444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US student accommodation market represents a dynamic and rapidly evolving sector within the broader real estate industry, catering specifically to the housing needs of college and university students across the nation. This specialized market encompasses various housing solutions including purpose-built student accommodation (PBSA), traditional dormitories, off-campus apartments, and shared housing arrangements designed to meet the unique requirements of student populations.

Market dynamics indicate robust growth driven by increasing enrollment rates, evolving student preferences for modern amenities, and growing demand for convenient, technology-enabled living spaces. The sector has experienced significant transformation over the past decade, with developers and operators focusing on creating comprehensive living experiences that extend beyond basic accommodation to include study spaces, recreational facilities, and community-building amenities.

Geographic distribution shows concentrated development in major university towns and metropolitan areas with significant student populations. Key markets include California, Texas, New York, Florida, and Illinois, where large public and private institutions drive consistent demand for quality student housing options. The market demonstrates resilience due to the essential nature of student accommodation and the steady pipeline of incoming students each academic year.

Investment activity has intensified as institutional investors recognize the sector’s defensive characteristics and attractive risk-adjusted returns. The market benefits from predictable cash flows, limited seasonality compared to other real estate sectors, and growing recognition of student accommodation as a distinct asset class worthy of dedicated investment strategies.

The US student accommodation market refers to the comprehensive ecosystem of housing solutions specifically designed, developed, and operated to serve the residential needs of college and university students throughout the United States. This market encompasses both on-campus and off-campus housing options, ranging from traditional dormitory-style accommodations to modern, amenity-rich apartment complexes and purpose-built student communities.

Core components of this market include various property types such as residence halls, apartment-style housing, townhomes, and specialized student living facilities that offer furnished units, flexible lease terms aligned with academic calendars, and services tailored to student lifestyles. The market serves both domestic and international students pursuing undergraduate, graduate, and professional degree programs across diverse educational institutions.

Operational characteristics distinguish student accommodation from conventional residential real estate through specialized management practices, academic year-based leasing cycles, and comprehensive support services including resident advisors, academic support facilities, and social programming designed to enhance the student experience and foster community engagement within residential environments.

Strategic positioning of the US student accommodation market reflects a mature yet continuously evolving sector characterized by increasing sophistication in development approaches, operational strategies, and investment methodologies. The market has demonstrated remarkable resilience through various economic cycles, supported by the fundamental necessity of student housing and the relatively inelastic demand from educational institutions and their student populations.

Growth trajectories indicate sustained expansion driven by several key factors including rising higher education enrollment, particularly among international students, increasing preference for off-campus living arrangements, and growing demand for premium amenities and services. The market benefits from demographic trends showing continued growth in college-age populations and expanding accessibility to higher education across diverse socioeconomic segments.

Investment landscape has evolved significantly with institutional capital recognizing student accommodation as a defensive real estate sector offering attractive yields and portfolio diversification benefits. Private equity firms, real estate investment trusts, and pension funds have increased their allocation to student housing, driving professionalization of development and management practices across the sector.

Technological integration has become increasingly important, with operators implementing digital platforms for leasing, resident services, and community engagement. Smart building technologies, high-speed internet infrastructure, and mobile applications for resident communication represent standard expectations rather than premium amenities in modern student accommodation developments.

Demand fundamentals remain robust across major university markets, with occupancy rates consistently maintaining strong levels despite periodic supply additions. The market benefits from predictable demand patterns tied to academic enrollment cycles and the essential nature of student housing needs.

Educational expansion continues to fuel market growth as universities increase enrollment capacity and expand program offerings to meet growing demand for higher education. This expansion creates direct demand for additional student housing capacity and drives development of new accommodation facilities in established and emerging university markets.

Demographic trends support sustained market growth through increasing college-age populations and rising participation rates in higher education across diverse demographic segments. The market benefits from growing recognition of higher education as essential for career advancement and economic mobility, driving consistent demand for quality student housing options.

International education represents a significant growth driver, with foreign students requiring comprehensive housing solutions that address unique needs including cultural integration, extended lease terms, and specialized support services. This segment often demonstrates willingness to pay premium rates for quality accommodations and comprehensive services.

Parental involvement in housing decisions has intensified, with families increasingly viewing student accommodation as an investment in educational success and personal development. This trend drives demand for higher-quality facilities and comprehensive services that provide peace of mind for parents and enhanced experiences for students.

Urban development patterns increasingly integrate student housing into broader mixed-use developments and urban revitalization projects, creating opportunities for innovative accommodation solutions that serve both student populations and broader community needs while enhancing property values and local economic development.

Regulatory challenges present ongoing constraints through complex zoning requirements, building codes, and local government policies that can limit development opportunities and increase project costs. Many municipalities struggle to balance student housing needs with community concerns about density, parking, and neighborhood character.

Construction costs have increased significantly, impacting development feasibility and requiring operators to balance affordability concerns with the need to deliver quality accommodations that meet modern student expectations. Rising material costs, labor shortages, and regulatory compliance requirements contribute to development cost pressures.

Affordability concerns limit market accessibility for many students, particularly those from lower-income backgrounds who may struggle with premium pricing for modern student accommodation options. This creates tension between market positioning strategies and broader accessibility objectives within higher education.

Seasonal occupancy patterns create operational challenges and revenue volatility, particularly for properties heavily dependent on traditional academic calendar cycles. Summer occupancy strategies and year-round programming require additional investment and operational complexity to optimize property performance.

Competition intensity has increased as more developers and operators enter attractive markets, potentially leading to oversupply conditions in certain locations and pressure on rental rates and occupancy levels. Market saturation risks require careful market analysis and differentiation strategies.

Technology integration offers substantial opportunities for operational efficiency improvements and enhanced resident experiences through smart building systems, digital service platforms, and data analytics capabilities. Operators can leverage technology to reduce operational costs while improving service delivery and resident satisfaction.

Public-private partnerships present opportunities for innovative development approaches that combine public sector land and policy support with private sector expertise and capital. These partnerships can address affordability challenges while delivering quality accommodations that serve broader community development objectives.

Sustainability initiatives create opportunities for differentiation and operational cost savings through energy-efficient building systems, renewable energy integration, and sustainable operational practices. Green building certifications and sustainability programs can attract environmentally conscious students and reduce long-term operating expenses.

Ancillary services represent significant revenue enhancement opportunities through retail partnerships, food service operations, fitness and wellness programs, and academic support services. These services can improve resident satisfaction while generating additional revenue streams and creating competitive advantages.

Market expansion opportunities exist in secondary and tertiary university markets where student housing supply has not kept pace with enrollment growth. These markets often offer more attractive development economics and less competitive operating environments while serving genuine student housing needs.

Supply and demand dynamics vary significantly across different university markets, with tier-one institutions and major metropolitan areas experiencing consistent demand growth while smaller markets may face more cyclical patterns. Understanding local market dynamics is crucial for successful development and investment strategies.

Competitive landscape has evolved from primarily local operators to include national and international companies with sophisticated development and management capabilities. This professionalization has raised operational standards while increasing competition for prime development sites and acquisition opportunities.

Student preferences continue evolving toward higher-quality accommodations with comprehensive amenities, flexible lease terms, and integrated technology solutions. Modern students expect accommodation experiences that support both academic success and personal development through community programming and support services.

Investment flows have increased substantially as institutional investors recognize student accommodation as a distinct asset class with attractive risk-return characteristics. This capital influx has supported market growth while raising development standards and operational sophistication across the sector.

Operational innovation drives continuous improvement in service delivery, cost management, and resident satisfaction through technology adoption, process optimization, and enhanced staff training programs. Leading operators focus on creating comprehensive living experiences that extend beyond basic accommodation services.

Comprehensive analysis of the US student accommodation market employs multiple research methodologies to ensure accurate and actionable insights for industry participants and stakeholders. The research approach combines quantitative data analysis with qualitative insights gathered from industry experts, operators, and market participants.

Primary research includes extensive interviews with key industry stakeholders including developers, operators, investors, university administrators, and students to gather firsthand insights into market trends, challenges, and opportunities. This primary research provides context and validation for quantitative market data and trend analysis.

Secondary research incorporates analysis of industry reports, academic studies, government data, and proprietary databases to establish comprehensive market baselines and identify emerging trends. This research foundation supports accurate market sizing and growth projections while ensuring historical context for current market conditions.

Market surveys conducted among student populations provide insights into housing preferences, satisfaction levels, and emerging needs that drive market evolution. These surveys help identify gaps between current market offerings and student expectations, informing development and operational strategies.

Data validation processes ensure research accuracy through cross-referencing multiple data sources, expert review, and statistical analysis techniques. According to MarkWide Research methodology, this multi-layered validation approach provides confidence in market insights and projections while identifying potential data limitations or market uncertainties.

California markets represent the largest concentration of student accommodation demand, driven by the University of California system, California State University campuses, and numerous private institutions. The state’s high cost of living and limited housing supply create strong fundamentals for student accommodation development, with 35% market share of national student housing investment activity.

Texas markets demonstrate robust growth supported by large public universities including the University of Texas system and Texas A&M University. The state’s favorable business climate and population growth contribute to sustained demand for student housing, representing approximately 18% market share of national development activity.

Northeast corridor markets including New York, Massachusetts, and Pennsylvania benefit from high concentrations of prestigious universities and colleges. These markets command premium rents but face significant development challenges due to high land costs and complex regulatory environments, accounting for 22% market share of total accommodation supply.

Southeast markets show strong growth potential driven by expanding university systems and favorable demographic trends. States including Florida, Georgia, and North Carolina attract both domestic and international students, creating opportunities for accommodation development and representing 15% market share of national capacity.

Midwest markets centered around major university towns demonstrate stable demand patterns and attractive development economics. These markets often offer more affordable accommodation options while maintaining quality standards, contributing 10% market share to national student housing inventory.

Market leadership is distributed among several major operators who have established national platforms through development, acquisition, and management expertise. These companies leverage economies of scale, standardized operating procedures, and institutional capital relationships to maintain competitive advantages.

By Property Type: The market segments into distinct categories based on accommodation styles and operational characteristics, each serving different student preferences and budget requirements while addressing specific market needs.

By Student Type: Market segmentation reflects diverse student populations with varying accommodation needs, preferences, and financial capabilities requiring tailored housing solutions.

By Location: Geographic segmentation reflects different market dynamics, development opportunities, and operational considerations across various university environments.

Purpose-Built Student Accommodation represents the fastest-growing segment, driven by student preferences for modern amenities and comprehensive services. This category commands premium rents while delivering enhanced resident experiences through specialized design and operational approaches tailored specifically for student populations.

Luxury student housing has emerged as a distinct subcategory featuring high-end finishes, resort-style amenities, and concierge services. This segment targets affluent students and families willing to pay premium rates for exceptional accommodation experiences and comprehensive lifestyle services.

Affordable student housing addresses growing concerns about accommodation costs through innovative design approaches, operational efficiencies, and public-private partnerships. This category focuses on delivering quality housing options at accessible price points while maintaining essential services and amenities.

Co-living arrangements have gained popularity among students seeking community-oriented housing with shared common areas and collaborative living environments. This category emphasizes social interaction and shared experiences while providing private bedroom spaces and flexible lease arrangements.

Micro-housing solutions address space constraints and affordability challenges through efficient unit designs and shared amenities. This emerging category maximizes space utilization while providing essential accommodation features at competitive price points in high-demand markets.

Investors benefit from stable cash flows, defensive characteristics, and attractive risk-adjusted returns that outperform many traditional real estate sectors. Student accommodation provides portfolio diversification and inflation protection through regular rent escalations and limited correlation with broader economic cycles.

Developers gain access to a specialized market with predictable demand patterns and opportunities for value creation through innovative design and comprehensive service offerings. The sector rewards expertise in student-focused development and operational strategies that enhance resident satisfaction and financial performance.

Universities receive valuable partnerships that address student housing shortages while allowing institutions to focus resources on core educational missions. Public-private partnerships can deliver modern accommodation facilities without requiring significant institutional capital investment or operational expertise.

Students enjoy access to high-quality housing options with comprehensive amenities and services designed to support academic success and personal development. Modern student accommodation provides safe, convenient living environments with technology infrastructure and community programming that enhance the overall educational experience.

Communities benefit from economic development, job creation, and increased local spending generated by student housing developments. Well-designed projects can contribute to neighborhood revitalization while providing tax revenue and supporting local businesses through increased student population density.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wellness-focused design has become a central trend, with developers incorporating fitness facilities, mental health resources, and outdoor spaces that support student well-being. This trend reflects growing awareness of the connection between living environment and academic performance, driving demand for accommodation that prioritizes resident health and wellness.

Technology integration continues advancing through smart building systems, mobile applications, and digital service platforms that streamline resident experiences. Students expect seamless technology integration including high-speed internet, smart locks, mobile payments, and digital communication platforms for community engagement and service requests.

Flexible living arrangements are gaining popularity as students seek accommodation options that adapt to changing needs and preferences. This includes convertible spaces, short-term lease options, and co-living arrangements that provide social interaction while maintaining privacy and individual space requirements.

Sustainability initiatives have become standard expectations rather than premium features, with students increasingly choosing accommodation based on environmental credentials. Green building certifications, renewable energy systems, and sustainable operational practices represent competitive advantages in student housing markets.

Community programming has expanded beyond basic social activities to include academic support, professional development, and cultural programming that enhances the residential experience. Operators invest in comprehensive programming that supports student success while building strong residential communities and resident retention.

Institutional investment has increased dramatically as pension funds, sovereign wealth funds, and insurance companies recognize student accommodation as a mature asset class with attractive characteristics. This capital influx has supported market growth while raising operational standards and development quality across the sector.

Public-private partnerships have emerged as important development models, combining public sector land and policy support with private sector expertise and capital. These partnerships address affordability challenges while delivering quality accommodation that serves broader community development objectives and university strategic goals.

Technology adoption has accelerated across all aspects of student housing operations, from development and construction to leasing and resident services. PropTech solutions are transforming how operators manage properties, engage residents, and optimize operational efficiency while enhancing the overall student experience.

Consolidation activity has intensified as larger operators acquire regional companies and development platforms to achieve scale economies and market coverage. This consolidation trend is creating more sophisticated operators with enhanced capabilities and resources to serve diverse student populations effectively.

Regulatory evolution continues as municipalities adapt zoning codes and development policies to address student housing needs while managing community concerns. Progressive policies supporting student accommodation development are emerging in markets that recognize the economic benefits of university-related development.

Market entry strategies should focus on thorough due diligence of local university dynamics, enrollment trends, and competitive landscape before committing development or investment capital. Successful market entry requires understanding of specific student populations, housing preferences, and regulatory environment in target markets.

Differentiation approaches must emphasize unique value propositions that address specific student needs while creating sustainable competitive advantages. This includes specialized programming, innovative amenities, technology integration, or service offerings that distinguish properties from competitive alternatives in crowded markets.

Partnership development with universities, local governments, and service providers can create strategic advantages and reduce operational risks. Strong institutional relationships provide market intelligence, development opportunities, and operational support that enhance long-term success in student accommodation markets.

Technology investment should prioritize solutions that improve operational efficiency while enhancing resident experiences and satisfaction. Operators should evaluate technology platforms based on their ability to streamline operations, reduce costs, and provide measurable improvements in resident engagement and retention.

Risk management strategies must address market-specific challenges including enrollment volatility, regulatory changes, and competitive pressures. Diversification across multiple markets, property types, and student segments can reduce concentration risk while providing growth opportunities in different market conditions.

Growth projections indicate continued market expansion driven by sustained enrollment growth, evolving student preferences, and increasing institutional investment in the sector. MarkWide Research analysis suggests the market will maintain strong fundamentals supported by demographic trends and the essential nature of student accommodation needs.

Development trends will emphasize sustainability, technology integration, and flexible design approaches that can adapt to changing student needs and preferences. Future developments will likely incorporate advanced building systems, renewable energy technologies, and innovative space utilization strategies that optimize both resident experience and operational efficiency.

Investment evolution will see continued institutionalization of the sector with more sophisticated capital sources and investment strategies. The market is expected to attract additional international investment while domestic institutions increase their allocation to student accommodation as a core real estate investment strategy.

Operational innovation will focus on service delivery enhancement, cost optimization, and resident satisfaction improvement through technology adoption and process innovation. Leading operators will differentiate through comprehensive service offerings that support student success while generating attractive financial returns for investors.

Market maturation will result in higher operational standards, more sophisticated development approaches, and enhanced resident experiences across all market segments. This maturation process will benefit students through improved accommodation options while providing investors with more predictable and attractive investment opportunities in the sector.

The US student accommodation market represents a dynamic and resilient sector within the broader real estate industry, characterized by strong fundamentals, growing institutional recognition, and continuous evolution to meet changing student needs and preferences. The market benefits from predictable demand patterns, defensive characteristics, and opportunities for value creation through innovative development and operational approaches.

Strategic opportunities exist across multiple market segments and geographic regions, with particular potential in underserved markets, technology integration, and sustainability initiatives. Success in this sector requires deep understanding of student populations, university dynamics, and local market conditions, combined with operational expertise and appropriate capital resources.

Future prospects remain positive, supported by demographic trends, continued enrollment growth, and increasing recognition of student accommodation as a distinct and attractive asset class. The market will continue evolving through technology adoption, sustainability initiatives, and enhanced service delivery that supports both student success and investor returns in this essential and growing sector.

What is Student Accommodation?

Student accommodation refers to housing options specifically designed for students, including dormitories, shared apartments, and private rentals. These accommodations often provide amenities tailored to student needs, such as study areas and proximity to educational institutions.

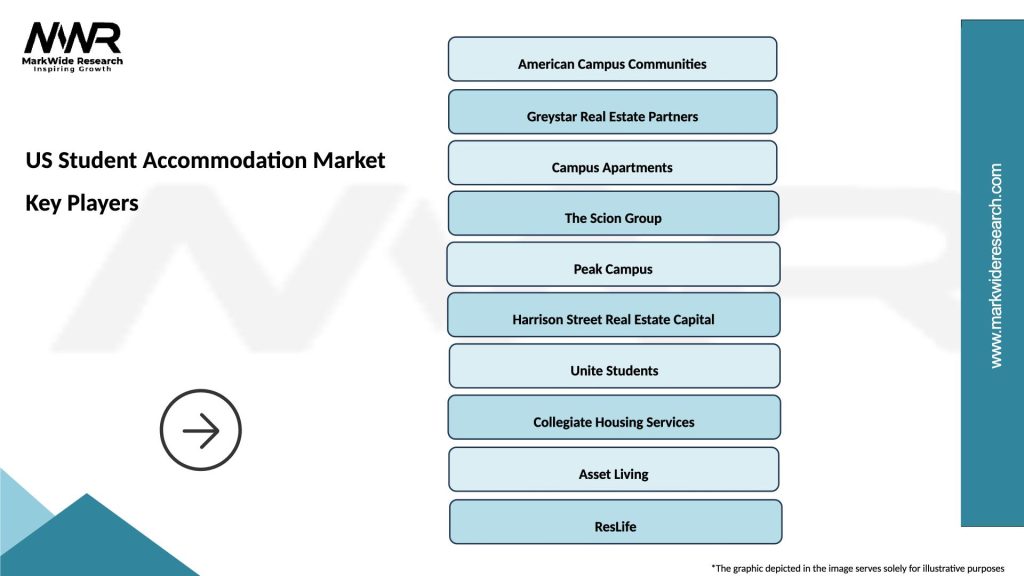

What are the key players in the US Student Accommodation Market?

Key players in the US Student Accommodation Market include companies like Greystar, American Campus Communities, and Campus Apartments. These firms specialize in providing various housing solutions for students, catering to different preferences and budgets, among others.

What are the main drivers of growth in the US Student Accommodation Market?

The main drivers of growth in the US Student Accommodation Market include the increasing number of students enrolling in higher education, the rising demand for quality housing, and the trend towards urban living among students. Additionally, the expansion of international student populations contributes to this growth.

What challenges does the US Student Accommodation Market face?

The US Student Accommodation Market faces challenges such as rising construction costs, regulatory hurdles, and competition from alternative housing options like short-term rentals. These factors can impact the availability and affordability of student housing.

What opportunities exist in the US Student Accommodation Market?

Opportunities in the US Student Accommodation Market include the development of purpose-built student housing and the integration of technology for enhanced living experiences. Additionally, there is potential for growth in sustainable accommodation options that appeal to environmentally conscious students.

What trends are shaping the US Student Accommodation Market?

Trends shaping the US Student Accommodation Market include the rise of co-living spaces, increased focus on wellness amenities, and the incorporation of smart technology in housing. These trends reflect changing student preferences and the need for more community-oriented living environments.

US Student Accommodation Market

| Segmentation Details | Description |

|---|---|

| Type | On-Campus Housing, Off-Campus Housing, Shared Apartments, Private Dormitories |

| Customer Type | Undergraduate Students, Graduate Students, International Students, Exchange Students |

| Service Type | Short-Term Rentals, Long-Term Rentals, Furnished Accommodations, Unfurnished Accommodations |

| Facility Type | Studios, Multi-Bedroom Units, Townhouses, Co-Living Spaces |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Student Accommodation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at