444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US smart lock market represents a rapidly evolving segment within the broader home automation and security industry, experiencing unprecedented growth driven by technological advancements and changing consumer preferences. Smart locks have emerged as a cornerstone technology in the Internet of Things (IoT) ecosystem, offering enhanced security, convenience, and connectivity features that traditional mechanical locks cannot provide. The market encompasses various technologies including Bluetooth-enabled locks, Wi-Fi connected systems, Z-Wave protocols, and biometric authentication solutions.

Market dynamics indicate robust expansion across residential and commercial sectors, with the residential segment commanding approximately 78% market share due to increasing smart home adoption rates. The commercial segment, while smaller, demonstrates significant growth potential driven by enterprise security requirements and workplace modernization initiatives. Regional distribution shows concentrated adoption in urban areas, with California, Texas, New York, and Florida leading in smart lock installations.

Technology integration continues to drive market evolution, with manufacturers focusing on seamless connectivity with popular smart home platforms including Amazon Alexa, Google Assistant, and Apple HomeKit. The market benefits from growing consumer awareness of home security solutions and the increasing prevalence of smartphone usage, which serves as the primary interface for smart lock operation. Installation trends reveal a shift toward DIY-friendly products, with approximately 65% of consumers preferring self-installation options over professional services.

The US smart lock market refers to the comprehensive ecosystem of electronically controlled locking mechanisms that utilize wireless communication technologies, mobile applications, and advanced authentication methods to provide keyless entry solutions for residential and commercial properties across the United States. Smart locks integrate traditional locking mechanisms with digital connectivity, enabling remote access control, user management, and real-time monitoring capabilities through smartphone applications and smart home platforms.

Core functionality encompasses multiple access methods including smartphone apps, key fobs, keypads, biometric scanners, and voice commands, providing users with flexible and convenient entry options. These systems typically feature encryption protocols to ensure secure communication between the lock and connected devices, while maintaining compatibility with existing door hardware in most installations. Advanced features include temporary access codes for guests, activity logs, automatic locking mechanisms, and integration with home security systems.

Market classification includes various product categories such as deadbolts, lever handles, padlocks, and cam locks, each designed for specific applications and security requirements. The technology spans multiple connectivity protocols including Bluetooth Low Energy, Wi-Fi, Z-Wave, Zigbee, and emerging standards that enable seamless integration with broader smart home ecosystems and professional security monitoring services.

Strategic positioning within the US smart lock market reveals a landscape characterized by rapid technological innovation, increasing consumer adoption, and expanding application scenarios across residential and commercial segments. The market demonstrates strong growth momentum driven by digital transformation trends, enhanced security awareness, and the proliferation of connected home technologies. Consumer behavior shifts toward contactless solutions, accelerated by recent global events, have further amplified demand for keyless entry systems.

Competitive dynamics showcase a diverse ecosystem of established security companies, technology startups, and traditional lock manufacturers transitioning to smart solutions. Market leaders leverage strategic partnerships with smart home platform providers, retail channels, and installation services to expand their market reach and enhance customer experience. Innovation focus centers on improving battery life, enhancing security protocols, and developing more intuitive user interfaces.

Market segmentation reveals distinct growth patterns across different product categories and price points, with mid-range products experiencing the highest adoption rates due to their balance of features and affordability. Distribution channels have evolved to include traditional hardware stores, online marketplaces, specialty security retailers, and direct-to-consumer sales models, with e-commerce platforms capturing approximately 42% of total sales volume.

Consumer adoption patterns demonstrate significant variations across demographic segments, with millennials and Gen Z consumers showing the highest propensity for smart lock adoption, driven by their comfort with digital technologies and preference for connected home solutions. Geographic distribution indicates concentrated growth in metropolitan areas where smart home infrastructure is more developed and consumer awareness is higher.

Technological advancement serves as the primary catalyst for smart lock market expansion, with continuous improvements in wireless communication protocols, battery technology, and mobile application interfaces enhancing user experience and system reliability. IoT ecosystem growth creates synergistic effects as consumers invest in comprehensive smart home solutions, driving demand for compatible security devices that integrate seamlessly with existing platforms.

Security consciousness among American consumers has intensified, particularly following increased awareness of home security vulnerabilities and the limitations of traditional lock systems. Convenience factors including keyless entry, remote access capabilities, and the ability to grant temporary access to service providers or guests without physical key exchange significantly influence consumer purchasing decisions.

Urbanization trends contribute to market growth as city dwellers seek sophisticated security solutions that align with their technology-forward lifestyles. Real estate market dynamics also play a crucial role, with smart locks increasingly viewed as value-adding home improvements that enhance property appeal and marketability. Workplace evolution toward flexible work arrangements has created demand for residential security solutions that accommodate varying occupancy patterns and remote access needs.

Generational preferences strongly favor digital solutions, with younger homeowners and renters demonstrating higher adoption rates for smart home technologies. Insurance incentives offered by some providers for enhanced home security systems create additional economic motivation for smart lock adoption, while energy efficiency considerations drive interest in integrated systems that optimize home automation and security functions.

Cost considerations remain a significant barrier for widespread adoption, particularly among price-sensitive consumer segments who perceive smart locks as premium products with questionable return on investment. Installation complexity for certain product categories requires professional assistance, adding to the total cost of ownership and potentially deterring DIY-oriented consumers who prefer simple replacement solutions.

Security concerns paradoxically serve as both a driver and restraint, with some consumers expressing skepticism about the vulnerability of connected devices to cyber attacks and hacking attempts. Battery dependency creates anxiety among users who worry about lockouts due to power failures, despite backup key options and low-battery alerts provided by most manufacturers.

Compatibility issues with existing door hardware and smart home systems can complicate the selection and installation process, particularly in older homes with non-standard door configurations. Technology reliability concerns persist among conservative consumers who prefer the simplicity and proven dependability of traditional mechanical locks over electronic alternatives.

Privacy implications associated with data collection and user activity tracking by smart lock manufacturers create hesitation among privacy-conscious consumers. Network dependency for certain features raises concerns about functionality during internet outages or Wi-Fi connectivity issues, while learning curve requirements for setup and operation may discourage less tech-savvy users from adoption.

Rental market expansion presents substantial growth opportunities as property managers and landlords recognize the operational benefits of smart locks for tenant management, keyless showings, and enhanced security monitoring. Multifamily housing developments increasingly specify smart lock systems as standard amenities to attract tech-savvy tenants and differentiate their properties in competitive markets.

Commercial sector penetration offers significant potential, particularly among small and medium enterprises seeking cost-effective access control solutions without the complexity of traditional commercial security systems. Healthcare facilities, educational institutions, and hospitality venues represent emerging application areas where smart locks can enhance operational efficiency and security management.

Integration opportunities with emerging technologies such as artificial intelligence, machine learning, and advanced biometrics create possibilities for next-generation products with enhanced security features and predictive capabilities. Subscription service models for premium features, cloud storage, and professional monitoring services represent new revenue streams beyond traditional hardware sales.

Rural market development remains largely untapped, with opportunities to address unique security needs and connectivity challenges in less densely populated areas. Retrofit solutions for existing commercial buildings and older residential properties offer substantial market potential, while partnership opportunities with home builders, security companies, and smart home platform providers can accelerate market penetration and customer acquisition.

Supply chain evolution within the smart lock market reflects broader trends in electronics manufacturing, with companies increasingly focusing on vertical integration to control quality and reduce costs. Component sourcing strategies emphasize reliable suppliers for critical elements including wireless modules, encryption chips, and battery systems, while manufacturers work to mitigate supply chain disruptions that have affected the broader technology sector.

Competitive intensity continues to escalate as traditional lock manufacturers compete with technology companies and startups, creating pressure for continuous innovation and competitive pricing. Market consolidation trends suggest potential merger and acquisition activity as companies seek to expand their technology portfolios and market reach through strategic combinations.

Regulatory landscape influences product development and market entry strategies, with cybersecurity standards and data privacy regulations shaping design requirements and compliance costs. Standards development for interoperability and security protocols affects long-term market dynamics and competitive positioning, while certification requirements create barriers to entry for new market participants.

Consumer education initiatives by manufacturers and industry associations play crucial roles in market development, addressing misconceptions about smart lock security and demonstrating practical benefits. Channel partner relationships with retailers, installers, and smart home integrators significantly influence market access and customer acquisition strategies, while after-sales support capabilities increasingly differentiate competitive offerings in a crowded marketplace.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the US smart lock market landscape. Primary research includes extensive surveys of consumers, industry professionals, and key stakeholders across the smart home and security sectors, providing firsthand insights into market trends, preferences, and challenges.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to establish market context and validate primary findings. Data triangulation methods ensure consistency across multiple information sources and enhance the reliability of market projections and trend analysis.

Quantitative analysis utilizes statistical modeling techniques to project market growth patterns, segment performance, and competitive dynamics based on historical data and current market indicators. Qualitative assessment incorporates expert interviews, focus group discussions, and case study analysis to provide deeper understanding of market drivers, barriers, and opportunities.

Market sizing methodologies combine top-down and bottom-up approaches, analyzing market segments, distribution channels, and regional variations to develop comprehensive market estimates. Competitive intelligence gathering includes monitoring of product launches, pricing strategies, and strategic partnerships to maintain current understanding of market dynamics and competitive positioning.

Geographic distribution of smart lock adoption across the United States reveals distinct regional patterns influenced by factors including urbanization levels, income demographics, technology adoption rates, and local security concerns. West Coast markets, particularly California, demonstrate the highest penetration rates with approximately 23% regional market share, driven by tech-savvy consumers and early adopter tendencies in metropolitan areas like San Francisco, Los Angeles, and Seattle.

Northeast corridor including New York, Massachusetts, and Connecticut represents another significant market concentration, accounting for roughly 19% of national adoption. Urban density and higher disposable incomes in these regions support premium smart lock adoption, while security concerns in metropolitan areas drive demand for advanced access control solutions.

Southern states show growing momentum with Texas and Florida leading regional adoption, collectively representing approximately 18% market share. New construction activity in these markets creates opportunities for smart lock integration in residential developments, while commercial growth in cities like Austin, Dallas, and Miami drives business segment expansion.

Midwest markets demonstrate steady but more conservative adoption patterns, with Illinois, Ohio, and Michigan showing gradual growth in smart lock deployment. Rural areas across all regions remain underserved, presenting significant expansion opportunities as connectivity infrastructure improves and product awareness increases through targeted marketing initiatives.

Market leadership in the US smart lock sector is distributed among several key players, each bringing distinct strengths and strategic approaches to capture market share and drive innovation. The competitive environment encompasses traditional lock manufacturers transitioning to smart solutions, pure-play technology companies, and established home automation providers expanding their security offerings.

Strategic positioning varies significantly across competitors, with some focusing on premium features and professional installation while others target mass market adoption through retail partnerships and DIY-friendly designs. Innovation cycles typically span 12-18 months, with companies regularly updating firmware, mobile applications, and hardware features to maintain competitive advantages.

Product segmentation within the US smart lock market encompasses multiple categories based on technology, application, price point, and installation requirements. Technology-based segmentation includes Bluetooth-enabled locks, Wi-Fi connected systems, Z-Wave compatible devices, and hybrid solutions that support multiple connectivity protocols for enhanced flexibility and reliability.

By Technology:

By Application:

Price-based segmentation reveals distinct consumer preferences across different market tiers, with mid-range products capturing the largest share due to their optimal balance of features and affordability for mainstream adoption.

Residential smart locks dominate market volume and revenue, with single-family homeowners representing the primary customer base seeking enhanced security and convenience features. Apartment dwellers show increasing interest in portable smart lock solutions that can be easily installed and removed without permanent modifications to rental properties.

Commercial applications demonstrate distinct requirements including higher security standards, audit trail capabilities, and integration with existing access control systems. Small business adoption focuses on cost-effective solutions that eliminate key management overhead while providing flexible access control for employees and contractors.

Retrofit market represents a substantial opportunity as existing homeowners upgrade traditional locks without major door modifications. New construction integration allows for optimal smart lock deployment with coordinated wiring and smart home system planning from the initial building phase.

Premium segment customers prioritize advanced features including biometric authentication, tamper alerts, and sophisticated mobile applications with detailed access logging. Value segment focuses on basic smart lock functionality with reliable operation and straightforward installation processes that appeal to price-conscious consumers seeking entry-level smart home security solutions.

Manufacturers benefit from expanding market opportunities driven by increasing consumer acceptance of smart home technologies and growing security awareness. Revenue diversification through software services, subscription models, and ecosystem partnerships creates sustainable competitive advantages beyond traditional hardware sales.

Retailers gain from higher margin products compared to traditional locks, while smart locks often drive additional sales of complementary smart home products and installation services. Online marketplaces particularly benefit from the research-intensive nature of smart lock purchases, where consumers value detailed product information and customer reviews.

Installation professionals find new service opportunities in smart lock deployment, configuration, and ongoing maintenance, while security companies can expand their service offerings to include smart home integration and monitoring services. Property managers realize operational efficiencies through keyless access management and reduced lock-changing costs.

Technology partners including smart home platform providers benefit from increased ecosystem adoption and user engagement, while component suppliers experience growing demand for specialized electronics, batteries, and wireless communication modules. Insurance companies can offer risk-based pricing advantages for properties with enhanced security systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Voice integration emerges as a dominant trend with smart locks increasingly supporting Amazon Alexa, Google Assistant, and Apple Siri for hands-free operation and status inquiries. Biometric authentication gains momentum as fingerprint and facial recognition technologies become more affordable and reliable for residential applications.

Invisible design represents a growing preference among consumers who want smart lock functionality without compromising traditional door aesthetics. Battery life optimization continues as a key focus area, with manufacturers achieving 12-24 month operation cycles through improved power management and low-energy wireless protocols.

Cloud connectivity expansion enables advanced features including remote monitoring, firmware updates, and integration with professional security services. Artificial intelligence applications begin emerging in pattern recognition, anomaly detection, and predictive maintenance capabilities that enhance security and user experience.

Subscription services for premium features, cloud storage, and professional monitoring create recurring revenue opportunities while providing enhanced value to consumers. Interoperability standards development, including Matter protocol adoption, promises improved compatibility across different smart home ecosystems and reduced consumer confusion about product selection.

Strategic partnerships between smart lock manufacturers and major smart home platform providers have accelerated market integration and consumer adoption. Amazon’s acquisition of Ring significantly impacted competitive dynamics, creating a vertically integrated security ecosystem that combines smart locks with doorbell cameras and professional monitoring services.

Technology standardization efforts through industry consortiums work to establish common protocols for device interoperability and security standards. Retail expansion into major home improvement chains and big-box retailers has improved product visibility and consumer accessibility, while e-commerce growth provides detailed product information and customer reviews that facilitate informed purchasing decisions.

Investment activity in smart lock startups and established companies reflects strong investor confidence in market growth potential and technology innovation opportunities. Patent development accelerates as companies seek to protect intellectual property in key areas including biometric authentication, wireless protocols, and mobile application interfaces.

Regulatory attention to cybersecurity and data privacy issues influences product development priorities and compliance requirements. MarkWide Research analysis indicates that industry consolidation trends may accelerate as companies seek scale advantages and technology portfolio expansion through strategic acquisitions and partnerships.

Market participants should prioritize user experience optimization through simplified installation processes and intuitive mobile applications that reduce barriers to adoption among mainstream consumers. Security messaging requires careful balance between highlighting advanced protection features and addressing consumer concerns about connected device vulnerabilities.

Product development focus should emphasize battery life extension, aesthetic design flexibility, and compatibility with existing door hardware to address primary consumer concerns. Pricing strategies need to consider value-conscious segments while maintaining premium positioning for advanced feature sets that justify higher price points.

Distribution channel expansion should include both traditional retail partnerships and direct-to-consumer models that provide comprehensive customer education and support services. Commercial market development represents significant growth opportunities requiring specialized products and sales approaches tailored to business customer needs.

Technology roadmaps should incorporate emerging standards including Matter protocol support and advanced biometric capabilities while maintaining backward compatibility with existing smart home ecosystems. Service model development for subscription-based features and professional installation can create differentiated value propositions and recurring revenue streams that enhance long-term customer relationships.

Market trajectory indicates continued strong growth driven by increasing smart home adoption, enhanced security awareness, and ongoing technology improvements that address current limitations. Penetration rates are expected to accelerate as prices decline and installation complexity decreases through improved product design and consumer education initiatives.

Technology evolution will likely focus on artificial intelligence integration, advanced biometrics, and seamless connectivity with broader IoT ecosystems. Commercial applications represent the fastest-growing segment with projected expansion rates exceeding 15% annually as businesses recognize operational benefits and cost savings from smart access control systems.

Geographic expansion beyond current urban concentrations will drive market growth as rural connectivity improves and product awareness increases through targeted marketing efforts. Regulatory developments in cybersecurity and privacy protection will shape product requirements and competitive positioning while potentially creating barriers for smaller market participants.

Industry consolidation trends suggest potential merger and acquisition activity as companies seek scale advantages and technology portfolio expansion. MWR projections indicate that subscription service models will become increasingly important revenue drivers, potentially accounting for 25-30% of total market revenue within the next five years as companies transition from hardware-centric to service-oriented business models.

The US smart lock market stands at a pivotal juncture characterized by robust growth momentum, technological innovation, and expanding consumer acceptance across residential and commercial applications. Market fundamentals remain strong with multiple growth drivers including smart home ecosystem expansion, enhanced security consciousness, and generational preferences for connected technologies creating sustainable demand patterns.

Competitive dynamics continue evolving as traditional lock manufacturers compete with technology companies and startups, driving continuous innovation in features, pricing, and user experience. Technology advancement in areas including biometric authentication, artificial intelligence, and wireless connectivity protocols promises to address current market limitations while creating new application opportunities.

Strategic opportunities abound for market participants who can successfully navigate challenges including price sensitivity, installation complexity, and security concerns while capitalizing on growing demand from underserved segments including commercial applications and rural markets. Future success will likely depend on companies’ ability to balance innovation with practical user needs, develop sustainable service models, and build comprehensive ecosystems that deliver ongoing value beyond initial hardware sales.

What is Smart Lock?

Smart locks are advanced locking mechanisms that allow users to secure and access their properties using smartphones, keypads, or biometric data. They often integrate with home automation systems and provide features like remote access and monitoring.

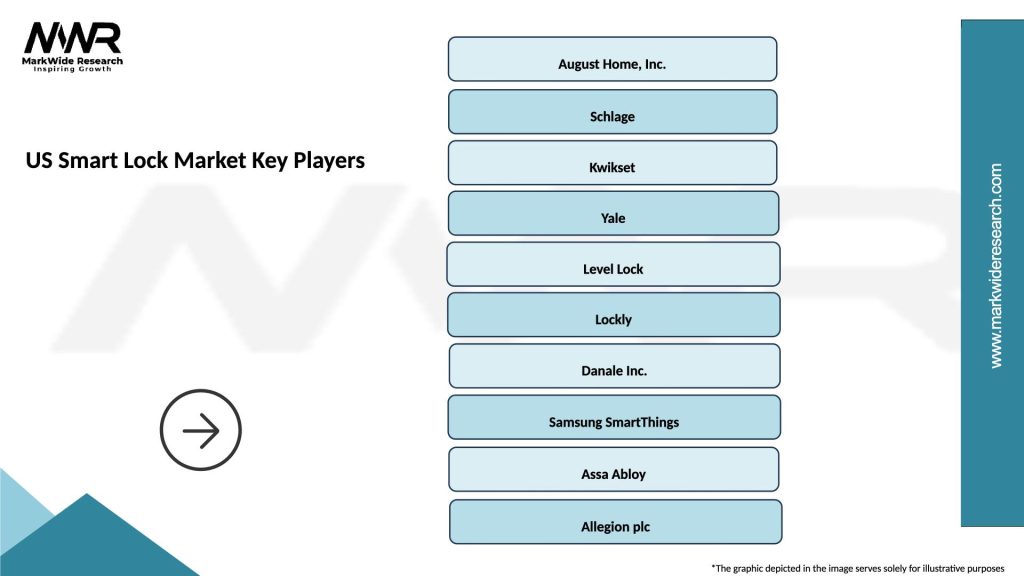

What are the key players in the US Smart Lock Market?

Key players in the US Smart Lock Market include August Home, Schlage, Yale, and Kwikset, among others. These companies are known for their innovative products and contributions to the smart home technology sector.

What are the main drivers of growth in the US Smart Lock Market?

The growth of the US Smart Lock Market is driven by increasing consumer demand for home automation, enhanced security features, and the convenience of remote access. Additionally, the rise in smart home technology adoption is fueling market expansion.

What challenges does the US Smart Lock Market face?

The US Smart Lock Market faces challenges such as cybersecurity concerns, compatibility issues with existing home systems, and the potential for technical malfunctions. These factors can hinder consumer trust and adoption rates.

What opportunities exist in the US Smart Lock Market?

Opportunities in the US Smart Lock Market include the integration of artificial intelligence for enhanced security features, the expansion of smart home ecosystems, and the growing trend of remote work, which increases the need for secure home access solutions.

What trends are shaping the US Smart Lock Market?

Trends in the US Smart Lock Market include the rise of voice-activated locks, increased focus on user-friendly mobile applications, and the development of locks with advanced biometric features. These innovations are making smart locks more accessible and appealing to consumers.

US Smart Lock Market

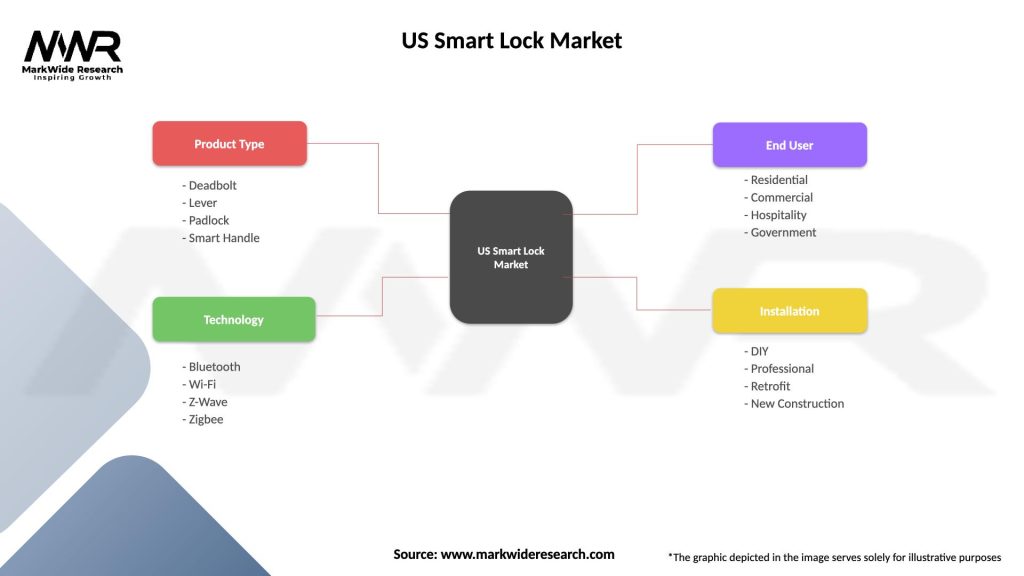

| Segmentation Details | Description |

|---|---|

| Product Type | Deadbolt, Lever, Padlock, Smart Handle |

| Technology | Bluetooth, Wi-Fi, Z-Wave, Zigbee |

| End User | Residential, Commercial, Hospitality, Government |

| Installation | DIY, Professional, Retrofit, New Construction |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Smart Lock Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at