444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US soy beverages market represents a dynamic and rapidly evolving segment within the broader plant-based beverage industry. This market encompasses a diverse range of soy-based drinks, including traditional soy milk, flavored varieties, and innovative formulations designed to meet the growing consumer demand for dairy alternatives. Market dynamics indicate robust growth driven by increasing health consciousness, dietary restrictions, and environmental sustainability concerns among American consumers.

Consumer preferences have shifted significantly toward plant-based alternatives, with soy beverages maintaining a substantial position despite increased competition from almond, oat, and other plant-based options. The market demonstrates strong growth momentum with a projected compound annual growth rate of 6.2% through 2030, reflecting sustained consumer interest and expanding product innovation.

Distribution channels have diversified considerably, spanning traditional grocery retailers, health food stores, convenience outlets, and e-commerce platforms. This multi-channel approach has enhanced product accessibility and contributed to market expansion across various demographic segments. Regional variations in consumption patterns reveal higher adoption rates in urban areas and coastal regions, where health-conscious consumers demonstrate greater willingness to embrace plant-based alternatives.

The US soy beverages market refers to the commercial sector encompassing the production, distribution, and sale of beverages derived from soybeans within the United States. These products serve as dairy milk alternatives and include various formulations such as original, vanilla, chocolate, and unsweetened varieties, along with fortified options containing added vitamins and minerals.

Soy beverages are manufactured through a process involving soaking, grinding, and filtering soybeans to extract a milk-like liquid that can be consumed directly or used in food preparation. The market includes both refrigerated and shelf-stable products, catering to different consumer preferences and storage requirements. Product categories within this market range from basic soy milk to premium organic varieties and specialized formulations targeting specific nutritional needs.

Market participants include established food and beverage companies, specialized plant-based product manufacturers, and emerging brands focused on innovative soy beverage formulations. The sector operates within the broader context of the alternative milk market, competing with other plant-based options while maintaining its unique nutritional profile and established consumer base.

The US soy beverages market demonstrates resilient growth patterns despite intensifying competition from alternative plant-based beverages. Current market conditions reflect a mature yet evolving landscape where established brands maintain significant market presence while innovative newcomers introduce novel formulations and marketing approaches. Consumer adoption rates indicate that approximately 28% of American households regularly purchase plant-based milk alternatives, with soy beverages capturing a substantial portion of this segment.

Key market drivers include increasing lactose intolerance awareness, growing vegan and vegetarian populations, and heightened environmental consciousness among consumers. The market benefits from soy’s complete protein profile, which distinguishes it from many other plant-based alternatives. Product innovation continues to drive market expansion, with manufacturers introducing enhanced flavors, improved textures, and fortified nutritional profiles.

Competitive dynamics reveal a market structure dominated by several major players while accommodating numerous smaller brands targeting niche segments. Distribution strategies have evolved to emphasize both traditional retail channels and direct-to-consumer approaches, particularly through e-commerce platforms. Market challenges include price sensitivity among consumers and the need to differentiate products in an increasingly crowded alternative beverage landscape.

Consumer behavior analysis reveals several critical insights shaping the US soy beverages market. Primary purchase motivations include health benefits, dietary restrictions, and environmental considerations, with nutritional content serving as a key differentiator. Research indicates that consumers increasingly scrutinize ingredient lists and nutritional panels when selecting plant-based beverages.

Market segmentation reveals distinct consumer clusters with varying preferences and purchasing behaviors. Premium segment consumers prioritize organic certification and unique flavor profiles, while value-oriented buyers focus on basic nutritional benefits and competitive pricing. Regional preferences demonstrate variations in flavor acceptance and brand recognition across different geographic markets.

Health consciousness represents the primary driver propelling the US soy beverages market forward. Increasing awareness of lactose intolerance, which affects approximately 65% of the global adult population, has created substantial demand for dairy alternatives. Soy beverages offer complete protein profiles containing all essential amino acids, making them particularly attractive to health-conscious consumers and those following plant-based diets.

Environmental sustainability concerns significantly influence consumer purchasing decisions, with many Americans seeking products that reduce their environmental footprint. Soy beverage production requires substantially less water and generates fewer greenhouse gas emissions compared to traditional dairy farming. Sustainability messaging resonates strongly with environmentally conscious consumers, particularly younger demographics who prioritize eco-friendly product choices.

Dietary diversification trends continue driving market expansion as consumers explore alternatives to traditional dairy products. The growing popularity of vegan and vegetarian lifestyles, combined with flexitarian approaches to eating, creates sustained demand for plant-based beverages. Nutritional awareness among consumers has increased significantly, with many recognizing soy beverages as viable sources of protein, vitamins, and minerals.

Product innovation serves as a crucial market driver, with manufacturers continuously developing new formulations, flavors, and functional benefits. Enhanced taste profiles, improved textures, and fortified nutritional content address previous consumer concerns about plant-based alternatives. Convenience factors including shelf-stable packaging and ready-to-drink formats appeal to busy consumers seeking healthy, portable beverage options.

Intense competition from alternative plant-based beverages poses significant challenges for the soy beverages market. Almond, oat, coconut, and other plant-based options have gained substantial market share, often benefiting from perceived taste advantages or trendy positioning. Consumer perception issues related to soy, including concerns about genetic modification and hormonal effects, continue to influence some purchasing decisions despite scientific evidence supporting soy safety.

Price sensitivity among consumers represents a persistent market restraint, particularly when soy beverages command premium pricing compared to conventional dairy milk. Economic fluctuations and inflationary pressures can impact consumer willingness to pay higher prices for plant-based alternatives. Cost structure challenges including raw material prices, processing expenses, and distribution costs affect manufacturers’ ability to offer competitive pricing.

Taste preferences remain a significant barrier for some consumers who find soy beverages less appealing than dairy milk or other plant-based alternatives. Despite improvements in formulation and processing techniques, some consumers continue to perceive soy beverages as having distinctive flavors or textures that differ from their preferred taste profiles. Cultural and traditional preferences for dairy milk in certain demographic segments create resistance to adoption of soy-based alternatives.

Regulatory considerations and labeling requirements can create compliance challenges for manufacturers, particularly regarding nutritional claims and organic certifications. Supply chain complexities including sourcing quality soybeans, maintaining consistent product quality, and managing inventory across multiple distribution channels present operational challenges that can impact market growth and profitability.

Product innovation opportunities present significant potential for market expansion through development of enhanced formulations, novel flavors, and functional beverages targeting specific health benefits. Manufacturers can capitalize on growing interest in protein-enriched beverages, probiotic formulations, and products designed for specific dietary needs such as keto-friendly or low-sugar options. Functional beverage trends create opportunities to incorporate additional nutrients, adaptogens, or wellness-focused ingredients.

E-commerce expansion offers substantial growth potential as online grocery shopping continues gaining popularity among American consumers. Direct-to-consumer sales models enable manufacturers to build stronger brand relationships, gather consumer insights, and offer subscription services for regular customers. Digital marketing strategies can effectively reach target demographics through social media platforms, influencer partnerships, and content marketing focused on health and sustainability benefits.

Foodservice sector penetration represents an underexplored opportunity for soy beverage manufacturers. Partnerships with coffee shops, restaurants, schools, and healthcare facilities can drive volume growth and introduce products to new consumer segments. Private label opportunities with major retailers offer potential for increased market share and improved distribution efficiency.

International expansion within North American markets, particularly targeting Hispanic and Asian American communities where soy consumption has cultural acceptance, presents growth opportunities. Premium positioning strategies focusing on organic, non-GMO, and artisanal formulations can capture higher-value market segments willing to pay premium prices for perceived quality and health benefits.

Supply and demand dynamics in the US soy beverages market reflect complex interactions between consumer preferences, production capabilities, and competitive pressures. Demand patterns show seasonal variations with higher consumption during health-focused periods such as January and summer months when consumers prioritize wellness goals. Supply chain considerations include soybean sourcing, processing capacity, and distribution logistics that influence product availability and pricing strategies.

Competitive dynamics continue evolving as established players defend market share while new entrants introduce innovative products and marketing approaches. Brand differentiation strategies focus on taste, nutrition, sustainability, and price positioning to capture specific consumer segments. Market consolidation trends may emerge as larger companies acquire smaller brands to expand product portfolios and distribution capabilities.

Technology adoption influences market dynamics through improved processing techniques, packaging innovations, and supply chain optimization. Advanced manufacturing processes enable better taste profiles, extended shelf life, and cost efficiencies that benefit both manufacturers and consumers. Consumer engagement strategies increasingly rely on digital platforms, social media marketing, and direct feedback mechanisms to understand and respond to market preferences.

Regulatory dynamics impact market operations through food safety requirements, labeling standards, and organic certification processes. Changes in trade policies, agricultural regulations, and environmental standards can influence raw material costs and operational procedures. Economic factors including inflation, consumer spending patterns, and disposable income levels affect market growth rates and consumer purchasing behavior across different demographic segments.

Market research approaches for analyzing the US soy beverages market employ comprehensive methodologies combining primary and secondary research techniques. Primary research involves consumer surveys, focus groups, and interviews with industry stakeholders including manufacturers, distributors, and retailers. Data collection methods encompass both quantitative and qualitative approaches to capture market trends, consumer preferences, and competitive dynamics.

Secondary research sources include industry reports, government databases, trade publications, and company financial statements to gather historical data and market intelligence. Statistical analysis techniques help identify trends, correlations, and growth patterns within the market. Market segmentation analysis examines consumer demographics, geographic regions, product categories, and distribution channels to provide comprehensive market understanding.

Competitive analysis methodologies involve examining market share data, product portfolios, pricing strategies, and marketing approaches of key industry participants. Brand performance metrics, consumer sentiment analysis, and social media monitoring provide insights into market positioning and consumer perceptions. Forecasting techniques utilize historical data, trend analysis, and economic indicators to project future market growth and development patterns.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert interviews, and statistical verification methods. Quality control measures include peer review, data triangulation, and sensitivity analysis to confirm research findings and recommendations. Continuous monitoring of market developments enables real-time updates and refinements to research conclusions and market projections.

West Coast markets demonstrate the highest adoption rates for soy beverages, with California leading consumption patterns due to health-conscious consumer demographics and established plant-based food culture. The region accounts for approximately 32% of national consumption, driven by urban populations, higher disposable incomes, and strong environmental awareness. Pacific Northwest markets show similar trends with emphasis on organic and sustainable product options.

Northeast corridor markets, including major metropolitan areas like New York, Boston, and Philadelphia, represent significant consumption centers with diverse consumer bases embracing plant-based alternatives. The region demonstrates strong growth potential with increasing health consciousness and dietary diversification among urban professionals. College towns and university areas within the Northeast show particularly high adoption rates among younger demographics.

Southeast markets present emerging opportunities as traditional dairy-consuming regions gradually adopt plant-based alternatives. Florida leads regional consumption due to diverse demographics and health-focused retiree populations. Urban centers throughout the Southeast, including Atlanta, Charlotte, and Nashville, demonstrate growing acceptance of soy beverages among younger, more diverse populations.

Midwest and Central regions show more conservative adoption patterns but represent substantial growth opportunities as awareness increases and product availability expands. Agricultural states with soybean production may develop stronger local market connections and supply chain advantages. Regional preferences vary significantly, with some areas showing stronger acceptance of flavored varieties while others prefer original formulations.

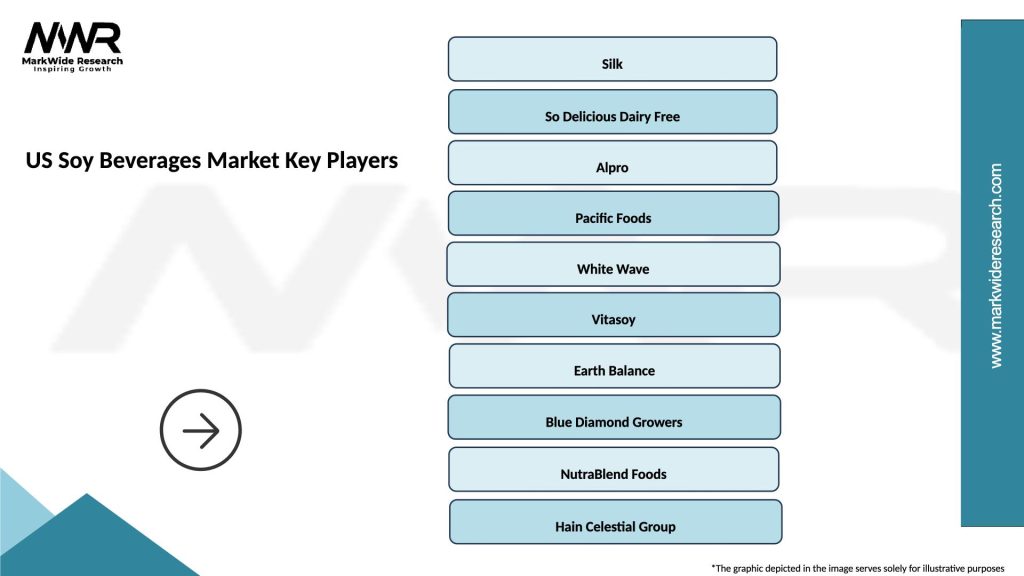

Market leadership in the US soy beverages sector involves several established companies that have built strong brand recognition and distribution networks. The competitive environment features both large multinational corporations and specialized plant-based beverage companies competing for market share through product innovation, marketing strategies, and pricing approaches.

Competitive strategies focus on product differentiation through taste improvements, nutritional enhancements, and packaging innovations. Brand positioning varies from premium organic options to value-oriented alternatives, enabling companies to target different consumer segments. Marketing approaches emphasize health benefits, environmental sustainability, and taste satisfaction to build consumer loyalty and drive repeat purchases.

Innovation initiatives among competitors include development of new flavors, functional ingredients, and improved formulations addressing previous consumer concerns about plant-based beverages. Distribution strategies involve expanding retail partnerships, developing e-commerce capabilities, and exploring foodservice opportunities to increase market reach and accessibility.

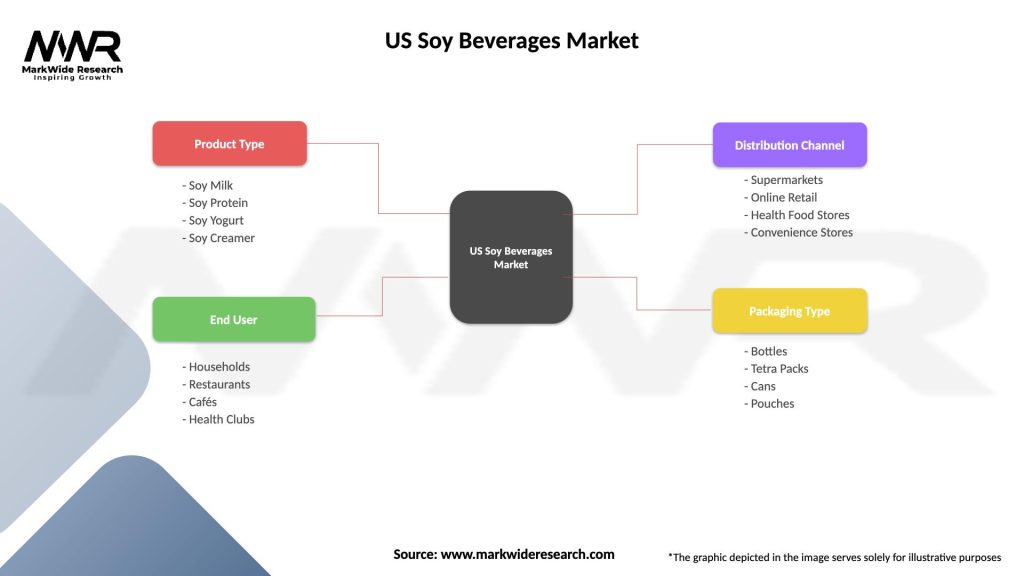

Product type segmentation reveals distinct categories within the US soy beverages market, each targeting specific consumer preferences and usage occasions. Original or plain soy milk represents the foundational segment, while flavored varieties including vanilla, chocolate, and strawberry cater to consumers seeking enhanced taste experiences. Nutritional segmentation includes regular, low-fat, and fortified options designed to meet diverse dietary requirements.

By packaging format:

By distribution channel:

Consumer demographic segmentation identifies key target groups including health-conscious millennials, environmentally aware Gen Z consumers, lactose-intolerant individuals, and plant-based diet followers. Geographic segmentation reveals regional preferences and consumption patterns that influence product development and marketing strategies.

Original soy milk category maintains the largest market share within the US soy beverages segment, appealing to consumers seeking straightforward dairy alternatives without added flavors or sweeteners. This category demonstrates steady growth driven by health-conscious consumers and those with dietary restrictions. Product characteristics focus on nutritional content, protein levels, and clean ingredient profiles that resonate with wellness-focused buyers.

Flavored varieties show dynamic growth patterns with vanilla and chocolate leading consumer preferences. These products successfully compete with dairy milk by offering familiar taste profiles while delivering plant-based benefits. Innovation opportunities within flavored categories include seasonal offerings, limited-edition flavors, and regional taste preferences that can drive trial and repeat purchases.

Organic soy beverages represent a premium category experiencing robust growth as consumers increasingly prioritize organic certification and sustainable farming practices. This segment commands higher price points while attracting environmentally conscious consumers willing to pay premiums for perceived quality and environmental benefits. Market positioning emphasizes purity, sustainability, and superior nutritional profiles.

Fortified formulations address specific nutritional needs by adding vitamins, minerals, and other beneficial compounds. Popular fortifications include calcium, vitamin D, vitamin B12, and omega-3 fatty acids that enhance the nutritional value proposition. Functional benefits appeal to consumers seeking convenient ways to meet daily nutritional requirements through beverage consumption.

Unsweetened varieties cater to consumers managing sugar intake, following ketogenic diets, or preferring natural taste profiles. This category demonstrates growing acceptance as awareness of added sugar concerns increases among health-conscious consumers. Market potential exists for expanding unsweetened options across different flavor profiles and packaging formats.

Manufacturers benefit from the growing US soy beverages market through expanded revenue opportunities, product portfolio diversification, and access to health-conscious consumer segments. The market offers potential for premium pricing on organic and specialty formulations while providing volume growth through mainstream adoption. Innovation advantages enable companies to differentiate products through unique formulations, packaging solutions, and functional benefits that command consumer loyalty.

Retailers gain from soy beverage sales through higher profit margins compared to traditional dairy products and increased foot traffic from health-conscious shoppers. The category attracts environmentally aware consumers who often purchase additional organic and natural products, increasing overall basket size. Category management benefits include cross-merchandising opportunities and the ability to position stores as health-focused destinations.

Distributors advantage from the soy beverages market through stable demand patterns, premium pricing structures, and growing market penetration requiring expanded distribution networks. The category offers opportunities for specialized distribution services targeting health food stores, organic retailers, and foodservice establishments. Logistics benefits include shelf-stable product options that reduce cold chain requirements and storage costs.

Consumers receive significant benefits including dairy-free alternatives for lactose-intolerant individuals, complete protein sources for plant-based diets, and environmentally sustainable beverage options. Health advantages encompass lower saturated fat content, absence of cholesterol, and potential benefits from soy isoflavones. Convenience factors include versatile usage in cooking, baking, and direct consumption applications.

Farmers and suppliers benefit from increased demand for soybeans, particularly organic and non-GMO varieties that command premium prices. The market creates opportunities for sustainable farming practices and direct relationships with beverage manufacturers. Economic benefits include stable crop demand and potential for value-added processing opportunities within agricultural communities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement significantly influences the US soy beverages market as consumers increasingly scrutinize ingredient lists and demand products with minimal, recognizable components. Manufacturers respond by simplifying formulations, removing artificial additives, and emphasizing natural ingredients. Transparency initiatives include detailed sourcing information, production methods, and nutritional content that build consumer trust and brand loyalty.

Functional beverage trends drive innovation in soy beverage formulations with additions of probiotics, adaptogens, protein enhancement, and targeted nutritional benefits. Consumers seek beverages that provide health benefits beyond basic nutrition, creating opportunities for premium positioning and differentiated products. Wellness positioning emphasizes specific health outcomes such as digestive health, immune support, and energy enhancement.

Sustainability focus becomes increasingly important as environmentally conscious consumers evaluate the ecological impact of their food choices. Soy beverages benefit from lower environmental footprints compared to dairy production, but manufacturers enhance sustainability messaging through packaging innovations, carbon footprint reduction, and sustainable sourcing practices. Circular economy principles influence packaging design and waste reduction initiatives.

Personalization trends emerge as consumers seek products tailored to individual dietary needs, taste preferences, and lifestyle requirements. Customizable nutrition profiles, flavor combinations, and functional benefits appeal to diverse consumer segments. Direct-to-consumer models enable manufacturers to offer personalized products and build stronger customer relationships through subscription services and custom formulations.

Premium positioning strategies gain traction as consumers demonstrate willingness to pay higher prices for perceived quality, organic certification, and unique formulations. Artisanal approaches, small-batch production, and specialty ingredients create differentiation opportunities in competitive markets. Brand storytelling emphasizes heritage, quality, and values alignment to justify premium pricing and build emotional connections with consumers.

Product innovation initiatives continue shaping the US soy beverages market through introduction of enhanced formulations, novel flavors, and functional benefits. Recent developments include protein-enriched varieties, probiotic formulations, and seasonal flavor offerings that expand consumer choice and drive trial. Technology advancements in processing techniques improve taste profiles, extend shelf life, and enhance nutritional content while reducing production costs.

Strategic partnerships between soy beverage manufacturers and retailers, foodservice operators, and ingredient suppliers create new distribution opportunities and market expansion possibilities. Collaborations with coffee chains, restaurant groups, and institutional buyers increase product visibility and accessibility. Acquisition activities consolidate market positions as larger companies acquire specialized brands to expand product portfolios and geographic reach.

Sustainability initiatives gain prominence as companies implement environmentally responsible practices throughout supply chains, from sustainable farming partnerships to recyclable packaging solutions. Carbon footprint reduction programs, water conservation efforts, and renewable energy adoption demonstrate corporate commitment to environmental stewardship. Certification programs including organic, non-GMO, and fair trade credentials enhance product credibility and appeal to conscious consumers.

Digital transformation efforts modernize marketing approaches, consumer engagement strategies, and distribution channels through e-commerce platforms, social media campaigns, and data analytics applications. MarkWide Research indicates that digital marketing investments have increased by 45% among leading brands as companies recognize the importance of online consumer touchpoints and direct-to-consumer sales channels.

Regulatory developments influence industry operations through updated labeling requirements, nutritional standards, and food safety protocols. Companies adapt to evolving regulations while advocating for favorable policies that support plant-based beverage growth and market access. International trade considerations affect raw material sourcing, export opportunities, and competitive dynamics within the domestic market.

Product differentiation strategies should focus on taste improvement, nutritional enhancement, and functional benefits that distinguish soy beverages from competing plant-based alternatives. Manufacturers should invest in research and development to address previous consumer concerns about taste and texture while highlighting unique nutritional advantages. Innovation priorities include developing premium organic formulations, seasonal flavors, and functional ingredients that command higher margins and build brand loyalty.

Market expansion opportunities exist in underserved geographic regions, particularly in the Southeast and Midwest, where plant-based beverage adoption rates remain below national averages. Targeted marketing campaigns, retail partnerships, and educational initiatives can increase awareness and trial among traditional dairy consumers. Demographic targeting should emphasize younger consumers, health-conscious individuals, and environmentally aware segments that demonstrate higher adoption rates.

Distribution channel diversification should include expanded e-commerce capabilities, foodservice partnerships, and convenience store placement to increase product accessibility and capture impulse purchases. Direct-to-consumer models offer opportunities for higher margins, customer data collection, and personalized marketing approaches. Subscription services can build recurring revenue streams and strengthen customer relationships through convenient delivery options.

Pricing strategies must balance premium positioning for quality and innovation with competitive pricing that attracts price-sensitive consumers. Value-oriented product lines, bulk packaging options, and promotional programs can expand market reach while maintaining profitability. Cost optimization through supply chain efficiency, production scaling, and ingredient sourcing can improve competitive positioning without compromising quality.

Brand building initiatives should emphasize health benefits, environmental sustainability, and taste satisfaction through integrated marketing campaigns across digital and traditional channels. Influencer partnerships, social media engagement, and content marketing can effectively reach target demographics and build brand awareness. Consumer education addressing soy safety concerns and nutritional benefits can overcome perception barriers and drive adoption among hesitant consumers.

Market growth projections indicate continued expansion of the US soy beverages market driven by sustained consumer interest in plant-based alternatives and health-conscious dietary choices. MarkWide Research forecasts suggest the market will maintain steady growth momentum with a projected compound annual growth rate of 6.2% through 2030, supported by product innovation, expanded distribution, and demographic shifts toward plant-based consumption.

Innovation trajectories point toward enhanced formulations incorporating functional ingredients, improved taste profiles, and personalized nutrition options. Future product development will likely focus on addressing specific health concerns, dietary restrictions, and lifestyle preferences through targeted formulations. Technology integration including smart packaging, traceability systems, and personalized nutrition platforms may transform consumer experiences and brand interactions.

Competitive landscape evolution suggests continued market consolidation as larger companies acquire specialized brands while new entrants introduce innovative products targeting niche segments. Market dynamics will likely favor companies that successfully balance innovation, quality, and competitive pricing while building strong brand recognition and consumer loyalty. Distribution strategies will increasingly emphasize omnichannel approaches combining traditional retail, e-commerce, and direct-to-consumer models.

Consumer behavior trends indicate growing sophistication in plant-based beverage selection, with increased attention to nutritional content, ingredient quality, and environmental impact. Future market success will depend on companies’ abilities to meet evolving consumer expectations while maintaining operational efficiency and profitability. Sustainability considerations will become increasingly important as environmental consciousness continues influencing purchasing decisions across all demographic segments.

Regulatory environment changes may impact labeling requirements, nutritional standards, and marketing claims, requiring companies to maintain compliance while advocating for favorable policies supporting plant-based beverage growth. International market opportunities may emerge as trade relationships evolve and global demand for plant-based products increases, potentially creating export opportunities for US manufacturers.

The US soy beverages market represents a mature yet dynamic segment within the broader plant-based beverage industry, demonstrating resilient growth despite increasing competition from alternative plant-based options. Market fundamentals remain strong, supported by growing health consciousness, environmental awareness, and dietary diversification trends among American consumers. Strategic positioning emphasizing nutritional benefits, taste improvements, and sustainability credentials will be crucial for maintaining market share and driving future growth.

Innovation opportunities continue to emerge through product development, functional formulations, and enhanced consumer experiences that differentiate soy beverages from competing alternatives. Companies that successfully balance quality, innovation, and competitive pricing while building strong brand recognition will be best positioned for long-term success. Market expansion potential exists in underserved geographic regions and demographic segments, providing growth opportunities for companies willing to invest in targeted marketing and distribution strategies.

Future success factors include adaptability to changing consumer preferences, operational efficiency, and strategic partnerships that enhance distribution capabilities and market reach. The market outlook remains positive, with continued growth expected as plant-based beverage adoption becomes more mainstream and consumer acceptance of soy beverages strengthens through improved formulations and marketing efforts. Sustainable practices and transparent communication will become increasingly important as environmentally conscious consumers seek products that align with their values and lifestyle choices.

What is Soy Beverages?

Soy beverages are plant-based drinks made primarily from soybeans, often used as alternatives to dairy milk. They are popular for their nutritional benefits, including high protein content and low saturated fat.

What are the key players in the US Soy Beverages Market?

Key players in the US Soy Beverages Market include Silk, So Delicious, and Eden Foods, among others. These companies are known for their diverse product offerings and commitment to quality in the plant-based beverage sector.

What are the main drivers of growth in the US Soy Beverages Market?

The growth of the US Soy Beverages Market is driven by increasing consumer demand for plant-based diets, rising awareness of lactose intolerance, and the health benefits associated with soy products. Additionally, the trend towards sustainable and environmentally friendly food choices is contributing to market expansion.

What challenges does the US Soy Beverages Market face?

The US Soy Beverages Market faces challenges such as competition from other plant-based beverages, fluctuating soybean prices, and consumer concerns regarding allergies to soy. These factors can impact market stability and growth potential.

What opportunities exist in the US Soy Beverages Market?

Opportunities in the US Soy Beverages Market include the development of innovative flavors and formulations, expansion into new distribution channels, and increasing partnerships with health-focused retailers. The growing trend of veganism also presents a significant opportunity for market players.

What trends are shaping the US Soy Beverages Market?

Trends shaping the US Soy Beverages Market include the rise of organic and non-GMO products, the introduction of fortified soy beverages with added vitamins and minerals, and the increasing popularity of ready-to-drink options. These trends reflect changing consumer preferences towards healthier and more convenient beverage choices.

US Soy Beverages Market

| Segmentation Details | Description |

|---|---|

| Product Type | Soy Milk, Soy Protein, Soy Yogurt, Soy Creamer |

| End User | Households, Restaurants, Cafés, Health Clubs |

| Distribution Channel | Supermarkets, Online Retail, Health Food Stores, Convenience Stores |

| Packaging Type | Bottles, Tetra Packs, Cans, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Soy Beverages Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at