444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US spectator sports market represents one of the most dynamic and culturally significant entertainment sectors in the American economy. This comprehensive market encompasses professional leagues, collegiate athletics, minor league competitions, and various sporting events that attract millions of spectators annually. Market dynamics indicate robust growth driven by increasing fan engagement, technological innovations, and evolving consumer preferences for live entertainment experiences.

Professional sports leagues including the NFL, NBA, MLB, NHL, and MLS form the cornerstone of this market, generating substantial revenue through ticket sales, broadcasting rights, sponsorships, and merchandise. The market has demonstrated remarkable resilience, with attendance rates showing consistent growth of approximately 3.2% annually over the past five years. Digital transformation has revolutionized fan experiences, creating new revenue streams and engagement opportunities.

Collegiate sports contribute significantly to market expansion, with major conferences driving substantial economic impact across university towns and metropolitan areas. The integration of streaming platforms and enhanced broadcasting technologies has expanded market reach, enabling sports organizations to capture broader audiences and generate increased revenue from media rights deals.

The US spectator sports market refers to the comprehensive economic ecosystem encompassing all organized sporting events where audiences pay to watch live or broadcast competitions. This market includes professional leagues, collegiate athletics, minor league sports, and various tournaments that generate revenue through ticket sales, broadcasting rights, sponsorships, concessions, and merchandise sales.

Spectator sports differentiate themselves from participatory sports by focusing on entertainment value for audiences rather than direct participation. The market encompasses venue operations, team management, player development, media production, and fan engagement services. Revenue generation occurs through multiple channels including gate receipts, corporate partnerships, broadcasting agreements, and ancillary services.

Market participants include professional sports franchises, collegiate athletic departments, broadcasting networks, venue operators, ticketing companies, and various service providers supporting the sports entertainment ecosystem. The market’s scope extends beyond game-day activities to include year-round fan engagement, training facilities, and community outreach programs.

Market performance in the US spectator sports sector demonstrates sustained growth momentum driven by technological innovation, enhanced fan experiences, and strategic expansion initiatives. The market benefits from strong demographic trends, with millennial and Gen Z audiences representing approximately 42% of total viewership, driving demand for digital-first engagement platforms and interactive experiences.

Revenue diversification has become a critical success factor, with organizations expanding beyond traditional ticket sales to embrace comprehensive entertainment offerings. Corporate sponsorship investments have increased by 8.5% annually, reflecting strong advertiser confidence in sports marketing effectiveness. The integration of sports betting legalization across multiple states has created additional revenue opportunities and enhanced fan engagement.

Competitive dynamics continue evolving as leagues invest in direct-to-consumer streaming platforms, reducing dependence on traditional broadcasting partnerships. Facility modernization initiatives have improved fan experiences while generating increased per-capita spending. The market’s resilience was demonstrated through successful adaptation to pandemic-related challenges, with innovative safety protocols and enhanced digital offerings maintaining fan loyalty.

Strategic insights reveal several transformative trends reshaping the US spectator sports landscape:

Market maturation has led to increased focus on fan experience optimization, with organizations investing heavily in venue upgrades, technology integration, and personalized services. Competitive differentiation increasingly depends on creating unique, memorable experiences that extend beyond traditional game attendance.

Primary growth drivers propelling the US spectator sports market include evolving consumer entertainment preferences, technological advancement, and strategic market expansion initiatives. Fan engagement has intensified through social media integration, mobile applications, and interactive content platforms that create year-round connection opportunities between teams and supporters.

Broadcasting evolution represents a significant market catalyst, with streaming platforms investing heavily in exclusive content rights and innovative viewing experiences. The shift toward cord-cutting has prompted sports organizations to develop direct-to-consumer offerings, capturing greater revenue shares while maintaining audience reach. Corporate sponsorship growth reflects strong advertiser confidence in sports marketing effectiveness and audience engagement quality.

Demographic trends support continued market expansion, with younger generations demonstrating strong sports consumption preferences despite changing media habits. Sports betting legalization across multiple states has created new engagement mechanisms and revenue opportunities. Infrastructure investment in modern venues enhances fan experiences while generating increased per-capita spending through premium amenities and services.

Economic factors including disposable income growth and urbanization trends support increased spectator sports participation. Cultural significance of sports in American society maintains strong demand for live entertainment experiences, particularly during major sporting events and championship seasons.

Market challenges facing the US spectator sports sector include rising operational costs, changing consumer behavior patterns, and increased competition from alternative entertainment options. Venue maintenance and modernization require substantial capital investments, particularly for aging facilities that must meet contemporary fan expectations and safety standards.

Economic sensitivity affects discretionary spending on entertainment, with ticket prices and concession costs potentially limiting accessibility for certain demographic segments. Cord-cutting trends have disrupted traditional broadcasting revenue models, forcing organizations to adapt monetization strategies while maintaining audience reach. Player salary inflation continues pressuring organizational budgets and ticket pricing structures.

Competition intensification from streaming entertainment, gaming, and other leisure activities challenges traditional sports viewership patterns. Generational preferences for shorter-form content and on-demand consumption conflict with traditional game formats and scheduling. Regulatory complexities surrounding sports betting, player safety, and venue operations create compliance costs and operational constraints.

Weather dependency for outdoor sports creates revenue volatility and scheduling challenges. Security concerns require increased investment in safety measures and emergency preparedness, adding operational complexity and costs to venue management.

Emerging opportunities in the US spectator sports market center on technological innovation, international expansion, and enhanced fan engagement platforms. Virtual reality and augmented reality technologies offer immersive viewing experiences that could revolutionize remote fan engagement and create new revenue streams through premium digital experiences.

Sports betting integration presents substantial growth potential as additional states legalize wagering, creating opportunities for partnerships, data monetization, and enhanced fan engagement. Esports convergence with traditional sports offers cross-promotional opportunities and access to younger demographic segments. International market development through overseas games, streaming partnerships, and franchise expansion could significantly broaden revenue bases.

Data analytics advancement enables sophisticated fan behavior analysis, personalized marketing, and optimized pricing strategies. Sustainability initiatives create opportunities for corporate partnerships, cost reduction, and brand differentiation among environmentally conscious consumers. Community partnerships and youth development programs strengthen local market penetration while building future fan bases.

Technology partnerships with streaming platforms, social media companies, and telecommunications providers offer innovative distribution channels and enhanced viewing experiences. Venue multipurpose utilization maximizes facility investment returns through concerts, conferences, and community events during off-seasons.

Market dynamics in the US spectator sports sector reflect complex interactions between traditional entertainment models and digital transformation initiatives. Consumer behavior evolution drives organizations to balance live attendance experiences with enhanced digital offerings, creating hybrid engagement models that serve diverse audience preferences.

Competitive pressures intensify as leagues and teams invest in facility upgrades, technology integration, and premium service offerings to differentiate their value propositions. Revenue optimization strategies increasingly focus on per-capita spending increases rather than pure attendance growth, emphasizing quality over quantity in fan experiences.

Partnership ecosystems have become critical success factors, with sports organizations collaborating with technology companies, media platforms, and corporate sponsors to create comprehensive entertainment experiences. MarkWide Research analysis indicates that organizations implementing integrated digital strategies achieve 23% higher fan retention rates compared to traditional approaches.

Market consolidation trends affect broadcasting rights, venue operations, and service provider relationships. Innovation cycles accelerate as organizations adopt emerging technologies to maintain competitive advantages and meet evolving fan expectations. Regulatory adaptation continues shaping market structure, particularly regarding sports betting, player safety, and broadcasting rights.

Comprehensive research methodology employed for this market analysis incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability. Primary research includes interviews with industry executives, venue operators, broadcasting professionals, and fan survey data to capture current market sentiment and behavioral trends.

Secondary research encompasses analysis of financial reports, industry publications, regulatory filings, and academic studies to establish market baselines and identify emerging trends. Quantitative analysis utilizes statistical modeling to project growth patterns, market share distributions, and revenue forecasting across different market segments and geographic regions.

Data validation processes include cross-referencing multiple sources, expert consultation, and historical trend analysis to ensure findings accuracy. Market segmentation analysis examines performance variations across professional leagues, collegiate sports, minor league competitions, and regional markets to provide granular insights.

Competitive intelligence gathering includes monitoring organizational strategies, investment patterns, and performance metrics across major market participants. Technology impact assessment evaluates digital transformation initiatives and their effects on fan engagement, revenue generation, and operational efficiency.

Regional market dynamics across the United States reveal significant variations in spectator sports preferences, spending patterns, and growth opportunities. Northeast markets demonstrate strong traditional sports loyalty with premium pricing tolerance approximately 18% above national averages, driven by established franchises and high disposable income levels.

Southeast regions show robust collegiate sports engagement, with university athletics generating substantial economic impact in smaller metropolitan areas. West Coast markets lead in technology adoption and innovative fan experiences, with digital engagement rates exceeding national averages by 25%. Midwest markets maintain strong professional sports loyalty with consistent attendance patterns across multiple leagues.

Southwest markets demonstrate rapid growth potential driven by population expansion and new franchise development. Texas markets particularly show strong performance across multiple sports categories, with per-capita spending on spectator sports ranking among the highest nationally. Mountain West regions present emerging opportunities as urban populations grow and new venues are developed.

Market penetration varies significantly by sport and region, with football dominating in certain areas while basketball, baseball, or hockey maintain stronger positions in others. Demographic composition influences regional preferences, with younger populations gravitating toward different sports and engagement methods compared to traditional fan bases.

Competitive landscape analysis reveals a complex ecosystem of professional leagues, collegiate conferences, and supporting organizations that shape market dynamics. Major professional leagues maintain dominant positions through established fan bases, extensive media partnerships, and comprehensive revenue generation strategies.

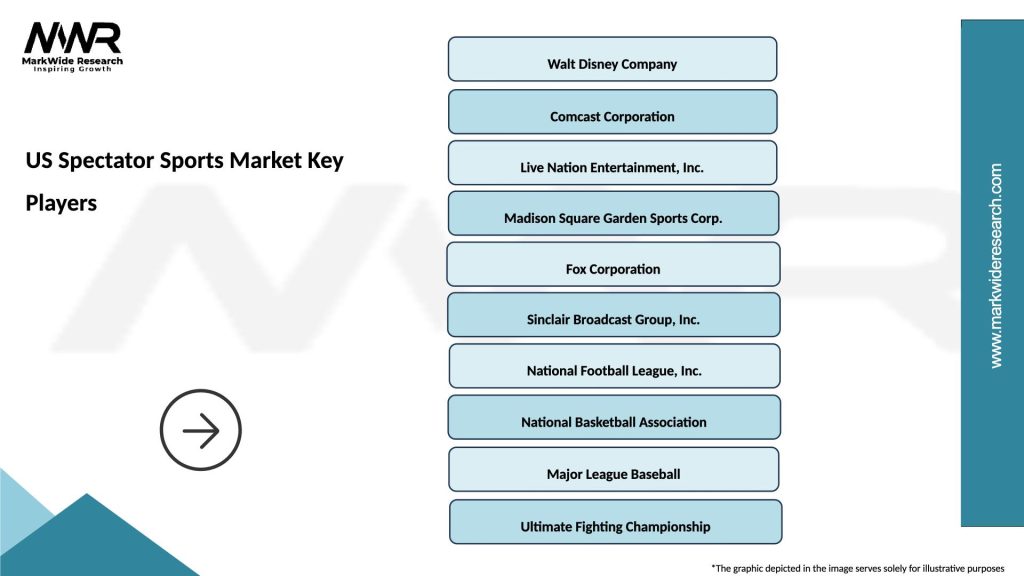

Key market participants include:

Competitive strategies increasingly focus on fan experience differentiation, technology integration, and revenue diversification. Market positioning varies from premium entertainment experiences to community-focused affordable options, serving different demographic segments and geographic markets.

Market segmentation analysis reveals distinct categories based on league level, sport type, venue characteristics, and target demographics. Professional sports represent the premium market segment with highest revenue generation and national media coverage, attracting corporate sponsors and affluent consumers seeking premier entertainment experiences.

By League Level:

By Sport Category:

Professional football maintains market leadership through strategic scheduling, extensive media partnerships, and cultural significance in American society. Revenue generation benefits from limited regular season games that create scarcity value and premium pricing opportunities. Playoff systems generate additional revenue through extended seasons and increased fan engagement.

Basketball markets demonstrate strong growth through international expansion, year-round engagement, and digital-first strategies appealing to younger demographics. Fast-paced gameplay aligns well with modern attention spans and social media consumption patterns. Star player marketing creates individual brand opportunities beyond team loyalty.

Baseball traditions maintain strong regional loyalty and historical significance, though organizations invest heavily in pace-of-play improvements and technology integration to attract younger audiences. Season length provides extensive content opportunities but challenges sustained fan attention throughout long campaigns.

Hockey markets show passionate regional support with opportunities for geographic expansion into non-traditional markets. Playoff intensity creates compelling television content and increased merchandise sales. International talent broadens global appeal and marketing opportunities.

Soccer growth reflects changing American demographics and international sport popularity, particularly among younger and diverse populations. MWR data indicates soccer viewership among adults under 35 has increased by 31% over five years.

Industry participants benefit from multiple revenue streams, brand building opportunities, and community engagement platforms that extend far beyond traditional ticket sales. Professional franchises leverage spectator sports investments to build valuable intellectual property, develop real estate assets, and create long-term fan relationships that generate consistent revenue streams.

Broadcasting partners gain access to premium content that drives subscription growth, advertising revenue, and platform differentiation in competitive media markets. Corporate sponsors achieve brand exposure, customer engagement, and marketing effectiveness through sports partnerships that provide measurable return on investment.

Venue operators maximize facility utilization through diverse event programming, premium hospitality services, and year-round activation opportunities. Local communities benefit from economic impact, job creation, and civic pride associated with professional sports presence.

Technology providers find lucrative partnership opportunities in areas including broadcasting enhancement, fan engagement platforms, data analytics, and venue management systems. Merchandise partners access passionate consumer bases willing to pay premium prices for authentic team-branded products.

Financial institutions benefit from sports marketing partnerships, naming rights opportunities, and customer acquisition through sports-themed products and services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the US spectator sports market, with organizations investing heavily in streaming platforms, mobile applications, and social media engagement to reach evolving audiences. Direct-to-consumer strategies reduce dependence on traditional broadcasting partnerships while capturing greater revenue shares and fan data.

Personalization technology enables customized fan experiences through targeted content, dynamic pricing, and individualized marketing campaigns. Augmented reality and virtual reality integration create immersive viewing experiences that enhance remote fan engagement and generate new revenue opportunities.

Sustainability initiatives gain prominence as organizations implement environmental programs, renewable energy systems, and waste reduction strategies to appeal to environmentally conscious consumers and reduce operational costs. Community engagement programs strengthen local connections through youth development, educational partnerships, and charitable initiatives.

Data analytics advancement enables sophisticated fan behavior analysis, optimized pricing strategies, and enhanced operational efficiency. Venue modernization focuses on premium amenities, technology integration, and flexible spaces that accommodate diverse events and maximize revenue generation.

International partnerships expand market reach through overseas games, streaming agreements, and cultural exchange programs that build global fan bases and revenue streams.

Recent industry developments highlight the dynamic nature of the US spectator sports market and organizations’ adaptability to changing conditions. Streaming platform investments by major leagues demonstrate commitment to direct-to-consumer strategies and reduced reliance on traditional broadcasting models.

Venue construction and renovation projects across multiple markets reflect ongoing investment in fan experience enhancement and revenue optimization. Technology partnerships with major platforms enable innovative viewing experiences, enhanced data collection, and improved operational efficiency.

Sports betting partnerships following state legalization create new revenue streams and fan engagement opportunities while requiring careful regulatory compliance and responsible gaming initiatives. International expansion efforts include overseas games, streaming partnerships, and franchise development in global markets.

Player safety initiatives address health concerns while maintaining competitive integrity and fan appeal. Sustainability programs implementation demonstrates corporate responsibility while reducing operational costs and appealing to environmentally conscious consumers.

Youth development programs investment builds future fan bases while strengthening community relationships and social impact. Corporate partnership evolution includes naming rights, integrated marketing campaigns, and technology collaborations that provide mutual value creation.

Strategic recommendations for US spectator sports market participants emphasize balanced investment in traditional strengths while embracing technological innovation and changing consumer preferences. Digital transformation should prioritize fan experience enhancement over pure technology adoption, ensuring investments generate measurable engagement and revenue improvements.

Revenue diversification strategies should expand beyond traditional sources to include data monetization, international partnerships, and premium experience offerings. MarkWide Research analysis suggests organizations implementing comprehensive digital strategies achieve superior financial performance compared to traditional approaches.

Fan engagement initiatives should focus on creating year-round connections through content platforms, community programs, and personalized experiences that extend beyond game attendance. Venue investment priorities should emphasize flexible spaces, technology integration, and premium amenities that maximize per-capita spending and event versatility.

Partnership development should target technology companies, streaming platforms, and corporate sponsors that align with organizational values and fan demographics. International expansion efforts require careful market analysis, cultural sensitivity, and sustainable business models that build long-term value.

Sustainability integration should balance environmental responsibility with operational efficiency and cost reduction opportunities.

Future market prospects for the US spectator sports sector indicate continued growth driven by technological innovation, demographic evolution, and strategic market expansion. Digital integration will accelerate as organizations develop sophisticated platforms that blend live and virtual experiences, creating new engagement models and revenue streams.

Generational transition will reshape consumption patterns, with younger audiences driving demand for interactive, social, and mobile-first experiences. Technology advancement in areas including virtual reality, artificial intelligence, and data analytics will enable unprecedented personalization and fan engagement opportunities.

Market consolidation may occur as organizations seek scale advantages and operational efficiencies, while niche markets could emerge for specialized sports and local competitions. International expansion will continue as leagues pursue global audiences and revenue diversification.

Sports betting integration will mature as regulatory frameworks stabilize and organizations develop sophisticated engagement strategies. Sustainability focus will intensify as environmental concerns influence consumer choices and operational decisions.

Growth projections indicate the market will expand at a compound annual growth rate of 4.7% over the next five years, driven by technology adoption, international expansion, and enhanced fan experiences. Revenue optimization will increasingly focus on per-capita spending improvements rather than pure attendance growth.

The US spectator sports market stands at a transformative juncture where traditional entertainment models converge with digital innovation to create unprecedented opportunities for growth and fan engagement. Market dynamics reflect the sector’s remarkable adaptability, demonstrated through successful navigation of recent challenges while maintaining strong cultural relevance and economic impact.

Strategic positioning for future success requires balanced investment in technological advancement, fan experience enhancement, and revenue diversification while preserving the authentic connections that define sports entertainment. Organizations that embrace comprehensive digital strategies, prioritize sustainability, and develop innovative partnership models will capture the greatest market opportunities.

Long-term prospects remain highly favorable as the US spectator sports market continues evolving to meet changing consumer preferences while maintaining its fundamental appeal as premium live entertainment. The sector’s ability to generate passionate fan loyalty, create community connections, and deliver compelling content positions it well for sustained growth in an increasingly competitive entertainment landscape.

What is Spectator Sports?

Spectator sports refer to organized sports events that are primarily designed for an audience to watch, including professional leagues, college sports, and major tournaments. These events often involve various sports such as football, basketball, baseball, and soccer, attracting large crowds and significant media attention.

What are the key players in the US Spectator Sports Market?

Key players in the US Spectator Sports Market include major leagues such as the NFL, NBA, and MLB, as well as prominent teams like the New York Yankees and Los Angeles Lakers. Additionally, sports networks and media companies like ESPN and NBC Sports play a crucial role in broadcasting these events, among others.

What are the growth factors driving the US Spectator Sports Market?

The US Spectator Sports Market is driven by factors such as increasing consumer interest in live sports events, advancements in broadcasting technology, and the rise of digital streaming platforms. Additionally, the growing popularity of fantasy sports and sports betting has contributed to market expansion.

What challenges does the US Spectator Sports Market face?

Challenges in the US Spectator Sports Market include competition from alternative entertainment options, fluctuating attendance rates, and the impact of economic downturns on consumer spending. Additionally, the ongoing effects of the pandemic have posed significant challenges to live event attendance.

What opportunities exist in the US Spectator Sports Market?

Opportunities in the US Spectator Sports Market include the potential for growth in e-sports and virtual events, as well as the expansion of international sports leagues. Furthermore, partnerships with technology companies for enhanced fan engagement and experience present significant growth avenues.

What trends are shaping the US Spectator Sports Market?

Trends shaping the US Spectator Sports Market include the increasing integration of technology in fan experiences, such as augmented reality and mobile apps for real-time engagement. Additionally, there is a growing focus on sustainability initiatives within sports organizations to reduce their environmental impact.

US Spectator Sports Market

| Segmentation Details | Description |

|---|---|

| Product Type | Professional Sports, College Sports, Esports, Recreational Sports |

| Customer Type | Individual Fans, Corporate Sponsors, Media Outlets, Event Organizers |

| Distribution Channel | Online Ticketing, Retail Outlets, Direct Sales, Third-Party Vendors |

| Event Type | Regular Season, Playoffs, Championships, All-Star Games |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Spectator Sports Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at