444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US whey protein ingredients market represents a dynamic and rapidly expanding segment within the broader protein ingredients industry. Whey protein has emerged as one of the most sought-after nutritional supplements, driven by increasing health consciousness, fitness trends, and growing awareness of protein’s role in overall wellness. The market encompasses various forms of whey protein including concentrates, isolates, and hydrolysates, each serving distinct applications across multiple industries.

Market growth in the United States has been particularly robust, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects the increasing integration of whey protein ingredients into diverse product categories ranging from sports nutrition and dietary supplements to functional foods and beverages. The versatility of whey protein as both a nutritional enhancer and functional ingredient has positioned it as a cornerstone of the modern health and wellness industry.

Consumer demographics driving market demand span across age groups, with millennials and Generation Z showing particularly strong adoption rates of 65% and 58% respectively. The market benefits from the protein’s complete amino acid profile, high bioavailability, and proven efficacy in supporting muscle development, weight management, and overall health objectives. Industrial applications have also expanded significantly, with food manufacturers increasingly incorporating whey protein ingredients to enhance nutritional profiles and meet clean label demands.

The US whey protein ingredients market refers to the commercial ecosystem encompassing the production, processing, distribution, and consumption of whey-derived protein products within the United States. Whey protein ingredients are high-quality protein compounds extracted from whey, the liquid byproduct of cheese manufacturing, through various filtration and purification processes.

These ingredients are characterized by their exceptional nutritional value, containing all nine essential amino acids in optimal ratios for human consumption. The market includes three primary categories: whey protein concentrate containing 25-89% protein content, whey protein isolate with 90% or higher protein content, and whey protein hydrolysate featuring pre-digested proteins for enhanced absorption. Each category serves specific applications based on protein content, functionality, and intended use cases.

Market participants include dairy processors, ingredient manufacturers, supplement companies, food and beverage producers, and various end-user industries. The ecosystem encompasses the entire value chain from raw milk processing facilities to finished consumer products, representing a comprehensive network of suppliers, manufacturers, distributors, and retailers serving diverse market segments.

The US whey protein ingredients market demonstrates exceptional growth momentum driven by evolving consumer preferences toward protein-enriched products and increasing health awareness. Market dynamics reflect a shift from traditional protein sources to more bioavailable and functionally superior whey-based alternatives, positioning the sector for sustained expansion across multiple application areas.

Key market drivers include the rising popularity of fitness and wellness lifestyles, with 73% of American consumers actively seeking protein-enhanced products. The sports nutrition segment continues to dominate market share, while emerging applications in functional foods, clinical nutrition, and infant formula present significant growth opportunities. Technological advancements in processing methods have enhanced product quality and expanded application possibilities.

Competitive landscape features established dairy giants alongside specialized protein ingredient manufacturers, creating a diverse ecosystem of suppliers serving various market segments. Innovation focus centers on developing specialized protein formulations, improving taste profiles, and enhancing functional properties to meet evolving consumer demands. The market benefits from strong domestic dairy production capabilities and advanced processing infrastructure supporting consistent supply chain operations.

Market segmentation reveals distinct growth patterns across different whey protein categories and applications. Whey protein isolate commands premium positioning due to its high protein content and superior functionality, while concentrates maintain strong volume leadership through cost-effectiveness and versatility. The following insights highlight critical market dynamics:

Consumer behavior analysis indicates strong preference for products with transparent labeling, third-party testing, and proven efficacy claims. Market penetration continues expanding beyond traditional fitness enthusiasts to include mainstream health-conscious consumers seeking convenient protein solutions.

Health and wellness trends represent the primary catalyst driving US whey protein ingredients market expansion. Consumer awareness regarding protein’s role in muscle maintenance, weight management, and overall health has reached unprecedented levels, with 82% of consumers actively seeking protein-enriched products in their daily nutrition routines.

Fitness culture proliferation across demographic segments has created sustained demand for high-quality protein supplements. The rise of boutique fitness studios, home workout trends, and social media fitness influencers has normalized protein supplementation beyond traditional bodybuilding communities. Aging population demographics also contribute significantly, as older adults increasingly recognize protein’s importance in maintaining muscle mass and bone health.

Convenience factor drives market growth as busy lifestyles create demand for portable, easy-to-consume protein solutions. Product innovation in ready-to-drink formats, protein bars, and functional snacks has expanded market accessibility. Scientific research continuously validates whey protein’s superior biological value and absorption characteristics, reinforcing consumer confidence and driving adoption across various applications.

Sports nutrition mainstream adoption has transformed from niche market to mass consumer category. Professional athlete endorsements and fitness influencer marketing have elevated whey protein’s profile, while improved taste formulations have addressed historical palatability concerns that limited broader market acceptance.

Price volatility in raw milk and dairy commodities presents ongoing challenges for whey protein ingredient manufacturers. Supply chain fluctuations can significantly impact production costs and pricing strategies, potentially limiting market accessibility for price-sensitive consumer segments. Seasonal variations in milk production also contribute to supply consistency challenges.

Lactose intolerance concerns among certain consumer populations restrict market penetration despite processing advances that reduce lactose content. Dietary restrictions including veganism and plant-based preferences create competitive pressure from alternative protein sources. Regulatory complexities surrounding health claims and labeling requirements can limit marketing flexibility and increase compliance costs.

Market saturation in traditional sports nutrition channels has intensified competition and compressed margins. Consumer skepticism regarding supplement efficacy and safety concerns about artificial additives can limit adoption among health-conscious demographics. Quality control challenges in maintaining consistent protein content and purity standards across large-scale production operations require significant investment in testing and quality assurance systems.

Environmental concerns related to dairy farming practices and sustainability issues may influence consumer preferences toward plant-based alternatives. Processing complexity and energy-intensive manufacturing requirements contribute to higher production costs compared to some alternative protein sources.

Functional food integration presents substantial growth opportunities as mainstream food manufacturers increasingly incorporate whey protein ingredients to enhance nutritional profiles. Product development in categories such as protein-enriched baked goods, dairy products, and beverages offers significant market expansion potential beyond traditional supplement applications.

Clinical nutrition applications represent an emerging high-value segment, with healthcare providers increasingly recognizing whey protein’s therapeutic benefits for muscle wasting conditions, wound healing, and immune system support. Aging population demographics create sustained demand for specialized protein formulations targeting age-related health concerns.

E-commerce channel expansion provides direct-to-consumer opportunities, enabling manufacturers to capture higher margins while building stronger customer relationships. Subscription-based models and personalized nutrition approaches offer innovative distribution strategies. International export opportunities leverage US dairy industry expertise and quality reputation in global markets.

Technological innovations in processing methods enable development of specialized protein formulations with enhanced functionality, improved taste profiles, and targeted nutritional benefits. Sustainability initiatives focusing on environmentally responsible sourcing and processing methods can differentiate products and appeal to environmentally conscious consumers.

Supply-demand equilibrium in the US whey protein ingredients market reflects the complex interplay between dairy production capacity, processing capabilities, and evolving consumer demand patterns. Market dynamics are influenced by seasonal milk production cycles, cheese manufacturing volumes, and the efficiency of whey processing operations across the country.

Competitive intensity has increased significantly as both established dairy companies and specialized protein manufacturers compete for market share. Pricing strategies vary considerably across different product categories, with premium isolates and hydrolysates commanding higher margins while concentrates compete primarily on volume and cost-effectiveness.

Innovation cycles drive market evolution through continuous product development, processing improvements, and application expansion. Consumer preferences shift toward cleaner labels, better taste profiles, and enhanced functionality, requiring manufacturers to invest heavily in research and development. According to MarkWide Research, innovation spending in the sector has increased by 15% annually as companies seek competitive differentiation.

Distribution channel dynamics continue evolving with traditional retail, specialty nutrition stores, and e-commerce platforms each serving distinct consumer segments. Market consolidation trends among ingredient suppliers and finished product manufacturers influence pricing power and competitive positioning throughout the value chain.

Market analysis methodology employed comprehensive primary and secondary research approaches to develop accurate insights into the US whey protein ingredients market. Primary research included extensive interviews with industry executives, ingredient suppliers, finished product manufacturers, and key stakeholders across the value chain to gather firsthand market intelligence.

Secondary research encompassed analysis of industry reports, trade publications, regulatory filings, company financial statements, and market databases to establish baseline market understanding and validate primary research findings. Data triangulation methods ensured accuracy and reliability of market insights through cross-verification of multiple information sources.

Quantitative analysis utilized statistical modeling techniques to project market trends, growth rates, and segment performance based on historical data patterns and identified market drivers. Qualitative assessment incorporated expert opinions, industry best practices, and competitive intelligence to provide comprehensive market understanding beyond numerical data points.

Market segmentation analysis examined various categorization approaches including product type, application, distribution channel, and regional variations to identify growth opportunities and competitive dynamics. Validation processes included peer review by industry experts and cross-referencing with established market research methodologies to ensure analytical rigor and credibility.

Regional distribution within the US whey protein ingredients market reveals distinct patterns reflecting local dairy production capabilities, population demographics, and consumer preferences. Midwest region dominates production capacity due to concentrated dairy farming operations and established cheese manufacturing infrastructure, accounting for approximately 45% of national production.

West Coast markets demonstrate the highest per-capita consumption rates, driven by health-conscious consumer demographics and strong fitness culture penetration. California leads in both production and consumption, benefiting from large-scale dairy operations and diverse food manufacturing base. Pacific Northwest shows growing demand for premium protein ingredients in specialty applications.

Northeast corridor represents a significant consumption market despite limited local production capacity, with high population density and affluent demographics supporting premium product segments. Urban centers including New York, Boston, and Philadelphia show particularly strong demand for convenient protein solutions and functional food applications.

Southeast region demonstrates rapid growth in both production capabilities and market demand, with expanding dairy operations and growing health awareness driving market development. Texas emerges as a key growth market with increasing dairy production and strong consumer demand across multiple application segments.

Market leadership in the US whey protein ingredients sector is distributed among several key categories of companies, each bringing distinct competitive advantages and market positioning strategies. Established dairy giants leverage integrated supply chains and processing scale to maintain cost leadership in commodity protein segments.

Competitive strategies vary significantly across market participants, with some companies focusing on volume leadership through cost optimization while others pursue premium positioning through specialized products and technical services. Innovation capabilities increasingly determine competitive success as customers demand enhanced functionality and performance characteristics.

Market consolidation trends continue as larger companies acquire specialized processors to expand capabilities and market reach. Strategic partnerships between ingredient suppliers and finished product manufacturers create integrated value chains and competitive advantages in specific market segments.

Product type segmentation represents the primary classification method for the US whey protein ingredients market, with distinct categories serving different applications and price points. Whey protein concentrate maintains the largest volume share due to cost-effectiveness and versatility across multiple applications.

By Protein Content:

By Application:

By Distribution Channel:

Sports nutrition category continues to dominate the US whey protein ingredients market, representing the most mature and established application segment. Consumer behavior in this category emphasizes product efficacy, taste, and convenience, with premium pricing accepted for superior quality and performance characteristics.

Functional foods segment demonstrates the highest growth potential as mainstream food manufacturers increasingly incorporate whey protein ingredients to enhance nutritional profiles. Product development focuses on seamless integration without compromising taste or texture, requiring specialized protein formulations and processing expertise.

Clinical nutrition applications represent the highest-value segment, with specialized protein formulations commanding premium pricing due to stringent quality requirements and proven therapeutic benefits. Market growth in this category is driven by aging demographics and increased healthcare focus on nutrition-based interventions.

Infant formula category requires the highest quality standards and regulatory compliance, creating significant barriers to entry but offering stable, high-margin opportunities for qualified suppliers. Product specifications must meet strict nutritional and safety requirements while supporting healthy infant development.

Emerging applications in areas such as pet nutrition, cosmetics, and pharmaceutical excipients present additional growth opportunities for specialized whey protein formulations. Innovation focus centers on developing targeted functionality for specific application requirements.

Dairy processors benefit significantly from whey protein ingredient production as it transforms a cheese manufacturing byproduct into a high-value revenue stream. Economic advantages include improved facility utilization, enhanced profitability, and reduced waste disposal costs while creating sustainable business models.

Food manufacturers gain access to versatile ingredients that enhance nutritional profiles, extend shelf life, and improve functional properties of finished products. Whey protein ingredients enable clean label formulations while meeting consumer demands for protein-enriched products across multiple categories.

Consumers receive high-quality, bioavailable protein sources that support health and fitness objectives through convenient, palatable product formats. Nutritional benefits include complete amino acid profiles, rapid absorption, and proven efficacy in supporting muscle development and maintenance.

Healthcare providers can recommend evidence-based protein solutions for patients with specific nutritional needs, including muscle wasting conditions, wound healing, and immune system support. Clinical applications benefit from extensive research validating whey protein’s therapeutic properties.

Retailers capitalize on growing consumer demand for protein products through expanded category offerings and premium pricing opportunities. Market growth in protein segments provides retailers with higher-margin product categories and increased customer traffic.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement represents one of the most significant trends shaping the US whey protein ingredients market. Consumer demand for minimally processed, naturally sourced ingredients drives product development toward simpler formulations with fewer additives and artificial components. Transparency initiatives including third-party testing and supply chain traceability become increasingly important for market differentiation.

Personalized nutrition emerges as a transformative trend, with companies developing customized protein formulations based on individual health goals, dietary restrictions, and lifestyle factors. Technology integration enables sophisticated consumer profiling and targeted product recommendations, creating opportunities for premium pricing and enhanced customer loyalty.

Sustainability focus influences both production methods and consumer purchasing decisions. Environmental responsibility initiatives including carbon footprint reduction, sustainable sourcing practices, and packaging innovations become competitive differentiators. MWR analysis indicates that 67% of consumers consider sustainability factors when selecting protein products.

Flavor innovation continues advancing to address historical taste challenges and expand consumer acceptance. Natural flavoring systems and improved processing techniques enable better-tasting products without compromising nutritional integrity. Exotic flavor profiles and seasonal varieties create product differentiation and consumer engagement opportunities.

Processing technology advances have revolutionized whey protein ingredient production, enabling higher yields, improved functionality, and enhanced nutritional profiles. Membrane filtration improvements allow for more precise protein concentration while preserving bioactive compounds and reducing processing costs.

Strategic acquisitions and partnerships reshape the competitive landscape as companies seek to expand capabilities, access new markets, and integrate value chains. Vertical integration strategies enable better cost control and quality assurance while providing competitive advantages in specific market segments.

Regulatory developments including updated nutrition labeling requirements and health claim guidelines influence product positioning and marketing strategies. Quality standards continue evolving to address consumer safety concerns and ensure product integrity throughout the supply chain.

Research breakthroughs in protein functionality and bioavailability create opportunities for specialized product formulations targeting specific health benefits. Clinical studies validating therapeutic applications expand market opportunities beyond traditional nutrition segments into healthcare and pharmaceutical applications.

Sustainability initiatives gain momentum as companies invest in environmentally responsible production methods, renewable energy systems, and waste reduction programs. Circular economy approaches maximize resource utilization while minimizing environmental impact throughout the production process.

Market participants should prioritize innovation investments to develop differentiated products addressing evolving consumer preferences and emerging application opportunities. Product development focus should emphasize clean label formulations, enhanced functionality, and improved taste profiles to capture premium market segments.

Supply chain optimization becomes critical for maintaining competitive positioning amid raw material price volatility and increasing quality requirements. Vertical integration strategies may provide advantages in cost control and quality assurance, particularly for companies serving high-value application segments.

Digital transformation initiatives should encompass e-commerce capabilities, customer relationship management, and data analytics to better understand consumer behavior and optimize marketing strategies. Direct-to-consumer channels offer opportunities for higher margins and stronger customer relationships.

Sustainability programs require immediate attention as environmental concerns increasingly influence consumer purchasing decisions and regulatory requirements. Investment priorities should include renewable energy adoption, waste reduction initiatives, and sustainable sourcing practices.

Strategic partnerships with food manufacturers, healthcare providers, and technology companies can accelerate market penetration and application development. Collaboration opportunities exist in research and development, market access, and supply chain optimization.

Long-term growth prospects for the US whey protein ingredients market remain highly favorable, supported by sustained consumer health awareness, demographic trends, and expanding application opportunities. Market evolution will likely emphasize specialized formulations, enhanced functionality, and integration into mainstream food products beyond traditional supplement categories.

Technological advancement will continue driving product innovation, with processing improvements enabling new protein formulations and enhanced nutritional profiles. Precision nutrition approaches may create opportunities for customized protein solutions tailored to individual consumer needs and health objectives.

Regulatory environment is expected to become more stringent regarding quality standards and health claims, potentially creating barriers for smaller players while benefiting established companies with robust quality systems. International trade opportunities may expand as global demand for high-quality protein ingredients continues growing.

Competitive dynamics will likely intensify as plant-based alternatives gain market share and new technologies enable alternative protein production methods. MarkWide Research projects that successful companies will differentiate through superior quality, innovative formulations, and strong customer relationships rather than competing solely on price.

Market maturation in traditional segments will drive expansion into emerging applications including clinical nutrition, functional foods, and international markets. Growth trajectory is expected to maintain momentum with projected CAGR of 7.5% over the next five years, driven by continued health consciousness and product innovation.

The US whey protein ingredients market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing health consciousness, demographic trends, and expanding application opportunities. Market fundamentals remain strong, supported by robust domestic dairy production capabilities, advanced processing infrastructure, and growing consumer demand across multiple product categories.

Success factors for market participants include continuous innovation, quality excellence, supply chain optimization, and strategic positioning in high-growth segments. Companies that effectively balance cost competitiveness with product differentiation while addressing evolving consumer preferences will capture the greatest market opportunities.

Future growth will likely emphasize specialized applications, enhanced functionality, and integration into mainstream food products as the market matures beyond traditional supplement categories. Sustainability initiatives and clean label trends will increasingly influence competitive positioning and consumer purchasing decisions, requiring ongoing investment in responsible production practices and transparent supply chains.

What is Whey Protein Ingredients?

Whey Protein Ingredients are derived from the liquid byproduct of cheese production and are rich in essential amino acids. They are commonly used in dietary supplements, sports nutrition products, and food applications for their high protein content and functional properties.

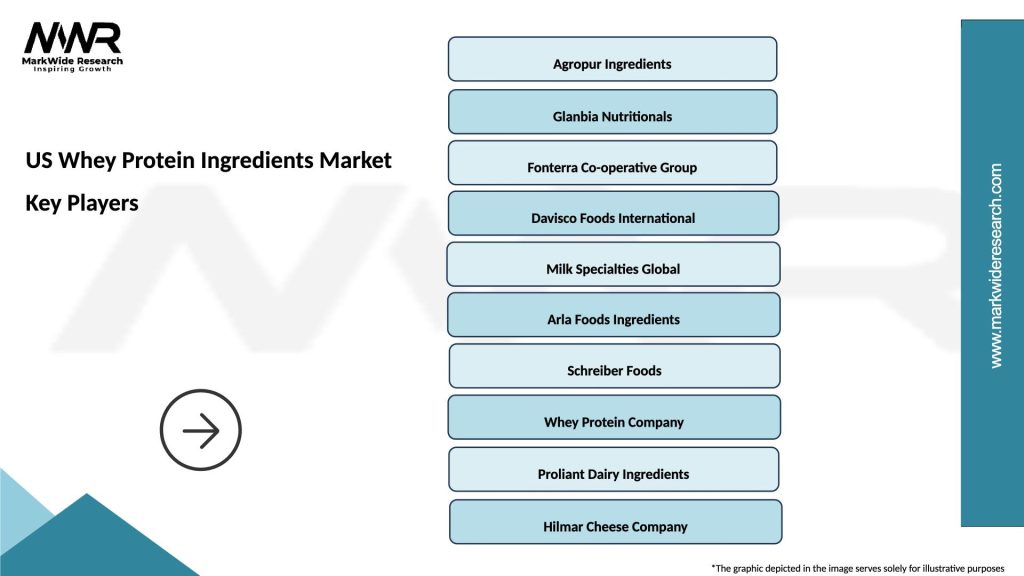

What are the key players in the US Whey Protein Ingredients Market?

Key players in the US Whey Protein Ingredients Market include companies like Glanbia Nutritionals, Arla Foods, and Fonterra, which are known for their extensive product ranges and innovations in protein formulations, among others.

What are the growth factors driving the US Whey Protein Ingredients Market?

The US Whey Protein Ingredients Market is driven by increasing consumer demand for high-protein diets, the rise of fitness and wellness trends, and the growing popularity of protein supplements among athletes and health-conscious individuals.

What challenges does the US Whey Protein Ingredients Market face?

Challenges in the US Whey Protein Ingredients Market include fluctuations in raw material prices, competition from plant-based protein alternatives, and regulatory scrutiny regarding food safety and labeling.

What opportunities exist in the US Whey Protein Ingredients Market?

Opportunities in the US Whey Protein Ingredients Market include the development of innovative products targeting specific dietary needs, such as lactose-free options, and the expansion of whey protein applications in functional foods and beverages.

What trends are shaping the US Whey Protein Ingredients Market?

Trends in the US Whey Protein Ingredients Market include the increasing incorporation of whey protein in clean label products, the rise of ready-to-drink protein beverages, and a growing focus on sustainability in sourcing and production practices.

US Whey Protein Ingredients Market

| Segmentation Details | Description |

|---|---|

| Product Type | Concentrate, Isolate, Hydrolysate, Blends |

| Grade | Food Grade, Feed Grade, Pharmaceutical Grade, Nutraceutical Grade |

| Application | Sports Nutrition, Dietary Supplements, Functional Foods, Bakery Products |

| End User | Fitness Enthusiasts, Athletes, Health-Conscious Consumers, Nutritional Manufacturers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Whey Protein Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at