444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US wireline logging services market represents a critical component of the nation’s oil and gas exploration and production industry, providing essential data acquisition and formation evaluation services for drilling operations. Wireline logging involves the deployment of sophisticated instruments down wellbores to measure and record various geological and petrophysical properties of subsurface formations. This market has experienced significant transformation driven by technological advancements, unconventional resource development, and evolving industry demands for precise reservoir characterization.

Market dynamics indicate robust growth potential, with the sector benefiting from increased drilling activities across major shale formations including the Permian Basin, Bakken, and Eagle Ford. The market demonstrates strong resilience despite cyclical industry challenges, supported by continuous innovation in logging technologies and growing emphasis on data-driven decision making in hydrocarbon exploration. Digital transformation initiatives have revolutionized traditional logging practices, introducing real-time data transmission, advanced analytics, and automated interpretation capabilities.

Regional distribution shows concentrated activity in key oil and gas producing states, with Texas leading with approximately 35% market share, followed by North Dakota, Pennsylvania, and Oklahoma. The market encompasses various logging techniques including open-hole logging, cased-hole logging, and production logging, each serving specific operational requirements throughout the well lifecycle. Service providers range from major oilfield service companies to specialized regional operators, creating a competitive landscape characterized by technological differentiation and service quality.

The US wireline logging services market refers to the comprehensive ecosystem of companies, technologies, and services dedicated to acquiring subsurface geological and petrophysical data through wireline operations in oil and gas wells across the United States. Wireline logging encompasses the deployment of sophisticated measurement tools and sensors via electrical cables to evaluate formation properties, fluid characteristics, and reservoir potential.

Core services within this market include formation evaluation logging, production logging, perforating services, and well intervention activities. Formation evaluation involves measuring parameters such as resistivity, porosity, density, and natural gamma radiation to characterize reservoir rocks and identify hydrocarbon-bearing zones. Production logging focuses on monitoring well performance, fluid flow rates, and production optimization throughout the operational lifecycle.

Market participants include major international oilfield service providers, regional specialists, and technology developers who collectively deliver comprehensive logging solutions. The market serves diverse customer segments including independent oil companies, major integrated operators, and drilling contractors operating across conventional and unconventional resource plays throughout the United States.

Strategic analysis reveals the US wireline logging services market as a fundamental enabler of domestic energy production, supporting critical decision-making processes throughout the exploration and production value chain. The market demonstrates strong growth momentum driven by technological innovation, increased drilling efficiency requirements, and expanding unconventional resource development activities.

Key growth drivers include the proliferation of horizontal drilling and hydraulic fracturing operations, which require sophisticated formation evaluation and completion monitoring services. Digital transformation initiatives have emerged as a primary market catalyst, with operators increasingly demanding real-time data acquisition, cloud-based analytics, and integrated interpretation platforms. Automation trends are reshaping service delivery models, with 65% of operators prioritizing automated logging systems to reduce operational costs and improve data quality.

Competitive dynamics reflect a market characterized by technological differentiation, with leading service providers investing heavily in next-generation logging tools and data analytics capabilities. Market consolidation trends have created opportunities for specialized regional players to capture market share through focused service offerings and customer relationships. Regulatory compliance requirements continue to influence market development, driving demand for enhanced environmental monitoring and safety protocols.

Future prospects indicate sustained growth potential supported by ongoing shale development, enhanced oil recovery initiatives, and emerging carbon capture and storage projects. The market is positioned to benefit from increasing emphasis on data-driven reservoir management and optimization strategies across the domestic oil and gas industry.

Market intelligence reveals several critical insights shaping the US wireline logging services landscape. Technology adoption patterns show accelerating deployment of advanced logging tools, with artificial intelligence and machine learning capabilities becoming standard features in modern logging systems.

Emerging trends include the integration of fiber optic sensing technologies, distributed acoustic sensing, and advanced imaging capabilities that provide unprecedented insights into reservoir characteristics and completion effectiveness.

Primary market drivers propelling the US wireline logging services market include the sustained growth of unconventional resource development, technological advancement in logging capabilities, and increasing demand for precise reservoir characterization. Shale oil and gas production continues to drive significant logging activity, with operators requiring comprehensive formation evaluation to optimize drilling and completion strategies.

Technological innovation serves as a fundamental growth catalyst, with next-generation logging tools offering enhanced measurement capabilities, improved data quality, and reduced operational time. Digital transformation initiatives across the oil and gas industry have created substantial demand for integrated logging solutions that combine data acquisition, processing, and interpretation capabilities. Real-time logging technologies enable immediate decision-making during drilling operations, reducing costs and improving well performance.

Regulatory requirements continue to drive market demand, with operators needing comprehensive formation evaluation data for environmental compliance, reservoir management, and production optimization. Enhanced oil recovery projects require detailed reservoir characterization through advanced logging techniques, creating opportunities for specialized service providers.

Economic factors including improved oil and gas prices have supported increased drilling activity and capital investment in logging services. Operational efficiency demands from operators have driven adoption of automated logging systems and integrated service offerings that reduce overall project costs while improving data quality and interpretation accuracy.

Market constraints affecting the US wireline logging services sector include cyclical industry volatility, high capital requirements for advanced technology development, and increasing competitive pressure on service pricing. Commodity price fluctuations directly impact drilling activity levels, creating uncertainty in service demand and revenue predictability for logging service providers.

Technology complexity presents significant challenges, with advanced logging systems requiring substantial investment in research and development, specialized personnel, and ongoing maintenance capabilities. Skilled labor shortages across the oilfield services sector have created operational constraints, with experienced logging engineers and technicians in high demand throughout the industry.

Environmental regulations continue to evolve, requiring continuous adaptation of logging procedures and equipment to meet changing compliance requirements. Permitting delays and regulatory uncertainties can impact project timelines and service demand patterns across different regions and formations.

Competitive pricing pressure from both established players and new market entrants has compressed service margins, requiring continuous operational efficiency improvements and technology differentiation strategies. Capital intensity of advanced logging equipment limits market entry opportunities and requires significant financial resources for technology upgrades and fleet expansion.

Significant opportunities exist within the US wireline logging services market, driven by emerging technologies, expanding application areas, and evolving industry requirements. Carbon capture and storage projects represent a substantial growth opportunity, requiring specialized logging services for geological characterization and monitoring of CO2 injection operations.

Geothermal energy development presents expanding market potential, with logging services essential for reservoir assessment and production optimization in geothermal projects. Enhanced oil recovery initiatives across mature fields require comprehensive formation evaluation and monitoring services, creating sustained demand for advanced logging capabilities.

Digital transformation opportunities include development of artificial intelligence-powered interpretation systems, cloud-based analytics platforms, and integrated data management solutions that provide comprehensive reservoir insights. Automation technologies offer potential for significant operational efficiency improvements and cost reduction opportunities.

International expansion opportunities exist for US-based service providers to leverage advanced technologies and operational expertise in global markets. Strategic partnerships with technology companies, data analytics firms, and software developers can create new service offerings and competitive advantages in the evolving market landscape.

Market dynamics within the US wireline logging services sector reflect the complex interplay of technological advancement, regulatory evolution, and economic factors influencing industry development. Supply and demand patterns demonstrate strong correlation with drilling activity levels, which fluctuate based on commodity prices, regulatory environment, and capital availability.

Competitive forces include technology differentiation, service quality, operational efficiency, and customer relationships as primary factors determining market success. Consolidation trends have created larger, more diversified service providers while also generating opportunities for specialized regional operators to capture niche market segments.

Innovation cycles drive continuous technology advancement, with research and development investments focused on improving measurement accuracy, reducing operational time, and enhancing data interpretation capabilities. Customer expectations continue to evolve toward integrated service offerings that combine logging, data analytics, and reservoir modeling capabilities.

Regulatory dynamics influence market development through environmental compliance requirements, safety standards, and operational protocols that impact service delivery methods and technology requirements. Economic sensitivity to commodity price cycles creates both challenges and opportunities for market participants, requiring flexible operational models and diversified service portfolios.

Comprehensive research methodology employed in analyzing the US wireline logging services market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with industry executives, service providers, technology developers, and end-users across various market segments and geographic regions.

Secondary research encompasses analysis of industry publications, regulatory filings, company reports, and technical literature to gather comprehensive market intelligence. Data triangulation methods validate findings through cross-referencing multiple information sources and analytical approaches to ensure consistency and accuracy of market assessments.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing methodologies that provide robust foundations for market projections and growth estimates. Qualitative research methods capture industry insights, competitive dynamics, and strategic trends that influence market development patterns.

Market segmentation analysis employs detailed categorization by service type, application, technology, and geographic region to provide comprehensive understanding of market structure and growth opportunities. Validation processes include expert review, industry feedback, and continuous monitoring of market developments to maintain accuracy and relevance of research findings.

Regional market distribution across the United States reflects the geographic concentration of oil and gas resources, with distinct patterns of logging service demand and competitive dynamics. Texas dominates the market with approximately 35% share, driven by extensive Permian Basin operations and diverse geological formations requiring comprehensive logging services.

North Dakota represents a significant market segment focused primarily on Bakken shale development, with specialized logging requirements for unconventional resource characterization. Pennsylvania and West Virginia comprise important markets centered on Marcellus and Utica shale formations, emphasizing gas-focused logging applications and environmental compliance requirements.

Oklahoma and Colorado demonstrate strong market presence with diverse geological formations and active drilling programs requiring varied logging services. Gulf Coast regions including Louisiana and offshore areas present unique market opportunities for specialized logging applications in deepwater and complex reservoir environments.

California markets focus on enhanced oil recovery projects and environmental monitoring applications, requiring specialized logging capabilities for mature field development. Regional service providers maintain competitive advantages through local expertise, customer relationships, and specialized knowledge of basin-specific geological characteristics and operational requirements.

Competitive dynamics within the US wireline logging services market feature a diverse ecosystem of service providers ranging from major international corporations to specialized regional operators. Market leadership positions are determined by technology capabilities, service quality, operational efficiency, and customer relationships across various market segments.

Competitive strategies emphasize technology differentiation, operational excellence, and integrated service offerings that provide comprehensive solutions for customer requirements. Innovation focus areas include automation, data analytics, and digital integration capabilities that enhance service value and operational efficiency.

Market segmentation analysis reveals distinct categories within the US wireline logging services market, each characterized by specific service requirements, technology applications, and customer needs. Service type segmentation provides the primary framework for understanding market structure and competitive dynamics.

By Service Type:

By Application:

By Technology:

Open-hole logging represents the largest market segment, accounting for approximately 45% of total market activity, driven by extensive drilling operations across unconventional resource plays. Formation evaluation services within this category focus on reservoir characterization, hydrocarbon identification, and completion design optimization. Advanced imaging tools and nuclear magnetic resonance technologies provide detailed insights into formation properties and fluid characteristics.

Cased-hole logging services demonstrate strong growth potential, particularly in mature fields requiring enhanced oil recovery and production optimization. Production logging applications include flow rate measurement, water cut determination, and completion effectiveness assessment. Well integrity monitoring services address regulatory compliance requirements and operational safety considerations.

Perforating services represent a specialized segment with high technical requirements and significant safety considerations. Shaped charge technology continues to evolve with improved penetration capabilities and reduced formation damage characteristics. Perforation optimization services integrate logging data with completion design to maximize production potential.

Digital logging technologies show the highest growth rates, with real-time data transmission and automated interpretation capabilities becoming standard requirements. Cloud-based analytics platforms enable collaborative data analysis and integrated reservoir modeling capabilities that enhance decision-making processes throughout the exploration and production value chain.

Industry participants across the US wireline logging services market realize substantial benefits through advanced service capabilities, operational efficiencies, and strategic insights that enhance overall project performance. Oil and gas operators benefit from comprehensive formation evaluation data that improves drilling success rates, optimizes completion designs, and maximizes production potential.

Service providers gain competitive advantages through technology differentiation, operational excellence, and integrated service offerings that create customer value and sustainable market positions. Technology developers benefit from continuous innovation opportunities and expanding market applications for advanced logging capabilities.

Operational benefits include:

Strategic benefits encompass improved reservoir understanding, optimized field development strategies, and enhanced production performance throughout the asset lifecycle. Environmental benefits include reduced operational footprint, improved regulatory compliance, and enhanced monitoring capabilities for environmental protection.

Economic benefits for stakeholders include improved project returns, reduced operational costs, and enhanced asset value through comprehensive reservoir characterization and production optimization strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the US wireline logging services market, with comprehensive integration of advanced analytics, artificial intelligence, and automated interpretation capabilities. Real-time data processing has become standard practice, enabling immediate decision-making during drilling operations and reducing overall project timelines.

Automation trends continue to accelerate, with automated logging systems reducing operational costs while improving data quality and safety performance. Machine learning applications enhance interpretation accuracy and provide predictive insights for reservoir performance and completion optimization.

Environmental sustainability initiatives drive development of eco-friendly logging fluids, reduced waste generation, and enhanced environmental monitoring capabilities. Carbon capture and storage projects create new market opportunities requiring specialized logging services for geological characterization and monitoring applications.

Integration trends emphasize comprehensive service offerings that combine logging, data analytics, and reservoir modeling capabilities. Cloud-based platforms enable collaborative data analysis and remote operations capabilities that improve operational efficiency and reduce costs. Fiber optic sensing technologies provide distributed measurement capabilities that enhance reservoir monitoring and production optimization strategies.

Recent industry developments highlight the dynamic nature of the US wireline logging services market, with continuous innovation in technology capabilities, service delivery methods, and market applications. Technology advancement initiatives focus on improving measurement accuracy, reducing operational time, and enhancing data interpretation capabilities through advanced analytics and automation.

Strategic partnerships between service providers and technology companies have accelerated development of integrated solutions combining logging services with data analytics and reservoir modeling capabilities. Acquisition activities continue to reshape the competitive landscape, with larger service providers expanding capabilities through strategic acquisitions of specialized technology companies and regional operators.

Digital platform development has emerged as a key focus area, with companies investing in cloud-based analytics, mobile applications, and collaborative data platforms that enhance customer experience and operational efficiency. Sustainability initiatives include development of environmentally friendly logging technologies and enhanced environmental monitoring capabilities.

Regulatory developments continue to influence market dynamics, with evolving environmental regulations and safety requirements driving technology innovation and operational procedure modifications. International expansion activities by US-based service providers leverage domestic technology expertise and operational capabilities in global markets, creating additional growth opportunities and revenue diversification.

Strategic recommendations for US wireline logging services market participants emphasize the importance of technology innovation, operational excellence, and customer-focused service delivery in maintaining competitive advantages. MarkWide Research analysis indicates that companies should prioritize digital transformation initiatives and automation capabilities to meet evolving customer requirements and improve operational efficiency.

Investment priorities should focus on advanced measurement technologies, data analytics capabilities, and integrated service platforms that provide comprehensive solutions for customer needs. Market positioning strategies should emphasize technology differentiation, service quality, and operational reliability as key competitive factors in the evolving market landscape.

Operational recommendations include:

Growth strategies should consider market diversification opportunities including carbon capture projects, geothermal development, and international expansion initiatives. Partnership opportunities with technology companies and data analytics firms can enhance service capabilities and create competitive advantages in the digital transformation era.

Future prospects for the US wireline logging services market indicate sustained growth potential driven by continued unconventional resource development, technological advancement, and expanding application areas. Market projections suggest steady growth with CAGR expectations of 6-8% over the next five years, supported by increasing drilling activity and enhanced service capabilities.

Technology evolution will continue to reshape market dynamics, with artificial intelligence, machine learning, and advanced automation becoming standard features in next-generation logging systems. Digital integration capabilities will expand to include comprehensive data management platforms, real-time analytics, and predictive modeling applications.

Market expansion opportunities include emerging applications in carbon capture and storage, geothermal energy, and enhanced oil recovery projects that require specialized logging services. Environmental considerations will drive continued innovation in sustainable logging technologies and enhanced monitoring capabilities.

Competitive landscape evolution will favor companies with strong technology capabilities, operational excellence, and integrated service offerings. MWR analysis indicates that market consolidation trends may continue, creating opportunities for strategic partnerships and technology integration initiatives. Regional growth patterns will reflect ongoing development in major shale formations and emerging resource plays across the United States.

The US wireline logging services market represents a dynamic and essential component of the domestic energy industry, providing critical data acquisition and formation evaluation services that enable successful oil and gas exploration and production activities. Market fundamentals remain strong, supported by continuous technological advancement, expanding application areas, and sustained demand from unconventional resource development.

Digital transformation initiatives continue to reshape the market landscape, creating opportunities for enhanced service delivery, improved operational efficiency, and comprehensive data analytics capabilities. Competitive dynamics favor companies that successfully integrate advanced technologies with operational excellence and customer-focused service delivery models.

Growth prospects remain positive, with emerging opportunities in carbon capture, geothermal development, and enhanced oil recovery projects complementing traditional oil and gas applications. Technology innovation will continue to drive market evolution, with automation, artificial intelligence, and digital integration capabilities becoming increasingly important competitive differentiators.

Strategic success in this market requires continuous investment in technology development, operational excellence, and customer relationships while maintaining focus on safety, environmental compliance, and service quality. The US wireline logging services market is well-positioned for sustained growth and continued importance in supporting domestic energy production and emerging energy transition initiatives.

What is Wireline Logging Services?

Wireline Logging Services refer to the techniques used to gather data from boreholes in the oil and gas industry. These services include various methods of measuring and recording geological and reservoir properties to aid in exploration and production.

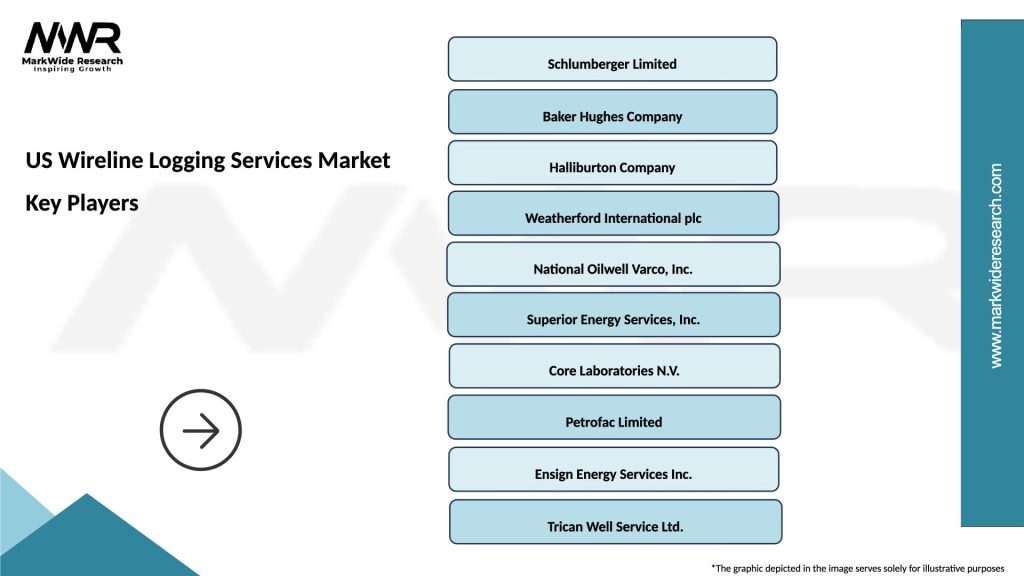

What are the key players in the US Wireline Logging Services Market?

Key players in the US Wireline Logging Services Market include Schlumberger, Halliburton, and Baker Hughes, among others. These companies provide a range of logging services and technologies to enhance oil and gas exploration and production.

What are the main drivers of the US Wireline Logging Services Market?

The main drivers of the US Wireline Logging Services Market include the increasing demand for oil and gas, advancements in logging technologies, and the need for efficient resource management. These factors contribute to the growth of exploration activities.

What challenges does the US Wireline Logging Services Market face?

The US Wireline Logging Services Market faces challenges such as fluctuating oil prices, regulatory hurdles, and the need for skilled labor. These factors can impact the operational efficiency and profitability of service providers.

What opportunities exist in the US Wireline Logging Services Market?

Opportunities in the US Wireline Logging Services Market include the expansion of unconventional oil and gas resources and the integration of digital technologies. These trends can enhance data accuracy and operational efficiency.

What trends are shaping the US Wireline Logging Services Market?

Trends shaping the US Wireline Logging Services Market include the adoption of automation and real-time data analytics. These innovations are improving the speed and accuracy of logging operations, leading to better decision-making in resource extraction.

US Wireline Logging Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Open Hole, Cased Hole, Production Logging, Wireline Coring |

| Technology | Electromagnetic, Acoustic, Nuclear, Resistivity |

| End User | Oil & Gas Companies, Mining Firms, Environmental Agencies, Research Institutions |

| Application | Reservoir Characterization, Well Integrity, Formation Evaluation, Environmental Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Wireline Logging Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at