444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US water meter market represents a critical infrastructure component driving water conservation and utility management across the nation. This dynamic sector encompasses traditional mechanical meters, advanced metering infrastructure (AMI), and smart water metering solutions that enable precise water consumption monitoring and billing accuracy. Market growth is accelerating at approximately 6.2% CAGR through 2030, driven by aging infrastructure replacement needs, regulatory mandates for water conservation, and increasing adoption of smart city initiatives.

Technological advancement continues reshaping the landscape as utilities transition from manual reading systems to automated meter reading (AMR) and advanced metering infrastructure solutions. The market encompasses residential, commercial, and industrial applications, with residential segment commanding approximately 68% market share due to widespread deployment across municipal water systems. Smart water meters are experiencing particularly robust adoption, with penetration rates reaching 35% in major metropolitan areas as utilities seek enhanced operational efficiency and customer engagement capabilities.

Regional distribution shows concentrated activity in states with water scarcity challenges and progressive utility modernization programs. California, Texas, Florida, and New York lead adoption rates, collectively representing over 42% of national installations. The market benefits from federal infrastructure investment programs, state-level water conservation mandates, and utility modernization initiatives that prioritize accurate metering and leak detection capabilities.

The US water meter market refers to the comprehensive ecosystem of devices, technologies, and services used to measure, monitor, and manage water consumption across residential, commercial, and industrial applications throughout the United States. This market encompasses traditional mechanical meters, electronic meters, smart meters with communication capabilities, and associated infrastructure including data management systems, communication networks, and analytics platforms.

Water meters serve as the fundamental interface between water utilities and consumers, enabling accurate billing, consumption monitoring, and resource management. Modern water metering solutions integrate advanced technologies including ultrasonic measurement, electromagnetic flow detection, and wireless communication protocols to provide real-time consumption data, leak detection alerts, and demand forecasting capabilities.

Market scope extends beyond hardware to include installation services, maintenance programs, data analytics platforms, and customer engagement solutions. The ecosystem supports utility operational efficiency, regulatory compliance, water conservation initiatives, and enhanced customer service delivery through accurate measurement and transparent consumption reporting.

Strategic market dynamics position the US water meter market for sustained expansion driven by infrastructure modernization imperatives and smart city development initiatives. The sector demonstrates resilience through diverse application segments, with residential metering maintaining dominant market position while commercial and industrial segments show accelerating smart meter adoption rates.

Technology evolution represents the primary growth catalyst, with utilities increasingly prioritizing advanced metering infrastructure over traditional mechanical systems. Smart water meters incorporating IoT connectivity, real-time monitoring, and predictive analytics capabilities are transforming utility operations and customer engagement models. Adoption acceleration reaches approximately 28% annually in major metropolitan markets as utilities recognize operational efficiency benefits and customer satisfaction improvements.

Competitive landscape features established meter manufacturers expanding smart technology portfolios alongside emerging technology providers offering innovative communication and analytics solutions. Market consolidation trends support comprehensive solution development while maintaining competitive pricing structures. Investment patterns show increasing focus on integrated platforms combining hardware, software, and services to deliver complete water management solutions.

Regulatory environment provides supportive framework through water conservation mandates, infrastructure investment programs, and utility modernization incentives. Federal and state initiatives promote advanced metering adoption while addressing cybersecurity requirements and data privacy concerns associated with smart meter deployments.

Market transformation accelerates through several critical insights that define current and future industry dynamics:

Infrastructure modernization serves as the primary market driver as utilities nationwide confront aging water meter installations requiring replacement or upgrade. Many existing meters approach end-of-service life, creating substantial replacement demand while offering opportunities for technology advancement. Utility modernization programs increasingly prioritize smart metering solutions that provide operational efficiency benefits beyond basic consumption measurement.

Water conservation mandates drive advanced metering adoption as regulatory authorities implement stricter water usage monitoring and reporting requirements. States experiencing water scarcity challenges mandate accurate metering systems capable of supporting conservation programs, tiered pricing structures, and leak detection initiatives. Regulatory compliance necessitates meter accuracy standards and data reporting capabilities that favor advanced metering technologies over traditional mechanical systems.

Operational efficiency demands motivate utilities to adopt smart metering solutions that reduce manual reading costs, improve billing accuracy, and enable proactive maintenance programs. Advanced meters provide real-time consumption data, leak detection alerts, and system performance monitoring that support optimized utility operations. Cost reduction objectives drive technology adoption as utilities seek to minimize operational expenses while improving service quality.

Customer service enhancement requirements push utilities toward metering solutions that enable transparent consumption reporting, usage alerts, and conservation guidance. Modern consumers expect digital engagement capabilities and real-time access to consumption information, driving demand for smart meters with mobile app integration and online portal connectivity.

High implementation costs represent the most significant market restraint as utilities evaluate smart metering investments against budget constraints and competing infrastructure priorities. Advanced metering infrastructure requires substantial upfront capital investment for meters, communication networks, data management systems, and installation services. Budget limitations particularly impact smaller municipal utilities with limited financial resources for comprehensive system upgrades.

Technical complexity challenges create implementation barriers as utilities must develop expertise in communication technologies, data analytics, and cybersecurity management. Smart meter deployments require integration with existing utility systems, staff training programs, and ongoing technical support capabilities. Operational complexity increases significantly compared to traditional mechanical meters, requiring enhanced technical competencies and support infrastructure.

Cybersecurity concerns limit smart meter adoption as utilities address data protection requirements and potential security vulnerabilities associated with connected devices. Regulatory compliance demands robust cybersecurity frameworks, ongoing security monitoring, and incident response capabilities that add complexity and cost to smart meter programs. Security investment requirements can substantially increase total project costs while creating ongoing operational obligations.

Customer privacy issues generate resistance to smart meter deployments as consumers express concerns about detailed consumption monitoring and data sharing practices. Some communities oppose smart meter installations due to privacy considerations, health concerns, or preference for traditional metering approaches. Public acceptance challenges require extensive community engagement and education programs to address concerns and build support for modernization initiatives.

Smart city integration presents substantial growth opportunities as municipalities develop comprehensive digital infrastructure programs incorporating water management systems. Smart meter deployments align with broader smart city initiatives, creating synergies with other connected infrastructure projects and enabling integrated urban management platforms. Technology convergence opportunities exist for solutions that integrate water metering with energy management, environmental monitoring, and public safety systems.

Data monetization potential emerges as utilities recognize value in consumption analytics, demand forecasting, and customer behavior insights generated by smart metering systems. Advanced analytics capabilities enable new service offerings, operational optimization programs, and partnership opportunities with technology providers. Service expansion opportunities include leak detection services, conservation consulting, and predictive maintenance programs that leverage meter-generated data.

Federal infrastructure investment creates significant market expansion opportunities through programs supporting water infrastructure modernization and smart city development. Government funding initiatives prioritize projects that demonstrate operational efficiency improvements, environmental benefits, and technology innovation. Grant programs and low-interest financing options reduce implementation barriers for utilities considering advanced metering investments.

Technology advancement opportunities continue emerging through innovations in sensor technology, communication protocols, and data analytics capabilities. Next-generation meters incorporating artificial intelligence, machine learning, and advanced materials offer enhanced performance and new functionality. Innovation partnerships between utilities and technology providers drive solution development tailored to specific market needs and operational requirements.

Competitive dynamics intensify as established meter manufacturers compete with emerging technology providers offering innovative smart metering solutions. Traditional companies expand product portfolios through internal development and strategic acquisitions while new entrants focus on specialized technologies like advanced analytics and communication systems. Market consolidation trends support comprehensive solution development as companies seek to offer integrated platforms combining hardware, software, and services.

Technology evolution accelerates market transformation as advances in sensor technology, wireless communication, and data analytics create new possibilities for water metering applications. Internet of Things (IoT) integration enables enhanced connectivity and remote monitoring capabilities while artificial intelligence supports predictive analytics and automated decision-making. Innovation cycles shorten as companies rapidly develop and deploy new features to maintain competitive advantages.

Regulatory influence shapes market development through water conservation mandates, infrastructure investment programs, and cybersecurity requirements that impact technology adoption decisions. State and federal policies promote advanced metering while establishing standards for accuracy, security, and interoperability. Policy evolution continues addressing emerging challenges related to data privacy, cybersecurity, and technology standardization.

Customer expectations drive market evolution as utilities respond to demands for transparent billing, real-time consumption information, and digital engagement capabilities. Modern consumers expect utility services comparable to other digital experiences, pushing utilities toward advanced metering solutions that enable enhanced customer interaction. Service standards increasingly emphasize customer satisfaction and engagement metrics alongside traditional operational efficiency measures.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US water meter market dynamics. Primary research includes extensive interviews with utility executives, meter manufacturers, technology providers, and regulatory officials to gather firsthand perspectives on market trends, challenges, and opportunities. Industry expertise from water utility professionals provides practical insights into operational requirements and technology adoption factors.

Secondary research encompasses analysis of industry reports, regulatory filings, utility procurement documents, and technology specifications to validate primary findings and identify market patterns. Government databases, industry associations, and academic research contribute additional data sources supporting comprehensive market understanding. Data triangulation methods ensure accuracy by comparing findings across multiple sources and research approaches.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns, technology adoption rates, and competitive dynamics. Market sizing methodologies incorporate utility installation data, replacement cycle analysis, and technology penetration rates to develop accurate market assessments. Forecasting models consider multiple scenarios including accelerated smart meter adoption, regulatory changes, and technology advancement impacts.

Qualitative research explores market drivers, barriers, and strategic considerations through in-depth discussions with industry stakeholders. Expert interviews provide insights into technology trends, competitive strategies, and future market evolution that complement quantitative findings. Stakeholder perspectives from utilities, manufacturers, and technology providers ensure comprehensive understanding of market dynamics and strategic implications.

Western region leads national smart meter adoption with California driving innovation through aggressive water conservation mandates and utility modernization programs. The state’s drought management requirements and environmental regulations create strong demand for advanced metering infrastructure capable of supporting conservation initiatives and accurate usage monitoring. California utilities demonstrate approximately 52% smart meter penetration rates, significantly above national averages, while neighboring states follow similar adoption patterns.

Southern region shows robust market growth driven by population expansion, infrastructure development, and water resource management challenges. Texas and Florida lead regional adoption with major utilities implementing comprehensive smart metering programs to support growing customer bases and operational efficiency objectives. Regional growth rates exceed national averages by approximately 15% as utilities modernize systems to accommodate demographic and economic expansion.

Northeastern region focuses on infrastructure replacement and system modernization as aging water systems require comprehensive meter upgrades. New York, Pennsylvania, and Massachusetts utilities prioritize advanced metering solutions that provide operational efficiency benefits while addressing regulatory compliance requirements. Replacement market dynamics drive steady demand as utilities upgrade systems approaching end-of-service life.

Midwestern region demonstrates measured adoption patterns with utilities evaluating smart metering investments against operational requirements and budget constraints. Illinois, Ohio, and Michigan utilities show increasing interest in advanced metering infrastructure while maintaining focus on cost-effective solutions. Market penetration reaches approximately 24% regional average with significant variation among individual utility systems based on modernization priorities and financial capabilities.

Market leadership encompasses established meter manufacturers with comprehensive product portfolios and emerging technology providers offering specialized smart metering solutions. The competitive environment features both traditional companies expanding into advanced technologies and new entrants focusing on innovation and differentiation.

Competitive strategies emphasize technology innovation, service expansion, and strategic partnerships to address evolving utility requirements. Companies invest heavily in research and development to maintain technological leadership while building comprehensive solution portfolios that address diverse customer needs.

Technology segmentation divides the market into distinct categories based on meter technology and functionality:

Application segmentation addresses diverse end-user requirements across market sectors:

By Technology: Smart meters demonstrate the highest growth potential with utilities increasingly prioritizing advanced functionality over traditional mechanical solutions. Technology adoption patterns show accelerating migration toward electronic and smart meters as utilities recognize operational benefits and customer service improvements. Ultrasonic meters gain market share in applications requiring high accuracy and long service life, while electromagnetic meters serve specialized industrial applications with challenging measurement conditions.

By Application: Residential segment maintains market dominance through sheer volume while commercial and industrial segments show higher value per installation and advanced feature requirements. Residential deployments focus on cost-effective solutions with basic smart functionality, while commercial applications emphasize accuracy, durability, and advanced monitoring capabilities. Industrial applications require specialized meters capable of handling high flow rates and harsh operating conditions.

By Communication Technology: Cellular communication protocols gain preference for smart meter deployments due to reliability and coverage advantages over other wireless technologies. Communication preferences vary by utility based on existing infrastructure, coverage requirements, and cost considerations. Fixed network solutions serve dense urban deployments while cellular technologies address rural and distributed applications effectively.

By Service Type: Installation and maintenance services represent growing market segments as utilities outsource specialized technical requirements to qualified service providers. Service demand increases with smart meter adoption as utilities require expertise in communication technologies, data management, and cybersecurity implementation.

Utility Benefits: Advanced water metering systems provide comprehensive operational advantages including reduced manual reading costs, improved billing accuracy, and enhanced customer service capabilities. Operational efficiency improvements reach 35% average cost reduction in meter reading operations while enabling proactive maintenance programs and system optimization. Real-time monitoring capabilities support leak detection, demand forecasting, and resource planning that improve overall system performance.

Customer Benefits: Smart metering solutions enable transparent consumption monitoring, usage alerts, and conservation guidance that empower customers to manage water usage effectively. Customer engagement improves through mobile applications and online portals providing real-time consumption data and billing information. Advanced meters eliminate estimated bills and provide accurate consumption measurement that ensures fair and transparent billing practices.

Manufacturer Benefits: Market expansion opportunities exist through technology innovation, service offerings, and strategic partnerships with utilities seeking comprehensive solutions. Revenue diversification through software, services, and analytics platforms provides recurring income streams beyond traditional hardware sales. Market consolidation trends create opportunities for companies with comprehensive solution portfolios and technical expertise.

Environmental Benefits: Advanced metering infrastructure supports water conservation initiatives through accurate monitoring, leak detection, and customer engagement programs that reduce overall water consumption. Conservation impact demonstrates measurable reductions in water waste and improved resource management across utility systems implementing smart metering solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

IoT Integration transforms water metering through enhanced connectivity and data collection capabilities that enable comprehensive utility system monitoring and management. Internet of Things technologies support real-time communication, predictive analytics, and automated response systems that optimize utility operations. Connected infrastructure creates opportunities for integrated management platforms combining water, energy, and environmental monitoring systems.

Artificial Intelligence applications emerge in water metering through advanced analytics, pattern recognition, and predictive maintenance capabilities that improve system performance and reduce operational costs. AI-powered solutions enable automated leak detection, demand forecasting, and customer behavior analysis that support utility decision-making. Machine learning algorithms continuously improve accuracy and functionality through operational data analysis and system optimization.

Sustainability Focus drives market development as utilities prioritize environmental responsibility and resource conservation through advanced metering technologies. Smart meters support water conservation programs, leak reduction initiatives, and sustainable resource management practices. Environmental compliance requirements increasingly influence technology selection and deployment strategies across utility systems.

Customer-Centric Solutions gain prominence as utilities recognize the importance of customer engagement and satisfaction in successful metering programs. Advanced meters enable transparent billing, usage monitoring, and conservation guidance that improve customer relationships. Digital engagement platforms provide customers with real-time access to consumption data and utility services through mobile applications and online portals.

Technology Partnerships accelerate market innovation as meter manufacturers collaborate with communication providers, software companies, and analytics specialists to develop comprehensive solutions. Strategic alliances enable companies to offer integrated platforms combining hardware, software, and services while leveraging specialized expertise. Partnership strategies focus on creating complete solutions that address diverse utility requirements and competitive differentiation.

Regulatory Evolution continues shaping market development through updated standards for meter accuracy, cybersecurity requirements, and interoperability specifications. New regulations address emerging challenges related to data privacy, system security, and technology standardization. Compliance frameworks evolve to address smart metering technologies while maintaining focus on consumer protection and system reliability.

Investment Acceleration occurs as utilities increase capital allocation for infrastructure modernization and smart city initiatives that include advanced metering systems. Federal and state funding programs provide financial support for utility modernization projects while private investment supports technology development. Funding availability reduces implementation barriers and accelerates adoption timelines across utility systems.

Market Consolidation trends continue as companies pursue strategic acquisitions and mergers to build comprehensive solution portfolios and expand market presence. Consolidation activities focus on combining complementary technologies and capabilities to create competitive advantages. Industry restructuring supports development of integrated platforms and comprehensive service offerings that address evolving utility requirements.

MarkWide Research recommends utilities prioritize comprehensive evaluation of smart metering technologies that align with long-term operational objectives and customer service goals. Strategic planning should consider total cost of ownership, technology roadmaps, and integration requirements rather than focusing solely on upfront costs. Utilities benefit from phased implementation approaches that enable learning and optimization while managing financial and operational risks.

Technology selection should emphasize interoperability, scalability, and cybersecurity capabilities that support future expansion and system evolution. Utilities should evaluate vendors based on comprehensive solution portfolios, technical support capabilities, and long-term viability rather than individual product features. Vendor partnerships require careful assessment of financial stability, technical expertise, and service commitment levels.

Customer engagement strategies should accompany smart meter deployments to address privacy concerns, explain benefits, and encourage conservation behaviors. Successful programs include comprehensive communication plans, educational resources, and responsive customer support systems. Community outreach efforts should begin early in project planning and continue throughout implementation to build public support and address concerns.

Cybersecurity investment must be prioritized as an integral component of smart metering programs rather than an afterthought or optional enhancement. Utilities should implement comprehensive security frameworks including device authentication, data encryption, network monitoring, and incident response capabilities. Security planning should address both current threats and evolving risk landscapes through adaptive protection strategies.

Market evolution continues accelerating through 2030 as utilities nationwide modernize infrastructure and adopt advanced metering technologies. Growth projections indicate sustained expansion driven by replacement demand, regulatory requirements, and operational efficiency objectives. Smart meter adoption rates are expected to reach 65% national penetration by 2030 as utilities recognize comprehensive benefits and overcome implementation barriers.

Technology advancement will focus on enhanced analytics capabilities, improved communication systems, and integrated platform development that address evolving utility requirements. Next-generation meters will incorporate artificial intelligence, machine learning, and advanced sensor technologies that provide unprecedented monitoring and management capabilities. Innovation cycles will continue shortening as companies compete through rapid technology development and deployment.

Regulatory environment will evolve to address emerging challenges related to cybersecurity, data privacy, and technology standardization while maintaining support for infrastructure modernization. Federal infrastructure investment programs will continue providing financial support for utility modernization projects that demonstrate operational efficiency and environmental benefits. Policy development will balance innovation promotion with consumer protection and system reliability requirements.

Market consolidation trends will continue as companies seek to build comprehensive solution portfolios and expand market presence through strategic acquisitions and partnerships. Industry structure will evolve toward integrated platform providers offering complete solutions combining hardware, software, and services. Competitive dynamics will emphasize technology innovation, service excellence, and customer relationship management as key differentiation factors.

The US water meter market stands positioned for sustained growth and transformation driven by infrastructure modernization needs, technology advancement, and evolving utility operational requirements. Smart metering solutions demonstrate clear advantages in operational efficiency, customer service, and resource management that justify investment despite higher upfront costs and implementation complexity.

Market dynamics favor companies with comprehensive solution portfolios, strong technical capabilities, and customer-focused service approaches. Success requires balancing innovation with reliability while addressing cybersecurity concerns and customer acceptance challenges. MWR analysis indicates utilities increasingly prioritize long-term value and operational benefits over initial cost considerations in technology selection decisions.

Future success depends on continued technology innovation, strategic partnerships, and effective customer engagement strategies that build support for advanced metering programs. The market will reward companies that demonstrate clear value propositions, comprehensive technical support, and commitment to long-term customer relationships. Strategic positioning requires focus on integrated solutions that address diverse utility requirements while maintaining competitive pricing and service excellence standards.

What is Water Meter?

Water meters are devices used to measure the volume of water that passes through a specific point in a water supply system. They are essential for billing, monitoring water usage, and managing water resources effectively.

What are the key players in the US Water Meter Market?

Key players in the US Water Meter Market include companies like Badger Meter, Itron, Sensus, and Neptune Technology Group. These companies are known for their innovative solutions and extensive product offerings in water measurement technology, among others.

What are the growth factors driving the US Water Meter Market?

The US Water Meter Market is driven by factors such as the increasing demand for accurate water billing, the need for efficient water management, and the growing adoption of smart water meters. Additionally, government initiatives promoting water conservation contribute to market growth.

What challenges does the US Water Meter Market face?

Challenges in the US Water Meter Market include the high initial costs of advanced metering infrastructure and the need for regular maintenance and upgrades. Additionally, resistance to adopting new technologies among some utilities can hinder market expansion.

What opportunities exist in the US Water Meter Market?

The US Water Meter Market presents opportunities in the development of smart metering solutions and IoT integration. As cities seek to enhance water management and reduce waste, innovative technologies that provide real-time data and analytics are increasingly in demand.

What trends are shaping the US Water Meter Market?

Trends in the US Water Meter Market include the shift towards smart water meters that offer remote monitoring and data collection capabilities. Additionally, there is a growing emphasis on sustainability and energy efficiency in water management practices.

US Water Meter Market

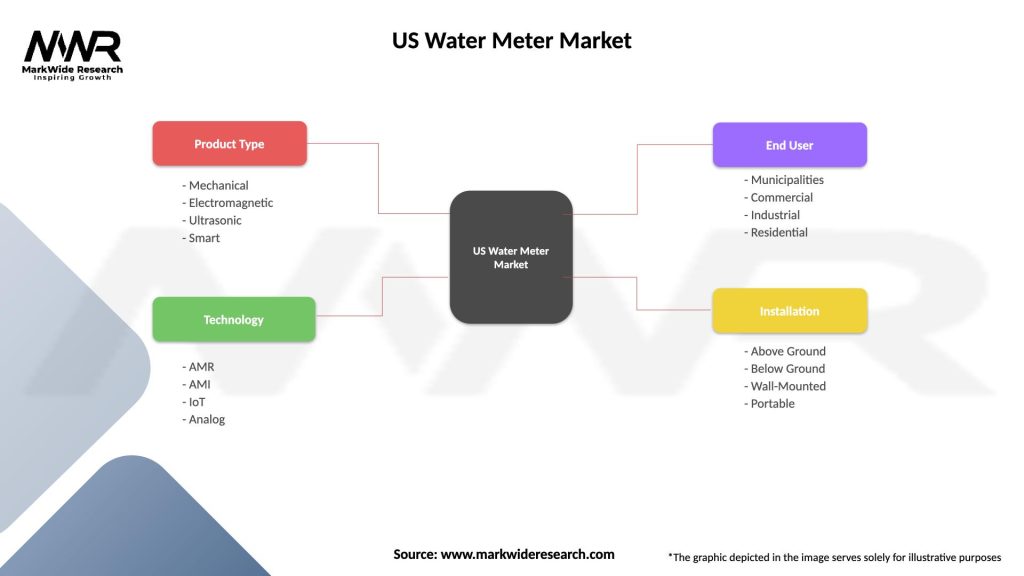

| Segmentation Details | Description |

|---|---|

| Product Type | Mechanical, Electromagnetic, Ultrasonic, Smart |

| Technology | AMR, AMI, IoT, Analog |

| End User | Municipalities, Commercial, Industrial, Residential |

| Installation | Above Ground, Below Ground, Wall-Mounted, Portable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Water Meter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at