. The market has witnessed consolidation among larger players seeking to achieve scale advantages while smaller firms focus on niche specialization or technology differentiation.

Service evolution continues to transform the industry, with customs brokers expanding beyond basic clearance services to offer comprehensive trade consulting, supply chain optimization, and strategic advisory services. This evolution reflects changing customer needs and the desire to create more valuable, differentiated service offerings that command premium pricing.

Technology disruption has fundamentally altered market dynamics, with digital platforms, automated processing systems, and data analytics capabilities becoming essential competitive requirements. The pace of technological change has accelerated, creating both opportunities for innovation and challenges for firms struggling to keep pace with digital transformation.

Customer expectations have evolved significantly, with clients demanding greater transparency, faster processing times, and more sophisticated reporting and analytics capabilities. The rise of self-service options and digital interfaces has changed the customer experience paradigm, requiring customs brokers to invest in user-friendly technology platforms and enhanced service delivery models.

Regulatory adaptation remains a constant dynamic, with customs brokers continuously adjusting their operations, systems, and procedures to comply with evolving trade regulations, security requirements, and government mandates. This ongoing adaptation requires significant investment in training, systems, and compliance infrastructure.

Comprehensive research methodology employed in analyzing the USA customs brokerage market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights and projections.

Primary research activities included extensive interviews with industry executives, customs brokers, trade professionals, and regulatory officials to gather firsthand insights into market trends, challenges, and opportunities. Survey research was conducted among customs brokerage firms of various sizes to understand operational practices, technology adoption patterns, and strategic priorities.

Secondary research analysis encompassed comprehensive review of government trade statistics, regulatory publications, industry reports, and academic studies related to customs brokerage and international trade. Analysis of customs clearance data, trade volume statistics, and regulatory compliance trends provided quantitative foundation for market assessment.

Market segmentation analysis utilized multiple classification frameworks to understand market structure, including service type, customer segment, geographic region, and industry vertical. This multidimensional approach enabled comprehensive understanding of market dynamics and competitive positioning across different market segments.

Competitive intelligence gathering involved detailed analysis of major market participants, their service offerings, pricing strategies, technology capabilities, and market positioning. This analysis included review of company financial reports, press releases, and strategic announcements to understand competitive dynamics and market trends.

Validation processes included cross-referencing data from multiple sources, conducting follow-up interviews with key stakeholders, and utilizing statistical analysis techniques to ensure data accuracy and reliability. Expert panels and industry advisory groups provided additional validation of research findings and market projections.

Regional market dynamics within the USA customs brokerage sector reflect the geographic distribution of international trade activity, with certain regions demonstrating higher concentration of customs brokerage services and specialized expertise.

West Coast dominance characterizes the regional landscape, with California ports handling approximately 40% of containerized imports and creating substantial demand for customs brokerage services. The Los Angeles-Long Beach port complex serves as the primary gateway for Asian trade, supporting a large concentration of customs brokers specializing in Pacific Rim commerce. Technology innovation is particularly prominent in this region, with many customs brokers investing heavily in digital platforms and automated processing systems.

East Coast markets demonstrate strong activity centered around major port cities including New York, New Jersey, Savannah, and Charleston. These markets benefit from diverse trade relationships with Europe, South America, and other regions, creating demand for customs brokers with broad geographic expertise. The region shows 25% market concentration in traditional manufacturing and automotive imports, requiring specialized knowledge of complex regulatory requirements.

Gulf Coast operations focus heavily on energy-related imports and exports, with customs brokers in Houston, New Orleans, and other Gulf ports developing specialized expertise in petroleum products, chemicals, and industrial equipment. This region demonstrates strong growth potential driven by expanding energy trade and industrial development.

Border regions along the Mexican frontier represent specialized market segments focused on NAFTA/USMCA trade facilitation, with customs brokers in cities like Laredo, El Paso, and San Diego developing expertise in land border procedures and cross-border logistics. These markets show consistent growth driven by nearshoring trends and integrated North American supply chains.

Competitive structure within the USA customs brokerage market features a diverse mix of service providers ranging from large multinational corporations to specialized boutique firms, each serving different market segments with distinct value propositions.

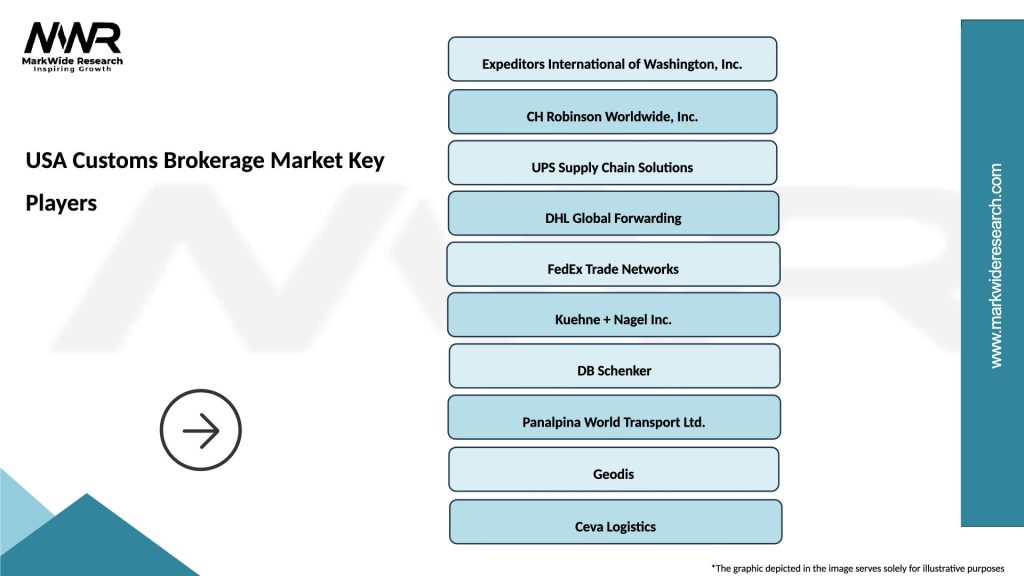

Major market participants include:

Competitive differentiation strategies include technology innovation, industry specialization, geographic expertise, and service integration. Leading firms invest heavily in digital platforms, automated processing systems, and data analytics capabilities to enhance operational efficiency and customer experience.

Market consolidation trends continue as larger firms acquire smaller specialists to expand geographic coverage, industry expertise, or technology capabilities. This consolidation creates opportunities for remaining independent firms to focus on niche specialization or innovative service delivery models.

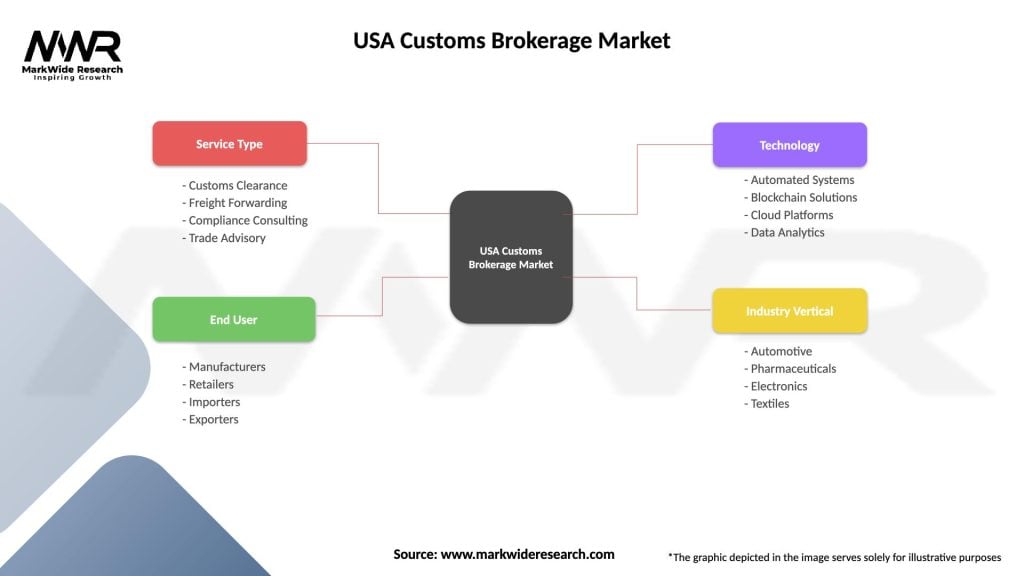

Market segmentation analysis reveals multiple dimensions along which the USA customs brokerage market can be categorized, providing insights into different customer needs, service requirements, and growth opportunities.

By Service Type:

By Customer Segment:

By Industry Vertical:

Service category analysis provides detailed insights into different segments of the USA customs brokerage market, revealing distinct characteristics, growth patterns, and competitive dynamics within each category.

Traditional Brokerage Services continue to represent the foundation of the market, with steady demand for basic customs clearance, documentation preparation, and regulatory compliance services. This category demonstrates mature market characteristics with established service standards and competitive pricing pressure. However, opportunities exist for differentiation through enhanced customer service, faster processing times, and specialized industry expertise.

Technology-Enabled Platforms represent the fastest-growing segment, with digital-first service providers leveraging automation, artificial intelligence, and self-service capabilities to deliver enhanced customer experiences. This category shows significant innovation potential and attracts investment from both traditional customs brokers and technology companies seeking to disrupt established market dynamics.

Integrated Logistics Solutions demonstrate strong growth as customers increasingly prefer single-source providers capable of managing comprehensive supply chain requirements. This category benefits from higher customer retention rates and increased revenue per client, though it requires substantial investment in infrastructure and capabilities across multiple service areas.

Specialized Consulting Services cater to sophisticated customers requiring strategic trade advisory services, compliance consulting, and regulatory guidance. This high-value category commands premium pricing and demonstrates resilience during economic downturns, though it requires deep expertise and industry knowledge to deliver effectively.

E-commerce Support Services have emerged as a distinct category driven by the explosive growth of online retail and cross-border commerce. These services require specialized capabilities for small shipment processing, consumer delivery, and returns management, creating new opportunities for customs brokers willing to adapt their service models.

Stakeholder benefits within the USA customs brokerage market extend across multiple participant categories, each realizing distinct advantages from professional customs services and market development.

For Importers and Exporters:

For Customs Brokers:

For Technology Providers:

For Government Agencies:

Strategic analysis of the USA customs brokerage market reveals key strengths, weaknesses, opportunities, and threats that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the USA customs brokerage market reflect broader changes in international trade, technology adoption, and customer expectations that influence strategic planning and competitive positioning.

Digital-First Service Delivery has emerged as a dominant trend, with customs brokers investing heavily in user-friendly digital platforms, mobile applications, and self-service portals. This trend reflects changing customer expectations for transparency, real-time visibility, and convenient access to customs services. Automation integration reduces manual processing requirements while improving accuracy and speed of customs clearance procedures.

Artificial Intelligence Adoption is accelerating across the industry, with AI-powered systems enhancing tariff classification accuracy, predicting potential compliance issues, and optimizing duty calculations. Machine learning algorithms analyze historical data to identify patterns and improve decision-making processes, while natural language processing capabilities streamline document review and analysis.

Supply Chain Integration continues to expand as customers seek comprehensive logistics solutions from single-source providers. Customs brokers are increasingly offering warehousing, transportation, inventory management, and distribution services to create more valuable and sticky customer relationships. This integration trend requires significant investment in infrastructure and capabilities but offers higher margins and customer retention.

Sustainability Focus is gaining prominence as businesses prioritize environmental responsibility and carbon footprint reduction. Customs brokers are developing services related to green trade practices, carbon tracking, and sustainable supply chain management. Environmental compliance services are becoming increasingly important as regulations evolve and customer awareness grows.

Small Business Specialization represents a growing trend as customs brokers develop service models specifically designed for small and medium enterprises entering international markets. These services emphasize simplicity, cost-effectiveness, and educational support to help smaller businesses navigate complex customs requirements successfully.

Recent industry developments within the USA customs brokerage market demonstrate the dynamic nature of the sector and highlight significant changes that influence competitive positioning and market evolution.

Technology Platform Launches have accelerated significantly, with major customs brokers introducing sophisticated digital platforms that provide real-time shipment tracking, automated documentation, and predictive analytics capabilities. These platforms represent substantial investments in customer experience enhancement and operational efficiency improvement.

Strategic Acquisitions continue to reshape the competitive landscape, with larger firms acquiring specialized customs brokers to expand geographic coverage, industry expertise, or technology capabilities. Recent consolidation activity has focused on companies with strong technology platforms or specialized vertical market expertise.

Regulatory Modernization initiatives by U.S. Customs and Border Protection have introduced new electronic filing requirements, enhanced security protocols, and streamlined clearance procedures. These changes require customs brokers to invest in system upgrades and staff training while creating opportunities for improved service delivery.

Partnership Developments between customs brokers and technology companies have increased, with traditional service providers collaborating with software developers, data analytics firms, and automation specialists to enhance their service capabilities and competitive positioning.

Service Innovation has expanded beyond traditional customs clearance to encompass trade consulting, supply chain optimization, and strategic advisory services. Leading customs brokers are developing specialized service offerings for emerging market segments such as e-commerce, pharmaceutical imports, and sustainable trade practices.

Investment Activity in customs brokerage technology has intensified, with venture capital and private equity firms recognizing the sector’s growth potential and investing in both established companies and innovative startups developing disruptive service models.

Strategic recommendations for customs brokerage market participants focus on positioning for sustained growth while adapting to evolving market conditions and customer expectations.

Technology Investment Priority should focus on customer-facing digital platforms that provide transparency, real-time visibility, and self-service capabilities. MarkWide Research analysis indicates that customs brokers with superior technology platforms demonstrate higher customer retention rates and improved operational efficiency. Investment in artificial intelligence, machine learning, and predictive analytics capabilities will become essential for competitive differentiation.

Service Portfolio Expansion beyond traditional customs clearance should emphasize high-value consulting services, supply chain optimization, and industry-specific expertise. Developing specialized capabilities in growing sectors such as e-commerce, pharmaceuticals, or sustainable trade practices can command premium pricing and reduce competitive pressure.

Strategic Partnership Development with technology providers, logistics companies, and industry specialists can accelerate capability development while sharing investment costs and risks. Partnerships enable access to new technologies, customer segments, and geographic markets without requiring substantial internal investment.

Talent Development Programs should address the industry’s skilled labor shortage through comprehensive training initiatives, university partnerships, and career development programs. Building internal expertise in emerging areas such as data analytics, cybersecurity, and trade compliance will be critical for long-term success.

Customer Segmentation Strategy should recognize the distinct needs of different market segments and develop tailored service offerings accordingly. Small businesses require different service models than large enterprises, while e-commerce customers have unique requirements compared to traditional importers.

Geographic Expansion Opportunities should focus on high-growth regions and emerging trade corridors where customs brokerage demand is expanding faster than supply. Secondary markets and specialized trade routes may offer better growth prospects than saturated primary markets.

Market projections for the USA customs brokerage sector indicate continued growth driven by expanding international trade, increasing regulatory complexity, and ongoing digital transformation initiatives that enhance service quality and operational efficiency.

Growth trajectory analysis suggests the market will experience sustained expansion over the next five to seven years, with compound annual growth rates expected to remain robust across most service categories. E-commerce-related services are projected to demonstrate the strongest growth, while traditional brokerage services will maintain steady demand with opportunities for margin improvement through technology adoption.

Technology evolution will continue to reshape the industry, with artificial intelligence, blockchain technology, and advanced analytics becoming standard capabilities rather than competitive differentiators. MWR projections indicate that customs brokers investing early in these technologies will capture disproportionate market share gains and achieve superior profitability metrics.

Service model transformation will accelerate as customers increasingly demand integrated logistics solutions rather than standalone customs clearance services. This evolution will favor larger, well-capitalized firms capable of investing in comprehensive service capabilities while creating niche opportunities for specialized providers.

Regulatory environment changes are expected to continue driving demand for professional customs services, with increasing complexity in trade agreements, security requirements, and compliance mandates. The ongoing evolution of international trade policies will create both challenges and opportunities for customs brokers with appropriate expertise and adaptability.

Market consolidation is likely to continue as larger firms seek to achieve scale advantages and smaller firms face pressure from technology investment requirements and competitive dynamics. This consolidation will create opportunities for remaining independent firms to focus on specialized niches or innovative service delivery models.

Sustainability integration will become increasingly important as environmental considerations influence trade practices and regulatory requirements. Customs brokers developing expertise in green trade practices and carbon management will be well-positioned for future growth opportunities.

The USA customs brokerage market represents a dynamic and essential component of the nation’s international trade infrastructure, characterized by steady growth, technological innovation, and evolving service sophistication. The market has demonstrated remarkable resilience and adaptability, successfully navigating regulatory changes, economic volatility, and technological disruption while maintaining its critical role in facilitating international commerce.

Key success factors for market participants include strategic technology investment, service portfolio diversification, and development of specialized expertise that creates competitive differentiation. The most successful customs brokers will be those that effectively balance traditional service excellence with innovative digital capabilities while building strong customer relationships and operational efficiency.

Future market development will be shaped by continued international trade growth, increasing regulatory complexity, and accelerating digital transformation that enhances service quality while reducing operational costs. The integration of artificial intelligence, automation, and advanced analytics will become essential capabilities for competitive positioning and customer satisfaction.

Strategic positioning for long-term success requires recognition that the customs brokerage market is evolving beyond traditional clearance services toward comprehensive trade facilitation and supply chain optimization solutions. Companies that successfully navigate this transformation while maintaining operational excellence will capture the greatest opportunities in this expanding and increasingly sophisticated market.

What is Customs Brokerage?

Customs brokerage refers to the services provided by licensed professionals who assist importers and exporters in complying with customs regulations. This includes the preparation and submission of necessary documentation, payment of duties, and ensuring that goods meet all legal requirements for entry or exit from a country.

What are the key players in the USA Customs Brokerage Market?

Key players in the USA Customs Brokerage Market include companies like Expeditors International, C.H. Robinson, and Kuehne + Nagel, which provide a range of logistics and customs services. These companies help facilitate international trade by ensuring compliance with customs regulations and efficient movement of goods, among others.

What are the main drivers of growth in the USA Customs Brokerage Market?

The main drivers of growth in the USA Customs Brokerage Market include the increasing volume of international trade, the complexity of customs regulations, and the rising demand for efficient supply chain management. Additionally, advancements in technology and e-commerce are contributing to the need for reliable customs brokerage services.

What challenges does the USA Customs Brokerage Market face?

The USA Customs Brokerage Market faces challenges such as evolving trade policies, increased scrutiny from customs authorities, and the need for continuous compliance with changing regulations. Additionally, the market must contend with competition from digital platforms that offer automated customs solutions.

What opportunities exist in the USA Customs Brokerage Market?

Opportunities in the USA Customs Brokerage Market include the potential for growth in e-commerce logistics, the expansion of trade agreements, and the increasing need for specialized customs services in emerging markets. Companies that can adapt to technological advancements and regulatory changes are likely to benefit.

What trends are shaping the USA Customs Brokerage Market?

Trends shaping the USA Customs Brokerage Market include the integration of technology such as blockchain for enhanced transparency, the use of data analytics for better decision-making, and a growing emphasis on sustainability in logistics practices. These trends are influencing how customs brokers operate and interact with clients.

USA Customs Brokerage Market

| Segmentation Details | Description |

|---|---|

| Service Type | Customs Clearance, Freight Forwarding, Compliance Consulting, Trade Advisory |

| End User | Manufacturers, Retailers, Importers, Exporters |

| Technology | Automated Systems, Blockchain Solutions, Cloud Platforms, Data Analytics |

| Industry Vertical | Automotive, Pharmaceuticals, Electronics, Textiles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the USA Customs Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at