444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US turf and ornamental protection market represents a dynamic and rapidly evolving sector within the broader agricultural protection industry. This specialized market encompasses a comprehensive range of products and services designed to maintain, protect, and enhance the health and appearance of turfgrass, ornamental plants, trees, and landscaping elements across diverse applications. Market dynamics indicate robust growth driven by increasing demand for aesthetic landscaping, professional sports facility maintenance, and sustainable green space management.

Professional landscapers, golf course superintendents, sports field managers, and residential property owners rely heavily on advanced protection solutions to combat various threats including fungal diseases, insect infestations, weed competition, and environmental stressors. The market has experienced significant expansion with growing awareness of integrated pest management practices and the adoption of precision application technologies.

Regional distribution shows concentrated activity in states with extensive golf course networks, professional sports facilities, and high-value residential landscaping markets. The sector benefits from year-round demand patterns, with seasonal variations driving specific product categories and application timing strategies across different climate zones.

The US turf and ornamental protection market refers to the comprehensive ecosystem of products, services, and technologies specifically designed to safeguard and enhance the health, appearance, and performance of managed turfgrass areas and ornamental plant installations. This specialized sector encompasses fungicides, insecticides, herbicides, plant growth regulators, fertilizers, and biological control agents formulated for non-agricultural applications.

Market scope includes protection solutions for golf courses, sports fields, commercial landscapes, residential lawns, parks, recreational facilities, and institutional grounds. The definition extends beyond chemical interventions to include integrated management approaches, precision application equipment, monitoring technologies, and professional service delivery systems.

Industry stakeholders recognize this market as distinct from traditional agricultural crop protection due to its focus on aesthetic quality, recreational functionality, and environmental stewardship in urban and suburban settings. The sector emphasizes sustainable practices, regulatory compliance, and specialized expertise in managing high-value turfgrass and ornamental plant systems.

Market performance in the US turf and ornamental protection sector demonstrates consistent growth momentum driven by expanding recreational infrastructure, increasing property values, and heightened awareness of professional landscape management. The industry has successfully adapted to evolving regulatory frameworks while maintaining innovation in product development and application technologies.

Key growth drivers include the proliferation of golf courses and sports facilities, rising consumer expectations for landscape quality, and the integration of sustainable management practices. Professional service providers report increasing demand for specialized expertise in integrated pest management, precision application techniques, and environmentally responsible protection strategies.

Competitive landscape features established multinational corporations alongside specialized regional providers, creating a diverse ecosystem of solution offerings. Market leaders continue investing in research and development to address emerging challenges such as herbicide resistance, climate adaptation, and regulatory compliance requirements.

Future projections indicate sustained growth potential supported by infrastructure development, technological advancement, and increasing recognition of the economic and environmental value of professionally managed green spaces. The sector is positioned to benefit from trends toward urbanization, recreational facility expansion, and sustainable landscape management practices.

Strategic analysis reveals several critical insights shaping the US turf and ornamental protection market landscape:

Primary growth catalysts propelling the US turf and ornamental protection market include expanding recreational infrastructure and increasing investment in aesthetic landscape management. The proliferation of golf courses, sports complexes, and recreational facilities creates sustained demand for specialized protection products and professional services.

Consumer expectations for high-quality landscape appearance drive residential and commercial property owners to invest in professional-grade protection solutions. Property value considerations and community standards contribute to increased spending on lawn care and ornamental plant maintenance, particularly in affluent suburban markets.

Climate challenges including extreme weather events, drought conditions, and temperature fluctuations necessitate advanced protection strategies. These environmental pressures create opportunities for innovative products that enhance plant resilience and stress tolerance while maintaining aesthetic quality.

Regulatory support for sustainable landscape management practices encourages adoption of integrated pest management approaches and environmentally responsible protection solutions. Government initiatives promoting green infrastructure and urban forestry programs contribute to market expansion in municipal and institutional segments.

Technological advancement in application equipment, monitoring systems, and product formulations enables more precise and effective protection strategies. These innovations improve treatment efficacy while reducing environmental impact and operational costs for end users.

Regulatory constraints present significant challenges for the US turf and ornamental protection market, with increasing restrictions on certain active ingredients and application methods. Registration requirements for new products involve lengthy approval processes and substantial investment, potentially limiting innovation and market entry for smaller companies.

Environmental concerns regarding pesticide use in urban and suburban environments create public resistance and regulatory scrutiny. Growing awareness of pollinator protection and water quality issues influences product selection and application practices, sometimes limiting available options for pest management.

Economic sensitivity affects market demand during periods of economic uncertainty, as discretionary spending on landscape maintenance may be reduced. Budget constraints in municipal and institutional segments can lead to deferred maintenance and reduced product usage.

Labor shortages in the professional landscape industry impact service delivery and market growth potential. Skilled applicator availability and training requirements create operational challenges for service providers and may limit market expansion in certain regions.

Resistance development in target pests and diseases necessitates continuous product innovation and rotation strategies. This biological challenge requires ongoing research investment and may reduce the effectiveness of existing protection solutions over time.

Emerging opportunities in the US turf and ornamental protection market center around sustainable technology adoption and expanding application segments. The growing emphasis on biological control agents and reduced-risk formulations creates significant potential for companies developing innovative, environmentally compatible solutions.

Digital integration presents substantial opportunities for market expansion through precision application technologies, data-driven decision making, and remote monitoring systems. Smart irrigation and automated treatment systems offer potential for improved efficiency and reduced environmental impact.

Specialty markets including organic certification, pollinator-friendly management, and climate-resilient landscaping represent high-growth segments with premium pricing potential. These niche applications allow for product differentiation and value-added service offerings.

Geographic expansion opportunities exist in underserved regions and emerging market segments such as urban agriculture, rooftop gardens, and vertical landscaping systems. Infrastructure development in growing metropolitan areas creates new demand for professional protection services.

Partnership opportunities with technology companies, research institutions, and service providers enable market participants to leverage complementary expertise and expand their solution offerings. Collaborative innovation can accelerate product development and market penetration.

Market forces shaping the US turf and ornamental protection sector reflect complex interactions between regulatory requirements, technological innovation, and evolving customer expectations. Supply chain dynamics have been influenced by global manufacturing considerations and raw material availability, affecting product pricing and availability patterns.

Competitive pressures drive continuous innovation in product formulations, application technologies, and service delivery models. Market leaders invest heavily in research and development to maintain competitive advantages and address emerging challenges such as resistance management and environmental compliance.

Customer behavior trends show increasing sophistication in product selection and application practices, with end users seeking integrated solutions rather than individual products. This shift toward comprehensive management approaches influences product development and marketing strategies across the industry.

Seasonal variations create predictable demand patterns while weather volatility introduces uncertainty in application timing and product requirements. Climate adaptation strategies become increasingly important as extreme weather events affect traditional management practices.

Regulatory evolution continues to shape market dynamics through changing approval processes, use restrictions, and environmental compliance requirements. Industry participants must balance innovation objectives with regulatory compliance while maintaining product efficacy and economic viability.

Comprehensive analysis of the US turf and ornamental protection market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, service providers, and end users across diverse market segments.

Secondary research incorporates analysis of industry publications, regulatory databases, trade association reports, and academic studies to provide comprehensive market context. Data triangulation methods validate findings across multiple sources to ensure analytical accuracy and reliability.

Market segmentation analysis examines product categories, application methods, end-user segments, and geographic regions to identify growth patterns and opportunity areas. Competitive intelligence gathering includes company financial analysis, product portfolio assessment, and strategic initiative evaluation.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified drivers and constraints. Statistical modeling techniques support quantitative analysis and growth projections across different market segments.

Expert consultation with industry specialists, regulatory officials, and academic researchers provides additional validation and insight into market dynamics and future trends. This multi-source approach ensures comprehensive coverage of market factors and reliable analytical conclusions.

Geographic distribution of the US turf and ornamental protection market shows significant regional variations driven by climate conditions, recreational infrastructure density, and economic factors. Southern states demonstrate year-round market activity with consistent demand for fungicide and insecticide applications due to favorable growing conditions and extended pest pressure periods.

Western regions exhibit strong market presence concentrated around metropolitan areas with extensive golf course networks and high-value residential landscaping. Water management considerations in these areas drive demand for drought-tolerant solutions and precision application technologies, with market share reaching approximately 28% of national activity.

Northeastern markets show seasonal demand patterns with intensive spring and fall application periods. This region accounts for roughly 25% of market activity, driven by dense population centers, established recreational facilities, and high property values supporting premium landscape maintenance investments.

Midwest regions demonstrate balanced market participation with strong golf course and sports facility presence. Agricultural expertise in these areas supports adoption of advanced application technologies and integrated management practices, contributing approximately 22% of total market share.

Climate zone variations influence product selection and application timing across regions, with cool-season turf markets showing different product mix preferences compared to warm-season grass areas. Regional distribution networks and service provider density also impact market accessibility and growth potential in different geographic areas.

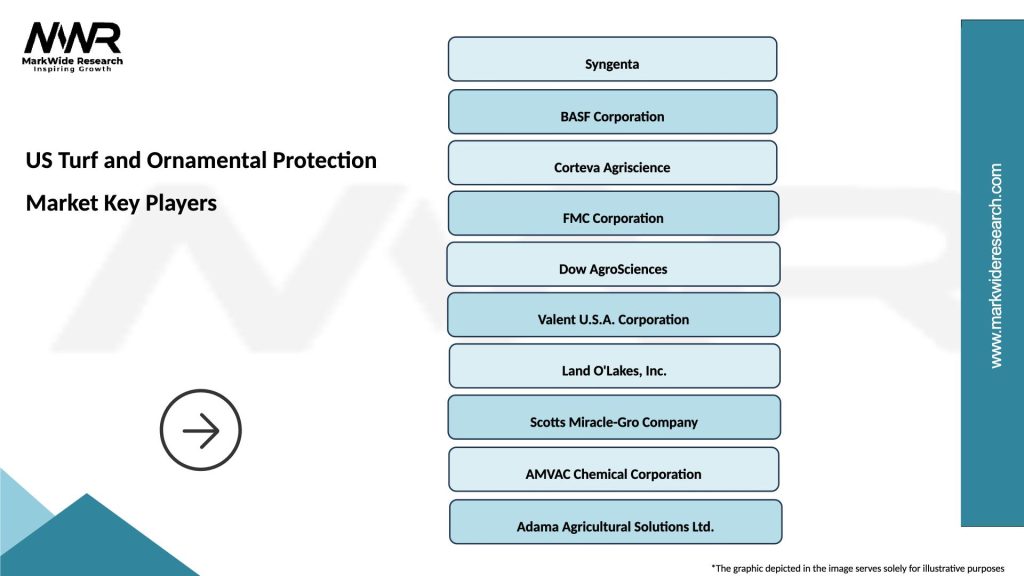

Market leadership in the US turf and ornamental protection sector features a diverse competitive landscape combining multinational corporations with specialized regional providers. Industry consolidation trends have created several dominant players while maintaining opportunities for niche specialists and innovative startups.

Competitive strategies emphasize product innovation, service differentiation, and strategic partnerships to maintain market position. Research investment levels vary significantly among competitors, with larger companies maintaining substantial R&D capabilities while smaller firms focus on specialized applications and regional expertise.

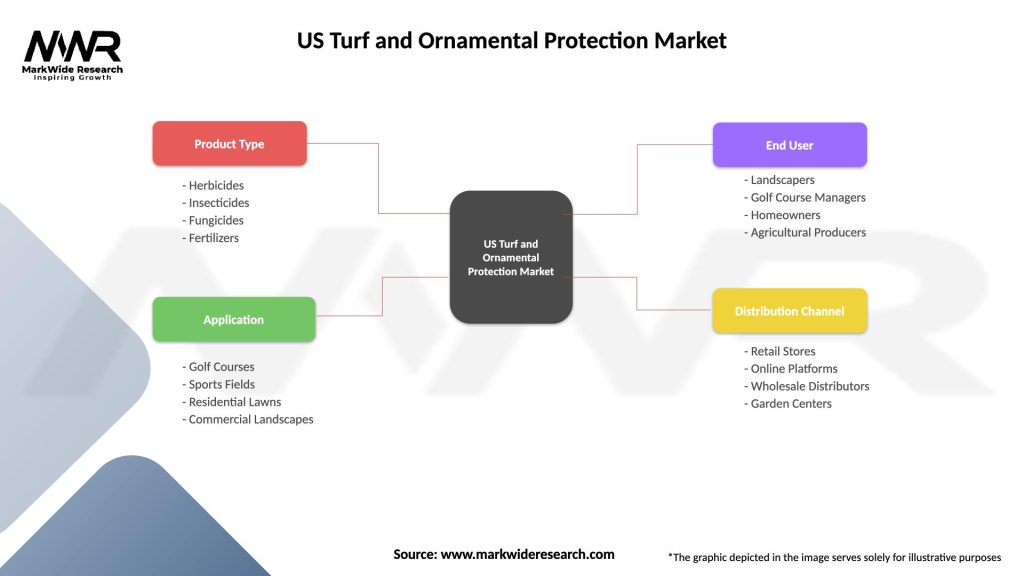

Product segmentation in the US turf and ornamental protection market encompasses diverse categories addressing specific pest management and plant health requirements:

By Product Type:

By Application Method:

By End User:

Fungicide applications dominate the US turf and ornamental protection market due to the critical importance of disease prevention in maintaining aesthetic quality and plant health. Preventive treatments show higher adoption rates compared to curative applications, with integrated disease management programs becoming standard practice among professional users.

Herbicide categories demonstrate strong demand driven by weed competition challenges and aesthetic requirements. Pre-emergent herbicides show consistent seasonal demand patterns, while post-emergent solutions experience variable usage based on weather conditions and weed pressure levels.

Insecticide segments reflect increasing pest pressure and expanding geographic ranges of target species. Systemic formulations gain preference over contact products due to improved efficacy and reduced application frequency requirements, with biological alternatives showing growing market acceptance.

Specialty products including plant growth regulators and stress tolerance enhancers represent high-value segments with premium pricing potential. These categories benefit from increasing awareness of climate adaptation requirements and sustainable management practices.

Biological solutions emerge as the fastest-growing category, driven by regulatory preferences and environmental considerations. Market penetration in this segment reaches approximately 12% of total applications, with expectations for continued expansion as product efficacy and availability improve.

Manufacturers in the US turf and ornamental protection market benefit from stable demand patterns and premium pricing opportunities compared to commodity agricultural markets. Product differentiation potential allows for value-added solutions and specialized formulations targeting specific applications and user requirements.

Distributors gain advantages through established customer relationships and technical service capabilities that create barriers to entry for competitors. Regional expertise and inventory management capabilities provide competitive advantages in serving diverse market segments with varying seasonal demands.

Service providers benefit from recurring revenue opportunities and expanding service offerings that include consultation, application services, and monitoring programs. Professional expertise commands premium pricing while building long-term customer relationships and market share.

End users realize benefits through improved plant health, enhanced aesthetic quality, and reduced long-term maintenance costs. Professional-grade products deliver superior performance compared to consumer alternatives, justifying investment in specialized protection programs.

Technology companies find opportunities in precision application equipment, monitoring systems, and data analytics solutions that enhance treatment efficacy and environmental compliance. Digital integration creates new revenue streams and competitive advantages for innovative solution providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the US turf and ornamental protection market, with increasing adoption of integrated pest management practices and environmentally compatible solutions. This trend drives innovation in biological products, reduced-risk formulations, and precision application technologies.

Digital transformation accelerates across the industry with widespread adoption of GPS-guided equipment, drone surveillance systems, and mobile applications for treatment planning and record keeping. These technologies improve application accuracy while reducing environmental impact and operational costs.

Regulatory evolution continues to influence market dynamics through changing approval processes and use restrictions. Pollinator protection requirements and water quality concerns drive development of specialized formulations and application methods that minimize environmental exposure.

Climate adaptation strategies become increasingly important as extreme weather events affect traditional management practices. Stress tolerance products and drought-resistant solutions gain market acceptance as climate variability increases across different regions.

Service consolidation trends show professional service providers expanding their offerings to include comprehensive landscape management programs. This integrated approach creates opportunities for product bundling and long-term customer relationships while improving treatment effectiveness.

Specialty market growth in organic certification, pollinator-friendly management, and urban agriculture creates new product categories and application methods. These niche segments command premium pricing while driving innovation in sustainable protection solutions.

Recent innovations in the US turf and ornamental protection market include breakthrough developments in biological control agents and precision application technologies. MarkWide Research analysis indicates that companies are investing heavily in sustainable solution development to address evolving regulatory requirements and customer preferences.

Strategic partnerships between traditional chemical companies and biotechnology firms accelerate development of next-generation products combining conventional and biological approaches. These collaborative efforts leverage complementary expertise to create more effective and environmentally compatible solutions.

Regulatory approvals for new active ingredients and formulation technologies provide market participants with expanded product portfolios and competitive advantages. Reduced-risk registrations receive priority review status, encouraging innovation in sustainable protection solutions.

Technology acquisitions by major market players demonstrate commitment to digital integration and precision agriculture capabilities. These strategic investments position companies to capitalize on growing demand for data-driven management solutions and automated application systems.

Market consolidation activities include strategic acquisitions and joint ventures that reshape competitive dynamics and distribution networks. These industry developments create opportunities for improved market coverage and enhanced customer service capabilities.

Research initiatives focus on resistance management, climate adaptation, and sustainable intensification of protection programs. University partnerships and government funding support development of innovative solutions addressing emerging challenges in turf and ornamental management.

Strategic recommendations for US turf and ornamental protection market participants emphasize the importance of sustainable innovation and technology integration to maintain competitive advantages. Companies should prioritize development of biological solutions and reduced-risk formulations to address evolving regulatory requirements and customer preferences.

Investment priorities should focus on precision application technologies, data analytics capabilities, and digital service platforms that enhance customer value and operational efficiency. Technology partnerships can accelerate development timelines while reducing investment risks in emerging solution categories.

Market expansion opportunities exist in underserved geographic regions and specialty application segments such as organic certification and pollinator-friendly management. Regional expertise and local partnerships can facilitate market entry and customer relationship development in these growth areas.

Service integration strategies should emphasize comprehensive management programs that combine product supply with technical expertise and application services. This value-added approach creates competitive differentiation while building long-term customer loyalty and recurring revenue streams.

Regulatory preparation requires proactive engagement with approval processes and compliance requirements to maintain market access for existing products while facilitating introduction of new solutions. Early investment in regulatory support capabilities provides competitive advantages in product development and market timing.

Sustainability positioning becomes increasingly important for market success, requiring authentic commitment to environmental stewardship and transparent communication of product benefits. Third-party certifications and independent validation can enhance credibility and market acceptance of sustainable solution claims.

Long-term projections for the US turf and ornamental protection market indicate sustained growth potential driven by infrastructure development, technology advancement, and increasing recognition of professional landscape management value. Market evolution will be shaped by regulatory changes, climate adaptation requirements, and continued innovation in sustainable protection solutions.

Growth trajectories show particular strength in biological products, precision application technologies, and integrated service offerings. MWR analysis suggests that companies successfully combining traditional expertise with innovative approaches will capture the largest share of future market expansion opportunities.

Technology integration will accelerate with widespread adoption of artificial intelligence, machine learning, and automated application systems. These digital capabilities will enable more precise treatment decisions, improved resource efficiency, and enhanced environmental compliance across all market segments.

Regulatory evolution will continue to favor sustainable solutions and integrated management approaches, creating opportunities for companies investing in environmentally compatible technologies. Approval processes may become more streamlined for reduced-risk products while maintaining rigorous safety standards.

Climate considerations will drive increasing demand for stress-tolerant solutions and adaptive management strategies as weather patterns become more variable. Regional specialization in climate-adapted products and services will create competitive advantages for market participants with local expertise.

Market consolidation trends may continue as companies seek to achieve scale advantages and comprehensive solution portfolios. However, innovation opportunities will maintain space for specialized providers and technology-focused startups to capture niche market segments and drive industry advancement.

The US turf and ornamental protection market represents a dynamic and evolving sector with substantial growth potential driven by infrastructure development, technology innovation, and increasing emphasis on sustainable management practices. Market participants who successfully balance traditional expertise with innovative approaches will be best positioned to capitalize on emerging opportunities while navigating regulatory challenges and competitive pressures.

Strategic success in this market requires commitment to continuous innovation, customer service excellence, and environmental stewardship. Companies that invest in biological solutions, precision technologies, and integrated service offerings will likely achieve the strongest competitive positions and long-term growth prospects.

Future market development will be characterized by increasing sophistication in product formulations, application methods, and service delivery models. The sector’s evolution toward sustainability and technology integration creates opportunities for value creation while addressing the growing demands of professional users and regulatory requirements.

Industry outlook remains positive with expectations for continued expansion driven by recreational infrastructure growth, climate adaptation needs, and increasing recognition of the economic and environmental value of professionally managed green spaces. Market participants who embrace innovation while maintaining focus on customer needs and environmental responsibility will be well-positioned for long-term success in this specialized and rewarding market sector.

What is Turf and Ornamental Protection?

Turf and Ornamental Protection refers to the practices and products used to safeguard lawns, gardens, and ornamental plants from pests, diseases, and environmental stressors. This includes the use of pesticides, herbicides, and integrated pest management strategies to maintain healthy landscapes.

What are the key players in the US Turf and Ornamental Protection Market?

Key players in the US Turf and Ornamental Protection Market include companies like Scotts Miracle-Gro, Syngenta, Bayer Crop Science, and BASF. These companies offer a range of products and solutions aimed at protecting turf and ornamental plants, among others.

What are the main drivers of growth in the US Turf and Ornamental Protection Market?

The growth of the US Turf and Ornamental Protection Market is driven by increasing urbanization, rising demand for aesthetically pleasing landscapes, and the need for effective pest control solutions. Additionally, the growing awareness of sustainable gardening practices is influencing market expansion.

What challenges does the US Turf and Ornamental Protection Market face?

The US Turf and Ornamental Protection Market faces challenges such as regulatory restrictions on pesticide use, environmental concerns regarding chemical applications, and the emergence of resistant pest populations. These factors can hinder product effectiveness and market growth.

What opportunities exist in the US Turf and Ornamental Protection Market?

Opportunities in the US Turf and Ornamental Protection Market include the development of organic and eco-friendly products, advancements in precision agriculture technologies, and the increasing popularity of smart gardening solutions. These trends are expected to shape the future of the market.

What trends are currently shaping the US Turf and Ornamental Protection Market?

Current trends in the US Turf and Ornamental Protection Market include a shift towards sustainable practices, the integration of technology in pest management, and the growing demand for customized solutions for specific plant types. These trends reflect a broader movement towards environmentally responsible gardening.

US Turf and Ornamental Protection Market

| Segmentation Details | Description |

|---|---|

| Product Type | Herbicides, Insecticides, Fungicides, Fertilizers |

| Application | Golf Courses, Sports Fields, Residential Lawns, Commercial Landscapes |

| End User | Landscapers, Golf Course Managers, Homeowners, Agricultural Producers |

| Distribution Channel | Retail Stores, Online Platforms, Wholesale Distributors, Garden Centers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Turf and Ornamental Protection Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at