444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US veterinary healthcare market represents a dynamic and rapidly evolving sector that encompasses comprehensive medical care for companion animals, livestock, and exotic pets across the United States. This market has experienced remarkable transformation driven by changing pet ownership patterns, advancing medical technologies, and increasing awareness of animal health and wellness. Pet humanization trends have fundamentally reshaped the veterinary landscape, with pet owners increasingly viewing their animals as family members deserving premium healthcare services.

Market growth has been consistently robust, with the sector demonstrating resilience even during economic uncertainties. The veterinary healthcare ecosystem includes veterinary clinics, animal hospitals, specialty care centers, emergency services, diagnostic laboratories, and pharmaceutical companies. Technological advancement continues to drive innovation, with telemedicine, advanced diagnostic equipment, and minimally invasive surgical procedures becoming increasingly prevalent. The market benefits from a growing pet population, with approximately 70% of US households owning pets, creating sustained demand for veterinary services.

Regional distribution shows concentrated activity in metropolitan areas, though rural veterinary services remain crucial for livestock and agricultural animals. The market encompasses both companion animal care, which dominates revenue generation, and livestock veterinary services supporting agricultural production. Preventive care adoption has increased significantly, with pet owners investing in regular wellness examinations, vaccinations, and preventive treatments to maintain their animals’ health and extend lifespans.

The US veterinary healthcare market refers to the comprehensive ecosystem of medical services, products, and technologies dedicated to maintaining and improving the health and welfare of animals within the United States. This market encompasses preventive care, diagnostic services, surgical procedures, emergency treatment, pharmaceutical products, medical devices, and specialized veterinary services for companion animals, livestock, and exotic species.

Veterinary healthcare includes primary care services provided by general practitioners, specialized care from veterinary specialists, emergency and critical care services, diagnostic imaging and laboratory services, pharmaceutical treatments, and medical devices specifically designed for animal use. The market serves diverse animal populations including dogs, cats, horses, cattle, poultry, swine, and exotic pets, each requiring specialized knowledge and treatment approaches.

Market participants include veterinary clinics and hospitals, animal health pharmaceutical companies, diagnostic equipment manufacturers, veterinary medical device companies, laboratory service providers, and educational institutions training veterinary professionals. The sector operates within a regulatory framework overseen by state veterinary medical boards and federal agencies ensuring animal welfare and public health protection.

The US veterinary healthcare market demonstrates exceptional growth potential driven by fundamental shifts in pet ownership demographics and evolving consumer attitudes toward animal healthcare. Pet humanization trends have created unprecedented demand for advanced veterinary services, with pet owners increasingly willing to invest in premium healthcare options for their animals. Companion animal care dominates market revenue, representing the largest segment due to the emotional bonds between pets and their owners.

Technology integration has revolutionized veterinary practice, with digital health records, telemedicine platforms, and advanced diagnostic equipment becoming standard practice. The COVID-19 pandemic accelerated telehealth adoption, with veterinary telemedicine usage increasing by over 3,800% during peak pandemic periods. Specialty care expansion continues as veterinary medicine becomes increasingly sophisticated, with oncology, cardiology, dermatology, and behavioral medicine emerging as high-growth specialty areas.

Market consolidation trends show corporate veterinary groups acquiring independent practices, creating larger healthcare networks with standardized protocols and enhanced service capabilities. Preventive care emphasis has shifted market dynamics, with wellness plans and subscription-based care models gaining popularity among pet owners seeking predictable healthcare costs and comprehensive coverage for their animals.

Strategic market insights reveal several critical trends shaping the US veterinary healthcare landscape. The following key insights demonstrate the market’s evolution and future trajectory:

Primary market drivers propelling the US veterinary healthcare market include fundamental demographic shifts, evolving consumer behaviors, and technological advancements that enhance service delivery capabilities. pet humanization represents the most significant driver, with pet owners increasingly treating their animals as family members deserving premium healthcare services comparable to human medical care.

Demographic trends strongly favor market growth, with millennials and Generation Z demonstrating higher pet ownership rates and greater willingness to invest in veterinary care. These younger demographics prioritize preventive care, seek specialist services, and embrace technology-enabled healthcare solutions. Aging pet populations require more frequent and complex medical interventions, driving demand for geriatric care, chronic disease management, and end-of-life services.

Technological advancement continues driving market expansion through improved diagnostic capabilities, minimally invasive surgical techniques, and enhanced treatment options. Telemedicine adoption has expanded access to veterinary care, particularly in underserved rural areas, while digital health records and practice management systems improve operational efficiency. Insurance penetration growth makes veterinary care more affordable for pet owners, with pet insurance enrollment increasing steadily as awareness and product availability expand.

Regulatory support for animal welfare and food safety creates sustained demand for veterinary services in both companion animal and livestock sectors. Zoonotic disease awareness following recent pandemic experiences has heightened focus on veterinary public health roles, creating new opportunities for veterinary professionals in disease surveillance and prevention programs.

Market restraints present significant challenges to sustained growth in the US veterinary healthcare sector. Veterinarian shortage represents the most critical constraint, with veterinary schools producing insufficient graduates to meet growing demand. This shortage drives up labor costs, limits practice expansion, and creates access barriers in underserved geographic areas, particularly rural regions dependent on livestock veterinary services.

High educational costs and lengthy training requirements discourage potential veterinary students, with average veterinary school debt exceeding undergraduate medical school debt levels. Practice acquisition costs have increased substantially due to corporate consolidation, making practice ownership challenging for new graduates and limiting independent practice opportunities.

Economic sensitivity affects discretionary veterinary spending, with pet owners potentially delaying non-essential procedures during economic downturns. Insurance coverage limitations remain problematic, as pet insurance penetration remains relatively low compared to human health insurance, leaving many pet owners responsible for full veterinary costs. Regulatory compliance costs continue increasing, particularly for controlled substances management, medical waste disposal, and occupational safety requirements.

Technology implementation costs can be prohibitive for smaller practices, creating competitive disadvantages and limiting access to advanced diagnostic and treatment capabilities. Client education challenges persist in communicating the value of preventive care and advanced treatments, particularly among price-sensitive consumer segments.

Emerging opportunities within the US veterinary healthcare market present substantial growth potential across multiple segments and service categories. Telemedicine expansion offers significant opportunities to reach underserved markets, provide follow-up care, and deliver specialized consultations remotely. MarkWide Research analysis indicates that veterinary telemedicine adoption rates continue accelerating, creating new revenue streams and improving practice efficiency.

Specialty care development presents lucrative opportunities as veterinary medicine becomes increasingly sophisticated. Oncology services, cardiology care, dermatology treatments, and behavioral medicine represent high-growth specialty areas with premium pricing potential. Mobile veterinary services address convenience demands and access barriers, particularly for elderly pet owners and busy professionals seeking in-home care options.

Technology integration opportunities include artificial intelligence applications for diagnostic imaging, wearable health monitoring devices for pets, and automated practice management systems. Preventive care programs and wellness plans offer recurring revenue opportunities while improving patient outcomes through early disease detection and intervention.

Corporate partnership opportunities exist between veterinary practices and pet retailers, insurance companies, and technology providers. International expansion potential exists for US veterinary healthcare companies seeking to export expertise, products, and services to developing markets with growing pet populations and increasing disposable incomes.

Market dynamics in the US veterinary healthcare sector reflect complex interactions between supply and demand factors, technological innovation, and evolving consumer expectations. Supply-demand imbalances characterize the current market, with veterinary service demand significantly exceeding available capacity, particularly in rural areas and specialty care segments.

Competitive dynamics show increasing consolidation as corporate veterinary groups acquire independent practices to achieve economies of scale and standardize care protocols. This consolidation trend creates both opportunities and challenges, offering improved resources and career advancement for veterinary professionals while potentially reducing practice autonomy and increasing corporate oversight.

Innovation cycles drive continuous market evolution, with pharmaceutical companies developing novel therapeutics, diagnostic equipment manufacturers introducing advanced imaging technologies, and software providers creating integrated practice management solutions. Adoption rates for new technologies vary significantly based on practice size, geographic location, and financial resources.

Pricing dynamics reflect increasing service costs driven by labor shortages, technology investments, and rising operational expenses. Consumer price sensitivity varies considerably, with premium service segments showing strong growth while price-conscious consumers seek value-oriented care options. Insurance market development continues influencing pricing strategies and service utilization patterns as coverage becomes more comprehensive and accessible.

Comprehensive research methodology employed for analyzing the US veterinary healthcare market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes extensive interviews with veterinary practitioners, practice owners, corporate executives, and industry experts to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, regulatory filings, academic studies, and professional association reports to validate primary findings and identify emerging trends. Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and regional variations based on historical data and current market indicators.

Market segmentation analysis examines various categorization approaches including service type, animal species, practice type, and geographic distribution to identify growth opportunities and competitive positioning. Competitive intelligence gathering involves monitoring corporate activities, merger and acquisition transactions, and strategic partnerships to understand market consolidation trends.

Technology assessment evaluates emerging innovations, adoption rates, and implementation challenges to forecast future market developments. Regulatory analysis monitors policy changes, compliance requirements, and government initiatives affecting market dynamics and growth prospects.

Regional market analysis reveals significant variations in veterinary healthcare demand, service availability, and growth patterns across different US geographic regions. Northeast region demonstrates the highest concentration of specialty veterinary services and advanced medical facilities, driven by high population density, elevated disposable incomes, and strong pet ownership rates. This region accounts for approximately 28% of total veterinary healthcare spending despite representing a smaller geographic area.

Southeast region shows rapid growth in both companion animal and livestock veterinary services, supported by population migration, agricultural activity, and increasing pet ownership among younger demographics. Rural veterinary challenges are particularly pronounced in this region, with veterinarian shortages affecting livestock care and food animal production systems.

West Coast markets lead in technology adoption and premium service offerings, with California representing the largest single state market for veterinary healthcare services. Innovation hubs in this region drive development of new technologies, treatment protocols, and business models that subsequently spread to other markets. The region shows approximately 15% higher per-pet spending compared to national averages.

Midwest region balances companion animal care with substantial livestock veterinary services supporting agricultural production. Practice consolidation trends are particularly evident in this region as corporate groups acquire practices to achieve operational efficiencies and expand service territories. Southwest region demonstrates strong growth potential driven by population increases and rising pet ownership rates among diverse demographic groups.

The competitive landscape of the US veterinary healthcare market features diverse participants ranging from large corporate veterinary groups to independent practices, pharmaceutical companies, and technology providers. Market leaders have emerged through strategic acquisitions, service expansion, and technology integration initiatives.

Competitive strategies include geographic expansion, service diversification, technology integration, and strategic partnerships. Independent practices compete through personalized service, community relationships, and specialized expertise while facing challenges from corporate consolidation trends.

Market segmentation analysis reveals distinct categories within the US veterinary healthcare market, each with unique characteristics, growth patterns, and competitive dynamics. Service-based segmentation provides the most comprehensive view of market structure and opportunities.

By Service Type:

By Animal Type:

By Practice Type:

Companion animal healthcare dominates the US veterinary market, driven by strong emotional bonds between pets and owners. Preventive care services show consistent growth as pet owners increasingly understand the value of regular wellness examinations, vaccinations, and early disease detection. Dental care has emerged as a significant growth category, with approximately 80% of dogs and cats showing signs of dental disease by age three, creating substantial treatment opportunities.

Specialty care categories demonstrate exceptional growth potential, with oncology services experiencing particularly strong demand as cancer treatment options for pets become more sophisticated. Cardiology services benefit from advanced diagnostic equipment and treatment protocols, while dermatology care addresses increasing prevalence of allergic conditions and skin disorders in companion animals.

Emergency and critical care represents a high-value segment with premium pricing due to urgent care requirements and specialized equipment needs. After-hours services command significant premiums while providing essential care for pet emergencies and critical conditions requiring immediate intervention.

Livestock veterinary services focus on production medicine, disease prevention, and food safety compliance. Herd health programs provide recurring revenue opportunities while supporting agricultural productivity and animal welfare standards. Equine services cater to both recreational and competitive horse owners, offering specialized treatments for performance animals and breeding programs.

Industry participants across the US veterinary healthcare market realize substantial benefits from current market dynamics and growth trends. Veterinary practitioners benefit from strong demand for services, competitive compensation packages, and diverse career opportunities ranging from general practice to specialized medicine. Practice owners experience robust revenue growth, premium valuations for practice sales, and opportunities for expansion through acquisition or partnership arrangements.

Corporate veterinary groups achieve economies of scale, standardized protocols, and enhanced service capabilities through consolidation strategies. Operational efficiencies result from centralized purchasing, shared resources, and technology integration across multiple practice locations. Investment opportunities attract private equity and strategic investors seeking exposure to the growing pet healthcare market.

Pharmaceutical companies benefit from expanding market demand, premium pricing for innovative products, and opportunities for product line extensions. Technology providers experience strong adoption rates for practice management software, diagnostic equipment, and telemedicine platforms. Pet owners gain access to advanced medical care, convenient service options, and improved health outcomes for their animals.

Educational institutions see increased enrollment interest in veterinary programs, research funding opportunities, and partnerships with industry participants. Regulatory agencies benefit from improved animal welfare standards, enhanced food safety protocols, and strengthened public health protection through veterinary oversight.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends are reshaping the US veterinary healthcare market, creating new opportunities and challenges for industry participants. Pet humanization continues driving demand for premium services, with pet owners increasingly seeking human-quality medical care for their animals. This trend supports growth in specialty care, advanced diagnostics, and alternative treatment modalities including acupuncture, physical therapy, and holistic medicine approaches.

Technology integration accelerates across all market segments, with artificial intelligence applications improving diagnostic accuracy, wearable devices monitoring pet health continuously, and automated systems streamlining practice operations. Telemedicine adoption has permanently altered service delivery models, with MWR data indicating sustained usage levels well above pre-pandemic baselines.

Consolidation trends continue reshaping market structure, with corporate veterinary groups acquiring independent practices to achieve operational efficiencies and expand service territories. Subscription-based care models gain popularity as pet owners seek predictable healthcare costs and comprehensive coverage through wellness plans and preventive care packages.

Workforce evolution includes increasing diversity in veterinary medicine, with women now representing over 60% of practicing veterinarians. Work-life balance priorities influence career choices and practice structures, driving demand for flexible scheduling, associate positions, and corporate employment opportunities offering structured benefits and support systems.

Recent industry developments demonstrate the dynamic nature of the US veterinary healthcare market and ongoing evolution in service delivery, technology adoption, and business models. Merger and acquisition activity has intensified, with major corporate groups expanding through strategic acquisitions of independent practices and specialty care providers.

Technology partnerships between veterinary practices and software companies have accelerated, creating integrated platforms combining practice management, client communication, and telemedicine capabilities. Pharmaceutical innovations include development of novel therapeutics for companion animals, including cancer treatments, pain management solutions, and preventive medications addressing emerging health challenges.

Educational initiatives focus on addressing workforce shortages through expanded veterinary school capacity, alternative career pathways, and continuing education programs for existing practitioners. Regulatory developments include updated telemedicine guidelines, controlled substance regulations, and animal welfare standards affecting practice operations and service delivery protocols.

Investment activity shows continued private equity interest in veterinary healthcare, with significant capital flowing into practice acquisitions, technology development, and market expansion initiatives. International expansion efforts by US veterinary companies seek to export expertise and services to developing markets with growing pet populations and increasing healthcare awareness.

Strategic recommendations for US veterinary healthcare market participants emphasize adaptation to evolving market dynamics while capitalizing on growth opportunities. Technology investment should prioritize integrated platforms combining practice management, client communication, and clinical decision support to improve efficiency and service quality. MarkWide Research analysis suggests that practices investing in comprehensive technology solutions achieve higher client satisfaction rates and improved financial performance.

Workforce development initiatives require immediate attention, with recommendations including competitive compensation packages, flexible scheduling options, and comprehensive benefits to attract and retain veterinary professionals. Partnership strategies with veterinary schools, continuing education providers, and professional organizations can help address staffing challenges while building talent pipelines.

Service diversification opportunities include expanding into specialty care areas, developing preventive care programs, and implementing telemedicine capabilities to reach underserved markets. Client education programs should emphasize the value of preventive care, early disease detection, and advanced treatment options to support premium service adoption.

Geographic expansion strategies should focus on underserved markets, particularly rural areas with limited veterinary access and growing suburban communities with increasing pet populations. Financial planning recommendations include exploring practice financing options, insurance partnerships, and subscription-based care models to improve service accessibility and revenue predictability.

The future outlook for the US veterinary healthcare market remains exceptionally positive, with multiple growth drivers supporting sustained expansion across all market segments. Demographic trends favor continued growth, with millennials and Generation Z demonstrating higher pet ownership rates and greater willingness to invest in premium veterinary services. Pet population growth is projected to continue, with approximately 12% of households planning to acquire pets within the next two years.

Technology advancement will continue revolutionizing veterinary practice, with artificial intelligence applications, wearable health monitoring devices, and automated diagnostic systems becoming standard practice tools. Telemedicine integration will expand beyond consultation services to include remote monitoring, follow-up care, and specialist consultations, improving access and reducing costs.

Specialty care expansion will accelerate as veterinary medicine becomes increasingly sophisticated, with new specialty disciplines emerging and existing specialties developing advanced treatment protocols. Preventive care emphasis will drive market growth as pet owners increasingly understand the value of wellness programs and early intervention strategies.

Market consolidation trends will continue, with corporate veterinary groups expanding through acquisitions while independent practices adapt through partnerships and technology adoption. Workforce challenges will persist but gradually improve through expanded educational capacity, alternative career pathways, and enhanced practice efficiency through technology integration. International opportunities will emerge as US veterinary companies export expertise and services to developing markets with growing pet healthcare awareness and increasing disposable incomes.

The US veterinary healthcare market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by fundamental demographic shifts, technological advancement, and changing consumer attitudes toward animal healthcare. Pet humanization trends have created unprecedented demand for premium veterinary services, while technology integration has revolutionized service delivery and practice efficiency.

Market opportunities abound across multiple segments, from specialty care expansion to telemedicine development and preventive care programs. Competitive dynamics continue evolving through consolidation trends, technology adoption, and service diversification initiatives. While workforce challenges present near-term constraints, long-term market fundamentals remain exceptionally strong.

Strategic success in this market requires adaptation to evolving consumer expectations, investment in technology solutions, and development of comprehensive service offerings addressing diverse animal healthcare needs. Industry participants who embrace innovation, prioritize client relationships, and maintain high-quality care standards will be well-positioned to capitalize on sustained market growth and emerging opportunities in the expanding US veterinary healthcare market.

What is Veterinary Healthcare?

Veterinary healthcare refers to the medical care and treatment provided to animals, including pets and livestock. It encompasses a range of services such as preventive care, diagnostics, surgery, and emergency treatment.

What are the key players in the US Veterinary Healthcare Market?

Key players in the US Veterinary Healthcare Market include Zoetis, Merck Animal Health, and Elanco Animal Health, among others. These companies are involved in the development of pharmaceuticals, vaccines, and diagnostic tools for animal health.

What are the main drivers of growth in the US Veterinary Healthcare Market?

The main drivers of growth in the US Veterinary Healthcare Market include the increasing pet ownership rates, rising awareness of animal health, and advancements in veterinary technology. Additionally, the growing demand for pet insurance is contributing to market expansion.

What challenges does the US Veterinary Healthcare Market face?

The US Veterinary Healthcare Market faces challenges such as the high cost of veterinary services and a shortage of qualified veterinary professionals. These factors can limit access to care for some pet owners and impact overall market growth.

What opportunities exist in the US Veterinary Healthcare Market?

Opportunities in the US Veterinary Healthcare Market include the development of telemedicine services for pets and the increasing focus on preventive care. Additionally, the rise in demand for specialty veterinary services presents growth potential.

What trends are shaping the US Veterinary Healthcare Market?

Trends shaping the US Veterinary Healthcare Market include the integration of technology in veterinary practices, such as telehealth and electronic health records. There is also a growing emphasis on holistic and preventive care approaches for pets.

US Veterinary Healthcare Market

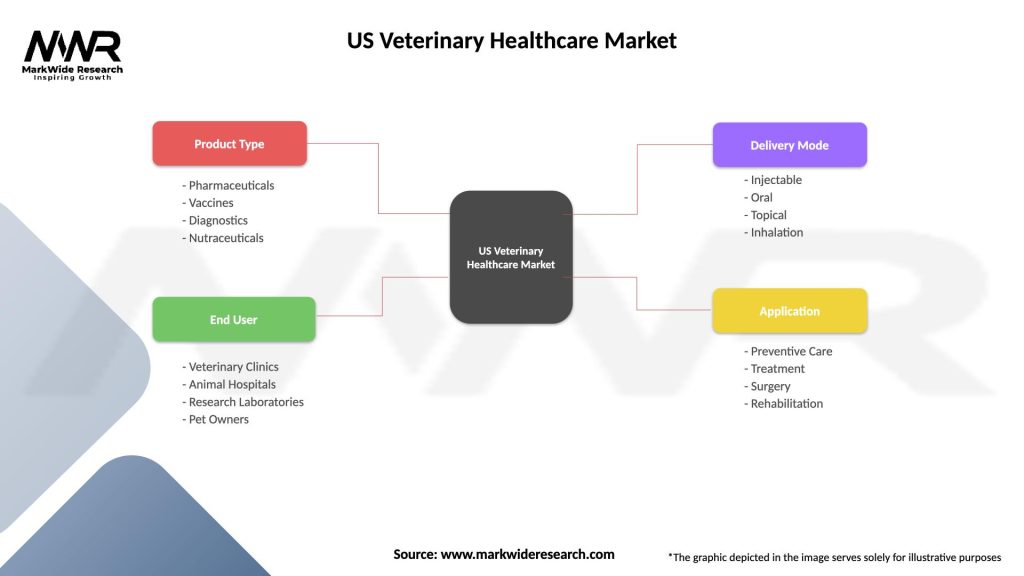

| Segmentation Details | Description |

|---|---|

| Product Type | Pharmaceuticals, Vaccines, Diagnostics, Nutraceuticals |

| End User | Veterinary Clinics, Animal Hospitals, Research Laboratories, Pet Owners |

| Delivery Mode | Injectable, Oral, Topical, Inhalation |

| Application | Preventive Care, Treatment, Surgery, Rehabilitation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Veterinary Healthcare Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at