444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US wound care management devices market represents a critical segment of the healthcare industry, encompassing advanced medical technologies designed to facilitate optimal wound healing outcomes. This dynamic market has experienced substantial growth driven by an aging population, increasing prevalence of chronic wounds, and technological innovations in wound care solutions. Healthcare providers across the United States are increasingly adopting sophisticated wound care management devices to improve patient outcomes and reduce treatment costs.

Market dynamics indicate robust expansion with the sector demonstrating a compound annual growth rate (CAGR) of 6.2% over recent years. The integration of advanced wound care technologies including negative pressure wound therapy, bioactive wound dressings, and smart wound monitoring systems has revolutionized traditional wound care approaches. Healthcare facilities are investing heavily in these innovative solutions to address the growing burden of chronic wounds, surgical site infections, and complex wound management challenges.

Regional distribution shows significant concentration in major metropolitan areas with advanced healthcare infrastructure, while rural markets present emerging opportunities for wound care device manufacturers. The market encompasses diverse product categories including traditional wound dressings, advanced wound care products, wound therapy devices, and active wound care solutions, each addressing specific clinical needs and patient populations.

The US wound care management devices market refers to the comprehensive ecosystem of medical devices, products, and technologies specifically designed to facilitate wound healing, prevent infections, and optimize patient outcomes in wound care treatment. This market encompasses a broad spectrum of solutions ranging from basic wound dressings to sophisticated therapeutic devices that actively promote healing through various mechanisms including negative pressure therapy, electrical stimulation, and bioactive compound delivery.

Wound care management devices serve multiple functions including wound protection, moisture management, infection prevention, pain reduction, and acceleration of the natural healing process. These devices are utilized across various healthcare settings including hospitals, outpatient clinics, long-term care facilities, and home healthcare environments, addressing diverse wound types such as chronic ulcers, surgical wounds, traumatic injuries, and burns.

Strategic analysis of the US wound care management devices market reveals a rapidly evolving landscape characterized by technological innovation, demographic shifts, and changing healthcare delivery models. The market demonstrates strong fundamentals with chronic wound prevalence increasing by approximately 15% annually due to rising diabetes rates and an aging population. Healthcare expenditure on wound care continues to escalate, driving demand for cost-effective, evidence-based wound management solutions.

Key market segments include advanced wound dressings, negative pressure wound therapy systems, wound closure devices, and active wound care products. Technology adoption rates vary significantly across different healthcare settings, with acute care facilities leading in advanced device utilization while long-term care and home healthcare markets present substantial growth opportunities. Regulatory compliance and clinical evidence requirements continue to shape product development and market entry strategies for device manufacturers.

Competitive dynamics feature a mix of established medical device companies and innovative startups developing next-generation wound care technologies. Market consolidation trends, strategic partnerships, and increasing focus on value-based healthcare delivery models are reshaping the competitive landscape and driving innovation in wound care management solutions.

Market intelligence reveals several critical insights shaping the US wound care management devices landscape:

Primary growth drivers propelling the US wound care management devices market include demographic trends, technological advancements, and evolving healthcare delivery models. The aging population represents a fundamental driver, with individuals over 65 experiencing higher rates of chronic wounds, surgical procedures, and healing complications. Diabetes prevalence continues to rise, with diabetic foot ulcers affecting approximately 25% of diabetic patients during their lifetime, creating sustained demand for specialized wound care solutions.

Healthcare cost containment initiatives are driving adoption of advanced wound care devices that demonstrate superior clinical outcomes and reduced total cost of care. Technology innovation in areas such as bioactive dressings, negative pressure wound therapy, and smart monitoring systems is expanding treatment options and improving patient outcomes. Regulatory support for innovative wound care technologies through expedited approval pathways is facilitating faster market entry for breakthrough devices.

Healthcare infrastructure improvements and expanding access to specialized wound care services are creating new market opportunities. Clinical evidence supporting the efficacy of advanced wound care devices is driving physician adoption and payer coverage decisions. Patient awareness and advocacy for better wound care outcomes are influencing treatment decisions and driving demand for innovative solutions.

Significant challenges constraining market growth include high device costs, reimbursement limitations, and regulatory complexities. Cost barriers remain a primary concern, particularly for advanced wound care technologies that require substantial upfront investment. Many healthcare facilities, especially smaller practices and rural hospitals, face budget constraints that limit their ability to adopt expensive wound care devices.

Reimbursement challenges create market access barriers, with many advanced wound care devices facing limited or inconsistent coverage from insurance providers. Clinical evidence requirements for new technologies can create lengthy and expensive development timelines, particularly for innovative devices requiring extensive clinical trials. Regulatory compliance costs and complexity can burden smaller manufacturers and limit innovation in certain market segments.

Healthcare provider resistance to change and preference for traditional wound care methods can slow adoption of new technologies. Training requirements for complex devices may create implementation barriers in busy healthcare settings. Supply chain disruptions and raw material cost fluctuations can impact device availability and pricing, affecting market growth and accessibility.

Emerging opportunities in the US wound care management devices market span multiple dimensions including technological innovation, market expansion, and service delivery transformation. Digital health integration presents significant opportunities for developing smart wound monitoring systems, telemedicine platforms, and data analytics solutions that improve care coordination and patient outcomes.

Home healthcare expansion offers substantial growth potential as healthcare systems seek to reduce costs and improve patient satisfaction through home-based care delivery. Rural market penetration represents an underserved opportunity, with telemedicine and portable wound care devices enabling access to specialized care in remote areas. Preventive care focus is creating demand for devices that prevent wound development and complications in high-risk populations.

Personalized medicine approaches in wound care are driving development of customized treatment solutions based on patient-specific factors and wound characteristics. Artificial intelligence and machine learning applications in wound assessment, treatment planning, and outcome prediction present innovative opportunities for device manufacturers. Value-based care contracts are creating opportunities for companies that can demonstrate superior clinical and economic outcomes.

Market dynamics in the US wound care management devices sector reflect complex interactions between demographic trends, technological innovation, regulatory evolution, and healthcare delivery transformation. Supply-demand equilibrium is influenced by increasing wound care needs driven by chronic disease prevalence and an aging population, while supply expansion is constrained by regulatory requirements and development costs.

Competitive intensity varies across market segments, with established players dominating traditional wound care products while emerging companies focus on innovative technologies and niche applications. Price competition is particularly intense in commodity wound care products, while advanced technology segments command premium pricing based on clinical differentiation and outcomes.

Innovation cycles are accelerating as companies invest in research and development to address unmet clinical needs and differentiate their offerings. Market consolidation trends are reshaping the competitive landscape through mergers, acquisitions, and strategic partnerships. Regulatory dynamics continue to evolve with FDA initiatives to streamline approval processes for innovative wound care devices while maintaining safety and efficacy standards.

Comprehensive research methodology employed in analyzing the US wound care management devices market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare providers, device manufacturers, distributors, and key opinion leaders across various market segments and geographic regions.

Secondary research encompasses analysis of industry reports, regulatory filings, clinical studies, and market intelligence from reputable sources. Quantitative analysis utilizes statistical modeling and forecasting techniques to project market trends and growth patterns. Qualitative insights are gathered through expert interviews and focus groups to understand market dynamics, competitive positioning, and emerging trends.

Data validation processes include cross-referencing multiple sources, triangulation of findings, and expert review to ensure accuracy and completeness. Market segmentation analysis employs both top-down and bottom-up approaches to validate market size estimates and growth projections. Regulatory analysis includes review of FDA databases, clinical trial registries, and regulatory guidance documents to understand approval pathways and compliance requirements.

Regional market distribution across the United States reveals significant variations in wound care device adoption, healthcare infrastructure, and market opportunities. Northeast region demonstrates the highest market concentration with 32% market share, driven by advanced healthcare systems, high physician density, and strong reimbursement coverage. Major metropolitan areas including New York, Boston, and Philadelphia serve as key market hubs with leading medical centers driving innovation adoption.

Southeast region represents the fastest-growing market segment with 8.5% annual growth rate, fueled by population growth, expanding healthcare infrastructure, and increasing chronic disease prevalence. Texas and Florida lead regional growth with significant investments in healthcare facilities and wound care specialty centers. Midwest region shows steady growth with strong adoption of cost-effective wound care solutions and emphasis on value-based care delivery models.

Western region demonstrates high adoption rates for innovative wound care technologies, with California leading in digital health integration and advanced device utilization. Rural markets across all regions present emerging opportunities for portable and telemedicine-enabled wound care solutions. Market penetration rates vary significantly between urban and rural areas, with rural regions showing 40% lower adoption rates for advanced wound care devices.

Competitive landscape analysis reveals a diverse ecosystem of established medical device companies, specialized wound care manufacturers, and innovative technology startups. Market leadership is distributed among several key players with distinct competitive advantages and market positioning strategies.

Competitive strategies include product innovation, clinical evidence development, strategic partnerships, and geographic expansion. Market differentiation is achieved through technology advancement, clinical outcomes, cost-effectiveness, and comprehensive service offerings.

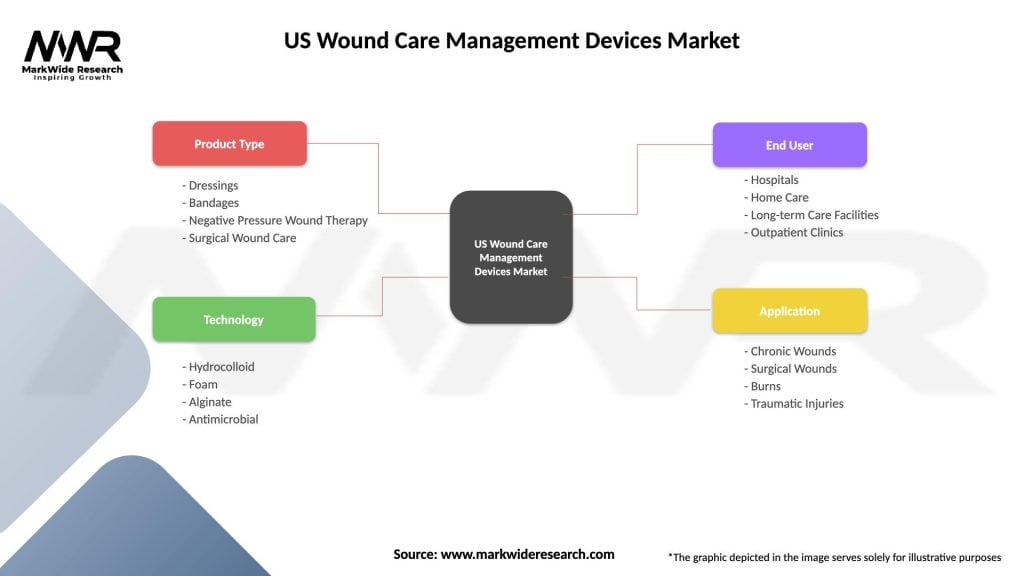

Market segmentation analysis provides detailed insights into various product categories, applications, and end-user segments within the US wound care management devices market. Product segmentation reveals distinct growth patterns and market opportunities across different device categories.

By Product Type:

By Wound Type:

By End User:

Advanced wound dressings represent the largest market category with 45% market share, driven by superior clinical outcomes and growing physician preference for evidence-based solutions. Hydrocolloid dressings maintain strong market position due to versatility and cost-effectiveness, while antimicrobial dressings show rapid growth driven by infection prevention focus.

Negative pressure wound therapy demonstrates the highest growth rate at 12% annually, supported by strong clinical evidence and expanding indications. Portable NPWT systems are gaining traction in outpatient and home care settings, offering improved patient mobility and quality of life. Single-use NPWT devices are emerging as cost-effective alternatives for appropriate wound types.

Biological wound care products show promising growth potential with tissue-engineered skin substitutes gaining clinical acceptance for complex wounds. Growth factor therapies and stem cell-based treatments represent emerging categories with significant future potential. Smart wound monitoring technologies are in early adoption phases with strong growth prospects as digital health integration accelerates.

Traditional wound care products maintain stable market presence with gradual decline in market share as advanced products gain adoption. Commodity pricing pressure affects traditional products while advanced categories command premium pricing based on clinical differentiation.

Healthcare providers benefit from improved patient outcomes, reduced treatment costs, and enhanced clinical efficiency through adoption of advanced wound care management devices. Clinical benefits include faster healing times, reduced infection rates, and improved patient satisfaction scores. Economic advantages encompass shorter hospital stays, reduced readmission rates, and lower total cost of care.

Patients experience significant benefits including reduced pain, improved quality of life, and faster return to normal activities. Advanced wound care devices offer better cosmetic outcomes, reduced scarring, and improved functional recovery. Home care options provide convenience and comfort while maintaining clinical effectiveness.

Device manufacturers benefit from growing market demand, premium pricing opportunities, and potential for recurring revenue through consumable products. Innovation opportunities in digital health, personalized medicine, and value-based care create competitive advantages and market differentiation. Strategic partnerships with healthcare providers enable co-development of solutions addressing specific clinical needs.

Healthcare systems achieve cost savings through reduced complications, shorter treatment durations, and improved resource utilization. Quality metrics improvement supports value-based care contracts and regulatory compliance requirements. Population health management benefits from preventive wound care approaches and early intervention strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the wound care management devices market. Smart wound monitoring systems incorporating sensors, mobile applications, and cloud-based analytics are enabling real-time wound assessment and treatment optimization. Artificial intelligence applications in wound imaging and healing prediction are improving clinical decision-making and patient outcomes.

Personalized wound care is gaining momentum with genetic testing and biomarker analysis informing treatment selection and device customization. 3D printing technology is enabling production of patient-specific wound care devices and skin grafts. Regenerative medicine approaches including stem cell therapy and tissue engineering are expanding treatment options for complex wounds.

Value-based care adoption is driving focus on clinical outcomes and cost-effectiveness rather than volume-based metrics. Bundled payment models are encouraging use of devices that demonstrate superior total cost of care. Remote monitoring and telemedicine integration are enabling continuous care delivery and early intervention for wound complications.

Sustainability initiatives are influencing product development with emphasis on eco-friendly materials and reduced packaging waste. Antimicrobial resistance concerns are driving development of novel infection prevention strategies and alternative antimicrobial approaches.

Recent industry developments highlight the dynamic nature of the US wound care management devices market with significant investments in innovation and market expansion. MarkWide Research analysis indicates accelerating merger and acquisition activity as companies seek to expand product portfolios and market reach.

Regulatory milestones include FDA approval of breakthrough wound care devices incorporating novel technologies such as bioengineered skin substitutes and advanced negative pressure systems. Clinical trial completions for next-generation wound care products are providing evidence for expanded indications and improved outcomes.

Strategic partnerships between device manufacturers and healthcare systems are enabling co-development of customized wound care solutions. Technology licensing agreements are facilitating rapid innovation transfer and market entry for emerging technologies. Digital health collaborations are integrating wound care devices with electronic health records and patient monitoring systems.

Manufacturing investments in automated production and quality systems are improving device consistency and reducing costs. Supply chain optimization initiatives are enhancing product availability and distribution efficiency. International expansion activities are extending proven US technologies to global markets.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing current market challenges. Device manufacturers should prioritize development of cost-effective solutions that demonstrate clear clinical and economic value. Digital health integration capabilities should be incorporated into product development roadmaps to meet evolving healthcare delivery requirements.

Healthcare providers should evaluate wound care device investments based on total cost of care rather than initial purchase price. Staff training programs and clinical protocols should be developed to optimize device utilization and patient outcomes. Data collection systems should be implemented to track clinical outcomes and support value-based care contracts.

Payers should consider evidence-based coverage policies that recognize the long-term cost benefits of effective wound care devices. Outcome-based reimbursement models should be developed to incentivize use of proven technologies. Prior authorization processes should be streamlined for devices with strong clinical evidence.

Investment opportunities exist in companies developing innovative technologies addressing unmet clinical needs. Digital health startups focusing on wound care applications present attractive growth potential. Regulatory expertise and clinical evidence development capabilities are critical success factors for emerging companies.

Future market prospects for the US wound care management devices sector remain highly positive with sustained growth expected across multiple market segments. Demographic trends including population aging and chronic disease prevalence will continue driving fundamental demand for wound care solutions. Technology advancement in areas such as regenerative medicine, digital health, and personalized care will create new market opportunities and expand treatment options.

Market evolution will be characterized by increasing integration of digital technologies, emphasis on value-based outcomes, and expansion of home-based care delivery models. Regulatory environment is expected to become more supportive of innovation through streamlined approval processes and breakthrough device designations. MWR projections indicate continued market expansion with growth rates exceeding 7% annually over the next five years.

Competitive dynamics will intensify as new entrants introduce disruptive technologies and established players expand through acquisitions and partnerships. Market consolidation is expected to continue with larger companies acquiring innovative startups and specialized manufacturers. Global expansion opportunities will drive international growth for successful US-based technologies.

Innovation focus will shift toward preventive care, personalized treatment approaches, and integrated care delivery systems. Artificial intelligence and machine learning applications will become standard features in advanced wound care devices. Sustainability considerations will increasingly influence product development and purchasing decisions.

The US wound care management devices market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, technological innovation, and healthcare delivery transformation. Market fundamentals remain strong with increasing demand for advanced wound care solutions addressing chronic wounds, surgical complications, and complex healing challenges.

Key success factors for market participants include focus on clinical evidence, cost-effectiveness demonstration, and integration with digital health platforms. Innovation opportunities in personalized medicine, regenerative therapies, and smart monitoring systems offer significant potential for market differentiation and growth. Regulatory support and evolving reimbursement models are creating favorable conditions for breakthrough technologies.

Strategic positioning for future success requires balancing innovation investment with practical clinical needs and economic constraints. Companies that can demonstrate superior patient outcomes while reducing total cost of care will be best positioned to capture market opportunities. The US wound care management devices market will continue serving as a critical component of the healthcare system, improving patient lives while driving economic value for all stakeholders.

What is Wound Care Management Devices?

Wound Care Management Devices refer to a range of products designed to assist in the treatment and management of wounds. These devices include advanced dressings, negative pressure wound therapy systems, and other technologies aimed at promoting healing and preventing infection.

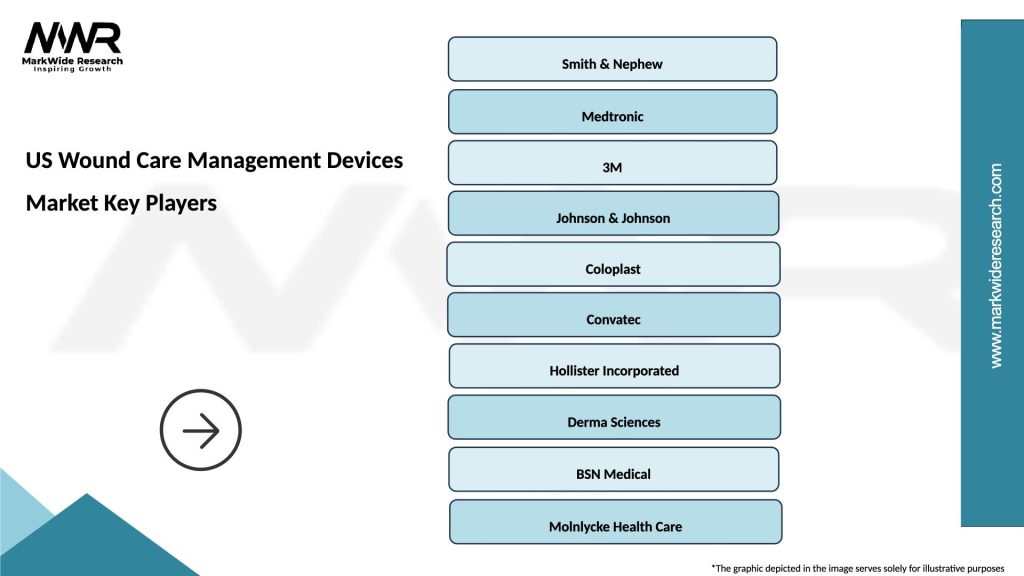

What are the key players in the US Wound Care Management Devices Market?

Key players in the US Wound Care Management Devices Market include Smith & Nephew, Medtronic, and ConvaTec, among others. These companies are known for their innovative products and extensive distribution networks in the wound care sector.

What are the main drivers of the US Wound Care Management Devices Market?

The main drivers of the US Wound Care Management Devices Market include the increasing prevalence of chronic wounds, a growing aging population, and advancements in wound care technologies. These factors contribute to a rising demand for effective wound management solutions.

What challenges does the US Wound Care Management Devices Market face?

The US Wound Care Management Devices Market faces challenges such as high costs associated with advanced wound care products and the need for skilled healthcare professionals to manage complex wounds. Additionally, regulatory hurdles can impact the speed of product approvals.

What opportunities exist in the US Wound Care Management Devices Market?

Opportunities in the US Wound Care Management Devices Market include the development of innovative products that incorporate smart technology and telehealth solutions. There is also potential for growth in home healthcare settings as patients seek more convenient care options.

What trends are shaping the US Wound Care Management Devices Market?

Trends shaping the US Wound Care Management Devices Market include the increasing adoption of bioactive dressings and the integration of digital health technologies. Additionally, there is a growing focus on personalized wound care solutions tailored to individual patient needs.

US Wound Care Management Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dressings, Bandages, Negative Pressure Wound Therapy, Surgical Wound Care |

| Technology | Hydrocolloid, Foam, Alginate, Antimicrobial |

| End User | Hospitals, Home Care, Long-term Care Facilities, Outpatient Clinics |

| Application | Chronic Wounds, Surgical Wounds, Burns, Traumatic Injuries |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Wound Care Management Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at