444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US wind energy market represents one of the most dynamic and rapidly expanding renewable energy sectors in North America, demonstrating remarkable growth trajectory and technological advancement. Wind power generation has emerged as a cornerstone of America’s clean energy transition, with installations spanning from offshore coastal regions to vast onshore wind farms across the Great Plains. The market encompasses a comprehensive ecosystem including wind turbine manufacturers, project developers, utility companies, and supporting infrastructure providers.

Market dynamics indicate sustained expansion driven by favorable policy frameworks, declining technology costs, and increasing corporate renewable energy procurement. The sector has achieved significant milestones in capacity additions, with wind energy now representing a substantial portion of new electricity generation capacity installed annually. Technological innovations in turbine design, blade efficiency, and grid integration continue to enhance the competitiveness of wind power against conventional energy sources.

Geographic distribution shows concentrated development in wind-rich regions, particularly Texas, Iowa, Oklahoma, and Kansas, while emerging offshore markets along the Atlantic coast present new growth opportunities. The market benefits from federal tax incentives, state renewable portfolio standards, and corporate sustainability commitments driving long-term demand for clean energy solutions.

The US wind energy market refers to the comprehensive sector encompassing the development, manufacturing, installation, operation, and maintenance of wind power generation systems across the United States. This market includes both onshore wind farms utilizing land-based turbines and offshore wind installations harnessing coastal wind resources to generate electricity for grid distribution.

Wind energy systems convert kinetic energy from moving air into electrical power through advanced turbine technology, representing a clean, renewable alternative to fossil fuel-based electricity generation. The market spans the entire value chain from component manufacturing including turbines, blades, towers, and control systems, to project development, financing, construction, and long-term operational services.

Market participants include original equipment manufacturers, independent power producers, utility companies, project developers, and specialized service providers supporting the wind energy ecosystem. The sector plays a crucial role in America’s energy independence strategy while contributing to carbon emission reduction goals and sustainable economic development.

Strategic positioning of the US wind energy market reflects a mature yet rapidly evolving sector characterized by technological innovation, cost competitiveness, and strong policy support. The market has demonstrated resilience through economic cycles while maintaining consistent growth in installed capacity and electricity generation output.

Key performance indicators highlight the sector’s success in achieving grid parity with conventional energy sources in many regions, supported by improving capacity factors and declining levelized cost of energy. Corporate procurement has emerged as a significant demand driver, with major corporations committing to renewable energy purchases through long-term power purchase agreements.

Market segmentation reveals distinct growth patterns between onshore and offshore wind development, with onshore installations continuing to dominate current capacity while offshore wind presents substantial future expansion potential. Regional concentration in wind-rich areas has created specialized industrial clusters supporting manufacturing, installation, and maintenance activities.

Investment flows into the sector remain robust, supported by favorable financing conditions, tax credit availability, and increasing institutional investor interest in renewable energy assets. The market outlook indicates continued expansion driven by decarbonization commitments, grid modernization initiatives, and advancing energy storage integration capabilities.

Fundamental market drivers demonstrate the wind energy sector’s transition from policy-dependent growth to market-driven expansion based on economic competitiveness and reliability improvements.

Economic competitiveness serves as the primary market driver, with wind energy achieving cost parity or advantage compared to conventional generation sources across multiple regions. Technological improvements in turbine efficiency, reliability, and performance have significantly reduced the levelized cost of energy while extending asset operational lifespans.

Policy frameworks continue supporting market growth through federal tax incentives, state renewable energy standards, and clean energy mandates. The Production Tax Credit provides crucial financial support for new wind projects, while state-level renewable portfolio standards create long-term demand certainty for developers and investors.

Corporate sustainability commitments drive substantial demand for renewable energy through direct procurement strategies. Major corporations across technology, retail, and manufacturing sectors have established ambitious carbon neutrality goals, creating a robust market for wind energy through long-term power purchase agreements.

Grid modernization initiatives enhance wind energy integration capabilities through improved transmission infrastructure, advanced forecasting systems, and flexible grid operations. Energy storage deployment addresses intermittency challenges while enabling wind power to provide additional grid services including frequency regulation and capacity reserves.

Environmental regulations and carbon pricing mechanisms create additional value for zero-emission wind energy generation. Public support for clean energy development remains strong, facilitating permitting processes and community acceptance for wind projects.

Transmission infrastructure limitations constrain wind energy development in optimal resource areas, particularly where existing grid capacity cannot accommodate large-scale wind farm output. Grid integration challenges related to wind power variability require substantial investments in transmission upgrades and grid flexibility measures.

Intermittency concerns continue affecting wind energy adoption despite technological improvements in forecasting and grid management. Energy storage costs, while declining, still represent significant additional investment requirements for wind projects seeking to provide firm power delivery.

Regulatory uncertainties surrounding federal tax credit extensions and state policy changes create investment planning challenges for long-term project development. Permitting complexities for transmission lines and wind farm development can extend project timelines and increase development costs.

Local opposition to wind projects in some communities creates siting challenges, particularly related to visual impacts, noise concerns, and property value considerations. Environmental considerations including wildlife impacts and habitat protection requirements add complexity to project development processes.

Supply chain constraints for specialized wind energy components can create delivery delays and cost pressures, particularly during periods of rapid market expansion. Skilled workforce availability in specialized areas such as turbine maintenance and offshore installation presents ongoing challenges for industry growth.

Offshore wind development presents the most significant growth opportunity, with vast untapped resources along the Atlantic, Pacific, and Gulf coasts offering higher capacity factors and proximity to major population centers. Federal lease auctions and state offshore wind targets create substantial market potential for the next decade.

Repowering opportunities for aging wind farms enable capacity increases and efficiency improvements through modern turbine technology. Life extension programs and component upgrades can significantly enhance the economic performance of existing wind assets while extending operational lifespans.

Energy storage integration creates new revenue streams for wind projects through grid services provision, peak demand management, and improved capacity value. Hybrid renewable projects combining wind, solar, and storage technologies offer enhanced grid reliability and economic optimization.

Green hydrogen production using wind energy presents emerging market opportunities for industrial applications, transportation fuel, and energy storage. Electrification trends in transportation and heating sectors increase electricity demand, creating additional markets for wind energy output.

Distributed wind systems for commercial and industrial applications offer growth potential in areas with suitable wind resources and high electricity costs. International market expansion opportunities exist for US wind energy companies in global markets seeking clean energy solutions.

Supply chain evolution reflects increasing domestic manufacturing capabilities reducing import dependence while supporting local economic development. Component localization strategies by major turbine manufacturers enhance supply chain resilience and reduce transportation costs for large wind energy components.

Competitive dynamics show consolidation among wind turbine manufacturers while project development remains fragmented across numerous independent developers and utility companies. Vertical integration strategies by some market participants aim to capture value across multiple segments of the wind energy value chain.

Financing mechanisms continue evolving with increased institutional investor participation, green bond issuance, and innovative risk management instruments. Tax equity markets remain crucial for project financing, though corporate renewable energy procurement provides alternative revenue structures.

Technology convergence with digitalization, artificial intelligence, and advanced materials science drives continuous performance improvements and cost reductions. Data analytics applications enhance wind resource assessment, operational optimization, and predictive maintenance capabilities.

Market maturation indicators include standardized contracting practices, established performance benchmarks, and sophisticated risk assessment methodologies. Secondary market development for wind energy assets enables portfolio optimization and capital recycling for continued growth.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US wind energy market dynamics. Primary research includes extensive interviews with industry executives, project developers, equipment manufacturers, and utility companies to gather firsthand market intelligence and strategic perspectives.

Secondary research incorporates analysis of government databases, industry reports, regulatory filings, and academic studies to establish market baselines and trend identification. Data validation processes cross-reference multiple sources to ensure accuracy and consistency of market information and statistical analysis.

Quantitative analysis utilizes statistical modeling techniques to project market trends, capacity additions, and technology adoption patterns. Qualitative assessment examines policy impacts, regulatory changes, and market sentiment factors affecting industry development trajectories.

Geographic segmentation analysis evaluates regional market variations, resource potential, and development constraints across different US markets. Technology assessment examines innovation trends, performance improvements, and cost reduction trajectories for wind energy systems.

Market participant analysis includes competitive positioning evaluation, strategic initiative assessment, and market share analysis across key industry segments. Stakeholder consultation ensures research findings reflect diverse perspectives from across the wind energy value chain.

Texas market leadership continues with the state maintaining approximately 30% market share of total US wind capacity, driven by excellent wind resources, supportive regulatory environment, and robust transmission infrastructure development. ERCOT grid integration demonstrates successful large-scale wind power accommodation with minimal curtailment issues.

Midwest region dominance across Iowa, Kansas, and Oklahoma reflects optimal wind resource availability and agricultural land use compatibility. Iowa achievement of generating over 60% of electricity from wind power demonstrates the technology’s capability to serve as a primary generation source in suitable markets.

Great Plains expansion continues across Nebraska, North Dakota, and South Dakota, supported by excellent wind resources and available land for development. Transmission development initiatives aim to connect wind-rich areas with distant load centers, enhancing market access for Great Plains wind projects.

Atlantic Coast emergence as the primary offshore wind development region, with Massachusetts, New York, and New Jersey leading state-level offshore wind procurement initiatives. Federal lease areas provide substantial development opportunities with over 25 GW of potential offshore wind capacity in various stages of development.

Western region challenges include transmission constraints and competing land uses, though California and other western states maintain significant wind development potential. Pacific offshore wind presents long-term opportunities despite deeper water depths requiring floating turbine technology.

Market leadership among wind turbine manufacturers reflects global competition with several international companies maintaining significant US market presence alongside domestic manufacturers.

Project development remains highly fragmented with numerous independent developers, utility companies, and energy companies active in wind project development. NextEra Energy maintains market leadership in wind project development and ownership, while other major utilities including Xcel Energy and MidAmerican Energy operate substantial wind portfolios.

Service providers including Vestas, GE Renewable Energy, and specialized maintenance companies provide ongoing operational support for the growing installed wind fleet. Market consolidation trends show increasing vertical integration and strategic partnerships across the wind energy value chain.

By Technology:

By Turbine Size:

By Application:

By Ownership Structure:

Onshore wind technology continues advancing through larger rotor diameters, taller towers, and improved generator efficiency. Capacity factors for new onshore wind projects now regularly exceed 45% in optimal locations, significantly improving project economics and grid value.

Offshore wind development represents the fastest-growing segment with MarkWide Research analysis indicating substantial capacity additions planned over the next decade. Fixed-bottom foundations dominate current offshore projects, while floating wind technology development enables access to deeper water resources.

Turbine technology evolution shows consistent increases in nameplate capacity, rotor diameter, and hub height to capture more wind energy and improve capacity factors. Advanced control systems optimize turbine performance across varying wind conditions while reducing mechanical stress and maintenance requirements.

Grid integration solutions include improved forecasting accuracy, flexible ramping capabilities, and enhanced grid services provision. Power electronics advancement enables better grid stability support and reactive power management from wind installations.

Maintenance strategies increasingly utilize predictive analytics, drone inspections, and condition monitoring systems to optimize operational performance and reduce maintenance costs. Component reliability improvements extend turbine operational lifespans while reducing lifecycle maintenance expenses.

Utility companies benefit from wind energy through diversified generation portfolios, reduced fuel cost exposure, and compliance with renewable energy standards. Long-term price stability from wind power purchase agreements provides hedge against volatile fossil fuel costs while supporting rate stability for customers.

Corporate energy buyers achieve sustainability goals through renewable energy procurement while potentially reducing electricity costs through long-term wind power contracts. Brand value enhancement and stakeholder engagement benefits result from demonstrated environmental leadership and carbon footprint reduction.

Local communities receive economic benefits through property tax revenues, lease payments to landowners, and local employment opportunities during construction and operation phases. Rural economic development from wind projects provides additional income streams for agricultural communities.

Equipment manufacturers access growing market opportunities while developing advanced technology solutions for domestic and international markets. Supply chain participants benefit from stable demand for specialized components, materials, and services supporting wind energy development.

Financial institutions participate in growing renewable energy investment opportunities with established risk profiles and stable cash flow characteristics. Insurance providers develop specialized products supporting wind energy project development and operational risk management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Turbine supersizing continues with manufacturers developing increasingly large turbines to capture more wind energy and improve project economics. Rotor diameter expansion and hub height increases enable wind energy generation in lower wind speed areas previously considered unsuitable for development.

Digitalization adoption transforms wind farm operations through advanced analytics, artificial intelligence, and Internet of Things applications. Predictive maintenance systems reduce operational costs while improving turbine availability and performance optimization.

Hybrid project development combines wind energy with solar power and energy storage to create more reliable and valuable renewable energy resources. Grid services provision from wind farms includes frequency regulation, voltage support, and capacity reserves enhancing system value.

Corporate procurement evolution shows sophisticated renewable energy purchasing strategies including virtual power purchase agreements and portfolio approaches. Green financing mechanisms expand with sustainability-linked loans and green bonds supporting wind energy project development.

Workforce development initiatives address skilled labor needs through specialized training programs and educational partnerships. Diversity and inclusion efforts aim to broaden participation in wind energy careers across underrepresented communities.

Federal offshore wind initiatives include major lease auctions and regulatory framework development supporting large-scale offshore wind deployment. Bureau of Ocean Energy Management activities accelerate offshore wind permitting and environmental review processes.

State renewable energy targets continue expanding with several states establishing 100% clean electricity goals driving long-term wind energy demand. Renewable portfolio standards updates in key markets create additional requirements for wind energy procurement.

Transmission infrastructure investments include major interstate transmission projects designed to connect wind-rich regions with load centers. Grid modernization initiatives enhance wind energy integration capabilities through advanced forecasting and flexible operations.

Technology breakthroughs in floating offshore wind platforms enable access to deeper water resources with higher wind speeds. Advanced materials development reduces turbine weight while improving durability and performance characteristics.

Manufacturing expansion by major turbine suppliers includes new US production facilities reducing supply chain risks and supporting domestic content requirements. Supply chain localization efforts enhance market resilience while creating manufacturing employment opportunities.

Strategic positioning recommendations emphasize the importance of long-term planning and stakeholder engagement for successful wind energy development. MWR analysis suggests that market participants should focus on technology innovation, operational excellence, and strategic partnerships to maintain competitive advantages.

Investment strategies should consider geographic diversification, technology risk management, and regulatory compliance requirements. Portfolio optimization through asset management best practices and performance monitoring systems can enhance investment returns while managing operational risks.

Policy engagement remains crucial for industry participants to support favorable regulatory frameworks and address potential policy challenges. Community relations investment can improve project acceptance and reduce development risks through proactive stakeholder engagement.

Technology adoption strategies should balance proven solutions with innovative technologies offering competitive advantages. Supply chain management requires careful vendor selection, contract negotiation, and risk mitigation to ensure project delivery and cost control.

Workforce development investments in training, safety, and career development support long-term industry growth while addressing skilled labor shortages. Sustainability integration across business operations enhances corporate reputation and stakeholder value creation.

Market expansion projections indicate continued robust growth driven by economic competitiveness, policy support, and corporate demand for renewable energy. Capacity additions are expected to maintain strong momentum with both onshore and offshore wind contributing to overall market growth.

Offshore wind acceleration represents the most significant growth opportunity with MarkWide Research projecting substantial capacity development over the next decade. Technology advancement in floating wind platforms will unlock additional offshore resources in deeper waters.

Grid integration improvements through transmission expansion, energy storage deployment, and advanced grid management will enhance wind energy value and market penetration. Electrification trends in transportation and heating sectors create additional electricity demand supporting wind energy growth.

Cost reduction continuation through technology improvements, manufacturing scale, and operational optimization will maintain wind energy competitiveness. Performance enhancement from larger turbines and improved capacity factors will drive project economics and investment attractiveness.

International competitiveness of US wind energy companies positions them for global market expansion opportunities as worldwide renewable energy demand accelerates. Innovation leadership in wind technology development supports domestic market growth while creating export opportunities.

The US wind energy market stands as a testament to successful renewable energy technology deployment, demonstrating remarkable growth from niche application to mainstream electricity generation source. Market maturation has been accompanied by dramatic cost reductions, technology improvements, and operational excellence achievements that position wind energy as a cornerstone of America’s clean energy future.

Strategic advantages including abundant wind resources, supportive policy frameworks, and established supply chains provide a strong foundation for continued market expansion. Offshore wind emergence presents transformational growth opportunities that could significantly expand the addressable market while providing higher-value electricity generation closer to major demand centers.

Industry evolution toward larger turbines, digitalized operations, and integrated energy solutions demonstrates the sector’s commitment to continuous improvement and competitive positioning. Corporate procurement trends and sustainability commitments create stable long-term demand supporting investment confidence and project development.

Future success will depend on continued technology innovation, strategic policy support, and effective stakeholder engagement to address remaining challenges while capitalizing on emerging opportunities. The US wind energy market is well-positioned to play an increasingly important role in America’s energy security, economic development, and environmental stewardship objectives.

What is Wind Energy?

Wind energy is the process of converting wind into electricity using wind turbines. It is a renewable energy source that contributes to reducing greenhouse gas emissions and is increasingly used in various applications, including residential, commercial, and utility-scale power generation.

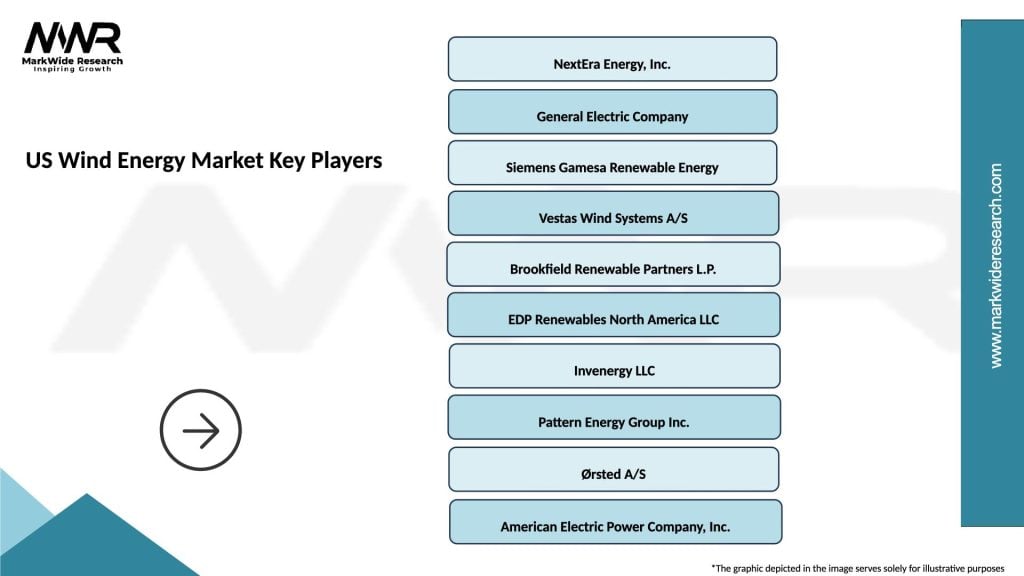

What are the key players in the US Wind Energy Market?

Key players in the US Wind Energy Market include companies like NextEra Energy, Siemens Gamesa, and Vestas Wind Systems, which are involved in the manufacturing and installation of wind turbines and related technologies, among others.

What are the growth factors driving the US Wind Energy Market?

The US Wind Energy Market is driven by factors such as the increasing demand for renewable energy, government incentives for clean energy projects, and advancements in wind turbine technology that enhance efficiency and reduce costs.

What challenges does the US Wind Energy Market face?

Challenges in the US Wind Energy Market include regulatory hurdles, land use conflicts, and the intermittency of wind energy, which can affect reliability and integration into the power grid.

What opportunities exist in the US Wind Energy Market?

Opportunities in the US Wind Energy Market include the expansion of offshore wind farms, technological innovations in energy storage, and increasing investments in sustainable infrastructure, which can enhance energy security and create jobs.

What trends are shaping the US Wind Energy Market?

Trends in the US Wind Energy Market include the growing adoption of hybrid energy systems, the integration of smart grid technologies, and a focus on sustainability practices that aim to minimize environmental impacts while maximizing energy output.

US Wind Energy Market

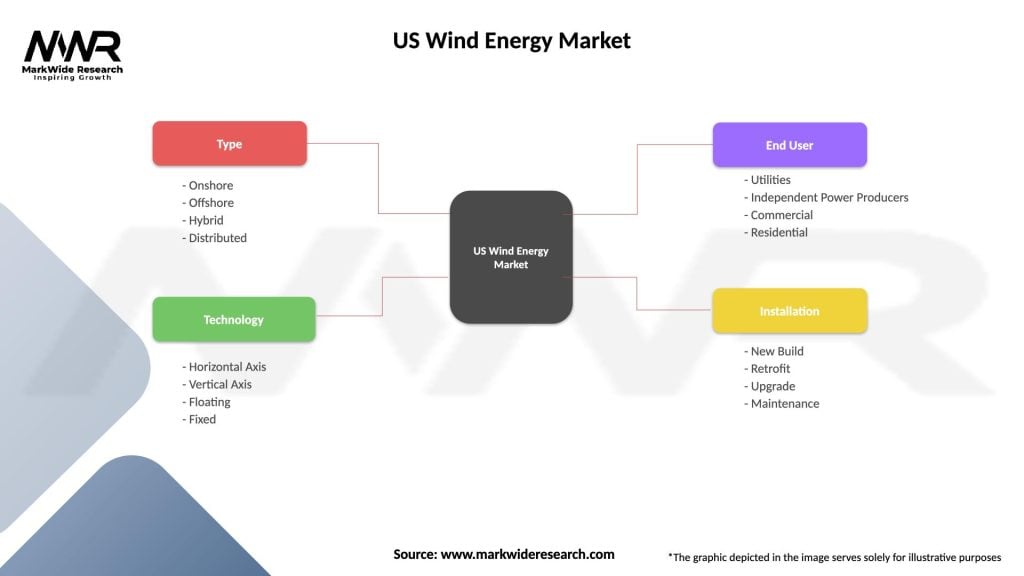

| Segmentation Details | Description |

|---|---|

| Type | Onshore, Offshore, Hybrid, Distributed |

| Technology | Horizontal Axis, Vertical Axis, Floating, Fixed |

| End User | Utilities, Independent Power Producers, Commercial, Residential |

| Installation | New Build, Retrofit, Upgrade, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Wind Energy Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at