444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US vitamin D supplements market represents one of the most dynamic and rapidly expanding segments within the American nutraceutical industry. Market dynamics indicate substantial growth driven by increasing awareness of vitamin D deficiency and its health implications across diverse demographic groups. The market encompasses various product formulations including tablets, capsules, gummies, liquid drops, and powder forms, catering to different consumer preferences and age groups.

Consumer demand has surged significantly following heightened health consciousness and scientific research highlighting vitamin D’s critical role in immune function, bone health, and overall wellness. The market demonstrates robust expansion with a projected CAGR of 8.2% through the forecast period, reflecting strong consumer adoption and healthcare professional recommendations.

Distribution channels span traditional retail pharmacies, health food stores, online platforms, and direct-to-consumer sales, with e-commerce experiencing particularly strong growth at 15.3% annually. The market benefits from favorable regulatory frameworks and increasing integration of vitamin D supplementation into preventive healthcare protocols across the United States.

The US vitamin D supplements market refers to the comprehensive ecosystem of products, manufacturers, distributors, and consumers involved in the production, marketing, and consumption of vitamin D nutritional supplements within the United States. This market encompasses both prescription and over-the-counter vitamin D products designed to address deficiency and support optimal health outcomes.

Vitamin D supplements include various formulations containing cholecalciferol (vitamin D3) or ergocalciferol (vitamin D2), available in multiple delivery formats to meet diverse consumer needs. The market includes products targeting specific demographics such as infants, children, adults, seniors, and pregnant women, each with tailored dosage recommendations and formulation characteristics.

Market participants include pharmaceutical companies, nutraceutical manufacturers, contract manufacturers, distributors, retailers, and healthcare providers who collectively contribute to the vitamin D supplement supply chain and consumer education initiatives.

Market performance in the US vitamin D supplements sector demonstrates exceptional resilience and growth potential, driven by widespread recognition of vitamin D’s essential health benefits. The market has experienced accelerated expansion following increased health awareness and scientific validation of vitamin D’s role in immune system support, particularly highlighted during recent global health challenges.

Key growth drivers include rising prevalence of vitamin D deficiency affecting approximately 42% of the US population, increasing healthcare costs driving preventive supplementation, and growing consumer preference for proactive health management. The market benefits from strong scientific backing, with over 1,000 published studies annually supporting vitamin D supplementation benefits.

Competitive landscape features established pharmaceutical companies, specialized nutraceutical brands, and emerging direct-to-consumer companies leveraging innovative marketing strategies and product formulations. Market leaders focus on quality differentiation, third-party testing, and consumer education to maintain competitive advantages in this expanding market.

Future prospects remain highly favorable with projected sustained growth driven by aging demographics, increased healthcare awareness, and expanding applications of vitamin D research in areas including cardiovascular health, mental wellness, and immune function optimization.

Market intelligence reveals several critical insights shaping the US vitamin D supplements landscape:

Primary market drivers propelling the US vitamin D supplements market include increasing awareness of vitamin D deficiency consequences and growing emphasis on preventive healthcare approaches. Healthcare professionals increasingly recommend vitamin D supplementation as standard practice, particularly for at-risk populations including elderly individuals, pregnant women, and those with limited sun exposure.

Scientific research continues to validate vitamin D’s critical role in immune function, bone health, cardiovascular wellness, and mental health, driving consumer confidence and adoption. Studies demonstrating vitamin D’s potential protective effects against respiratory infections have particularly influenced consumer behavior and healthcare recommendations.

Demographic trends significantly impact market growth, with aging populations requiring higher vitamin D intake and younger generations adopting proactive health management strategies. The market benefits from increased health consciousness across all age groups, with 73% of consumers actively seeking nutritional supplements to support overall wellness.

Lifestyle factors including indoor work environments, urban living, and reduced outdoor activities contribute to widespread vitamin D deficiency, creating sustained demand for supplementation. Additionally, dietary restrictions and limited vitamin D food sources necessitate supplementation for optimal health maintenance.

Market challenges facing the US vitamin D supplements sector include regulatory complexities surrounding health claims and dosage recommendations. FDA regulations require careful navigation regarding therapeutic claims, limiting marketing flexibility and requiring substantial scientific evidence for health benefit assertions.

Consumer confusion regarding appropriate dosage levels, product quality variations, and conflicting information from various sources can impede market growth. The abundance of product options and varying quality standards may overwhelm consumers and create decision paralysis in product selection.

Healthcare skepticism from some medical professionals regarding supplement necessity and potential over-supplementation risks can limit market expansion. Concerns about vitamin D toxicity, though rare, may influence conservative prescribing practices and consumer hesitation.

Economic factors including healthcare cost pressures and insurance coverage limitations for supplements may restrict access for price-sensitive consumer segments. Additionally, seasonal demand fluctuations can create inventory management challenges and revenue volatility for market participants.

Significant opportunities exist within the US vitamin D supplements market through product innovation and market expansion strategies. Personalized nutrition trends create opportunities for customized vitamin D formulations based on individual testing results, genetic factors, and lifestyle characteristics.

Combination products incorporating vitamin D with complementary nutrients such as vitamin K2, magnesium, and calcium present substantial growth potential. These synergistic formulations address multiple health concerns simultaneously and provide enhanced consumer value propositions.

Digital health integration offers opportunities for companies to develop connected health solutions including vitamin D testing kits, mobile applications for dosage tracking, and telemedicine consultations. These technological innovations can enhance consumer engagement and treatment compliance.

Emerging demographics including pediatric populations, athletes, and individuals with specific health conditions represent untapped market segments with specialized supplementation needs. Additionally, expanding into functional food and beverage categories through vitamin D fortification presents significant growth opportunities.

Market dynamics in the US vitamin D supplements sector reflect complex interactions between consumer behavior, healthcare trends, and regulatory environments. Supply chain considerations include raw material sourcing, manufacturing quality control, and distribution efficiency, all critical factors influencing market competitiveness and consumer satisfaction.

Competitive pressures drive continuous innovation in product formulations, delivery mechanisms, and marketing strategies. Companies increasingly focus on differentiation through superior bioavailability, organic certifications, and sustainable packaging solutions to capture market share in this competitive landscape.

Seasonal fluctuations significantly impact market dynamics, with demand typically increasing during fall and winter months when natural vitamin D synthesis decreases. This seasonality requires strategic inventory management and marketing campaign timing to optimize sales performance.

Regulatory evolution continues to shape market dynamics as authorities refine guidelines for supplement manufacturing, labeling, and health claims. Companies must maintain compliance while adapting to changing regulatory requirements and consumer expectations for transparency and quality assurance.

Comprehensive research methodology employed in analyzing the US vitamin D supplements market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes extensive surveys of consumers, healthcare professionals, and industry stakeholders to gather firsthand insights into market trends, preferences, and challenges.

Secondary research encompasses analysis of published scientific literature, industry reports, regulatory documents, and company financial statements to establish market context and validate primary findings. This approach ensures comprehensive coverage of market dynamics and emerging trends.

Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and competitive positioning. Advanced analytics help identify correlation patterns and predictive indicators for future market developments.

Qualitative assessment through expert interviews and focus group discussions provides deeper understanding of consumer motivations, healthcare professional perspectives, and industry challenges. This methodology combination ensures robust and actionable market intelligence for stakeholders.

Regional market distribution across the United States reveals significant variations in vitamin D supplement consumption patterns and growth rates. Northeast regions demonstrate the highest per-capita consumption rates at 34% market share, driven by limited sunlight exposure during winter months and higher health consciousness among urban populations.

Western states show strong growth momentum with 28% market share, particularly in California, where health and wellness trends originate and spread nationally. The region benefits from high disposable income levels and strong adoption of preventive healthcare practices.

Southern regions account for 25% market share despite higher natural vitamin D synthesis potential, indicating growing awareness of supplementation benefits regardless of geographic location. The market growth in these areas reflects increasing healthcare access and education initiatives.

Midwest markets represent 13% market share but demonstrate rapid growth potential as awareness campaigns and healthcare provider education expand. Rural areas within these regions present particular opportunities for market expansion through targeted distribution and education strategies.

Competitive dynamics in the US vitamin D supplements market feature diverse participants ranging from established pharmaceutical companies to specialized nutraceutical brands and emerging direct-to-consumer companies. Market leaders maintain competitive advantages through brand recognition, distribution networks, and research investments.

Key market participants include:

Competitive strategies focus on product differentiation, quality assurance, consumer education, and strategic partnerships with healthcare providers. Companies increasingly invest in clinical research to support product claims and build consumer confidence.

Market segmentation analysis reveals distinct categories based on product type, dosage strength, target demographics, and distribution channels. Product type segmentation includes tablets, capsules, gummies, liquid drops, and powder formulations, each serving specific consumer preferences and usage scenarios.

By Product Form:

By Dosage Strength:

Category analysis reveals distinct performance patterns and growth opportunities across different vitamin D supplement segments. Adult formulations represent the largest category with 67% market share, driven by widespread deficiency awareness and healthcare provider recommendations for routine supplementation.

Pediatric supplements show exceptional growth potential with 18.5% annual growth rate, as parents increasingly recognize vitamin D’s importance for child development and immune function. This category benefits from innovative delivery formats including flavored gummies and liquid drops designed for young consumers.

Senior-specific formulations account for 19% market share and demonstrate steady growth as aging populations require higher vitamin D intake for bone health maintenance and fall prevention. These products often combine vitamin D with calcium and other bone-supporting nutrients.

Prenatal supplements containing vitamin D represent a specialized but important category, with healthcare providers routinely recommending supplementation during pregnancy and lactation. This segment benefits from strong medical endorsement and insurance coverage in many cases.

Sports nutrition applications emerge as a growing category, with athletes and fitness enthusiasts recognizing vitamin D’s role in muscle function, recovery, and performance optimization. These products often feature higher dosages and combination formulations with other performance-supporting nutrients.

Industry participants in the US vitamin D supplements market enjoy numerous strategic advantages and growth opportunities. Manufacturers benefit from strong and sustained demand growth, enabling predictable revenue streams and investment planning for capacity expansion and product development initiatives.

Retailers experience enhanced customer loyalty and increased basket sizes as vitamin D supplements often serve as gateway products for broader health and wellness purchases. The category’s high repeat purchase rates and strong margins contribute significantly to retail profitability.

Healthcare providers gain valuable tools for preventive care and patient health optimization through vitamin D supplementation recommendations. This approach supports improved patient outcomes while potentially reducing long-term healthcare costs associated with deficiency-related conditions.

Consumers access affordable and effective solutions for addressing vitamin D deficiency and supporting overall health goals. The wide variety of product options enables personalized supplementation approaches tailored to individual needs, preferences, and lifestyles.

Investors find attractive opportunities in a market characterized by steady growth, increasing consumer awareness, and expanding applications for vitamin D supplementation. The sector’s resilience and growth potential make it appealing for both strategic and financial investment considerations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the US vitamin D supplements market reflect evolving consumer preferences and technological advancements. Personalized supplementation gains momentum as consumers seek customized solutions based on individual vitamin D blood levels, genetic testing results, and lifestyle factors.

Clean label movement influences product development with increasing demand for organic, non-GMO, and additive-free formulations. Consumers prioritize transparency in ingredient sourcing and manufacturing processes, driving companies to adopt cleaner formulation approaches and third-party certifications.

Sustainable packaging becomes increasingly important as environmentally conscious consumers seek products with minimal environmental impact. Companies respond with recyclable packaging materials, reduced packaging waste, and carbon-neutral shipping options.

Digital health integration transforms how consumers approach vitamin D supplementation, with at-home testing kits, mobile apps for dosage tracking, and telemedicine consultations becoming mainstream. MarkWide Research indicates that 31% of consumers now use digital tools to manage their supplementation routines.

Functional food integration expands vitamin D availability beyond traditional supplements through fortified foods, beverages, and snacks. This trend broadens market reach and provides convenient supplementation options for consumers preferring food-based nutrition approaches.

Recent industry developments demonstrate the dynamic nature of the US vitamin D supplements market and ongoing innovation efforts. Manufacturing advances include improved bioavailability technologies, enhanced stability formulations, and novel delivery systems that improve consumer compliance and therapeutic outcomes.

Strategic partnerships between supplement companies and healthcare providers expand market reach and credibility. These collaborations often involve educational initiatives, clinical research support, and professional product lines designed specifically for healthcare practitioner recommendations.

Regulatory updates continue to refine industry standards for manufacturing quality, labeling requirements, and health claim substantiation. Companies invest significantly in compliance systems and quality assurance programs to meet evolving regulatory expectations.

Research breakthroughs regularly emerge regarding vitamin D’s role in various health conditions, supporting market expansion and new product development opportunities. Recent studies exploring vitamin D’s impact on immune function, mental health, and chronic disease prevention drive consumer interest and healthcare provider recommendations.

Technology integration advances through development of smart packaging, dosage tracking systems, and connected health platforms that enhance consumer engagement and treatment adherence. These innovations position the industry for continued growth and differentiation opportunities.

Strategic recommendations for market participants focus on leveraging growth opportunities while addressing industry challenges. Product differentiation through superior formulations, enhanced bioavailability, and targeted health benefits can help companies maintain competitive advantages in an increasingly crowded marketplace.

Consumer education initiatives should emphasize the importance of vitamin D testing, appropriate dosage selection, and long-term supplementation benefits. Companies investing in educational content and healthcare provider partnerships typically achieve stronger brand loyalty and market positioning.

Digital transformation strategies should incorporate e-commerce optimization, direct-to-consumer sales channels, and technology-enabled customer engagement platforms. MWR analysis suggests that companies with strong digital presence achieve 23% higher customer retention rates compared to traditional retail-focused competitors.

Quality assurance investments become increasingly critical as consumers demand transparency and third-party verification of product quality. Companies should prioritize manufacturing excellence, testing protocols, and certification programs to build consumer trust and regulatory compliance.

Market expansion opportunities exist through geographic penetration, demographic targeting, and product line extensions. Companies should consider specialized formulations for underserved populations and emerging applications supported by scientific research.

Future market prospects for the US vitamin D supplements sector remain exceptionally positive, driven by sustained consumer health awareness and expanding scientific validation of vitamin D benefits. Long-term growth projections indicate continued market expansion with projected CAGR of 7.9% over the next decade, supported by demographic trends and healthcare evolution.

Innovation opportunities will likely focus on personalized nutrition solutions, advanced delivery technologies, and combination products addressing multiple health concerns simultaneously. The integration of artificial intelligence and machine learning in dosage optimization and health monitoring presents significant growth potential.

Market maturation may lead to increased consolidation as larger companies acquire specialized brands and innovative technologies. This consolidation could improve distribution efficiency and research capabilities while maintaining product diversity for consumers.

Regulatory evolution will continue shaping market dynamics, with potential developments in health claim substantiation requirements and quality standards. Companies preparing for regulatory changes through robust compliance systems and clinical research investments will maintain competitive advantages.

Global expansion opportunities may emerge as US companies leverage their expertise and brand recognition in international markets experiencing similar vitamin D deficiency challenges and growing health consciousness trends.

The US vitamin D supplements market represents a robust and expanding sector within the broader nutraceutical industry, characterized by strong fundamentals and promising growth prospects. Market dynamics reflect the convergence of widespread vitamin D deficiency, increasing health awareness, and scientific validation of supplementation benefits across diverse health applications.

Key success factors for market participants include product quality excellence, consumer education, strategic distribution partnerships, and continuous innovation in formulations and delivery systems. Companies that prioritize these elements while maintaining regulatory compliance and consumer trust will likely achieve sustained competitive advantages.

Future opportunities abound through personalized nutrition approaches, digital health integration, and expansion into emerging demographic segments and health applications. The market’s resilience and growth potential make it attractive for continued investment and strategic development initiatives across the value chain.

Overall market outlook remains highly favorable, supported by demographic trends, healthcare evolution, and expanding scientific understanding of vitamin D’s critical role in human health and wellness optimization.

What is Vitamin-D Supplements?

Vitamin-D supplements are products designed to provide the body with vitamin D, which is essential for maintaining healthy bones, supporting immune function, and regulating calcium levels. These supplements can come in various forms, including capsules, tablets, and liquid drops.

What are the key players in the US Vitamin-D Supplements Market?

Key players in the US Vitamin-D Supplements Market include companies like Nature Made, Garden of Life, and NOW Foods, which offer a range of vitamin D products targeting different consumer needs. These companies focus on quality and efficacy to meet the growing demand for dietary supplements, among others.

What are the growth factors driving the US Vitamin-D Supplements Market?

The US Vitamin-D Supplements Market is driven by increasing awareness of the health benefits of vitamin D, rising incidences of vitamin D deficiency, and a growing trend towards preventive healthcare. Additionally, the aging population and the popularity of health and wellness products contribute to market growth.

What challenges does the US Vitamin-D Supplements Market face?

The US Vitamin-D Supplements Market faces challenges such as regulatory scrutiny regarding health claims, competition from alternative supplements, and potential overconsumption leading to health risks. These factors can impact consumer trust and market dynamics.

What opportunities exist in the US Vitamin-D Supplements Market?

Opportunities in the US Vitamin-D Supplements Market include the development of innovative formulations, such as vegan and organic options, and the expansion of online sales channels. Additionally, increasing partnerships with healthcare professionals for recommendations can enhance market reach.

What trends are shaping the US Vitamin-D Supplements Market?

Trends in the US Vitamin-D Supplements Market include a growing preference for natural and plant-based supplements, increased focus on personalized nutrition, and the rise of subscription services for regular deliveries. These trends reflect changing consumer behaviors and preferences towards health products.

US Vitamin-D Supplements Market

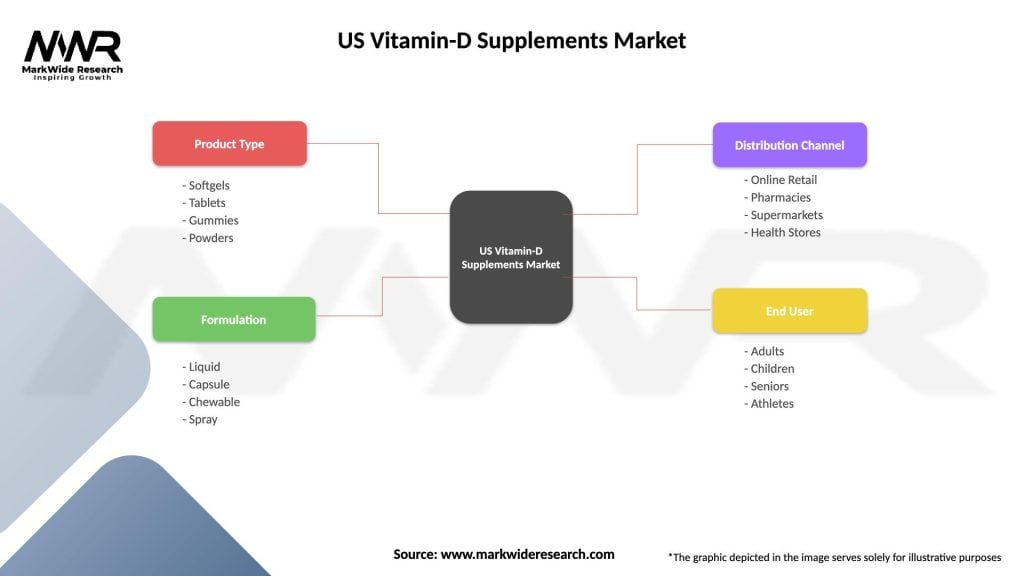

| Segmentation Details | Description |

|---|---|

| Product Type | Softgels, Tablets, Gummies, Powders |

| Formulation | Liquid, Capsule, Chewable, Spray |

| Distribution Channel | Online Retail, Pharmacies, Supermarkets, Health Stores |

| End User | Adults, Children, Seniors, Athletes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Vitamin-D Supplements Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at