444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US strategic consulting market represents a dynamic and rapidly evolving sector that provides critical advisory services to organizations across diverse industries. This market encompasses comprehensive business transformation solutions, including strategic planning, operational optimization, digital transformation initiatives, and organizational restructuring services. Strategic consulting firms in the United States serve as trusted advisors to Fortune 500 companies, government agencies, and emerging enterprises seeking to navigate complex business challenges and capitalize on growth opportunities.

Market dynamics indicate robust expansion driven by increasing demand for specialized expertise in digital transformation, sustainability consulting, and post-pandemic recovery strategies. The sector demonstrates remarkable resilience with projected growth rates of 8.2% CAGR through the forecast period. Technology integration and data-driven decision-making capabilities have become fundamental differentiators among leading consulting firms, while client expectations continue to evolve toward outcome-based engagement models.

Industry transformation accelerated significantly following global disruptions, with organizations increasingly relying on external strategic guidance to maintain competitive advantages. The market showcases strong regional concentration in major metropolitan areas, particularly New York, Chicago, Boston, and San Francisco, where 65% of strategic consulting activities are concentrated. Emerging trends include increased focus on environmental, social, and governance (ESG) consulting, artificial intelligence implementation strategies, and supply chain resilience planning.

The US strategic consulting market refers to the comprehensive ecosystem of professional advisory services that help organizations develop and implement strategic initiatives to achieve sustainable competitive advantages and operational excellence. This market encompasses specialized consulting firms, independent practitioners, and boutique advisory services that provide expert guidance on critical business decisions, organizational transformations, and strategic planning processes.

Strategic consulting services typically include comprehensive business strategy development, market entry strategies, merger and acquisition advisory, organizational design, change management, and performance improvement initiatives. These services are characterized by their focus on high-level strategic decision-making rather than operational implementation, requiring deep industry expertise and analytical capabilities to deliver actionable insights and recommendations.

Market participants range from global consulting giants with extensive resources and international reach to specialized boutique firms offering niche expertise in specific industries or functional areas. The sector serves diverse client segments including large corporations, government agencies, non-profit organizations, and private equity firms seeking strategic guidance for portfolio companies.

Strategic consulting demand in the United States continues to demonstrate exceptional growth momentum, driven by accelerating digital transformation initiatives and increasing complexity of business environments. Organizations across industries are investing heavily in external strategic expertise to navigate evolving market conditions, regulatory changes, and technological disruptions that require specialized knowledge and objective perspectives.

Key growth drivers include rising demand for sustainability and ESG consulting services, which now represent 23% of total consulting engagements, alongside continued expansion in technology strategy and digital transformation advisory services. The market benefits from strong client retention rates and expanding scope of services as consulting firms develop deeper relationships with existing clients while attracting new engagements through thought leadership and industry expertise.

Competitive dynamics reflect ongoing consolidation among mid-tier firms seeking to expand capabilities and geographic reach, while boutique specialists continue to thrive by offering deep expertise in emerging areas such as artificial intelligence strategy, cybersecurity consulting, and regulatory compliance advisory. The sector maintains healthy profit margins despite increasing competition, supported by strong demand for high-value strategic advisory services.

Future prospects remain highly favorable with projected growth acceleration driven by post-pandemic recovery strategies, increasing focus on operational resilience, and growing recognition of strategic consulting as essential for maintaining competitive positioning in rapidly evolving markets.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of strategic consulting services in the United States:

Market maturation indicators suggest continued evolution toward more specialized service offerings and deeper industry expertise, with successful firms developing proprietary methodologies and intellectual property to differentiate their value propositions.

Primary growth catalysts propelling the US strategic consulting market include accelerating digital transformation initiatives across industries, with organizations recognizing the critical importance of external expertise in navigating complex technology implementations and organizational changes. Digital disruption continues to create unprecedented challenges and opportunities, driving sustained demand for strategic guidance on technology adoption, data strategy, and digital business model development.

Regulatory complexity serves as another significant driver, particularly in heavily regulated industries such as healthcare, financial services, and energy. Organizations increasingly rely on specialized consulting expertise to navigate evolving compliance requirements, implement new regulatory frameworks, and maintain operational efficiency while meeting stringent regulatory standards.

Competitive pressures intensify across industries as market dynamics shift rapidly, creating sustained demand for strategic advisory services focused on competitive positioning, market entry strategies, and business model innovation. Companies seek external perspectives to identify emerging opportunities, assess competitive threats, and develop differentiated value propositions that resonate with evolving customer expectations.

Organizational transformation needs drive significant consulting demand as companies adapt to changing workforce dynamics, implement hybrid work models, and restructure operations for improved efficiency and agility. Change management expertise becomes increasingly valuable as organizations navigate complex transformations while maintaining operational continuity and employee engagement.

Economic uncertainties present ongoing challenges for the strategic consulting market, as organizations may defer or reduce consulting investments during periods of financial constraint or market volatility. Budget pressures can lead to delayed decision-making on strategic initiatives, impacting consulting firm revenue streams and growth projections.

Internal capability development represents a growing restraint as organizations invest in building internal strategic planning and analytical capabilities, potentially reducing reliance on external consulting services. Companies increasingly develop in-house expertise in areas traditionally dominated by external consultants, particularly in technology strategy and data analytics.

Pricing pressures intensify as clients become more sophisticated in evaluating consulting value propositions and demanding greater transparency in pricing models. Competitive bidding processes can compress margins and create pressure for consulting firms to demonstrate clear return on investment for their services.

Talent retention challenges within consulting firms can impact service quality and client satisfaction, as experienced consultants may transition to client organizations or establish independent practices. Knowledge management becomes critical as firms work to maintain institutional expertise and service consistency despite personnel changes.

Emerging technology consulting presents substantial growth opportunities as organizations seek guidance on artificial intelligence implementation, blockchain applications, and advanced analytics integration. Technology strategy development becomes increasingly complex, creating demand for specialized expertise in emerging technologies and their strategic implications for business operations and competitive positioning.

Sustainability and ESG consulting represents a rapidly expanding opportunity as organizations face increasing pressure from stakeholders to demonstrate environmental responsibility and social impact. ESG strategy development requires specialized knowledge of regulatory requirements, industry best practices, and stakeholder expectations, creating significant demand for expert advisory services.

Healthcare transformation offers substantial opportunities as the industry undergoes fundamental changes driven by technological innovation, regulatory evolution, and changing patient expectations. Healthcare consulting encompasses digital health strategy, value-based care implementation, and operational optimization initiatives that require deep industry expertise and strategic guidance.

Government modernization initiatives create opportunities for consulting firms with public sector expertise, as agencies seek to improve service delivery, implement new technologies, and enhance operational efficiency. Public sector consulting requires specialized knowledge of government processes, regulatory requirements, and stakeholder management approaches.

Competitive landscape evolution reflects ongoing consolidation among mid-tier consulting firms seeking to expand service capabilities and geographic reach, while boutique specialists continue to thrive by offering deep expertise in emerging areas. Market consolidation creates opportunities for larger firms to acquire specialized capabilities and talent, while smaller firms focus on developing niche expertise and maintaining agility in service delivery.

Client expectations continue to evolve toward outcome-based engagement models that emphasize measurable results and long-term value creation rather than traditional time-based billing approaches. Performance-based contracts become increasingly common as clients seek greater accountability and alignment between consulting fees and achieved outcomes.

Technology integration transforms service delivery models as consulting firms invest in advanced analytics platforms, artificial intelligence tools, and digital collaboration technologies to enhance service quality and operational efficiency. Digital capabilities become essential differentiators in competitive positioning and client value propositions.

Talent market dynamics reflect intense competition for experienced consultants with specialized expertise, driving innovation in recruitment strategies, compensation models, and professional development programs. Workforce flexibility increases as firms adapt to changing work preferences and implement hybrid service delivery models that combine remote and on-site consulting services.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research includes extensive interviews with industry executives, consulting firm leaders, and client organizations to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and academic studies to validate primary research findings and provide comprehensive market context. Data triangulation ensures consistency across multiple information sources and enhances the reliability of market assessments and growth projections.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth rates, segment performance, and competitive dynamics. Market sizing methodologies incorporate bottom-up and top-down approaches to ensure comprehensive coverage of market segments and geographic regions.

Expert validation involves consultation with industry thought leaders, academic researchers, and market specialists to verify research findings and ensure alignment with industry best practices. Continuous monitoring of market developments ensures research findings remain current and relevant to evolving market conditions.

Northeast region dominates the US strategic consulting market, accounting for approximately 38% of total market activity, driven by the concentration of Fortune 500 headquarters, financial services firms, and technology companies in major metropolitan areas. New York City serves as the primary hub for strategic consulting services, hosting numerous global consulting firm headquarters and maintaining strong client relationships across diverse industries.

West Coast markets demonstrate exceptional growth momentum, particularly in technology strategy consulting and digital transformation services, with Silicon Valley and Seattle emerging as key centers for innovation-focused consulting engagements. The region benefits from proximity to leading technology companies and venture capital firms seeking strategic advisory services for portfolio companies and emerging market opportunities.

Midwest region maintains significant market presence driven by manufacturing, healthcare, and financial services industries concentrated in Chicago, Detroit, and Minneapolis. The region demonstrates strong demand for operational improvement consulting and supply chain optimization services, reflecting the industrial base and logistics infrastructure concentration.

Southeast markets show accelerating growth as regional economic development attracts corporate relocations and expansion initiatives, creating increased demand for strategic consulting services. Atlanta, Charlotte, and Miami emerge as growing consulting hubs serving diverse client bases across multiple industries and supporting regional market expansion strategies.

Market leadership remains concentrated among established global consulting firms that maintain comprehensive service portfolios and extensive industry expertise. The competitive landscape reflects ongoing evolution as firms adapt to changing client expectations and market dynamics:

Boutique specialists continue to thrive by offering deep expertise in specific industries or functional areas, often providing more agile service delivery and specialized knowledge that complements larger firm capabilities. Regional players maintain strong market positions through local market knowledge and established client relationships.

Service type segmentation reveals diverse consulting categories addressing specific client needs and market opportunities:

By Service Type:

By Industry Vertical:

By Client Size:

Corporate strategy consulting maintains its position as the largest segment, driven by continuous need for strategic planning, competitive analysis, and growth strategy development. Strategic planning engagements increasingly incorporate digital elements and sustainability considerations, reflecting evolving business priorities and stakeholder expectations.

Digital transformation consulting represents the fastest-growing category, with technology strategy services experiencing exceptional demand as organizations accelerate digitization initiatives. This segment benefits from increasing complexity of technology decisions and the critical importance of digital capabilities for competitive positioning.

Operational excellence consulting demonstrates steady growth as organizations seek to improve efficiency, reduce costs, and enhance performance across all business functions. Process optimization and organizational design services remain core components of consulting portfolios, particularly during periods of economic uncertainty when operational efficiency becomes paramount.

ESG and sustainability consulting emerges as a high-growth category, driven by increasing regulatory requirements, investor expectations, and stakeholder pressure for environmental and social responsibility. Sustainability strategy development requires specialized expertise in regulatory compliance, stakeholder engagement, and impact measurement.

Industry-specific consulting continues to differentiate successful firms, with deep sector expertise becoming increasingly valuable as industries face unique challenges and opportunities. Healthcare consulting and financial services advisory represent particularly strong growth areas due to regulatory complexity and technological disruption.

Strategic consulting clients benefit from access to specialized expertise, objective perspectives, and proven methodologies that accelerate decision-making and improve outcomes. External advisory services provide organizations with capabilities that may be difficult or expensive to develop internally, particularly in rapidly evolving areas such as digital transformation and regulatory compliance.

Consulting firms benefit from strong market demand, healthy profit margins, and opportunities for geographic and service expansion. Professional development opportunities attract top talent while client diversity provides resilience against industry-specific downturns and economic fluctuations.

Industry professionals enjoy attractive career opportunities, competitive compensation, and exposure to diverse business challenges across multiple industries and functional areas. Skill development in strategic consulting provides valuable experience applicable across various career paths and industries.

Economic stakeholders benefit from improved business performance, enhanced competitiveness, and more efficient resource allocation resulting from strategic consulting engagements. Innovation acceleration and best practice dissemination contribute to overall economic productivity and growth.

Technology providers benefit from increased demand for consulting services that incorporate advanced analytics, artificial intelligence, and digital platforms. Partnership opportunities with consulting firms create channels for technology adoption and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Outcome-based consulting models gain traction as clients demand greater accountability and alignment between consulting fees and achieved results. Performance-based contracts increasingly replace traditional time-and-materials billing, requiring consulting firms to develop new risk management approaches and service delivery methodologies.

Technology integration accelerates across all consulting services, with artificial intelligence, machine learning, and advanced analytics becoming standard components of strategic advisory engagements. Data-driven insights enhance the quality and speed of strategic recommendations while enabling more precise measurement of consulting impact.

Sustainability focus permeates all consulting categories as ESG considerations become integral to strategic planning rather than separate advisory services. Climate strategy consulting and social impact advisory represent rapidly growing specializations within traditional consulting portfolios.

Remote service delivery models mature following pandemic-driven adoption, with hybrid engagement approaches combining virtual and in-person consulting services. Digital collaboration tools enable more efficient service delivery while reducing travel costs and expanding geographic reach for consulting engagements.

Industry specialization deepens as consulting firms develop sector-specific expertise and proprietary methodologies tailored to unique industry challenges and opportunities. Vertical integration strategies focus on building comprehensive capabilities within targeted industry segments.

Strategic acquisitions reshape the competitive landscape as major consulting firms acquire specialized boutiques and technology companies to expand service capabilities and market reach. Capability expansion through acquisitions enables firms to offer more comprehensive solutions while accessing new client segments and geographic markets.

Technology partnerships proliferate as consulting firms collaborate with software providers, analytics companies, and platform developers to enhance service offerings and delivery efficiency. Strategic alliances enable consulting firms to incorporate cutting-edge technologies without significant internal development investments.

Talent development initiatives intensify as firms invest in advanced training programs, certification processes, and career development pathways to attract and retain top consulting professionals. Skills enhancement focuses on emerging areas such as artificial intelligence, sustainability consulting, and digital transformation leadership.

Client engagement evolution reflects shift toward longer-term partnerships and embedded consulting models that provide ongoing strategic support rather than project-based engagements. Relationship depth increases as consulting firms develop deeper understanding of client organizations and industry dynamics.

Regulatory compliance services expand as consulting firms develop specialized capabilities to help clients navigate complex and evolving regulatory environments across multiple industries. Compliance expertise becomes increasingly valuable as regulatory requirements continue to expand and evolve.

MarkWide Research analysis indicates that consulting firms should prioritize investment in digital capabilities and data analytics platforms to maintain competitive positioning in an increasingly technology-driven market environment. Technology integration represents a critical success factor for future growth and client value creation.

Service portfolio diversification emerges as a key strategic imperative, with successful firms expanding beyond traditional strategy consulting to include implementation support, change management, and ongoing advisory services. End-to-end solutions provide greater client value while creating more sustainable revenue streams.

Industry specialization strategies should focus on developing deep expertise in high-growth sectors such as healthcare, technology, and renewable energy, where regulatory complexity and rapid change create sustained demand for external advisory services. Sector focus enables premium pricing and stronger client relationships.

Talent management requires innovative approaches to recruitment, retention, and development as competition for experienced consultants intensifies. Professional development programs and flexible work arrangements become essential for maintaining competitive talent acquisition and retention capabilities.

Geographic expansion opportunities exist in emerging markets and secondary metropolitan areas where consulting penetration remains relatively low but economic growth creates increasing demand for strategic advisory services. Market development strategies should balance growth opportunities with resource allocation efficiency.

Market growth prospects remain exceptionally strong with projected expansion driven by accelerating digital transformation initiatives, increasing regulatory complexity, and growing recognition of strategic consulting value in navigating uncertain business environments. MWR projections indicate sustained growth momentum with consulting demand expected to outpace overall economic growth rates.

Technology evolution will continue to reshape service delivery models and create new consulting categories focused on artificial intelligence implementation, cybersecurity strategy, and data governance. Emerging technologies present both opportunities for service expansion and requirements for continuous capability development and investment.

Client expectations will evolve toward greater integration between strategy development and implementation support, driving consulting firms to expand service portfolios and develop new engagement models. Outcome accountability will become standard practice with 75% of engagements expected to incorporate performance-based elements by the forecast period end.

Competitive dynamics will intensify as market boundaries blur between traditional consulting firms, technology companies, and specialized advisory services. Market consolidation may accelerate as firms seek to achieve scale advantages and comprehensive capability portfolios necessary for competitive success.

Sustainability integration will become ubiquitous across all consulting services rather than remaining a specialized practice area, with ESG considerations embedded in strategic planning, operational improvement, and organizational development engagements. Climate consulting and social impact advisory represent particularly high-growth opportunities within the broader sustainability trend.

The US strategic consulting market demonstrates exceptional resilience and growth potential, driven by increasing complexity of business environments, accelerating technological change, and evolving stakeholder expectations. Market fundamentals remain strong with sustained demand across diverse industry sectors and geographic regions, supported by healthy profit margins and expanding service portfolios among leading consulting firms.

Future success in this dynamic market will require continuous adaptation to changing client needs, investment in emerging technologies, and development of specialized expertise in high-growth areas such as digital transformation, sustainability consulting, and regulatory advisory services. Strategic positioning must balance comprehensive capability development with focused expertise in targeted market segments and industry verticals.

Industry participants who successfully navigate evolving market dynamics while maintaining service quality and client relationships will benefit from sustained growth opportunities and strong financial performance. The strategic consulting market represents a critical component of the broader professional services ecosystem, providing essential expertise that enables organizational success and economic growth across the United States.

What is Strategic Consulting?

Strategic consulting involves providing expert advice to organizations on their overall strategy, including business planning, market entry, and competitive positioning. It helps businesses identify opportunities and challenges in their operational landscape.

What are the key players in the US Strategic Consulting Market?

Key players in the US Strategic Consulting Market include McKinsey & Company, Boston Consulting Group, Bain & Company, and Deloitte Consulting, among others.

What are the main drivers of growth in the US Strategic Consulting Market?

The main drivers of growth in the US Strategic Consulting Market include increasing demand for digital transformation, the need for strategic guidance in navigating complex market dynamics, and the rising importance of data analytics in decision-making.

What challenges does the US Strategic Consulting Market face?

Challenges in the US Strategic Consulting Market include intense competition among firms, the need for continuous adaptation to rapidly changing business environments, and the pressure to deliver measurable results to clients.

What opportunities exist in the US Strategic Consulting Market?

Opportunities in the US Strategic Consulting Market include the expansion of services in emerging technologies, the growing focus on sustainability and ESG initiatives, and the increasing demand for specialized consulting in niche sectors.

What trends are shaping the US Strategic Consulting Market?

Trends shaping the US Strategic Consulting Market include the rise of remote consulting services, the integration of artificial intelligence in strategic planning, and a shift towards more collaborative client-consultant relationships.

US Strategic Consulting Market

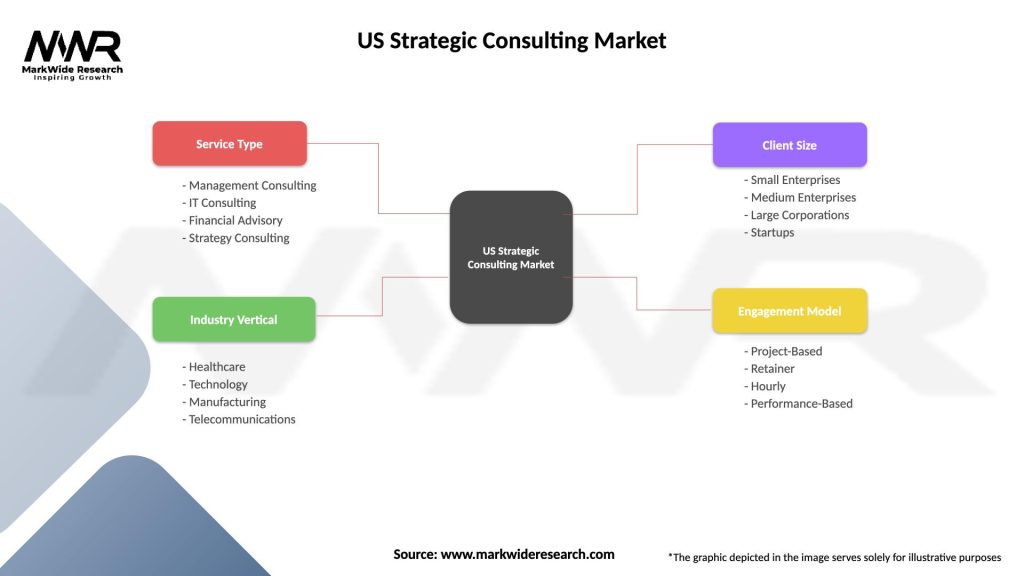

| Segmentation Details | Description |

|---|---|

| Service Type | Management Consulting, IT Consulting, Financial Advisory, Strategy Consulting |

| Industry Vertical | Healthcare, Technology, Manufacturing, Telecommunications |

| Client Size | Small Enterprises, Medium Enterprises, Large Corporations, Startups |

| Engagement Model | Project-Based, Retainer, Hourly, Performance-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Strategic Consulting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at