444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US valves market represents a critical component of the nation’s industrial infrastructure, serving diverse sectors from oil and gas to water treatment and manufacturing. Industrial valves function as essential control mechanisms that regulate, direct, or stop the flow of fluids, gases, and other materials through piping systems across countless applications. The market demonstrates robust growth potential driven by infrastructure modernization, energy sector expansion, and increasing automation in industrial processes.

Market dynamics indicate sustained demand across multiple end-use industries, with the energy sector representing the largest consumption segment. The ongoing transition toward cleaner energy sources, coupled with traditional oil and gas operations, creates a complex landscape of opportunities for valve manufacturers. Technological advancement in smart valve systems and IoT integration further enhances market prospects, with adoption rates showing significant acceleration in recent years.

Regional distribution across the United States reflects industrial concentration patterns, with Texas, Louisiana, and California leading in valve consumption due to their extensive energy and manufacturing infrastructure. The market exhibits strong resilience despite economic fluctuations, supported by essential infrastructure maintenance requirements and regulatory compliance needs that drive consistent replacement and upgrade cycles.

The US valves market refers to the comprehensive ecosystem encompassing the design, manufacture, distribution, and maintenance of valve systems within the United States industrial landscape. Industrial valves serve as mechanical devices that control fluid flow by opening, closing, or partially obstructing various passageways in piping systems, ensuring operational safety and efficiency across diverse applications.

Valve functionality extends beyond simple on-off control, incorporating sophisticated pressure regulation, flow modulation, and directional control capabilities. Modern valve systems integrate advanced materials, precision engineering, and smart technologies to meet increasingly demanding operational requirements. The market encompasses various valve types including gate valves, ball valves, butterfly valves, globe valves, and specialized control valves designed for specific industrial applications.

Market scope includes both original equipment manufacturing and aftermarket services, reflecting the critical importance of valve maintenance and replacement in industrial operations. The definition encompasses traditional mechanical valves as well as emerging smart valve technologies that incorporate sensors, actuators, and connectivity features for enhanced monitoring and control capabilities.

Strategic analysis of the US valves market reveals a mature yet dynamic industry positioned for sustained growth through technological innovation and infrastructure investment. The market benefits from diverse end-use applications spanning energy, water treatment, chemical processing, and manufacturing sectors, creating multiple revenue streams and reducing dependency on any single industry segment.

Key growth drivers include aging infrastructure requiring replacement, increasing automation in industrial processes, and stringent regulatory requirements for safety and environmental compliance. The energy sector transformation, encompassing both traditional fossil fuel operations and renewable energy development, presents significant opportunities for valve manufacturers to expand their market presence.

Competitive landscape features a mix of established multinational corporations and specialized regional manufacturers, with market consolidation trends creating opportunities for strategic partnerships and acquisitions. Innovation focus centers on smart valve technologies, advanced materials, and enhanced durability features that reduce total cost of ownership for end users.

Market challenges include raw material price volatility, skilled labor shortages, and increasing pressure for sustainable manufacturing practices. However, these challenges also drive innovation and efficiency improvements that strengthen long-term market fundamentals and create competitive advantages for forward-thinking manufacturers.

Industrial automation trends significantly influence valve market dynamics, with smart valve adoption rates increasing by 12% annually as manufacturers seek enhanced operational efficiency and predictive maintenance capabilities. The integration of IoT sensors and wireless connectivity transforms traditional valve systems into intelligent components of broader industrial automation networks.

Infrastructure modernization serves as a primary market driver, with aging industrial facilities requiring comprehensive valve system upgrades to maintain operational efficiency and regulatory compliance. The average industrial valve system operates for 15-20 years before requiring replacement, creating predictable replacement cycles that support sustained market demand.

Energy sector expansion continues driving valve demand across multiple segments, from traditional oil and gas operations to emerging renewable energy projects. Pipeline infrastructure development, refinery capacity expansions, and natural gas processing facilities require extensive valve installations, while wind and solar projects incorporate specialized valve systems for hydraulic and cooling applications.

Regulatory compliance requirements mandate regular valve inspections, testing, and replacement to ensure safety and environmental protection standards. Stricter emissions regulations, workplace safety standards, and environmental protection measures create ongoing demand for upgraded valve systems that meet evolving regulatory requirements.

Technological advancement in valve design and manufacturing enables enhanced performance characteristics that justify system upgrades even before end-of-life replacement cycles. Smart valve technologies, improved materials, and enhanced durability features provide compelling value propositions for industrial operators seeking operational optimization.

Industrial automation trends drive demand for electronically controlled and monitored valve systems that integrate seamlessly with modern process control systems. The shift toward Industry 4.0 manufacturing practices requires valve systems capable of providing real-time performance data and remote control capabilities.

High capital costs associated with valve system installations and upgrades can delay project implementation, particularly for smaller industrial operators with limited capital budgets. Specialized valve systems for demanding applications often require significant upfront investment that may strain operational budgets and extend decision-making timelines.

Skilled labor shortages in valve installation, maintenance, and repair services create bottlenecks that can limit market growth potential. The specialized knowledge required for proper valve system design, installation, and maintenance becomes increasingly scarce as experienced technicians retire without adequate replacement training programs.

Raw material price volatility affects valve manufacturing costs and pricing stability, creating challenges for both manufacturers and end users in budget planning and project cost estimation. Steel, brass, and specialized alloy price fluctuations can significantly impact valve system costs and project feasibility assessments.

Long replacement cycles for industrial valve systems mean that market demand can be cyclical and difficult to predict accurately. The durable nature of quality valve systems, while beneficial for end users, creates challenges for manufacturers in maintaining consistent production volumes and revenue streams.

Competitive pressure from low-cost international manufacturers can impact domestic market share and pricing power, particularly in standard valve applications where differentiation is limited. Price-sensitive customers may prioritize initial cost savings over long-term performance and reliability considerations.

Smart valve technology presents significant growth opportunities as industrial operators increasingly adopt IoT and automation technologies. The integration of sensors, wireless connectivity, and predictive analytics capabilities creates new revenue streams and higher-margin product offerings for innovative valve manufacturers.

Infrastructure investment programs at federal and state levels create substantial opportunities for valve suppliers serving water treatment, transportation, and energy infrastructure projects. Government funding for infrastructure modernization drives demand for high-quality valve systems that meet stringent performance and durability requirements.

Energy transition initiatives open new market segments as renewable energy projects, carbon capture systems, and hydrogen infrastructure development require specialized valve solutions. The growing focus on clean energy creates opportunities for valve manufacturers to develop innovative products for emerging applications.

Aftermarket service expansion offers opportunities for recurring revenue through maintenance contracts, spare parts supply, and system optimization services. The installed base of valve systems requires ongoing support, creating stable revenue streams for companies that develop comprehensive service capabilities.

Advanced materials development enables valve manufacturers to address challenging applications in corrosive, high-temperature, or high-pressure environments. Innovation in materials science creates opportunities to expand into new market segments and command premium pricing for specialized solutions.

Supply chain considerations significantly influence market dynamics, with valve manufacturers balancing domestic production capabilities against global sourcing opportunities. The complexity of valve manufacturing requires sophisticated supply chain management to ensure quality control while maintaining cost competitiveness in diverse market segments.

Technology integration trends reshape traditional valve market dynamics as smart technologies become increasingly important differentiators. Manufacturers must balance investment in advanced technologies with the need to maintain cost-effective solutions for price-sensitive applications, creating complex product portfolio management challenges.

Customer relationship evolution reflects the shift from transactional valve sales toward comprehensive solution partnerships that include design consultation, installation support, and ongoing maintenance services. This evolution requires valve manufacturers to develop broader capabilities and deeper customer relationships.

Regulatory environment changes continuously influence market dynamics through evolving safety, environmental, and performance standards that drive valve system upgrades and replacements. Manufacturers must stay ahead of regulatory trends to ensure product compliance and market access.

Economic cycle sensitivity affects different market segments variably, with some applications showing resilience during economic downturns while others experience significant volatility. Understanding these dynamics enables better strategic planning and risk management for valve manufacturers and distributors.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, technical specialists, and end-user representatives across diverse market segments to gather firsthand perspectives on market trends and challenges.

Secondary research incorporates analysis of industry publications, technical standards, regulatory documents, and company financial reports to validate primary research findings and provide comprehensive market context. This approach ensures thorough coverage of market dynamics and competitive landscape factors.

Data validation processes include cross-referencing multiple sources, statistical analysis of market trends, and expert review of findings to ensure accuracy and reliability. The methodology emphasizes both quantitative analysis and qualitative insights to provide a complete market picture.

Industry expert consultation provides specialized knowledge on technical developments, regulatory changes, and market evolution trends that may not be readily apparent through traditional research methods. Expert insights help identify emerging opportunities and potential market disruptions.

Market segmentation analysis examines valve applications across multiple dimensions including end-use industry, valve type, material composition, and geographic distribution to provide detailed market understanding and identify specific growth opportunities within the broader market context.

Texas leads the US valves market with approximately 22% market share, driven by extensive oil and gas infrastructure, petrochemical facilities, and refining operations concentrated along the Gulf Coast. The state’s energy industry dominance creates sustained demand for specialized valve systems capable of handling challenging operating conditions.

Louisiana maintains significant market presence with 15% market share, supported by major petrochemical complexes, offshore oil and gas operations, and extensive pipeline infrastructure. The state’s strategic location for energy transportation and processing creates diverse valve application requirements across multiple industry segments.

California represents a substantial market with 12% share, driven by diverse industrial applications including water treatment, manufacturing, and emerging renewable energy projects. The state’s stringent environmental regulations drive demand for advanced valve technologies that ensure compliance with emission and safety standards.

Pennsylvania and Ohio combine for approximately 18% market share, benefiting from shale gas development, chemical manufacturing, and traditional industrial applications. The Marcellus and Utica shale formations drive significant valve demand for natural gas processing and transportation infrastructure.

Regional distribution patterns reflect industrial concentration and infrastructure density, with Gulf Coast states maintaining the highest valve consumption rates due to energy industry presence. However, emerging opportunities in renewable energy and infrastructure modernization create growth potential across all regions, particularly in states with aging industrial infrastructure requiring comprehensive upgrades.

Market leadership is distributed among several major manufacturers, each with distinct strengths and market positioning strategies. The competitive landscape reflects both global corporations with comprehensive product portfolios and specialized manufacturers focused on specific valve types or applications.

Competitive strategies emphasize technological innovation, comprehensive service capabilities, and strategic market positioning to differentiate offerings in an increasingly sophisticated marketplace. Companies invest heavily in research and development to maintain technological leadership and address evolving customer requirements.

By Valve Type: The market segments into multiple categories based on valve design and functionality, with each type serving specific application requirements and operating conditions.

By End-Use Industry: Market segmentation reflects diverse application requirements across industrial sectors.

Control valves represent the highest-growth segment with annual growth rates of 9%, driven by increasing industrial automation and process optimization requirements. These sophisticated valve systems integrate advanced actuators, positioners, and control electronics to provide precise flow regulation and system integration capabilities.

Ball valves maintain strong market position due to their versatility and reliability across diverse applications, with particular strength in oil and gas sector applications where quarter-turn operation and excellent sealing characteristics provide operational advantages. The segment benefits from continuous material and design improvements that enhance durability and performance.

Smart valve technologies emerge as a distinct category with rapid adoption rates across all valve types, incorporating sensors, wireless connectivity, and diagnostic capabilities that enable predictive maintenance and operational optimization. This category represents the convergence of traditional valve manufacturing with advanced electronics and software capabilities.

Specialty valve applications in challenging environments drive demand for advanced materials and specialized designs, including cryogenic valves for LNG applications, high-temperature valves for power generation, and corrosion-resistant valves for chemical processing. These applications command premium pricing and require specialized engineering expertise.

Aftermarket services constitute a growing category encompassing maintenance, repair, and upgrade services that extend valve system life and optimize performance. This category provides recurring revenue opportunities and strengthens customer relationships through ongoing technical support and system optimization services.

Manufacturers benefit from diverse market opportunities across multiple end-use industries, reducing dependence on any single sector and providing stability during economic fluctuations. The combination of new equipment sales and aftermarket services creates multiple revenue streams with different risk profiles and growth characteristics.

End users gain access to increasingly sophisticated valve technologies that improve operational efficiency, reduce maintenance requirements, and enhance safety performance. Smart valve systems provide real-time performance data that enables predictive maintenance and operational optimization, reducing total cost of ownership.

Distributors and service providers benefit from the technical complexity of modern valve systems, which creates opportunities for value-added services including system design, installation support, and ongoing maintenance contracts. The specialized knowledge required for valve applications creates barriers to entry that protect established service providers.

Technology suppliers find growing opportunities in the integration of electronics, sensors, and software capabilities into traditional valve systems. The convergence of mechanical and electronic technologies creates new market segments and partnership opportunities between valve manufacturers and technology companies.

Infrastructure operators benefit from improved valve technologies that enhance system reliability, reduce maintenance costs, and provide better operational control. Advanced valve systems contribute to overall infrastructure efficiency and help meet increasingly stringent regulatory requirements for safety and environmental performance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation reshapes the valve industry through integration of IoT sensors, wireless connectivity, and cloud-based monitoring systems that enable remote valve monitoring and predictive maintenance capabilities. This trend transforms traditional valve systems into intelligent components of broader industrial automation networks.

Sustainability focus drives demand for energy-efficient valve designs, environmentally friendly materials, and manufacturing processes that reduce environmental impact. Customers increasingly consider lifecycle environmental impact in valve selection decisions, creating opportunities for manufacturers with strong sustainability credentials.

Customization requirements increase as industrial processes become more specialized and demanding, requiring valve manufacturers to develop flexible manufacturing capabilities and engineering expertise to address unique application requirements. This trend favors manufacturers with strong technical capabilities and customer collaboration skills.

Predictive maintenance adoption accelerates across industrial sectors, driving demand for valve systems equipped with condition monitoring capabilities that can predict maintenance needs and prevent unexpected failures. This trend creates opportunities for service-based business models and recurring revenue streams.

Supply chain localization gains importance as companies seek to reduce supply chain risks and improve delivery reliability, potentially benefiting domestic valve manufacturers with strong local presence and manufacturing capabilities. MarkWide Research analysis indicates growing preference for suppliers with robust domestic supply chain capabilities.

Technological advancement in valve actuator systems incorporates advanced materials, precision manufacturing, and electronic control systems that improve valve performance and reliability. Recent developments include brushless motor actuators, advanced position feedback systems, and integrated diagnostic capabilities that enhance valve system functionality.

Strategic acquisitions reshape the competitive landscape as major manufacturers acquire specialized valve companies to expand product portfolios and market reach. These transactions reflect industry consolidation trends and the importance of comprehensive product offerings in serving diverse customer requirements.

Manufacturing automation improvements enable valve manufacturers to improve quality consistency, reduce production costs, and enhance manufacturing flexibility. Advanced manufacturing technologies including robotics, precision machining, and automated testing systems improve product quality while reducing labor requirements.

Regulatory compliance initiatives drive product development focused on meeting evolving safety and environmental standards, including fugitive emissions requirements, fire safety standards, and cybersecurity protocols for smart valve systems. These developments require significant investment in product development and testing capabilities.

Partnership development between valve manufacturers and technology companies creates integrated solutions that combine mechanical valve expertise with advanced electronics and software capabilities. These partnerships enable rapid development of smart valve technologies without requiring extensive internal technology development investments.

Investment prioritization should focus on smart valve technology development and manufacturing capabilities that enable integration of IoT sensors, wireless connectivity, and predictive analytics capabilities. Companies that successfully combine traditional valve engineering with advanced technology integration will capture the highest growth opportunities in the evolving market.

Service capability expansion represents a critical strategic priority for valve manufacturers seeking to develop recurring revenue streams and strengthen customer relationships. Comprehensive service offerings including predictive maintenance, system optimization, and remote monitoring services provide competitive differentiation and higher profit margins.

Market segment specialization can provide competitive advantages in specific applications where technical expertise and specialized product development create barriers to entry. Focus on challenging applications such as high-temperature, high-pressure, or corrosive environments enables premium pricing and customer loyalty.

Supply chain optimization becomes increasingly important as customers prioritize delivery reliability and supply chain resilience. Manufacturers should evaluate supply chain strategies to balance cost efficiency with reliability and responsiveness to customer requirements.

Sustainability initiatives should encompass both product development and manufacturing processes to meet growing customer expectations for environmental responsibility. MWR research indicates that sustainability credentials increasingly influence customer purchasing decisions, particularly in large industrial projects.

Market evolution toward smart valve systems will accelerate over the next decade, with intelligent valve technologies achieving penetration rates exceeding 50% in new installations by 2030. This transformation requires significant investment in technology development and manufacturing capabilities but creates substantial opportunities for market leadership.

Infrastructure modernization programs will drive sustained valve demand as aging industrial facilities require comprehensive upgrades to meet modern performance and regulatory standards. The replacement cycle for industrial valve systems ensures consistent market demand even during economic downturns, providing stability for manufacturers and service providers.

Energy sector transformation creates both challenges and opportunities as traditional oil and gas applications evolve while renewable energy and clean technology applications emerge. Successful valve manufacturers will adapt product portfolios to serve both traditional and emerging energy applications effectively.

Automation integration will become standard rather than optional as industrial operators seek operational efficiency improvements and labor cost reduction. Valve systems that seamlessly integrate with broader automation systems will command premium pricing and customer preference over traditional manual valve systems.

Global competition will intensify as international manufacturers develop advanced capabilities and seek to expand market presence in the United States. Domestic manufacturers must leverage technological innovation, service capabilities, and customer relationships to maintain competitive advantages in an increasingly competitive marketplace.

The US valves market demonstrates strong fundamentals supported by essential infrastructure requirements, diverse end-use applications, and continuous technological advancement. Market growth prospects remain positive despite cyclical challenges, driven by infrastructure modernization needs, energy sector evolution, and increasing automation adoption across industrial sectors.

Strategic opportunities center on smart valve technology development, comprehensive service capability expansion, and specialized application focus that creates competitive differentiation. Companies that successfully navigate the transition from traditional valve manufacturing to integrated technology solutions will capture the highest growth potential in the evolving market landscape.

Market resilience stems from the essential nature of valve systems in industrial operations and the predictable replacement cycles that ensure consistent baseline demand. While economic fluctuations may impact timing of capital investments, the fundamental need for valve systems across diverse industries provides stability and long-term growth potential for well-positioned market participants.

What is a valve?

A valve is a mechanical device that regulates, directs, or controls the flow of fluids (liquids, gases, or slurries) by opening, closing, or partially obstructing passageways. Valves are essential components in various applications, including water supply systems, chemical processing, and HVAC systems.

What are the key players in the US Valves Market?

Key players in the US Valves Market include companies such as Emerson Electric Co., Flowserve Corporation, and Parker Hannifin Corporation, which are known for their innovative valve solutions and extensive product lines, among others.

What are the main drivers of the US Valves Market?

The main drivers of the US Valves Market include the growing demand for automation in industrial processes, the expansion of the oil and gas sector, and the increasing need for efficient water management systems. These factors contribute to the rising adoption of advanced valve technologies.

What challenges does the US Valves Market face?

The US Valves Market faces challenges such as fluctuating raw material prices, stringent regulatory requirements, and the need for continuous innovation to meet evolving industry standards. These factors can impact production costs and market competitiveness.

What opportunities exist in the US Valves Market?

Opportunities in the US Valves Market include the growing focus on sustainable and energy-efficient solutions, advancements in smart valve technologies, and the increasing demand for valves in renewable energy applications. These trends are expected to drive market growth in the coming years.

What trends are shaping the US Valves Market?

Trends shaping the US Valves Market include the integration of IoT technology for predictive maintenance, the rise of automation in manufacturing processes, and the development of environmentally friendly materials for valve production. These innovations are enhancing operational efficiency and sustainability.

US Valves Market

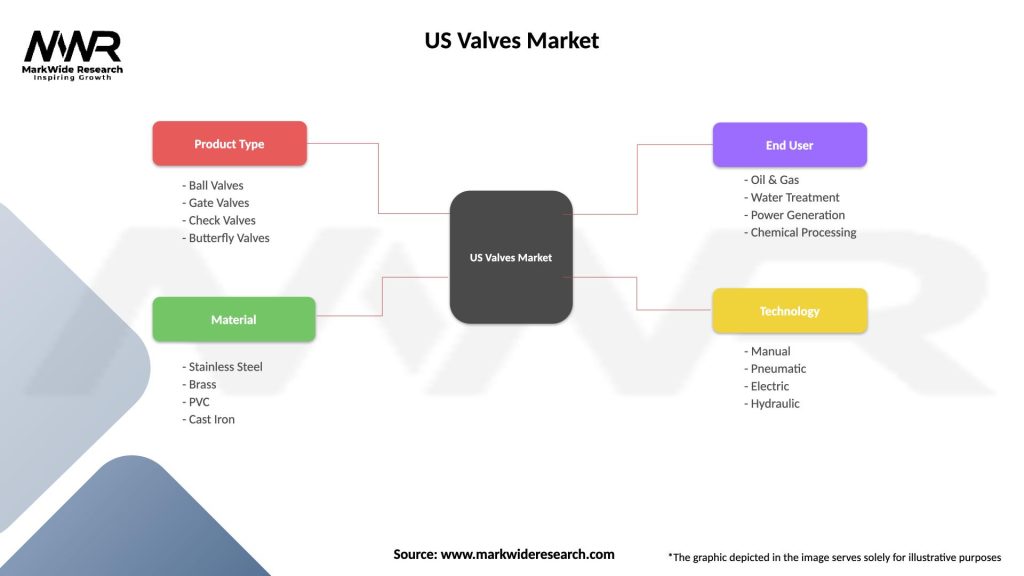

| Segmentation Details | Description |

|---|---|

| Product Type | Ball Valves, Gate Valves, Check Valves, Butterfly Valves |

| Material | Stainless Steel, Brass, PVC, Cast Iron |

| End User | Oil & Gas, Water Treatment, Power Generation, Chemical Processing |

| Technology | Manual, Pneumatic, Electric, Hydraulic |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Valves Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at