444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US smart oven market represents a rapidly evolving segment within the broader smart home appliance industry, characterized by innovative cooking technologies and connected device capabilities. Smart ovens integrate advanced features such as Wi-Fi connectivity, mobile app control, voice activation, and artificial intelligence-powered cooking algorithms to enhance user experience and cooking precision. The market encompasses various product categories including countertop smart ovens, built-in smart wall ovens, and combination microwave-convection smart units.

Market dynamics indicate robust growth driven by increasing consumer adoption of smart home technologies and growing demand for convenient cooking solutions. The integration of Internet of Things (IoT) technology has transformed traditional cooking appliances into sophisticated devices capable of remote monitoring, automatic cooking adjustments, and personalized recipe recommendations. Consumer preferences are shifting toward energy-efficient appliances with advanced cooking capabilities, contributing to market expansion at a compound annual growth rate of 12.3% through the forecast period.

Technological advancements in smart oven functionality include precision temperature control, steam cooking capabilities, air frying functions, and integration with popular voice assistants. The market benefits from increasing urbanization, rising disposable incomes, and growing awareness of energy-efficient cooking solutions. Premium features such as built-in cameras, automatic food recognition, and guided cooking programs are becoming standard offerings from leading manufacturers.

The US smart oven market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and sales of intelligent cooking appliances equipped with connected technologies and advanced automation features. Smart ovens are kitchen appliances that utilize Wi-Fi connectivity, mobile applications, sensors, and artificial intelligence to provide enhanced cooking experiences through remote control, automated cooking programs, and real-time monitoring capabilities.

These appliances distinguish themselves from conventional ovens through their ability to connect to home networks, receive software updates, and integrate with broader smart home ecosystems. The market includes various form factors and price points, from affordable countertop models to premium built-in units with comprehensive smart features. Key characteristics include app-based control, voice command compatibility, preset cooking programs, energy monitoring, and maintenance alerts.

Market participants include established appliance manufacturers, emerging technology companies, and specialized smart home device producers. The ecosystem also encompasses software developers, component suppliers, and retail distribution channels that collectively support the smart oven value chain.

The US smart oven market demonstrates exceptional growth potential driven by technological innovation and evolving consumer cooking preferences. Market expansion is supported by increasing smart home adoption rates, with 68% of American households expressing interest in connected kitchen appliances. The convergence of artificial intelligence, IoT connectivity, and advanced cooking technologies creates compelling value propositions for consumers seeking convenience and cooking precision.

Key market drivers include rising demand for time-saving cooking solutions, growing health consciousness among consumers, and increasing penetration of smart home ecosystems. The market benefits from continuous product innovation, with manufacturers introducing features such as guided cooking, automatic meal planning, and integration with popular meal delivery services. Consumer adoption is accelerated by improving user interfaces, enhanced mobile applications, and competitive pricing strategies.

Competitive dynamics feature established appliance brands competing alongside technology-focused startups, creating a diverse product landscape. Market leaders leverage their distribution networks and brand recognition while emerging players focus on innovative features and direct-to-consumer sales models. Regional variations in adoption rates reflect differences in urbanization levels, income demographics, and technology acceptance patterns across different US markets.

Market intelligence reveals several critical insights shaping the US smart oven landscape:

Market research indicates that consumers prioritize ease of use, cooking versatility, and energy savings when evaluating smart oven options. The integration of artificial intelligence for personalized cooking recommendations represents a significant growth opportunity for manufacturers.

Primary market drivers propelling US smart oven adoption include the accelerating smart home ecosystem expansion and increasing consumer demand for connected kitchen appliances. The proliferation of smart home platforms creates natural integration opportunities for intelligent cooking devices, with smart home adoption rates reaching 43% among US households. Lifestyle changes driven by busy work schedules and dual-income households fuel demand for time-saving cooking solutions that offer convenience without compromising food quality.

Technological advancement serves as a fundamental driver, with improvements in Wi-Fi connectivity, mobile app functionality, and artificial intelligence capabilities enhancing smart oven appeal. The integration of voice control through popular assistants like Amazon Alexa and Google Assistant provides intuitive operation methods that resonate with tech-savvy consumers. Energy efficiency concerns drive adoption as smart ovens offer precise temperature control and optimized cooking cycles that reduce energy consumption compared to traditional appliances.

Health and wellness trends contribute significantly to market growth, with smart ovens enabling healthier cooking methods through features like steam cooking, air frying, and precise temperature monitoring. The ability to track cooking progress remotely and receive notifications prevents overcooking and food waste, aligning with sustainability consciousness among consumers. Urbanization patterns and smaller living spaces increase demand for compact, multifunctional appliances that maximize kitchen efficiency.

Market growth faces several significant restraints that impact adoption rates and expansion potential. High initial costs associated with smart oven technology create barriers for price-sensitive consumers, particularly when compared to conventional oven alternatives. The premium pricing of advanced smart features limits market penetration in middle and lower-income segments, restricting overall market expansion potential.

Technical complexity and connectivity requirements present challenges for less tech-savvy consumers who may find smart oven setup and operation intimidating. Issues related to Wi-Fi reliability, app functionality, and software updates can create user frustration and impact brand perception. Privacy and security concerns regarding connected appliances collecting usage data and potential cybersecurity vulnerabilities deter some consumers from adopting smart kitchen technologies.

Infrastructure limitations in certain regions, including unreliable internet connectivity and limited smart home ecosystem development, constrain market growth in rural and suburban areas. The dependence on mobile applications and cloud services for full functionality creates concerns about long-term product support and obsolescence. Maintenance complexity and potential repair costs for sophisticated electronic components may discourage consumers accustomed to simpler appliance technologies.

Significant opportunities exist for market expansion through product innovation and strategic market positioning. The integration of artificial intelligence and machine learning capabilities presents opportunities to develop personalized cooking experiences that adapt to individual preferences and dietary requirements. Subscription-based services for recipe content, cooking guidance, and maintenance support create recurring revenue streams while enhancing customer engagement and loyalty.

Partnership opportunities with meal kit delivery services, grocery retailers, and nutrition apps offer potential for ecosystem expansion and enhanced value propositions. The development of specialized smart ovens for specific dietary needs, such as gluten-free, keto, or plant-based cooking, addresses niche market segments with strong growth potential. Commercial applications in restaurants, cafes, and food service establishments represent untapped market opportunities for scaled smart oven solutions.

Emerging technologies such as augmented reality cooking guidance, advanced food recognition systems, and integration with smart refrigerators create differentiation opportunities for innovative manufacturers. The potential for smart ovens to serve as central hubs for connected kitchen ecosystems positions them as strategic platforms for broader smart home integration. Sustainability features including energy monitoring, carbon footprint tracking, and eco-friendly cooking modes align with growing environmental consciousness among consumers.

Market dynamics in the US smart oven sector reflect the interplay between technological innovation, consumer behavior evolution, and competitive pressures. The rapid pace of smart home technology advancement creates both opportunities and challenges for manufacturers seeking to maintain product relevance and competitive positioning. Consumer expectations continue to evolve, demanding increasingly sophisticated features while maintaining ease of use and reliability.

Supply chain considerations impact market dynamics through component availability, manufacturing costs, and distribution efficiency. The integration of advanced sensors, processors, and connectivity modules requires sophisticated supply chain management and quality control processes. Regulatory factors including energy efficiency standards, safety certifications, and data privacy regulations influence product development and market entry strategies.

Competitive intensity drives continuous innovation cycles, with manufacturers investing heavily in research and development to differentiate their offerings. The market experiences pressure from both traditional appliance companies leveraging their manufacturing expertise and technology startups introducing disruptive innovations. Consumer education remains crucial for market development, as many potential buyers require demonstration of smart oven benefits and capabilities to justify premium pricing.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US smart oven market landscape. Primary research includes structured interviews with industry executives, technology developers, retail partners, and end consumers to gather firsthand perspectives on market trends, challenges, and opportunities. Consumer surveys and focus groups provide quantitative and qualitative data on purchase behavior, feature preferences, and satisfaction levels.

Secondary research encompasses analysis of industry reports, patent filings, regulatory documents, and financial statements from public companies operating in the smart appliance sector. Market data collection includes retail sales tracking, online marketplace analysis, and pricing trend evaluation across different distribution channels. Technology assessment involves evaluation of emerging innovations, competitive product analysis, and feature comparison studies.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert consultation, and statistical verification methods. Market modeling incorporates historical trends, current market conditions, and projected growth scenarios to develop reliable forecasts. Regional analysis considers demographic variations, economic factors, and technology adoption patterns across different US geographic markets to provide comprehensive market understanding.

Regional market dynamics across the United States reveal significant variations in smart oven adoption patterns and growth potential. The West Coast region leads in market penetration with 37% of total smart oven sales, driven by high technology adoption rates, affluent consumer demographics, and strong smart home ecosystem development in markets like California, Washington, and Oregon. Urban centers including San Francisco, Seattle, and Los Angeles demonstrate particularly strong demand for premium smart appliances.

The Northeast corridor represents the second-largest market segment, accounting for 28% of national sales volume, with strong performance in metropolitan areas such as New York, Boston, and Philadelphia. High population density, elevated income levels, and tech-savvy consumer bases support robust smart oven adoption rates. Market characteristics in this region include preference for built-in smart ovens and integration with existing luxury kitchen designs.

Southern and Midwest regions show emerging growth potential with combined market share of 35%, though adoption rates vary significantly between urban and rural areas. Texas, Florida, and Illinois lead regional growth, supported by expanding metropolitan areas and increasing smart home awareness. Rural markets present challenges related to internet connectivity and technology familiarity, though improving infrastructure and generational shifts create long-term opportunities.

The competitive landscape features a diverse mix of established appliance manufacturers, technology companies, and innovative startups competing for market share through differentiated product offerings and strategic positioning. Market leaders leverage their manufacturing expertise, distribution networks, and brand recognition to maintain competitive advantages while investing in smart technology capabilities.

Competitive strategies include product differentiation through unique features, strategic partnerships with smart home platforms, and direct-to-consumer sales models that enable closer customer relationships and higher margins.

Market segmentation analysis reveals distinct categories based on product type, price range, and target consumer demographics. By Product Type: The market divides into countertop smart ovens, built-in smart wall ovens, and combination units that integrate multiple cooking functions. Countertop models dominate with 62% market share due to lower costs and easier installation requirements.

By Price Range: Market segments include entry-level smart ovens under $500, mid-range products between $500-$1,500, and premium units exceeding $1,500. The mid-range segment captures 45% of total sales volume, balancing advanced features with accessible pricing for mainstream consumers.

By Technology Features: Segmentation based on connectivity options includes Wi-Fi enabled models, voice control integration, mobile app functionality, and AI-powered cooking assistance. Advanced feature sets command premium pricing while basic connectivity options serve price-sensitive market segments.

By Distribution Channel: Market channels encompass online retail platforms, specialty appliance stores, home improvement retailers, and direct manufacturer sales. Online channels account for 58% of smart oven sales, reflecting consumer preference for researching features and comparing options digitally.

Countertop Smart Ovens represent the largest and fastest-growing category, appealing to consumers seeking smart cooking capabilities without major kitchen renovations. These units offer portability, affordability, and comprehensive feature sets that include convection cooking, air frying, and steam functions. Consumer preferences favor compact designs that maximize counter space efficiency while providing versatile cooking options for small to medium households.

Built-in Smart Wall Ovens target premium market segments with sophisticated integration requirements and luxury kitchen designs. These products emphasize seamless connectivity with existing smart home systems and offer professional-grade cooking capabilities. Market characteristics include longer replacement cycles, higher average selling prices, and strong brand loyalty among affluent consumers.

Combination Smart Units integrate multiple cooking functions including microwave, convection, and steam capabilities in single appliances. These products address space constraints in urban kitchens while providing comprehensive cooking solutions. Growth drivers include increasing apartment living, smaller kitchen footprints, and consumer desire for multifunctional appliances that reduce clutter and maximize utility.

Commercial Smart Ovens serve restaurants, cafes, and food service establishments seeking operational efficiency and consistency. These units emphasize durability, high-volume capacity, and integration with point-of-sale systems for streamlined operations.

Manufacturers benefit from smart oven market participation through premium pricing opportunities, enhanced customer engagement, and differentiation from commodity appliance competitors. The integration of smart technologies enables manufacturers to develop ongoing relationships with customers through software updates, content services, and data-driven product improvements. Revenue diversification opportunities include subscription services, extended warranties, and accessory sales that create recurring income streams.

Retailers gain advantages through higher margin products, reduced inventory turnover challenges, and enhanced customer service opportunities. Smart ovens typically command premium shelf space and attract tech-savvy consumers who often purchase complementary smart home products. Online retailers particularly benefit from detailed product information requirements and comparison shopping behaviors that favor digital platforms.

Consumers receive value through enhanced cooking convenience, energy efficiency improvements, and access to guided cooking experiences that improve meal quality and reduce food waste. Smart ovens enable remote monitoring and control, allowing users to manage cooking processes while multitasking. Long-term benefits include software updates that add new features and cooking programs without requiring hardware replacement.

Technology partners including component suppliers, software developers, and connectivity providers benefit from growing demand for smart appliance integration and ongoing service requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a dominant trend, with smart ovens incorporating machine learning algorithms that adapt to user preferences and cooking patterns. These systems analyze cooking history, dietary preferences, and seasonal ingredients to suggest optimal recipes and cooking parameters. AI capabilities extend to automatic food recognition through built-in cameras and sensors that identify ingredients and recommend appropriate cooking methods.

Voice Control Adoption accelerates as consumers embrace hands-free operation during cooking activities. Integration with popular voice assistants enables natural language commands for temperature adjustments, timer settings, and cooking program selection. Voice technology particularly appeals to users with limited mobility or those managing multiple cooking tasks simultaneously.

Sustainability Features gain prominence as environmentally conscious consumers seek energy-efficient cooking solutions. Smart ovens incorporate energy monitoring, carbon footprint tracking, and eco-friendly cooking modes that optimize resource consumption. Sustainability trends include integration with renewable energy systems and waste reduction features that minimize food spoilage through precise cooking control.

Health and Wellness Focus drives development of features supporting specific dietary requirements and nutritional goals. Smart ovens offer specialized cooking programs for gluten-free, keto, paleo, and plant-based diets while providing nutritional information and portion control guidance.

Recent industry developments highlight the dynamic nature of smart oven innovation and market evolution. Major manufacturers are investing heavily in artificial intelligence capabilities, with several companies launching ovens featuring advanced food recognition and automated cooking adjustment systems. These developments represent significant technological leaps that enhance user experience and cooking precision.

Strategic partnerships between appliance manufacturers and meal kit delivery services create integrated cooking ecosystems that combine smart ovens with curated ingredient deliveries and guided cooking experiences. MarkWide Research analysis indicates these partnerships drive customer acquisition and retention while creating new revenue opportunities for participating companies.

Regulatory developments include updated energy efficiency standards and cybersecurity requirements for connected appliances. Manufacturers are adapting product designs and software architectures to comply with evolving regulations while maintaining competitive feature sets. Industry standards for smart appliance interoperability are emerging, facilitating better integration with diverse smart home platforms.

Investment activity in smart kitchen technology startups demonstrates continued confidence in market growth potential. Venture capital funding supports development of innovative features, manufacturing scale-up, and market expansion efforts. Technology acquisitions by established appliance companies accelerate smart capability development and market entry timelines.

Market analysts recommend that manufacturers focus on user experience simplification while maintaining advanced functionality to address the complexity barrier limiting broader market adoption. Streamlined interfaces and intuitive mobile applications can significantly improve consumer acceptance and satisfaction rates. Investment in customer education and demonstration programs will accelerate market penetration among less tech-savvy consumer segments.

Pricing strategy optimization should include development of entry-level smart oven models that provide basic connectivity features at accessible price points. This approach can expand market reach while creating upgrade pathways for consumers seeking advanced capabilities. Subscription service models for premium features and content can reduce initial purchase barriers while generating recurring revenue streams.

Partnership development with smart home platform providers, meal delivery services, and kitchen design professionals can enhance market positioning and customer acquisition efficiency. Retail channel diversification including expansion into home improvement stores and specialty kitchen retailers can improve product visibility and consumer access.

Innovation priorities should emphasize reliability, energy efficiency, and seamless integration with existing kitchen workflows. MWR analysis suggests that manufacturers prioritizing these fundamental attributes alongside advanced features will achieve stronger market positions and customer loyalty.

The future outlook for the US smart oven market indicates sustained growth driven by technological advancement and evolving consumer preferences. Market expansion is projected to continue at robust rates, with penetration increasing from current levels to reach 25% of US households within the next five years. This growth trajectory reflects improving affordability, enhanced product reliability, and increasing consumer familiarity with smart home technologies.

Technological evolution will focus on artificial intelligence sophistication, with future smart ovens offering predictive cooking capabilities that anticipate user needs and automatically adjust cooking parameters based on environmental conditions and ingredient variations. Integration capabilities will expand to include seamless connectivity with smart refrigerators, grocery delivery services, and nutrition tracking applications.

Market maturation will drive product standardization and interoperability improvements, making smart ovens more accessible to mainstream consumers. Price normalization through manufacturing scale economies and component cost reductions will expand market reach across diverse income segments. The emergence of smart oven rental and leasing models may further reduce adoption barriers for price-sensitive consumers.

Commercial market expansion presents significant growth opportunities as restaurants and food service establishments adopt smart cooking technologies to improve operational efficiency and food quality consistency. MarkWide Research projects that commercial applications could represent 30% of total market volume by the end of the forecast period, driven by labor cost pressures and quality standardization requirements.

The US smart oven market represents a dynamic and rapidly evolving sector within the broader smart home appliance industry, characterized by continuous innovation, growing consumer acceptance, and significant expansion potential. Market fundamentals remain strong, supported by increasing smart home adoption, technological advancement, and evolving consumer cooking preferences that favor convenience and precision.

Key success factors for market participants include balancing advanced functionality with user-friendly operation, developing competitive pricing strategies that address diverse market segments, and creating comprehensive customer support systems that ensure positive ownership experiences. The integration of artificial intelligence, voice control, and sustainability features will continue driving product differentiation and consumer value creation.

Future market development will be shaped by technological innovation, regulatory evolution, and changing consumer lifestyles that increasingly prioritize convenience, health, and environmental responsibility. Companies that successfully navigate these trends while maintaining focus on reliability, affordability, and customer satisfaction will achieve sustainable competitive advantages in this promising market segment.

What is a Smart Oven?

A Smart Oven is a kitchen appliance that integrates advanced technology to enhance cooking efficiency and convenience. These ovens often feature connectivity options, allowing users to control them remotely via smartphones or smart home systems.

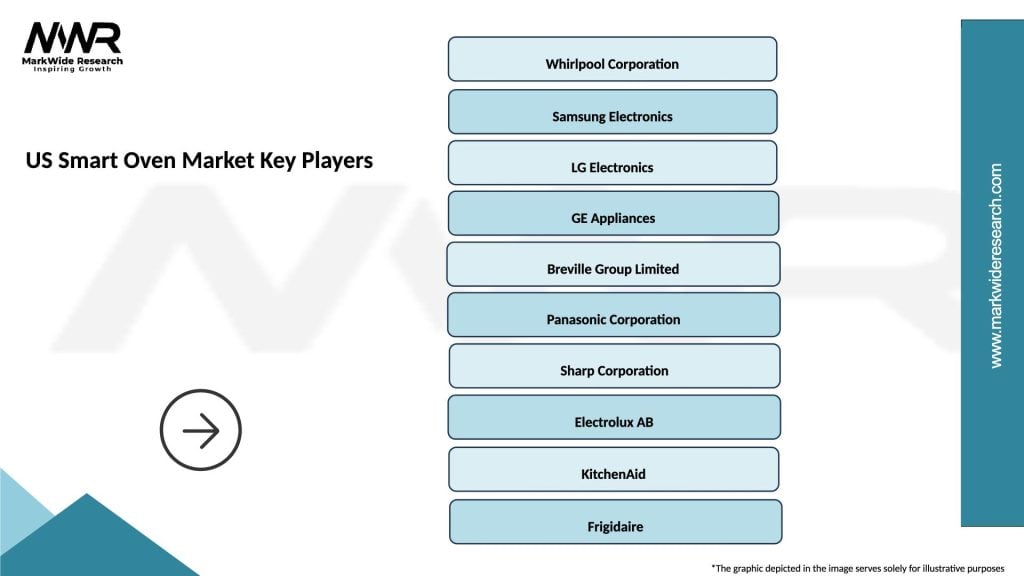

What are the key players in the US Smart Oven Market?

Key players in the US Smart Oven Market include companies like Whirlpool, GE Appliances, and Samsung, which are known for their innovative cooking technologies and smart features, among others.

What are the main drivers of growth in the US Smart Oven Market?

The growth of the US Smart Oven Market is driven by increasing consumer demand for convenience, the rise of smart home technology, and a growing focus on energy efficiency in cooking appliances.

What challenges does the US Smart Oven Market face?

The US Smart Oven Market faces challenges such as high initial costs, consumer skepticism regarding technology reliability, and competition from traditional cooking appliances that may deter some buyers.

What opportunities exist in the US Smart Oven Market?

Opportunities in the US Smart Oven Market include the potential for integration with other smart home devices, the development of new cooking technologies, and the increasing popularity of healthy cooking options among consumers.

What trends are shaping the US Smart Oven Market?

Trends in the US Smart Oven Market include the rise of voice-activated controls, the incorporation of artificial intelligence for personalized cooking experiences, and the growing emphasis on sustainable materials and energy-efficient designs.

US Smart Oven Market

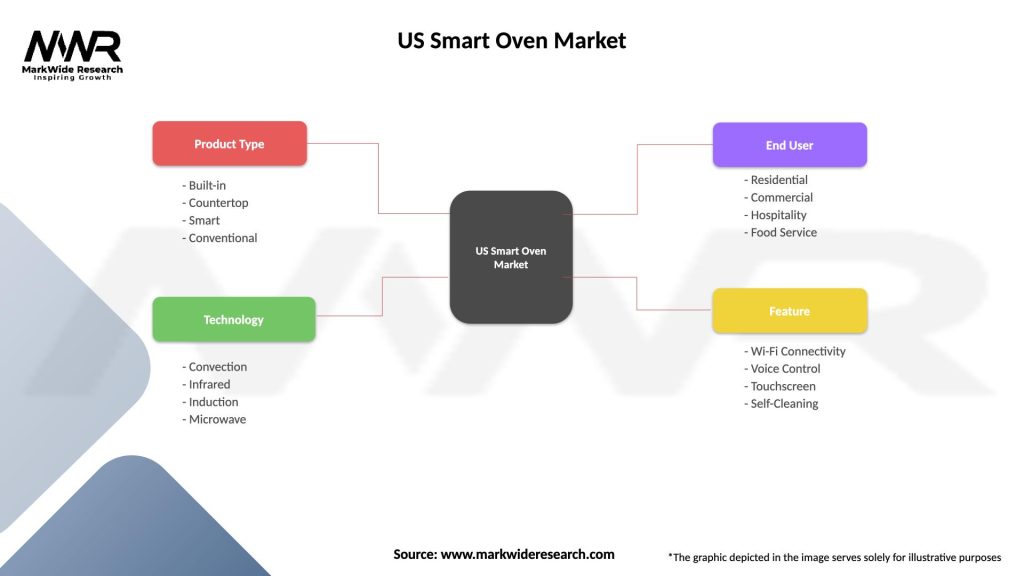

| Segmentation Details | Description |

|---|---|

| Product Type | Built-in, Countertop, Smart, Conventional |

| Technology | Convection, Infrared, Induction, Microwave |

| End User | Residential, Commercial, Hospitality, Food Service |

| Feature | Wi-Fi Connectivity, Voice Control, Touchscreen, Self-Cleaning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Smart Oven Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at