444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US transformer market represents a critical component of America’s electrical infrastructure, encompassing power distribution, transmission, and specialized electrical equipment sectors. This comprehensive market analysis reveals significant growth opportunities driven by modernization initiatives, renewable energy integration, and smart grid development across the United States. Market dynamics indicate robust expansion fueled by aging infrastructure replacement needs and increasing electricity demand from industrial, commercial, and residential sectors.

Transformer technology continues evolving with advanced materials, digital monitoring capabilities, and enhanced efficiency standards. The market encompasses various transformer types including power transformers, distribution transformers, instrument transformers, and specialty units designed for specific applications. Growth projections suggest the market will experience a 6.2% CAGR through the forecast period, driven by utility modernization programs and renewable energy integration requirements.

Regional distribution shows concentrated demand in industrial corridors, urban centers, and renewable energy development zones. The market benefits from supportive regulatory frameworks, infrastructure investment programs, and technological advancement initiatives. Key market participants include established manufacturers, emerging technology providers, and specialized component suppliers serving diverse end-user segments.

The US transformer market refers to the comprehensive ecosystem of electrical transformer manufacturing, distribution, installation, and maintenance services within the United States, encompassing all voltage levels from low-voltage distribution to high-voltage transmission applications across utility, industrial, commercial, and residential sectors.

Transformer systems serve as essential electrical infrastructure components that modify voltage levels, enabling efficient power transmission and distribution throughout the electrical grid. These devices facilitate voltage step-up for long-distance transmission, step-down for local distribution, and specialized applications including isolation, impedance matching, and power quality improvement.

Market scope includes various transformer categories such as power transformers for utility applications, distribution transformers for local networks, instrument transformers for measurement and protection, and specialty transformers for industrial processes. The market encompasses both oil-filled and dry-type technologies, with emerging trends toward environmentally friendly designs and smart monitoring capabilities.

Strategic analysis of the US transformer market reveals substantial growth potential driven by infrastructure modernization, renewable energy integration, and grid reliability enhancement initiatives. The market demonstrates resilience through diverse application segments, technological innovation, and supportive regulatory environments promoting electrical infrastructure development.

Key growth drivers include aging infrastructure replacement needs, with approximately 70% of transmission infrastructure exceeding 25 years of age, creating significant replacement demand. Renewable energy integration requirements drive specialized transformer demand for wind farms, solar installations, and energy storage systems. Smart grid initiatives promote advanced transformer technologies with digital monitoring and control capabilities.

Market segmentation analysis shows power transformers commanding significant market share in utility applications, while distribution transformers dominate in commercial and residential sectors. Industrial applications drive demand for specialized transformers designed for specific processes, voltage requirements, and environmental conditions. Regional concentration occurs in areas with high industrial activity, renewable energy development, and urban population centers.

Competitive landscape features established manufacturers with comprehensive product portfolios, emerging technology providers focusing on innovation, and specialized suppliers serving niche applications. Market consolidation trends create opportunities for strategic partnerships, technology licensing, and vertical integration initiatives.

Market intelligence reveals several critical insights shaping the US transformer industry’s trajectory and competitive dynamics:

Primary growth drivers propelling the US transformer market include comprehensive infrastructure modernization initiatives addressing aging electrical systems nationwide. Utility companies face increasing pressure to replace transformers installed decades ago, with many units approaching or exceeding design life expectations. This replacement cycle creates sustained demand for modern transformer technologies offering improved efficiency, reliability, and monitoring capabilities.

Renewable energy expansion significantly impacts transformer demand as wind farms, solar installations, and energy storage systems require specialized equipment for grid interconnection. These applications demand transformers capable of handling variable power flows, voltage fluctuations, and bidirectional energy transfer. Clean energy initiatives drive approximately 25% of new transformer installations in certain regions, creating opportunities for specialized product development.

Grid modernization programs promote smart transformer adoption with digital monitoring, remote control, and predictive maintenance capabilities. These advanced systems enable utilities to optimize grid operations, reduce maintenance costs, and improve system reliability. Industrial growth in manufacturing, data centers, and technology sectors creates additional demand for specialized transformers serving specific voltage and power requirements.

Regulatory compliance drives adoption of higher efficiency transformers meeting updated energy standards. These requirements promote advanced core materials, optimized winding designs, and improved cooling systems that reduce energy losses and operational costs throughout transformer lifecycles.

Market challenges include significant capital investment requirements for transformer procurement and installation, particularly for large power transformers serving utility applications. High upfront costs can delay infrastructure projects and limit market growth, especially for smaller utilities and industrial customers with constrained budgets.

Supply chain complexities affect transformer availability and pricing, with specialized components requiring long lead times and careful coordination among multiple suppliers. Raw material price volatility, particularly for copper, steel, and specialized insulating materials, creates cost pressures and project planning challenges for market participants.

Technical complexity in modern transformer systems requires specialized expertise for design, installation, and maintenance activities. Skills shortages in electrical engineering and technical trades can limit market growth and increase project costs. Regulatory compliance requirements add complexity and cost to transformer development and manufacturing processes.

Environmental concerns regarding traditional transformer fluids and disposal requirements create additional compliance costs and operational challenges. Legacy transformer replacement often involves environmental remediation activities that increase project complexity and duration.

Significant opportunities emerge from the ongoing energy transition toward renewable sources and grid modernization initiatives. The integration of distributed energy resources creates demand for advanced transformer technologies capable of managing bidirectional power flows, voltage regulation, and grid stability functions.

Smart grid development presents opportunities for intelligent transformer systems with integrated sensors, communication capabilities, and predictive analytics. These advanced systems enable utilities to optimize operations, reduce maintenance costs, and improve system reliability through real-time monitoring and automated control functions.

Industrial expansion in sectors such as data centers, electric vehicle manufacturing, and advanced manufacturing creates demand for specialized transformers with specific voltage, power, and environmental requirements. Market penetration in these growing sectors offers approximately 15% annual growth potential for specialized transformer applications.

Export opportunities exist for US transformer manufacturers serving international markets with advanced technology products and engineering services. Domestic manufacturing capabilities provide competitive advantages in quality, delivery, and technical support for global customers seeking reliable transformer solutions.

Market dynamics reflect the complex interplay between infrastructure investment cycles, technological advancement, and regulatory requirements shaping the US transformer industry. Utility modernization programs create sustained demand for replacement transformers while driving adoption of advanced technologies with enhanced monitoring and control capabilities.

Competitive forces include established manufacturers with comprehensive product portfolios competing against specialized suppliers focusing on niche applications and emerging technologies. Market consolidation trends create opportunities for strategic partnerships while potentially reducing competitive intensity in certain segments.

Technology evolution drives continuous product development in areas such as digital monitoring, predictive maintenance, and environmental compliance. Advanced materials and manufacturing processes enable higher efficiency levels and improved reliability while meeting increasingly stringent regulatory requirements.

Customer preferences shift toward comprehensive solutions including installation, commissioning, and lifecycle maintenance services. This trend creates opportunities for market participants offering integrated service capabilities and long-term customer relationships. Efficiency improvements of up to 12% in energy losses drive adoption of premium transformer technologies despite higher initial costs.

Comprehensive research methodology employed for this market analysis incorporates primary research through industry expert interviews, utility company surveys, and manufacturer consultations. Secondary research includes analysis of industry reports, regulatory filings, and technical publications from authoritative sources within the electrical equipment sector.

Data collection encompasses quantitative analysis of market trends, pricing dynamics, and competitive positioning combined with qualitative insights regarding technology developments, regulatory impacts, and customer preferences. MarkWide Research analytical frameworks ensure comprehensive coverage of market segments, regional variations, and emerging trends affecting the transformer industry.

Market sizing methodology utilizes bottom-up analysis of end-user segments, application categories, and regional markets combined with top-down validation through industry statistics and expert opinions. Forecasting models incorporate historical trends, planned infrastructure projects, and regulatory requirement impacts on future demand patterns.

Quality assurance processes include data triangulation from multiple sources, expert validation of key findings, and sensitivity analysis of critical assumptions underlying market projections and growth estimates.

Regional market distribution shows significant concentration in industrial corridors, major metropolitan areas, and regions with substantial renewable energy development. The Northeast region commands approximately 28% market share driven by aging infrastructure replacement needs and high population density requiring extensive distribution networks.

Western states demonstrate strong growth potential through renewable energy integration projects, particularly in California, Texas, and other states with aggressive clean energy mandates. These regions drive demand for specialized transformers supporting wind farms, solar installations, and energy storage systems. Market growth rates in renewable-focused regions exceed 8% annually compared to national averages.

Southern regions benefit from industrial expansion, population growth, and infrastructure development projects creating sustained transformer demand. The Gulf Coast area shows particular strength in industrial applications serving petrochemical, refining, and manufacturing sectors with specialized power requirements.

Midwest markets focus on agricultural applications, manufacturing facilities, and utility infrastructure serving rural and suburban communities. These regions emphasize reliability and cost-effectiveness in transformer selection while gradually adopting advanced monitoring technologies for improved operational efficiency.

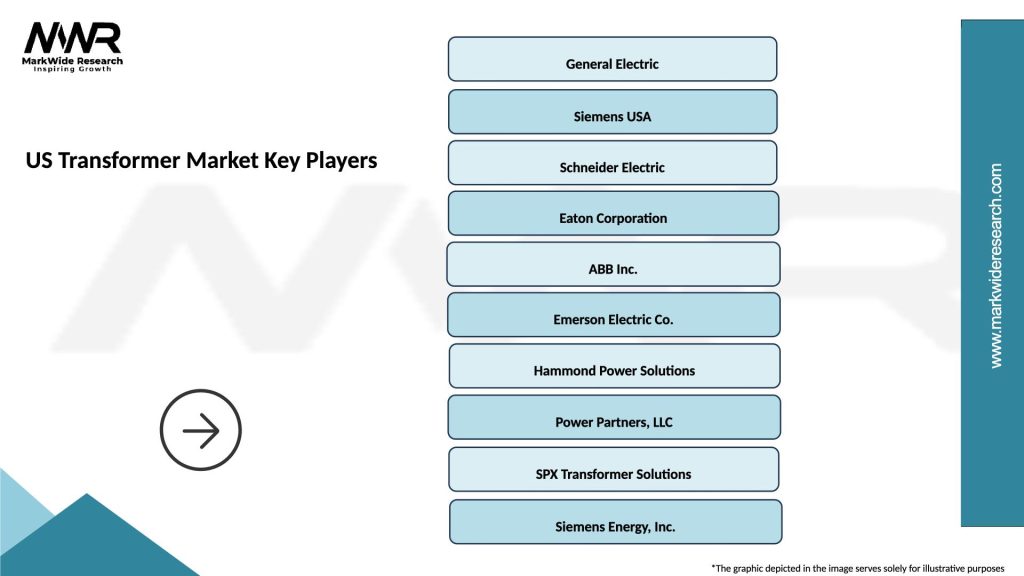

Market leadership is distributed among several key players with distinct competitive advantages and market positioning strategies:

Competitive strategies include technology differentiation, service expansion, and strategic partnerships with utilities and engineering firms. Market participants invest heavily in research and development to maintain technological leadership while expanding manufacturing capabilities to meet growing demand.

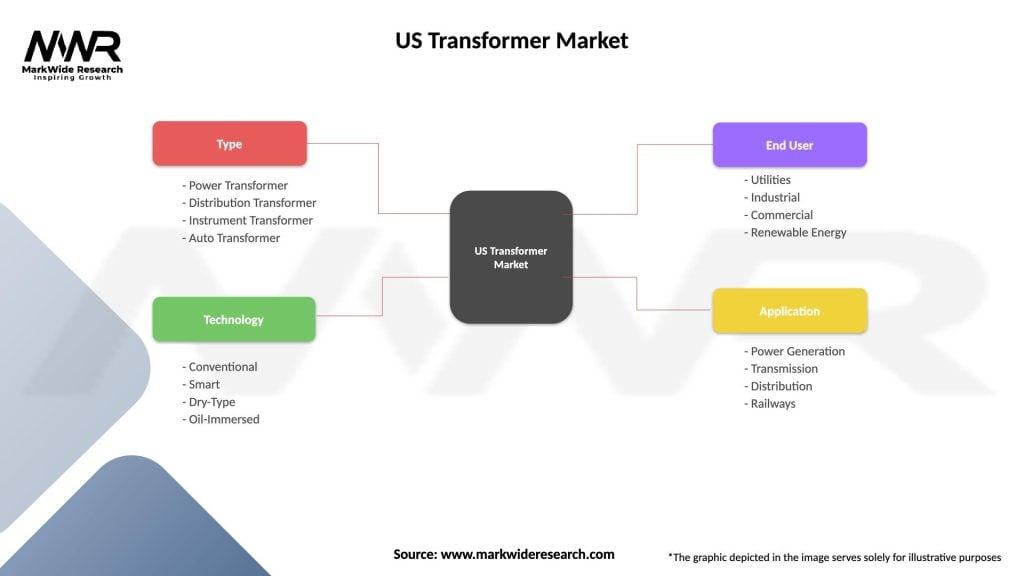

Market segmentation analysis reveals distinct categories based on product type, application, voltage level, and end-user requirements:

By Product Type:

By Application:

By Voltage Level:

Power transformer segment demonstrates strong growth driven by utility infrastructure modernization and renewable energy integration requirements. These large units require specialized manufacturing capabilities, extensive testing, and complex installation procedures. Market demand shows approximately 35% concentration in power transformer applications serving transmission and subtransmission networks.

Distribution transformers represent the largest volume segment with widespread applications in commercial, residential, and light industrial sectors. These units benefit from standardization opportunities while incorporating efficiency improvements and digital monitoring capabilities. Technology trends include adoption of amorphous core materials and environmentally friendly insulating fluids.

Instrument transformers show steady growth driven by grid modernization initiatives requiring advanced measurement and protection systems. These specialized units enable accurate monitoring, control, and protection of electrical systems while supporting smart grid functionality development.

Specialty transformers serve niche applications with customized designs for specific voltage, power, and environmental requirements. This segment offers higher margins but requires specialized engineering capabilities and flexible manufacturing processes to meet diverse customer specifications.

Utility companies benefit from modern transformer technologies offering improved reliability, efficiency, and monitoring capabilities that reduce operational costs and enhance system performance. Advanced transformers enable utilities to optimize grid operations, implement predictive maintenance programs, and improve customer service through reduced outages and faster restoration times.

Industrial customers gain access to specialized transformer solutions designed for specific process requirements, environmental conditions, and operational constraints. These customized solutions optimize energy efficiency, reduce maintenance requirements, and improve production reliability while meeting regulatory compliance standards.

Manufacturers benefit from growing market demand driven by infrastructure modernization and renewable energy integration. Technology leadership in areas such as digital monitoring, efficiency improvement, and environmental compliance creates competitive advantages and premium pricing opportunities.

Service providers gain opportunities through increasing demand for installation, commissioning, maintenance, and lifecycle management services. Service market growth exceeds 10% annually as customers seek comprehensive solutions rather than equipment-only purchases.

Technology suppliers benefit from increasing adoption of advanced materials, digital monitoring systems, and smart grid technologies integrated into modern transformer designs. These specialized components command premium pricing while enabling differentiated product offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend with intelligent transformers incorporating sensors, communication systems, and analytics capabilities. These smart transformers enable real-time monitoring, predictive maintenance, and automated control functions that optimize grid operations and reduce lifecycle costs. Adoption rates for digital monitoring systems reach approximately 40% in new installations.

Sustainability focus drives development of environmentally friendly transformer technologies including biodegradable insulating fluids, recyclable materials, and energy-efficient designs. Manufacturers invest in green technology development to meet environmental regulations and customer sustainability requirements.

Modular design concepts gain traction for applications requiring flexible installation, maintenance, and expansion capabilities. These designs enable faster deployment, reduced installation costs, and improved serviceability compared to traditional transformer configurations.

Cybersecurity integration becomes critical as transformers incorporate digital communication and control systems. Manufacturers develop security protocols and hardware solutions to protect against cyber threats while maintaining operational functionality and reliability.

Condition monitoring advancement utilizes artificial intelligence and machine learning algorithms to analyze transformer performance data and predict maintenance requirements. These systems enable proactive maintenance strategies that reduce unplanned outages and extend equipment lifecycles.

Recent industry developments include significant investments in domestic manufacturing capabilities to reduce supply chain dependencies and improve delivery times. Major manufacturers expand production facilities and develop specialized capabilities for emerging applications such as renewable energy integration and electric vehicle charging infrastructure.

Technology partnerships between transformer manufacturers and digital technology providers accelerate development of smart transformer solutions. These collaborations combine traditional electrical engineering expertise with advanced software and analytics capabilities to create differentiated product offerings.

Regulatory initiatives promote higher efficiency standards and environmental compliance requirements that drive product innovation and market differentiation. New standards for energy efficiency, environmental impact, and safety performance create opportunities for technology leaders while challenging traditional approaches.

Strategic acquisitions reshape the competitive landscape as companies seek to expand technological capabilities, market reach, and service offerings. MWR analysis indicates consolidation trends continue as market participants pursue scale advantages and comprehensive solution capabilities.

Research and development investments focus on advanced materials, digital integration, and specialized applications serving emerging market segments. These investments enable product differentiation and premium pricing while addressing evolving customer requirements and regulatory standards.

Strategic recommendations for market participants include prioritizing digital transformation initiatives that integrate monitoring, analytics, and control capabilities into transformer products. Companies should invest in software development capabilities and strategic partnerships to compete effectively in the evolving smart grid marketplace.

Manufacturing optimization should focus on flexible production capabilities that can adapt to changing product mix requirements and customer specifications. Lean manufacturing principles and advanced production technologies can improve efficiency while maintaining quality standards and delivery performance.

Service expansion represents a significant growth opportunity as customers increasingly seek comprehensive lifecycle solutions rather than equipment-only purchases. Companies should develop service capabilities including installation, commissioning, maintenance, and asset management to capture additional value and strengthen customer relationships.

Technology investment priorities should include advanced materials research, digital integration capabilities, and environmental compliance solutions. These investments enable product differentiation and premium pricing while addressing regulatory requirements and customer sustainability goals.

Market diversification strategies should explore emerging applications such as electric vehicle charging infrastructure, data center power systems, and renewable energy integration. These growing segments offer opportunities for specialized products and premium pricing compared to traditional utility applications.

Long-term market prospects remain positive driven by ongoing infrastructure modernization requirements, renewable energy integration, and smart grid development initiatives. The market is expected to maintain steady growth with projected CAGR of 6.8% through the next decade, supported by favorable regulatory environments and increasing electricity demand.

Technology evolution will continue toward intelligent transformer systems with enhanced monitoring, control, and analytics capabilities. Integration of artificial intelligence, machine learning, and advanced materials will create new product categories and application opportunities while improving operational efficiency and reliability.

Market consolidation trends are expected to continue as companies seek scale advantages, technological capabilities, and comprehensive service offerings. Strategic partnerships and acquisitions will reshape the competitive landscape while creating opportunities for specialized suppliers and technology providers.

Regulatory developments will drive continued focus on efficiency improvement, environmental compliance, and safety standards. These requirements create opportunities for technology leaders while potentially challenging traditional approaches and business models.

MarkWide Research projections indicate that emerging applications in renewable energy, electric vehicles, and industrial automation will drive approximately 30% of market growth over the forecast period, creating opportunities for specialized transformer solutions and premium pricing strategies.

The US transformer market presents substantial opportunities for growth and innovation driven by infrastructure modernization, renewable energy integration, and digital transformation initiatives. Market participants who invest in advanced technologies, comprehensive service capabilities, and strategic partnerships will be well-positioned to capitalize on emerging opportunities and maintain competitive advantages.

Success factors include technology leadership in smart transformer solutions, manufacturing flexibility to serve diverse applications, and service capabilities that provide comprehensive lifecycle support. Companies must balance investment in innovation with operational efficiency to compete effectively in this evolving marketplace.

Market outlook remains positive with sustained growth expected across multiple segments and applications. The combination of aging infrastructure replacement needs, renewable energy expansion, and smart grid development creates a favorable environment for transformer manufacturers and service providers committed to meeting evolving customer requirements and regulatory standards.

What is Transformer?

Transformers are electrical devices that transfer electrical energy between two or more circuits through electromagnetic induction. They are essential in power distribution and voltage regulation in various applications, including residential, commercial, and industrial sectors.

What are the key players in the US Transformer Market?

Key players in the US Transformer Market include General Electric, Siemens, Schneider Electric, and Eaton, among others. These companies are known for their innovative transformer solutions and extensive product portfolios.

What are the main drivers of growth in the US Transformer Market?

The growth of the US Transformer Market is driven by increasing demand for electricity, the expansion of renewable energy sources, and the need for grid modernization. Additionally, the rise in electric vehicle adoption is also contributing to market growth.

What challenges does the US Transformer Market face?

The US Transformer Market faces challenges such as the high cost of raw materials and the complexity of manufacturing processes. Additionally, regulatory compliance and the need for technological upgrades can pose significant hurdles for manufacturers.

What opportunities exist in the US Transformer Market?

Opportunities in the US Transformer Market include advancements in smart grid technology and the increasing integration of renewable energy sources. Furthermore, the growing focus on energy efficiency presents new avenues for innovation and product development.

What trends are shaping the US Transformer Market?

Trends in the US Transformer Market include the shift towards digital transformers, increased automation in manufacturing, and the development of eco-friendly transformer designs. These trends are driven by the need for improved efficiency and sustainability in energy systems.

US Transformer Market

| Segmentation Details | Description |

|---|---|

| Type | Power Transformer, Distribution Transformer, Instrument Transformer, Auto Transformer |

| Technology | Conventional, Smart, Dry-Type, Oil-Immersed |

| End User | Utilities, Industrial, Commercial, Renewable Energy |

| Application | Power Generation, Transmission, Distribution, Railways |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Transformer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at