444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US vinyl floorings market represents one of the most dynamic and rapidly evolving segments within the American flooring industry. This comprehensive market encompasses luxury vinyl tiles (LVT), luxury vinyl planks (LVP), vinyl composite tiles (VCT), and sheet vinyl products that have revolutionized residential and commercial flooring applications across the United States. The market has experienced unprecedented growth driven by technological innovations, changing consumer preferences, and the increasing demand for durable, cost-effective flooring solutions.

Market dynamics indicate robust expansion with the sector demonstrating remarkable resilience and adaptability. The vinyl flooring industry has successfully positioned itself as a premium alternative to traditional hardwood, ceramic, and stone flooring options while maintaining competitive pricing structures. Advanced manufacturing techniques have enabled producers to create vinyl products that closely mimic natural materials while offering superior performance characteristics including water resistance, durability, and ease of maintenance.

Growth trajectory analysis reveals the market is expanding at a significant CAGR of 6.2%, reflecting strong consumer adoption and increasing market penetration across diverse application segments. The residential sector continues to dominate market demand, accounting for approximately 68% of total consumption, while commercial applications represent a rapidly growing segment with substantial potential for future expansion.

The US vinyl floorings market refers to the comprehensive industry ecosystem encompassing the manufacturing, distribution, and retail of vinyl-based flooring products specifically within the United States domestic market. This market includes various vinyl flooring categories ranging from traditional sheet vinyl to advanced luxury vinyl tiles and planks that incorporate cutting-edge manufacturing technologies and design innovations.

Vinyl flooring products are synthetic flooring materials composed primarily of polyvinyl chloride (PVC) combined with various additives, stabilizers, and design layers to create durable, versatile flooring solutions. Modern vinyl flooring incorporates multiple layers including wear layers, design layers, core layers, and backing layers that work together to provide enhanced performance characteristics including scratch resistance, water impermeability, and dimensional stability.

Market scope encompasses both residential and commercial applications, covering single-family homes, multi-family housing units, retail establishments, healthcare facilities, educational institutions, hospitality venues, and office buildings. The market includes various distribution channels including specialty flooring retailers, home improvement centers, online platforms, and direct-to-consumer sales channels.

The US vinyl floorings market demonstrates exceptional growth momentum driven by evolving consumer preferences, technological advancements, and increasing recognition of vinyl flooring’s superior value proposition. Market analysis reveals strong performance across multiple segments with luxury vinyl products leading growth initiatives and traditional vinyl categories maintaining stable market positions.

Key market drivers include rising renovation activities, new construction projects, and growing consumer awareness of vinyl flooring benefits including durability, water resistance, and design versatility. The market benefits from continuous product innovations that have elevated vinyl flooring from basic utility products to premium design solutions capable of replicating natural materials with remarkable authenticity.

Competitive landscape features established manufacturers investing heavily in research and development, production capacity expansion, and strategic partnerships to strengthen market positions. Market leaders focus on product differentiation through advanced manufacturing technologies, sustainable production practices, and comprehensive product portfolios addressing diverse consumer needs and preferences.

Regional distribution shows strong market presence across all major US regions with the South and West regions demonstrating particularly robust growth rates driven by population growth, construction activities, and favorable economic conditions. The market exhibits seasonal variations with peak demand periods typically occurring during spring and summer months coinciding with increased renovation and construction activities.

Market intelligence reveals several critical insights that define the current state and future trajectory of the US vinyl floorings market:

Primary growth drivers propelling the US vinyl floorings market include multiple interconnected factors that create sustained demand momentum across residential and commercial segments. These drivers represent fundamental market forces that continue to strengthen vinyl flooring’s competitive position within the broader flooring industry.

Residential renovation activities constitute a major market driver as homeowners increasingly recognize vinyl flooring’s superior value proposition combining aesthetic appeal, durability, and cost-effectiveness. The growing trend toward home improvement projects, accelerated by changing lifestyle patterns and increased time spent at home, has created substantial demand for high-quality flooring solutions that offer both immediate visual impact and long-term performance benefits.

New construction projects across residential and commercial sectors provide consistent demand streams for vinyl flooring products. Builders and developers increasingly specify vinyl flooring due to its competitive pricing, installation efficiency, and ability to meet diverse design requirements while maintaining budget constraints. The construction industry’s recovery and continued growth directly translates to increased vinyl flooring consumption.

Technological advancements in manufacturing processes have dramatically improved vinyl flooring quality, appearance, and performance characteristics. Advanced printing technologies, enhanced wear layer formulations, and improved core materials have elevated vinyl products to compete directly with premium flooring categories while maintaining cost advantages. These innovations continue to expand vinyl flooring’s addressable market segments.

Water resistance properties represent a significant competitive advantage driving adoption in moisture-prone areas including bathrooms, kitchens, basements, and commercial facilities. Unlike traditional hardwood or laminate flooring, vinyl products maintain structural integrity and appearance when exposed to moisture, making them ideal for challenging installation environments.

Market challenges facing the US vinyl floorings industry include several factors that may limit growth potential or create operational difficulties for market participants. Understanding these restraints enables stakeholders to develop appropriate strategies for market navigation and risk mitigation.

Environmental concerns regarding PVC-based products continue to influence consumer perceptions and purchasing decisions. Despite industry efforts to address sustainability issues through improved manufacturing processes and recycling programs, some environmentally conscious consumers remain hesitant to choose vinyl flooring over perceived eco-friendly alternatives such as bamboo, cork, or reclaimed hardwood products.

Raw material price volatility affects manufacturing costs and profit margins throughout the vinyl flooring supply chain. Fluctuations in petroleum-based raw material prices, particularly PVC resin costs, can create pricing pressures that impact manufacturer profitability and potentially influence end-user pricing strategies. Supply chain disruptions can exacerbate these challenges and create inventory management difficulties.

Competition from alternative flooring categories including laminate, engineered hardwood, and ceramic tile products creates ongoing market pressure. These competing products have also experienced technological improvements and may offer specific advantages in certain applications or appeal to particular consumer segments, potentially limiting vinyl flooring market share expansion.

Installation complexity for certain vinyl flooring products may require professional installation services, increasing total project costs and potentially deterring cost-conscious consumers. While click-lock systems have simplified installation processes, some vinyl products still require adhesive installation methods that demand professional expertise and specialized tools.

Emerging opportunities within the US vinyl floorings market present significant potential for growth expansion and market development. These opportunities reflect evolving market conditions, technological possibilities, and changing consumer behaviors that create new avenues for business development and market penetration.

Smart flooring integration represents an innovative opportunity as manufacturers explore incorporating technology features into vinyl flooring products. Potential developments include embedded sensors for monitoring foot traffic patterns, temperature regulation capabilities, and integration with smart home systems. These advanced features could differentiate vinyl products and justify premium pricing strategies.

Sustainable product development offers substantial opportunities for manufacturers willing to invest in environmentally responsible production methods and materials. Development of bio-based vinyl alternatives, improved recycling programs, and carbon-neutral manufacturing processes could address environmental concerns while appealing to sustainability-focused consumer segments.

Commercial market expansion presents significant growth potential as businesses increasingly recognize vinyl flooring’s operational advantages including low maintenance requirements, durability, and cost-effectiveness. Healthcare facilities, educational institutions, and retail establishments represent particularly promising segments for commercial vinyl flooring adoption.

E-commerce channel development creates opportunities for direct-to-consumer sales and expanded market reach. Online platforms enable manufacturers and retailers to access broader customer bases while providing detailed product information, virtual design tools, and convenient ordering processes that enhance customer experience and potentially improve profit margins.

Market dynamics within the US vinyl floorings sector reflect complex interactions between supply-side factors, demand-side influences, and external market forces that collectively shape industry performance and competitive positioning. These dynamics create both challenges and opportunities for market participants while influencing strategic decision-making processes.

Supply chain optimization has become increasingly critical as manufacturers seek to improve efficiency, reduce costs, and enhance product availability. Vertical integration strategies, strategic supplier partnerships, and advanced inventory management systems enable companies to better control quality, costs, and delivery timelines while responding more effectively to market demand fluctuations.

Innovation cycles continue to accelerate as manufacturers invest in research and development activities focused on product performance enhancement, design innovation, and manufacturing process improvement. These innovation efforts result in regular product launches, technology upgrades, and feature enhancements that maintain consumer interest and drive replacement demand.

Pricing strategies reflect competitive pressures and value positioning considerations as manufacturers balance profitability objectives with market share goals. Premium product segments command higher margins but require substantial marketing investments and brand development efforts, while value-oriented products compete primarily on price and basic performance characteristics.

Distribution channel evolution includes the growing importance of online sales platforms, specialty flooring retailers, and big-box home improvement stores. Each channel serves different customer segments and requires tailored marketing approaches, product presentations, and support services to maximize effectiveness and customer satisfaction.

Comprehensive research methodology employed for analyzing the US vinyl floorings market incorporates multiple data collection techniques, analytical frameworks, and validation processes to ensure accuracy, reliability, and actionable insights. The methodology combines quantitative and qualitative research approaches to provide holistic market understanding.

Primary research activities include extensive interviews with industry executives, manufacturers, distributors, retailers, and end-users to gather firsthand insights regarding market trends, challenges, opportunities, and competitive dynamics. These interviews provide qualitative context and validate quantitative findings while revealing emerging trends and strategic considerations.

Secondary research sources encompass industry publications, trade association reports, government statistics, company financial statements, and market databases to establish baseline market data and historical trend analysis. This information provides foundational understanding of market size, growth patterns, and competitive landscape characteristics.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and growth projections. These models incorporate multiple variables including economic indicators, demographic trends, construction activity levels, and consumer spending patterns to generate comprehensive market outlook assessments.

Data validation processes ensure research findings accuracy through cross-referencing multiple sources, expert review panels, and logical consistency checks. This validation approach minimizes potential errors and enhances confidence in research conclusions and strategic recommendations.

Regional market distribution across the United States reveals distinct patterns of vinyl flooring consumption, growth rates, and market characteristics that reflect local economic conditions, demographic trends, and construction activity levels. Understanding these regional variations enables targeted marketing strategies and optimized distribution approaches.

Southern region dominance continues with this area representing approximately 32% of national vinyl flooring consumption, driven by robust population growth, active construction markets, and favorable climate conditions that support year-round building activities. States including Texas, Florida, Georgia, and North Carolina demonstrate particularly strong market performance with sustained demand growth across residential and commercial segments.

Western region markets account for roughly 28% of total market share, with California leading consumption due to its large population base and active renovation markets. The region benefits from strong economic conditions, high disposable income levels, and consumer preferences for modern, low-maintenance flooring solutions that align with contemporary lifestyle trends.

Northeastern region characteristics include mature markets with approximately 22% market share and emphasis on renovation projects rather than new construction. The region’s older housing stock creates substantial replacement demand while urban markets demonstrate growing appreciation for vinyl flooring’s practical advantages in high-density living environments.

Midwestern region performance represents about 18% of national consumption with steady demand patterns reflecting the region’s stable economic conditions and balanced mix of residential and commercial applications. The region’s manufacturing heritage creates strong relationships between local contractors and vinyl flooring suppliers, supporting consistent market development.

Competitive environment within the US vinyl floorings market features established industry leaders, emerging innovators, and specialized manufacturers competing across multiple dimensions including product quality, design innovation, pricing strategies, and customer service excellence. This competitive dynamic drives continuous improvement and market evolution.

Market leaders maintain competitive advantages through comprehensive product portfolios, extensive distribution networks, and substantial marketing investments:

Competitive strategies include product differentiation through advanced manufacturing technologies, strategic acquisitions to expand market reach, and partnerships with distributors and retailers to enhance market penetration. Companies invest heavily in brand development, marketing campaigns, and customer education programs to build market awareness and preference.

Innovation focus areas encompass wear layer enhancement, design realism improvement, installation system development, and sustainability initiatives. These innovation efforts create competitive differentiation while addressing evolving consumer preferences and market requirements.

Market segmentation analysis reveals distinct product categories, application segments, and distribution channels that serve different customer needs and market requirements. Understanding these segments enables targeted product development, marketing strategies, and resource allocation decisions.

By Product Type:

By Application:

By Installation Method:

Luxury vinyl segment represents the fastest-growing category within the US vinyl floorings market, demonstrating exceptional performance driven by consumer preference shifts toward premium flooring solutions that combine aesthetic appeal with practical benefits. This segment includes both LVT and LVP products that have revolutionized vinyl flooring perceptions and market positioning.

LVT products excel in applications requiring stone or ceramic appearances while providing superior water resistance and durability compared to natural materials. Advanced manufacturing techniques enable realistic texture reproduction and color variation that closely mimics natural stone, marble, and ceramic tile appearances. The segment benefits from growing bathroom and kitchen renovation activities where water resistance is paramount.

LVP products dominate wood-look flooring applications by offering authentic hardwood appearances without traditional wood flooring limitations including moisture sensitivity, maintenance requirements, and installation restrictions. These products appeal to consumers seeking hardwood aesthetics with enhanced durability and lower lifecycle costs.

Commercial vinyl categories including VCT products maintain stable market positions by serving institutional and commercial applications requiring cost-effective, durable flooring solutions. These products emphasize performance characteristics over aesthetic considerations while providing reliable service in high-traffic environments.

Sheet vinyl products continue serving specific market niches where seamless installation and water impermeability are critical requirements. Healthcare facilities, commercial kitchens, and industrial applications represent primary markets for sheet vinyl products that prioritize functionality over design considerations.

Industry participants within the US vinyl floorings market realize multiple strategic and operational benefits that enhance competitive positioning, profitability, and long-term sustainability. These benefits create value for manufacturers, distributors, retailers, and service providers throughout the market ecosystem.

Manufacturers benefit from growing market demand, product innovation opportunities, and operational efficiency improvements. The expanding market provides revenue growth potential while technological advancements enable product differentiation and premium pricing strategies. Manufacturing scale economies reduce unit costs and improve profit margins as production volumes increase.

Distributors and retailers enjoy strong product demand, healthy profit margins, and diverse customer bases spanning residential and commercial segments. Vinyl flooring’s broad appeal across multiple market segments reduces business risk while providing opportunities for cross-selling complementary products and services.

Installation contractors benefit from consistent project demand, reasonable profit margins, and growing market acceptance of vinyl flooring products. The development of user-friendly installation systems expands the contractor base while maintaining professional installation demand for complex projects.

End-users realize significant value through cost-effective flooring solutions that provide superior performance, aesthetic appeal, and long-term durability. Vinyl flooring’s low maintenance requirements reduce ongoing costs while water resistance and durability characteristics minimize replacement frequency.

Property developers and builders appreciate vinyl flooring’s competitive pricing, installation efficiency, and broad design options that enable cost-effective project completion while meeting diverse aesthetic requirements and performance specifications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the US vinyl floorings market reflect evolving consumer preferences, technological advancements, and industry innovations that shape future market development and competitive dynamics. These trends provide insights into market direction and strategic opportunities.

Luxury vinyl dominance continues accelerating as consumers increasingly choose premium vinyl products over traditional vinyl options. This trend reflects growing appreciation for vinyl flooring’s enhanced aesthetic capabilities and performance characteristics while maintaining cost advantages over natural materials. Market data indicates luxury vinyl segments growing at 8.5% annually, significantly outpacing traditional vinyl categories.

Sustainability focus intensifies as manufacturers develop environmentally responsible products and production processes. Initiatives include recycled content integration, bio-based material development, and comprehensive recycling programs that address environmental concerns while maintaining product performance standards.

Design authenticity improvements through advanced printing technologies, texture enhancement, and color variation techniques create increasingly realistic natural material replications. These improvements expand vinyl flooring’s addressable market by appealing to consumers who previously preferred natural materials for aesthetic reasons.

Installation innovation continues with development of simplified installation systems that reduce labor requirements and enable DIY installations. Click-lock systems, improved adhesive technologies, and loose-lay products expand installation options while reducing total project costs.

Commercial market penetration accelerates as businesses recognize vinyl flooring’s operational advantages including durability, maintenance efficiency, and cost-effectiveness. Healthcare, education, and retail sectors demonstrate particularly strong adoption rates driven by performance requirements and budget considerations.

Recent industry developments highlight significant changes, innovations, and strategic initiatives that influence market dynamics and competitive positioning within the US vinyl floorings sector. These developments reflect ongoing industry evolution and adaptation to changing market conditions.

Manufacturing capacity expansion by major producers indicates confidence in continued market growth and demand sustainability. Several leading manufacturers have announced significant capital investments in new production facilities and equipment upgrades to meet growing demand while improving operational efficiency and product quality.

Technology partnerships between vinyl flooring manufacturers and technology companies explore smart flooring applications including embedded sensors, temperature regulation capabilities, and integration with building management systems. These partnerships represent early-stage development of next-generation flooring products that could differentiate vinyl offerings.

Sustainability initiatives include development of recycling programs, bio-based material research, and carbon footprint reduction efforts. MarkWide Research analysis indicates that sustainability-focused initiatives are becoming increasingly important for maintaining competitive positioning and addressing consumer environmental concerns.

Acquisition activities within the industry reflect consolidation trends as larger manufacturers seek to expand product portfolios, geographic reach, and market share through strategic acquisitions of specialized manufacturers and regional competitors.

Distribution channel evolution includes enhanced e-commerce capabilities, virtual design tools, and direct-to-consumer sales programs that expand market reach while improving customer experience and potentially increasing profit margins through disintermediation.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing competitive challenges and market constraints. These suggestions reflect comprehensive market analysis and industry expertise regarding optimal positioning strategies and growth initiatives.

Product innovation investment should prioritize luxury vinyl segment development, sustainability initiatives, and smart flooring technology integration. Companies that successfully differentiate products through advanced features and environmental responsibility will likely achieve superior market positioning and pricing power.

Commercial market focus represents significant opportunity for manufacturers willing to develop specialized products and marketing approaches targeting institutional customers. Healthcare, education, and retail segments offer substantial growth potential with less price sensitivity than residential markets.

Distribution strategy optimization should emphasize multi-channel approaches combining traditional retail partnerships with enhanced e-commerce capabilities. Online platforms provide opportunities for direct customer engagement while traditional channels maintain importance for product demonstration and professional installation services.

Sustainability leadership development through environmental responsibility initiatives, recycled content integration, and transparent sustainability reporting will become increasingly important for maintaining competitive positioning as consumer environmental awareness continues growing.

Geographic expansion strategies should focus on high-growth regions while strengthening positions in mature markets through product innovation and customer service excellence. Regional market characteristics require tailored approaches reflecting local preferences and competitive conditions.

Future market prospects for the US vinyl floorings industry appear highly favorable with multiple growth drivers supporting sustained expansion across residential and commercial segments. Market fundamentals remain strong while emerging opportunities create additional growth potential for well-positioned market participants.

Growth projections indicate continued market expansion with projected CAGR of 6.8% over the next five years, driven by ongoing residential renovation activities, new construction projects, and increasing commercial market penetration. Luxury vinyl segments are expected to maintain leadership in growth rates while traditional vinyl categories stabilize at sustainable levels.

Technology integration will likely accelerate with smart flooring features, advanced manufacturing techniques, and sustainable material development creating new product categories and market opportunities. These technological advances should enhance vinyl flooring’s competitive positioning while expanding addressable market segments.

Market maturation in established segments will drive focus toward innovation, customer service excellence, and operational efficiency as competitive advantages. Companies that successfully balance growth investments with operational optimization will likely achieve superior long-term performance.

Regulatory environment evolution may influence manufacturing processes, product specifications, and marketing approaches as environmental regulations and building codes adapt to sustainability concerns and performance requirements. Proactive compliance strategies will provide competitive advantages.

Consumer preference evolution toward premium products, sustainable options, and convenient installation methods will continue shaping product development priorities and marketing strategies. According to MWR analysis, companies that successfully anticipate and respond to these preference shifts will capture disproportionate market share growth.

The US vinyl floorings market represents a dynamic and rapidly evolving industry segment with exceptional growth prospects driven by technological innovation, changing consumer preferences, and expanding application opportunities. Market analysis reveals strong fundamentals supporting continued expansion across residential and commercial segments while emerging trends create additional growth potential for innovative market participants.

Key success factors include product innovation leadership, sustainability initiative development, commercial market penetration, and distribution strategy optimization. Companies that successfully execute comprehensive strategies addressing these critical areas will likely achieve superior market positioning and financial performance in the evolving competitive landscape.

Market outlook remains highly positive with multiple growth drivers supporting sustained expansion while technological advances and sustainability initiatives create opportunities for market differentiation and premium positioning. The industry’s ability to continuously improve product quality, expand application possibilities, and address environmental concerns positions vinyl flooring for continued success in the competitive US flooring market.

What is Vinyl Floorings?

Vinyl floorings are synthetic flooring materials made primarily from polyvinyl chloride (PVC) that are designed to mimic the appearance of natural materials like wood or stone. They are popular for their durability, water resistance, and ease of maintenance, making them suitable for various residential and commercial applications.

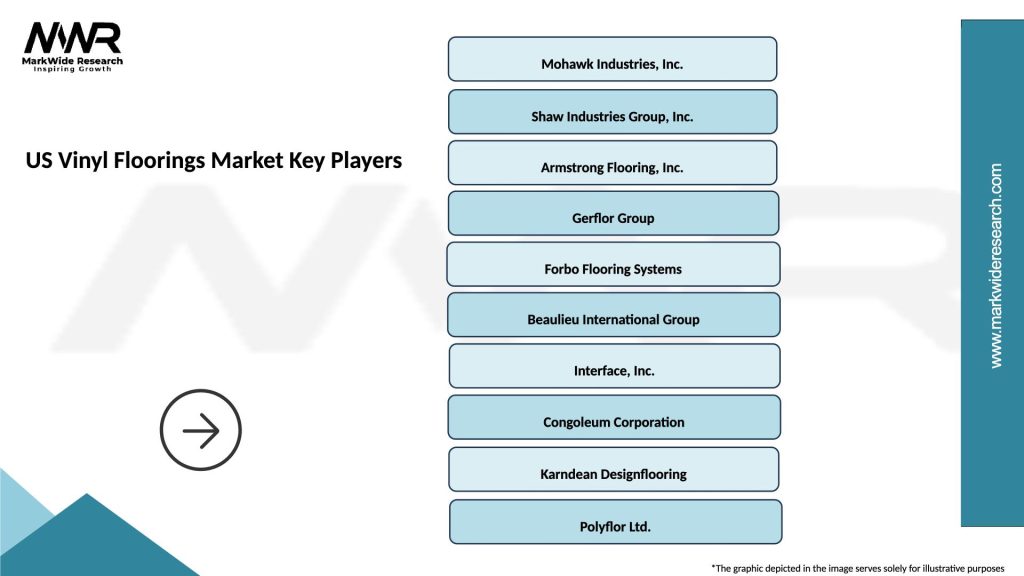

What are the key players in the US Vinyl Floorings Market?

Key players in the US Vinyl Floorings Market include companies such as Mohawk Industries, Shaw Industries, and Armstrong Flooring, which are known for their innovative designs and extensive product ranges. These companies compete on quality, sustainability, and customer service, among others.

What are the growth factors driving the US Vinyl Floorings Market?

The US Vinyl Floorings Market is driven by factors such as the increasing demand for affordable and durable flooring solutions, the rise in home renovation projects, and the growing trend of DIY home improvement. Additionally, advancements in manufacturing technology have led to improved product quality and design options.

What challenges does the US Vinyl Floorings Market face?

The US Vinyl Floorings Market faces challenges such as environmental concerns regarding the production and disposal of vinyl materials, competition from alternative flooring options like laminate and hardwood, and fluctuating raw material prices. These factors can impact market growth and consumer preferences.

What opportunities exist in the US Vinyl Floorings Market?

Opportunities in the US Vinyl Floorings Market include the growing demand for eco-friendly and sustainable flooring options, the expansion of the commercial sector, and the increasing popularity of luxury vinyl tiles (LVT). Innovations in design and technology also present avenues for market growth.

What trends are shaping the US Vinyl Floorings Market?

Trends shaping the US Vinyl Floorings Market include the rise of luxury vinyl flooring, which offers high-end aesthetics at a lower cost, and the increasing focus on sustainability, with manufacturers developing products that are recyclable and made from recycled materials. Additionally, the integration of smart technology in flooring solutions is gaining traction.

US Vinyl Floorings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Luxury Vinyl Tile, Vinyl Plank, Vinyl Sheet, Vinyl Composite Tile |

| End User | Residential, Commercial, Industrial, Hospitality |

| Installation Type | Glue Down, Loose Lay, Click Lock, Floating |

| Thickness | 2mm, 3mm, 4mm, 5mm |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Vinyl Floorings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at