444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US water enhancer market represents a dynamic and rapidly evolving segment within the broader beverage industry, characterized by innovative liquid and powder formulations designed to transform plain water into flavorful, functional drinks. Market dynamics indicate substantial growth potential driven by increasing health consciousness, rising demand for sugar-free alternatives, and growing consumer preference for customizable hydration solutions. The market encompasses various product categories including flavor enhancers, electrolyte boosters, vitamin-infused concentrates, and energy-enhancing formulations.

Consumer adoption rates have accelerated significantly, with health-conscious individuals seeking convenient alternatives to traditional sugary beverages. The market demonstrates robust expansion across multiple distribution channels, from traditional retail outlets to e-commerce platforms, reflecting changing consumer shopping behaviors and preferences. Innovation trends continue to drive market evolution, with manufacturers introducing organic formulations, natural sweeteners, and functional ingredients targeting specific health benefits.

Regional distribution shows concentrated demand in urban areas where busy lifestyles drive convenience-oriented product adoption. The market benefits from increasing awareness of hydration importance, particularly among fitness enthusiasts, working professionals, and health-conscious consumers seeking better-for-you beverage options. Growth projections indicate sustained expansion at approximately 8.5% CAGR through the forecast period, supported by continuous product innovation and expanding consumer base.

The US water enhancer market refers to the commercial ecosystem encompassing liquid concentrates, powder mixes, and tablet formulations designed to add flavor, nutrients, or functional benefits to plain water. These products enable consumers to customize their hydration experience by transforming ordinary water into flavored, vitamin-enriched, or energy-boosting beverages according to personal preferences and nutritional needs.

Water enhancers typically contain concentrated flavoring agents, natural or artificial sweeteners, vitamins, minerals, electrolytes, or other functional ingredients packaged in convenient, portable formats. The market includes various product subcategories such as liquid drops, powder sachets, effervescent tablets, and concentrated syrups, each offering unique advantages in terms of convenience, shelf stability, and customization options.

Functional benefits provided by these products range from basic flavor enhancement to targeted health outcomes including hydration optimization, energy boosting, immune support, and electrolyte replenishment. The market serves diverse consumer segments seeking healthier alternatives to traditional soft drinks while maintaining convenience and taste satisfaction.

Market performance in the US water enhancer sector demonstrates exceptional resilience and growth momentum, driven by fundamental shifts in consumer beverage preferences toward healthier, customizable options. The industry has successfully capitalized on increasing health awareness, with consumer adoption rates reaching approximately 42% penetration among regular water drinkers seeking flavor variety and functional benefits.

Key market drivers include rising obesity concerns, growing fitness culture, increasing demand for sugar-free alternatives, and expanding awareness of proper hydration importance. The market benefits from strong innovation pipelines, with manufacturers continuously introducing new flavors, functional formulations, and improved delivery systems to meet evolving consumer expectations.

Competitive dynamics feature established beverage companies alongside emerging specialty brands, creating a diverse marketplace with options spanning from basic flavor enhancement to sophisticated functional formulations. Distribution expansion across multiple channels, including traditional retail, online platforms, and specialty health stores, has improved product accessibility and market penetration.

Future prospects remain highly favorable, supported by demographic trends favoring health-conscious consumption, continued product innovation, and expanding applications in sports nutrition, wellness, and functional beverage categories. The market demonstrates strong potential for sustained growth and category expansion.

Consumer behavior analysis reveals significant insights driving market evolution and growth patterns. The following key insights shape market dynamics:

Health and wellness trends serve as the primary catalyst driving US water enhancer market expansion, with consumers increasingly prioritizing nutritious beverage choices over traditional sugary alternatives. The growing awareness of obesity-related health risks and diabetes prevention has created substantial demand for low-calorie, sugar-free hydration solutions that maintain taste satisfaction without compromising health objectives.

Fitness culture proliferation significantly contributes to market growth, as active individuals seek convenient hydration solutions that support exercise performance and recovery. The expanding gym membership base and increasing participation in recreational sports activities create sustained demand for electrolyte-enhanced and energy-boosting water enhancer products.

Convenience lifestyle demands drive adoption among busy professionals and families seeking quick, portable solutions for improving water taste and nutritional value. The ability to transform plain water into flavored, functional beverages without refrigeration requirements or preparation time appeals to time-constrained consumers across various demographic segments.

Economic considerations favor water enhancers as cost-effective alternatives to purchasing pre-flavored beverages, with consumers recognizing significant savings potential. The concentrated nature of these products provides excellent value proposition, enabling multiple servings from single packages while reducing per-serving costs compared to bottled alternatives.

Innovation momentum continues driving market expansion through introduction of new flavors, improved formulations, and enhanced functional benefits. Manufacturers’ commitment to research and development creates continuous product evolution, maintaining consumer interest and expanding market applications across different usage occasions and consumer needs.

Artificial ingredient concerns present significant challenges for market expansion, as health-conscious consumers increasingly scrutinize product labels and avoid items containing artificial colors, flavors, or preservatives. Growing preference for natural, organic ingredients creates formulation challenges for manufacturers seeking to maintain taste quality, shelf stability, and cost-effectiveness while meeting clean label demands.

Taste consistency issues can limit consumer adoption and retention, particularly when products fail to deliver consistent flavor profiles or leave undesirable aftertastes. The challenge of creating appealing flavors using natural ingredients while avoiding artificial additives requires sophisticated formulation expertise and may result in higher production costs.

Market saturation risks emerge as numerous brands compete for consumer attention, potentially leading to confusion and decision fatigue among shoppers. The proliferation of similar products with minimal differentiation may commoditize the category and pressure profit margins across the industry.

Regulatory compliance requirements create ongoing challenges for manufacturers, particularly regarding health claims, ingredient safety, and labeling accuracy. Evolving FDA guidelines and state-level regulations require continuous monitoring and potential reformulation to maintain market access and avoid compliance issues.

Consumer habit inertia represents a fundamental challenge, as many individuals maintain established beverage consumption patterns and resist trying new products. Overcoming traditional preferences for familiar beverages requires significant marketing investment and compelling value propositions to drive trial and adoption.

Functional beverage expansion presents substantial growth opportunities as consumers increasingly seek products delivering specific health benefits beyond basic hydration. The integration of probiotics, adaptogens, nootropics, and specialized vitamins into water enhancer formulations can create premium product categories targeting wellness-focused consumers willing to pay higher prices for functional benefits.

E-commerce channel development offers significant potential for market expansion, particularly through subscription models and direct-to-consumer sales strategies. Online platforms enable targeted marketing, personalized product recommendations, and convenient repeat purchasing, while providing valuable consumer data for product development and marketing optimization.

Demographic expansion opportunities exist in underserved segments including seniors seeking convenient nutrition delivery, children requiring appealing hydration encouragement, and ethnic communities with specific flavor preferences. Tailored product development and targeted marketing can unlock these growth segments and expand market reach.

International market potential creates opportunities for successful US brands to expand globally, leveraging proven formulations and marketing strategies in emerging markets with growing middle-class populations and increasing health consciousness. Export opportunities can provide additional revenue streams and market diversification benefits.

Partnership opportunities with fitness centers, healthcare providers, and wellness programs can create new distribution channels and credibility enhancement. Collaborative marketing efforts and co-branded products can expand market reach while building brand authority in health and wellness segments.

Supply chain evolution continues reshaping market dynamics as manufacturers optimize ingredient sourcing, production efficiency, and distribution networks to meet growing demand while maintaining cost competitiveness. The integration of sustainable sourcing practices and environmentally friendly packaging solutions responds to consumer environmental consciousness while potentially commanding premium pricing.

Competitive intensity drives continuous innovation and marketing investment as established beverage companies compete with emerging specialty brands for market share. This dynamic environment benefits consumers through improved product quality, expanded flavor options, and competitive pricing, while challenging manufacturers to differentiate their offerings effectively.

Technology integration enhances market dynamics through improved manufacturing processes, quality control systems, and consumer engagement platforms. Advanced formulation techniques enable better taste profiles and functional ingredient stability, while digital marketing tools provide precise targeting and performance measurement capabilities.

Consumer education efforts by industry participants help expand market awareness and drive category growth. Educational campaigns highlighting hydration benefits, product usage instructions, and health advantages contribute to market expansion while building consumer confidence in product efficacy and safety.

Seasonal demand patterns create dynamic market conditions with increased consumption during warmer months and fitness-focused periods. Understanding and planning for these fluctuations enables manufacturers to optimize inventory management, production scheduling, and marketing campaign timing for maximum effectiveness.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into US water enhancer market dynamics. Primary research initiatives include consumer surveys, focus groups, and in-depth interviews with industry stakeholders to gather firsthand perspectives on market trends, consumer preferences, and competitive dynamics.

Secondary research components encompass analysis of industry reports, company financial statements, regulatory filings, and trade publication data to establish market context and validate primary research findings. This multi-source approach ensures comprehensive coverage of market factors and reduces potential bias in data interpretation.

Quantitative analysis methods include statistical modeling, trend analysis, and market sizing calculations based on retail sales data, consumer purchase behavior, and demographic segmentation. These analytical techniques provide measurable insights into market performance and growth projections.

Qualitative assessment approaches involve expert interviews, industry observation, and competitive intelligence gathering to understand market nuances, emerging trends, and strategic implications. This qualitative dimension adds depth and context to quantitative findings.

Data validation processes ensure research accuracy through cross-referencing multiple sources, peer review procedures, and ongoing market monitoring to identify and correct potential discrepancies or outdated information.

Geographic distribution across the United States reveals distinct regional preferences and consumption patterns that influence market dynamics and growth opportunities. The Western region demonstrates the highest adoption rates at approximately 48% market penetration, driven by health-conscious lifestyles, active outdoor culture, and early adoption of wellness trends.

Northeast markets show strong performance in urban areas where busy professionals seek convenient hydration solutions, with particular strength in premium and functional product categories. The region’s higher income levels support willingness to pay for quality and convenience, creating opportunities for premium positioning and specialized formulations.

Southern states exhibit growing demand driven by hot climate conditions and increasing health awareness, though traditional beverage preferences create some adoption challenges. The region shows particular interest in sweet flavor profiles and energy-enhancing formulations that align with local taste preferences and active lifestyles.

Midwest regions demonstrate steady growth with strong value-consciousness driving preference for cost-effective products offering multiple servings per package. Rural areas show increasing adoption as distribution networks expand and product awareness grows through digital marketing channels.

State-level variations reflect local regulations, demographic compositions, and cultural preferences that influence product acceptance and market penetration rates. California, Texas, Florida, and New York represent the largest individual state markets, collectively accounting for approximately 52% of national consumption.

Market leadership features a diverse competitive environment with established beverage giants competing alongside innovative specialty brands and emerging direct-to-consumer companies. The competitive dynamics create opportunities for differentiation through unique formulations, targeted marketing, and specialized distribution strategies.

Competitive strategies emphasize product innovation, flavor variety expansion, functional benefit enhancement, and targeted marketing to specific consumer segments. Companies invest heavily in research and development to create differentiated products while building brand loyalty through consistent quality and effective marketing communications.

Product type segmentation reveals distinct categories serving different consumer needs and usage occasions. The market divides into several key segments based on format, functionality, and target applications:

By Product Format:

By Functionality:

By Target Demographics:

Flavor enhancement category represents the largest market segment, accounting for approximately 58% of total consumption, driven by consumer desire for variety and taste improvement in daily hydration routines. This category benefits from continuous innovation in natural flavoring systems and seasonal variety introductions that maintain consumer engagement and prevent taste fatigue.

Functional hydration products demonstrate the fastest growth rates, expanding at approximately 12.3% annually as consumers increasingly seek products delivering specific health benefits beyond basic taste enhancement. The integration of electrolytes, vitamins, and specialized ingredients creates premium positioning opportunities and higher profit margins for manufacturers.

Sports nutrition applications show strong performance among active demographics, with products specifically formulated for pre-workout, during-exercise, and recovery applications. This category benefits from growing fitness culture participation and increasing awareness of proper hydration’s role in athletic performance and recovery.

Children-focused formulations present significant growth potential as parents seek healthy alternatives to sugary drinks while encouraging adequate water consumption. Products featuring appealing flavors, fun packaging, and nutritional benefits can capture this important demographic segment.

Premium natural products command higher prices and demonstrate strong growth among health-conscious consumers willing to pay for organic ingredients, clean labels, and sustainable packaging. This category reflects broader consumer trends toward natural, environmentally responsible products.

Manufacturers benefit from expanding market opportunities, improved profit margins compared to traditional beverages, and reduced distribution costs due to concentrated product formats. The category’s growth potential and innovation opportunities enable companies to build strong brand positions and customer loyalty while achieving sustainable competitive advantages.

Retailers gain from high-margin products with excellent shelf stability, compact storage requirements, and strong consumer demand driving consistent inventory turnover. Water enhancers typically generate higher profit per square foot compared to traditional beverages while requiring less refrigeration space and handling complexity.

Consumers receive significant value through cost-effective hydration solutions, convenience benefits, customization control, and health advantages compared to traditional sugary beverages. The ability to transform plain water into appealing, functional drinks provides flexibility and supports healthier lifestyle choices.

Healthcare providers can recommend water enhancers as tools for encouraging adequate hydration among patients while supporting specific nutritional needs through vitamin-fortified formulations. These products help address common hydration challenges and support overall wellness objectives.

Fitness professionals benefit from having convenient tools to help clients maintain proper hydration and electrolyte balance during training and competition. The availability of specialized sports formulations supports performance optimization and recovery protocols.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient prioritization dominates current market trends as consumers increasingly demand clean label products free from artificial colors, flavors, and preservatives. MarkWide Research analysis indicates that products featuring natural ingredients command approximately 23% price premiums while demonstrating stronger growth rates compared to conventional formulations.

Functional benefit integration continues expanding beyond basic flavor enhancement to include specialized health applications such as immune support, stress relief, cognitive enhancement, and digestive health. Manufacturers increasingly incorporate probiotics, adaptogens, and targeted vitamin complexes to create differentiated products serving specific wellness needs.

Sustainability focus drives packaging innovation and ingredient sourcing decisions as environmentally conscious consumers prefer brands demonstrating commitment to environmental responsibility. Recyclable packaging, reduced plastic usage, and sustainable ingredient sourcing become important competitive differentiators.

Personalization trends emerge through customizable flavor intensity options, mix-and-match variety packs, and targeted formulations for specific demographic segments or usage occasions. Technology integration enables personalized recommendations and subscription services tailored to individual preferences and consumption patterns.

Premium positioning expansion reflects consumer willingness to pay higher prices for superior quality, unique flavors, and enhanced functionality. Craft and artisanal water enhancer brands gain traction by offering distinctive flavor profiles and premium ingredient selections that appeal to discerning consumers.

Product innovation acceleration characterizes recent industry developments as manufacturers invest heavily in research and development to create differentiated offerings. Recent launches include organic formulations, sugar-free options using natural sweeteners, and specialized products targeting specific health conditions or lifestyle needs.

Acquisition activity increases as large beverage companies seek to expand their portfolios through strategic purchases of successful specialty brands. These transactions provide emerging companies with distribution capabilities and marketing resources while giving established players access to innovative products and loyal customer bases.

Distribution expansion continues across multiple channels, with particular growth in e-commerce platforms, subscription services, and specialty health retailers. Companies invest in omnichannel strategies to meet consumers wherever they prefer to shop while optimizing inventory management and customer experience.

Marketing evolution emphasizes digital channels, influencer partnerships, and content marketing strategies that educate consumers about product benefits and usage applications. Social media campaigns and user-generated content help build brand communities and drive organic growth through peer recommendations.

Regulatory compliance improvements reflect industry maturation as companies implement more sophisticated quality control systems, ingredient testing protocols, and labeling accuracy measures to ensure consumer safety and regulatory compliance across all markets.

Innovation investment should focus on developing natural formulations that deliver superior taste experiences while meeting clean label requirements. Companies should prioritize research into natural flavoring systems, plant-based sweeteners, and functional ingredients that provide measurable health benefits without compromising taste quality or shelf stability.

Market segmentation strategies should target underserved demographic groups including seniors, children, and ethnic communities with specific flavor preferences or nutritional needs. Tailored product development and targeted marketing can unlock growth opportunities in these segments while building brand loyalty and market share.

Distribution optimization requires balanced investment in traditional retail relationships and emerging e-commerce channels. Companies should develop omnichannel strategies that provide consistent brand experiences while leveraging each channel’s unique advantages for customer acquisition and retention.

Partnership development with healthcare providers, fitness centers, and wellness programs can create credibility and expand market reach. Collaborative marketing efforts and co-branded products can build brand authority while accessing new customer segments through trusted intermediaries.

Sustainability initiatives should encompass packaging innovation, ingredient sourcing practices, and manufacturing processes to meet growing consumer environmental expectations. Companies that proactively address sustainability concerns can differentiate their brands and command premium pricing while building long-term customer loyalty.

Growth projections for the US water enhancer market remain highly favorable, with MWR forecasting sustained expansion driven by demographic trends, health consciousness growth, and continued product innovation. The market is expected to maintain robust growth rates exceeding 8% annually through the next five years, supported by expanding consumer base and increasing per-capita consumption.

Technology integration will enhance product development capabilities, manufacturing efficiency, and consumer engagement opportunities. Advanced formulation techniques, smart packaging solutions, and personalized nutrition platforms will create new possibilities for product differentiation and customer relationship building.

Market maturation will likely result in consolidation among smaller players while creating opportunities for innovative companies to establish strong positions in specialized segments. The industry will benefit from improved consumer education, standardized quality measures, and enhanced regulatory clarity.

International expansion opportunities will emerge as successful US brands leverage proven formulations and marketing strategies in global markets. Export potential and international licensing agreements can provide additional revenue streams while diversifying market risk.

Category evolution will continue toward more sophisticated functional formulations addressing specific health needs and lifestyle applications. The integration of personalized nutrition concepts and targeted wellness solutions will create premium market segments with higher profit potential and stronger customer loyalty.

The US water enhancer market demonstrates exceptional growth potential and strategic importance within the broader beverage industry, driven by fundamental consumer trends toward healthier hydration solutions and convenient lifestyle products. The market’s evolution from basic flavor enhancement to sophisticated functional formulations reflects growing consumer sophistication and willingness to invest in products delivering measurable health benefits.

Market dynamics favor continued expansion through multiple growth drivers including health consciousness, convenience demands, cost-effectiveness, and innovation momentum. While challenges exist regarding natural ingredient formulation and market competition, the overall outlook remains highly positive with substantial opportunities for both established companies and emerging brands.

Success factors in this dynamic market include commitment to product innovation, understanding of consumer preferences, effective distribution strategies, and ability to communicate product benefits clearly. Companies that invest in natural formulations, functional benefits, and sustainable practices while maintaining competitive pricing will be best positioned for long-term success in this expanding market opportunity.

What is Water Enhancer?

Water enhancers are concentrated liquid or powdered products designed to add flavor, nutrients, or other functional benefits to water, making it more appealing to consumers. They are often used to encourage hydration and can include vitamins, electrolytes, and natural flavors.

What are the key players in the US Water Enhancer Market?

Key players in the US Water Enhancer Market include brands like Mio, Stur, and Crystal Light, which offer a variety of flavored water enhancers. These companies focus on innovation and marketing to attract health-conscious consumers, among others.

What are the growth factors driving the US Water Enhancer Market?

The US Water Enhancer Market is driven by increasing health awareness among consumers, a growing demand for convenient hydration solutions, and the popularity of flavored beverages. Additionally, the rise in fitness trends and the need for electrolyte replenishment contribute to market growth.

What challenges does the US Water Enhancer Market face?

Challenges in the US Water Enhancer Market include competition from traditional beverages, concerns over artificial ingredients, and regulatory scrutiny regarding health claims. These factors can impact consumer trust and market penetration.

What opportunities exist in the US Water Enhancer Market?

Opportunities in the US Water Enhancer Market include the development of organic and natural product lines, expansion into new distribution channels, and targeting niche markets such as fitness enthusiasts and children. Innovations in packaging and flavor profiles also present growth potential.

What trends are shaping the US Water Enhancer Market?

Trends in the US Water Enhancer Market include a shift towards clean-label products, increased interest in functional beverages that offer health benefits, and the incorporation of unique flavors and ingredients. Sustainability in packaging and sourcing is also becoming increasingly important to consumers.

US Water Enhancer Market

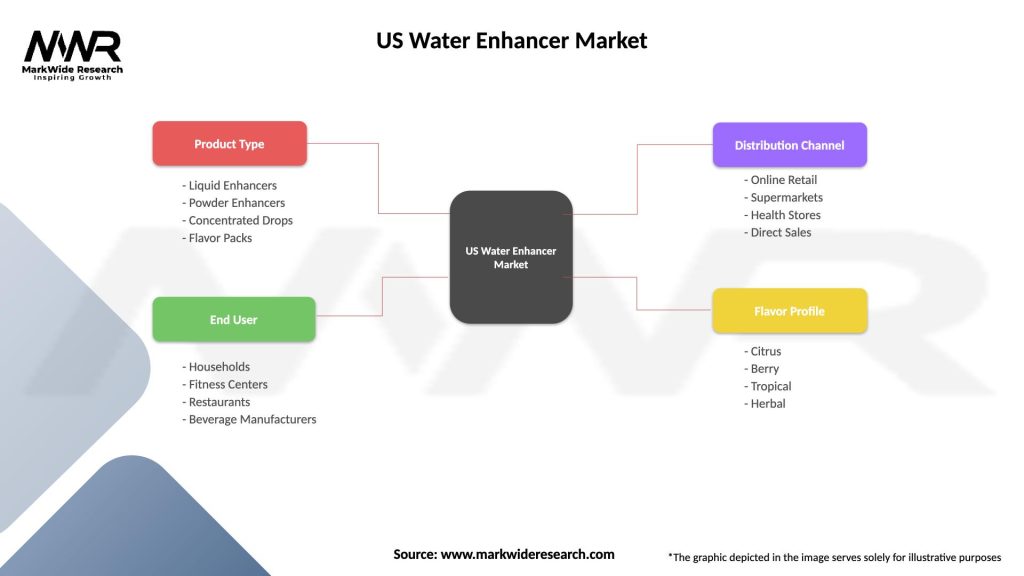

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Enhancers, Powder Enhancers, Concentrated Drops, Flavor Packs |

| End User | Households, Fitness Centers, Restaurants, Beverage Manufacturers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Direct Sales |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Water Enhancer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at