444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US wall covering and wall decor market represents a dynamic and evolving segment within the broader home improvement and interior design industry. This comprehensive market encompasses a diverse range of products including wallpaper, wall panels, decorative tiles, wall stickers, murals, and various other aesthetic wall enhancement solutions. Market dynamics indicate robust growth driven by increasing consumer interest in home personalization, rising disposable income, and the growing influence of social media on interior design trends.

Consumer preferences have shifted significantly toward premium and customizable wall covering solutions, with homeowners increasingly viewing walls as canvases for personal expression. The market benefits from technological advancements in printing techniques, material innovation, and digital design capabilities that enable more sophisticated and durable wall covering options. Growth projections suggest the market will expand at a steady CAGR of 6.2% through the forecast period, supported by residential construction activity and renovation projects across the United States.

Regional distribution shows strong performance across major metropolitan areas, with California, Texas, and New York leading in market adoption. The integration of smart home technologies and sustainable materials has created new opportunities for market expansion, while e-commerce platforms have revolutionized product accessibility and consumer purchasing patterns.

The US wall covering and wall decor market refers to the comprehensive industry segment encompassing all products, services, and technologies designed to enhance, protect, and beautify interior and exterior wall surfaces in residential, commercial, and institutional settings. This market includes traditional wallpaper, modern vinyl coverings, fabric-based wall treatments, decorative panels, wall decals, artistic murals, and innovative digital wall covering solutions.

Market scope extends beyond mere aesthetic enhancement to include functional benefits such as moisture resistance, sound dampening, thermal insulation, and surface protection. The industry serves diverse customer segments ranging from individual homeowners seeking personalized decor solutions to commercial developers requiring large-scale wall covering installations for hotels, restaurants, offices, and retail spaces.

Product categories within this market span from budget-friendly peel-and-stick options to luxury custom-designed installations, reflecting the broad spectrum of consumer needs and preferences. The market’s evolution reflects changing lifestyle trends, technological capabilities, and environmental consciousness among American consumers.

Market performance in the US wall covering and wall decor sector demonstrates sustained growth momentum driven by multiple converging factors. The industry has successfully adapted to changing consumer preferences while embracing technological innovations that enhance product quality, installation ease, and design flexibility. Key growth drivers include the booming home renovation market, increased focus on interior aesthetics, and the rising popularity of DIY home improvement projects.

Competitive landscape features a mix of established manufacturers, emerging design-focused brands, and technology-enabled startups offering innovative solutions. Market leaders have invested heavily in digital printing capabilities, sustainable materials, and direct-to-consumer distribution channels to maintain competitive advantages. Consumer adoption rates show particularly strong growth in the 35-55 age demographic, representing 42% of total market demand.

Strategic opportunities emerge from the integration of augmented reality visualization tools, eco-friendly material development, and customization technologies that enable personalized design solutions. The market’s resilience during economic fluctuations reflects its position as both a necessity and discretionary spending category, with consumers prioritizing home comfort and aesthetic appeal.

Market intelligence reveals several critical insights shaping the US wall covering and wall decor landscape:

Consumer behavior analysis indicates increasing willingness to invest in premium wall covering solutions, with average spending per project rising consistently. The influence of social media platforms, particularly Instagram and Pinterest, significantly impacts design trend adoption and purchase decisions across all demographic segments.

Primary growth drivers propelling the US wall covering and wall decor market include robust residential construction activity and extensive home renovation projects. The housing market recovery following economic challenges has created substantial demand for interior enhancement products, with homeowners investing in aesthetic improvements to increase property values and personal satisfaction.

Demographic trends significantly influence market expansion, particularly the millennial generation’s entry into homeownership and their preference for personalized living spaces. This demographic demonstrates strong willingness to invest in unique wall covering solutions that reflect individual style and personality. Social media influence amplifies design trends and creates viral demand for specific wall covering styles and applications.

Technological advancement serves as a crucial market driver through improved manufacturing processes, enhanced durability, and simplified installation methods. Digital printing capabilities enable cost-effective customization, while new adhesive technologies make installation more accessible to DIY enthusiasts. Material innovation continues expanding product possibilities with moisture-resistant, antimicrobial, and smart-enabled wall covering options.

Economic factors including rising disposable income, low interest rates, and increased home equity enable consumers to invest in discretionary home improvement projects. The growing awareness of interior design’s impact on mental health and productivity further drives demand for aesthetically pleasing wall covering solutions across residential and commercial applications.

Installation complexity remains a significant market restraint, particularly for traditional wallpaper and complex decorative panels requiring professional installation. Many consumers hesitate to invest in wall covering solutions due to concerns about installation difficulty, potential wall damage, and removal challenges. This barrier particularly affects rental property occupants who face restrictions on permanent wall modifications.

Cost considerations present ongoing challenges, especially for premium and custom wall covering solutions that require substantial upfront investment. Economic uncertainty can quickly impact discretionary spending on home decor, making the market vulnerable to economic downturns. Price sensitivity among budget-conscious consumers limits market penetration in certain demographic segments.

Maintenance requirements and durability concerns influence consumer purchasing decisions, with some wall covering types requiring regular cleaning, touch-ups, or eventual replacement. The perception of wall coverings as temporary solutions compared to paint creates hesitation among consumers seeking long-term value. Style obsolescence risks associated with trendy designs may deter investment in permanent wall covering installations.

Regulatory challenges including building codes, fire safety requirements, and environmental regulations can limit product options and increase compliance costs. Commercial applications face particularly stringent requirements that may restrict material choices and increase project complexity. Supply chain disruptions and raw material price volatility also create market uncertainties affecting both manufacturers and consumers.

Emerging opportunities in the US wall covering and wall decor market center around technological integration and sustainability initiatives. The development of smart wall coverings incorporating LED lighting, temperature regulation, and interactive capabilities represents a significant growth frontier. These innovative products appeal to tech-savvy consumers and commercial clients seeking multifunctional interior solutions.

Customization technologies create substantial opportunities for market expansion through personalized design services and on-demand manufacturing. Advanced digital printing capabilities enable cost-effective small-batch production, allowing consumers to create unique wall covering designs from personal photographs, artwork, or custom patterns. This trend particularly resonates with younger demographics seeking distinctive home environments.

Sustainable material development opens new market segments among environmentally conscious consumers. Opportunities exist for bio-based materials, recycled content integration, and biodegradable wall covering solutions that align with growing environmental awareness. Green building certifications increasingly require sustainable interior materials, creating demand in commercial construction projects.

E-commerce expansion and virtual reality visualization tools present opportunities to reach broader customer bases and enhance the purchasing experience. Online platforms enable direct manufacturer-to-consumer sales, reducing distribution costs and enabling competitive pricing. Augmented reality applications allow customers to visualize wall covering options in their actual spaces before purchase, reducing return rates and increasing customer satisfaction.

Market dynamics in the US wall covering and wall decor sector reflect complex interactions between consumer preferences, technological capabilities, and economic conditions. The industry demonstrates cyclical patterns aligned with broader construction and home improvement trends, while maintaining underlying growth momentum driven by demographic shifts and lifestyle changes.

Supply chain dynamics have evolved significantly with increased direct-to-consumer sales and shortened distribution channels. Manufacturers increasingly bypass traditional retail intermediaries to offer competitive pricing and enhanced customer service. This shift has intensified competition while providing consumers with greater product access and customization options. Inventory management strategies have adapted to accommodate both large-scale commercial projects and individual consumer orders.

Innovation cycles drive continuous market evolution through new material development, printing technologies, and installation methods. The integration of digital technologies accelerates product development timelines and enables rapid response to emerging design trends. Consumer feedback loops through social media and online reviews provide manufacturers with real-time market intelligence for product improvement and development.

Competitive dynamics feature increasing consolidation among traditional manufacturers while new entrants focus on niche segments and innovative technologies. Market leaders maintain advantages through established distribution networks and brand recognition, while smaller companies compete through specialization and customer service excellence. Price competition intensifies in commodity segments while premium markets support higher margins through differentiation strategies.

Comprehensive research methodology employed for analyzing the US wall covering and wall decor market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes extensive surveys of consumers, retailers, manufacturers, and industry professionals to gather firsthand insights into market trends, preferences, and challenges.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and identify growth patterns. MarkWide Research utilizes proprietary databases and analytical tools to process large datasets and extract meaningful market intelligence from diverse information sources.

Quantitative analysis employs statistical modeling techniques to project market trends, segment performance, and regional variations. Data validation processes ensure consistency across multiple sources while accounting for seasonal variations and economic cycles that influence market performance. Qualitative research through expert interviews and focus groups provides contextual understanding of market dynamics and consumer behavior patterns.

Market segmentation analysis utilizes demographic, psychographic, and behavioral data to identify distinct consumer groups and their specific needs. Geographic analysis considers regional preferences, climate factors, and local market conditions that influence product demand and distribution strategies. Competitive intelligence gathering includes monitoring of product launches, pricing strategies, and marketing initiatives across the industry landscape.

Regional market distribution across the United States reveals distinct patterns reflecting demographic concentrations, economic conditions, and cultural preferences. West Coast markets, particularly California, demonstrate strong demand for innovative and sustainable wall covering solutions, driven by environmental consciousness and higher disposable incomes. This region accounts for approximately 28% of national market share, with premium and custom products showing particularly strong performance.

Northeast markets including New York, Massachusetts, and Pennsylvania emphasize traditional and luxury wall covering options, reflecting established wealth concentrations and historic home renovation projects. The region’s mature housing stock creates consistent demand for wall covering solutions in both residential and commercial applications. Urban centers within this region show 15% higher adoption rates compared to suburban areas.

Southern states demonstrate rapid market growth driven by population migration, new construction activity, and rising income levels. Texas and Florida lead regional demand with strong performance in both residential and hospitality sectors. The region’s growth rate exceeds the national average by 3.2 percentage points, supported by favorable economic conditions and demographic trends.

Midwest markets show steady demand patterns with emphasis on value-oriented products and practical applications. The region’s manufacturing heritage influences preferences toward durable and functional wall covering solutions. Commercial sector demand remains strong in industrial and office applications, while residential markets focus on cost-effective aesthetic enhancement options.

Market leadership in the US wall covering and wall decor sector features a diverse mix of established manufacturers, specialty brands, and emerging technology companies. The competitive landscape reflects industry maturation while accommodating innovation and niche market development.

Competitive strategies emphasize product differentiation, technological innovation, and customer experience enhancement. Market leaders invest heavily in digital capabilities, sustainable materials, and direct-to-consumer distribution channels to maintain competitive advantages in an increasingly crowded marketplace.

Market segmentation analysis reveals distinct categories based on product type, application, end-user, and distribution channel preferences. Product-based segmentation includes traditional wallpaper, vinyl wall coverings, fabric wall treatments, decorative panels, wall decals, and digital wall coverings, each serving specific consumer needs and price points.

By Product Type:

By Application:

Residential segment dominates market demand, accounting for approximately 68% of total market volume, driven by homeowner investment in interior aesthetics and property value enhancement. This category shows strong growth in premium and custom products as consumers increasingly view wall coverings as long-term investments rather than temporary decorative elements.

Commercial applications demonstrate steady growth with emphasis on durability, maintenance ease, and brand representation. Office environments increasingly adopt wall coverings for acoustic benefits and aesthetic improvement, while retail spaces use decorative walls for customer experience enhancement and brand storytelling.

Hospitality sector represents a high-value market segment with demand for unique and Instagram-worthy wall designs that enhance guest experience and social media visibility. Hotels and restaurants invest in distinctive wall covering solutions to create memorable environments and differentiate from competitors. Project values in this segment typically exceed residential applications by 250-300%.

Healthcare applications focus on functional benefits including antimicrobial properties, easy cleaning, and durability under intensive use conditions. This specialized segment requires compliance with strict regulatory standards while maintaining aesthetic appeal for patient comfort and staff satisfaction.

DIY segment shows exceptional growth driven by simplified installation methods and online tutorial availability. Peel-and-stick products and removable wall coverings particularly appeal to younger demographics and rental property occupants seeking personalization options without permanent modifications.

Manufacturers benefit from expanding market opportunities through technological innovation and product diversification. Digital printing capabilities enable cost-effective customization while sustainable material development opens new market segments. Operational advantages include improved manufacturing efficiency, reduced waste, and enhanced quality control through advanced production technologies.

Retailers and distributors gain from increased consumer interest in home improvement and the growing DIY market segment. E-commerce integration provides expanded reach and reduced overhead costs while augmented reality tools enhance customer experience and reduce return rates. Inventory management benefits from improved demand forecasting and just-in-time delivery capabilities.

Consumers enjoy enhanced product variety, improved installation ease, and competitive pricing through direct-to-consumer sales channels. Technological advances provide better visualization tools, customization options, and product durability. Value proposition improvements include longer product lifecycles, easier maintenance, and enhanced aesthetic appeal.

Commercial end-users benefit from improved acoustic properties, brand differentiation opportunities, and enhanced customer experience capabilities. Wall covering solutions provide cost-effective alternatives to major renovations while enabling rapid space transformation for changing business needs. Operational benefits include reduced maintenance requirements and improved indoor air quality through advanced material formulations.

Installation professionals gain from simplified installation methods, improved adhesive technologies, and expanded market demand. Training programs and certification opportunities enhance professional capabilities while technology integration provides competitive advantages in project execution and customer service.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the US wall covering and wall decor market. Advanced printing technologies enable photorealistic designs, custom patterns, and on-demand production capabilities that were previously impossible or cost-prohibitive. Augmented reality applications allow consumers to visualize wall covering options in their actual spaces, significantly improving purchase confidence and reducing return rates.

Sustainability focus drives innovation in eco-friendly materials, recyclable products, and low-emission formulations. Consumers increasingly prioritize environmental impact in purchasing decisions, creating demand for bio-based materials, recycled content, and biodegradable options. Green building certifications require sustainable interior materials, expanding opportunities in commercial construction projects.

Customization and personalization trends reflect consumer desire for unique living and working environments. Digital printing capabilities enable cost-effective small-batch production of personalized designs, while online design tools allow consumers to create custom patterns and colors. Social media influence amplifies demand for Instagram-worthy wall designs and unique aesthetic elements.

Multifunctional products gain popularity as consumers seek solutions that provide multiple benefits beyond aesthetics. Wall coverings with acoustic properties, antimicrobial treatments, and thermal insulation capabilities appeal to health-conscious and energy-efficient building practices. Smart wall coverings incorporating LED lighting, temperature regulation, and interactive capabilities represent emerging market opportunities.

DIY market expansion continues driven by simplified installation methods, online tutorials, and removable product options. Peel-and-stick technologies and temporary solutions particularly appeal to younger demographics and rental property occupants seeking personalization without permanent modifications.

Technological breakthroughs in digital printing have revolutionized product capabilities and manufacturing efficiency. Recent developments include ultra-high-resolution printing, metallic and textural effects, and rapid prototyping capabilities that enable quick response to design trends. Material innovations focus on durability enhancement, environmental sustainability, and functional benefits beyond traditional aesthetic applications.

Strategic partnerships between manufacturers and technology companies accelerate innovation in smart wall coverings and digital integration. Collaborations with interior design platforms and augmented reality developers enhance customer experience and market reach. Acquisition activity consolidates market leadership while enabling smaller companies to access broader distribution networks and manufacturing capabilities.

Regulatory developments increasingly emphasize environmental safety and indoor air quality standards. New formulations eliminate harmful chemicals while maintaining product performance and durability. Industry certifications for sustainable materials and low-emission products create competitive advantages and market differentiation opportunities.

Distribution channel evolution reflects changing consumer shopping preferences and digital commerce growth. Direct-to-consumer sales models bypass traditional retail intermediaries while online marketplaces provide expanded product access and competitive pricing. Omnichannel strategies integrate online and offline experiences to optimize customer engagement and sales conversion.

Market expansion initiatives target underserved segments including healthcare, education, and hospitality applications. Specialized product development addresses unique requirements in these sectors while creating new revenue opportunities for manufacturers and distributors.

Strategic recommendations for market participants emphasize technology adoption, sustainability integration, and customer experience enhancement. MWR analysis suggests manufacturers prioritize digital printing capabilities and customization technologies to capture growing demand for personalized wall covering solutions. Investment in sustainable materials and production processes addresses environmental concerns while creating competitive differentiation.

Market positioning strategies should focus on specific customer segments rather than broad market approaches. Premium segments offer higher margins and growth potential, while DIY markets provide volume opportunities through simplified products and competitive pricing. Brand development initiatives should emphasize quality, innovation, and customer service excellence to build lasting competitive advantages.

Distribution optimization requires balancing traditional retail relationships with direct-to-consumer opportunities. E-commerce capabilities become essential for market participation, while augmented reality tools enhance online customer experience and reduce return rates. Inventory management strategies must accommodate both large commercial projects and individual consumer orders efficiently.

Innovation priorities should address multifunctional products that provide acoustic, thermal, and antimicrobial benefits alongside aesthetic appeal. Smart wall covering development represents significant long-term opportunities, while sustainable material innovation addresses immediate market demands. Partnership strategies with technology companies and design platforms accelerate innovation and market access.

Risk management approaches should address economic sensitivity through product portfolio diversification and flexible manufacturing capabilities. Supply chain resilience requires multiple sourcing options and inventory optimization strategies to manage material cost volatility and availability challenges.

Long-term projections for the US wall covering and wall decor market indicate sustained growth driven by demographic trends, technological advancement, and evolving consumer preferences. The market is expected to maintain a compound annual growth rate of 6.2% through the next decade, supported by residential construction activity, commercial renovation projects, and increasing consumer investment in interior aesthetics.

Technology integration will fundamentally transform product capabilities and customer experience over the forecast period. Smart wall coverings with integrated electronics, interactive capabilities, and environmental monitoring functions represent the next evolution in wall covering technology. Digital customization will become standard practice, enabling consumers to create unique designs through online platforms and mobile applications.

Sustainability initiatives will drive material innovation and manufacturing process improvements, with bio-based materials and circular economy principles becoming industry standards. Regulatory requirements for environmental performance and indoor air quality will accelerate adoption of low-emission and recyclable products across all market segments.

Market consolidation is expected to continue as larger manufacturers acquire specialized companies and technology platforms to enhance capabilities and market reach. However, niche opportunities will persist for innovative companies focusing on specific applications or customer segments. Geographic expansion within the US market will target underserved regions and emerging demographic concentrations.

Consumer behavior evolution will emphasize experience-driven purchasing decisions, with visualization tools and virtual reality becoming standard sales processes. MarkWide Research projects that online sales will account for 45% of total market transactions within five years, fundamentally changing distribution strategies and customer relationships throughout the industry.

Market assessment of the US wall covering and wall decor sector reveals a dynamic and evolving industry positioned for sustained growth through technological innovation, demographic trends, and changing consumer preferences. The market successfully balances traditional aesthetic applications with emerging functional benefits, creating diverse opportunities for manufacturers, retailers, and service providers across multiple customer segments.

Strategic positioning requires companies to embrace digital transformation while maintaining focus on product quality, customer service, and sustainable practices. The integration of advanced technologies, customization capabilities, and environmental responsibility creates competitive advantages in an increasingly sophisticated marketplace. Success factors include innovation capacity, distribution excellence, and adaptability to changing consumer needs and preferences.

Future growth prospects remain positive despite economic uncertainties and competitive pressures. The market’s resilience reflects its position as both a functional necessity and aesthetic enhancement category, with consumers continuing to prioritize home comfort and personalization. Investment opportunities exist across the value chain, from manufacturing innovation to retail technology and customer experience enhancement, positioning the US wall covering and wall decor market for continued expansion and evolution in the years ahead.

What is Wall Covering and Wall Decor?

Wall Covering and Wall Decor refers to various materials and designs used to enhance the aesthetic appeal of interior spaces. This includes wallpapers, decals, murals, and other decorative elements that can transform walls in residential and commercial settings.

What are the key players in the US Wall Covering and Wall Decor Market?

Key players in the US Wall Covering and Wall Decor Market include companies like Sherwin-Williams, Armstrong World Industries, and York Wallcoverings, among others. These companies are known for their innovative designs and extensive product ranges.

What are the growth factors driving the US Wall Covering and Wall Decor Market?

The US Wall Covering and Wall Decor Market is driven by factors such as increasing consumer interest in home improvement, the rise of DIY projects, and the growing trend of personalized interior design. Additionally, advancements in printing technology have expanded design possibilities.

What challenges does the US Wall Covering and Wall Decor Market face?

Challenges in the US Wall Covering and Wall Decor Market include fluctuating raw material costs and competition from alternative wall treatment options like paint. Additionally, environmental concerns regarding the sustainability of materials can impact consumer choices.

What opportunities exist in the US Wall Covering and Wall Decor Market?

Opportunities in the US Wall Covering and Wall Decor Market include the growing demand for eco-friendly materials and the potential for smart wall decor solutions that integrate technology. Furthermore, the expansion of e-commerce platforms offers new avenues for reaching consumers.

What trends are shaping the US Wall Covering and Wall Decor Market?

Trends in the US Wall Covering and Wall Decor Market include the increasing popularity of textured wallpapers, bold patterns, and sustainable materials. Additionally, there is a rising interest in customizable wall decor that reflects individual style and preferences.

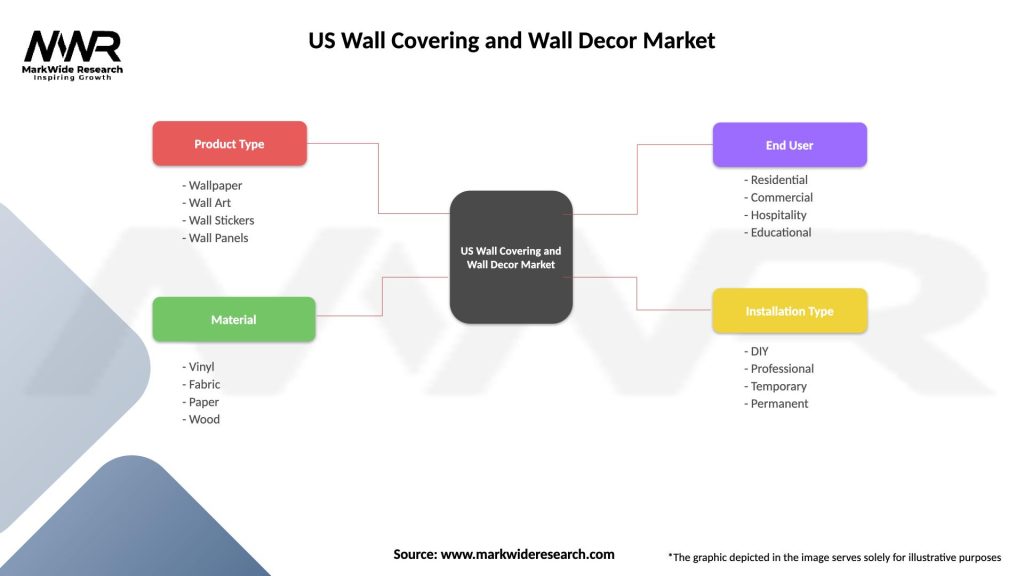

US Wall Covering and Wall Decor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wallpaper, Wall Art, Wall Stickers, Wall Panels |

| Material | Vinyl, Fabric, Paper, Wood |

| End User | Residential, Commercial, Hospitality, Educational |

| Installation Type | DIY, Professional, Temporary, Permanent |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Wall Covering and Wall Decor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at